On April 3, the China Energy Storage Alliance kicked off the 2018 Energy Storage International Conference and Expo at the National Convention Center in Beijing. The opening ceremony featured a presentation by China Energy Storage Alliance Chief Supervisor Zhang Jing announcing the release of CNESA’s Energy Storage Industry White Paper 2018. This year's white paper features a list of the top five technology providers and systems integrators both domestic and international.

China Energy Storage Alliance Chief Supervisor Zhang Jing Announces the Release of the Energy Storage Industry White Paper 2018

The lists rely on data provided primarily by the CNESA Global Energy Storage Project Database, as well as publicly available project information and information provided voluntarily by companies. The lists are focused on the newly installed capacity of energy storage technology providers and systems integrators in the year 2017.

The “technology providers” category, as defined by CNESA, includes companies that provide energy storage technologies, battery modules, and battery systems. The “systems integrators” category includes companies that are involved in the energy storage systems integration business, providing customers with a complete energy storage system. Such products include BMS, PCS, EMS and all other components that are needed for a complete set of equipment.

China’s Energy Storage Market List

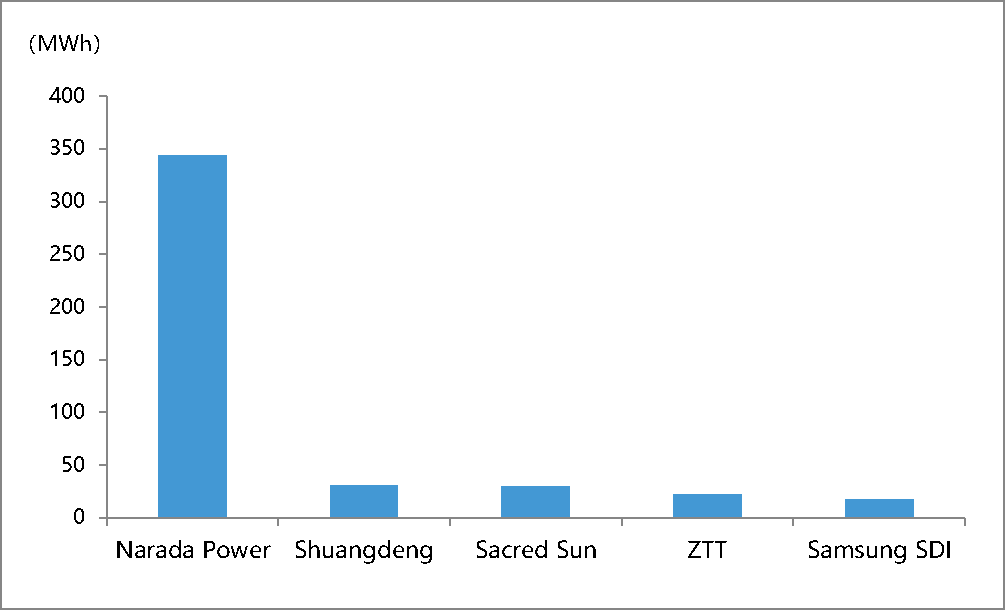

In 2017, among China’s newly added electrochemical energy storage projects, the top five technology providers with the largest new capacity included Narada Power, Shuangdeng, Sacred Sun, ZTT, and Samsung SDI.

China’s Top Technology Providers for 2017 (MWh)

In 2017, among China’s newly added electrochemical energy storage projects, the top five systems integrators in terms of MW capacity included (in order from greatest to least) Narada Power, Sungrow-Samsung, CLOU, Shuangdeng, and ZTT. In terms of MWh capacity, the top five systems integrators included (in order from greatest to least) Narada Power, Shuangdeng, ZTT, Sungrow-Samsung, and CLOU.

China’s Top Systems Providers for 2017 (MW)

China’s Top Systems Providers for 2017 (MWh)

From the rankings, it is clear to see that the 2017 Chinese energy storage market’s most active areas continued to be Li-ion battery and lead-acid battery manufacturers and systems integrators. Also of note is that the companies making the lists are predominantly those that serve the role of both technology provider and systems integrator. Of these, Narada Power stands out as the clear leader in installed capacity, sitting at the top of all three lists. ZTT occupied the top spot in energy generation (MWh) as both technology provider and systems integrator, while Sungrow-Samsung occupied the top of the list of Li-ion battery systems integratiors in terms of power (MW) capacity.