In 2019, China’s solar industry transitioned from an era of subsidized solar to a new era without subsidies. Solar power has now reached a state of near grid parity, meaning that solar generation must now face direct competition with conventional fossil fuel generation. Those in the energy industry are aware of the challenges of solar generation, including instability and intermittency, sensitivity to weather changes, and the difficulty of the grid to consume solar generation on a large scale. These issues put solar power at a disadvantage when compare to conventional generation and pose a challenge to the entire energy system. Energy storage offers one method of confronting these challenges. Energy storage can stabilize generation, improve power quality, provide storage of excess generation, help increase the grid’s consumption of renewable generation, and increase the flexibility of grid dispatch. Through grid parity, solar power generation may now pave the way for development of the “solar-plus-storage” market.

1. China’s Solar-plus-storage Market Scale

According to CNESA Global Energy Storage Project Database statistics, as of the end of 2019, operational energy storage projects paired with solar generation (including molten salt thermal storage) totaled 800.1MW of capacity, an increase of 66.8% compared to the 2018 year’s end and comprising 2.5% of total energy storage capacity (including physical, electrochemical, and molten salt energy storage capacity). In 2019, newly operational solar-plus-storage capacity totaled 320.5MW, an increase of 16.2% compared to 2018. Numerous renewable energy companies have begun to understand and recognize energy storage and the value it can bring to solar generation.

Figure 1: total operational solar-plus-storage project capacity (2016-2019)

Data source: CNESA Global Energy Storage Project Database

I. Centralized solar-plus-storage projects

According to CNESA database statistics, as of the end of 2019, China had deployed a total of 625.1MW of operational energy storage projects paired with centralized solar generators, equivalent to 78.1% of all solar-plus-storage capacity. Regionally, these projects were deployed primarily in China’s northern regions, among which Qinghai province featured the greatest proportion of capacity at 294.3MW, or 47.1%. In 2019, State Grid Qinghai Power Co. announced their innovative shared energy storage model, China’s first shared energy storage blockchain platform. The program’s transaction model combines negotiated service agreements, competitive market pricing, and grid dispatch to provide a new method for marketized transactions between energy storage stations and renewable energy generators, promoting the widespread application of energy storage for increasing grid consumption of renewables, and opening a new market for centralized solar-plus-storage. Qinghai province also saw two molten salt thermal storage projects go online in September 2019, each at a scale of 50MW.

Figure 2: Regional distribution of operational centralized solar-plus-storage projects (MW%)

Data source: CNESA Global Energy Storage Project Database

II. Distributed solar-plus-storage projects

According to CNESA database statistics, as of the end of 2019, China had deployed a total of 175.0MW of operational energy storage projects paired with distributed solar generation, or 21.9% of total solar-plus-storage capacity. Distributed solar-plus-storage has a wide variety of applications, such as in rural areas with poor grid access, industrial solar-plus-storage projects, solar+storage+charging stations, island solar-plus-storage, military solar-plus-storage applications, and others. Of these applications, solar-plus-storage projects deployed in rural areas comprise the greatest portion of capacity, at 69.1MW, or 39.5% of total applications, a decrease of nearly 14% compared to the end of 2018. In contrast, industrial solar-plus-storage project capacity rose 8% over the same period, showing that an increasing number of industrial customers are using solar-plus-storage to lower the costs of their energy bills.

Figure 3: Distribution of operational distributed solar-plus-storage projects by application (MW%)

Data source: CNESA Global Energy Storage Project Database

2. Chinese Solar-plus-storage Project Case Studies

I. Qinghai Golmud DC-side Solar Generation Plant Energy Storage Project

The project is located in a solar industry park in Golmud city, Qinghai province. The project was developed by the Huaneng Group. Solar generation capacity totals 180MW, while energy storage capacity totals 1.5MW/3.5MWh. The energy storage project utilizes lead-carbon batteries and LiFePo lithium-ion batteries, and averages one daily charge-discharge cycle for storage of solar energy that would normally be curtailed. The project went operational in January 2018 and was developed at a total investment cost of 950,000 RMB.

