Recently, China Power Construction Group officially signed the EPC contract for the 2.1GW + 7.75GWh RTC solar-plus-storage project in Abu Dhabi, United Arab Emirates (UAE), with a contract value of approximately RMB 13.962 billion. As one of the largest integrated solar-plus-storage projects in the Middle East and even the world, the signing of the contract marks the project’s transition into the full implementation phase, which is projected to be delivered in 2027.

DOE now requires energy storage for large-scale renewable energy projects

Jinko ESS SunTera 5MWh Passes Stringent Large-Scale Fire Test, Validating Safety Boundaries

Jinko ESS, a global leading energy storage solution provider and a subsidiary of Jinko Solar Co., Ltd., recently announced the successful completion of a large-scale fire test for SunTera 5MWh Liquid-Cooling Energy Storage System. Conducted at a specialized testing facility in Suzhou City, Anhui Province, the test followed the CSA C800 standard and the November 2025 draft of UL 9540A and was witnessed on-site by CSA Group representatives and North American fire protection engineers.

Sharp Pullback! User-Side Energy Storage Additions in January Down 58% Year-on-Year

10.9 GWh! Newly Added New-Type Energy Storage Capacity in January Doubled Year-on-Year

Major Breakthrough Achieved in the R&D of the World’s First and Most Powerful Single-Unit Compressed Air Energy Storage Compressor

Recently, China has achieved a major breakthrough in the research and development of compressed air energy storage(CAES) technology . Developed jointly by the Institute of Engineering Thermophysics, Chinese Academy of Sciences(IET, CAS) and ZHONG-CHU-GUO-NENG(BEIJING)TECHNOLOGY CO.,LTD., the world’s first CAES compressor with the largest single unit power has successfully passed the third-party testing accredited by CNAS. According to the test results, the compressor achieved maximum discharge pressure of 10.1MPa, a maximum power output of 101MW and an operating range of 38.7% to 118.4% under variable conditions and an efficiency of 88.1% at maximum discharge pressure, reaching an internationally leading level.

Major Policy Breakthrough! China Officially Includes New-Type Energy Storage Into Capacity Pricing Mechanism for the First Time! Notice on Improving Generation-Side Capacity Pricing Mechanism Released

On January 30, 2026, National Development and Reform Commission (NDRC) and National Energy Administration (NEA) jointly issued Notice on Improving Generation-side Capacity Pricing Mechanism.

Establishment of a capacity pricing mechanism for grid-side independent new-type energy storage. In terms of grid-side independent new-type energy storage power station serving safe electricity system operation and not engaging in energy distribution, local government can grant capacity prices. On the basis of local coal-fired capacity price benchmarks, the capacity prices shall be converted according to peak-shaving capability ( conversion rate is the ratio of full-power continuous discharge duration to the longest annual net-load peak duration, capped at 1) and considers factors like electricity market development and power system demand. Such projects shall be managed under a project list system, with specific requirements determined by NEA. Provincial energy and pricing authorities shall jointly formulate the project lists.

To the Development and Reform Commissions of all provinces, autonomous regions, Municipality directly under the Central Government and the Xinjiang Production and Construction Corps, National Energy Storage Commission, Tianjin Industrial and Information Technology Bureau, Department of Industry and Information Technology of Liaoning Province, Chongqing Economic and Information Commission, Industry and Information Department of Gansu Province, Beijing Municipal Commission of Urban Management, National Energy Administration Regional Offices, State Grid Corporation of China, China Southern Power Grid Company Limited, Inner Mongolia Power(Group) Corporation Limited, China National Nuclear Corporation, China Huaneng Group.,Ltd, China Datang Corporation Ltd., China Huadian Corporation, State Power Investment Corporation, China Three Gorges Corporation, China Energy Investment Corporation Co., Ltd., State Development & Investment Corp., Ltd., China Resources (Holdings) Co., Ltd., China General Nuclear Power Group:

To implement the decisions and arrangements of the CPC Central Committee and State Council on advancing pricing reform in the energy sector, accelerate to build new-type energy system, guide the stable and orderly construction of adjustable power supply, ensure safe and stable operation of power system and facilitate green economic and social development, the following matters concerning the improvement of the generation-side capacity pricing mechanism are hereby notified.

I. Overall Approach

In line with the development needs of new-type power system and the electricity market system, greater coordination shall be achieved among safe and stable power supply, green and low-carbon energy transformation and efficient economic allocation of resources. Capacity pricing mechanisms for coal-fired power, natural gas power generation, pumped storage hydropower and new-type energy storage shall be improved in a differentiated manner and electricity market mechanisms shall be optimized. After the continuous operation of the electricity spot market, a generation-side reliable capacity compensation mechanism shall be gradually established. Reliable capacity shall be compensated based on peak contribution capability under unified principles, fairly reflecting the contribution of different types of generation and storage resources to system peak demand.

II. Differentiated Improvement of Capacity Pricing Mechanism

A. Coal-fired power and natural gas generation. In align with the demand of Notice on Establishing a Coal-Fired Power Capacity Pricing Mechanism (NDRC Price Document No. 1501 [2023]), local departments shall increase the ratio of fixed costs recovered through capacity pricing for coal-fired units to no less than 50%, which can be further enhanced according to the practical situation including local market development and utilization hours.

Provincial-level pricing authorities may establish a capacity pricing mechanism for natural gas power generation with capacity price determined by the recovery of a certain proportion of fixed assets.

B. Pumped storage hydropower. For pumped storage projects that commenced construction (Water intake abstraction, temporary land use and environment impact assessment approvals) before the issuance of Opinions on Further Improving the Pricing Formation Mechanism for Pumped Storage Hydropower (NDRC [2021] No. 633, hereinafter referred to as the “Document No. 633”), capacity prices shall continue to be government-regulated and determined or reviewed by provincial pricing authorities in accordance with Document No. 633. After the expiration of operation period, price should be reviewed on principles of compensating necessary technology reform output and operation and maintenance costs.

