On January 16th, a 107.12MW/428.48MWh green hydropower-based aluminium user-side energy storage project jointly developed by Great Power and Henan Zhongfu Industry was officially commissioned in Guangyuan, Sichuan Province.

RMB 180 Billion! China Southern Power Grid Hit a New High for Investment in 2026

Expanding effective investment is a key lever for stabilizing growth and improving people’s livelihoods. According to China Southern Power Grid, the company has embarked RMB 180 billion for fixed-asset investment in 2026, marking a record high for fifth consecutive year, with an annual growth rate of 9.5%. Investment will be directed primarily toward the development of a new-type power system, the growth of strategic emerging industries and the enhancement of high-quality power supply services, providing solid support for a strong start to the 15th Five-Year Plan period.

100MW/200MWh! Sineng Electric Supports Commissioning of Phase I of Nanlang Energy Storage Power Station

The Phase I 100MW/200MWh Nanlang energy storage power station, supplied by Sineng Electric, has now been successfully commissioned and put into operation. As the first large-scale standalone energy storage project on the grid side to be completed and commissioned in Zhongshan, China, the facility not only injects enhanced flexibility into the regional power grid, but establishes efficient and reliable revenue mechanism through an innovative frequency regulation service model.

500MW/200MWh! JD Energy’s First GWh-Level Project Successfully Grid-Connected

In December 2025, the 500MW/2000MWh energy storage project was successfully grid-connected in Dengkou, Inner Mongolia. The energy storage station, standing proudly under the winter sun, is the first GWh-level project delivered by JD Energy. It not only set a new record for the scale of a single project but marked a significant milestone in the company’s development with its outstanding construction achievements.

2025 Marks the First Year of Mass Production for Large Energy Storage Cells! 500Ah+ Mass Deliveries, ESIE 2026 Energy Storage Expo Invites Global Buyers to Explore New Opportunities

2025 marks a pivotal year for the energy storage industry. The large energy storage cells, which were once limited to “theoretical parameters”, will officially bid farewell to the technical competition phase and enter the practical testing stage of capacity release, yield improvement, and project implementation. Leading enterprises like CATL, EVE, Envision, HTHIUM, and SUNWODA have successively achieved mass production and delivery, and with the intensive landing of GWh-level strategic cooperation and accelerated expansion into overseas markets, this marks the transition of large-capacity cells from lab prototypes to commercial applications. The speed at which energy storage systems are evolving to higher energy density and lower cost has far exceeded industry expectations.

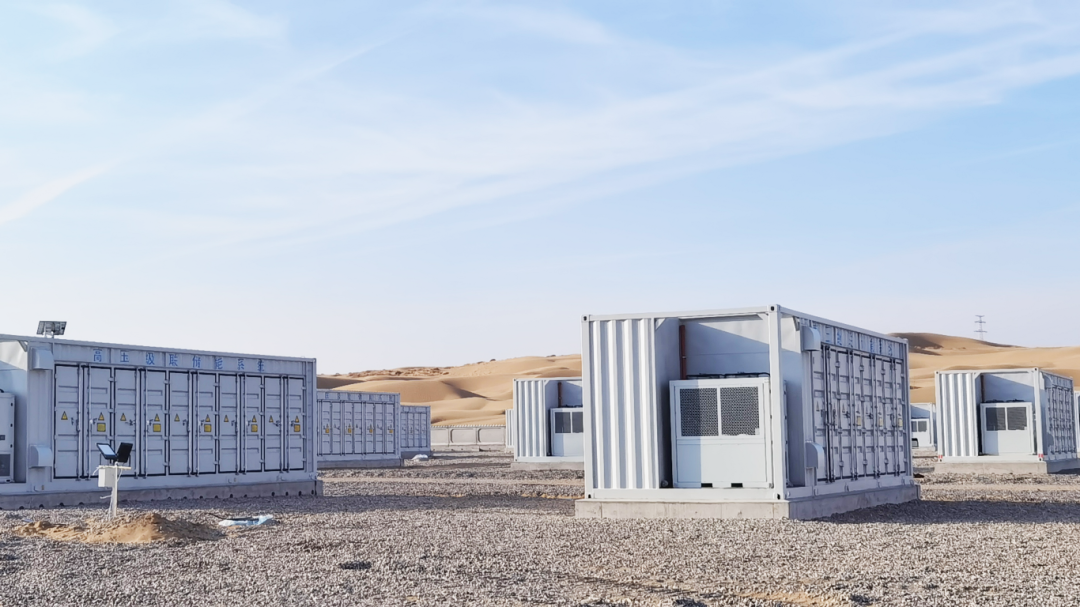

Sungrow’s First Energy Storage Plant in the Middle East Launched,with an Annual Capacity of 10 GWh

Egypt has taken a major step toward accelerating its clean energy transition, as Chinese energy storage leader Sungrow and Norwegian renewable developer Scatec partner with the Egyptian government to deliver large-scale solar+storage projects and establish the Middle East’s first battery energy storage manufacturing base, with a planned annual capacity of 10 GWh.

4.8 GWh Installed: Beijing KeRui Supports the Grid Connection of Two Major Grid-Side Energy Storage Projects in Inner Mongolia, Chi

China Mingyang Longyuan’s First 100MW/400MWh High-Voltage Cascade Independent Energy Storage Project Achieves Full-Capacity Grid Connection

Mingyang Longyuan has built a major milestone in China’s energy storage sector with the successful full-capacity grid connection of its first 100MW/400MWh high-voltage cascade independent energy storage project in Ordos, Inner Mongolia. The project’s commissioning highlights the company’s technological strength in large-scale, high-efficiency, and highly reliable energy storage solutions, while reinforcing the critical role of advanced storage systems in supporting grid stability and renewable energy integration.

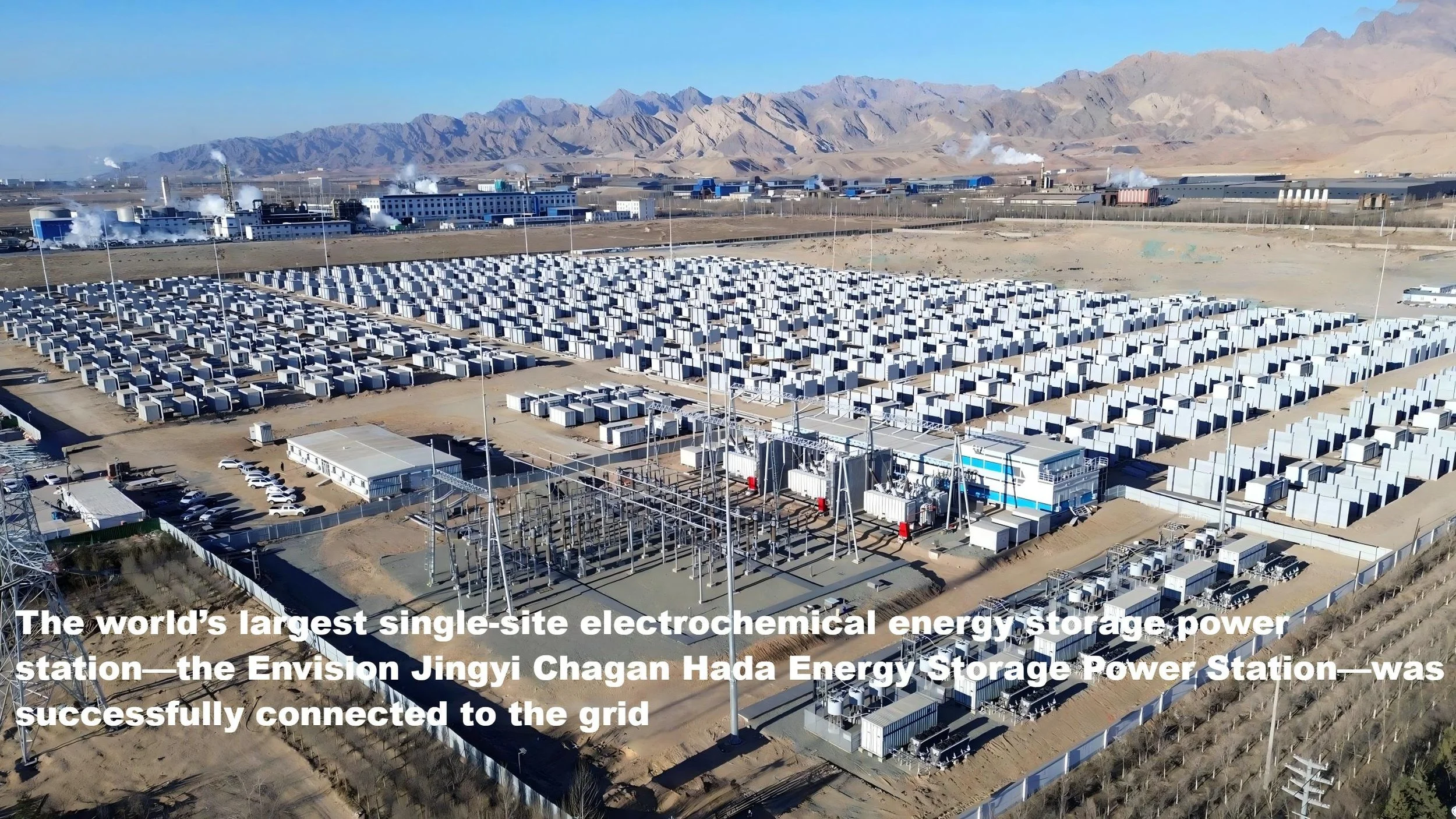

12.8 GWh Energy Storage Cluster Connected to the Grid AI-Powered Energy Storage Reshapes the Future of New Power Systems

The world’s largest single-site electrochemical energy storage power station—the Envision Jingyi Chagan Hada Energy Storage Power Station—was successfully connected to the grid, completing a 12.8 GWh AI-powered energy storage cluster in Inner Mongolia. The project sets new global benchmarks for scale, grid-connection speed, and system reliability, while demonstrating advanced grid-forming capabilities that enable rapid commissioning, deep grid interaction, and large-scale renewable integration.

