According to the CNESA Global Energy Storage Database, newly commissioned user-side projects in China reached 408.3 MW / 894.3 MWh in August 2025 -- a 124% / 137% YoY increase and 66% / 73% MoM growth.

The China Energy Storage Alliance (CNESA) has always adhered to standardized, timely, and comprehensive information collection practices to continuously track developments in energy storage projects. Leveraging its long-term accumulated data and in-depth professional analysis, CNESA regularly publishes objective articles on the energy storage installed capacity market, providing industry peers with valuable references for market decision-making. Due to the typical differences between grid&source-side energy storage markets and user-side energy storage markets, CNESA’s monthly energy storage project analysis has been split into two separate reports since June 2025: “Grid&Source-Side Market” and “User-Side Market”. This issue focuses on the user-side market in August.

The analysis of grid&source-side energy storage projects for August has already been published. Details can be found here:

Overall Analysis of New Energy Storage Projects in August

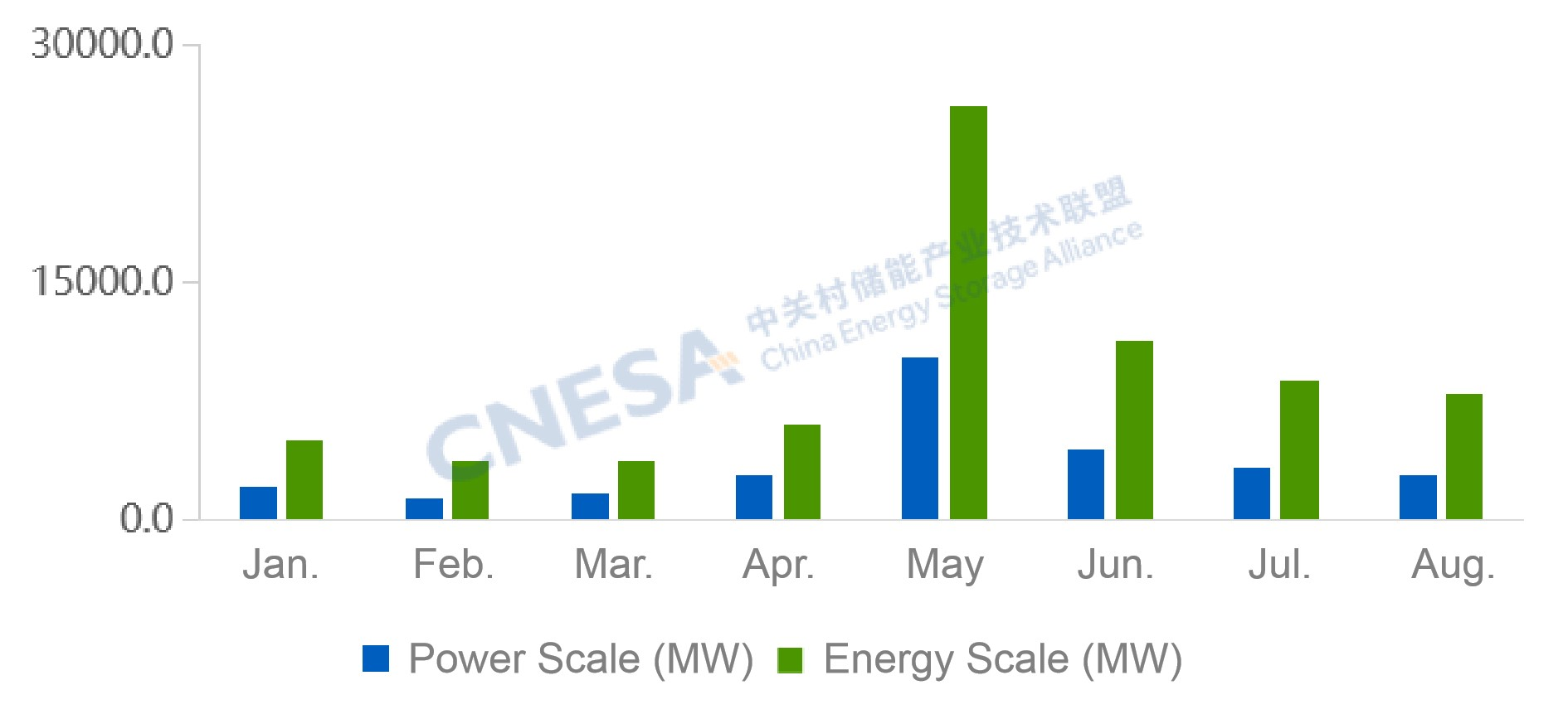

According to incomplete statistics from the Global Energy Storage Database of the CNESA DataLink, in August 2025, newly commissioned new energy storage projects in China totaled 2.90 GW / 7.97 GWh, representing a YoY increase of +30% / +43%, but a month-on-month decrease of -11% / -10%. While the newly added installed capacity in August continued to decline, the MoM drop was smaller than in the same period last year.