In spirit of the gradual achievement through participation in market to recoup cost and acquire revenue of Document No. 633, for projects commenced after the issuance of Document No. 633, provincial pricing authorities shall, every 3–5 years, determine a unified capacity price for newly commenced projects within the same provincial grid based on the principle of covering average costs over the operating period according to the cost parameter rules clarified in Document No. 633. Capacity prices shall be reduced for projects with full-power generation duration of less than six hours. Implement years are determined on electricity market construction and development, power system demand and sustainable development of power stations. Meanwhile, pumped storage power stations shall independently participate in electricity energy markets and ancillary services markets. Market revenues shall be shared between the power station and the system according to proportions determined by provincial pricing authorities, with the remaining portion used to offset system operating costs and benefit users.

C. Establishment of a capacity pricing mechanism for grid-side independent new-type energy storage. In terms of grid-side independent new-type energy storage power station serving safe electricity system operation and not engaging in energy distribution, local government can grant capacity prices. On the basis of local coal-fired capacity price benchmarks, the capacity prices shall be converted according to peak-shaving capability ( conversion rate is the ratio of full-power continuous discharge duration to the longest annual net-load peak duration, capped at 1) and considers factors like electricity market development and power system demand. Such projects shall be managed under a project list system, with specific requirements determined by NEA. Provincial energy and pricing authorities shall jointly formulate the project lists.

III. Orderly establishment of a grid-side reliable capacity compensation mechanism

A. General acquirement on reliable capacity compensation mechanism. Reliable capacity refers to the sustainable power supply from units in system peak period all year round. After continuous operation of spot market, provincial pricing authorities together with relevant departments shall establish a reliable capacity compensation mechanism and compensate units’ reliable capacity on unified principles. To compensate the unrecovered fixed cost of marginal units in energy and auxiliary services market, the compensation standards will take electricity supply-demand conditions, user affordability and electricity market development into account and make appropriate adjustments. Regions with high new energy installations and heavy dependable capacity demand shall accelerate to establish a reliable capacity compensation mechanism. Guided by national policies, regions equipped with relative conditions can combine electricity market construction situation to form capacity price through ways like capacity markets.

B. Justify compensation scope. The compensation scope of capacity compensation mechanism may includes coal-fired power, natural gas power and correspondent grid-side independent new-type energy storage that voluntarily participating in local electricity market and combine electricity market development and market-based price reform to gradually expanded into pumped storage hydropower and other units equipped with reliable capacity; no duplicate compensation shall be provided for capacity that receives other forms of support or guarantee. Units subject to government-administered pricing are not eligible for compensation.

C. Ensure effective coordination with capacity price policies. After establishing a reliable capacity compensation mechanism, relevant units including coal-fired power, natural gas power and grid-side independent new-type energy storage shall no longer perform original capacity prices. Leveraging the relatively mature market system, provincial-level pricing authorities may uniformly apply the reliable capacity compensation mechanism to pumped storage hydropower stations whose construction commenced after the issuance of this Notice. Such stations shall also participate in the energy and ancillary service markets, with all market proceeds accruing to the station owners. Pumped storage hydropower stations whose construction commenced after the release of Document No. 633 are encouraged to voluntarily opt for the reliable capacity compensation mechanism and participate in the electricity market.

IV. Improve relevant supporting policies

A. Improve electricity market trading and pricing mechanisms. After the improvement of coal-fired power capacity pricing mechanisms, regions may adjust the floor price of medium- and long-term market transaction prices of provincial coal-fired power according to electricity market supply and demand and all units variable cost participating in market and loose the ratio requirements of coal-fired power medium- and long-term contract signing while ensure power and energy balance. Both supply and demand sides are encouraged to sign flexible pricing mechanisms according to market supply-demand and generation cost changes in medium- and long-term contracts. While supply and demand sides in provincial market signing medium- and long-term contracts, local authorities cannot enforce the fixed-price contracts. They may require that a certain proportion of energy in annual medium- and long-term contracts adopt flexible prices reflecting real-time supply and demand according to power supply-demand and market structure.

B. Improve electricity fee settlement policies. Capacity fee and reliable capacity compensation fee of above adjustable power supply will be included into local system operation fee. In regions where spot markets operate continuously, pumped hydro storage’s pumping/generation and grid-side independent new-type energy storage charging/discharging prices are performed by market rules or real-time spot prices; In regions where spot market do not operate continuously, pumping (charging) price shall follow the grid-procured electricity price for commercial and industrial procxy users. The method for determining the generation (discharging) price shall be established by provincial pricing authorities, taking into account factors such as charging/discharging losses across different technology pathways. During pumping (charging), pumped storage hydropower and grid-side independent new energy storage shall be considered as consumers, liable for transmission and distribution network loss fees and system operation fees, and shall temporarily be subject to transmission and distribution tariffs on a per-energy-consumed basis. The corresponding transmission and distribution fees shall be deducted or refunded for generated (discharged) energy. Market revenue shared by pumped storage hydropower stations according to specified proportions shall be settled monthly and cleared annually.

C. Clarify allocation methods for capacity fees of regionally shared pumped storage hydropower. The allocation ratio for capacity fees of regional shared pumped storage hydropower stations shall be determined by capacity allocation ratio which are encouraged to be improved in a market-based way. For stations with clearly defined capacity allocation ratios, the specific ratio applies; For projects that have been approved but lack a defined capacity allocation ratio, the energy and pricing authorities of the province where the project is located shall organize consultations with the energy and pricing authorities of provinces intending to share the costs to determine and specify the ratio. For newly proposed projects not yet approved, the ratio shall be determined through consultation following the above principles and specified in the project approval document.

V. Ensure effective organization and implementation.

A. Strengthen work synergy. Provincial pricing authorities together with relevant departments shall improve capacity pricing policies and build a reliable capacity compensation mechanism. Besides, they are expected to ensure effective organization and implementation as well as policy interpretation to guide companies strengthen operation and management and boost sound industrial development. Relevant departments should also scientifically evaluate the reliable capacity demand of local electricity systems. Local areas should speed up to establish and improve power market system to encourage the equal access to markets including power and energy and auxiliary services for pumped storage hydropower and new-type storage units so as to better reflect adjustment value and strengthen the adjustable capabilities. Grid companies should work together with departments to roll out data evaluation, sign adjustment and operation agreements and contracts with power stations, perform well in market revenue calculation and settlement, report relative situation to provincial pricing authorities and National Development and Reform Commission( Department of Price). The state will strengthen guidance to all regions to promote smooth implementation.

