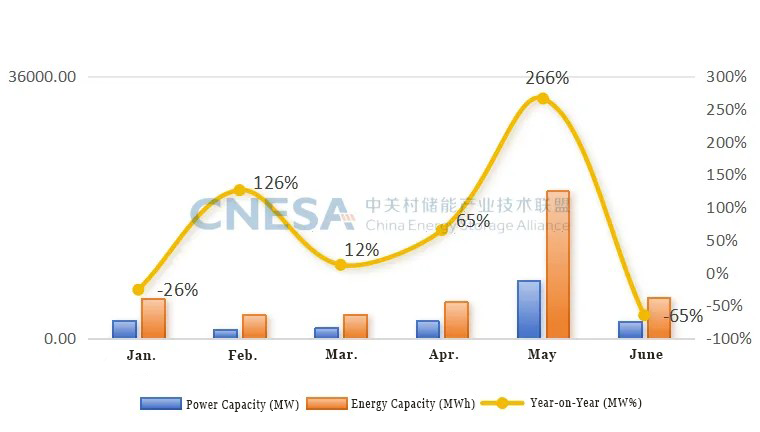

According to incomplete statistics from the CNESA DataLink Global Energy Storage Database, in June 2025, newly commissioned domestic new energy storage projects totaled 2.33GW/5.63GWh, a year-on-year change of -65%/-66%, and a month-on-month change of -71%/-72%.

It can be observed that due to the “installation rush” in the new energy sector, the grid connection peak for new energy storage projects in the first half of this year shifted forward to before the May 31 node, and for the first time, the grid connection activity around the “June 30” node declined.

Although June saw a decline in newly added installations, second-quarter new installations still exceeded historical levels for the same period, reaching 12.61GW/30.82GWh, representing a year-on-year increase of +24%/+27%. (The Alliance will release the 2025 H1 new energy storage industry data shortly.)

Figure 1: Installed Capacity of Newly Commissioned New energy storage Projects in China, January–June 2025

Data Source: CNESA DataLink Global Energy Storage Database

https://www.esresearch.com.cn/

Note: Year-on-year comparison uses the same period from the previous year as a base; month-on-month comparison uses the immediately preceding statistical period as a base.

Starting in June, we will publish monthly updates on new energy storage projects in both grid-side and user-side application markets. Below is the user-side new energy storage installation situation for June.

In June, newly added user-side energy storage installations reached 328.6MW/841.4MWh, a year-on-year increase of +22%/+43%, and a month-on-month increase of +77%/+55%.

User-side new energy storage installations exhibited the following characteristics.

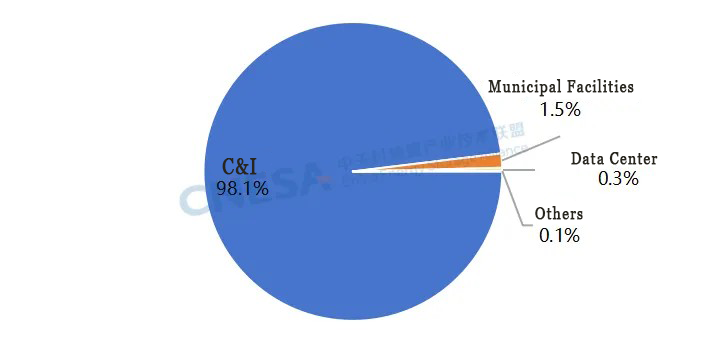

Number of 100MWh-scale C&I Projects Hits New High for H1

In June, the user-side energy storage market was dominated by commercial and industrial (C&I) applications. C&I scenarios accounted for 322.3MW/828.6MWh of newly added installations, a year-on-year increase of +25%/+47%. The number of newly commissioned 100MWh-level projects hit a new high for the first half of this year. Project owners were primarily from high energy-consuming industries such as metallurgy, chemicals, and machinery manufacturing. Large-capacity C&I storage is playing an increasingly important role in helping high energy-consuming industries decarbonize, reduce electricity costs, and ensure reliable power supply for C&I users.