Countdown: 100 Days to Go! - ESIE 2026 Energy Storage Expo Announces First Batch of Exhibitors

Source: CNESA

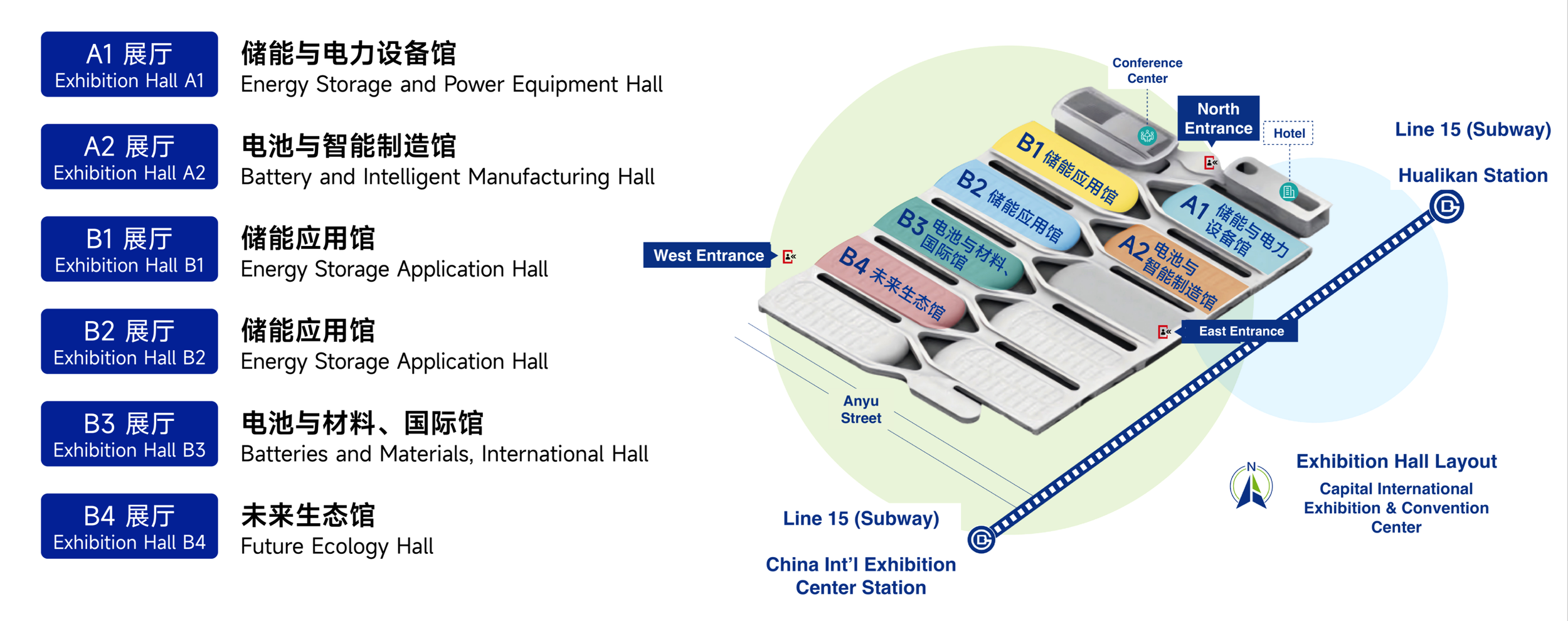

The 14th Energy Storage International Conference & Expo (ESIE 2026)

March 31 - April 3, 2026

Capital International Exhibition & Convention Center, Beijing, China

With just 100 days remaining until the opening of the 14th Energy Storage International Conference & Expo (ESIE 2026), anticipation across the industry continues to build. Momentum is accelerating, and companies are actively registering to exhibit.

As exhibitor recruitment enters its final countdown, this landmark event - designed to build industry consensus, drive technological innovation, and foster global exchange - warmly invites energy storage professionals worldwide to gather in Beijing.

Exhibition Overview

ESIE 2026 will feature 6 themed exhibition halls:

Energy Storage & Power Equipment Hall

Battery & Intelligent Manufacturing Hall

2 Energy Storage Application Halls

Battery & Materials, International Hall

Future Ecology Hall

In addition, 9 specialized zones will be set up, covering:

power equipment, zero-carbon industrial parks, data centers, EV charging infrastructure, fire safety, intelligent manufacturing, hydrogen energy, materials, and testing & certification.

Together, the exhibition comprehensively covers enterprises across the entire upstream and downstream energy storage industry chain.

Figure | Layout Plan of the 14th Energy Storage International Conference & Expo

A1 - Energy Storage & Power Equipment Hall

Well-known brands exhibiting include: HyperStrong, EVE Energy, Zhongqi New Energy, Pengcheng Infinite, CLOU, Zhongchu Guoneng, Great Power, Inpai Battery, Huadian Heavy Industries, Hongzheng Energy Storage, Chint Electrics, Guodian Nanjing Automation, Elecnova, Envicool, Qianye Technology, Tiansu, Futronics, Dafu Integrated Equipment Technology, UTL Electrical, Winsure Communication, Sanwo Liyuan, Fans-tech Electrical, Kait, Qingyuan HeYi, YNTECH, Regal Rexnord, and more.

A2 - Battery & Intelligent Manufacturing Hall

Exhibitors include: CATL, Soaring Electric, XYZ Storage, Kehua Digital Energy, Cornex, Sineng Electric, NR Electric, AlphaESS, Hopewind, Ampace, Nebula Electronics, Autowell, Gaodengsai Energy, RelyEZ, Phoenix Contact, Youxing Shark, Lead Technology, Iron Man Fire Fighting, RePower Technology, Kelvin New Energy, Huasi Systems, Ligoo New Energy, Zonzsin, Tangent, Xenbo Heat Sink, Ubetter, Yaliqu, Heidun Cloud, Luoweite, National Center for Advanced Energy Storage Product Quality Inspection & Testing, Balance Intelligent Fire, and others.

B1 - Energy Storage Application Hall

Participating companies include: CRRC Zhuzhou Institute, Gotion High-Tech, Goldwind, Huawei, Sunwoda, Hoymiles, Hithium, Ganfeng, KE Electric & Hisense, Pylontech, Zhiguang Energy Storage, Liangxin Electrical, Ancheng New Energy, Xingchen New Energy, Gold Electronic, TCL, PULSST, Advantech, Chuancheng Energy Storage, SAV, SGS-CSTC Standards, TYT, Xinyuan Tech, Enerflow, Hysea, Stif, TIG Technology, Candera, TYES Energy Storage, among others.

B2 - Energy Storage Application Hall

Exhibitors include: Sungrow, CALB, Narada, REPT BATTERO Energy, Robestec, Windey Energy, iPotisEdge, TONGFEI, Siyuan Electric, Dongfang Electric, InfyPower, Xiqing, HYXiPOWER, Kgooer, Xiamen Hongfa, Qualtech, REsource Electric, HIGEE, State Energy XinControl, Beijing Micro Control Industrial Gateway Technology, Rongke Power, BMSER, Sinofuse, Southern CIMC, EMKA (Tianjin), Lanrui Electric, Hecheng Smart Electric, ZONZEN, Kefa Electronics, and more.

B3 - Battery & Materials, International Hall

Exhibitors include: Shuangdeng Group, Megarevo, Concord New Energy, Kstar, GoodWe, ZTT, Wocheng, Sigenergy, German Pavilion, Suqian Times, CVC Testing, SHENG YANG Electric, Heyuan Magnetics, Shentong Mechanical & Electrical, TOPOS, Honghaisheng, Dianwei, Carbon Energy Technology, WILO SE, Cergen New Energy, Longxiang Rubber, Onpow Push Button, Hefei Zhiyou Electric, WSF, CHEVRON Electronic, and others.

B4 - Future Ecology Hall

Exhibitors include: Envision Storage, BYD, Trina Storage, Singularity Energy, Longking, CSG Energy Storage, Jinko, State Power Rixin Technology, Contemporary Nebula Energy Technology, iBatteryCloud, Gresgying, CSG Technology, Wincell, ESF Technology, Sino Group, and more.

One-Stop Access to Cross-Sector Energy Storage Innovations

Visitors can explore a wide range of integrated application scenarios, including:

Energy Storage + Industry: Steel, cement, chemicals, petroleum, aluminum, coal, oilfields, and more - discover how energy-intensive enterprises reduce costs and improve efficiency with storage solutions.

Energy Storage + Wind & Solar: BIPV storage, CIPV storage, source-grid-load-storage integration, PV-storage-DC-flexible systems - all solutions for coordinated renewable and storage development.

Energy Storage + Desert & Gobi Mega Bases: Wind-solar-storage bundled transmission, grid-forming storage, multi-energy complementarity (wind + solar + storage + coal/solar thermal), and ecological desert control - unlock efficient desert energy utilization.

Energy Storage + Zero-Carbon Parks / Green Power Direct Supply: Microgrids, distributed PV-storage consumption, dedicated green power lines, peak-valley arbitrage, emergency backup, and green power traceability - ensuring stable green electricity supply.

Energy Storage + Data Centers / Telecom Base Stations: Backup power, peak-valley arbitrage, off-grid power supply, and green power integration - supporting stable and cost-efficient digital infrastructure.

Smart Energy: Smart grids, microgrids, virtual power plants, distributed energy management systems, and energy IoT platforms - key tools for future energy management.

Energy Storage + Transportation: Vehicle-to-grid interaction, charging and swapping facilities, PV-storage-charging stations, EVs, electric heavy trucks, low-altitude economy, and new energy solutions for ports and airports.