B. Establish an Electricity Price Affordability Assessment System. Provincial pricing authorities, in conjunction with energy authorities, shall establish a user economic affordability assessment system. The assessment results shall serve as a crucial basis for determining reliable capacity compensation standards, formulating plans for power system regulation capabilities, and development plans for new energy and new energy storage, as well as for approving projects like pumped storage hydropower. Regions with abundant reliable power system capacity or weak user economic affordability shall strictly control the addition of new adjustable power source projects. Projects lacking a user economic affordability assessment shall not be included in planning or approved, and shall not be eligible for capacity fees or reliable capacity compensation.

C. Strengthen Capacity Fee Assessment. Capacity fee assessment measures shall be refined in conjunction with management requirements for various types of generating units, conducting assessments by category to guide units in improving production operation levels and enhancing peak output capability. After the establishment of the reliable capacity compensation mechanism, assessments shall be further strengthened and strictly enforced to fully leverage the guiding role of capacity pricing. Capacity fees or reliable capacity compensation shall be deducted for units failing to meet assessment requirements, with specifics to be clarified by provincial pricing authorities in consultation with relevant parties.

National Development and Reform Commission

National Energy Administration

January 27, 2026

In 2025, under the guidance of relevant departments, the China Energy Storage Alliance (CNESA) led a consortium including North China Electric Power University, the Institute of Finance, Accounting and Auditing of State Grid Energy Research Institute, the Institute of Energy Strategy and Planning of State Grid Energy Research Institute, and the Institute of Engineering Thermophysics of the Chinese Academy of Sciences to complete the research project "Study on Market-Oriented Capacity Compensation Mechanisms for Energy Storage." This study provides an important reference for national policy formulation.

To assist the industry in accurately grasping policy opportunities, CNESA will host an online live broadcast for the "Study on Market-Oriented Capacity Compensation Mechanisms for Energy Storage" Results Release and Policy Interpretation session in the near future. Core experts from the research project will be invited to share the findings and analyze key points of capacity compensation policies.

Everyone is welcome to scan the QR code to schedule the live broadcast.

Register now to attend Asia’s Largest Energy Storage Trade Show for free:

What: The 14th Energy Storage International Conference & Expo

When: Conferences: March 31 - April 2, 2026

Exhibitions: April 1-3, 2026

Where: CIECC Beijing, China

Address: No. 55 Yudong road, Shunyi District, Beijing China

Key Energy Storage Standards to Watch in 2026 Highly Recommended for Industry Reference

500MWh!BYD Energy Storage Has Commissioned Its Largest Energy Storage Project in East Europe

On January 8, 2026, a 500MWh standalone Battery Energy Storage System(BESS) project located at Maritsa East 3 in Bulgaria was officially commissioned. The project was the jointly developed by BYD Energy Storage and ContourGlobal under their strategic collaboration which is one of the largest standalone energy storage projects in East Europe.

Tianneng Signs a 1GWh Project in Malaysia, Build a benchmark for Integrated “Solar- Storage- Computing”Solutions

Recently, Tianneng Group signed a strategic agreement with NASDAQ-listed company VCIG Group. The two parties will build a 1GWh AIDC solar energy storage power station in Malacca, Malaysia. The project aims to address the high-energy-consumption challenge of AIDC and will be developed under an “EPC+F” model.

An additional 66.43GW/189.48GWh Added! CNESA DataLink 2025 Annual Energy Storage Data Release

On January 22, Energy Storage International Conference and Expo 2026 Press together with CNESA DataLink 2025 Annual Energy Storage Data Release was held in Beijing, China. Enterprises across the energy storage value chain and authoritative media outlets closely following the sector gather together to review the past developments and look ahead to the future.

During the press, Chen Haisheng, director, Institute of Engineering Thermophysics, Chinese Academy of Sciences Chairman, China Energy Storage Alliance, on behalf of China Energy Storage Alliance (CNESA), delivered a comprehensive overview of the development of China’s new-type energy storage industry in 2025 and shared insights into trends for 2026.

Liu Wei, Secretary General of CNESA reported the preparatory progress of the 14th Energy Storage International Conference And Expo (ESIE 2026). ESIE 2026 is set to achieve comprehensive value upgrade with the core to build a true “energy storage ecosystem exhibition”. It aims to not only attract attention but committed more to create industry value-- through accurate resource matching, in-depth content services and long-term and effective ecosystem connections to establish a platform empowering the full lifecycle growth of energy storage enterprises.

Meanwhile, as China stands at the critical juncture of market-oriented transition for standalone energy storage during the 15th Five-Year Plan period, amid widening regional policy divergence and rising challenges in industrial decision-making, CNESA released the first toolbook-style policy map for standalone energy storage market mechanisms. It will also focus on key policies in 21 provinces, break down their revenue models, explore mechanism highlights and evaluate the profitability level, providing efficient decision-making references for governments, companies and investment institutions and contributing to the industry high-quality development.

01.

