On August 19, 2025, the 10th Western China Energy Storage Forum grandly opened in Hohhot, Inner Mongolia. This forum was hosted by the China Energy Research Society, China Energy Storage Alliance, New Energy Storage Innovation Consortium of Centra SOEs, Inner Mongolia Energy Storage Promotion Association, and Hohhot Industrial Innovation Research Institute, and co-hosted by CRRC Zhuzhou Institute, HyperStrong, and Kehua Digital Energy Tech Co., Ltd. Haisheng Chen, Chairman of China Energy Storage Alliance and Director of the Institute of Engineering Thermophysics, Chinese Academy of Sciences, delivered a keynote report entitled "Current Status and Trends of New Energy Storage Industry Development," and released data on the energy storage industry for the first half of 2025.

Haisheng Chen, Chairman of China Energy Storage Alliance and Director of the Institute of Engineering Thermophysics, Chinese Academy of Sciences

1. Scale of New Energy Storage Projects

Cumulative Power Storage Installed Capacity Reaches 164.3GW, Share of Pumped Storage Falls Below 40% for the First Time

According to incomplete statistics from the CNESA DataLink Global Energy Storage Database, as of the end of June 2025, China's cumulative installed capacity of power storage reached 164.3GW, a year-on-year increase of 59%. This year marks the final year of the "14th Five-Year Plan." Compared with the end of the "13th Five-Year Plan," significant changes have occurred in the structure of storage technology routes. The share of pumped storage has fallen below 40% for the first time, while new energy storage represented by lithium-ion batteries has achieved leapfrog growth. In addition, single-technology routes are accelerating toward diversification.

Figure 1: Distribution of Cumulative Installed Capacity of Power Storage in China (Unit: GW%)

Cumulative Installed Capacity of New Energy Storage Surpasses 100GW for the First Time

As of the first half of 2025, China’s cumulative installed capacity of new energy storage reached 101.3GW, a year-on-year increase of 110%, surpassing 100GW for the first time. The cumulative installed capacity is 32 times that at the end of the "13th Five-Year Plan."

Figure 2: Cumulative Installed Capacity of New Energy Storage in China (Unit: GW)

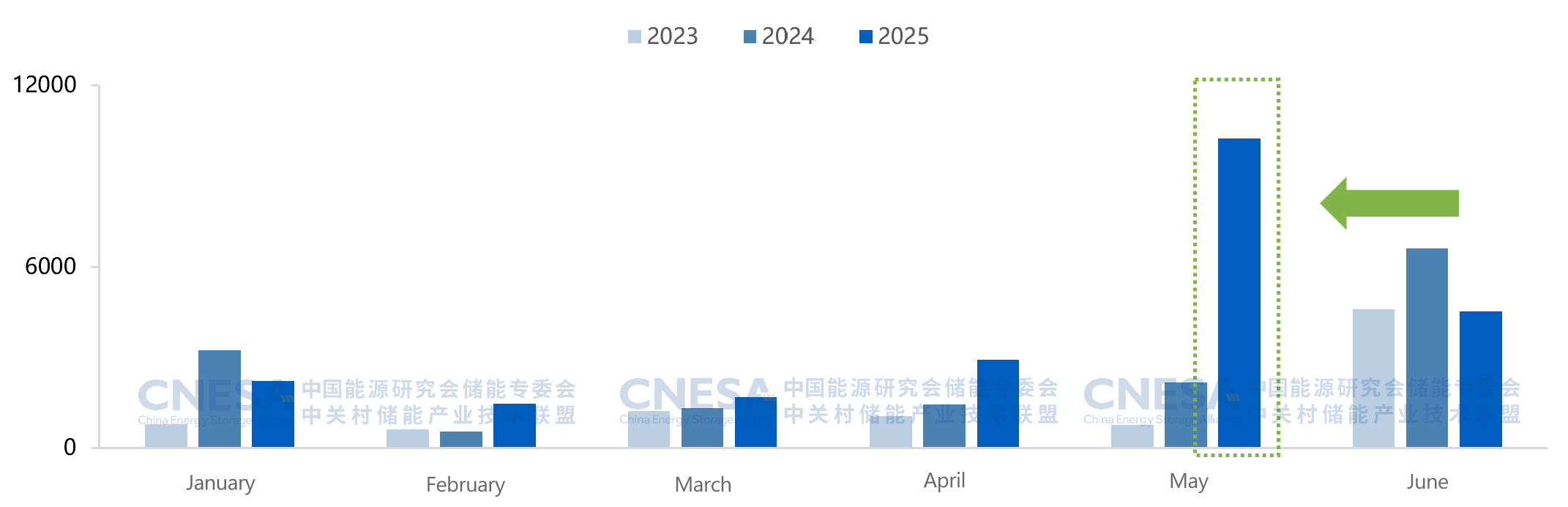

New Energy Storage Added 23.03GW/56.12GWh

In the first half of 2025, newly commissioned new energy storage projects reached 23.03GW/56.12GWh, with both power and energy scales increasing 68% year-on-year. Due to policy adjustments, project grid-connection timelines shifted earlier to "5·31." In May, new installations hit a record monthly high of 10.25GW/26.03GWh, a year-on-year increase of 462%/527%.

