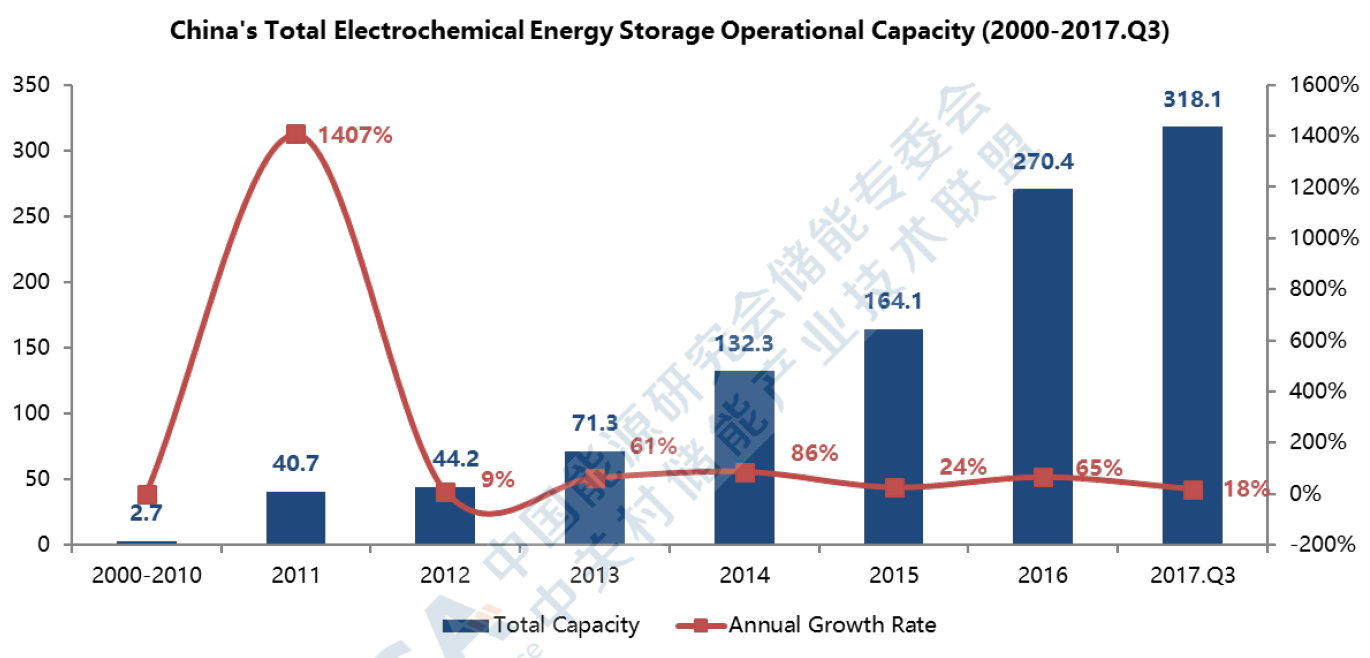

In response to the rapid development of energy storage, many PCS vendors have begun expanding their business models to become more deeply involved in energy storage services. According to the CNESA Global Energy Storage Vendor Database, China’s current PCS manufacturers can be divided into three categories. The first group includes companies focused predominantly on solar inverters, such as Sungrow. The second is companies predominantly focused on UPS, such as Kelong. The final group is those who focus on energy recovery products, such as Soaring. Data from CNESA’s Global Energy Storage Database reveals that in recent years Sungrow and other companies have become increasingly involved in energy storage projects by taking on the role of energy storage solutions providers. Examples include:

- In June 2017, Sungrow provided solutions for a complete solar-plus-storage system in the Maldives. The system included a PV inverter, energy storage inverter, BMS, and Li-ion battery.

- In March 2018, Kelong provided the Baitu substation second-life battery demonstration project with an SPH series energy storage converter and EMS smart energy management system.

- In 2013, Soaring won a successful tender to provide a PCS for China Southern Grid’s “Modular Distributed Energy Storage System Critical Technology Research Project.” Soaring will supply the project with a bidirectional energy storage converter, project plan design, and engineering services.

Current trends reveal that these and other vendors will continue to expand their activities beyond the sole supply of PCSs to diversified roles in multiple aspects of the energy storage business.

