Grid-side Energy Storage Projects Take Off, Carrying Energy Storage into Large-Scale Applications

“Grid-side energy storage” was the industry hot topic in China for 2018. According to statistics from the CNESA Energy Storage Project Tracking Database, China’s newly operational grid-side energy storage capacity (not including planned, under construction, or undergoing initial debugging) totaled 206.8MW, or 36% of all newly deployed energy storage in 2018, making grid-side storage the year’s leading application category in terms of new capacity.

The sudden leap in grid-side energy storage capacity was in many ways both expected and unexpected. Though Jiangsu province’s call for bids for 100MW of storage projects was caused by the unexpected retirement of a group of generators and the subsequent grid pressure caused by summertime peaks, grid company enthusiasm for energy storage was not a surprise. Since the start of the Zhangbei Wind, Solar, Energy Storage, and Transmission Project in 2011, grid companies have never ceased interest in exploring energy storage technologies, applications, and models. A few years ago, one expert predicted, “when energy storage prices dip below 1500 RMB/kWh, we will see large-scale applications in the grid.” With the proliferation of electric vehicles having caused the price of battery cells to drop significantly, grid-side energy storage has now reached this turning point.

In 2018, the grid companies of Jiangsu, Henan, Hunan, Gansu, and Zhejiang provinces each released their own large-scale energy storage procurement targets. At CNESA’s Grid-Side Energy Storage Project Forum held in Nanjing this past November, many provincial grid companies expressed desires to construct grid-side energy storage projects. CNESA’s preliminary statistics show that the total capacity of grid-side energy storage projects currently planned/under construction surpasses 1407.3MWh. Support from China State Grid leadership has given direction to grid-side storage development, and it is likely that in the next 1-2 years grid-side energy storage will see breakthrough development.

Rapid Development of Grid-Side Applications Will Influence the Entire Energy Storage Industry

Because there are currently no defined parameters for what type of energy storage system is needed for the grid, nor specialized energy storage products for the grid, traditional (i.e. electric vehicle) testing and evaluation methods cannot objectively reflect what battery performance parameters the electricity system requires. Following the launch of the first grid-side storage system and the completion of necessary testing and evaluation methods, future project tenders will be able to include more accurate technological thresholds and requirements, thereby helping to continually improve the performance of energy storage systems with each new project.

China’s grid-side project investors are largely third-party entities (companies within the grid system) who manage the project’s entire construction and operations. Systems integrators and battery manufacturers provide the battery system. Grid companies supply the land and sign the agreement with the third party. The agreement will specify what type of payment method will be used, whether a fixed payment plan or profit-sharing model. As the operator, the grid has already begun to take notice of energy storage’s multiple values. Such attention will help push the improvement of system management and price mechanisms for energy storage.

Because each country’s power market is structured differently and the amount of freedom in each market varies, there is an array of opinions over how much capital in energy storage a grid company should own. China is currently undertaking the first steps in power market reforms. Growth in grid-side energy storage projects will create experiences that will help define storage project ownership, define the limits of each players’ role in the market, ensure healthy competition during the market transition period, and help energy storage to thrive within an open power market.

Competition Increases in Thermal Power Frequency Regulation, though Many Challenges Remain

As one of the earliest storage applications to develop a clear business model, worldwide, frequency regulation has not seen significant growth in new applications. In many ways, the current market has already neared its limit. The experience of the Tesla 100MW energy storage project in South Australia shows that only players who enter the market early can make a profit, while later entrants can only search for new markets to replicate the model.

In comparison to the international market, frequency regulation in China offers both opportunities and challenges.

In the context of ongoing electricity reforms, opportunities arise in regions such as northeast china (Dongbei), Fujian, Gansu, Xinjiang, Shanxi, Ningxia, Beijing-Tianjin-Tangshan, Guangdong, Anhui, Henan, north China (Huabei), east China (Huadong), and northwest china (Xibei), where decisionmakers have shown support for ancillary service markets by encouraging power generation companies, power sellers, power customers, and independent ancillary services providers to invest in the construction of energy storage infrastructure to participate in frequency regulation ancillary services. In practice, aside from the Shanxi mechanism—which compensates based on the “mileage” and effectiveness of frequency regulation, a model that provides major support for storage—Guangdong is also experimenting with new market regulation designs for frequency regulation, borrowing from compensation mechanisms used in north China (Huabei) and PJM market regulations in the United States, retiring the earlier model of settlement based on quantity of electricity, and adopting a new model based on the duration and quality of frequency adjustment. Such a model will provide major opportunities for energy storage to participate in Guangdong’s frequency regulation market. Following trial runs of the new rules which began at the end of 2017, power generation companies in Guangdong have signed six contracts for energy storage frequency regulation projects at thermal power plants.