Figure 3: Comparison of Monthly New Installations of New Energy Storage in China (2023-2025.H1, Unit: MW)

2. Shipment Situation of Chinese Energy Storage Companies in H1 2025

At the same time, Chairman Haisheng Chen also released the shipment data of Chinese energy storage technology providers and energy storage system integrators in the first half of 2025. CATL, CRRC Zhuzhou Institute, and Sungrow ranked at the top. The specific shipment situation is as follows:

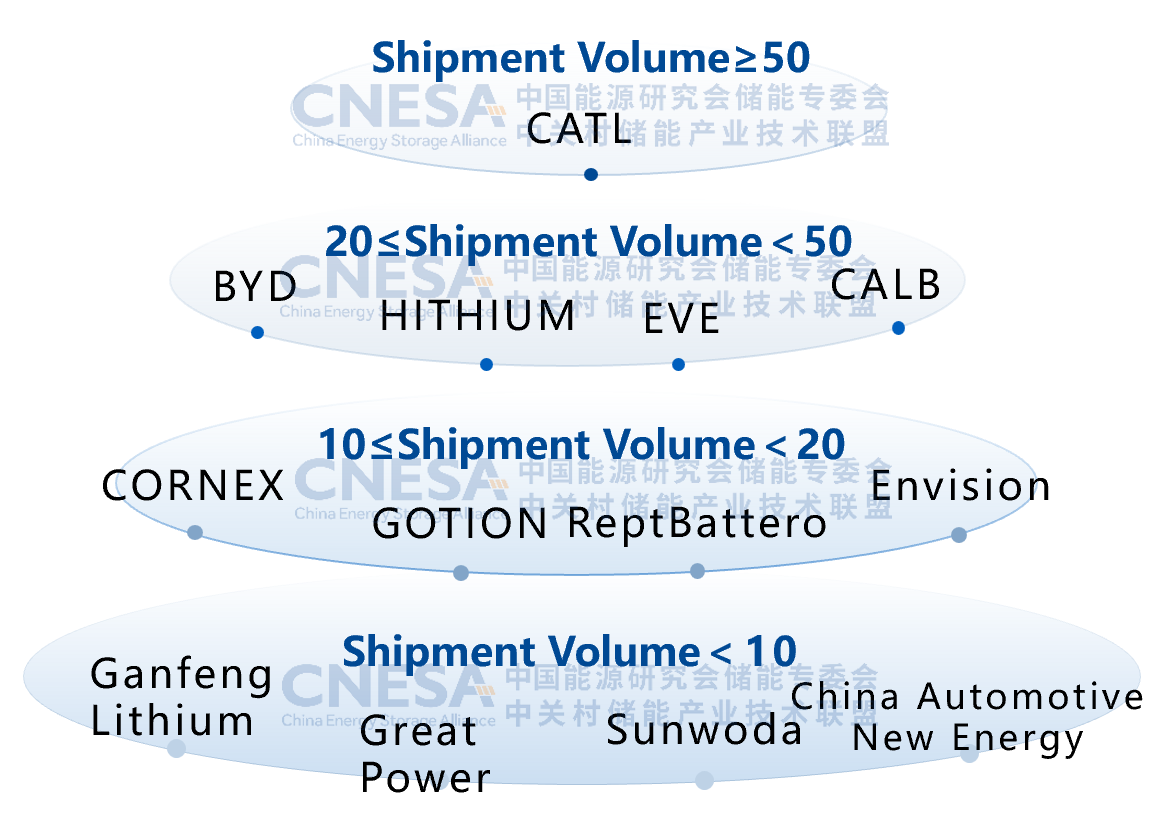

2025.H1 Shipment of Energy Storage Batteries in the Global Market by Chinese Technology Providers

According to incomplete statistics from the CNESA DataLink Global Energy Storage Database, in the first half of 2025, shipments of energy storage batteries (excluding base station and data center cells) from Chinese companies to the global market reached 233.6GWh. Based on shipment volumes ≥50GWh, 20GWh≤shipment<50GWh, 10GWh≤shipment<20GWh, and shipment<10GWh, the shortlisted companies are shown in the figure below.

