The China Energy Storage Alliance has always adhered to standardized, timely, and comprehensive information collection criteria, continuously tracking the dynamics of energy storage projects. Relying on the solid data accumulated over the long term and in-depth professional analysis, the alliance regularly publishes objective market analysis articles on energy storage installations, providing industry peers with valuable market decision-making references. Since June 2025, the monthly energy storage project analysis has been refined into two sections: 'Generation-Grid Market' and 'User-Side Market.' This issue focuses on the analysis of the Source-Grid Market in August.

Overall Analysis of New Energy Storage Projects of August

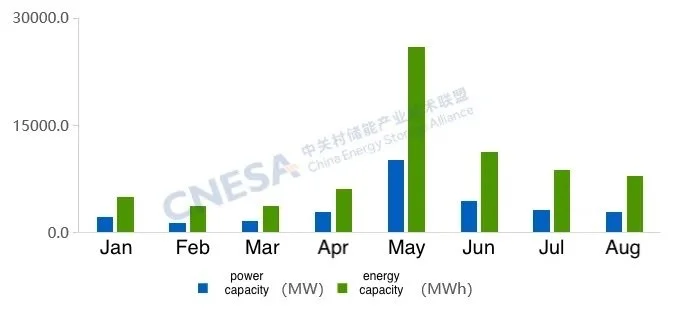

According to incomplete statistics from CNESA, in August 2025, the newly commissioned installed capacity of new energy storage projects in China totaled 2.90 GW/7.97 GWh, a year-on-year increase of +30%/+43%, and a month-on-month decrease of -11%/-10%. The newly installed capacity continued to decline in August, but the month-on-month decrease was smaller than the same period last year.

Figure 1: Newly Installed Capacity of New Energy Storage Projects in China from January to August 2025

Data Source: CNESA DataLink Global Energy Storage Database [https://www.esresearch.com.cn/](https://www.esresearch.com.cn/)

Note: Year-on-year (YoY) compares with the same period in the previous year; month-on-month (MoM) compares with the previous adjacent statistical period.

Analysis of New Energy Storage Projects on the Generation-Grid Side

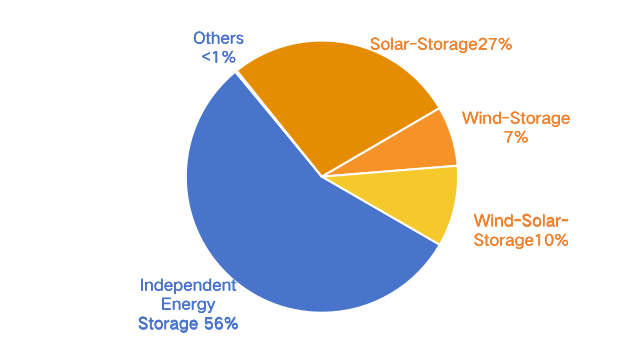

In August, newly added grid-side energy storage installations reached 2.50GW/7.08GWh, representing a 22%/36% year-on-year increase but a 17%/15% month-on-month decline. The grid-side new energy storage projects demonstrated the following characteristics:

• Independent energy storage accounted for more than half of the total newly added capacity.

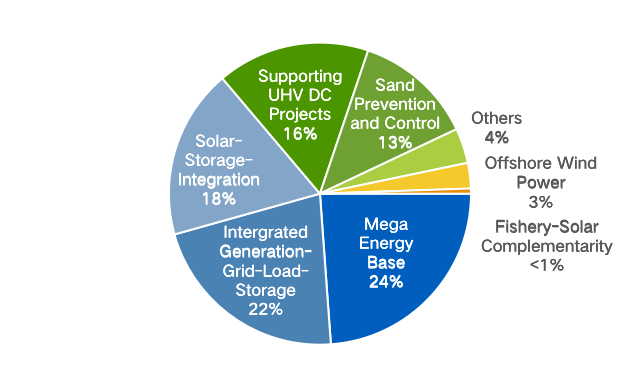

• In August, newly added independent energy storage installations totaled 1.39GW/3.98GWh, marking a 21%/12% year-on-year decrease. Projects with a capacity of 100MW and above represented 88% of the total. Newly added power-side installations reached 1.10GW/3.09GWh, showing a 285%/354% year-on-year surge. These projects covered a wide range of application scenarios, including large-scale energy bases, integrated generation-grid-load-storage projects, solar-storage integration, ultra-high-voltage (UHV) DC supporting projects, and desertification control initiatives.Among these, projects with capacities of 100MW and above accounted for 38%, an increase of 25 percentage points compared with July.

