1. The Global Market

Electrochemical Energy Storage Programs Continue a Steady Growth

According to partial statistics of the China Energy Storage Association (CNESA), as of 2017 Q3, energy storage projects have reached a total worldwide operational scale of 169.2GW. Among these, pumped hydro occupies the largest number of installations at 97%. Electrochemical energy storage systems rank third in scale, at 2244.4MW, or 1.3% of the total, an increase of 15% from last year.

The third quarter of 2017 has seen a worldwide increase of 94.4MW in the total number of operational electrochemical energy storage projects, a 551% increase from Q3 of 2016, and 50% increase since Q2 of 2017.

Q3 Markets in the United Kingdom, Australia, United States, and China are Active

A comparison of worldwide Q3 increases reveals the UK, China, and Japan to be the top three countries with the largest scale of projects in operation. Projects in these three countries have all been dedicated to the renewable integration and ancillary service sectors. Australia, the US, and the UK rank top three in scale of projects under construction/planning, with 91% of such projects in these countries dedicated to renewable integration and the ancillary service sectors.

Ancillary Services Occupy the Largest Proportion of Q3 Market

In quarter three of 2017, the scale of global increase in energy storage projects has been largest in the ancillary services sector at 31.5MW, or 33% of the total global capacity. This is a 6200% increase since Q3 2016, and 75% increase since Q2 2017. Projects have largely been concentrated in the UK, Germany, and Belgium, such as the UK’s frequency regulation projects in Bristol and Darlington. The energy storage systems operate as independent electric stations, or in conjunction with gas turbines to provide a primary frequency control service for the European market.

Lithium Battery Enterprises Occupy the Top Four Spots in the Q3 Market

A comparison of energy storage enterprises by newly installed capacity revealed that the top ten energy storage manufacturers were responsible for 82% of the total installed capacity in Q3 2017. Among these, lithium battery manufacturers occupied the top four spots on the list, and a total of eight spots altogether. Lead-acid battery manufacturers Sacred Sun and Narada occupied the remaining two spots on the list.

Notes:

1. Subject of the rankings: global energy storage system providers

2. Ranking Criteria: based on the “Global Energy Storage Project Database”; Data used comes from the publicly available and self-reported information for each enterprise; Rankings are based on the global total new increases in overall capacity (MW) in the first three quarters of the 2017 year.