In terms of technology, newly commissioned projects were mainly based on electrochemical energy storage technologies, with lithium iron phosphate (LFP) battery installations accounting for over 99% of the installed power capacity. Among long-duration storage technologies, one vanadium redox flow battery project was commissioned, and among short-duration high-frequency technologies, one flywheel energy storage project was also brought online—both on the user side.

Figure 2: Application Distribution of Newly Commissioned User-Side New energy storage Projects in June 2025 (MW%)

Data Source: CNESA DataLink Global Energy Storage Database

https://www.esresearch.com.cn/

Note: “C&I” includes industrial and commercial buildings; “Others” includes data centers, EV charging stations, and rail transit.

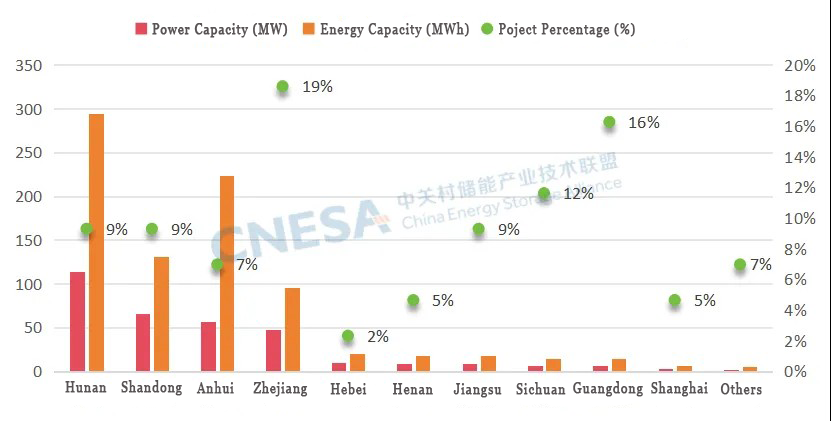

Hunan’s Share of New User-Side Storage Installations Exceeds 30%

In terms of regional distribution, newly commissioned projects were mainly located in 12 provinces including Hunan, Shandong, Anhui, Zhejiang, and Hebei.

In terms of installed capacity, Hunan had the largest newly added capacity, accounting for over 30% of the national total. The combined newly added capacity of East China provinces including Shandong, Anhui, and Zhejiang accounted for nearly 55% of the national total.

In terms of project quantity, Zhejiang had the highest number of newly commissioned projects, accounting for nearly 1/5 of the national total. Guangdong and Sichuan also each accounted for more than 10% of newly commissioned project numbers nationwide.

Figure 3: Provincial Distribution of Newly Commissioned User-Side New energy storage Projects in China, June 2025

Data Source: CNESA DataLink Global Energy Storage Database

https://www.esresearch.com.cn/

Decline in Jiangsu and Guangdong Filings Year-on-Year; Anhui Sees 150%+ Growth

In terms of project filings, Zhejiang remains one of the most active provinces in the user-side energy storage market. In June, Zhejiang filed over 310 new user-side energy storage projects, a year-on-year increase of 14%, continuing to lead nationwide.

Jiangsu filed over 150 new user-side projects, a decrease from the same period last year, but with an increase in single-project capacity—more projects exceeded 100MWh compared to the same period last year.

Guangdong filed over 170 new user-side projects, also fewer than the same period last year.

Additionally, in June, Anhui filed over 60 new user-side storage projects, a year-on-year increase of more than 150%. Anhui is emerging as a promising province for cultivating the user-side energy storage market.

User-Side Storage to Grow at 45.8% CAGR from 2025 to 2030

Overall, national electricity supply-demand dynamics are becoming increasingly tight, and the power “gap” is expanding year by year. The demand for reliable power supply may become a major driving force for user-side energy storage market growth. CNESA forecasts that the compound annual growth rate (CAGR) for user-side storage installations will be 57.9% from 2023 to 2025, and is expected to reach 45.8% from 2025 to 2030.

For more analysis of China’s user-side energy storage market, refer to the report “2024 Review and 2025 Outlook of China’s User-Side Energy Storage Market” published by the China Energy Storage Alliance.

More content available at:

https://www.esresearch.com.cn/report/?category_id=25