The project relies on distributed DC-side solar PV and energy storage technologies to help solve the problem of pairing between solar generation and the energy storage system. In comparison to conventional AC-side solar PV and energy storage technologies, distributed DC-side solar PV energy storage technology not only reduces the power variation between the photovoltaic components and batteries, but also utilize the original photovoltaic inverter system’s inverter equipment, step up equipment, and circuitry, reducing the need to invest in additional equipment and saving physical space. In addition, the DC-side access does not affect the PV station’s original outgoing capacity, nor does it require approval for new grid-connected equipment. For older solar PV stations which produce high-cost electricity, the energy storage retrofit can significantly increase grid-connected power generation and economic benefit.

The solar PV station in the above case is one of relatively early construction, producing power at a cost of 1 RMB/kWh. If a 250kW/500kWh lead-carbon battery energy storage system was to be connected to this station, it could enjoy the same price rate for generation as the solar PV station. With an annual charge-discharge rate of 4000 cycles, the system would generate an additional 150,000kWh annually, providing 150,000 RMB of revenue at an ROI period of 6.96 years. At present, it is very economical to retrofit or add new energy storage systems to solar PV stations which are compensated at a rate of 0.9 RMB/kWh or higher. With the continuous decline in the cost of energy storage batteries, it may also be economical for PV stations which are compensated at 0.7 RMB/kWh to install new energy storage systems.

II. BYD industrial park renewable energy microgrid project

The project is located at the BYD plant in the Pingshan New District, Shenzhen, and was self-constructed by the BYD Electric Power Research Institute. Construction began in September 2013 and completed in July 2014. The project covers a total area of 1500 sq. meters, has a capacity of 20MW/40MWh, and was developed at a total investment cost of 148 million RMB. The station includes a medium voltage system, fire suppression system, ventilation system, energy conversion system, battery, and battery management system. Of these components, the energy conversion system, battery, and battery management system were researched and developed by BYD. The entire station is comprised of 59,000 220ah battery cells and 128 160kW PCS systems, with a design life of 20 years. The station’s primary purpose is smoothing of solar PV power generation, load shifting, and providing the industrial park with the ability to independently adjust its power consumption.

Figure 5: BYD Industrial Park renewable energy microgrid project

Source: BYD Electric Power Research Institute

According to station operation data, the system is combined with the park’s 12MW rooftop solar PV, storing off-peak electricity at night. The park’s real-time electricity consumption can be optimized based on external conditions, allowing the system to utilize a dynamic ratio of solar generation, energy storage, and grid energy. According to estimates, after taking into consideration the electricity cost savings for the park and the basic industrial electricity capacity costs, the project will achieve a return on investment in eight years. In areas where the peak and off-peak electricity price differences are high, this model shows early commercial value.

For distributed solar-plus-storage projects, the key factor to generating revenue is the price difference between peak and off-peak electricity at the customer side. Currently, as costs of energy storage continue to decrease, it will be economically viable to develop such projects in areas with a peak and off-peak price difference of 0.75 RMB/kWh or more.

3. China’s Solar-plus-storage Policy Environment

In addition to the national “531 Policy” released in 2018, there have been many recent regional policies which have had major influence on solar-plus-storage, such as those in Anhui, Xinjiang, Tibet, Shandong, and Jiangsu provinces, as well as the northwest China region. A few of these polices are listed below:

On May 31, 2018, the National Development and Reform Commission issued the "Notice on Matters Related to Photovoltaic Power Generation in 2018" (the "531 Policy”), which tightened subsidies and indicators for solar generation and made clear that the future development of solar generation would be based on unsubsidized grid parity. In response, many solar PV companies set their sights on energy storage, viewing the combination of solar generation and energy storage as one way for the future solar PV market to develop.

In September 2018, the Hefei government released the first subsidy policy for distributed solar PV combined with energy storage, the “Suggestions for Promoting the Development of the Solar PV Industry,” encouraging the development of solar-plus-storage applications by providing a 1 RMB/kWh charging subsidy to energy storage systems.