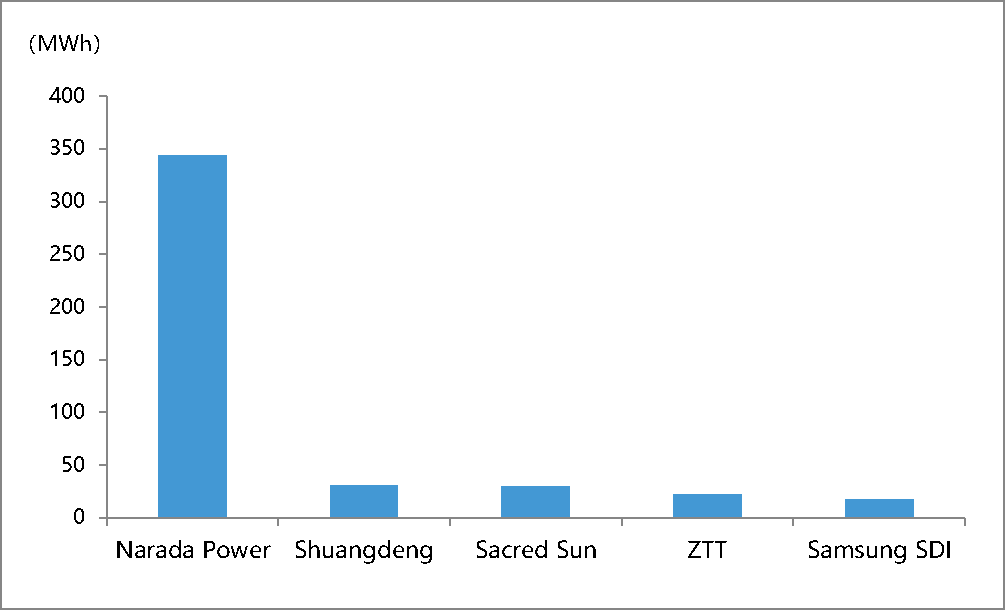

Sungrow was the earliest company in China to begin research, development, and production of inverter products. According to the company’s 2017 annual report, by the end of the 2017 year, a total of 60000 MW of Sungrow’s inverter equipment was deployed worldwide. In 2016, Sungrow and Samsung SDI joined to created Samsung-Sungrow and Sungrow-Samsung companies. Sungrow-Samsung’s range of business includes the production and sale of energy storage inverters, Li-ion batteries, and energy management systems (EMS), among other products. Production began in July of 2016 and has reached an annual production capacity of 2000MWh of electric energy storage equipment. The production of batteries for energy storage is significant in that it allows Sungrow to provide system integration services that not only make use of its own PCS system, but also a battery produced by its joint venture company, ensuring a stable product supply and convenient and accurate assembly during systems integration. In 2017, Sungrow began promoting its “inverter-plus-storage technology” solution. The service not only lowers the cost of the system, but also provides more efficient energy generation through the system’s integrated functionality. Sungrow has also built a reputation in photovoltaics, energy storage, wind power, electric vehicles, and similar areas, which has helped the company’s energy storage solutions achieve better recognition and acceptance among customers.

Kelong has established a name for itself as a PCS provider with over 30 years of industry experience. The company has three main business sectors. Kelong’s core is its “Energy Foundation” business, including high-end UPS, customized power sources, military and industrial power sources, and automated power systems. The second sector is the “Cloud Computing Service,” including data center, data protection, and cloud resource services. The final category is the “Renewable Energy” business, including solar and wind generation, energy storage, microgrids, and electric vehicle charging systems. In energy storage, Kelong’s main focus has been PCSs, supplemented by research in energy routers and microgrid technologies in order to increase competitiveness in the storage market. In residential storage, Kelong provides a 2-5kW residential PV inverter system (SPH). The system’s functions include self-generation, load shifting, backup power, and others. Kelong has expressed the advantages of using technologies from the same production source, expanding and diversifying business activities to transition from equipment supplier to systems solutions and service platform provider, from equipment manufacturer to a manufacturer of advanced technologies and services models.

Soaring represents China’s first company to provide energy recovery and energy storage microgrid system solutions. Soaring’s ES-500K and ES-250k bidirectional converters are specialized for smartgrid construction. Soaring has also researched and designed its own monitoring software for energy storage stations. In providing customers with complete storage solutions, Soaring is able to utilize its own core energy storage converter technology, energy management system, and other equipment, as well as its own software system. Core product technologies and specialized integrated systems and services has helped increase Soaring’s competitive advantage.

PCS providers have begun to make the switch from the supply of a single equipment type to a comprehensive solutions model. This represents not only the individual development of these companies and the increasing diversity of the industry, but also reflects their technological advantages and accumulation of resources for energy storage applications. As consumers place greater needs on energy storage equipment providers for more comprehensive and diverse services, companies that are able to provide a diversified services model will have the biggest competitive advantage in the industry.