Figure 2: Application Distribution of Newly Commissioned Source-Network Side New Energy Storage Projects in August 2025 (MW%)

Data Source: CNESA DataLink Global Energy Storage Database [https://www.esresearch.com.cn/](https://www.esresearch.com.cn/)

Note: "Other" includes distribution network side and transformer station energy storage.

Figure 3: Distribution of Subdivided Application Scenarios for Newly Commissioned New Energy and Storage Projects in August 2025 (MW%)

Data Source: CNESA DataLink Global Energy Storage Database [https://www.esresearch.com.cn/](https://www.esresearch.com.cn/)

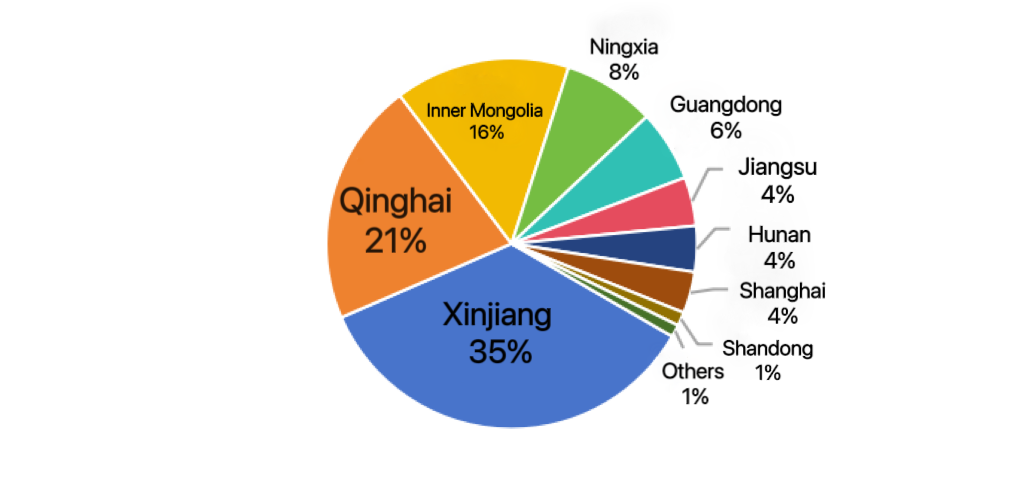

Northwest Region Accounts for 65% of New Installations, Xinjiang Leads in Scale

In August, newly added grid-side installations in Xinjiang exceeded 0.8GW, with independent energy storage accounting for 68%. As a key national energy base, Xinjiang’s new energy capacity has continued to expand rapidly. According to State Grid Xinjiang Electric Power, by the end of July the total installed capacity of the Xinjiang power grid had reached 219 million kW, of which 128 million kW came from new energy, accounting for about 60%. This represented an increase of around 10 percentage points compared with the same period last year, further driving the sustained growth in demand for grid-side new energy storage installations.

In addition, on July 11, 2025, Xinjiang issued detailed rules for ancillary services, allowing independent energy storage to generate revenue through peak shaving, frequency regulation, and reserve services, thereby expanding income sources. Starting from August 1, 2025, independent energy storage enterprises in Xinjiang, which had previously only been allowed to participate in monthly bilateral transactions, were permitted to take part in provincial medium- and long-term transactions with cycles of annual, monthly, and multi-day trading, including bilateral negotiated trading, centralized bidding, and rolling matching mechanisms. These changes have made trading methods more flexible.

