Southeast Asia’s Ambitious Cross-Border Renewable Project Takes Shape with CATL’s Energy Storage Commitment

A major milestone has been reached in Southeast Asia’s cross-border renewable energy ambitions, as China’s Contemporary Amperex Technology Ltd. (CATL) secured a framework agreement to provide 2.2GWh of battery energy storage systems (BESS) for the landmark Vanda Solar & Battery Project. The initiative is set to deliver solar power from Indonesia’s Riau Islands to land-constrained Singapore under a broader regional energy collaboration plan.

The deal underscores CATL’s expanding footprint in the global BESS market while reinforcing Indonesia’s and Singapore’s strategic alignment on clean energy trade. With the storage capacity representing half of the project’s total 4.4GWh BESS needs, the agreement is pivotal for enabling stable, dispatchable energy exports across the undersea transmission corridor.

Bilateral Policy Moves Enable a Regional Clean Energy Exchange

The battery supply deal follows policy groundwork laid by the Indonesian and Singaporean governments in the form of a “green economic corridor” — a bilateral agreement designed to facilitate renewable energy trade between the two nations. Singapore’s Energy Market Authority (EMA) has conditionally approved the export of 300MW of renewable electricity from the Vanda Solar & Battery Project, marking a first-of-its-kind international clean energy trade route for the city-state.

This framework aligns with Singapore’s Green Plan 2030, which seeks to import up to 4GW of low-carbon electricity by 2035, as domestic land limitations severely restrict large-scale renewable development. Indonesia, on the other hand, benefits from extensive land availability and an increasing policy emphasis on clean energy buildout, as demonstrated by its newly ratified plan for state-owned utility PLN to add 42.6GW of renewable generation and 10.3GW of energy storage by 2034.

Technical Design Anchored in Local Manufacturing and Supply Chain Localization

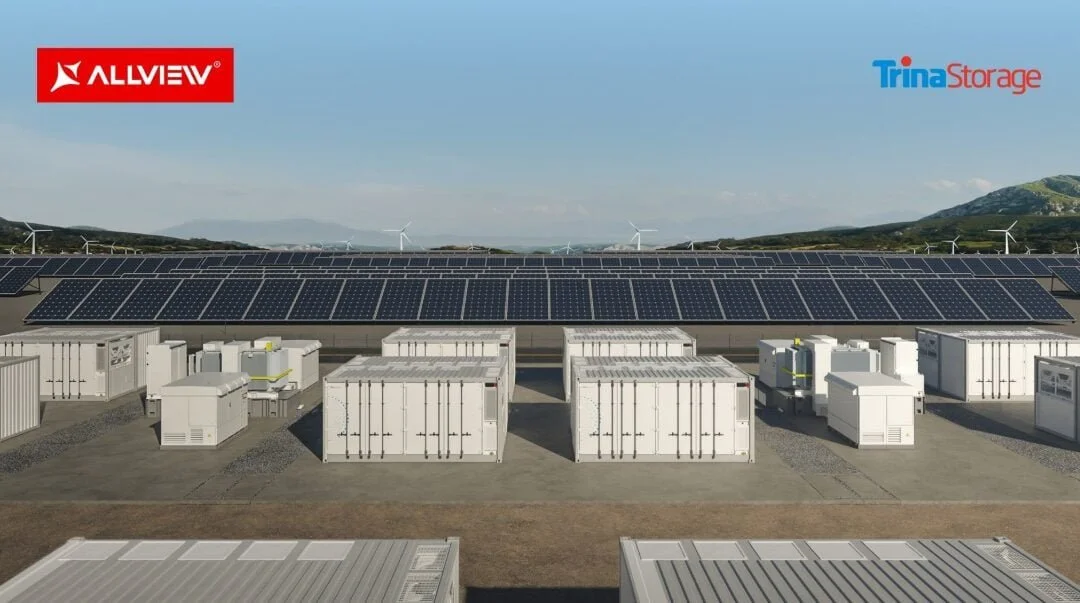

The Vanda project is planned to include 2GWp of solar photovoltaic (PV) capacity alongside the 4.4GWh of energy storage. The 2.2GWh of EnerX BESS units sourced from CATL will be vital to managing the intermittency of solar production and ensuring reliable export to Singapore.

