Driven by the national strategic goals of carbon peaking and carbon neutrality, energy storage, as an important technology and basic equipment supporting the new power systems, has become an inevitable trend for its large-scale development. Since April 21, 2021, the National Development and Reform Commission and the National Energy Administration have issued the ‘Guidance on Accelerating the Development of New Energy Storage (Draft for Solicitation of Comments)’(referred to as the ‘Guidance’), which has given rise to the energy storage industry and even the energy industry. The industry has given a high degree of recognition to the release of the Guidance and positive feedback. On July 23, the National Development and Reform Commission and the National Energy Administration formally issued the "Guidance" after fully soliciting suggestions from all walks of life.

China Energy Storage Alliance (CNESA) combines the research and understanding of industries and policies to briefly interpret and analyze the content of the guidelines, policies and industrial impacts:

Comparison of the ‘Guidance’ draft and official documents

Compared with the draft, the official document has not changed much, emphasizing strict adherence to the bottom line of energy storage safety, and integrating the advantages of the upstream and downstream of the industry chain through the method of "revealing the list and taking command" to promote the integrated development of industry, university, research and application, and concentrate efforts to tackle key problems in the large-scale development of the industry, promoting the diversified development of energy storage, and ensuring that energy storage becomes a strong support for the realization of the ‘dual carbon’ goal. In addition, in the improvement of the ‘new energy + energy storage’ project , adding a ‘sharing model’ has become one of the ways to implement new energy power generation projects for new energy storage, and it is clear that the ‘sharing model’ is to optimize the coordinated development of regional renewable energy and energy storage , also it is an effective way to promote the formation of a variety of energy storage business models.

The practical significance of the ‘Guidance’ to the development of the energy storage industry