Moreover, Xinjiang’s high curtailment rates have also been a major driver of the rapid increase in new energy storage installations. According to data from the National Renewable Energy Consumption Monitoring and Early Warning Center, in the first half of 2025, Xinjiang’s wind curtailment rate reached 10.1%, and the solar curtailment rate reached 12.9%, both falling below the national red line requiring 90% utilization of renewable energy.

Figure 4: Distribution of New Energy Storage Projects on the Source Network Side in China's Provinces in August 2025

Data source: CNESA DataLink Global Energy Storage Database

https://www.esresearch.com.cn/

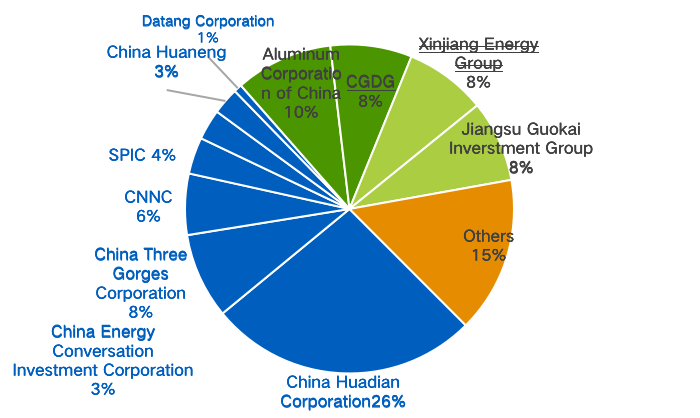

More Than Half of New Installations Attributed to the ‘Big Five and Little Six’

From the perspective of project owners, power generation groups such as Huadian, China Three Gorges, and China National Nuclear Corporation (CNNC) — collectively known as the “Big Five and Little Six” — accounted for more than half of the newly added installation market share. Among them, Huadian held the largest market share, with key projects such as the Huadian Xinjiang Changji Mulei Kaisheng Wind-Solar-Storage Base and the Urumqi Photovoltaic Base 1GW/4GWh Independent New Energy Storage Demonstration Project achieving phased grid connection.

In addition, state-owned enterprises including Aluminum Corporation of China (CHALCO), China Green Development Group, and various local energy groups together represented 38% of the market share, underscoring the comprehensive advantages of large-scale energy enterprises in investment scale, construction coordination, and operational managementof energy storage projects.

Figure 5 :Distribution of owners of new energy storage projects on the grid side of newly added operating sources in China in August 2025 (MW%)

Data source: CNESA DataLink Global Energy Storage Database https://www.esresearch.com.cn/

Average Storage Duration Up 12% YoY, Core Function Shifts to Long-Duration Supply Security.

Since May this year, the average storage duration of grid-side projects has exceeded the levels of the same period last year each month. In August, the average storage duration reached 2.84 hours, representing a 12% year-on-year increase.

Among the regions, Xinjiang recorded the longest average duration, at around 4.0 hours. This is mainly due to the seasonal mismatch between new energy generation and grid demand: Xinjiang’s renewable output is typically high in spring and autumn but low in summer and winter, while grid load is highest in summer and winter. Additionally, within a single day, there is a sharp contrast between midday peaks in wind and solar output and morning/evening peaks in electricity demand. Combined with the fact that large energy bases are located far from load centers, this results in significant spatial and temporal mismatches between renewable output and demand, driving higher requirements for storage system duration.

Qinghai followed with an average of 2.7 hours, while other provinces maintained an average storage duration of around 2 hours.

The average storage duration of generation-grid-side projects increased by 12% year-on-year, with the core function of energy storage shifting toward long-duration supply security.

Since May this year, the monthly average storage duration of generation-grid-side projects has consistently exceeded that of the same period last year. In August, the average storage duration reached 2.84 hours, representing a 12% year-on-year increase. Among provinces, Xinjiang recorded the longest average storage duration, at around 4.0 hours. This is primarily due to the mismatch between the seasonal characteristics of Xinjiang’s renewable generation—“large in spring and autumn, small in winter and summer”—and the grid’s demand profile of “higher loads in summer and winter.” In addition, the pronounced intra-day contradiction between midday renewable peaks and morning/evening load peaks, coupled with the long distance between energy bases and load centers, highlights the issue of spatiotemporal mismatch between renewable output and load demand, resulting in higher requirements for storage duration. Qinghai ranked second, with an average of 2.7 hours, while other provinces generally averaged 2 hours.

