Core Data:

• In June, newly commissioned new energy storage reached 2.33GW/5.63GWh in China; for the first time, the “June 30” grid-connection peak cooled down.

• In the second quarter, newly commissioned new energy storage still exceeded previous years at 12.61GW/30.82GWh.

• Jiangsu’s new installed capacity exceeded 750MW, accounting for more than 35% of the national total.

• The average energy storage duration of new projects in Xinjiang, Inner Mongolia, and Qinghai exceeded 3.5 hours.

• Inner Mongolia saw 17 projects start construction in June, totaling 8.2GW/33.1GWh.

• The full-year new installed capacity for large-scale energy storage in 2025 is expected to exceed 43GW.

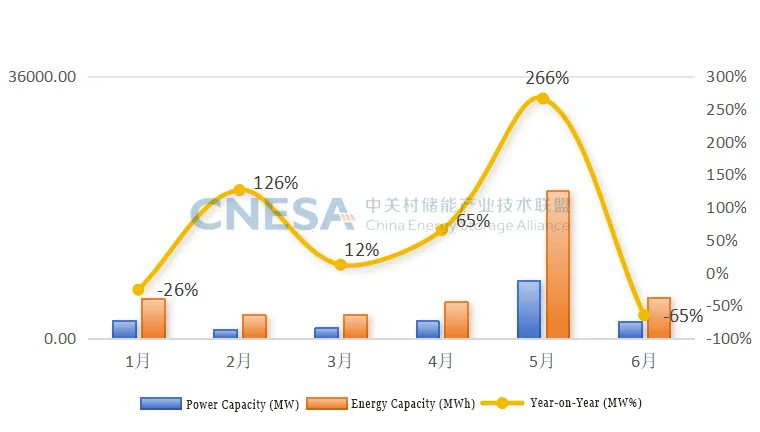

According to incomplete statistics from the CNESA DataLink Global Energy Storage Database, in June 2025, newly commissioned new energy storage projects in China reached a total of 2.33GW/5.63GWh, down 65%/66% year-on-year and 71%/72% month-on-month.

It can be seen that, due to the “rush installation” of new energy, the grid-connection surge for new energy storage projects in the first half of the year shifted forward to before the “May 31” node, and the “June 30” node’s grid-connection activity declined for the first time in history. Although new installations in June showed negative growth, second-quarter additions still exceeded those of previous years, reaching 12.61GW/30.82GWh, a year-on-year increase of 24%/27%.

Figure 1: New Commissioned Capacity of New Energy Storage Projects in China from January to June 2025

Data Source: CNESA DataLink Global Energy Storage Database

https://www.esresearch.com.cn/

Note: Year-on-year compares with the same period last year; month-on-month compares with the previous statistical period.

Starting this month, we will publish monthly updates on grid-side and user-side new energy storage projects by application market. The following is the installed capacity status of grid-side new energy storage projects in June.

In June, newly installed grid-side capacity was 2.00GW/4.79GWh, down 68%/64% year-on-year and 74%/76% month-on-month. Of this, grid-side new installations were 1.39GW/3.56GWh, down 74%/69% year-on-year, all of which were independent storage; power-side new installations were 0.61GW/1.23GWh, down 33%/42% year-on-year, with nearly 90% of new installations coming from new energy configuration sub-scenarios.

Figure 2: Application Distribution of Newly Commissioned New Energy Storage Projects in June 2025 (MW%)

Data Source: CNESA DataLink Global Energy Storage Database

https://www.esresearch.com.cn/

The newly commissioned grid-side new energy storage projects in June exhibited the following characteristics.

By Region:

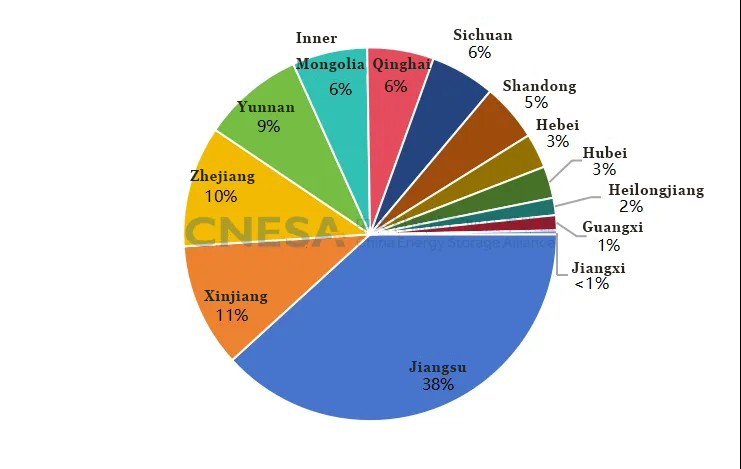

Jiangsu leads in newly installed capacity nationwide

This month, Jiangsu’s newly installed capacity exceeded 750MW, accounting for more than 35% of the national total; among this, newly installed independent storage accounted for 43% of the national grid-side new capacity.