Scale of New-type Energy Storage Projects

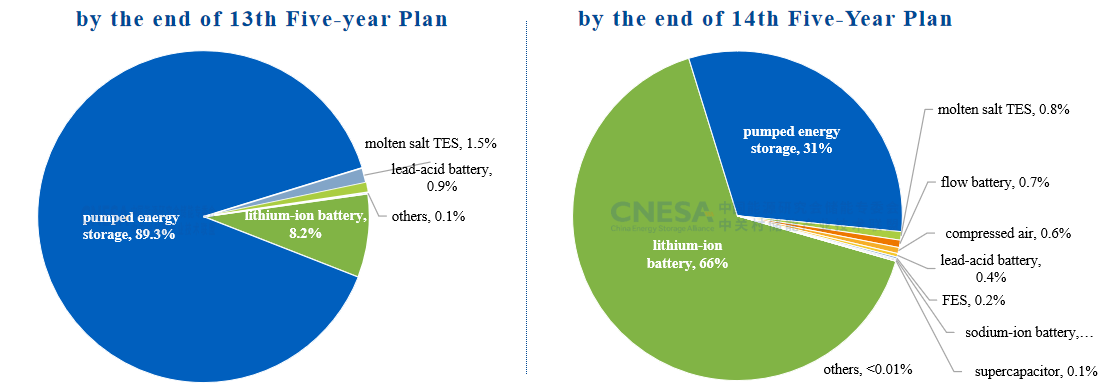

Total Power Storage Capacity Reaches 213.3GW with New-Type Energy Storage Accounting for Over Two Thirds

According to the incomplete statistics from CNESA Datalink Global Energy Storage Database, by the end of December, 2025, China’s cumulative installed power storage capacity reached 213.3GW with an increase of +54% year on year. 2025 marks the end year of the 14th Five-Year Plan, the market share of energy storage technologies saw changes compared with that of the 13th Five-Year Plan period. Pumped hydro storage accounted for 31.3% of total capacity, the new-type energy storage represented by lithium battery witnessing leapfrog growth and the cumulative installed capacity of new-type energy storage exceeded two thirds of the total, accelerating the industry’s transition from single dominant technology toward diversified development.

