On the evening of August 21, EVE Energy released its 2025 semi-annual report. In the first half of the year, the company achieved operating revenue of approximately 28.2 billion RMB, a year-on-year increase of 30.06%; net profit attributable to shareholders of the listed company was 1.605 billion RMB, a year-on-year decrease of 24.9%; net profit attributable to shareholders of the listed company excluding non-recurring items was 1.157 billion RMB, a year-on-year decrease of 22.82%.

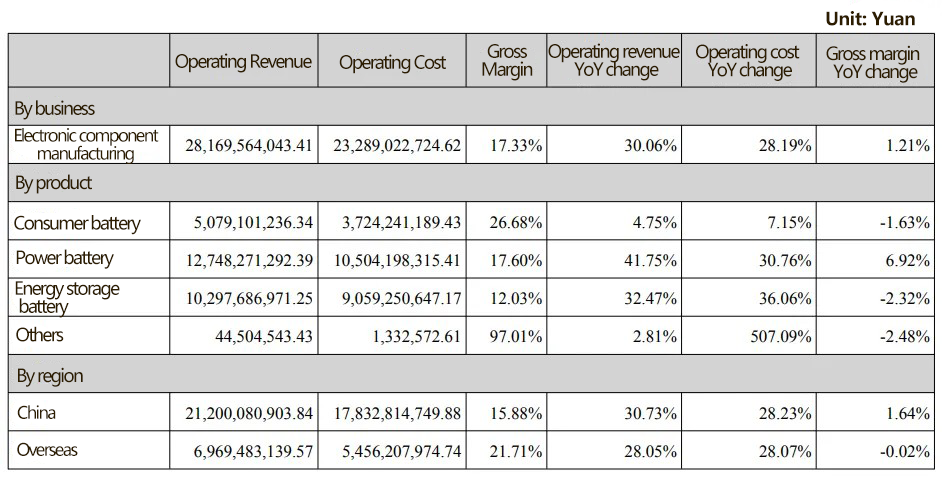

By main business:

l Power battery revenue was 12.748 billion RMB, a year-on-year increase of 41.75%, with a gross margin of 17.60%, and gross margin increased by 6.92% year-on-year;

l Energy storage battery revenue was 10.298 billion RMB, a year-on-year increase of 32.47%, with a gross margin of 12.03%, and gross margin decreased by 2.32% year-on-year;

In terms of shipment volume, during the reporting period, power battery shipments reached 21.48GWh, a year-on-year increase of 58.58%; energy storage battery shipments reached 28.71GWh, a year-on-year increase of 37.02%.

By region:

l Domestic revenue was 21.2 billion RMB, a year-on-year increase of 30.73%, with a gross margin of 15.88%, and gross margin increased by 1.64% year-on-year;

l Overseas revenue was 6.969 billion RMB, a year-on-year increase of 28.05%, with a gross margin of 21.71%, and gross margin decreased by 0.02% year-on-year;

Strong installation demand both domestically and overseas drove rapid growth in energy storage battery shipments. Against the backdrop of the global transition to a low-carbon economy, policies and incentive measures such as China’s “Dual Carbon” strategy and the EU’s “Green Deal” have promoted the deployment of energy storage systems in multiple fields, expanded the market, and consolidated the dominant position of lithium-ion batteries in the energy storage industry.

In the first half of 2025, global energy storage demand grew rapidly, and the market showed a dual driving pattern of “quality improvement in core markets and volume release in emerging regions.”

In China, according to CNESA data, from January to June, newly installed capacity of new energy storage reached 42.61GWh, a year-on-year increase of 27.5%, mainly driven by the full entry of new energy into the market and the May 31 grid-connection node. As China, the world’s largest energy storage market, enters a new stage of value creation, companies with high-quality production capacity and products will have greater competitiveness and occupy a larger market share.

In addition, overseas market demand remained strong, showing a diversified growth pattern. The U.S. energy storage market demand remained strong, with total installed energy storage capacity for the year expected to reach 49GWh. The European market promoted energy storage development through subsidies, further increasing overall energy storage demand. Large-capacity tender projects in emerging markets such as Asia and the Middle East continued to be launched, driving explosive demand growth in the energy storage industry.

The company adheres to creating benefits and value for customers, reaching strategic cooperation with leading energy enterprises at home and abroad, accelerating the implementation of innovative technologies and global market expansion. Against the background of technological innovation and power market reform, the energy storage industry will shift from “scale expansion” to “value creation.” With the application of 500Ah+ ultra-large cells, the integration level of a new generation of 6MWh+ energy storage systems will be significantly improved. Combined with intelligent power trading decisions, greater economic value will be created for energy storage, and high-quality, safe energy storage products will capture more market share. The company empowers innovation, taking the lead in mass production of 600Ah+ cells, and drives energy storage value enhancement through full-scenario solutions.