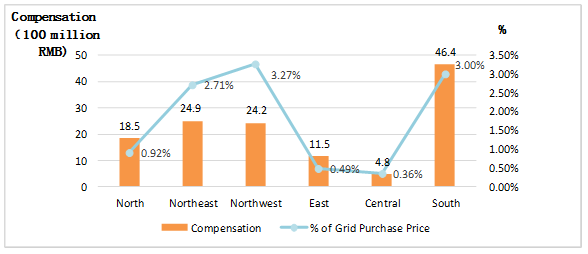

At the end of 2018, the Northwest China Energy Regulatory Bureau released an updated edition of the “Two Regulations,” which strengthened the assessment accuracy and penalization of renewable energy stations, as well as increased the types and standards for compensation. Renewable energy companies can optimize the operations of their renewable energy generators by installing energy storage, minimizing the risk of penalization and increasing revenue.

In June 2019, the Xinjiang Development and Reform Commission released the “Notice on the Development of Generation-side Solar-plus-storage Projects,” which provides 100 hours of priority generation for a five-year period to solar PV stations that install new energy storage systems.

In August 2019, the Shandong Energy Administration released the “Notice on Improving Grid Access for Grid Parity Projects in Shandong,” which encouraged large-scale centralized solar PV projects to install energy storage systems in order to reduce solar curtailment.

In December 2019, the Jiangsu Energy Regulatory Office released the "Notice on Further Promoting Grid Connection and Use of Renewable Energy” and “Distributed Generation Market Transaction Regulations for Jiangsu Province (Trial).” The policies encourage renewable energy generators to install a certain amount of generation-side energy storage, support energy storage project participation in the ancillary services market, and promote the combined operation of energy storage systems with renewable energy to increase system regulation abilities. The policies also encourage distributed generation projects to increase their power supply flexibility and stability through methods such as installing energy storage.

Although the Xinjiang policy provided centralized solar-plus-storage projects with 100 hours of priority generation, calculations from project operators revealed that investment returns would not be ideal. Even so, this type of project still has potential profit points. At present, ancillary services reforms in the five northwestern provinces of China, including the construction of power spot markets, are currently under way. In the future, solar-plus-storage projects are very likely to have the opportunity to provide ancillary services such as peak shaving and frequency regulation, as well as participate in renewable energy market transactions. In addition, at a time when the economy is not ideal, some enterprises still choose to build solar-plus-storage projects, in part to accumulate project experience and create opportunities for potential future profit points. The business models, ownership, capital schemes, role division, and cooperation models of such projects are all still being explored.

4. Solar-plus-storage Market Development Trends

The development trends of solar-plus-storage in China are closely linked to the development trends of solar PV. In the beginning, solar-plus-storage relied primarily on solar PV subsidy policies and the solar-plus-storage subsidy policies of individual provinces and cities, saving money on electricity fees through energy arbitrage and preventing losses by improving reliability of the power supply and power quality. These models gradually shifted to supporting the self- generation and use of solar power and promotion of onsite consumption of solar generation. During this period, solar PV subsidies began to decline, and the early stage of marketization began to appear. In addition to increasing solar PV generation income, energy storage could also delay the need for new investment in distribution networks, increase the stability of the power supply, and provide value-added services for the distribution of electricity. In the future, users may harness solar-plus-storage applications to avoid high electricity prices while also participating in the ancillary services market to earn greater profits. In the future we may also expect a variety of business models to emerge, and solar-plus-storage will formally enter the full marketization stage.