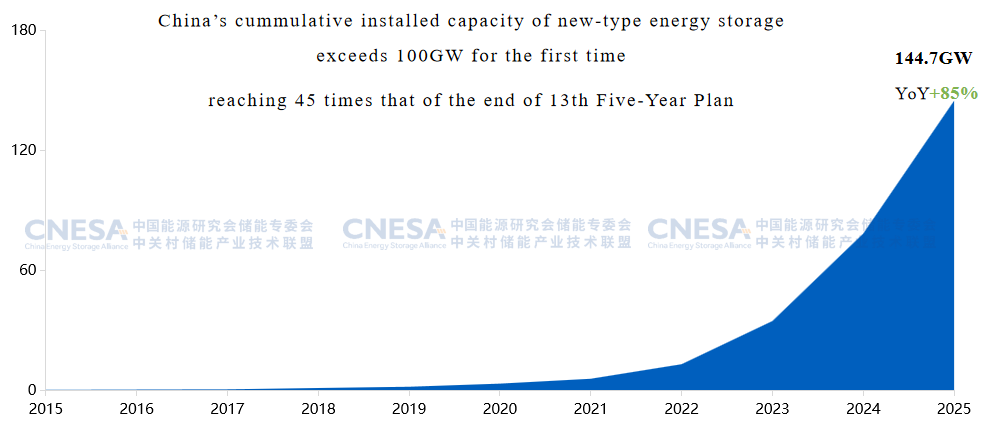

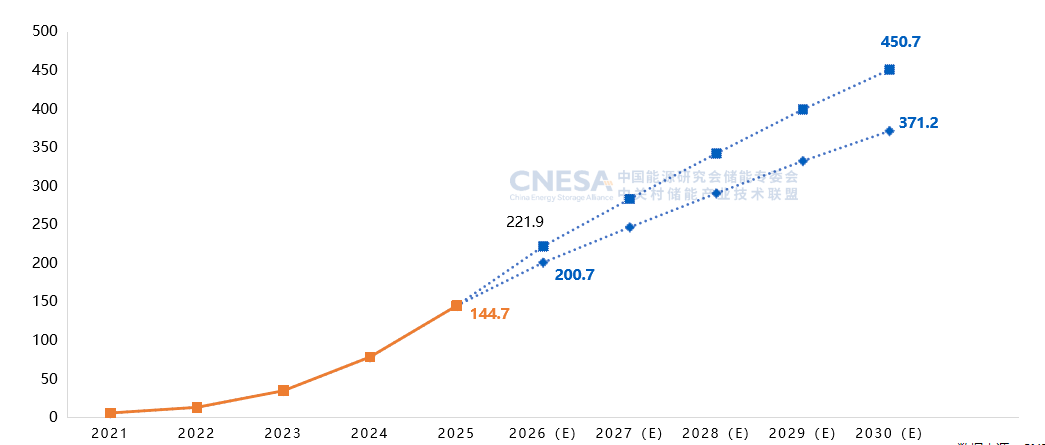

Cumulative Installed Capacity of New-Type Energy Storage Exceeds 100GW

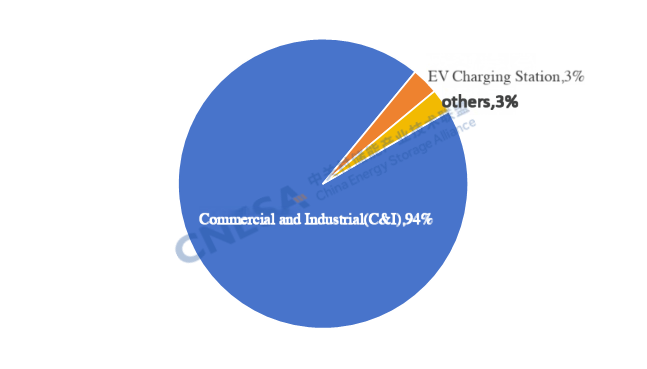

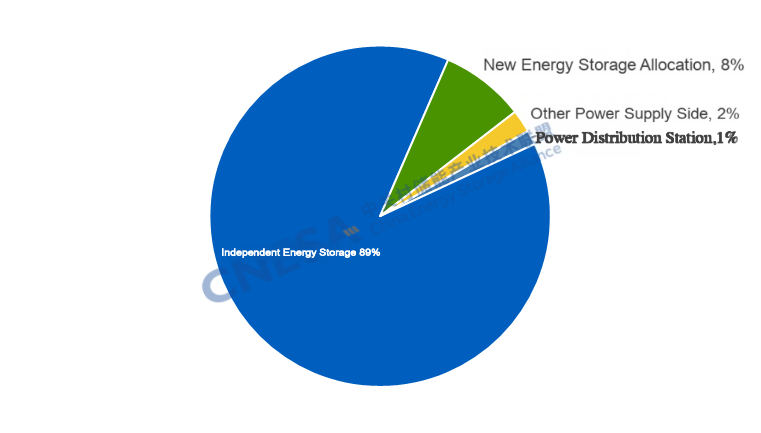

By the end of December, 2025, China’s cumulative installed capacity of new-type energy storage reached 144.7GW, witnessing a year-on-year increase of +85%. It was the first time that China’s cumulative installed capacity of new-type energy storage exceeded 100GW, reaching 45 times that of the end of 13th Five-Year Plan. The major application scenario of China’s new-type energy storage has shifted from being dominated by the user-side (35%) to being primarily standalone energy storage (58%); Thermal power plus storage for frequency regulation (1.4%) and user-side storage (8%) witnessed evident decline; New energy paired storage share remains steady.

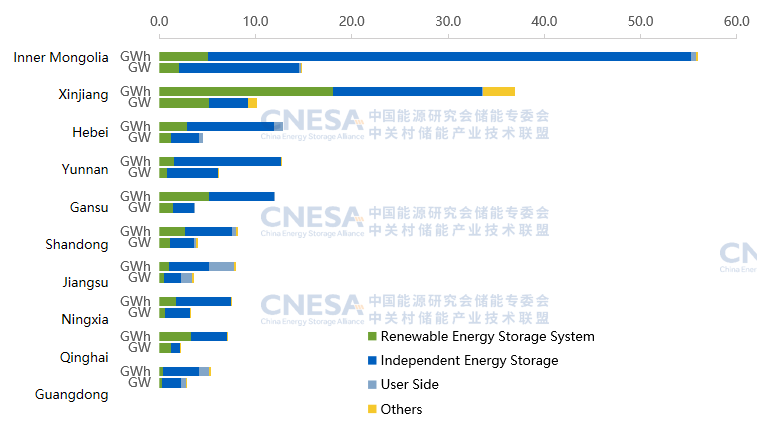

Newly Commissioned Capacity Reaches 66.43GW/189.48GWh

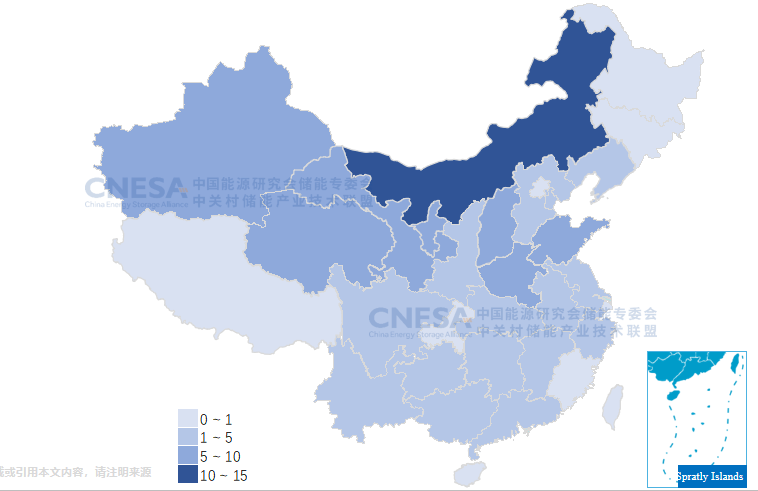

China commissioned 66.43GW/ 189.48GWh of new-type energy storage capacity, with an increase of 52%/73% in power size and energy scale respectively. In terms of regional dispatch, all top 10 provinces’ installed capacity was more than 5GWh, totaling about 90%; Western provinces took full lead, with Inner Mongolia ranking first in both power and energy capacity, surpassing California to become the world’s leading province by scale. Yunnan Province entered the Top10 for the first time.

