On January 22, Energy Storage International Conference and Expo 2026 Press together with CNESA DataLink 2025 Annual Energy Storage Data Release was held in Beijing, China. Enterprises across the energy storage value chain and authoritative media outlets closely following the sector gather together to review the past developments and look ahead to the future.

During the press, Chen Haisheng, director, Institute of Engineering Thermophysics, Chinese Academy of Sciences Chairman, China Energy Storage Alliance, on behalf of China Energy Storage Alliance (CNESA), delivered a comprehensive overview of the development of China’s new-type energy storage industry in 2025 and shared insights into trends for 2026.

Liu Wei, Secretary General of CNESA reported the preparatory progress of the 14th Energy Storage International Conference And Expo (ESIE 2026). ESIE 2026 is set to achieve comprehensive value upgrade with the core to build a true “energy storage ecosystem exhibition”. It aims to not only attract attention but committed more to create industry value-- through accurate resource matching, in-depth content services and long-term and effective ecosystem connections to establish a platform empowering the full lifecycle growth of energy storage enterprises.

Meanwhile, as China stands at the critical juncture of market-oriented transition for standalone energy storage during the 15th Five-Year Plan period, amid widening regional policy divergence and rising challenges in industrial decision-making, CNESA released the first toolbook-style policy map for standalone energy storage market mechanisms. It will also focus on key policies in 21 provinces, break down their revenue models, explore mechanism highlights and evaluate the profitability level, providing efficient decision-making references for governments, companies and investment institutions and contributing to the industry high-quality development.

01.

Scale of New-type Energy Storage Projects

Total Power Storage Capacity Reaches 213.3GW with New-Type Energy Storage Accounting for Over Two Thirds

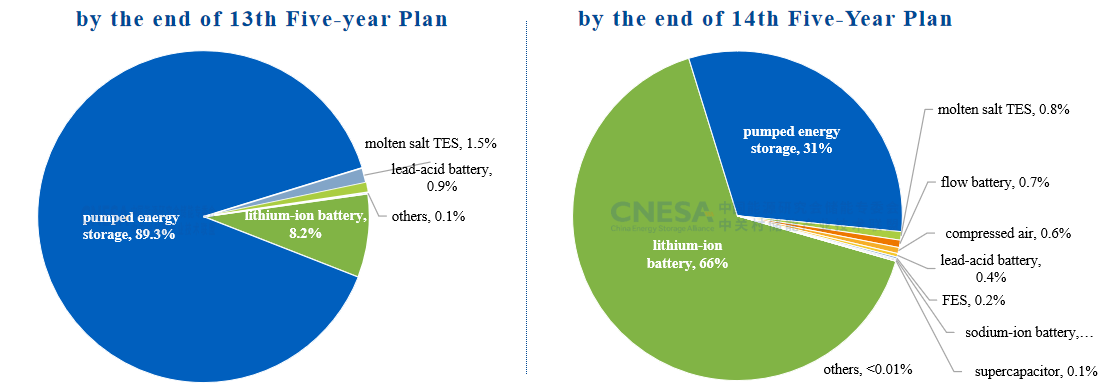

According to the incomplete statistics from CNESA Datalink Global Energy Storage Database, by the end of December, 2025, China’s cumulative installed power storage capacity reached 213.3GW with an increase of +54% year on year. 2025 marks the end year of the 14th Five-Year Plan, the market share of energy storage technologies saw changes compared with that of the 13th Five-Year Plan period. Pumped hydro storage accounted for 31.3% of total capacity, the new-type energy storage represented by lithium battery witnessing leapfrog growth and the cumulative installed capacity of new-type energy storage exceeded two thirds of the total, accelerating the industry’s transition from single dominant technology toward diversified development.

