Global Movements:

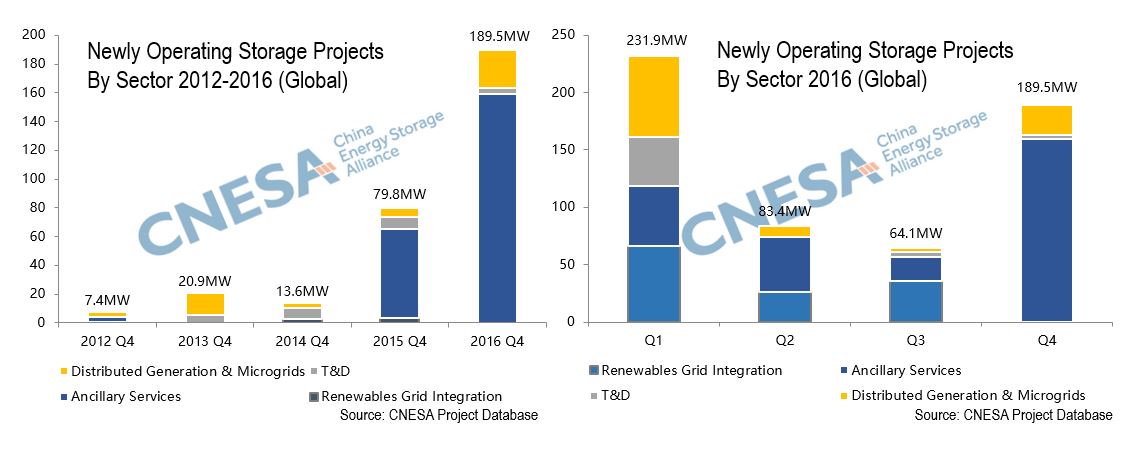

In the 4th quarter of 2016, 37 storage projects totaling 189.4 MW began operating across the world. This represents a 95% increase over Q4 of 2015 and a 164% increase compared to Q3 of 2016. Over the past five years 2012-2016, installed storage capacity showed a CAGR of 125%. Total capacity installed during Q4 of 2016 also marked a 137% increase when compared to the same period last year, and a 196% increase since the previous quarter.

In 2016 Q4 84% of installed capacity was in the ancillary services sector, while distributed generation and microgrids came in 2nd with 14% of installed capacity. The ancillary service sector saw a 155% increase compared to Q4 last year and a 677% increase since last quarter, while the distributed generation and microgrid sector increased by 317% since Q4 last year and 748% since last quarter.

Global Markets:

US: California and New York state were the most active markets this quarter. Market developments were also accompanied several announcements of storage-related policy.

Europe: England saw the most activity in Q4 especially with storage's participation in grid-side applications and capacity markets.

APAC: Australia's storage deployments focused on residential solar + solar and centralized large-scale solar fields. Japan and India also deployed storage in large-scale solar fields.

China:

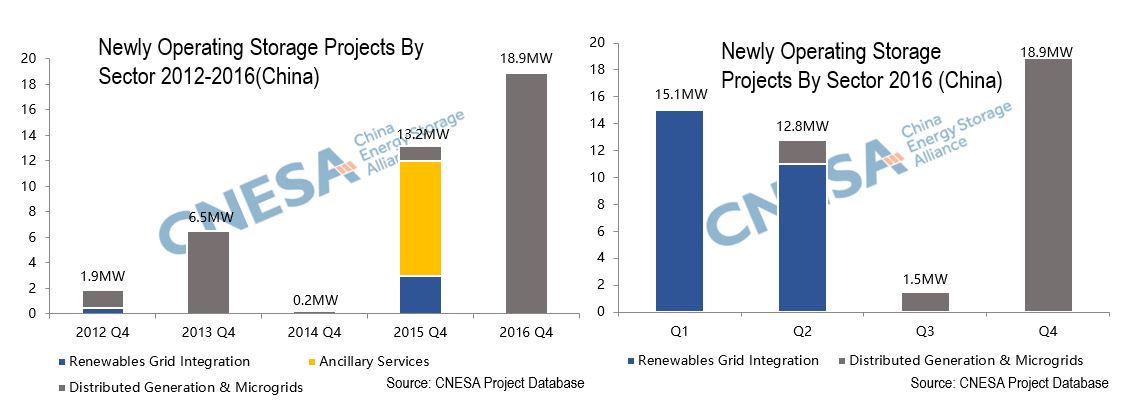

In Q4 of this year 10 projects came online with representing a total capacity of 18.9 MW. This marks a 25% increase over same period last year, and a 233% increase compared to Q3 of 2016. China's five-year installed storage capacity CAGR from 2012-2016 is 78%.

Q4 storage projects were largely in the distributed generation and microgrids sector, this sector has a five-year capacity CAGR of 92%, Distributed gen. & microgrid capacity increased by 147 % compared to Q4 last year and 116% compared to Q3 of this year.

This quarter, 85% of of operating capacity came online in China’s southwestern region, 9% in the East China, and 6% in South China. Projects along the coastlines of Southern and Eastern China focused on price arbitrage helping commercial users looking to save on energy bills. Projects in Western China aimed at increasing renewables consumption.

China Market Movements

Policy: on the national level several major related policy documents were released including the 13th Five Year Plan for Power Sector Development and 13th Five Year Plan for Renewable Energy Development as well as the National Electricity Demonstration Project Management Guidelines. Provincial and local policy developments were largely focused on multi-province electricity reform trials along with announcing ancillary service market operation regulations in China’s northeast.

Industry: Domestic market activity centered around construction of production centers, and launching project demonstrations individually and in coordinating with local governments, design institutes and other work units. Chinese engagement in the foreign markets largely involved establishing subsidiary companies and joint ventures as a means to enter local markets abroad and increase sales volume.

About the Tracking Project

CNESA began the "World Tracking Report" in 2017 to synthesize and share the data collected in the CNESA project database. Interested parties are welcome to contact the CNESA research department to understand more.