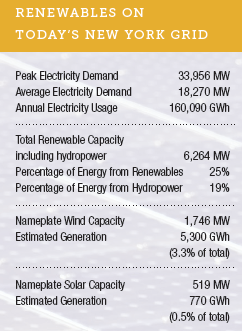

In January 2016, NY-BEST (New York Battery and Energy Storage Technology Consortium) publicly released a report titled ‘Energy Storage Roadmap for New York’s Electric Grid.’ NY-BEST sees energy storage as a key technology capable of making NY’s grid cleaner, more efficient, more cost-effective, and more flexible and reliable.

Source: NY-BEST

In March 2015, NY-BEST convened its ‘Capture the Energy 2015’ conference, where discussion led to the initial ideas of the roadmap, which concentrated on grid sectors. The report received funding from NYSERDA, and the support of NYSERDA, National Grid, NYISO, AES Energy Storage, Saft, Tesla, DNV GL, and other internal government, grid companies, ISOs, technology companies, energy companies, aggregators, and research organizations. The report shows the state government’s aim to build new oversight and market mechanisms, allowing for the comprehensive monetization of energy storage’s value. As well as building financial platforms, providing financial support, and decreasing project financial risks. Building standardized methods, rules, and laws and other means of decreasing soft costs and realizing the 15 year development goals:

2017: Establish standardized safety rules and regulations

2018: Fix NYISO’s market rules to allow storage to participate in the wholesale electric market. (Lowering the electric market’s capacity sizing restrictions, allowing customer-sited storage assets to participate in the electric markets, etc.)

2019: Provide detailed distribution system data for local zone prices. (Improve local management of distributed assets).

2020: Decrease the soft costs of energy storage by 33%

2022: Energy storage installed capacity to reach 1 GW (NY-BEST, 2012 roadmap’s goal)

2025: Energy storage installed capacity to reach 2 GW (reducing peak load, strengthening grid reliability and flexibility)

2030: Energy storage installed capacity to reach 4 GW – 50% of electric installations come from renewable energy, greenhouse gasses reduced 40%.

2050: Greenhouse gasses reduced 80%.

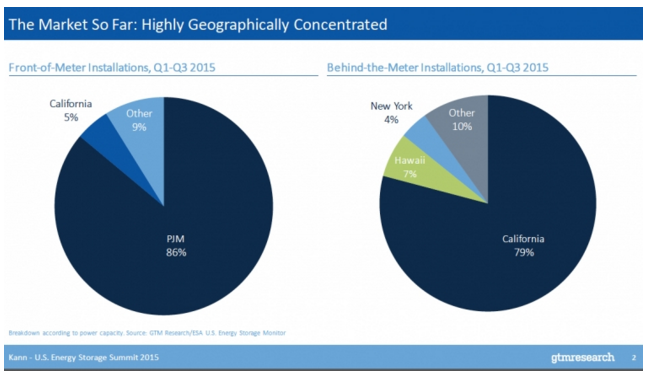

Source: GTM

New York grid-scale pipeline: startlingly small – 28 MW in operation and 0 in development as of end of 2015.

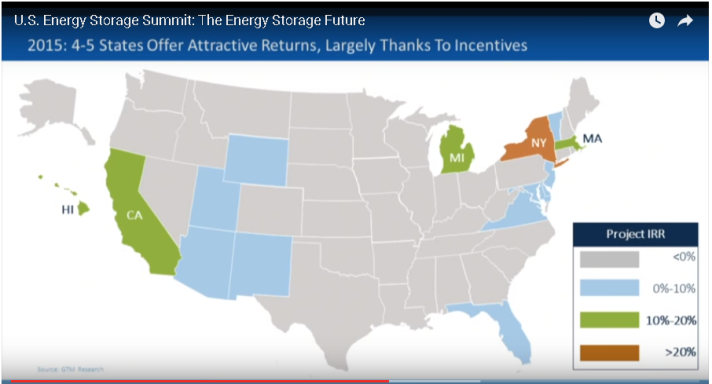

Source:GTM

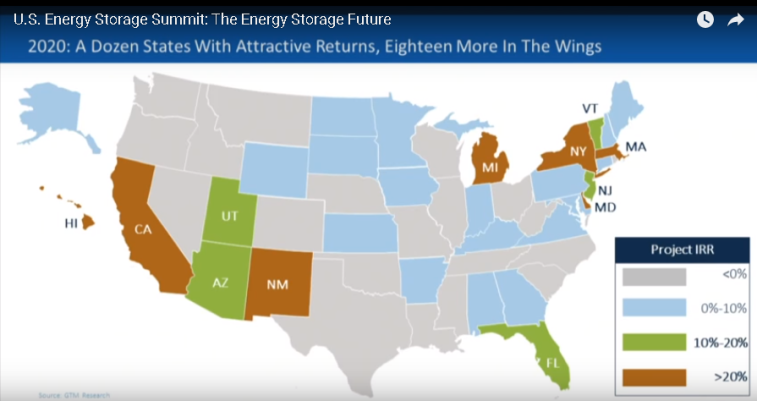

However, the state is not without economic potential for ES when incentives are included.