02. New-Type Energy Storage Bidding and Tendering Market

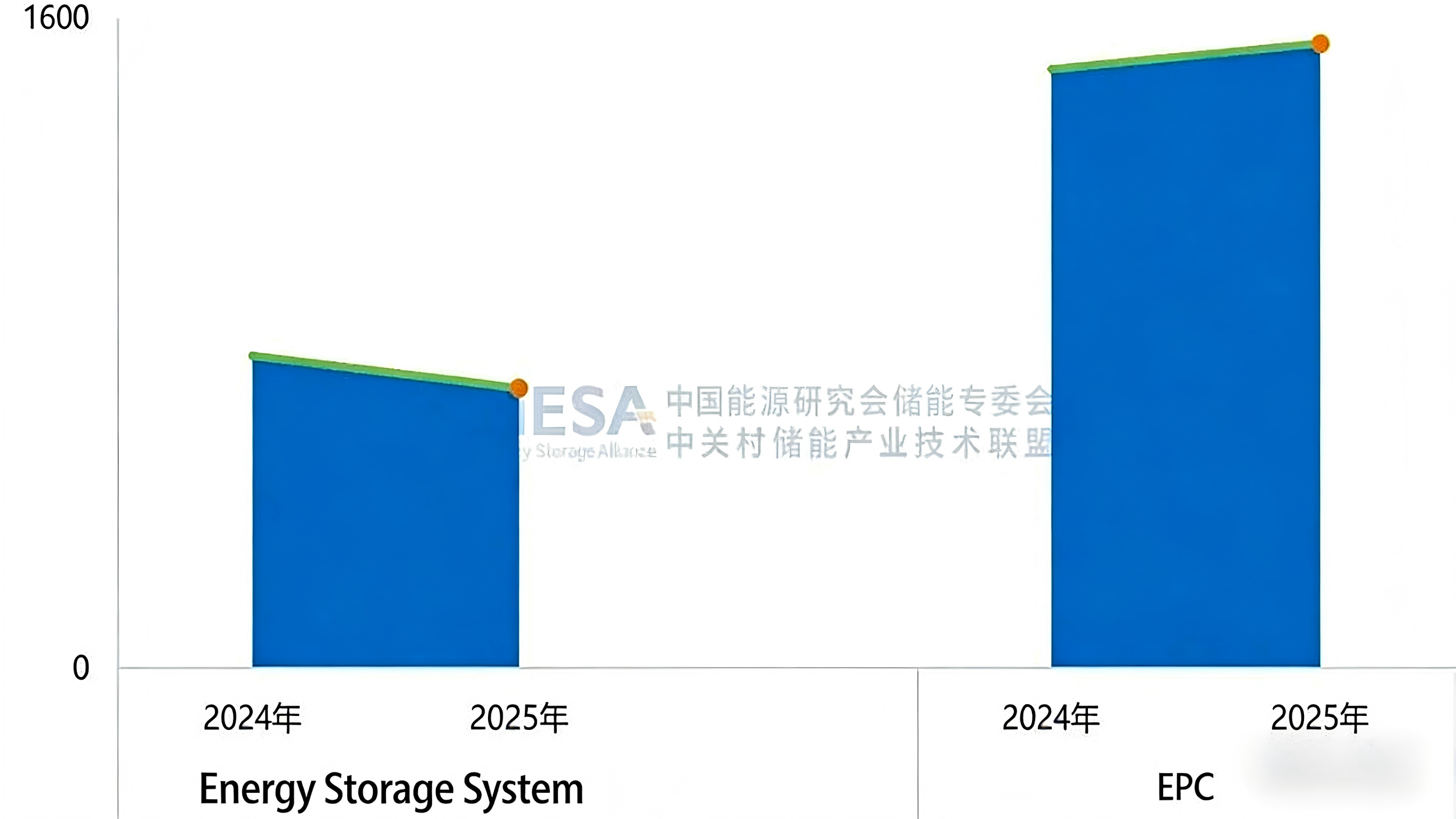

Decline in Energy Storage System Tenders, Increase in EPC Tenders

According to incomplete statistics from CNESA DataLink Global Energy Storage Database,690 energy storage system tender packages (excluding centralized and framework procurement) were issued in 2025, down 10.4% year on year. In contrast, 1,536 EPC tender packages (excluding centralized and framework procurement) were released, representing a 4.5% increase. This shift indicates changing construction preferences in the non-centralized and framework procurement market, with project owners increasingly favoring integrated, turnkey delivery models that outsource construction and risk management.

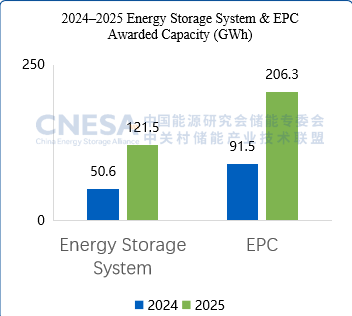

Winning Bid Volumes for Energy Storage Systems reach 121.5GWh and 206.3GWh for EPC

In 2025, the winning bid volume for energy storage systems (excluding centralized and framework procurement) reached 121.5GWh, up 140.1% year on year. Meanwhile, EPC projects recorded a winning bid volume of 206.3GWh, representing a 125.5% increase.

