Source: CNESA

The 14th Energy Storage International Conference & Expo (ESIE 2026)

March 31 - April 3, 2026

Capital International Exhibition & Convention Center, Beijing, China

With just 100 days remaining until the opening of the 14th Energy Storage International Conference & Expo (ESIE 2026), anticipation across the industry continues to build. Momentum is accelerating, and companies are actively registering to exhibit.

As exhibitor recruitment enters its final countdown, this landmark event - designed to build industry consensus, drive technological innovation, and foster global exchange - warmly invites energy storage professionals worldwide to gather in Beijing.

Exhibition Overview

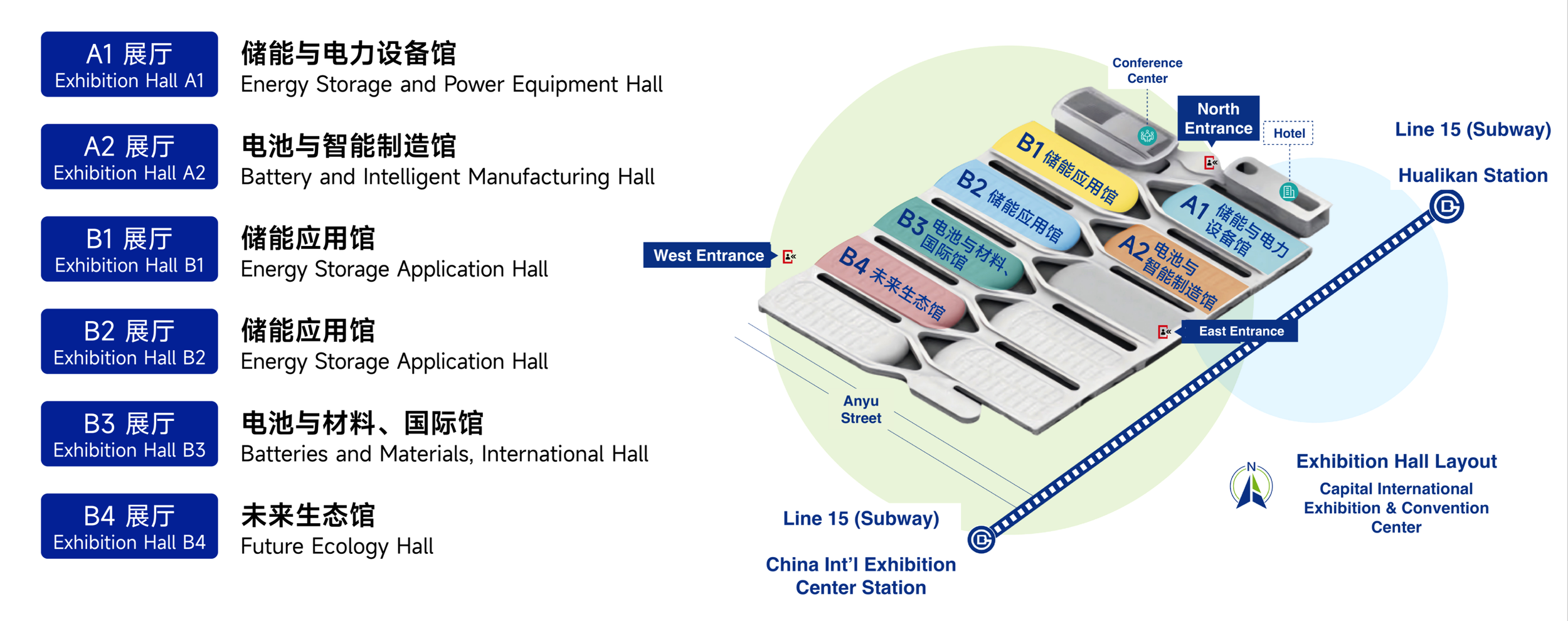

ESIE 2026 will feature 6 themed exhibition halls:

Energy Storage & Power Equipment Hall

Battery & Intelligent Manufacturing Hall

2 Energy Storage Application Halls

Battery & Materials, International Hall

Future Ecology Hall

In addition, 9 specialized zones will be set up, covering:

power equipment, zero-carbon industrial parks, data centers, EV charging infrastructure, fire safety, intelligent manufacturing, hydrogen energy, materials, and testing & certification.

Together, the exhibition comprehensively covers enterprises across the entire upstream and downstream energy storage industry chain.

Figure | Layout Plan of the 14th Energy Storage International Conference & Expo

A1 - Energy Storage & Power Equipment Hall

Well-known brands exhibiting include: HyperStrong, EVE Energy, Zhongqi New Energy, Pengcheng Infinite, CLOU, Zhongchu Guoneng, Great Power, Inpai Battery, Huadian Heavy Industries, Hongzheng Energy Storage, Chint Electrics, Guodian Nanjing Automation, Elecnova, Envicool, Qianye Technology, Tiansu, Futronics, Dafu Integrated Equipment Technology, UTL Electrical, Winsure Communication, Sanwo Liyuan, Fans-tech Electrical, Kait, Qingyuan HeYi, YNTECH, Regal Rexnord, and more.