Vanda RE, the project’s joint venture developer—comprising Singapore-based Gurīn Energy and Gentari International Renewables, a Petronas subsidiary—has also secured PV module supply agreements with LONGi Green Energy (1GW) and Trinasolar (1.4GW). All three Chinese manufacturers, including CATL, are building production facilities within Indonesia. This enables the project to satisfy the country’s domestic content requirement (TKDN), which is a policy condition for participation in national infrastructure projects.

CATL’s battery factory, currently under construction in Karawang, West Java, is slated for an initial annual production capacity of 6.9GWh, scalable to 15GWh. This facility is part of a broader US$6 billion investment across the Indonesian battery value chain, involving recycling operations and material processing in partnership with state-owned Indonesia Battery Corporation (IBC) and CATL’s subsidiary Brunp.

Growing Corporate and Governmental Appetite for Regional Energy Integration

The Vanda project is emblematic of a larger trend in Southeast Asia toward energy interconnectivity. As highlighted by a recent Rystad Energy report, a Southeast Asian power grid centered around Singapore could support the deployment of 25GW of renewables and energy storage. Singapore is already importing hydro and solar energy from Laos and Thailand, and new corridors are under consideration for wind from Vietnam and hydropower from Malaysia.

From a geopolitical perspective, Singapore’s leadership in financing and regulation provides a bankable counterpart for countries like Indonesia, Vietnam, and Cambodia, which offer land resources but require external investment to realize energy infrastructure at scale.

This momentum was further reinforced at the 2025 ASEAN Summit, where Singapore signed renewable energy export cooperation agreements with Malaysia and Vietnam. These transnational partnerships mark a shift toward integrated clean energy development, positioning the region to become a global model for renewable electricity trade.

Scaling Challenges Highlight the Complexity of Cross-Border Projects

Despite the promising progress, Vanda RE and its partners face several implementation risks. For one, the complexity of constructing interconnection infrastructure, including undersea transmission, remains a significant engineering and regulatory hurdle. Permitting, financing, and synchronization across jurisdictions are often protracted processes that can delay execution.

Another key challenge involves ensuring timely and reliable delivery of BESS and PV components, even from locally situated factories. While Indonesian localization policy offers benefits, it may also introduce bottlenecks if industrial ramp-up lags behind project schedules.

Furthermore, navigating different national energy regulations, tariff structures, and capacity planning frameworks can strain coordination, particularly as the project scales toward commercial operation. Ensuring grid stability and aligning market rules across countries will require substantial regulatory harmonization.

Strategic Implications for Clean Energy Supply Chains and Investment

The Vanda Solar & Battery Project reflects broader shifts in the global clean energy landscape. For Indonesia, it offers a blueprint for stimulating industrial development through energy exports, while creating domestic manufacturing jobs and advancing climate goals. For Singapore, the project is part of a necessary pivot toward energy import diversification amid space constraints and growing electricity demand.

The CATL agreement also signals increased localization of clean energy supply chains in Southeast Asia. If successfully executed, Indonesia could emerge as a critical node in the global battery and solar module supply web, drawing investment from upstream mineral extraction to downstream manufacturing.

From an investor standpoint, such projects present a high-reward opportunity tied to long-term regional energy demand growth. However, they also entail significant exposure to geopolitical, regulatory, and execution risks that must be carefully managed.

Looking Ahead: A New Regional Clean Energy Ecosystem in Formation

As Southeast Asia intensifies efforts to decarbonize and integrate its energy systems, projects like Vanda represent more than bilateral energy trade—they are foundational steps toward a regional clean energy ecosystem. The combination of robust policy frameworks, maturing supply chains, and growing private-sector participation may create a replicable model for other transnational renewable energy projects.

However, sustained success will depend on harmonizing technical standards, securing finance for grid infrastructure, and balancing domestic interests with regional goals. The CATL deal is a meaningful indicator that stakeholders across the region are aligning around these objectives, but implementation will be the true test.

If executed successfully, the Vanda project could mark a new era of Southeast Asian energy cooperation—one in which clean power flows across borders as freely as capital and innovation already do.