2017: An Unexpectedly Busy Year for Energy Storage Development Around the World

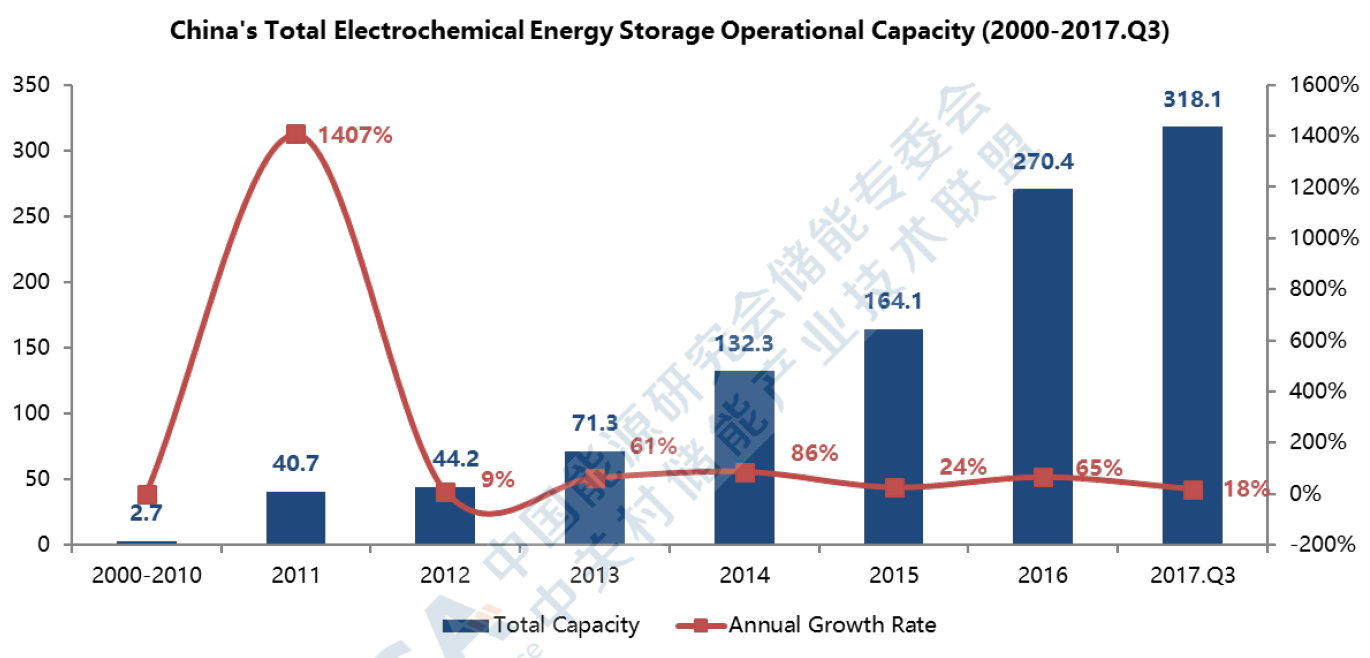

Amongst the variety of energy storage technologies, electrochemical storage technologies have developed more speedily than any other. Li-ion batteries, NaS batteries, lead-acid batteries, and flow batteries have all entered the fast lane of development. According to statistics from the China Energy Storage Alliance (CNESA), worldwide total capacity for electrochemical energy storage from 2000-2017 was 2.6GW, or 4.1 GWh. These numbers represent a growth of 30% and 52% from 2016, respectively. 2017 saw a total increase of 0.6GW, or 1.4GWh, with over 130 new projects put into operation.

