Australia has unveiled a significant overhaul of its flagship Capacity Investment Scheme (CIS), shifting to a one-stage tender model aimed at accelerating project timelines and providing greater clarity for developers. With four major tenders scheduled for 2025, the government is reinforcing its commitment to a more flexible and reliable clean energy system while opening doors for smaller-scale participants through a parallel consultation process.

Transition to Single-Stage Tendering: A Strategic Pivot

The move to consolidate CIS tenders into a single-stage format reflects a targeted response to delays and uncertainties that have characterized previous rounds. By eliminating the two-step process—formerly divided into technical and financial bidding phases—the Department of Climate Change, Energy, the Environment and Water (DCCEEW) aims to shorten the tender cycle from nine to six months. This streamlined structure is expected to provide earlier decision-making, reduce administrative burden, and help prevent overlapping rounds that have historically complicated planning for developers.

According to the department, this reform is not merely procedural—it represents a structural evolution in how Australia procures firmed renewables, offering clarity and efficiency in a fast-moving energy transition.

Regulatory Context: Enabling a Clean Energy Backbone

This revision aligns with broader national energy policy goals: to secure reliable, dispatchable capacity as coal exits the grid and renewables scale up. Under the CIS, the federal government underwrites long-term revenue for selected projects, providing investment certainty in a market increasingly shaped by variable supply and rising electrification demands.

The scheme complements state-level initiatives and dovetails with the federal government’s Rewiring the Nation plan, which prioritizes grid upgrades to support renewable integration. By refining the CIS process, Australia positions itself to better execute its national emissions targets and clean energy rollout.

Merit Criteria Refined for Competitive Clarity

With the single-stage process now in place, proponents are required to submit comprehensive bids within a 6–8 week window. These will undergo a dual-layer evaluation by AEMO Services—first for eligibility compliance, then for in-depth merit assessment.

The revised merit framework preserves key pillars—financial value, system reliability, and social impact—but now presents them in a reorganized, holistic structure. Criteria include:

Project financial value

System benefits and reliability

Deliverability and timeline

Organizational and financial capability

Revenue strategy and risk mitigation

First Nations participation and social outcomes

While assessment categories remain largely consistent across tender rounds, DCCEEW has indicated that weightings and thresholds may be fine-tuned depending on technology type or regional focus.

This reconfiguration offers a clearer roadmap for developers while aligning with Australia’s equity and sustainability goals, especially regarding First Nations inclusion and local community benefit sharing.

2025 Tender Timeline: National Rollout across Two Grids

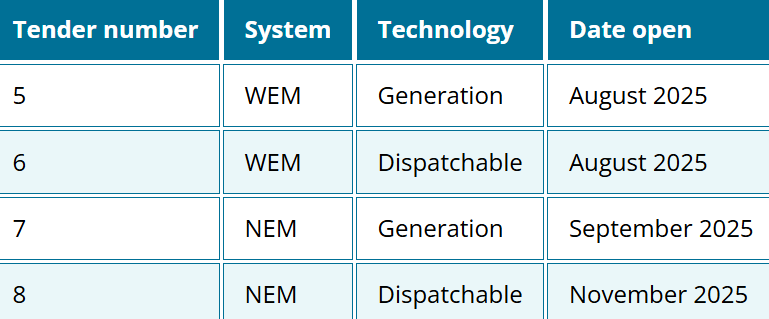

In a parallel announcement, DCCEEW confirmed four CIS tenders will be launched before the end of 2025. These will span both of Australia’s primary electricity markets:

Image: DCCEEW.

Each market—Western Australia’s Wholesale Electricity Market (WEM) and the National Electricity Market (NEM) on the east coast—will see one generation and one dispatchable capacity tender.

This even distribution reflects a balanced national strategy, ensuring that renewable build-out and firming resources are deployed where most needed. Prior consultations, particularly on WEM tender design, have informed the criteria and process for the upcoming rounds.

Aggregated Resources: Unlocking Decentralized Capacity

In a forward-looking step, DCCEEW is also exploring how Aggregated Resources (ARs)—a collection of smaller-scale assets—could be integrated into future CIS rounds. A public consultation now open through early August seeks feedback on including assets like:

Small-scale wind and solar projects (<5MW)

Community and distribution-level batteries

Virtual power plants (VPPs) aggregating residential solar and battery systems

From a system operations perspective, ARs can contribute flexible, distributed capacity and enhance grid resilience. But their participation in traditional procurement programs has been limited by complex eligibility and merit frameworks designed for utility-scale infrastructure.

By launching this consultation, the government is acknowledging the value of decentralized energy resources while also signaling intent to reform access mechanisms to foster fair competition. Submissions from developers, community groups, and the public will shape how ARs are positioned within the CIS architecture going forward.

Industry Dynamics: Competitive Gains and Compliance Pressures

The tender streamlining is expected to benefit both project economics and market stability. Faster timelines mean developers can secure financing earlier, align with supply chain schedules, and bring capacity online more predictably.

However, the tighter submission window and broader scope of required documentation may prove challenging for smaller developers or first-time applicants. Projects lacking robust financial modeling or community engagement frameworks may find themselves disadvantaged under the merit criteria.

In contrast, established players with experienced bid teams and vertically integrated capabilities are likely to find the process more navigable, further intensifying competition in Australia’s clean energy landscape.

Challenges Ahead: Timeline Pressure and Coordination

While the streamlined process reduces waiting periods, it also compresses preparatory timelines, increasing pressure on developers to finalize engineering, financing, and stakeholder engagement strategies quickly. For larger or more complex projects, especially in regions with permitting or grid connection constraints, this may create a bottleneck.

Additionally, coordinating multiple concurrent tenders—especially across two separate electricity markets—demands high administrative capacity and cross-jurisdictional alignment. Any discrepancies in process, criteria, or approval timelines between the NEM and WEM could create inefficiencies or distort market outcomes.

Strategic Implications: Toward a More Adaptive Procurement Model

Australia’s CIS redesign reflects a maturing energy procurement framework that prioritizes speed, transparency, and systemic value. By coupling procedural reform with a national tender rollout and inclusivity consultation, the government signals a long-term commitment to evolving how clean energy is integrated into the grid.

Looking ahead, the integration of Aggregated Resources could mark a shift toward a more modular, distributed model of capacity procurement. If implemented effectively, this would democratize participation, deepen community engagement, and unlock a wider set of tools for achieving net-zero goals.

Ultimately, how the restructured CIS plays out will shape investment decisions, grid readiness, and energy equity in the years ahead.