Leading up to Q3 2016, China has accumulated a total of 170.6 MW of operating energy storage, this figure represents a 34% increase compared to the same period last year.

In Q3 of 2016, 14 new projects were announced including projects in the planning stage, projects under construction, and newly operation projects totaling 587.0 MW in scale, representing a 586% increase compared to Q3 of 2015, and a 50% increase compared to Q2 of this year. These new storage systems are part of projects geared at renewable energy grid integration along with distributed electricity generation and microgrids.

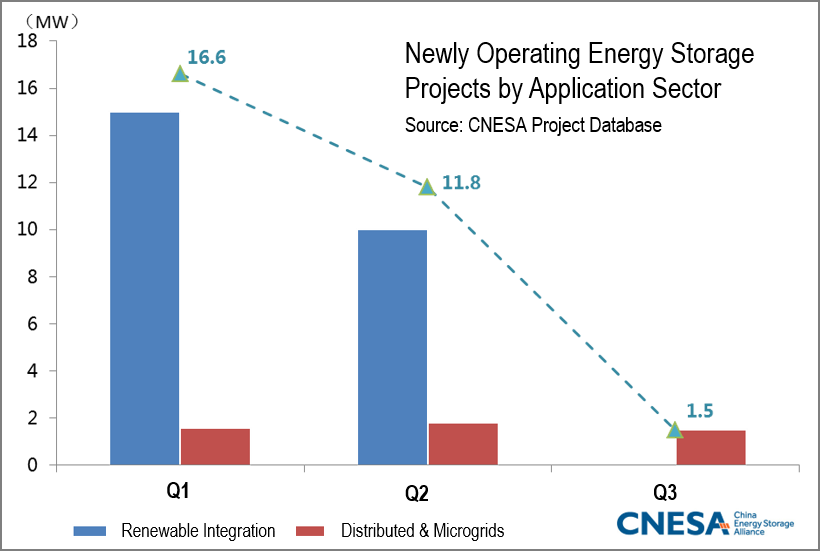

Q3 also saw 3 projects beginning operations totaling 1.5 MW in scale, a 50% increase compared to the same period last year, and an 87% increase compared to Q2 of 2015. These projects primarily focus on distributed generation and microgrids.

Bulk of New Projects Concentrated in China's Northwest

Gansu Province:

Guazhou County, Jiuquan City: Shidai Jiahua Co. has announcement plans for a 400 MW*4h super capacitor storage station as part of a wind curtailment microgrid project demonstration. Investments totaling US$860 million with an expected payback of 16-18 years.

Inner Mongolia

Xilin Gol: Plans announced for a 160 MW microgrid and renewable grid integration project demonstration as part of local government plans to explore setting up independent electricity retailers.

Jiangsu Province

Xuzhou Economic Development Zone: A 1.5MW/12MWh project under China Silicon Industries, Narada Power, Sungrow, GCL Power began operations.

Wuxi City Xingzhou Industrial Park: A Narada Power backed 15 MW/120 MWh project, with plans to increase capacity.

Huai’an City: Huai’an Electricity Supply Co., Nanrui Huaisheng Cable Co., Sunwoda jointly collaborated on a 500kW/1000kWh project.

Tibet

Shuanghu County: A new storage project owned by Northwest Engineering Corporation began operations. Storage by Samsung SDI- Sungrow (7 MW/ 13.6 MWh) Clou Electronics (3 MW/10.08 MWh).

Power Reforms Take Shape on a Regional Level

Several rounds of regional-level reforms

| Electricity trading centers established | Guangxi Province Guangdong Province Beijing Hebei Province Kunming Chongqing |

| Reform plans approved by NEA | Fujian Province Beijing (submitted only) Hainan Province Shandong Province |

| Comprehensive reform trials approved by NEA |

Yunnan Province Guizhou Province Shanxi Province Guangxi Province |

| Electricity Retail Reforms approved by NEA |

Guangdong Province Chongqing Xinjiang |

| Power Trading/Power Market under construction |

Chongqing Tianjin Tang Grid Jing-Jin-Ji Grid (regional grid connecting Beijing, Hebei Province, and Tianjin) |

Storage Appears in Q3 Renewables Sector plans

Large scale wind/solar

Xinjiang recently published a policy document “Opinions on Increasing Expansion of Renewables Consumption Sustainable Development” accelerating plans for wind and solar + storage project construction and demonstrations.

Thermal Storage

National Energy Administration issued “Notification on Construction of Solar Thermal Generation Project Demonstrations” confirming 20 new solar thermal pilot projects, totaling 1349 MW. Projects will be distributed across Qinghai Province, Gansu Province, Hebei Province, Inner Mongolia Autonomous Region, and Xinjiang Autonomous Region. Construction on approved projects is required to be completed by the end of 2018.

Q3 Industry News

Production Plans

- Chinese PV/inverter manufacturer now storage manufacturer, Sungrow, has formally began joint operations with Samsung SDI. By the end of this year production capacity will reach 100 MWh, with 500 MWh expected by next year

- GCL Integrators: plans to invest USD13 million in a 500 MWh annual capacity battery manufacturing facility.

Investments

- Gree Electronics: purchased of Zhuhai Yinlong Co. (珠海银隆) for US$1.8 billion

- Shanghai Power: over the next five years will execute the “10,000 Storage Stations” project. The company has annoucned plans to invest US$870 million within the next 3 years to construct 100-200 storage projects in Wuxi, Jiangsu Province. Within the next 5 years Shanghai Power plans to invest a total US$4.3 billion planning over 1000 storage projects in Hubei province.

Electric Vehicles

Planning Documents

Beijing: According to the “Beijing City 13th Five Year Period Plan for Strengthening National Science and Technology Innovation,” by 2020, Beijing will become China’s leading alternate energy vehicle R&D center. The entire city aims to produce 500,000 electric vehicles by 2020.

EV Battery/ EV Manufacturing

Shaanxi Optimum Nano: the first of a three stage electric vehicle battery manufacturing project went into operations in Weinan City, Shannxi Province (10 GW production capacity, total investment US$720 million)

Guoxuan High-Tech & Kang Sheng Co. in Luzhou, Sichuan Province will invest US$430 million to build a 1000MAh production capacity production center.

BYD: in Xining, Qinghai Province invested US$580 million for a 10 GWh Li-ion battery production project. In the next three years, BYD also plans to expand operations to a US-based EV factory operations, increasing production capacity from 300 buses/year to 1000 buses, trucks, and other specialized vehicles.