1. Clarify the goal of 30GW of energy storage, and boost to achieve leapfrog development

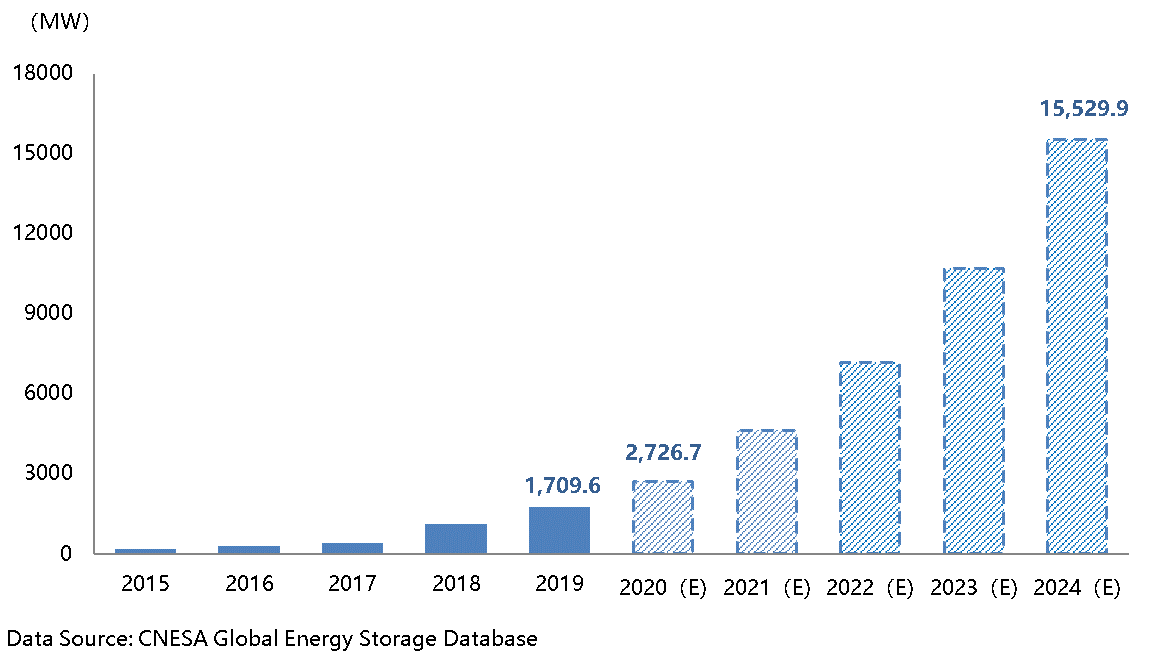

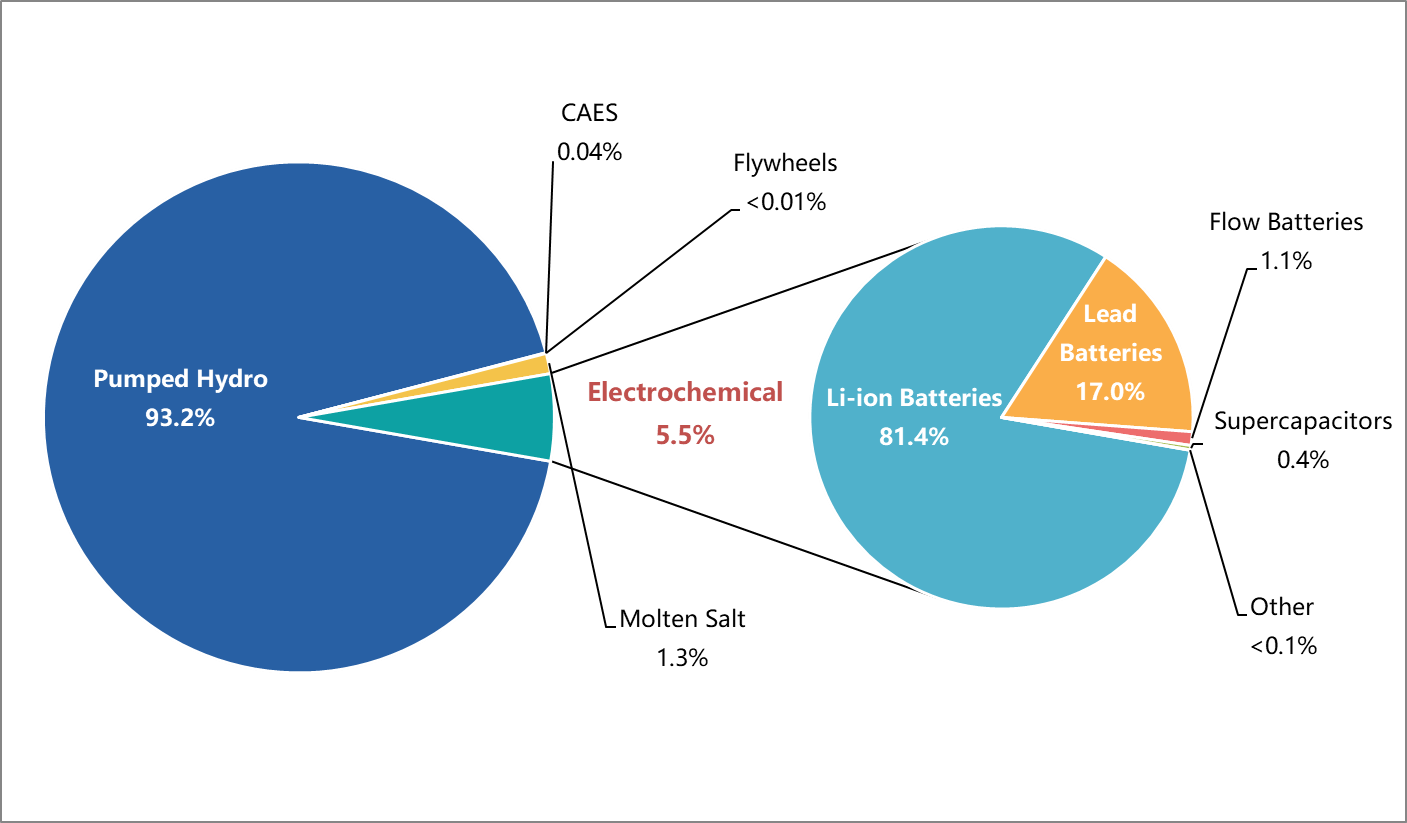

According to the statistics of the database from China Energy Storage Alliance , the cumulative installed capacity of new electric energy storage (including electrochemical energy storage, compressed air, flywheel, super capacitor, etc.) that has been put into operation by the end of 2020 has reached 3.28GW, from 3.28GW at the end of 2020 to With 30GW in 2025, the scale of the new energy storage market will expand to 10 times the current level in the next five years, with an average annual compound growth rate of more than 55%. This total scale and growth rate, and the clarification of my country's new energy storage installed capacity targets will release positive policy signals for society and capital, guide social capital to flow into technology and industries, and boost the rapid arrival of the trillion-dollar energy storage market.