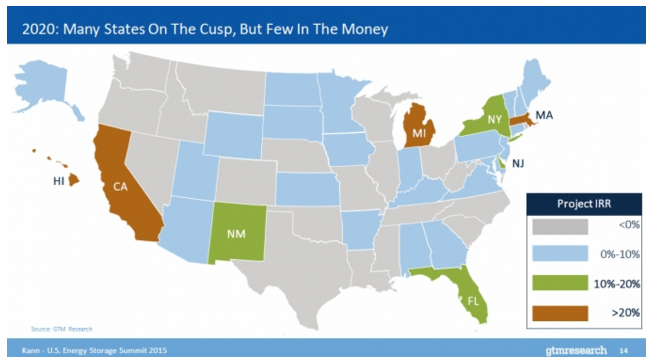

Source: GTM

Source: GTM

New York could be even more attractive in the future in less conservative cases.

Source: GTM

Source: GTM

Driver: T&D Investment Deferral – Barrier: Monetization

To avoid a $1B T&D investment, ConEd proposed spending $200M on behind-the-meter load management and an additional $300M on traditional substation upgrades. At projected rates of load growth, ConEd needs to reduce or realign the timing of 52 MW of load by 2018 to avoid overloading the substations. This comes to about 120 hours of about 26 MW of ES each summer during substation peak events.

The value assigned to storage for providing this service is calculated using an assumed installed cost of $1B and an equipment carrying charge of 12%, resulting in an annual deferral value of $120M. It is assumed that this value is distributed equally between the energy storage fleet (paid out over two years) and the energy efficiency/demand response programs.

In this scenario, the above distribution upgrade deferral only accounts for 1% of the ES unit’s time, creating over half its revenue and allowing it to provide other services. Still, this does not seem enough to cover costs under the given conditions.

Source: RMI

Source: RMI

Projects

Green Charge Networks does have a major demonstration presence in the state – 6 of the 13 projects in operation (331 kW 694 kWh total), with 1 project under construction (96 kW 96 kWh). The GCN demonstration projects were commercial in application and commissioned in 2013 and 2014. Given their specs, it is unclear if they qualified for the below ConEdison demand management subsidy, while they did receive partial federal funding under the DOE’s Smart Grid Demonstration Program.

The market is surprisingly diverse. GCN is the only standout.

50 kW over 4 hours is 200 kWh at full charge. This implies that a device must be larger than 50 kW 200 kWh to get the incentives, however, since aggregations are allowed, there may be more flexibility. GCN’s 6 operational projects come in above this line in aggregate, though their individual installations seem to be closer to 100 kW 100 kWh.

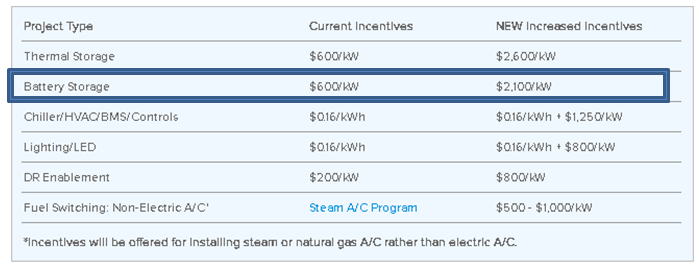

Incentives

Below are the key features of ConEdison’s energy storage and load shifting incentives.

Incentives are based on the average output kW discharged over On-Peak Hours, provided at least 50% of the incentivized battery capacity is discharged continuously during all On-Peak Hours.

Projects or portfolios must have a combined peak demand reduction of 50kW or greater. Peak Demand Reduction (kW) is defined as the system-coincident peak demand reduction that occurs during the summer capability period, between the hours of 2pm-6pm, Monday through Friday, from June 1 through September 30, excluding legal holidays.

Incentives are capped at 50% of installed project cost.

Source: ConEdison

Source: ConEdison

Given the state’s interest, we expect energy storage to gain access to more and more revenue streams and service markets in the near future. Since utilities like ConEd are procuring many energy storage systems themselves, they may be able to internalize enough benefits through their own usage to make the projects viable, similar to how distribution company Oncor did in Texas. CNESA will continue tracking the development of the high-potential New York energy storage market.