The 2018 global electrochemical energy storage market saw continued growth from many different players. Projects continued to accumulate, application areas continued to expand, and market capacities increased all at dazzling speeds.

The Global Storage Domain

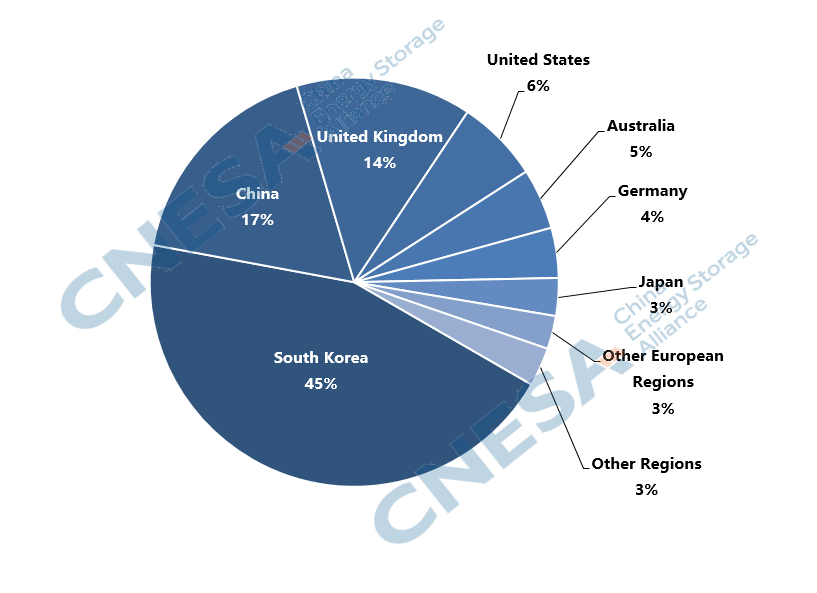

It is no surprise that countries in the Asia-Pacific, North America, and Western Europe who possess strong industrial power foundations and widespread renewable energy markets are the leaders in energy storage growth. According to statistics from the China Energy Storage Alliance global energy storage project tracking database, South Korea, the United States, China, the United Kingdom, Japan, Germany, and Australia contributed to 94% of the world’s newly added storage capacity in 2018. These countries also accounted for 94% of storage capacity between 2000-2018.

The presence of South Korea amongst these countries is somewhat unexpected. In 2017, South Korea’s energy storage capacity was nearly equal to that of China, yet in just a year, South Korea’s energy storage market experienced a tremendous growth spurt, adding 1580.3MW of new capacity, equivalent to 45% of the globe’s new total for 2018, vastly exceeding that of China, the United States, or any country in Europe.

Graph 1: 2018 Global Distribution of Newly Added Electrochemical Energy Storage Projects

According to statistics from the CNESA Global Energy Storage Project Database, in 2018, global newly operational electrochemical energy storage project capacity totaled 3545.7MW, an increase of 288% from the previous year. Total accumulated capacity reached a total of 6472.3MW.

Graph 2: Global Accumulated Operational Electrochemical Energy Storage Capacity (2010-2018)

An observation of each country’s growth reveals the following: first, the Chinese market’s largest source of growth is grid-side and behind-the-meter applications. Second, South Korea’s market growth is driven by renewable integration and behind-the-meter applications. Third, UK market growth is based primarily on ancillary services, while the United States and Australia see a substantial portion of capacity come from residential behind-the-meter markets.

Aside from the seven countries above, other countries—including Canada, France, and Portugal, as well as emerging markets such as India and Brazil—are also growing their energy storage capacities, releasing ambitious plans for storage development. The addition of new countries to the global stage has brought diversity to global energy storage market needs.

With grid remodeling and renewable energy development acting as drivers for energy storage around the world, the need for energy storage has become widespread.

The Appeal of the International Market

In comparison to the other countries above, China occupies a somewhat awkward position. Despite China’s status as the world leader in battery production, the country lags behind in many energy storage applications. Grid-side applications still lack an effective price mechanism. In behind-the-meter applications, uncertain I&C electricity policies and ever-shrinking peak and off-peak price gaps have had major effects on energy storage project earnings, putting the future of many projects at risk.

In contrast to the pressures and uncertainties that China’s energy storage industry faces, the international energy storage industry displays a more mature level of commercialization. Yet at the same time, major markets such as the United States, United Kingdom, Germany, and Australia lack sufficient battery production capacities to match needs. The international market therefore provides one of the biggest opportunities for Chinese energy storage companies to grow.

Fierce competition in the domestic market has already had an effect on some companies. For example, in August 2018, BYD’s energy storage business division announced plans to cease participation in the domestic competitive bidding process and limit themselves only to the role of equipment supplier. BYD could only afford to take such a bold measure due to the company’s strong overseas presence. BYD’s success in Europe and the Americas has become a benchmark for other Chinese energy storage companies seeking to go abroad.