Innovative Energy Storage Technologies: Hydrogen energy; chemical storage (sodium-ion, solid-state, aqueous, all-vanadium flow, etc.); physical storage (compressed air, flywheel, gravity, molten salt, etc.).

Preparations for ESIE 2026 have entered the full-scale sprint phase. The organizing committee is advancing all work in a coordinated and efficient manner to deliver a high-level professional exchange platform for the industry.

Exhibition booths are now in short supply, with only a limited number of premium locations remaining. Energy storage enterprises across the entire value chain are warmly invited to join ESIE 2026 - uniting around technological innovation, advancing industrial upgrading, and jointly shaping a high-quality future for the new energy storage industry.

Register Now to attend, free before Dec 31, 2025:

https://mailchi.mp/2a7b423a7efb/esie-2026-registration-socialmedia

New Installations Down 67% YoY: Analysis of China's User-Side New Energy Storage Projects in November

Source: CNESA

In November 2025, newly installed user-side new energy storage capacity in China recorded a year-on-year decline of over 65%.

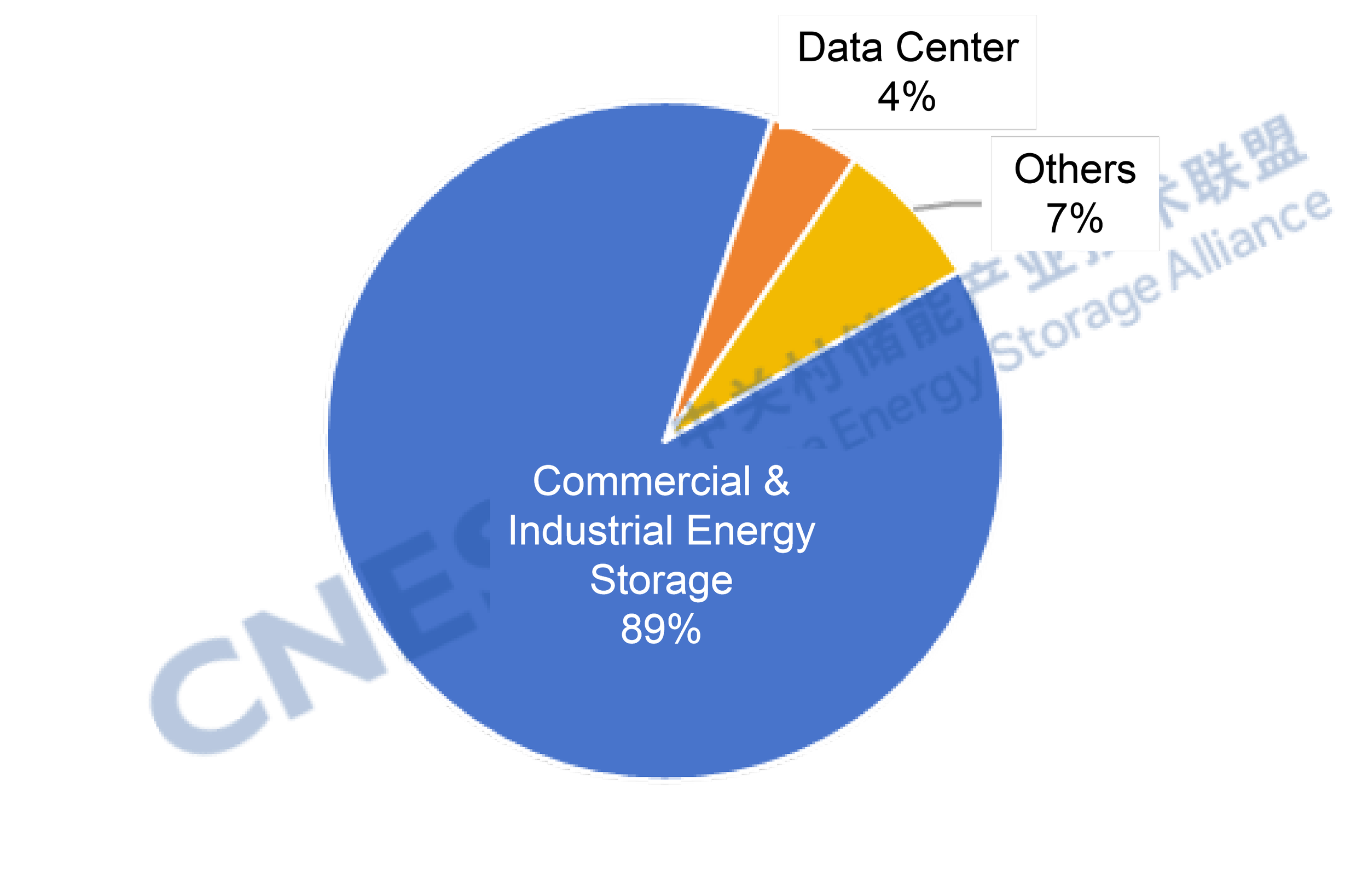

Compared with October, the market structure showed notable adjustments:

Commercial and industrial (C&I) energy storage accounted for nearly 90%, while long-duration energy storage technologies accelerated deployment.

East China contributed more than half of newly commissioned capacity, with Fujian leading in installed capacity.

Although filing activity in traditional user-side markets (Zhejiang, Guangdong, Jiangsu) declined compared with the same period last year, overall demand remained higher year-on-year. Emerging markets such as Anhui, Henan, and Sichuan are becoming new growth engines driving the national user-side energy storage market.

Analysis of User-Side New Energy Storage Projects in November

In November, newly installed user-side capacity reached 185.27 MW / 555.83 MWh, representing -67% / -57% year-on-year, and -5% / +16% month-on-month. User-side new energy storage projects exhibited the following characteristics:

(1) Installed Capacity by Application

In November, the user-side energy storage market continued to be dominated by C&I applications, accounting for nearly 90% of total installations. Newly installed C&I capacity reached 163.9 MW / 541.3 MWh, -68% / -58% year-on-year, and -9% / +15% month-on-month.

The largest data center user-side energy storage project in Zhejiang was officially commissioned. Rapid development of AI data centers (AIDC) and intelligent computing centers is driving growth in user-side energy storage demand.

From a technology perspective, all newly commissioned projects adopted electrochemical energy storage technologies. Lithium iron phosphate (LFP) batteries accounted for over 99% of installed power capacity. In terms of long-duration storage, one 8-hour, 202 MWh lithium-based C&I energy storage project and one 8-hour, 2 MWh all-vanadium redox flow battery project were completed and put into operation.

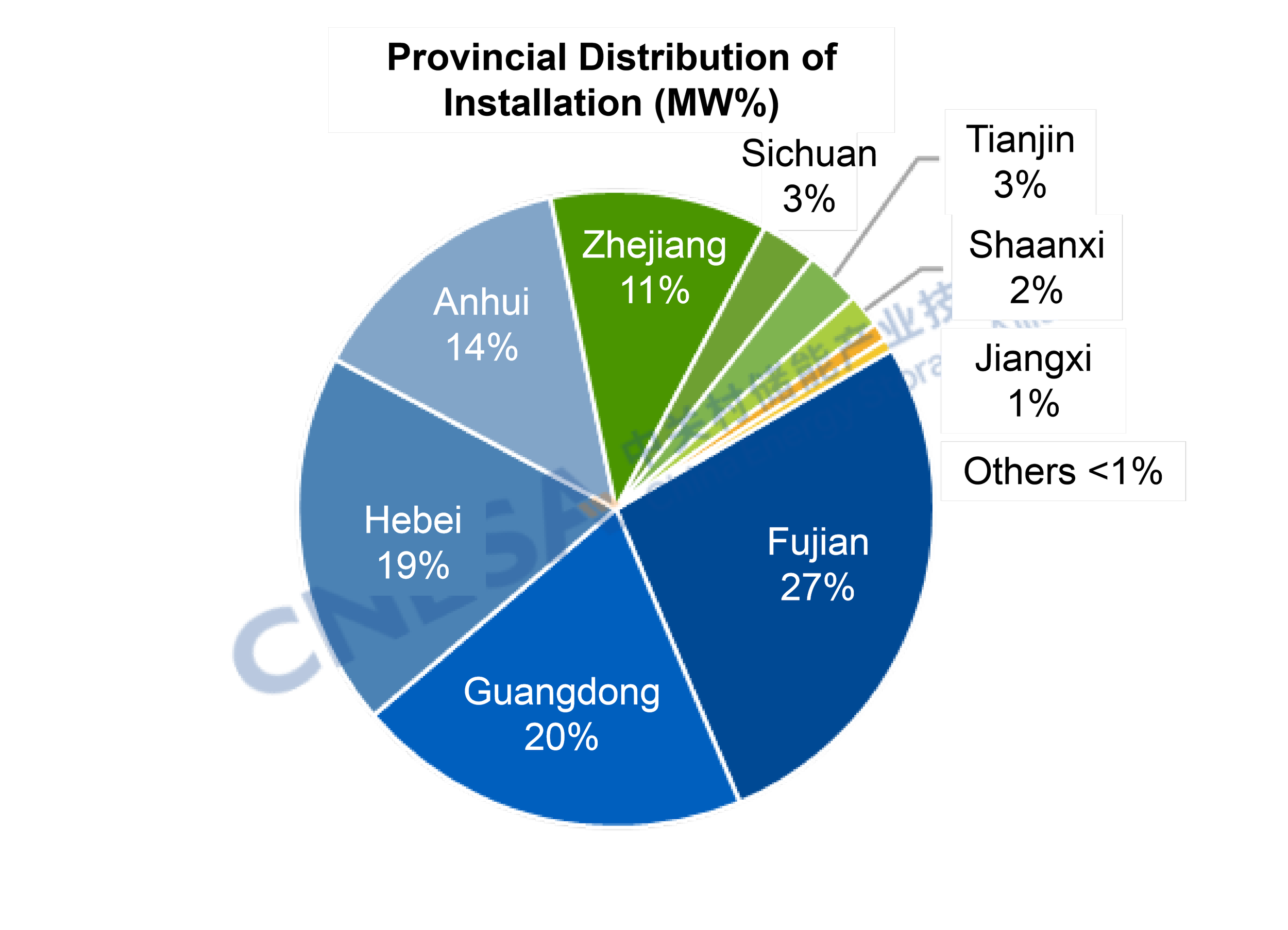

Figure 1: Application Distribution of Newly Commissioned User-Side New Energy Storage Projects in November 2025 (MW%)

Data Source: CNESA DataLink Global Energy Storage Database

https://www.esresearch.com.cn/

Note: “C&I” includes industrial facilities, industrial parks, and commercial buildings. “Others” include mining areas, oilfields, remote regions, and municipal institutions, etc.