2. The Chinese Market

Electrochemical Energy Storage Programs See Similar Steady Growth

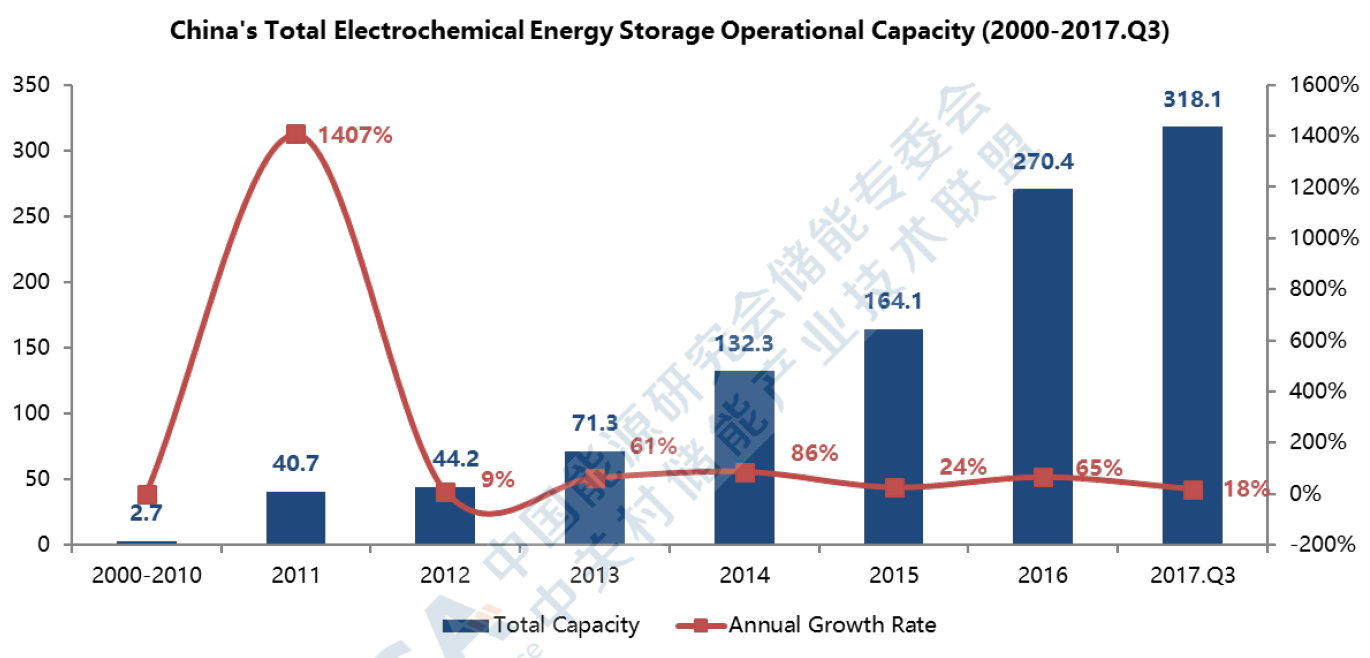

According to partial statistics of the China Energy Storage Association (CNESA), as of the third quarter of 2017, operational energy storage projects have reached a scale of 27.7GW. Among these, pumped hydro occupies the largest number of installations at 99%. Electrochemical energy storage projects hold a total capacity of 318.1MW, or 1.1% of total installations, an increase of 18% from the previous year.

In the third quarter of 2017, new energy storage projects reached a total scale of 22.8MW, a 114% increase from Q3 2016 and 1% increase from Q2 2017.

Q3 Markets in Eastern China Show High Activity

A geographic comparison of the total newly implemented capacity reveals that Eastern China occupies the largest scale at 12.2MW, or 53% of the total capacity across China. All applications are within the behind-the-meter sector, with the bulk of applications seen in industrial parks, helping enterprises to track peak and off-peak costs and save money through arbitrage of energy.

Behind-the-Meter Sector Occupies the Largest Proportion of Q3

China’s newly added energy storage projects have all been concentrated on the renewable integration and behind-the-meter sectors. The behind-the-meter sector is the largest at 17.8MW, occupying a 78% proportion, a 67% increase since Q3 2016, and 287% increase since Q2 2017. The third quarter increases in the behind-the-meter sector have all been in lithium-ion and lead-acid battery technologies, with lead-acid batteries occupying the greatest proportion at 54%.

Lithium Battery and Lead-Acid Battery Enterprises Occupy the Main Spots in Q3 Market

The energy storage providers holding the top five spots in new capacity held 80% of the total new capacity in China for Q3 2017, with Narada occupying the first place on the list. The bulk of the storage capacity for these five enterprises has been applied to the behind-the-meter sector, at nearly 70% of the total new capacity. New projects have largely been concentrated in Jiangsu, Zhejiang, Guangdong, and other areas of eastern and southern China, with the bulk of the energy storage systems applied to industrial parks.

Notes:

1. Subject of the rankings: Chinese energy storage system providers

2. Ranking criteria: based on the “Global Energy Storage Project Database”; Data used comes from the publicly available and self-reported information for each enterprise; Rankings are based on China’s total new increases in overall capacity (MW) in the first three quarters of the 2017 year.

3. About this Report

In order to strengthen the sharing of industry information and assist enterprises in better understanding market developments, the China Energy Storage Alliance (CNESA) has, beginning in 2017, provided the “Energy Storage Industry Data Sharing and Transmission Platform.”

Each quarter year, we send our platform members the full version of our Report on the Global Energy Storage Market. Our summary versions, once available, are also shared freely amongst industry colleagues.

We welcome any enterprise wishing to join our information sharing platform to contact the CNESA Research Department, to share information and receive a copy of the Report on the Global Energy Storage Market.

Contact: Na Ning

Telephone: 010-65667068-805

Email: na.ning@cnesa.org