Germany's battery storage sector is urging the Federal Network Agency (BNetzA) to extend the current grid fee exemption for battery energy storage systems (BESS) through 2034. The exemption, which currently applies to all storage systems, is set to expire at the end of 2028 for new installations. Industry leaders warn that prematurely reinstating grid fees in 2029 could hinder billions in investment, delay deployment, and obstruct Germany’s clean energy targets.

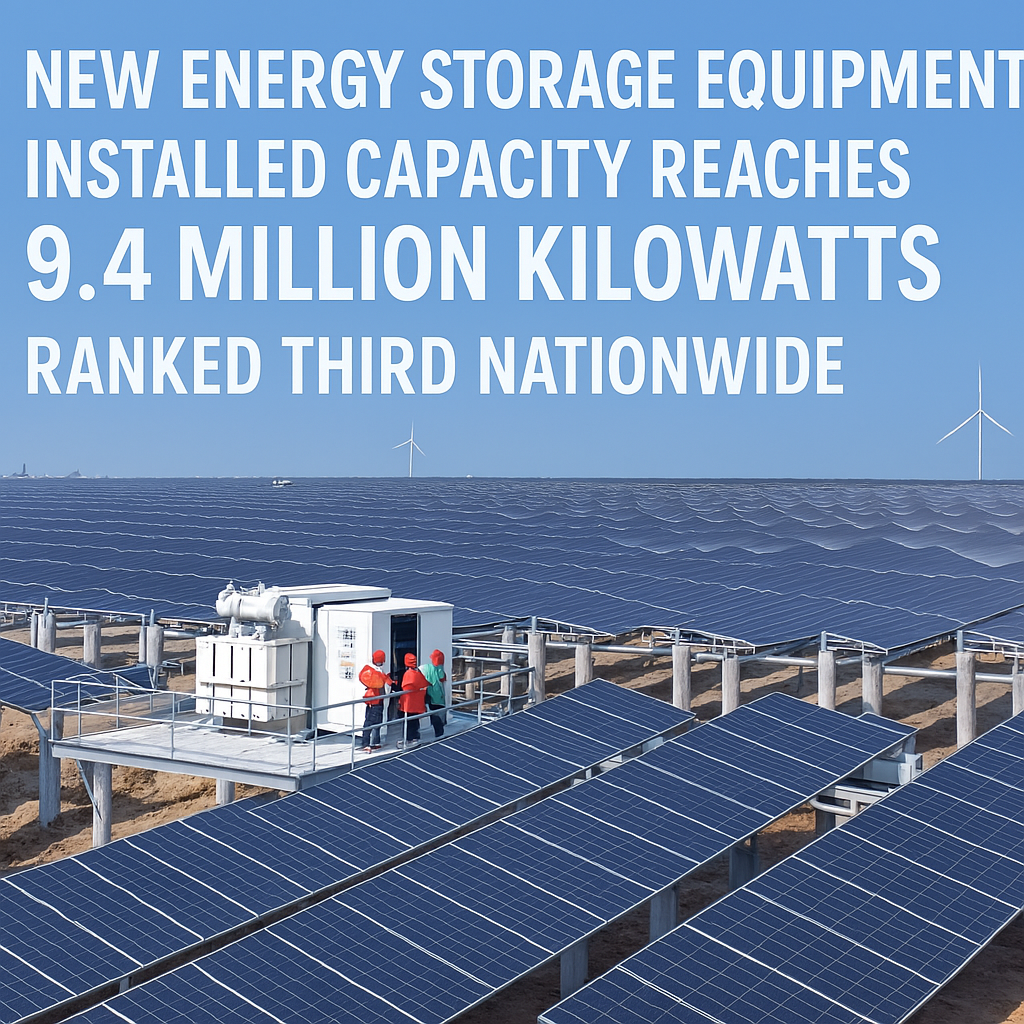

Image: ABO Energy

Under the proposed grid fee reform, the Federal Network Agency is developing a new General Grid-Fee System (AgNES), which would begin charging BESS to contribute to grid expansion costs. While the agency argues for broad participation in funding the grid, the battery sector cautions that implementing charges without a clear, defined rationale could disrupt market development. Thorsten Klöpper, head of German operations at Voltwise, emphasized that a rushed reintroduction would restrict both the growth of storage systems and their ability to support grid and market operations.

As part of the consultation, Voltwise and over 20 companies submitted a joint declaration supporting a phased model that allows for continued exemption through the next regulatory period, ending in 2034. They argue that this timeframe would enable collaborative definition and measurement of “grid friendliness,” allowing for the eventual integration of storage into a fair and functional fee system.