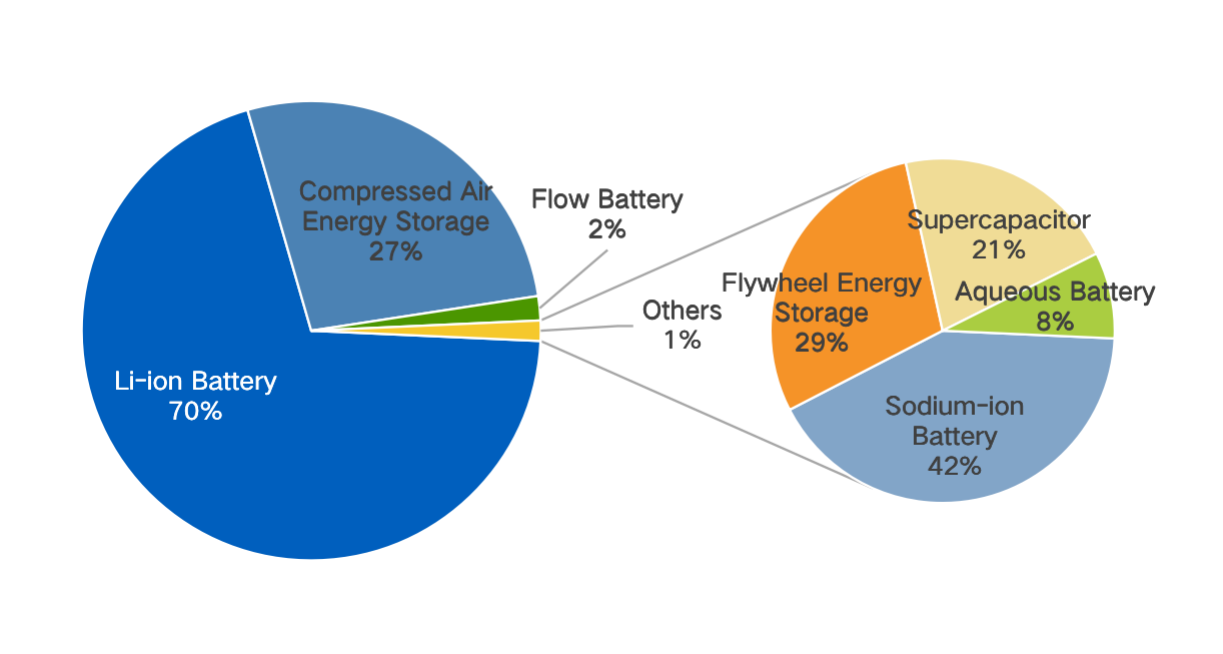

Acceleration in Deployment of Non-Lithium Technologies

From a technology perspective, in August, all newly commissioned generation-grid-side storage projects adopted lithium iron phosphate (LFP) battery technology. Furthermore, grid-forming storage systems achieved gigawatt-hour–scale demonstration applications again in large-base projects, with a total station capacity of 1.05 GWh.

On the planning and construction side, the deployment of non-lithium technologies such as compressed air energy storage (CAES) and hybrid storage is accelerating. In CAES, construction has begun on the 300 MW advanced CAES project at Longquanshan, Yueyang, Hunan, as well as the 400 MW/1600 MWh artificial-cavern CAES project in Yongchuan District, Chongqing.In hybrid storage, projects under construction include a comprehensive demonstration project that integrates five technologies—lithium iron phosphate batteries, sodium-ion batteries, solid-state batteries, supercapacitors, and organic aqueous batteries—as well as a hybrid storage plant combining flywheels and lithium iron phosphate batteries for joint frequency regulation.

Figure 6: Technical distribution of new energy storage projects under construction on the source network side in China in August 2025 (unit: MW%)

Data source: CNESA DataLink Global Energy Storage Database

https://www.esresearch.com.cn/