(2) Regional Distribution of User-Side Energy Storage

By region, newly commissioned projects were mainly distributed across 11 provinces, including Fujian, Guangdong, Hebei, Anhui, and Zhejiang. East China led the market in November, accounting for 52% of newly installed capacity and 39% of total projects, ranking first nationwide in both installed scale and number of commissioned projects.

At the provincial level, Fujian recorded the largest share of newly installed power capacity, exceeding 25%, while Hebei led in newly installed energy capacity, accounting for 40%. Guangdong had the highest number of newly commissioned projects, representing over 18%, ranking first nationwide.

Fujian hosts a high concentration of energy-intensive industries such as steel and chemicals, where demand for peak shaving, valley filling, and backup power is strong. In addition, diversified application scenarios - including integrated PV-storage-charging systems and virtual power plant aggregation - are being increasingly developed, leaving substantial growth potential for the user-side energy storage market.

From an industrial and supply chain perspective, Fujian is home to the country's largest lithium battery R&D and manufacturing base, with lithium battery production capacity ranking among the national leaders. Driven by leading energy storage companies, a complete local supply chain has been established for core components such as cells, PCS, BMS, and EMS, effectively reducing overall system costs. Moreover, Fujian supports energy storage project financing through green credit and industrial funds, covering multiple project types including pumped hydro storage and new energy storage.

Figure 2: Provincial Distribution of Newly Operating User-Side New Energy Storage Projects in China, November 2025

Data Source: CNESA DataLink Global Energy Storage Database

https://www.esresearch.com.cn/

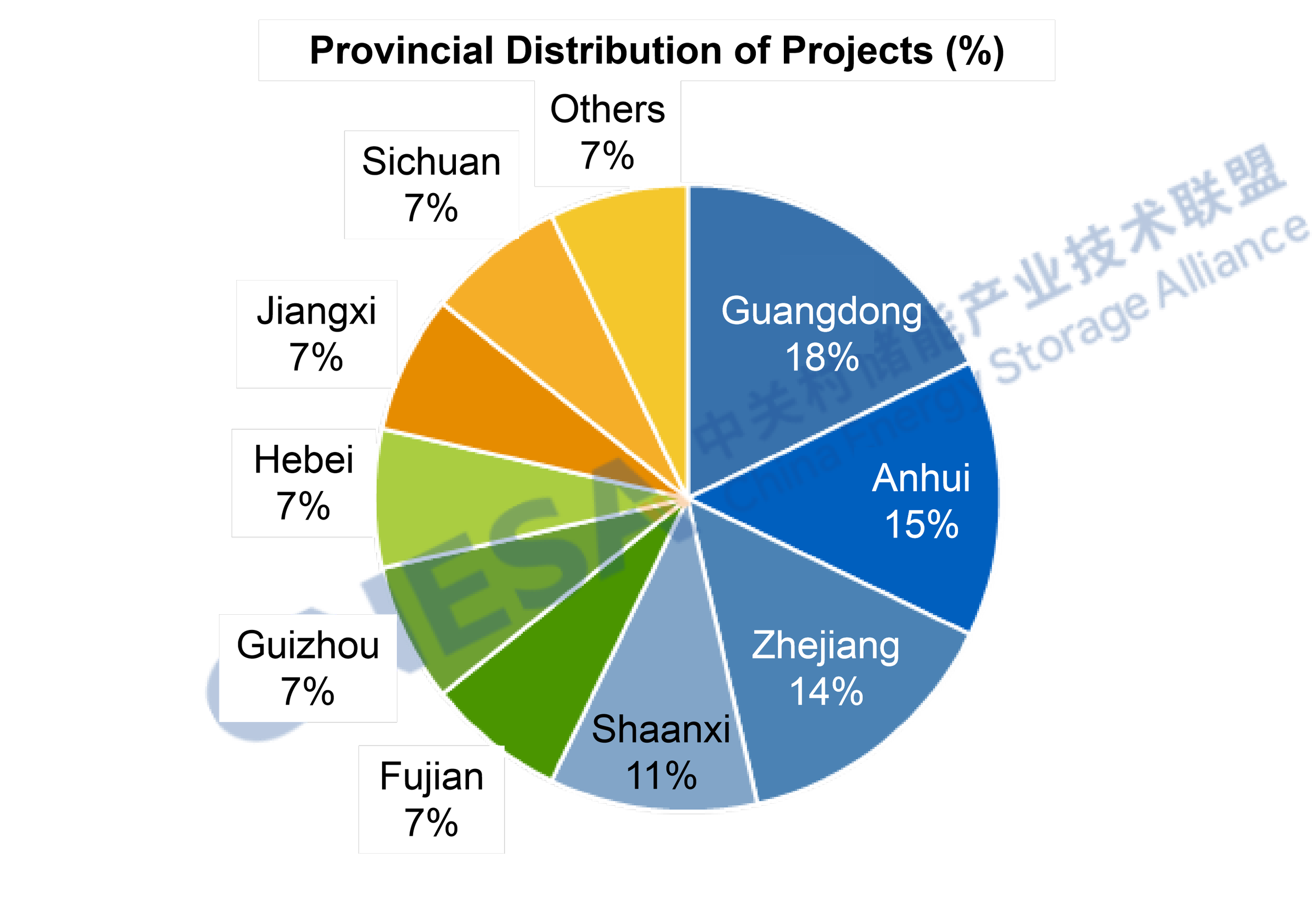

(3) Filed User-Side Energy Storage Projects

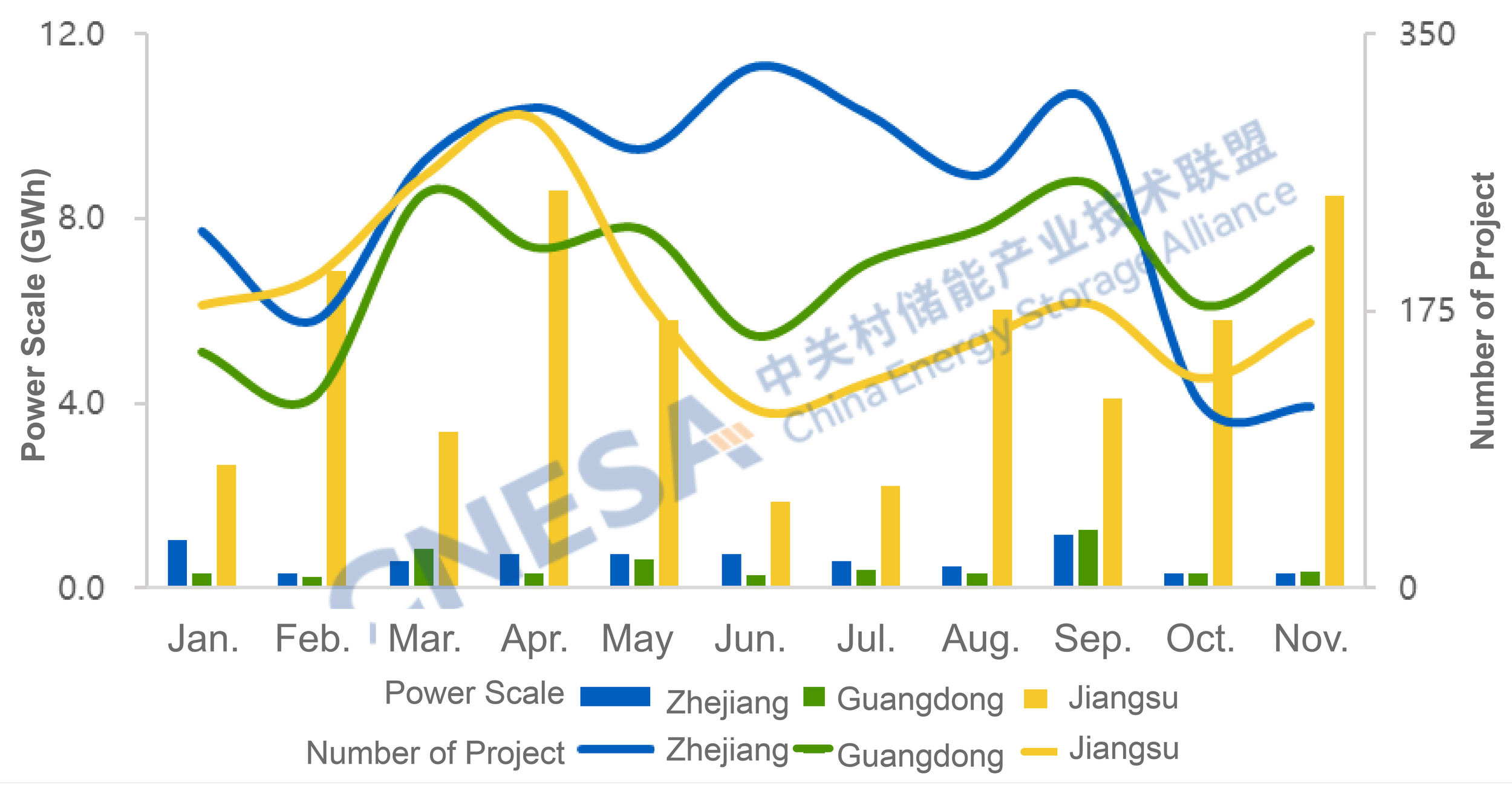

Based on project filings, national user-side market demand in November exceeded the level of the same period last year, with differentiated regional adjustments. Nationwide, both the total scale and number of newly filed user-side projects in November were higher year-on-year, up 8% and 5%, respectively. However, filing activity in traditional markets - Zhejiang, Guangdong, and Jiangsu - declined compared with last year.

