Developers accelerate construction as industry navigates foreign content restrictions and shifting clean energy priorities

The U.S. energy storage sector is expected to continue expanding after the enactment of the FY2025 Budget Act, which secures Investment Tax Credit (ITC) eligibility for storage projects commencing construction through the end of 2033. Amid changes to federal policy and evolving supply chain rules, developers are expediting project timelines to stay ahead of emerging compliance constraints.

Signed into law on July 4 during the Independence Day holiday, the legislation—branded by Republicans as the “One, Big, Beautiful Bill Act”—introduces sweeping reforms to federal clean energy incentives. While support for solar and wind has been significantly curtailed, the final law preserves robust incentives for storage, geothermal, biomass, and hydropower via a new technology-neutral ITC structure.

Incentive Structure Realigned: Solar and Wind Scale Back, Storage Stays Protected

The legislation effectively eliminates Sections 48E and 45Y tax credits for solar and wind installations. To retain residual incentives, these projects must either begin construction within a year of the bill’s passage or reach operational status by the close of 2027. Meanwhile, residential energy efficiency programs are scheduled to sunset by year-end, accompanied by a reduction in environmental research funding.

Energy storage, however, avoided a parallel rollback. The House-passed version initially proposed shortening ITC eligibility for storage, mirroring the limitations set for solar and wind. But during Senate deliberations, the original timeline was reinstated following Finance Committee revisions and vote-a-rama negotiations.

Under the updated framework, qualifying storage and other dispatchable technologies can receive a base ITC of 30% of capital expenditures. Projects that satisfy domestic content standards may unlock an additional 15% bonus, pushing the total potential tax credit to 45%.

“Construction Start” Benchmark Replaces Commissioning Date for ITC Eligibility

A key change introduced in the law is the replacement of the “placed in service” requirement with a more flexible “construction start” standard for determining ITC eligibility. This aligns with prior changes under the 2022 Inflation Reduction Act (IRA), providing developers with expanded planning options.

Projects that commence construction before 2033 qualify for the full ITC, with credit values dropping to 75% in 2034 and 50% in 2035. Industry observers point to this extended phase-down as a critical advantage that sets storage apart from other clean energy technologies now facing tighter timelines.

FEOC Provisions Drive Pre-2026 Construction Rush

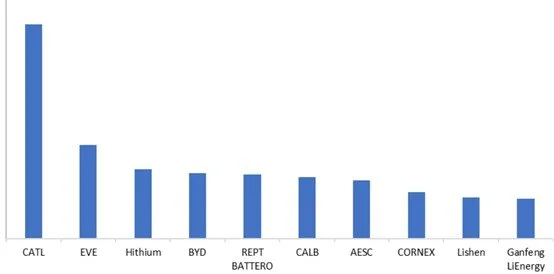

Beginning in 2026, the law introduces new sourcing requirements tied to “foreign entities of concern” (FEOC). To qualify for the ITC, at least 55% of a project’s costs must originate from non-FEOC sources—a threshold that will rise to 75% by 2030. Battery cells, which make up roughly 52% of total storage system costs, are a key focus of this provision.

To navigate compliance, the Internal Revenue Service (IRS) is expected to issue new cost allocation tables by 2027. Until those are available, developers may reference existing safe harbor benchmarks used to determine domestic content bonus eligibility under current ITC rules.

Due to limited availability and elevated costs of non-Chinese battery cells, many developers are working to launch projects before the end of 2025 to avoid the stricter FEOC rules. Projects slated for later execution will need to reconfigure procurement strategies or face diminished credit access.

Domestic Battery Supply Remains a Bottleneck

Current domestic manufacturing capacity is not yet sufficient to meet projected demand for FEOC-compliant battery cells. Fluence is utilizing Tennessee-made AESC cells for a portion of its U.S. projects, while LG Energy Solution has initiated construction of a lithium iron phosphate (LFP) facility in Michigan. Meanwhile, startup Our Next Energy (ONE) has begun domestic LFP cell production, taking advantage of domestic content incentives.

Even with support from the Section 45X advanced manufacturing tax credit, the industry awaits detailed IRS guidance on applying FEOC criteria to domestically produced components. Until then, developers face supply limitations and ongoing uncertainty.

Trade Policy Clouded by Looming Tariff Expiration

U.S. tariffs on batteries imported from China—currently set at approximately 54%—are due to expire on August 12. The absence of clarity on whether these duties will be extended or modified is leading developers to accelerate purchases and construction while trade conditions remain stable.

Although some projects may be economically viable even without ITC support due to low-cost components from China, ongoing policy volatility and compliance risk are prompting many developers to pursue more secure, domestic-aligned supply chains.

Non-Lithium Alternatives Emerge, Face Cost Barriers

A range of alternative battery chemistries—including vanadium flow, zinc-based, and iron-air technologies—are gaining attention for their potential to meet long-duration energy storage (LDES) needs. These technologies may also help circumvent FEOC-related challenges by tapping into non-Chinese supply sources.

LDES applications are particularly relevant in states like California, Massachusetts, and New York, where policy incentives and market demand are aligned. However, cost competitiveness remains a key barrier. Lithium-ion batteries still enjoy strong economies of scale, making alternatives less attractive for large-scale deployment in the near term.

Policy Focus Shifts from Decarbonization to Grid Reliability

According to policy watchers, the current administration’s sustained support for energy storage is driven more by concerns over electric grid stability than by emissions reductions. Dispatchable resources like storage, geothermal, and nuclear are viewed as essential to maintaining power system reliability, which has become a central focus of federal energy strategy.

Despite the rollback of many climate-oriented subsidies, these technologies remain integral to the administration’s broader vision for a secure and resilient grid.

Outlook: Storage Maintains Strategic Position Amid Regulatory Shifts

While sweeping changes to federal clean energy policy have introduced new constraints for several sectors, energy storage retains a favorable position. A longer ITC phase-out schedule, expanded eligibility flexibility, and ongoing federal manufacturing incentives provide a runway for continued growth.

However, developers must act swiftly to navigate FEOC-related deadlines, tariff uncertainties, and domestic capacity bottlenecks. The sector’s success will depend on how effectively stakeholders can adapt to these shifting conditions and restructure their supply chains to align with evolving regulatory requirements.