Figure 1: Installed Capacity of Newly Commissioned New Energy Storage Projects in China, Jan.-Aug. 2025

Data Source: CNESA DataLink Global Energy Storage Database

https://www.esresearch.com.cn/

Note: YoY (year-on-year) increase compares with the same period last year; MoM (month-on-month) decrease compares with the previous reporting period.

August Analysis of User-Side Energy Storage Projects

In August, newly installed user-side energy storage capacity reached 408.3 MW / 894.3 MWh, representing a YoY increase of +124% / +137% and a MoM increase of +66% / +73%.

The newly commissioned user-side energy storage projects showed the following characteristics:

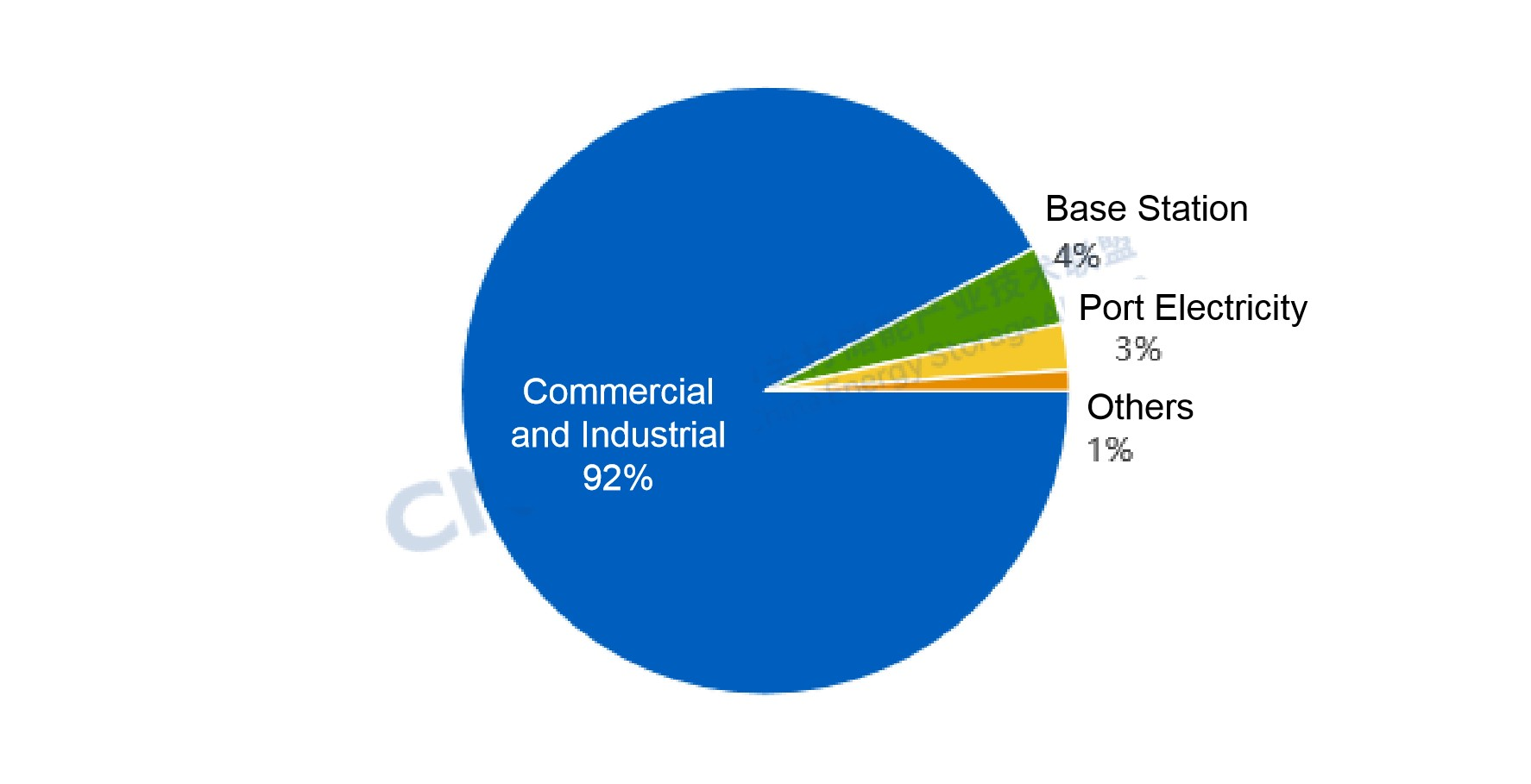

01. Commercial and industrial storage dominates, deployment of long-duration technologies accelerates

In August, the user-side energy storage market was dominated by commercial and industrial (C&I) applications, accounting for over 90% of the total. Newly installed capacity in commercial and industrial scenarios reached 376.63 MW / 828.85 MWh, up +115% / +131% year-on-year.

All newly commissioned projects adopted electrochemical energy storage technologies, among which the installed power scale of lithium iron phosphate (LFP) battery technology accounted for 98.7%. Regarding non-lithium technologies, two all-vanadium flow battery energy storage projects and one solid-state lead battery energy storage project were commissioned, with an average storage duration of 4.19 hours.

Figure 2: Application Distribution of Newly Commissioned User-Side New Energy Storage Projects in August 2025 (MW%)

Data Source: CNESA DataLink Global Energy Storage Database

https://www.esresearch.com.cn/

Note: “Commercial and Industrial” includes industrial districts, industrial parks and commercial buildings; “Others” include EV charging stations, municipal districts, and oil fields in mining areas.

02. Regional Distribution: Guangdong Accounts for 35% of Newly Installed Capacity

In terms of regional distribution, newly commissioned projects in August were mainly concentrated in 14 provinces, including Guangdong, Sichuan, Jiangsu, Anhui, and Zhejiang. By project count, the East China region accounted for half of the new projects nationwide, holding the largest market share. Jiangsu led the country with over one-fifth of the total project count.