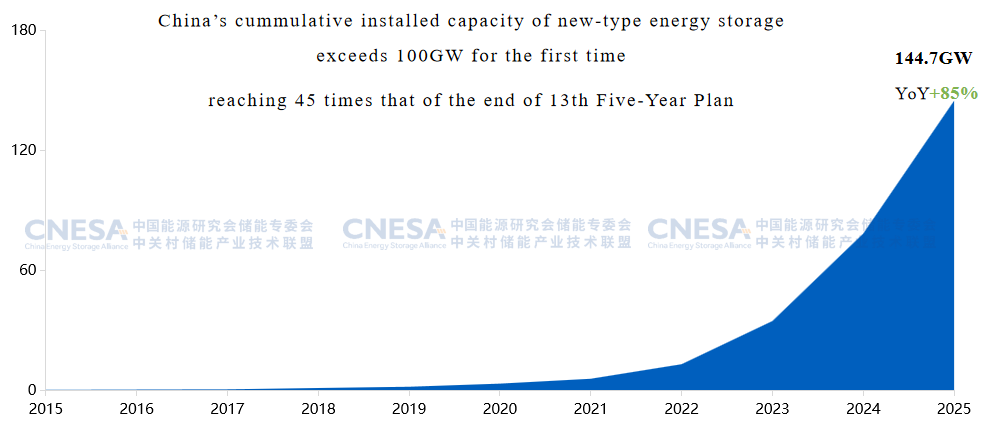

Cumulative Installed Capacity of New-Type Energy Storage Exceeds 100GW

By the end of December, 2025, China’s cumulative installed capacity of new-type energy storage reached 144.7GW, witnessing a year-on-year increase of +85%. It was the first time that China’s cumulative installed capacity of new-type energy storage exceeded 100GW, reaching 45 times that of the end of 13th Five-Year Plan. The major application scenario of China’s new-type energy storage has shifted from being dominated by the user-side (35%) to being primarily standalone energy storage (58%); Thermal power plus storage for frequency regulation (1.4%) and user-side storage (8%) witnessed evident decline; New energy paired storage share remains steady.

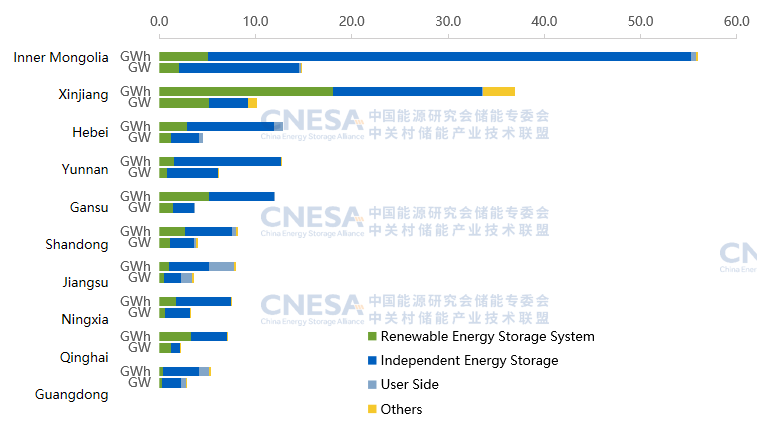

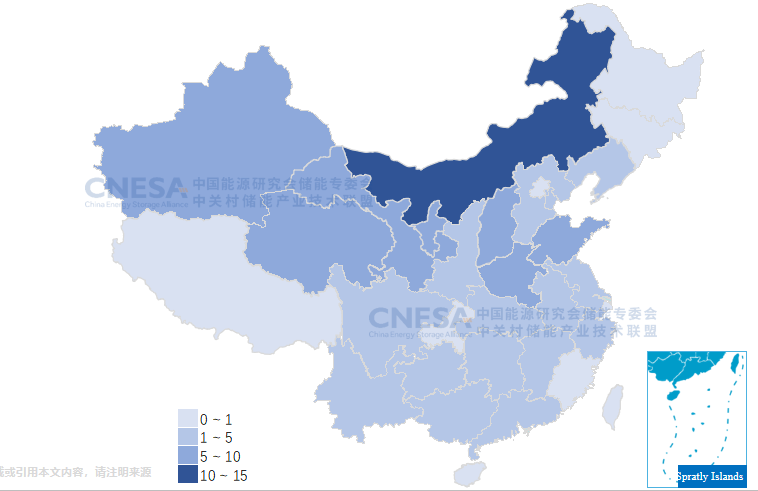

Newly Commissioned Capacity Reaches 66.43GW/189.48GWh

China commissioned 66.43GW/ 189.48GWh of new-type energy storage capacity, with an increase of 52%/73% in power size and energy scale respectively. In terms of regional dispatch, all top 10 provinces’ installed capacity was more than 5GWh, totaling about 90%; Western provinces took full lead, with Inner Mongolia ranking first in both power and energy capacity, surpassing California to become the world’s leading province by scale. Yunnan Province entered the Top10 for the first time.