03. New-Type Energy Storage Policies

High Policy Activity Maintained

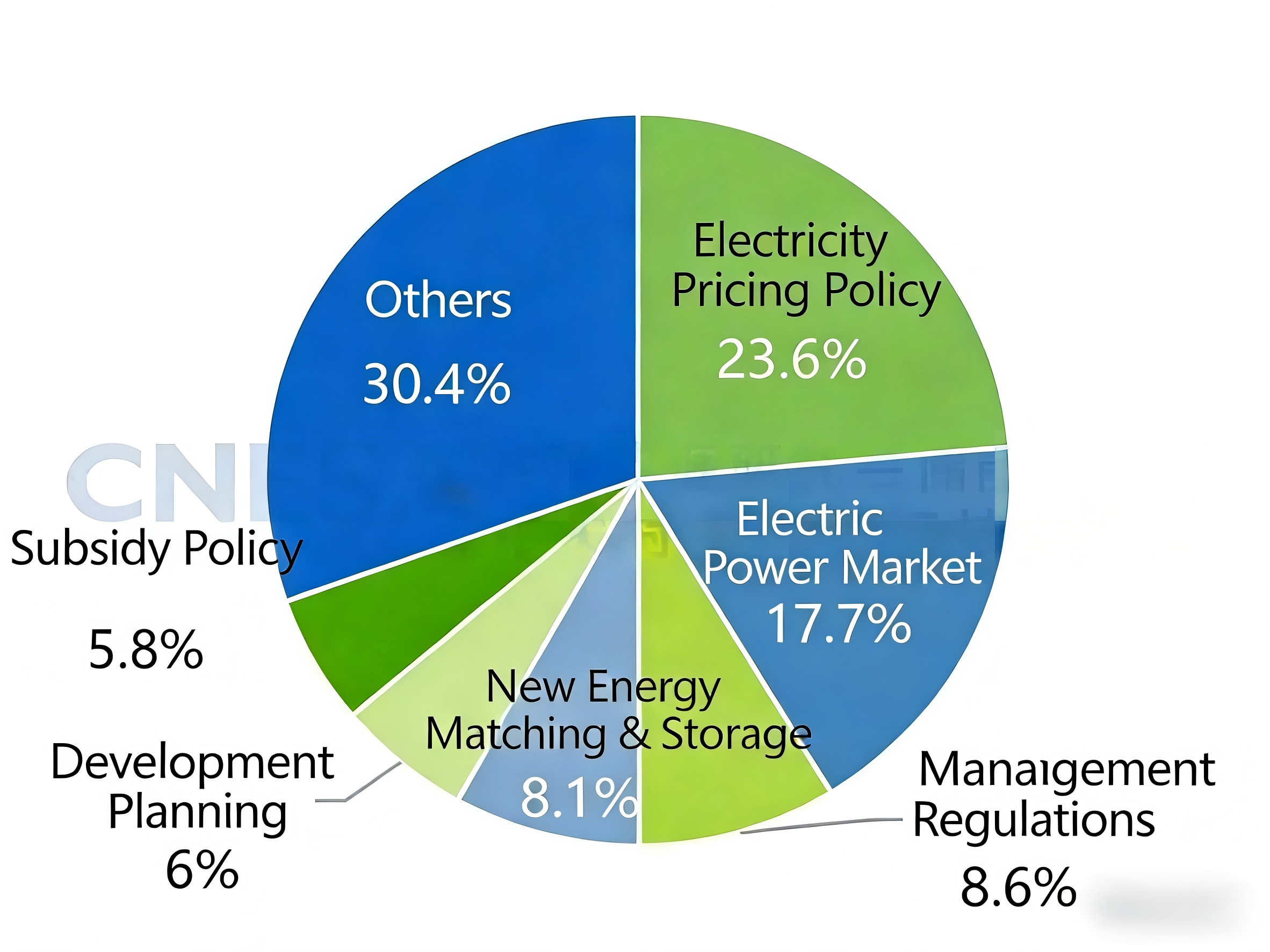

CNESA pays attention to energy storage policy development for a long term and rolled out 869 relevant policies with a year-on-year increase of 13%; Market-oriented reform entered rapid development with electricity pricing and power market policies keeping the heat high and regulatory and management-oriented policies sharing larger proportion.

Many Provinces Have Realized the 14th Five-Year Plan Targets

By the end of 2025, the total installed capacity of provincial new-type energy storage in 14th Five-Year Plan period exceeded 91.6GW. In terms of practical installed capacity, most provinces nationwide have achieved their respective planning targets of the 14th Five-Year Plan.

Commercial and Industrial Energy Storage Moves Toward Marketization, with Cumulative Capacity Expected to Exceed 30GW During the 15th Five-Year Plan

In early 2025, document No. 136 promoted the full market participation of the new energy electricity generation. The medium-and-long-term rules by the end of 2025 canceled artificially prescribed time-of-use pricing for market participants. It can be seen that the load-side users will gradually enter market and commercial and industrial energy storage in 2026 will move towards marketization in phase.

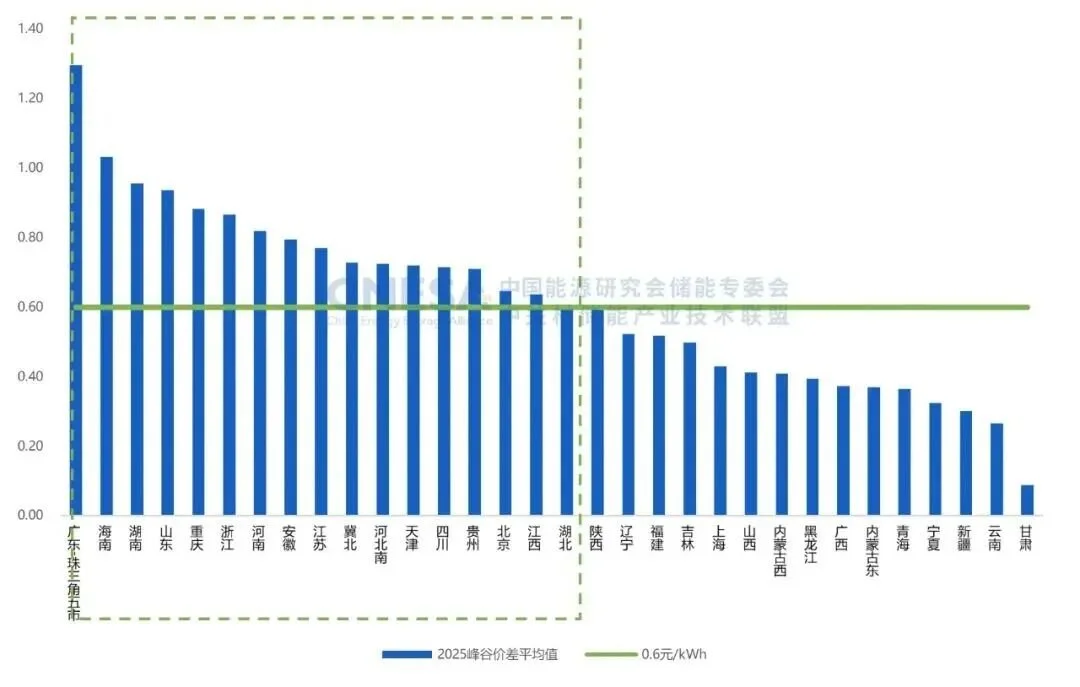

For time-of-use pricing, several places have matched spot market to adjust time-of-use and pricing scope with a general narrowing of price spreads. A majority of regions saw bearish news from the short term. For grid agency purchase electricity price, the average price spread of 32 regions was RMB0.616 per kWh with a year-on-year decrease of 9.4%.

Meanwhile, China encourages commercial and industrial users at 10kv and above to directly participate in the electricity market and gradually narrow the grid agency purchase user scope. Therefore, in the future, the pricing spread arbitrage of commercial and industrial will be decided by the real-time market supply and demand, which is unsustainable only depending on the fixed price spread arbitrage model.

Looking into the 15th Five-Year Plan, commercial and industrial energy storage will keep steady growth with diverse revenue streams, shifting from single “fixed price spread arbitrage model” to “fluctuated market price spread arbitrage+demand charge management+demand response”. The cumulative installed capacity is expected to exceed 30GW.

04.

Outlook for the New-Type Energy Storage

Cumulative installed capacity of new-type energy storage is expected to exceed 370GW by 2030

Looking ahead to the 15th Five-Year Plan, key development trends include:

Policy: New-type energy storage will be driven by market mechanisms, continue to expand new application scenarios and innovate business models together the green value and facilitate the industrial high-quality development.

Technology: The industry has entered a phase of multi-technology coexistence. Diverse energy storage technologies are expected to continue achieving breakthroughs across multiple scenarios and scales throughout the 15th Five-Year Plan period and long-duration energy storage will come into a critical development phase.