By installed capacity, Guangdong had the largest increase, representing 35% of the national total, followed by Sichuan. In August, in Shenzhen’s Guangming District, Guangdong, newly upgraded user-side energy storage projects connected to virtual power plants were eligible for grants of up to 1 million yuan, equivalent to 20% of the actual retrofit investment. The municipal government of Guangzhou City, Guangdong Province, has launched the application of municipal-level virtual power plants, with annual municipal financial incentives of up to 10 million yuan.

Figure 3: Provincial Distribution of Newly Commissioned User-Side New Energy Storage Projects in China, August 2025

Data Source: CNESA DataLink Global Energy Storage Database

https://www.esresearch.com.cn/

Note: Data provided by provincial grid companies, compiled and analyzed by CNESA.

Based on filed projects, the user-side market maintained a low-growth trend. Traditional user-side energy storage markets in Zhejiang, Guangdong, and Jiangsu showed insufficient growth momentum, while user-side projects in Jiangsu overly pursued large-scale operations. In these three provinces, over 620 newly filed user-side energy storage projects were recorded, representing a 32% YoY decline.

In Zhejiang, both the number of projects and energy capacity decreased year-on-year by 38% and 34%, respectively. In Guangdong, the number of filed projects remained stable compared with the same period last year, while energy capacity fell by 6% year-on-year. Jiangsu saw the largest decline in project count at -50% year-on-year, but its energy capacity increased sharply by +341% year-on-year.

User-side energy storage projects in Jiangsu are increasingly “moving toward large-scale”. For example, in the Xinyi Economic Development Zone industrial park in Jiangsu province, 350 MW / 700 MWh user-side projects and other projects above the 100 MW scale accounted for over 10% of total projects, showing a substantial increase compared with the same period last year. Projects above the 100 MW scale collectively represented 40% of the newly filed capacity in Jiangsu for August.

Figure 4: Monthly Distribution of Newly Filed Energy Storage Project Capacity in Zhejiang, Guangdong, and Jiangsu (Jan.-Aug. 2025)

Data Source: CNESA DataLink Global Energy Storage Database

The 14th ESIE - largest energy storage event in China is coming on April 1-3, 2026, Beijing, China!

Register Now to attend, free before Oct 31, 2025.