Across these three provinces, a total of 497 new projects were filed, down 47% year-on-year, while energy capacity declined 7% year-on-year.

Guangdong recorded the highest number of newly filed projects, but project count fell 25% year-on-year, and scale declined 73%.

Zhejiang saw the largest drop in project count, down 65% year-on-year, with scale decreasing 34%.

Jiangsu recorded a 48% year-on-year decline in project count, but project scale increased 6%.

In November, Jiangsu ranked first nationwide in newly filed project scale. The average project size was approximately twice that of the same period last year, indicating a shift in user-side energy storage development from small-scale, distributed projects toward large-scale, centralized investments in high-quality application scenarios.

Meanwhile, Anhui, Henan, and Sichuan collectively added 440 newly filed projects, up 89% year-on-year and 47% month-on-month, accounting for about 38% of the national total, 5 percentage points higher than in October. Emerging user-side markets represented by Anhui, Henan, and Sichuan are rapidly releasing growth potential and are expected to become new engines driving nationwide user-side energy storage market growth.

Figure 3: Monthly Distribution of Newly Filed Energy Storage Project Scale in Zhejiang, Guangdong, and Jiangsu (January - November 2025)

Data Source: CNESA DataLink Global Energy Storage Database

https://www.esresearch.com.cn/

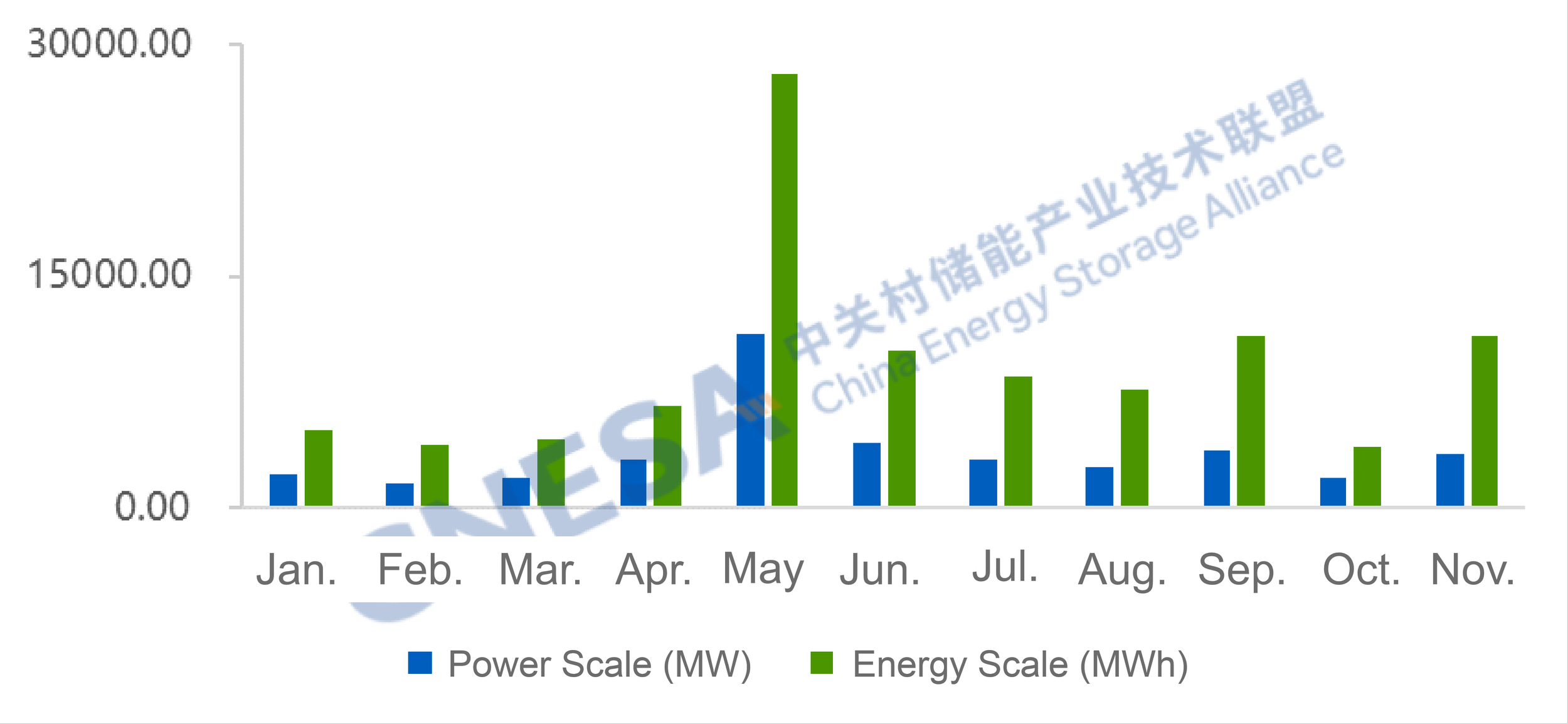

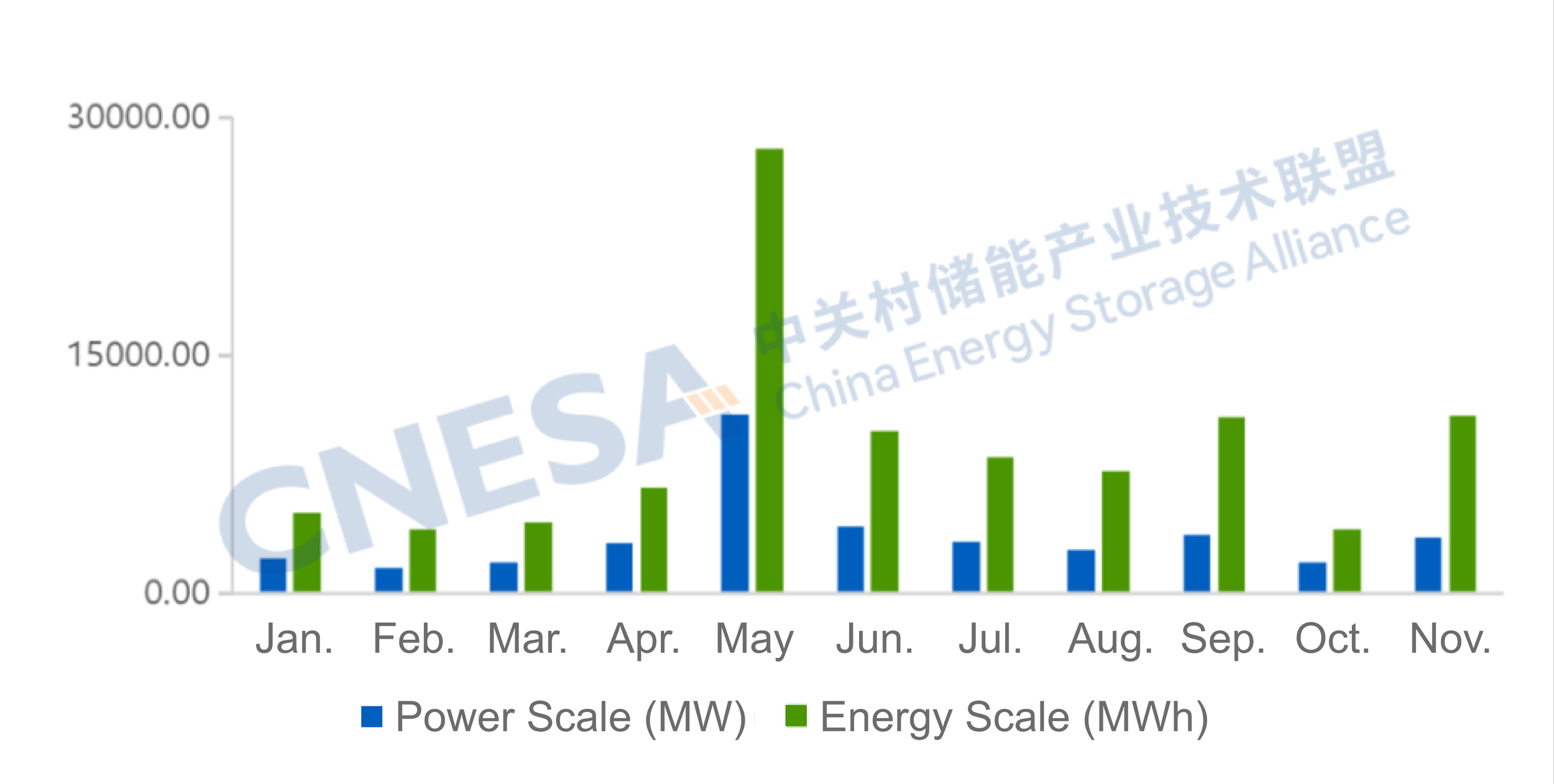

Overall Analysis of New Energy Storage Projects in November

According to incomplete statistics from CNESA, in November 2025, newly commissioned new energy storage projects in China totaled 3.51 GW / 11.18 GWh, representing -22% / -7% year-on-year, and +81% / +180% month-on-month. While monthly additions continued to decline year-on-year, cumulative newly installed capacity in the first eleven months reached 39.5 GW, up 28% year-on-year. Considering the potential for concentrated grid connections ahead of the “12.30” commissioning deadline, total new installations for the year are expected to exceed last year's level.