Energy Storage Duration: According to CNESA, the average time-spun of cumulative new-type energy storage installations witnessed slow increase between 2021 and 2025 from 2.11 hours to 2.58 hours. From 2026 onwards, the duration growth is expected to speed up evidently, which will reach 3.47 hours by 2030. This change reflects the intensified demand of ongoing technological progress and market for long-duration energy storage. This industry is moving towards in-depth application scenario emphasizing more on energy capacity including energy transfer time and system regulation.

Installation Capacity: Historical statistic shows that China’s new-type energy storage has entered rapid development. Over the past 5 years, the cumulative installation of new-type energy has been 40 times larger. As installed base grows, growth rate slowing down will be definite. Looking into the 15th Five-Year Plan, in spite of moderate development, the large base will continue to generate considerable absolute increase. The cumulative installed capacity in 2030 is expected to exceed 370GW.

Register now to attend Asia’s Largest Energy Storage Trade Show for free:

What: The 14th Energy Storage International Conference & Expo

When: Conferences: March 31 - April 2, 2026

Exhibitions: April 1-3, 2026

Where: CIECC Beijing, China

Adress: No. 55 Yudong road, Shunyi District, Beijing China

Amazon buys 1.2GW Sunstone solar-plus-storage project from bankrupt Pine Gate

Annual Power Cost Savings Exceed RMB 60 Million ! Great Power’s 107MW/428MWh Hydropower-based Aluminium User-side Energy Storage Project is Commissioned

RMB 180 Billion! China Southern Power Grid Hit a New High for Investment in 2026

Expanding effective investment is a key lever for stabilizing growth and improving people’s livelihoods. According to China Southern Power Grid, the company has embarked RMB 180 billion for fixed-asset investment in 2026, marking a record high for fifth consecutive year, with an annual growth rate of 9.5%. Investment will be directed primarily toward the development of a new-type power system, the growth of strategic emerging industries and the enhancement of high-quality power supply services, providing solid support for a strong start to the 15th Five-Year Plan period.

CORNEX Secures a 6GWh Energy Storage Order in Egypt, Successfully Expanding Into the North African Market

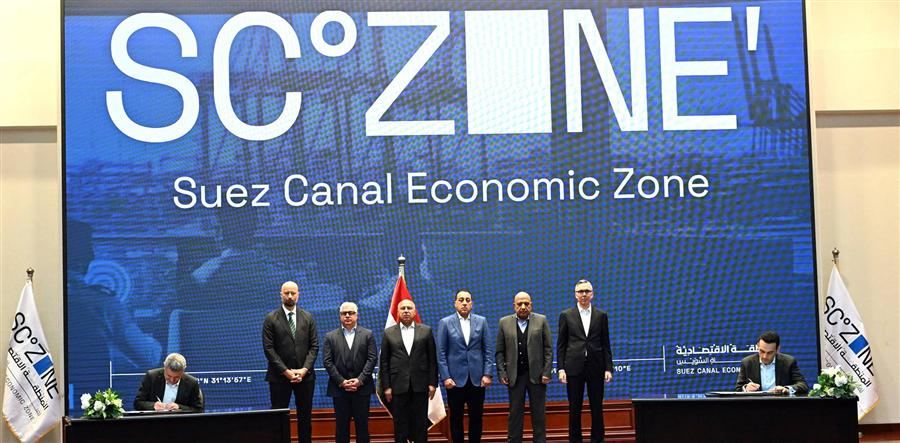

On January 16th, Cornex New Energy signed a strategic cooperation agreement with Egypt-based partners WeaCan and Kemet.

The agreement was signed by Dai Deming, chairman of Cornex New Energy and Ahmed Salaheldin Abdelwahab Elabd, Chiarman of the Board of Kemet. The signing ceremony was witnessed by Moustafa Kamal Esmat Mahmoud, minister of Egypt’s Ministry of Electricity and Renewable Energy, along with other government officials and senior executives from relevent enterprises.

100MW/200MWh! Sineng Electric Supports Commissioning of Phase I of Nanlang Energy Storage Power Station

The Phase I 100MW/200MWh Nanlang energy storage power station, supplied by Sineng Electric, has now been successfully commissioned and put into operation. As the first large-scale standalone energy storage project on the grid side to be completed and commissioned in Zhongshan, China, the facility not only injects enhanced flexibility into the regional power grid, but establishes efficient and reliable revenue mechanism through an innovative frequency regulation service model.

500MW/200MWh! JD Energy’s First GWh-Level Project Successfully Grid-Connected

In December 2025, the 500MW/2000MWh energy storage project was successfully grid-connected in Dengkou, Inner Mongolia. The energy storage station, standing proudly under the winter sun, is the first GWh-level project delivered by JD Energy. It not only set a new record for the scale of a single project but marked a significant milestone in the company’s development with its outstanding construction achievements.

2025 Marks the First Year of Mass Production for Large Energy Storage Cells! 500Ah+ Mass Deliveries, ESIE 2026 Energy Storage Expo Invites Global Buyers to Explore New Opportunities

2025 marks a pivotal year for the energy storage industry. The large energy storage cells, which were once limited to “theoretical parameters”, will officially bid farewell to the technical competition phase and enter the practical testing stage of capacity release, yield improvement, and project implementation. Leading enterprises like CATL, EVE, Envision, HTHIUM, and SUNWODA have successively achieved mass production and delivery, and with the intensive landing of GWh-level strategic cooperation and accelerated expansion into overseas markets, this marks the transition of large-capacity cells from lab prototypes to commercial applications. The speed at which energy storage systems are evolving to higher energy density and lower cost has far exceeded industry expectations.

Sungrow’s First Energy Storage Plant in the Middle East Launched,with an Annual Capacity of 10 GWh

Egypt has taken a major step toward accelerating its clean energy transition, as Chinese energy storage leader Sungrow and Norwegian renewable developer Scatec partner with the Egyptian government to deliver large-scale solar+storage projects and establish the Middle East’s first battery energy storage manufacturing base, with a planned annual capacity of 10 GWh.