Beginning in 2018, many Chinese solar PV and battery companies began ratcheting up efforts to expand their international market presence.

In the first half of 2018, Sungrow’s energy storage business division reported a revenue increase four times that of the same period in 2017. Following China’s cuts to solar subsidies and feed-in-tariff prices in May 2018, Sungrow began to consolidate its solar and energy storage business lines. Relying on the company’s established international solar marketing channels, Sungrow’s energy storage business line was able to break through to markets in the United States, Germany, and Japan in 2018.

BYD and Sungrow have been established in the international market for some time, giving them an established advantage over other Chinese companies. For many small and medium-sized companies, emerging markets in the Asia-Pacific, Middle East, and Africa show greater appeal. One example is Shoto’s contract won last year to provide EPC services for projects totaling 80 million USD in Afghanistan.

With numerous companies competing in a small market, many have been motivated to go abroad. China’s energy storage companies have landed in many regions, from Southeast Asia to India, Europe, America, Africa, and the Middle East. As China’s lack of an open power market continues to present a challenge for energy companies domestically, it is quite possible that China’s battery and energy storage companies might copy the business model of the country’s solar companies, producing domestically and marketing globally.

In 2019, China’s battery manufacturers and energy storage companies have accelerated their international activities, driven largely by two major factors. First, Chinese companies have the desire and need to develop internationally. Second, international market changes have provided Chinese companies with much room for expansion. In 2018, South Korea’s rapid growth in storage projects caused LG and Samsung to focus more attention on their domestic markets. Prices for international battery and energy storage systems began to rise, providing a great opportunity for Chinese battery manufacturers to supply batteries for global developers and systems integrators.

In the battery industry, South Korea and Japan are China’s biggest competitors. While Japanese batteries have a reputation for being technically advanced and South Korea’s batteries have a reputation for good quality-to-price ratio, Chinese batteries could be said to show technical advancement at the fastest rate. With the support of strong government subsidies, Chinese battery manufacturers earned a place on the global stage in a few short years.

Unlike the nickel-magnesium-cobalt battery which leads the Li-ion battery market internationally, China’s lithium-iron-phosphate battery is much more price competitive. According to data on battery pack procurement prices for grid-side energy storage projects in 2018, China’s average battery pack price was 1073 RMB/kWh, approximately 30% lower than that of the average price for battery packs in the international market. It is very likely that China’s manufacturing capacity will allow the country to become the leading supplier for the global battery and energy storage industries, much as the country has done for the solar PV industry.

Revelations from Global Leaders

Europe and North America both possess mature business models for integrated energy services. The development of the power market in these regions follows the proliferation of the “smart grid” concept, including new power industry services brought about through the emerging internet of energy.

Sonnen, recently acquired by Shell, possesses over 30,000 residential energy storage installations worldwide. Sonnen not only distributes its energy storage equipment to residential users, it also creates virtual power plant networks out of its customer communities, allowing distributed energy storage systems to become dispatchable peak shaving and frequency regulation networks for use by the grid.

With renewable integration applications diversifying, power grids and regulators face major challenges. Exceptional energy storage systems integrators are adopting increasingly important roles in the electricity system. According to evaluations by market researcher Navigant, Fluence, Nidec ASI, RES, and Tesla are the leaders in energy storage systems integration.

Fluence has over 10 years of industry experience providing energy storage solutions to power grids, energy developers, and large-scale power customers. The company has deployed over 600MW of energy storage project capacity globally. Fluence’s customers require a high level of expertise and financial stability for such projects, which typical battery manufacturers would be unable to provide.

In contrast, China still lacks system integrators with a thoroughly researched understanding of energy storage systems. Systems integration requires expertise in multiple subjects, including electrochemistry, power electronics, information technology, and power dispatching, while also knowing what components, software, and other equipment will be the proper fit for the multitude of varying applications and scenarios.

For Chinese companies, developing from a battery manufacturer and/or PCS provider into a full solutions provider that can compare with other industry leaders is no small task, yet the window of opportunity is still large.

Looking globally, should Chinese companies wish to enter the Korean and Japanese markets on a large scale, they will have to go up against major competitors such as LG, Samsung, and Panasonic. Europe and North America are both important energy storage markets, with strong demands for high quality inverters and batteries, and high technical requirements for energy storage systems in general. Other countries with developing markets may also pose risks that are not present in countries with a more developed energy storage industry.

If Chinese energy storage companies wish to gain a bigger foothold in international markets, they will need to be familiar with local energy policies, power markets, and the variety of applications scenarios required for energy storage systems in each country. International market expansion is a long-term process, and the questions of how to localize products/services and build cooperative partnerships with local developers and systems integrators are ones that Chinese companies will have to solve before they can be truly successful.

Author: Energy Storage 100 Translation: George Dudley