Strategic licensing agreement aims to cut costs, expand global reach, and challenge lithium-ion’s dominance in long-duration energy storage

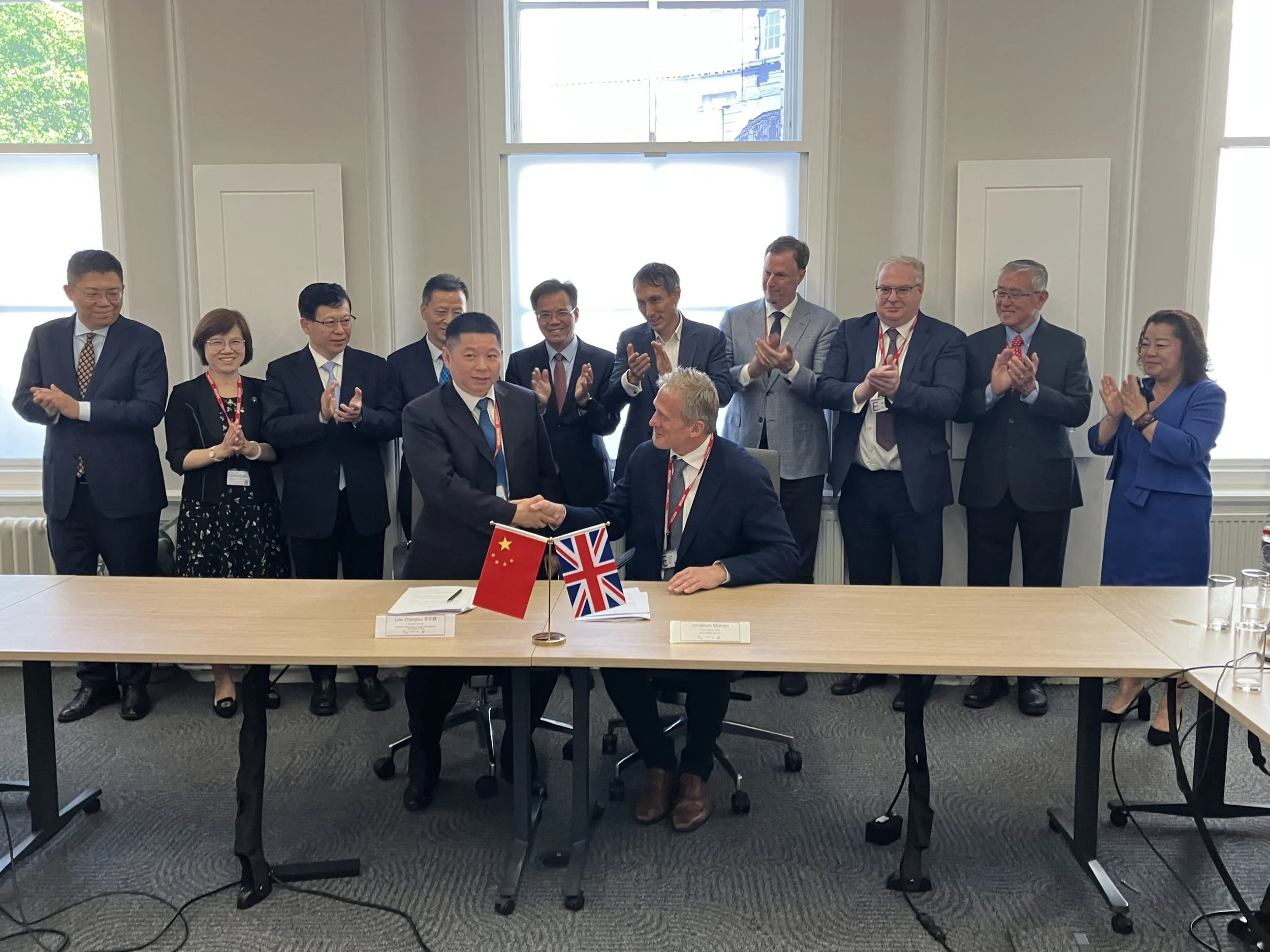

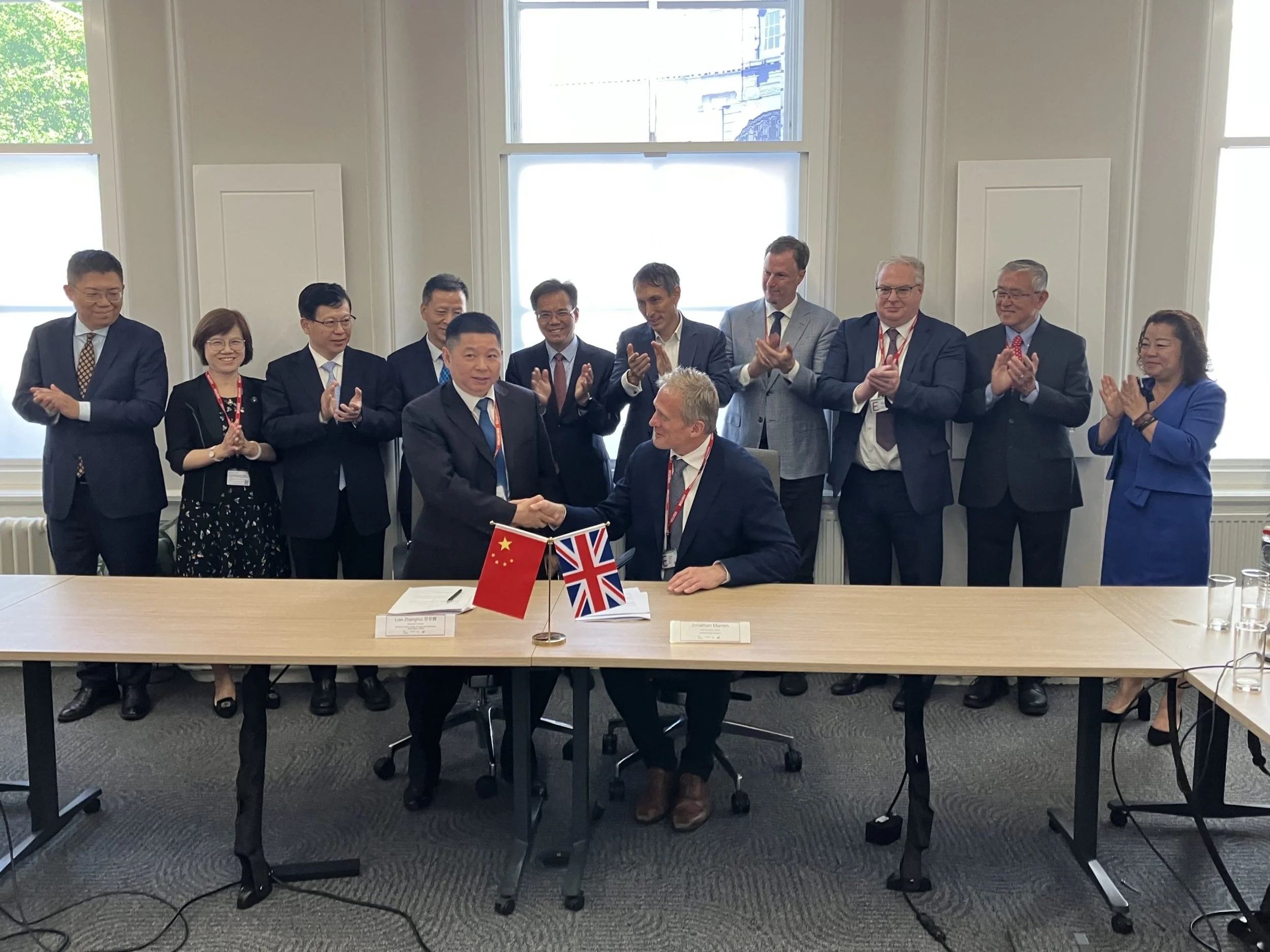

Invinity Energy Systems is doubling down on cost competitiveness and global scale by entering a licensing and royalty agreement with Guangxi United Energy Storage New Materials Technology (UESNT), a Chinese battery materials firm. The deal represents a calculated bid to lower production costs of its Endurium vanadium redox flow battery (VRFB) while maintaining high-performance standards and expanding into both domestic and international markets. More than a manufacturing partnership, this alignment signals a critical inflection point for flow batteries as a contender in long-duration energy storage (LDES).

Image: Invinity Energy Systems

From Invinity’s perspective, the arrangement enables a dual-front strategy: accessing China's deeply embedded vanadium supply chain while using UESNT’s processing innovations to achieve broader market penetration. The move is particularly timely given the growing pressure on energy storage providers to offer scalable, cost-effective, and non-lithium alternatives amid the limitations of conventional lithium-ion technologies in multi-hour grid support applications.