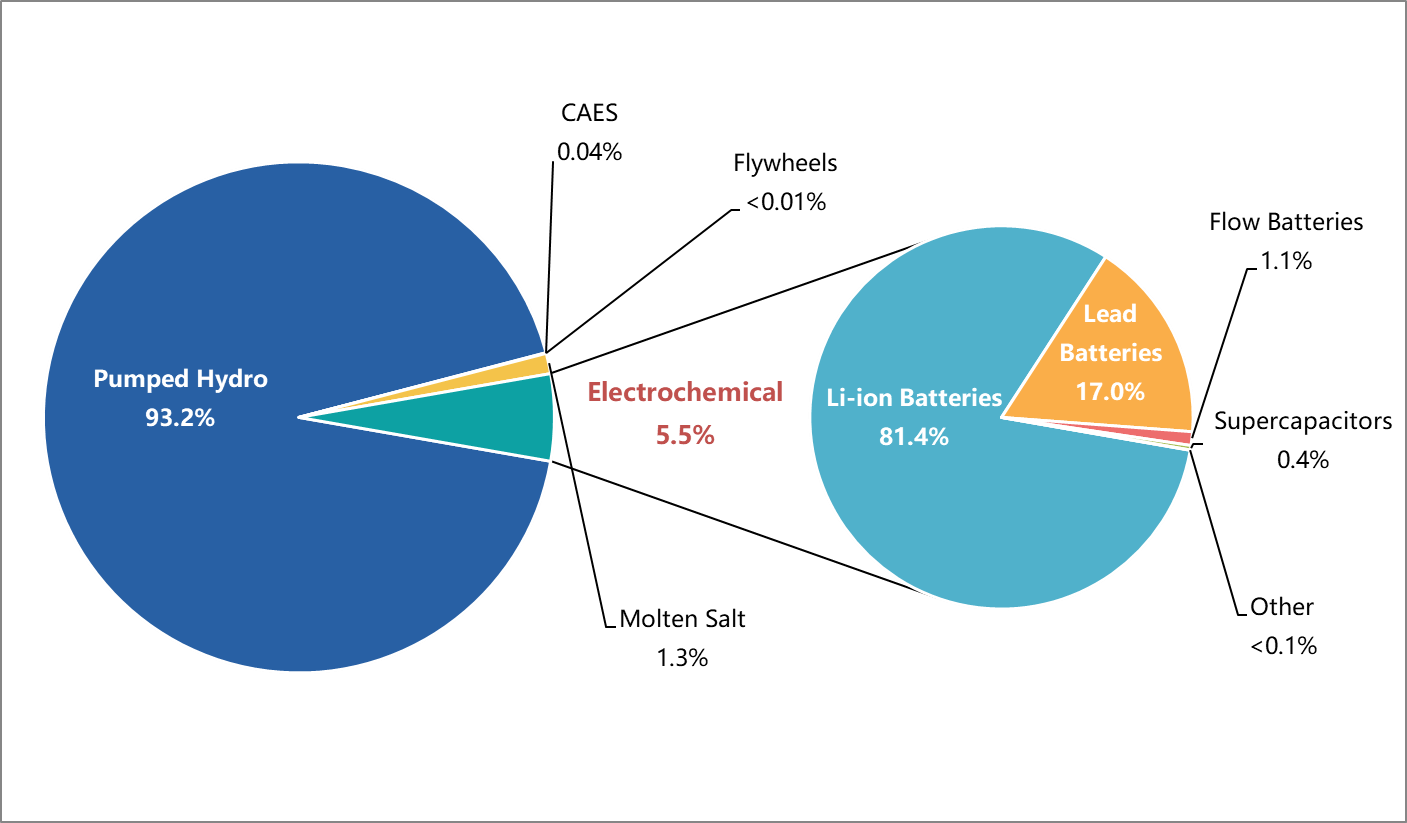

As the global energy transformation continues, future power grids around the world will be dominated by a high proportion of renewable energy. In this energy structure, solar PV will account for the largest proportion of renewable energy. The International Renewable Energy Agency (IRENA) forecasts that by 2050, global installed solar PV capacity will reach 8,519GW, while the installed capacity of wind power will reach 6,014GW, which together will account for 72.5% of the global installed electric power capacity. The development of renewable energy requires the support of flexible resources such as energy storage. According to IRENA’s forecast on the global energy storage market, under the baseline scenario, global stationary energy storage station capacity will reach 100-167GWh by 2030. In an ideal scenario, this number will reach 181-421GWh. No matter which outcome, the highest portion of energy storage capacity will be dedicated to time shifting of solar PV generation.

Therefore, in the future, as the global energy structure shifts to a high proportion of renewables and the large-scale development of solar PV, the solar-plus-storage model will become one of the primary models for energy storage development in the future, ushering in a huge potential new market for energy storage.

Authors: Yu Zhenhua, Chairman, and Ning Na, Senior Research Manager, China Energy Storage Alliance Translation: George Dudley