Figure 4: Installed Capacity of Newly Operating New Energy Storage Projects in China, January - November 2025

Data Source: CNESA DataLink Global Energy Storage Database

https://www.esresearch.com.cn/

Note: Year-on-year comparisons are based on the same period of the previous year; month-on-month comparisons are based on the immediately preceding statistical period.

The China Energy Storage Alliance (CNESA) has consistently adhered to standardized, timely, and comprehensive information collection practices to continuously track developments in energy storage projects. Leveraging its long-term data accumulation and in-depth professional analysis, CNESA regularly publishes objective market analyses on installed energy storage capacity, providing valuable references for industry decision-making. Since June 2025, the monthly energy storage project analysis has been divided into two sections: “Grid&Source-Side Market” and “User-Side Market”. This issue focuses on interpreting the user-side market in November.

CENSA Upcoming Events:

Apr. 1-3, 2026 | The 14th Energy Storage International Conference & Expo

Register Now to attend, free before Dec 31, 2025.

MoM Surge of 90%! Grid&Source-Side Energy Storage Rebounds Sharply in November, with Full-Year Scale Expected to Exceed Last Year

Source: CNESA

After a phase adjustment in China's new-type energy storage market in October 2025, the commissioning scale of new-type energy storage in November declined slightly year on year but rebounded markedly month on month. Meanwhile, the market's deeper structure adjusted compared with October:

Market recovery with a positive long-term outlook: Although installed capacity in November declined year on year, the month-on-month increase was significant. Newly added installations in the first 11 months reached nearly 40 GW, up more than 25% year on year, and full-year additions are expected to exceed last year.

Accelerated deployment of independent storage: In November, independent energy storage accounted for over 70%, with month-on-month growth rates exceeding 80% in power capacity and 200% in energy capacity. Inner Mongolia recorded more than 1.1 GW of newly commissioned independent storage, ranking first nationwide in both power and energy capacity.

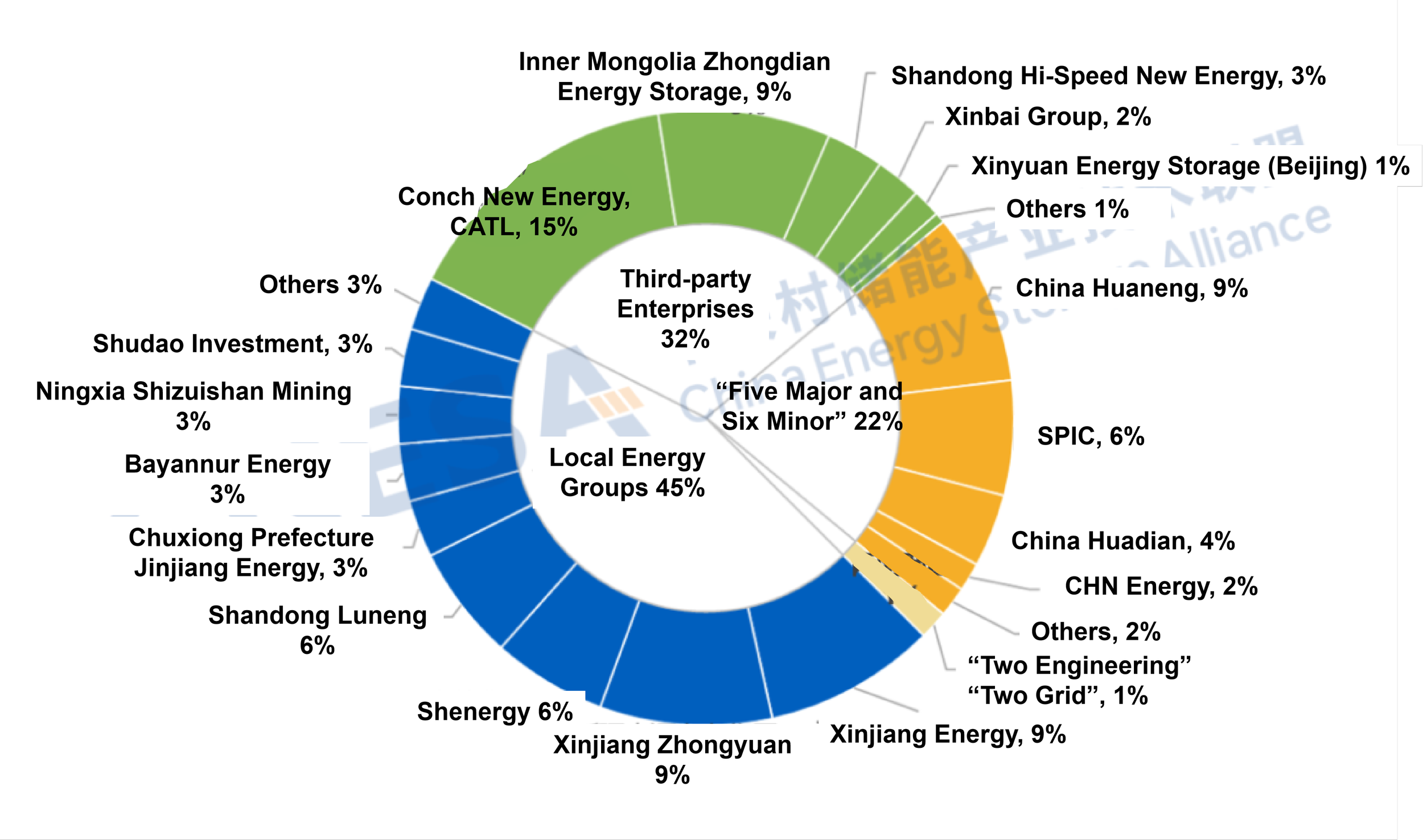

Rise of local energy groups: Newly added installations by local energy groups reached a 45% share, surpassing for the first time the “Five Major and Six Minor” power generation groups and the “third-party enterprises”, highlighting a further diversification of market investors.

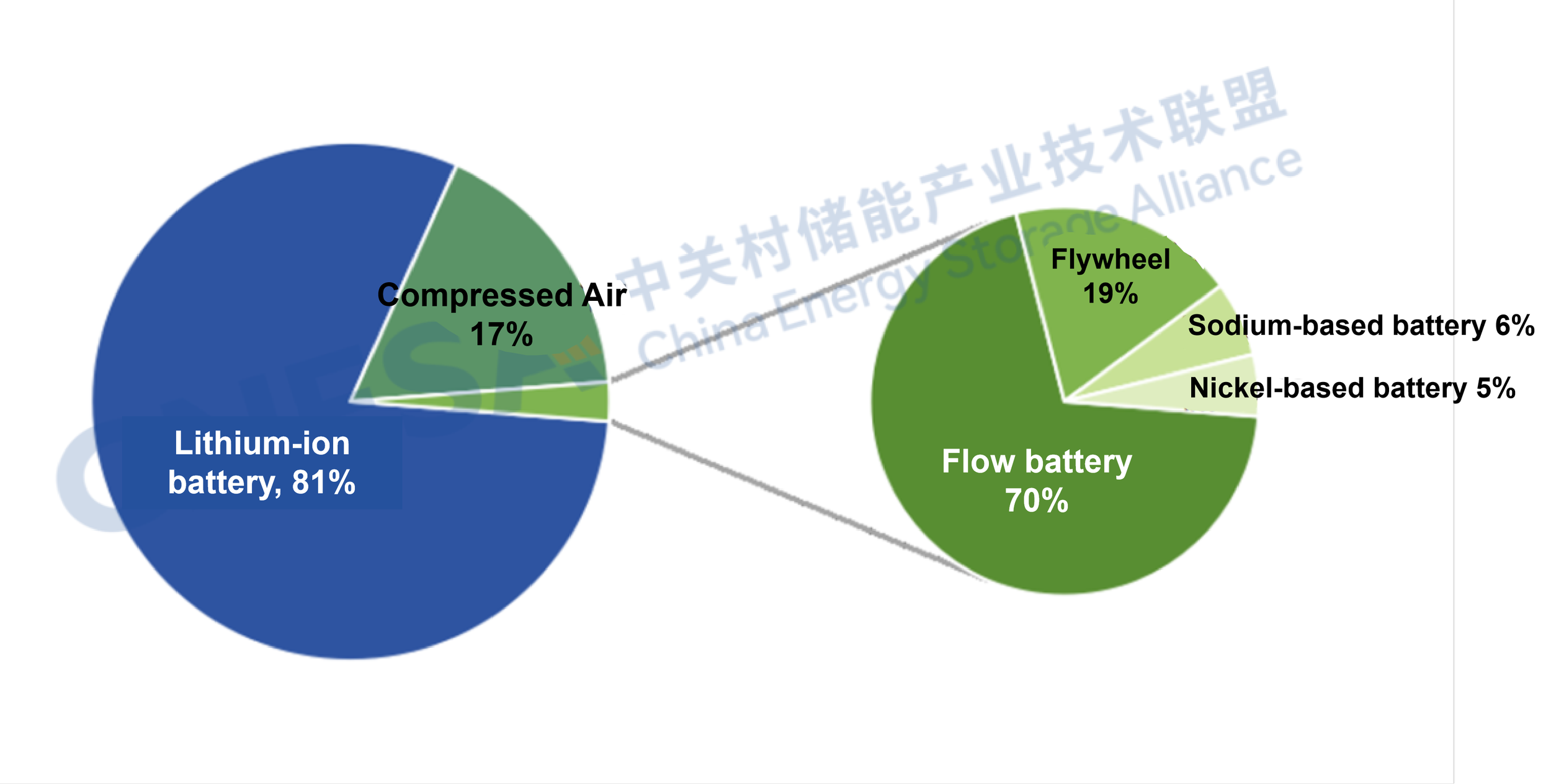

Faster rollout of diversified technologies: Beyond mainstream lithium batteries, technologies such as compressed air, flow batteries, and flywheels are being deployed at an accelerated pace, supporting the industry's long-term development.