CATL still firmly holds the top position, while second-tier companies are rapidly narrowing the gap.

Figure 4: Shipment Volume of Energy Storage Batteries in the Global Market by Chinese Technology Providers in H1 2025 (Unit: GWh)

Note: (Companies within each range are listed in order of the initials of their short names in Pinyin.)

Statistical scope: Global shipment volume of energy storage cells (excluding base station and data center cells) independently produced by enterprises in H1 2025. Shipment volume is based on cells that have left the factory and been delivered to customers or project sites.

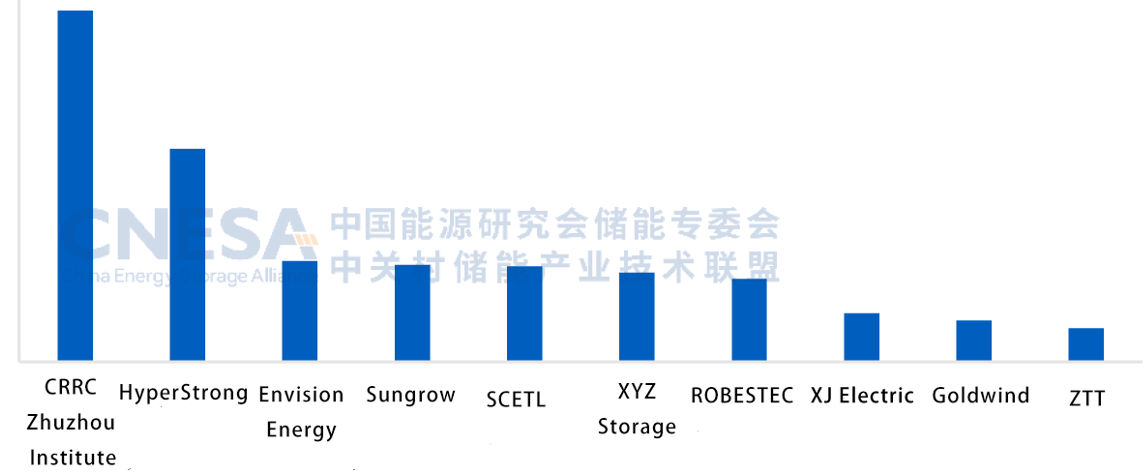

2025.H1 Top 10 Energy Storage System Integrators in the Chinese Domestic Market by Shipment Volume

In the first half of 2025, the Top 10 Chinese companies in terms of energy storage system shipments in the domestic market were, in order: CRRC Zhuzhou Institute, HyperStrong, Envision Energy, Sungrow, SCETL, XYZ Storage, ROBESTEC, XJ Electric, Goldwind, and ZTT.

Figure 5: Top 10 Energy Storage System Integrators in the Chinese Domestic Market by Shipment Volume in H1 2025 (Unit: GWh)

Note: Energy storage system specifically refers to an AC-side system composed of an energy storage battery DC system, converter and boosting system, EMS, and related auxiliary equipment.

2025.H1 Top 10 Energy Storage System Integrators in the Global Market by Shipment Volume

In the first half of 2025, the Top 10 Chinese companies in terms of energy storage system shipments in the global market were, in order: Sungrow, CRRC Zhuzhou Institute, HyperStrong, Envision Energy, SCETL, XYZ Storage, ROBESTEC, Sunwoda Energy, CSI Solar, and Trina Storage.

Figure 6: Top 10 Energy Storage System Integrators in the Global Market by Shipment Volume in H1 2025 (Unit: GWh)

Note: Energy storage system specifically refers to an AC-side system composed of an energy storage battery DC system, converter and boosting system, EMS, and related auxiliary equipment.