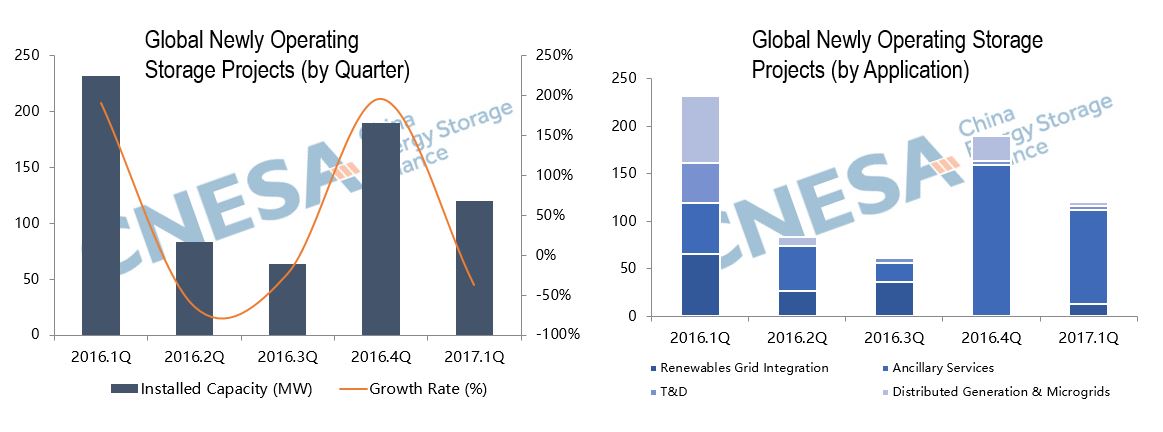

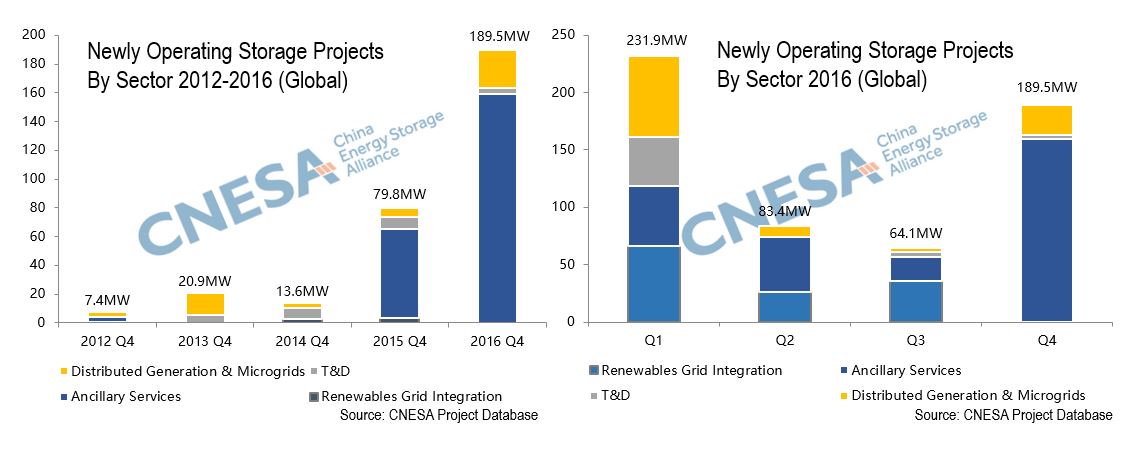

Beginning in 2016, electrochemical energy storage began to see rapid new applications. Construction of new energy storage programs became “large, numerous, and popular.” According to CNESA statistics, from 2016-2017, the global combined total scale of projects planned or under construction was 4.7GW, with an increasing number of projects hoping to be implemented in the following year to two years. In order for large-scale electrochemical storage to meet the needs of power systems, the capacity of independent electrochemical storage systems has been ever increasing. Over 40 projects with a capacity of 10MW or more were recorded between 2016-2017. Popularity for energy storage applications has increased worldwide. According to CNESA statistics, in 2015, ten countries including the United States, China, and Germany deployed electrochemical storage systems. By 2017, close to 30 countries had implemented energy storage projects, demonstrating how energy storage has become increasingly globalized.

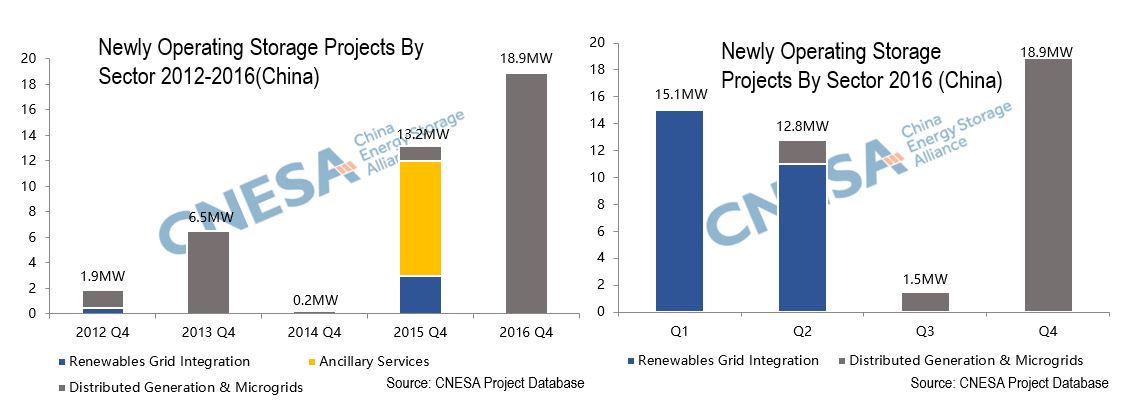

Yet it is the speed of China’s electrochemical energy storage development that catches the most attention. According to CNESA statistics, from 2000-2017 China’s total electrochemical storage capacity was close to 360MW, 14% of the world’s total, with an annual growth rate of 40%, surpassing the global growth rate. Between 2016 and 2017, China had nearly 1.6GW of capacity planned or under construction, 34% of the world’s total. China hopes to lead the industry’s development in the next few years.