Overall Analysis of New-Type Energy Storage Projects in November

According to incomplete statistics from CNESA, in November 2025 China commissioned a total of 3.51 GW / 11.18 GWh of new-type energy storage projects, representing -22% / -7% year on year and +81% / +180% month on month. While monthly additions continued to decline year on year in November, cumulative additions in the first 11 months reached 39.5 GW, up 28% year on year. Considering potential concentrated grid connections ahead of the “12.30” commissioning deadline, total additions for the year are expected to exceed last year.

Figure 1. Installed Capacity of Newly Commissioned New-Type Energy Storage Projects in China, Jan-Nov 2025

Data source: CNESA DataLink Global Energy Storage Database

https://www.esresearch.com.cn/

Note: Year-on-year (YoY) compares the same period last year; month-on-month (MoM) compares the previous statistical period.

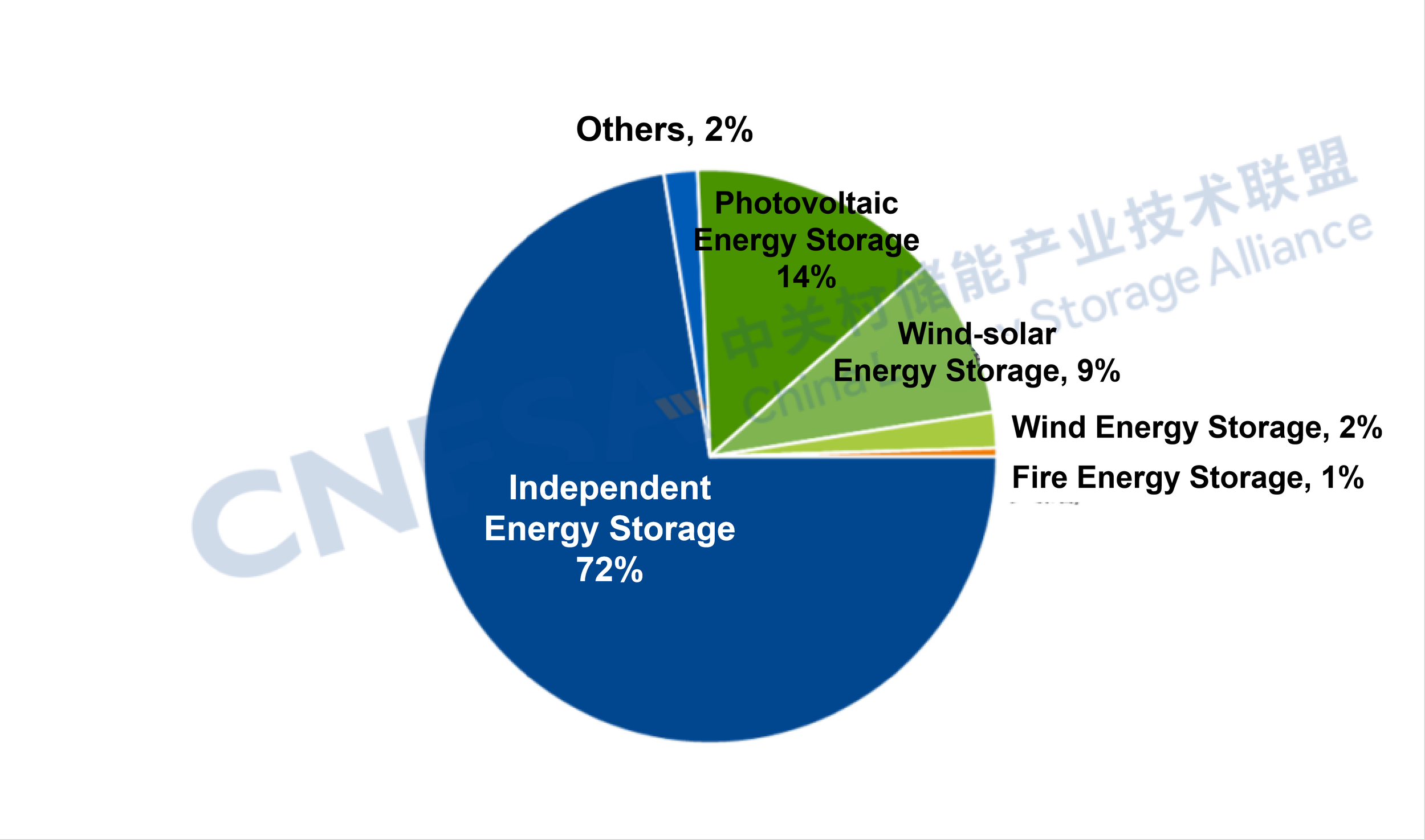

Analysis of Grid&Source-Side New-Type Energy Storage Projects in November

In November, newly added grid&source-side installations totaled 3.32 GW / 10.62 GWh, -15% / -1% year on year and +90% / +202% month on month.

Key characteristics include:

Newly added Independent storage accounted for 72%, down 6 percentage points from October.

Independent storage additions reached 2.41 GW / 8.19 GWh, -9% / +11% year on year and +82% / +217% month on month, with projects of 100 MW or above accounting for 79% by number.

Power-generation-side additions were 853.3 MW / 2,322.1 MWh, -33% / -31% year on year and +99% / +148% month on month. Renewable-plus-storage projects accounted for 98% of power capacity, covering multiple application scenarios such as UHV DC projects, agrivoltaics, and pastoral-solar hybrid systems.

Figure 2. Application Breakdown of Newly Commissioned Grid&Source-Side Energy Storage Projects in Nov. 2025 (MW%)

Data source: CNESA DataLink Global Energy Storage Database

https://www.esresearch.com.cn/

Note: “Others” include substations, emergency power supply, etc.