Policy and Market Frameworks Shape New Avenues for Flow Battery Deployment

Regulatory momentum for LDES is picking up globally, creating fertile ground for Invinity’s technology. In the UK, for instance, the government's upcoming cap-and-floor revenue model for storage projects of eight hours or more offers one of the first structured incentives specifically designed for long-duration systems. According to Invinity, developer Frontier Power has already earmarked up to 2GWh of Endurium-based capacity for bids under the scheme, with several other developers preparing similarly scaled projects.

The model, to be overseen by UK energy regulator Ofgem, aims to address the lack of adequate market compensation for the extended discharge durations that flow batteries provide. This regulatory structure not only supports financial viability but also prioritizes grid-relevant outcomes such as stability and renewable integration—key areas where VRFBs excel.

Beyond the UK, Invinity is eyeing similar LDES solicitations in U.S. states like California and New York, as well as Canadian provinces such as Ontario and British Columbia. These jurisdictions have shown a preference for non-lithium technologies, often with an emphasis on local content—a potential advantage for Invinity’s facility in Vancouver.

Licensing Strategy Targets Systemic Cost Reduction Without Compromising Core Manufacturing

The partnership with UESNT involves licensing the production of Invinity’s modular Endurium system for the Chinese market. However, the broader value lies in what UESNT brings to the table in terms of vanadium electrolyte processing. According to Invinity President Matt Harper, UESNT's methods for converting both raw and recycled vanadium into battery-grade electrolyte have proven highly efficient, potentially reshaping material cost dynamics globally.

While manufacturing will take place in China, Invinity stresses that its own facilities in Scotland and Canada will remain integral. The company plans to continue in-house production of its core battery stacks, citing intellectual property protection, quality control, and engineering optimization as reasons for retaining this capability. Harper argues that the expertise required to fine-tune system performance—particularly at the electronics and control level—still resides uniquely within Invinity’s internal teams.

This hybrid approach allows Invinity to blend cost-effective upstream production with proprietary downstream integration, maintaining system quality while boosting competitiveness.

Flow Batteries Gain Traction as Developers Question Lithium’s Suitability for Grid-Scale Roles

As the energy storage market matures, the one-size-fits-all role of lithium-ion is being increasingly scrutinized. For applications requiring high energy throughput and long-duration discharge, the thermal and cycling limitations of lithium technologies present engineering and economic challenges.

Flow batteries, by contrast, offer decoupled power and energy scaling, longer operational life, and minimal degradation over time—traits that are especially valuable for multi-hour grid support. Invinity sees a growing number of developers recognizing this differentiation, particularly as Endurium's pricing becomes more competitive through scaled manufacturing and supply chain efficiencies.

BloombergNEF recently noted that China’s domestic flow battery pricing is less than half the global average, highlighting how cost remains a pivotal barrier to mainstream adoption outside China. Invinity’s collaboration with UESNT, a company deeply embedded in vanadium supply and processing, is designed to bridge that cost gap while also improving global distribution capabilities.

Market Dynamics and Competitive Landscape

With flow battery deployments in Spain already exceeding performance expectations, and a rising global appetite for LDES, Invinity is positioning itself at the intersection of two forces: lithium-ion’s limitations and the declining cost trajectory of VRFBs. In this sense, the company is not simply responding to market trends—it is actively working to shape them.

In the UK’s cap-and-floor program alone, the number of developers proposing Endurium-based projects suggests a high level of confidence in the technology. Although Invinity has not disclosed exact figures, Harper acknowledges that even a fraction of the total would represent gigawatt-hours of potential deployment.

The program’s over-subscription also hints at increasing competition in the non-lithium storage segment. Yet, Invinity views this as a positive signal—both for the maturity of flow battery offerings and for the regulatory discipline needed to ensure optimal project selection.

A Strategic Inflection Point for Flow Battery Commercialization

Invinity’s partnership with UESNT may prove to be more than just a commercial expansion. It signals a maturing inflection point for flow batteries in the global energy storage market. By blending high-performance engineering with cost-effective supply chain tactics, Invinity is attempting to recalibrate the economics of LDES.

As policy frameworks begin to align with the functional strengths of long-duration storage—and as market participants grow more critical of lithium’s limits—flow battery technology is poised to occupy a more central role in the energy transition.

Invinity’s hybrid approach of internal stack production, external electrolyte processing, and strategic market targeting reflects a company increasingly confident in both its technology and its timing.