A2 - Battery & Intelligent Manufacturing Hall

Exhibitors include: CATL, Soaring Electric, XYZ Storage, Kehua Digital Energy, Cornex, Sineng Electric, NR Electric, AlphaESS, Hopewind, Ampace, Nebula Electronics, Autowell, Gaodengsai Energy, RelyEZ, Phoenix Contact, Youxing Shark, Lead Technology, Iron Man Fire Fighting, RePower Technology, Kelvin New Energy, Huasi Systems, Ligoo New Energy, Zonzsin, Tangent, Xenbo Heat Sink, Ubetter, Yaliqu, Heidun Cloud, Luoweite, National Center for Advanced Energy Storage Product Quality Inspection & Testing, Balance Intelligent Fire, and others.

B1 - Energy Storage Application Hall

Participating companies include: CRRC Zhuzhou Institute, Gotion High-Tech, Goldwind, Huawei, Sunwoda, Hoymiles, Hithium, Ganfeng, KE Electric & Hisense, Pylontech, Zhiguang Energy Storage, Liangxin Electrical, Ancheng New Energy, Xingchen New Energy, Gold Electronic, TCL, PULSST, Advantech, Chuancheng Energy Storage, SAV, SGS-CSTC Standards, TYT, Xinyuan Tech, Enerflow, Hysea, Stif, TIG Technology, Candera, TYES Energy Storage, among others.

B2 - Energy Storage Application Hall

Exhibitors include: Sungrow, CALB, Narada, REPT BATTERO Energy, Robestec, Windey Energy, iPotisEdge, TONGFEI, Siyuan Electric, Dongfang Electric, InfyPower, Xiqing, HYXiPOWER, Kgooer, Xiamen Hongfa, Qualtech, REsource Electric, HIGEE, State Energy XinControl, Beijing Micro Control Industrial Gateway Technology, Rongke Power, BMSER, Sinofuse, Southern CIMC, EMKA (Tianjin), Lanrui Electric, Hecheng Smart Electric, ZONZEN, Kefa Electronics, and more.

B3 - Battery & Materials, International Hall

Exhibitors include: Shuangdeng Group, Megarevo, Concord New Energy, Kstar, GoodWe, ZTT, Wocheng, Sigenergy, German Pavilion, Suqian Times, CVC Testing, SHENG YANG Electric, Heyuan Magnetics, Shentong Mechanical & Electrical, TOPOS, Honghaisheng, Dianwei, Carbon Energy Technology, WILO SE, Cergen New Energy, Longxiang Rubber, Onpow Push Button, Hefei Zhiyou Electric, WSF, CHEVRON Electronic, and others.

B4 - Future Ecology Hall

Exhibitors include: Envision Storage, BYD, Trina Storage, Singularity Energy, Longking, CSG Energy Storage, Jinko, State Power Rixin Technology, Contemporary Nebula Energy Technology, iBatteryCloud, Gresgying, CSG Technology, Wincell, ESF Technology, Sino Group, and more.

One-Stop Access to Cross-Sector Energy Storage Innovations

Visitors can explore a wide range of integrated application scenarios, including:

Energy Storage + Industry: Steel, cement, chemicals, petroleum, aluminum, coal, oilfields, and more - discover how energy-intensive enterprises reduce costs and improve efficiency with storage solutions.

Energy Storage + Wind & Solar: BIPV storage, CIPV storage, source-grid-load-storage integration, PV-storage-DC-flexible systems - all solutions for coordinated renewable and storage development.

Energy Storage + Desert & Gobi Mega Bases: Wind-solar-storage bundled transmission, grid-forming storage, multi-energy complementarity (wind + solar + storage + coal/solar thermal), and ecological desert control - unlock efficient desert energy utilization.

Energy Storage + Zero-Carbon Parks / Green Power Direct Supply: Microgrids, distributed PV-storage consumption, dedicated green power lines, peak-valley arbitrage, emergency backup, and green power traceability - ensuring stable green electricity supply.

Energy Storage + Data Centers / Telecom Base Stations: Backup power, peak-valley arbitrage, off-grid power supply, and green power integration - supporting stable and cost-efficient digital infrastructure.

Smart Energy: Smart grids, microgrids, virtual power plants, distributed energy management systems, and energy IoT platforms - key tools for future energy management.

Energy Storage + Transportation: Vehicle-to-grid interaction, charging and swapping facilities, PV-storage-charging stations, EVs, electric heavy trucks, low-altitude economy, and new energy solutions for ports and airports.

Innovative Energy Storage Technologies: Hydrogen energy; chemical storage (sodium-ion, solid-state, aqueous, all-vanadium flow, etc.); physical storage (compressed air, flywheel, gravity, molten salt, etc.).

Preparations for ESIE 2026 have entered the full-scale sprint phase. The organizing committee is advancing all work in a coordinated and efficient manner to deliver a high-level professional exchange platform for the industry.

Exhibition booths are now in short supply, with only a limited number of premium locations remaining. Energy storage enterprises across the entire value chain are warmly invited to join ESIE 2026 - uniting around technological innovation, advancing industrial upgrading, and jointly shaping a high-quality future for the new energy storage industry.

Register Now to attend, free before Dec 31, 2025:

https://mailchi.mp/2a7b423a7efb/esie-2026-registration-socialmedia