Challenges arise in two major areas. First, policy support has encouraged many domestic companies to enter the frequency regulation market. Aside from companies such as Ray Power and CLOU, numerous other systems integrators and project developers have been entering the frequency regulation market, including Sunwoda, Hyperstrong, Zhizhong, Beijing Clean Energy Group, and others. With so many players in a market that has already neared its limit, it is not surprising that competition has been extraordinarily fierce. In 2018, the proportion of energy storage operators to owners saw continual decrease. In a space where profits are limited, price battles have become increasingly intense. A second challenge is that although numerous thermal power plant storage projects have been announced, truly operational projects are few, in part due to insufficient fire safety standards, a concern which looms over every frequency regulation project.

In 2018, research and testing in battery heat management, fire extinguishment materials and equipment, fire safety standards, and other safety management measures all became areas of increased focus. CNESA member standardization groups have contributed to standards such as the “Electrochemical Energy Storage System Evaluation Regulations” and “Energy Storage System Fire Alarm and Fire Prevention Systems,” both of which are currently in the working phase and seeking comments. We hope that the release of these standards will contribute to increased deployment of new systems.

Finally, as the “ancillary services market” works through its current transition period, early stage competitive price models attract fierce price competition, frequency regulation compensation prices continue to drop, and investment risks for frequency regulation energy storage projects continue to rise. In contrast, mechanisms for energy storage in peak shaving and for backup power applications have yet to be clearly defined. While northeast China (Dongbei), Xinjiang, Fujian, Gansu, and Anhui have announced needs for peak shaving capacity supplied by independent energy storage market entities, Jiangsu has also announced that energy storage may contribute to high levels of peak shaving and has drafted regulations for compensation. However, dispatch strategies and technological requirements for grid-connected independent energy storage stations, standards for connecting to the grid, pricing for battery charging and discharging, and settlement strategies are all still lacking proper rules and regulations. In the short term, such issues are an obstacle to energy storage value stacking.

If Penalties and Rewards are Clearly Defined, What Additional Assistance Does Renewable Energy and Storage Need?

Although the development of renewable energy is an important factor contributing to the use of energy storage in the electricity system, in China the two still do not have a close enough relationship. Examples of renewable energy stations coupled with energy storage are few in China. Aside from a few individual wind-plus-storage demonstration projects, the majority are projects installed at large-scale solar PV stations with high FIT rates using storage to manage curtailment. In 2018, with the release of the “Renewable Energy Fair Price Policy,” the installation of energy storage for curtailment has lost its advantage. Future efforts must explore other ways in which energy storage can add value to renewable energy stations.

Internationally, as renewables continue to penetrate grids at increasingly higher levels, grid operators have looked to differentiate the way that renewable generators of varying performance are penalized and compensated. Generators that are more stable or “trustworthy” earn higher grid purchase prices, or can have their “penalties” minimized.

The recently updated “Two Regulations” for the Northwest (Xibei) region follows this same line of thinking. Though simply lowering the risk of penalties does not increase motivation for renewable energy stations to install storage, in the future, as the ancillary services market matures, policymakers are certain to consider the advantage of renewable energy stations combined with storage and encourage such installations to participate in market transactions and ancillary services. Such measures would help highlight the many benefits of storage combined with renewable energy.