02. New-Type Energy Storage Bidding and Tendering Market

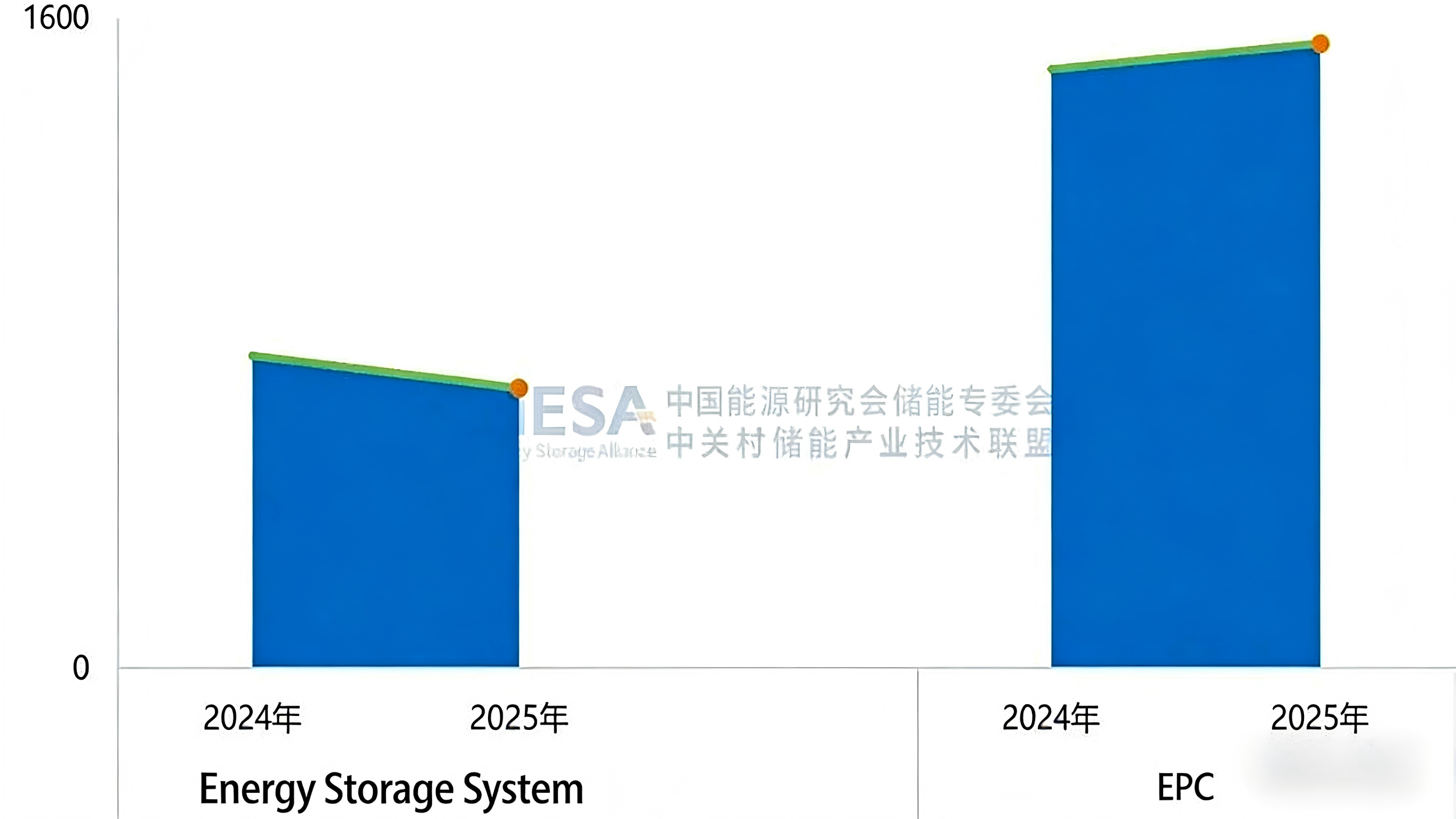

Decline in Energy Storage System Tenders, Increase in EPC Tenders

According to incomplete statistics from CNESA DataLink Global Energy Storage Database,690 energy storage system tender packages (excluding centralized and framework procurement) were issued in 2025, down 10.4% year on year. In contrast, 1,536 EPC tender packages (excluding centralized and framework procurement) were released, representing a 4.5% increase. This shift indicates changing construction preferences in the non-centralized and framework procurement market, with project owners increasingly favoring integrated, turnkey delivery models that outsource construction and risk management.