2. Emphasize planning guidance and deepen the layout of energy storage in various application fields

At present, energy storage has entered a stage of rapid development, and it is urgent for the country to coordinate all parties to issue a special plan for it. Through strengthening management and guidance, it can effectively standardize industry management, optimize industrial layout, improve the efficiency of energy storage systems, and avoid disorderly development of the industry.

In the ‘Guidance on New Energy Storage’, energy storage on the power side emphasizes the layout of system-friendly new energy power station projects, the planning and construction of large-scale clean energy bases for cross-regional transmission, and the exploration and utilization of existing plant sites and transmission and transformation facilities for decommissioned thermal power units, or wind and solar storage facilities. These tasks on the one hand meet the current demand for energy storage in the development of renewable energy, and at the same time, they are in line with the previously issued ‘Guidance on Promoting the Integration of Power Sources the Development of Multi-energy Complementarity’ and ‘Notice: Regarding the Development of Wind Power and Photovoltaic Power Generation in 2021’ . It can be said that the implementation is supported and the policies are guaranteed.

Grid side energy storage emphasizes the role of new energy storage on the flexible adjustment capability and safety and stability of the grid, improving the power supply capacity of the grid, emphasizing the emergency power supply guarantee capability of the grid, and delaying the demand for energy storage in the upgrading and transformation of power transmission and transformation. It can be said that the grid-side energy storage that has been suspended since 2019 has re-pressed the start button. At the same time, with the industry’s new understanding of grid-side energy storage and the entry of various social entities, we believe that under the guidance of policies, the grid-side energy storage Energy storage will be rejuvenated.

User side energy storage has always been the most viable application field of the energy storage industry. With the development of new infrastructure and new business formats, user-side energy storage has increasingly shown a development trend of ‘energy storage’ +. With the continuous development of the electricity market deepening, this field will be the main force in energy storage business model innovation, which will bring vitality and surprises to the development of the industry.

3. Improve the new energy storage price mechanism and promote the establishment of energy storage business models

In the "Guidance", for the first time, the establishment of a grid-side independent energy storage power station capacity price mechanism was proposed, and the study and exploration of the cost and benefit of grid alternative energy storage facilities into the recovery of transmission and distribution prices, improved the peak and valley price policy, and created greater development for the user-side energy storage space. Based on the ‘Opinions on Further Improving the Price Formation Mechanism for Pumped Storage’ and the ‘Plan on Deepening the Reform of the Price Mechanism during the 14th Five-Year’ period, the country clearly proposes the establishment of a new type of energy storage price mechanism and a new type of storage price mechanism. Energy should be formed in the form of market competition, and energy storage facilities that play the role of grid substitution will be recovered through transmission and distribution prices. New energy storage can participate in the medium and long-term, spot and ancillary service markets to obtain benefits.

4. Aiming at the points of new allocation for energy storage, and specifying the focus of subsequent policies

At present, more than 20 provinces and cities in China have issued policies for the deployment of new energy storage. After energy storage is configured, how to dispatch and operate energy storage, how to participate in the market, and how to channel costs have become the primary issues which plague new energy companies and investors. In response to the current issues in the allocation of energy storage in various provinces, the document also further clarifies the coordinated development of energy storage and new energy, through competitive configuration, project approval (filing), grid connection timing, system scheduling and operation arrangements, and ensuring utilization hours , power auxiliary service compensation and assessment, etc. are given appropriate inclination, which points out the direction for the rationalization of new energy allocation of energy storage to achieve rational cost relief. In the transitional stage of the power market reform, it is possible to further explore the feasibility of allocation of energy storage in increasing the weight of ‘green power transactions’.

Based on the above analysis, as the first comprehensive policy document for the energy storage industry during the ‘14th Five-Year Plan’ period, the ‘Guidance’ provided reassurance for the development of the industry. In the context of the ‘dual-carbon’ goal and energy transition, the energy storage industry’s leapfrog development is the general trend and demand. The follow-up actions will inevitably introduce a series of policies for the development of energy storage to eliminate industrial development. Faced with ‘obstacles’ one by one. At the local level, with the improvement of policies and market mechanisms, new business models will emerge. We firmly believe that China will become the world’s largest energy storage market. On this huge and diverse fertile soil, the energy storage technology from China will be fully developed and verified, and will lead the development of the global energy storage industry! After all the exploration and perseverance, China's energy storage industry will surely gain steam!