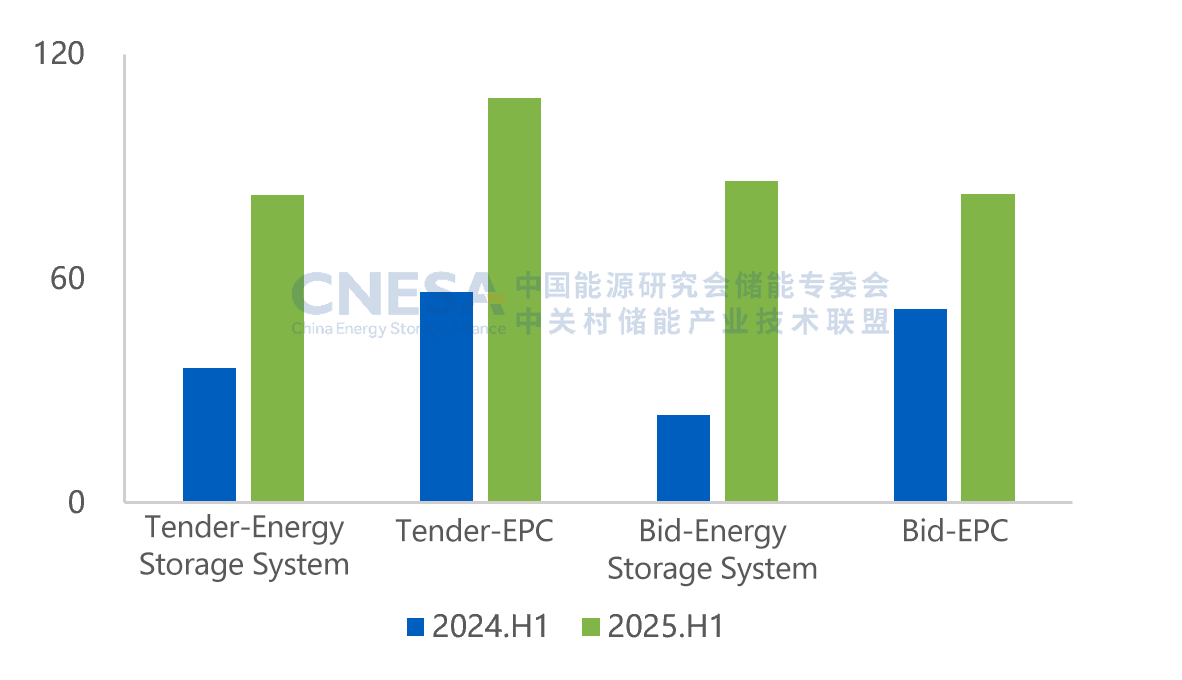

3. New Energy Storage Tendering and Bidding Market

Scale of New Energy Storage Tenders and Bids

According to incomplete statistics from the CNESA DataLink Global Energy Storage Database, in the first half of 2025, China’s new energy storage tender and bid market grew significantly, especially the bidding scale of energy storage systems, reaching 86.2GWh, a year-on-year increase of 264%. The main reason was the surge in centralized procurement/framework procurement bidding scale, which increased 618% year-on-year. Several large-scale centralized/framework procurements announced bid results in the first half of this year, accounting for 69% of the total energy storage system bidding market, up 33% from the same period last year.

Figure 7: Distribution of Tender and Bid Scale in H1 2025 (excluding centralized/framework procurements, Unit: GWh)

Centralized/Framework Procurement Bidding Scale of Energy Storage Systems

In terms of centralized/framework procurement of energy storage systems, both tendering scale and bidding scale achieved substantial growth in the first half of 2025 compared with the same period last year. Tendering scale increased by 176% year-on-year, and bidding scale increased by 606%. Among tendering entities, China Energy Engineering Corporation ranked first with a tendering scale of 25GWh, followed by SPIC and China Huadian. Among winning enterprises, HyperStrong, CRRC Zhuzhou Institute, and BYD ranked top three in terms of the number of winning bid sections.

Figure 8: Distribution of Tendering Entities with Over 1GWh in Centralized/Framework Procurement in H1 2025 (Unit: GWh)

Figure 9: Distribution of Enterprises with Four or More Winning Bid Sections in Centralized/Framework Procurement in H1 2025 (Unit: Sections)

Note: Lithium iron phosphate energy storage systems (including grid-forming type), excluding centralized/framework procurements and user-side applications.

4. Market Outlook for New Energy Storage

Looking ahead to the "15th Five-Year Plan," new energy storage will be driven by the market. Combining its green value, it will continuously expand new application scenarios, innovate business models, and promote the industry’s upgrade toward high-quality development.

First, market participation progress will accelerate. The market-oriented development of energy storage has become inevitable. Facing different needs across regional markets in the future, more innovative business models will emerge.

Second, scientific planning and coordination will gradually be achieved. Energy storage will be more closely coupled with the construction of new power systems and achieve diversified applications in zero-carbon parks, green power direct connections, and other fields, expanding new business models.

Third, the construction of capacity mechanisms will accelerate. The role of new energy storage capacity is emerging. Reasonable evaluation of the capacity value and conversion methods of new energy storage, and its coordinated development with pumped storage and thermal power as regulation resources, will be the research focus.

