This is part two in a series on our trip to San Diego for the Energy Storage North America Conference and Expo. If you haven't yet, check out part one.

The first day of the expo and conference featured our debut on the conference floor, and discussions about California's massive storage procurement and the future of solar storage.

Sharing What We Know…

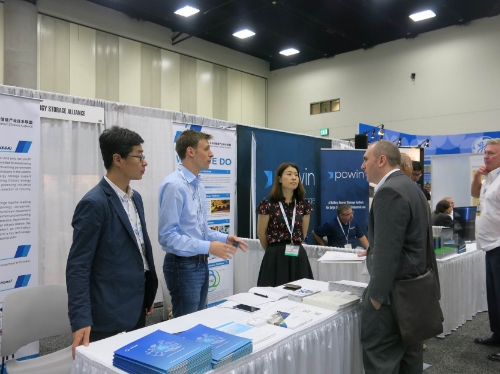

Vivian Wei, director of member services, and I made the final touches CNESA’s booth on day one of the expo. We’re here to share information about our efforts to promote energy storage policies and technologies in China. CNESA member companies we saw in the crowd included Primus Power, Schneider Electric, NGK, Sifang, Today Energy, ENN Group, Parker, Trina Solar, Sumitomo Electric, Imergy, Saft, ABB, GE and more.

The expo was a great opportunity for manufacturers, integrators and other energy storage players to share their technologies and business models with potential customers. For industry associations like CNESA, this is a chance to show the world what we do, and bring new members into the fold.

…And Learning from the Experts

Conference sessions also began today, focusing on three themes: distributed energy, hot markets, and utility-scale storage.

In a utility session, representatives from California’s three largest utilities discussed what lessons can be learned from their procurement of 350+ MW of energy storage capacity. Although the representatives were in consensus that their energy storage portfolios should be diverse, commercially sustainable, and flexible, questions posed in the Q&A segment about how utilities value different energy storage technologies, both now and in the future, were left largely unanswered.

Utility representatives said that their procurement requirement standards are expected to rise in 2016, which suggests that Chinese and other international companies should find suitable and experienced local partners if they intend to bid their products into California’s electricity markets.

In a distributed energy session, three industry experts from different backgrounds looked ahead at opportunities for solar-plus-storage. The panel featured Boris von Bormann, CEO of German battery business Sonnenbatterie; Ruud Kempener, analyst at the International Renewable Energy Agency (IRENA); and Barbara Lockwood, general manager at a US utility, Arizona Public Service.

Ruud Kempener challenged industry watchers to expand their perspectives beyond large-scale projects in developed countries, and consider the market possibilities for small-scale solar-plus-storage projects in countries with unstable grids and low rates of electrification. He remarked that although the cost of solar-plus-storage systems are often still too high to be considered cost competitive, they hold great value by providing grid reliability and resilience. Nonetheless, in the United States and Europe, cost competitiveness is still the most critical factor for the success of solar-storage projects.

Barbara Lockwood described how her utility is restructuring rates to encourage smart energy decisions. She argued that net metering – which reduces electricity bills for solar customers by subtracting total electricity produced from the electricity consumed from the grid – doesn’t accurately reflect the cost of electricity at various times, and discourages the adoption of technologies which can help utilities keep the grid stable. Solar panels cease to produce electricity at sundown, but load remains high well into the evening. In areas with high solar penetration, this means that utilities have to quickly ramp up generation in ways which can be costly and inefficient. Lockwood claimed that new rate structures, such as demand rates – which charge a consumer a separate fee based on the level of their peak consumption during a month or year – can encourage the use of energy storage technologies to even out load spikes which can cause instability and inefficiency in the grid.

Our trip blog continues in part three, where we hear from experts on distributed storage and breakthrough technologies.