Recently, the southern region’s first electricity spot market trading category—regional frequency regulation market technology systems (hereafter referred to as the “regional frequency regulation system”) entered trial operations. The trials symbolize a big step forward in the construction of electricity spot markets, and supports the China Southern Grid’s optimization of frequency regulation across its entire grid.

The regional frequency regulation system is organized and constructed by China Southern Grid. Following half a year of deployment and testing, a price clearing model was created, and the first test linking Guangxi province with the Southern Grid frequency regulation control area was successfully completed, confirming the possibility for both eastern and western dispatch agencies to jointly participate in unified frequency regulation of the entire grid. Beginning November 5th of this year, the regional systems and the existing Southern Grid frequency regulation market technology support system (based in Guangdong) began simultaneous operations. During the simultaneous operations trials, price clearing and settlement are still carried out on the Guangdong frequency regulation system. Once proper conditions are available, clearance and settlement will be handled through the regional frequency regulation system, and the market will be expanded throughout the entire grid network.

The regional frequency regulation system is designed for smooth access by all southern provinces, as well as the different price-clearing practices of the main grid and the Yunnan asynchronous grid. The clearing algorithm supports the entire grid network of frequency regulation resources in meeting the diverse safety constraints across a varied grid geography.

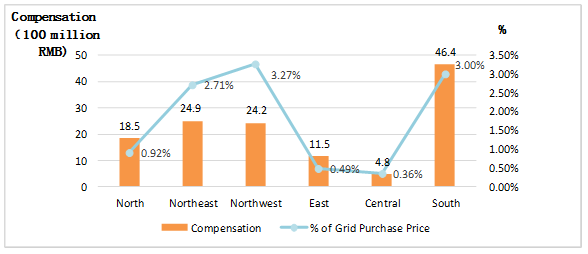

On November 5th, the National Energy Administration released Announcement on the Status of Ancillary Services in the First Half of 2019. The report reveals that in the first half of 2019, there were 4,566 power generation companies in China (excluding Tibet) participating in compensated ancillary services, with an installed capacity of 1.37 billion KW and compensation for services totaling 13.033 billion RMB, equivalent to 1.47% of total grid purchase fees. Among these, ancillary services compensation in the southern region reached 4.64 billion RMB, accounting for 3% of total grid purchase fees, second only to 3.27% in the northwest region.

Among ancillary services in the southern region, frequency regulation compensation totaled 48.389 million RMB, among which the frequency regulation market compensation of Guangdong in the first half of 2019 totaled 33.105 million RMB.

Graph: Ancillary Services Compensation by Region

Since the implementation of the Guangdong Frequency Regulation Ancillary Services Market Transaction Regulations (Trial) on September 1, 2018, the energy storage frequency regulation market in Guangdong has seen vigorous development. According to the China Energy Storage Alliance Global Energy Storage Project Database, as of September 2019, frequency regulation projects in Guangdong (including those operational, under construction, or planned) covered 13 cities, with a total capacity of 388MW, and all projects utilizing Li-ion battery energy storage technologies. Among these cities, Guangzhou, Shanwei, and Zhanjiang featured the largest capacities, at 71MW, 50MW, and 42MW, respectively. The Shanwei Xiaomo power station project is currently the largest capacity domestic frequency regulation energy storage project in operation, at 30MW/15MWh.