2017: A Year of Policy Support for Energy Storage Around the World

As a country that developed policy support for energy storage at a relatively early stage, the United States has seen policies emerge across many states, starting in California and stretching to over 10 others, including Massachusetts, Oregon, and Hawaii. The United Kingdom, Austria, Czech Republic, Italy, Australia, India, and China all released energy storage development policies in 2017. Policy support, both in its depth of detail and breadth across regions, has proven beneficial for the rapid development of energy storage in 2017.

In October 2017, China released the first national-level energy storage policy for technology and applications support, the “Guiding Policies on Promoting Energy Storage Technology and Industry Development.” The “Guiding Policies” lays out support plans for energy storage in five different areas: support for energy storage equipment research, support for energy storage’s utilization of renewable resources, support for the use of energy storage in the stabilization and flexibility of power systems, support for energy storage in increasing smart-energy applications, and support for energy storage as a means of diversifying the energy internet. At present, Dalian, Yichun, Beijing, Handan, and other areas have already released local policies supporting energy storage. In the future, it is likely that more policies will emphasize the use of local resources and industry advantages at the provincial and city level. It is also expected that future policy emphasis will be placed on the creation of electricity market entrance mechanisms and price compensation mechanisms for energy storage.

Following California’s declaration of a 1.325GW procurement plan, Oregon, Massachusetts, and New York released their own energy storage procurement plans for electric utilities. New Mexico has already added energy storage to its list of resources for public utilities. Maryland has designated sites across the state for the design, construction, investment, and operation of renewable resource and energy storage programs. The United Kingdom and Australia are two countries that have seen rapid development of energy storage recently, with policy support following quickly behind. The British government has emphasized the use of energy storage as part of the strategy for its “smart systems and flexibility plan,” providing recognition for energy storage as part of the nation’s electricity market. Multiple regional governments in Australia have released incentive plans for storage installations, using subsidies to support behind-the-meter energy storage systems.

2017: A Year of Energy Storage Systems and Market Needs

Although industry development has intensified and policy support has gradually opened the market to energy storage, we cannot ignore the fact that the current driving factor for energy storage development is still policy. The road to profitable and commercialized energy storage is still full of challenges and uncertainties. Energy storage has become a closely watched “blue ocean” market. In 2016, worldwide investment in energy storage exceeded 4.33 billion dollars. Public acknowledgment and participation has given the industry confidence, yet as demonstrations gradually become marketized, independent, non-market demonstrations will end, and policy support will weaken. Energy storage must then operate and compete in the real market, and technological performance, system configuration, application models, the profit feasibility, and scientific methods must all come under market scrutiny. Energy storage has now entered the stage in which it must began to mature in the market.

In 2017, two separate battery storage projects, sized at 2.1GW and 4.8GW, were granted the opportunity to participate in the UK’s T-1 and T-4 capacity market auction. Yet controversy arose regarding the relatively short dispatch duration of battery installations, which limits their ability to handle pressure on electricity systems. After considering the fairness to long dispatch duration, non-energy storage technologies, the UK’s BEIS (Department for Business, Energy, and Industrial Strategy) conducted an evaluation, and, in December of 2017, decided to lower the de-rating factor for 30-minute duration batteries in the T-4 and T-1 capacity auctions. The ruling put new demands on energy storage systems that can provide flexible response in a short time duration. In the short term, the ruling can be viewed as a restriction on short duration storage in the capacity market, yet such a ruling also provides motivation for energy storage providers to develop long duration energy storage solutions.

The PJM market, which currently possesses 265MW of energy storage capacity in frequency regulation, has also recently update its regulations for the frequency regulation market. During periods of high ramp rate, the RTO requires large-scale generators or load switching to maintain balance. While decreasing the purchase of services classified as RegD (those that have fast ramp rates but limited power), the RTO has also increased the charge and dispatch rates for grid energy storage systems. This regulation update demonstrates how energy storage must now compete with other resources in a balanced market. How energy storage will profit and find a suitable place in the market under these new regulations remains to be seen.

The standardization of energy storage products is a much needed development. In Germany, 52,000 residential energy storage systems were installed in 2017. Demand for solar+storage systems for industrial and commercial applications is also quite high, yet growth has been challenged by a lack of product standardization, technological standardization, interface standardization, and standardization of commercial models. Additionally, standardization is needed for fire protection, health, safety, and other factors. If such issues are ignored, it will be difficult for energy storage to spread throughout Germany at a large scale.

As energy storage continues to marketize, market demands and technological capabilities will continue to conflict. As technology continues to become more feasible in the market, hardware, software, and interface performance will continue to not only improve but become more compatible with other equipment. In the electricity market, energy storage’s position, applications, and value will continue to shift and rectify itself in a positive direction. Within the power price mechanism, energy storage will continue to gain recognition as a means of replacing other power equipment. Energy storage will also need to work faster to create standards and regulations to satisfy the environmental and safety demands of users. These issues will, in the short term, cause energy storage’s development to slow, yet this is not a negative. The development of energy storage requires continuous exploration, trials, and even failures to fight for its place in the market and move increasingly forward. An industry that has passed the tests of the market is one that possesses the greatest competitiveness and ability to survive.