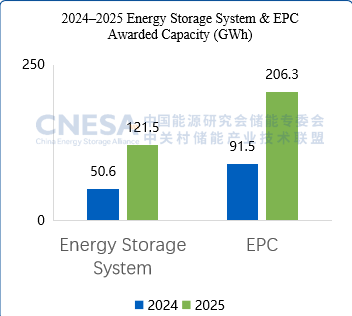

Winning Bid Volumes for Energy Storage Systems reach 121.5GWh and 206.3GWh for EPC

In 2025, the winning bid volume for energy storage systems (excluding centralized and framework procurement) reached 121.5GWh, up 140.1% year on year. Meanwhile, EPC projects recorded a winning bid volume of 206.3GWh, representing a 125.5% increase.

03. New-Type Energy Storage Policies

High Policy Activity Maintained

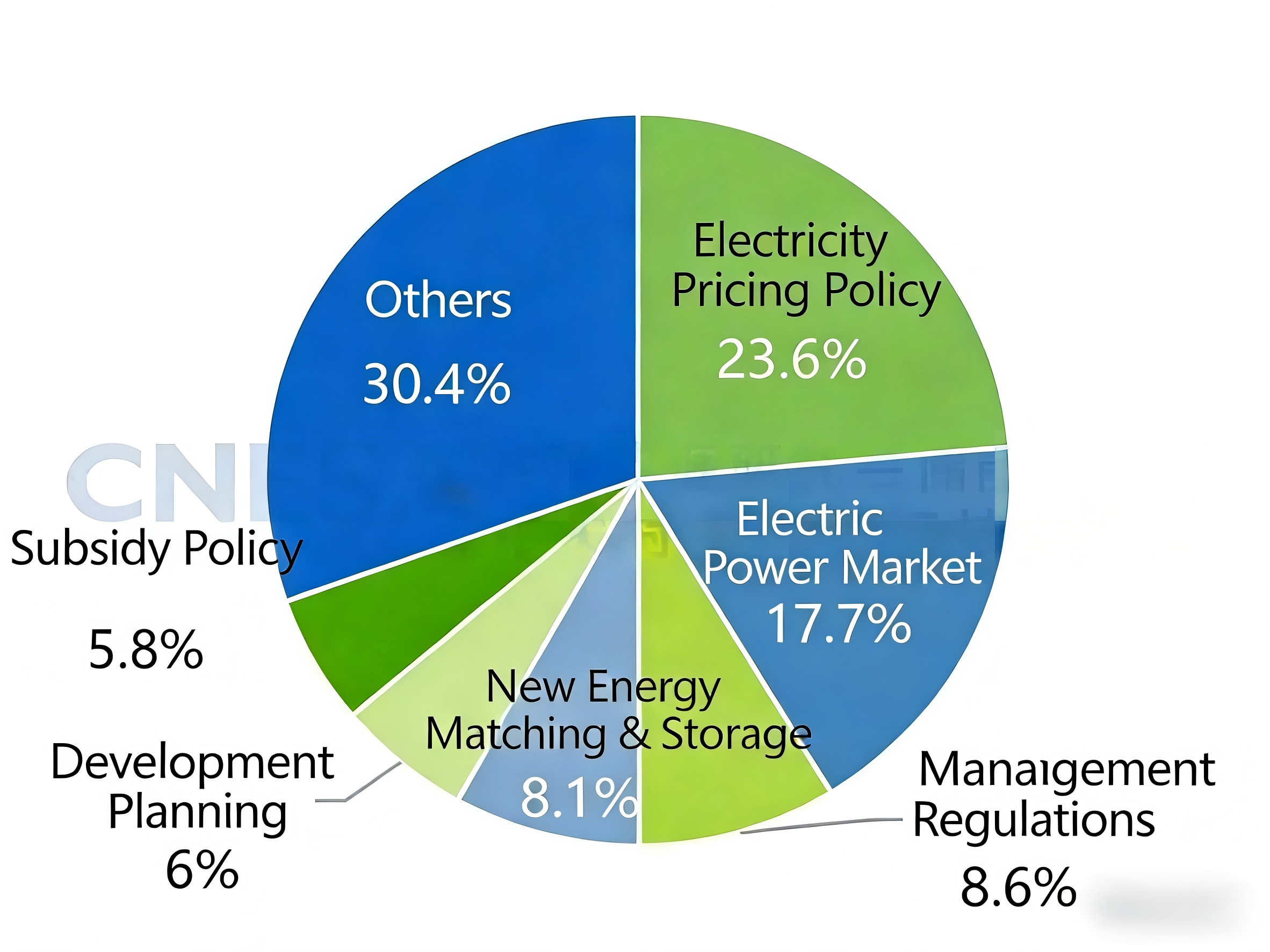

CNESA pays attention to energy storage policy development for a long term and rolled out 869 relevant policies with a year-on-year increase of 13%; Market-oriented reform entered rapid development with electricity pricing and power market policies keeping the heat high and regulatory and management-oriented policies sharing larger proportion.

Many Provinces Have Realized the 14th Five-Year Plan Targets

By the end of 2025, the total installed capacity of provincial new-type energy storage in 14th Five-Year Plan period exceeded 91.6GW. In terms of practical installed capacity, most provinces nationwide have achieved their respective planning targets of the 14th Five-Year Plan.