Fourth, the market will drive industrial upgrading. China’s new energy storage business models have already shifted. Energy storage products with high technical performance, strong safety assurance, and reasonable costs will be more competitive in the market and will also promote the industry’s continuous upgrade toward high-quality development.

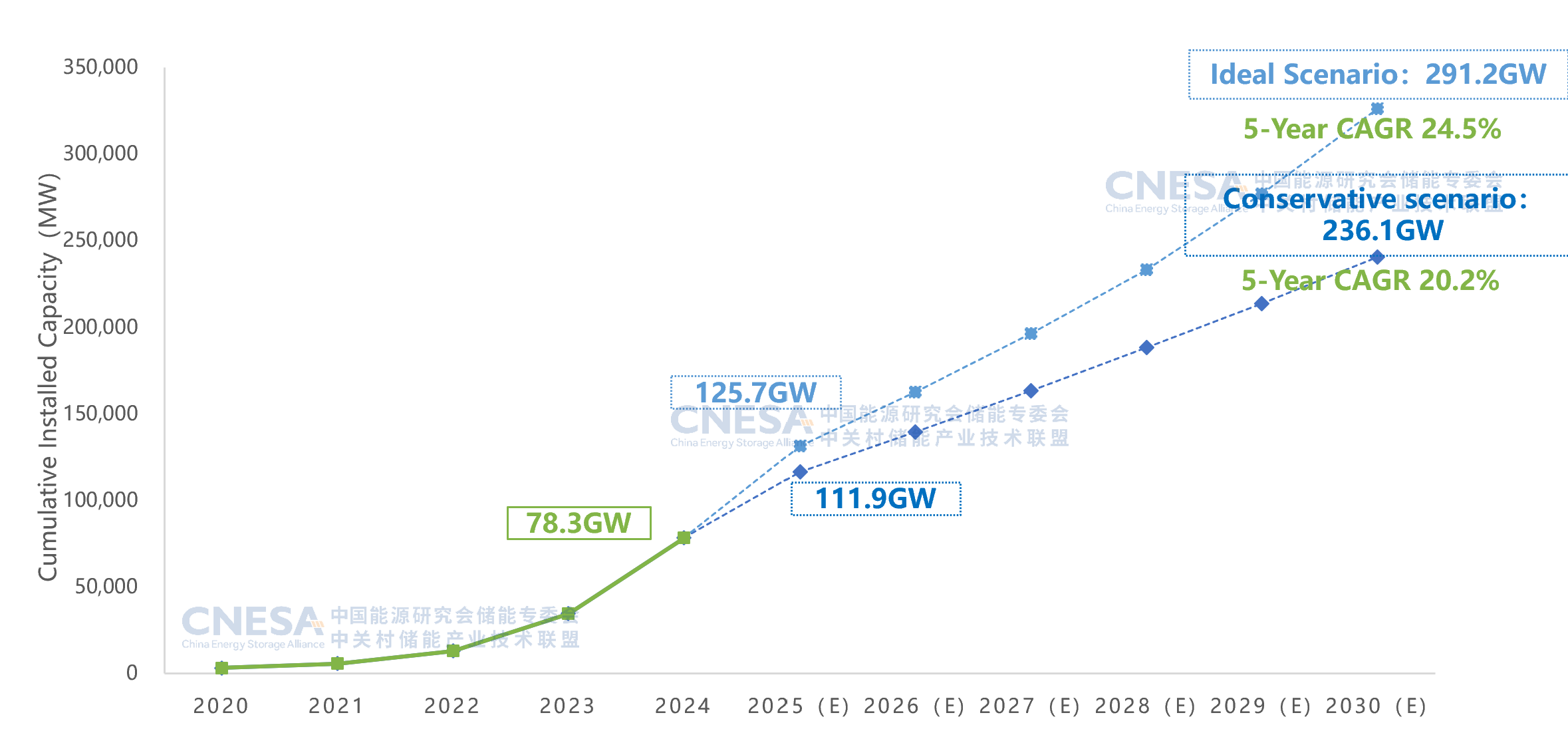

Looking to the future, CNESA forecasts that by 2030, China’s cumulative installed capacity of new energy storage will reach 236.1GW in a conservative scenario and exceed 291GW in an ideal scenario, with a compound annual growth rate of over 20% in the next five years. With the expansion of new scenarios such as desert-Gobi-wasteland large bases, zero-carbon parks, and virtual power plants, as well as collaborative innovation in materials, structures, and intelligent technologies, new energy storage will play a more central role in ensuring power security and achieving the "dual carbon" goals.

Figure 10: Forecast of Cumulative Installed Capacity of New Energy Storage in China (2025-2030)