On one hand, construction of independent storage power stations in Jiangsu accelerated in the first half of the year; all independent storage power stations commissioned in June were started and commissioned within the first half of the year, with the shortest construction time being only 81 days (from commencement to commissioning).

On the other hand, on June 1, 2025, Jiangsu officially launched trial operation of long-cycle settlement in the electricity spot market. The “Jiangsu Electricity Spot Market Operation Rules (Version 2.0)” stipulate that grid-side storage voluntarily participates in the spot market, and during participation, is no longer settled based on the charging and discharging prices defined in the “Notice by the Provincial Development and Reform Commission on Accelerating the High-Quality Development of New Energy Storage Projects in Our Province” (Su Fa Gai Neng Yuan Fa [2024] No. 775). Grid-side storage participates in the spot market through “quantity bidding and pricing” on a per-station basis.

Figure 3: Provincial Distribution of New Grid-Side New Energy Storage Projects in China in June 2025 (MW%)

Data Source: CNESA DataLink Global Energy Storage Database

https://www.esresearch.com.cn/

By Energy Storage Duration:

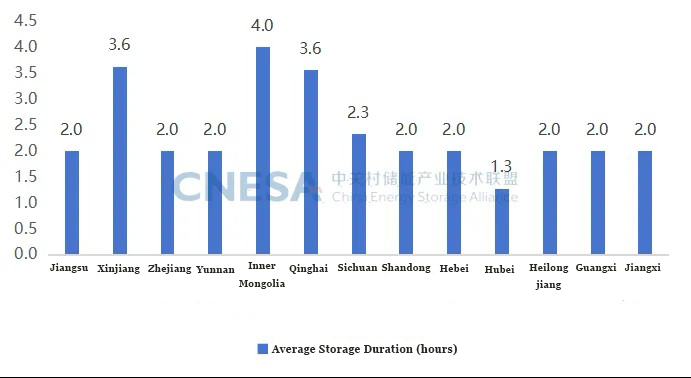

Average durations in Xinjiang, Inner Mongolia, and Qinghai exceed 3.5 hours

From a regional perspective, the average energy storage duration of newly commissioned grid-side storage projects in most provinces such as Jiangsu, Zhejiang, and Yunnan was around 2 hours. In Xinjiang, Inner Mongolia, and Qinghai, the average energy storage duration exceeded 3.5 hours, with all newly commissioned projects in Inner Mongolia being 4-hour storage projects.

According to official information, as of May this year, the proportion of new energy installed capacity in Xinjiang, Inner Mongolia, and Qinghai exceeded half of total local generation capacity, leading to higher energy storage duration requirements for new energy storage projects.

Figure 4: Average Energy Storage Duration of New Grid-Side New Energy Storage Projects in China in June 2025 (Unit: Hours)

Data Source: CNESA DataLink Global Energy Storage Database

https://www.esresearch.com.cn/

By Technology:

Lithium-ion dominates, non-lithium technologies accelerating deployment

Newly commissioned projects were primarily based on electrochemical energy storage technology, with lithium iron phosphate batteries accounting for 89% of installed power capacity. For non-lithium technologies, two 100MW-class all-vanadium flow battery energy storage projects were commissioned, with flow battery technology accounting for 10% of installed power capacity. Frequency regulation stations using lithium iron phosphate + flywheel hybrid storage and grid-side stations combining lithium iron phosphate + aqueous flow batteries were also commissioned.

By Energy Storage Planning:

Demonstration project deployment for new energy storage accelerating

Among the independent new energy storage projects included in the “2025 New Energy Storage Special Action Implementation Project List” and the “First Batch of Independent New Energy Storage Construction Projects List in 2025” released by Inner Mongolia in the first half of the year, 17 started construction in June, totaling 8.2GW/33.1GWh. These projects involve multiple technology routes including lithium-ion batteries, flow batteries, solid-state batteries, and compressed air energy storage.

Guizhou Province included 24 grid-side independent new energy storage projects—such as the 500MW/1000MWh shared energy storage station in Zhenning Autonomous County—into its “2025 Provincial Key Projects and Major Engineering Projects” list, with a total scale of 2.7GW/5.5GWh.

Yangquan City in Shanxi released the “Yangquan City Carbon Peaking Implementation Plan for the Energy Sector,” prioritizing construction of grid-side new energy storage projects including the Hongshengtong 500MW/1000MWh independent storage project, with a total scale exceeding 1.1GW.

Market Outlook:

Full-year new grid-side installations expected to exceed 43GW

According to CNESA’s incomplete statistics, more than 23GW of grid-side new energy storage was under construction in the first half of the year. Additionally, over 10GW of provincial new energy storage demonstration projects still in the planning stage are expected to be connected to the grid by the end of 2025. Assuming 80% of these projects are completed and commissioned in the second half of the year, new grid-side installations for the year are expected to exceed 43GW (compared with 41GW for all of last year).