Commercial and Industrial Energy Storage Moves Toward Marketization, with Cumulative Capacity Expected to Exceed 30GW During the 15th Five-Year Plan

In early 2025, document No. 136 promoted the full market participation of the new energy electricity generation. The medium-and-long-term rules by the end of 2025 canceled artificially prescribed time-of-use pricing for market participants. It can be seen that the load-side users will gradually enter market and commercial and industrial energy storage in 2026 will move towards marketization in phase.

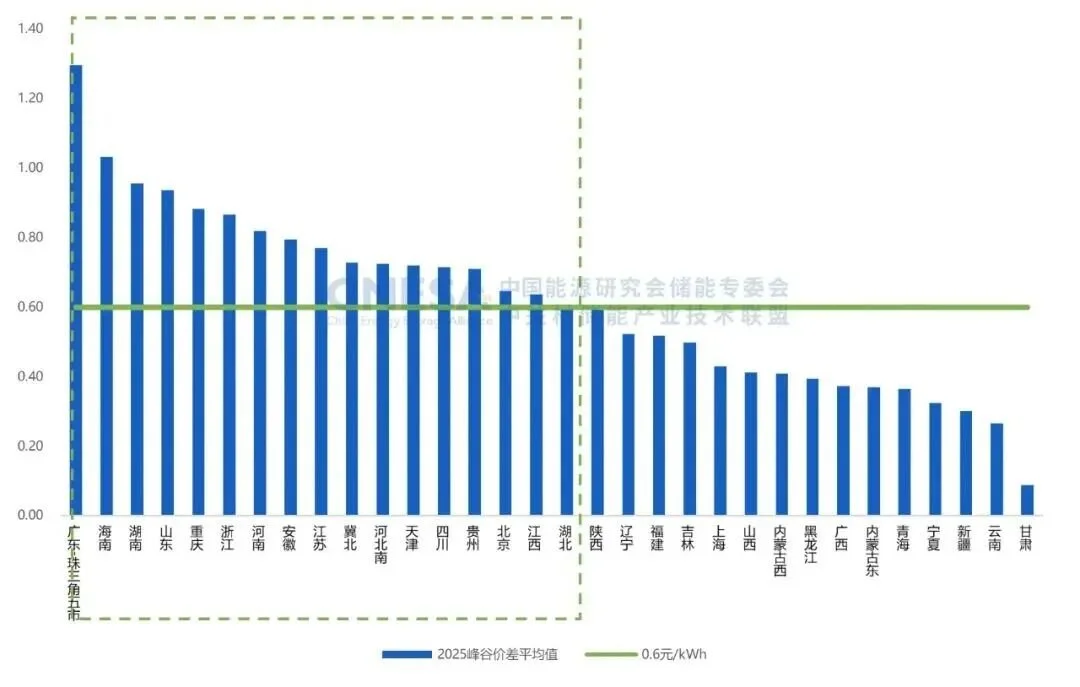

For time-of-use pricing, several places have matched spot market to adjust time-of-use and pricing scope with a general narrowing of price spreads. A majority of regions saw bearish news from the short term. For grid agency purchase electricity price, the average price spread of 32 regions was RMB0.616 per kWh with a year-on-year decrease of 9.4%.