Foreign Behind-the-Meter Storage Market Thrives While the Domestic Market Slows

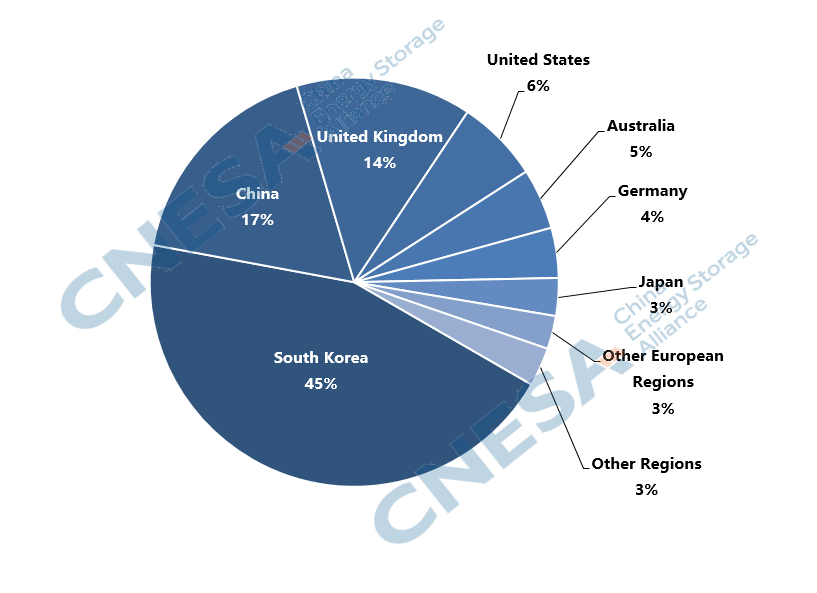

The behind-the-meter market outside of China continued to thrive throughout 2018. Aside from the United States, Germany, and Australia, emerging behind-the-meter markets in Canada’s Ontario province, South Korea, and Italy all became battlegrounds for new competition between global storage vendors. The behind-the-meter market in the United Kingdom also attracted attention, and is predicted to experience an explosion in growth in 2019.

In contrast to the growth in behind-the-meter storage internationally, China’s behind-the-meter market, which once led the industry’s development, slowed in 2018.

One reason for this is the implementation of new policies which have narrowed the gap in price differences between peak and off-peak periods in many regions. In Beijing for example, general industrial-commercial customers are permitted to utilize the two-part tariff system, which allows electricity bills to be paid either (a), according to transformer capacity or maximum demand, or (b), according to their actual power usage. As a result of this plan, price differences between peak and off-peak power periods shrank significantly, making it difficult to sustain a profit using energy storage for energy arbitrage.

Another issue has been the concern of business owners and fire departments towards the use of energy storage systems in commercial buildings, particularly safety issues caused by the installation of energy storage systems in underground parking garages and the lack of proper fire safety standards. Such issues have caused many commercial storage projects to be delayed indefinitely.

Policy updates and market adjustments have touched a nerve with energy storage stakeholders, and investment in large-scale applications at current technology prices carries a certain amount of risk. Yet from the viewpoint of project developers, energy storage is just one technology in an entire range of energy services. An open power market still promises many potential benefits, and customers are the key to increasing the value of energy services. In the future, the ability to provide a full range of energy services will be critical to maintaining customer confidence. Though policies tend to focus on the big picture, planning and design must begin by considering the way in which energy is changing and the market is opening. Doing so will avoid taking actions that support one area while inhibiting another. In the future, regional government agencies must put additional effort into the creation of environmentally minded power price mechanisms that push for reasonable peak and off-peak prices which reflect actual power supply-and-demand, and encourage customers to use power in a rational and realistic way.

Looking Ahead

2018 was a year of both excitement and disappointment for energy storage. The sudden leap in grid-side storage capacity infused new vigor into the industry, providing not only market growth but also driving the costs of energy storage technology down and pushing technologies towards applications that are more closely integrated with the grid. The advancements also helped bring China’s energy storage applications into the global spotlight. At the same time, the slow development of a mature market mechanism and policy support continues to lag behind the pace in which new storage applications are appearing. Ancillary services market regulations and long-term mechanisms are unclear, a lack of a proper behind-the-meter price mechanism has created increased investment risk, and many other issues have appeared or persist. The industry’s short-term benefits and long-term existence are still in urgent need of adjustment and resolution.

Despite just ten years of development, the rapid growth of energy storage is visible to all. Yet a mature storage industry cannot occur overnight. The support of renewable energy and the new generation of power systems is the natural purpose of energy storage, and the basis of its rapid development. With the encouragement of proper policies and the hard work of a variety of government bodies, we believe that energy storage can break through from its current challenges to become a driving force in the advancement of China’s energy system.