Compliance Framework & Industry Response

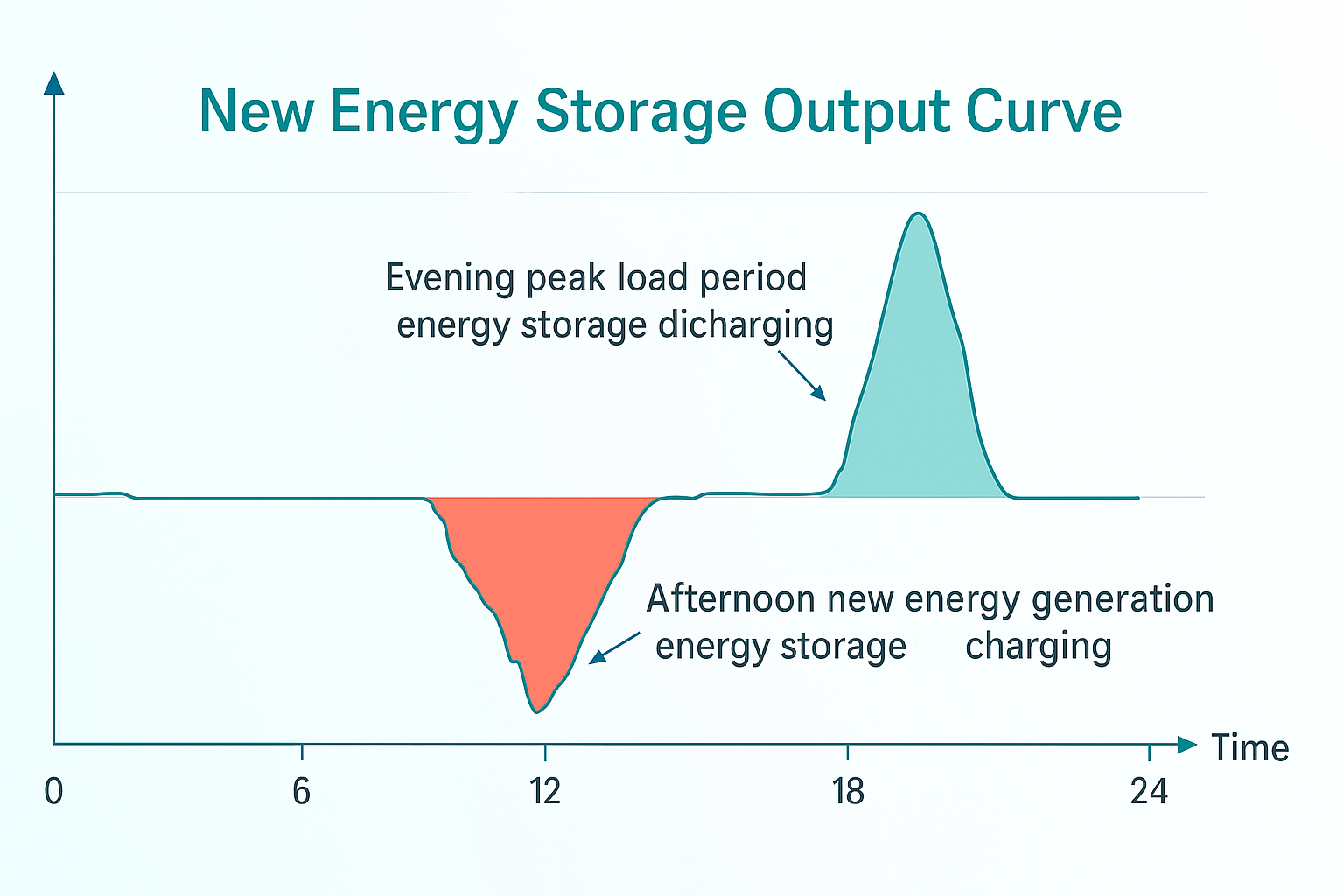

The proposed three-stage model includes: an extension of the exemption until 2034; subsequent introduction of performance-based tariffs that reflect grid support; and long-term development of dynamic, cost-reflective pricing based on actual system impact. According to the declaration, this approach aligns with Germany’s coalition government agreement, which advocates support for flexibility resources without additional financial burdens.

Currently, Germany has only 2 GW of connected large-scale BESS capacity, with a significant volume of projects awaiting grid access. Developers face long delays — up to 15 years for large systems — due to backlogs and “phantom” applications that overload grid operators’ processing capacity. This mismatch between demand and implementation is creating operational bottlenecks that risk undermining energy transition goals.

Participating companies in the joint appeal include Voltwise Power Holdings, ABO Energy Fabrik, Aquila Capital, Suena GmbH, and LEAG Group, among others. These firms represent a broad segment of the battery storage value chain, from developers to system integrators. They collectively stress that early grid fees could jeopardize up to €10 billion in planned investments through 2030 and make co-located renewable projects economically unviable in regions with weak grid infrastructure.

The Netherlands is cited as a cautionary example: adverse fee structures there stalled battery deployment, a policy misstep only recently corrected. To avoid similar setbacks, the German industry proposes pilot programs, joint efforts with grid operators, and digital infrastructure upgrades to establish feasible grid integration pathways.

The battery storage industry’s appeal emphasizes the need for deliberate planning before integrating BESS into the national grid fee structure. As of July 2025, no official definition or measurement criteria for "grid friendliness" exist. The sector is calling for a development phase through 2034 to test models, gather data, and create a stable regulatory environment.

The Federal Network Agency’s final decision is expected in the coming months, and industry stakeholders regard this period as critical for shaping long-term storage policy. The sector argues that grid fees should ultimately incentivize, not hinder, market- and grid-supportive behavior — and that implementation must reflect the evolving role of BESS in Germany’s 80% renewable electricity target by 2030.