Meanwhile, China encourages commercial and industrial users at 10kv and above to directly participate in the electricity market and gradually narrow the grid agency purchase user scope. Therefore, in the future, the pricing spread arbitrage of commercial and industrial will be decided by the real-time market supply and demand, which is unsustainable only depending on the fixed price spread arbitrage model.

Looking into the 15th Five-Year Plan, commercial and industrial energy storage will keep steady growth with diverse revenue streams, shifting from single “fixed price spread arbitrage model” to “fluctuated market price spread arbitrage+demand charge management+demand response”. The cumulative installed capacity is expected to exceed 30GW.

04.

Outlook for the New-Type Energy Storage

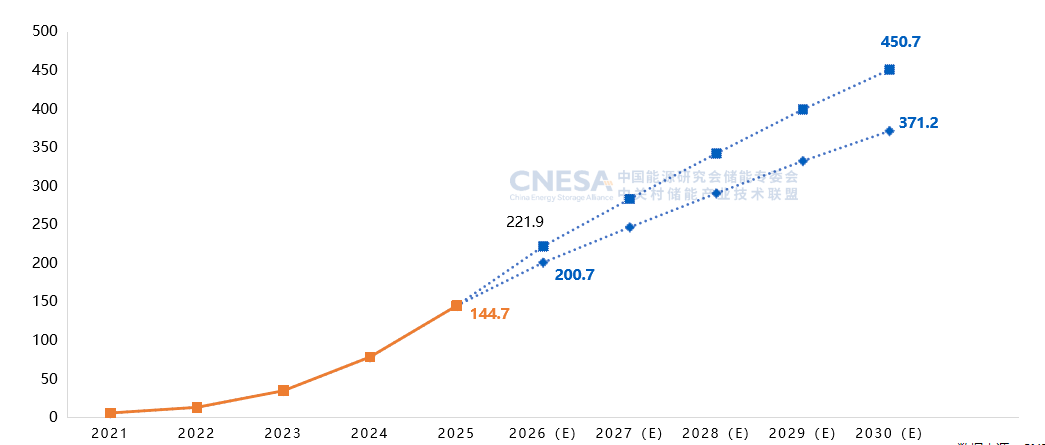

Cumulative installed capacity of new-type energy storage is expected to exceed 370GW by 2030

Looking ahead to the 15th Five-Year Plan, key development trends include:

Policy: New-type energy storage will be driven by market mechanisms, continue to expand new application scenarios and innovate business models together the green value and facilitate the industrial high-quality development.

Technology: The industry has entered a phase of multi-technology coexistence. Diverse energy storage technologies are expected to continue achieving breakthroughs across multiple scenarios and scales throughout the 15th Five-Year Plan period and long-duration energy storage will come into a critical development phase.

Energy Storage Duration: According to CNESA, the average time-spun of cumulative new-type energy storage installations witnessed slow increase between 2021 and 2025 from 2.11 hours to 2.58 hours. From 2026 onwards, the duration growth is expected to speed up evidently, which will reach 3.47 hours by 2030. This change reflects the intensified demand of ongoing technological progress and market for long-duration energy storage. This industry is moving towards in-depth application scenario emphasizing more on energy capacity including energy transfer time and system regulation.

Installation Capacity: Historical statistic shows that China’s new-type energy storage has entered rapid development. Over the past 5 years, the cumulative installation of new-type energy has been 40 times larger. As installed base grows, growth rate slowing down will be definite. Looking into the 15th Five-Year Plan, in spite of moderate development, the large base will continue to generate considerable absolute increase. The cumulative installed capacity in 2030 is expected to exceed 370GW.

Register now to attend Asia’s Largest Energy Storage Trade Show for free:

What: The 14th Energy Storage International Conference & Expo

When: Conferences: March 31 - April 2, 2026

Exhibitions: April 1-3, 2026

Where: CIECC Beijing, China

Adress: No. 55 Yudong road, Shunyi District, Beijing China