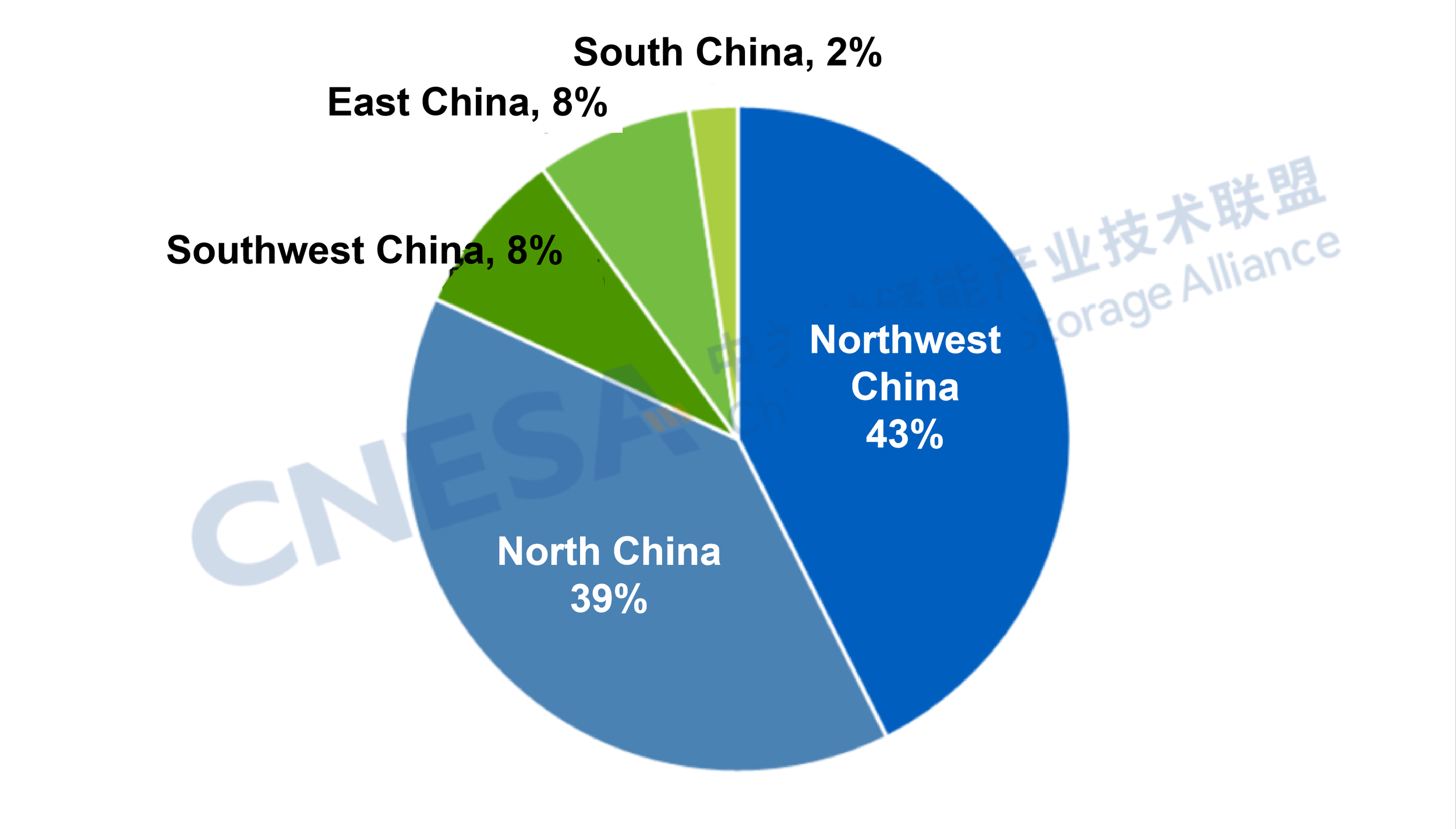

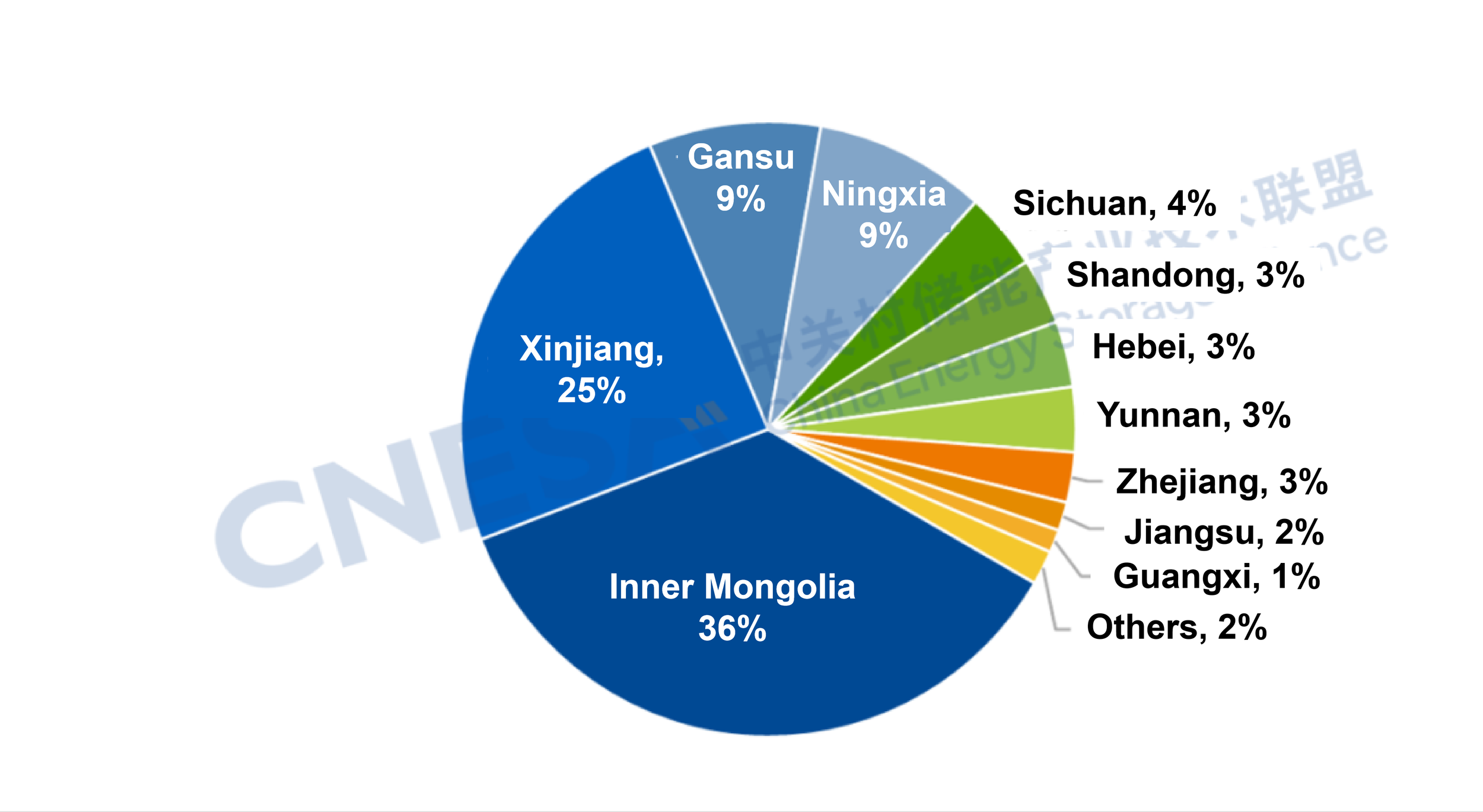

Northwest Leads with Over 40% Share; Inner Mongolia Ranks First

In November, the Northwest region accounted for 43% of newly added capacity, ranking first nationwide. Combined additions in the Northwest and Southwest exceeded half of the national total.

By province, the Inner Mongolia Autonomous Region saw multiple Independent grid-side demonstration projects commissioned - such as those included in the 2025 New-Type Energy Storage Special Action Implementation Project List and the first batch of Independent storage construction projects - totaling over 1.1 GW with an average storage duration of 4 hours, ranking first nationwide in both power and energy capacity. Xinjiang, Gansu, and Ningxia followed closely.

As a key national energy and strategic resource base in China, Inner Mongolia had surpassed 150 GW of installed renewable capacity by the end of October 2025, ranking first nationwide. Wind and solar accounted for over 80% of new installed capacity, further solidifying their dominant role (data source: Inner Mongolia Autonomous Region Energy Bureau). From the perspective of consumption, approximately 80% of renewable generation is consumed locally, with around 20% exported. The combined pressure of local consumption and grid stabilization continues to drive demand for new-type energy storage.

Figure 3. Regional Distribution of Newly Commissioned Grid&Source-Side Energy Storage Projects in China, November 2025 (MW%)

Source: CNESA Datalink Global Energy Storage Database

Figure 4. Provincial Distribution of Newly Commissioned Grid&Source-Side Energy Storage Projects in China, November 2025 (MW%)

Source: CNESA Datalink Global Energy Storage Database

https://www.esresearch.com.cn/

Faster Deployment by Local Energy Groups Highlights Investor Diversification

Driven by rising market demand, supportive national policies, diversified technology pathways, and declining costs, the market potential of energy storage is being fully released, with increasing investor diversification.

In November, projects invested in and built by local energy groups such as Xinjiang Energy Group, Xinjiang Zhongyuan Power Group, and Shenergy Group were commissioned in succession. Local energy groups accounted for 45% of newly added power capacity - the highest among all enterprise types - contrasting sharply with September and October, when third-party enterprises and the “Five Major and Six Minor” power generation groups dominated.

Leveraging advantages in policy coordination and approvals, resource integration and location, business linkage and industrial chain synergy, capital strength and decision-making efficiency, and operations, local energy groups have become a key pillar of the new-type energy storage market. Meanwhile, third-party enterprises - such as joint entities involving Conch New Energy and CATL, and Inner Mongolia Zhongdian Energy Storage - maintained a high level of participation, accounting for over 30% of monthly additions. The “Five Major and Six Minor” power generation groups (including China Huaneng, SPIC, and China Huadian) accounted for 22%, down 9 percentage points from October, continuing the decline seen since August.

Figure 5. Owner Distribution of Newly Commissioned Grid&Source-Side Energy Storage Projects in China, November 2025 (MW%)

Data source: CNESA DataLink Global Energy Storage Database

https://www.esresearch.com.cn/

Note: “Third-party enterprises” refer to entities other than large state-owned generation groups, the two grid companies, two construction groups and local energy companies.

Accelerated Deployment of Non-Lithium Technologies

Technologically, newly commissioned grid&source-side projects were dominated by lithium iron phosphate (LFP) batteries, accounting for 91% of power capacity, followed by lead-carbon batteries (6%) and flow batteries (3%).

From a project development perspective, non-lithium technologies such as compressed air energy storage and hybrid systems are accelerating, highlighting a trend toward diversified technology pathways.

In compressed air storage, multiple 300 MW-class projects have completed filings and entered the planning stage; the Golmud 60 MW liquid air energy storage demonstration project and the Yumen 300 MW compressed air energy storage demonstration project have entered commissioning.

For hybrid storage, multiple 100 MW-class demonstration projects have launched or completed tenders, with some under construction or advancing, involving combinations such as lithium + sodium-ion batteries, lithium + flow batteries, lithium + flywheels, and lithium + nickel-metal hydride batteries.

Figure 6. Technology Distribution of Newly Planned and Under-Construction Grid&Source-Side Energy Storage Projects in China, November 2025 (MW%)

Source: CNESA Datalink Global Energy Storage Database

https://www.esresearch.com.cn/

The China Energy Storage Alliance (CNESA) has consistently adhered to standardized, timely, and comprehensive information collection practices to continuously track developments in energy storage projects. Leveraging its long-term data accumulation and in-depth professional analysis, CNESA regularly publishes objective market analyses on installed energy storage capacity, providing valuable references for industry decision-making. Since June 2025, the monthly energy storage project analysis has been divided into two sections: “Grid&Source-Side Market” and “User-Side Market”. This issue focuses on interpreting the grid&source-side market in November.

CENSA Upcoming Events:

Apr. 1-3, 2026 | The 14th Energy Storage International Conference & Expo

Register Now to attend, free before Dec 31, 2025.

Energy Storage Leaders Converge in Xiamen: Executives from Ten Industry Giants Share Insights at the 2025 China Energy Storage CEO Summit

Source: CNESA

On December 4, 2025, the “2025 China Energy Storage CEO Summit & the 10th International Energy Storage Innovation Competition - Preliminary Round,” hosted by the China Energy Storage Alliance (CNESA) and co-hosted by Xiamen University, Kehua Digital Energy, and Cornex New Energy, was successfully held in Xiamen.

The summit brought together top leaders from the most influential companies in the energy storage sector - Kehua Data, Envision Energy, Cornex New Energy, Shuangdeng Group, XYZ Storage, Trina Storage, HyperStrong, Potisegde, and Phoenix Contact. Chairmen, presidents, and key executives gathered to explore breakthroughs in energy storage technology, global strategies, and the construction of a robust industrial ecosystem. Their insights not only represent the direction of their companies but also reflect the core trajectory and future momentum of China's energy storage industry.

Chen Chenghui

Chairman, Kehua Data

“Charting the course forward means not only seizing opportunities but anchoring growth in technological innovation and safeguarding it through coordinated standards. Going fast alone is not enough - only through openness, cooperation, and ecosystem-wide collaboration can we enhance the quality and sustainability of global energy transition.”

Tian Qingjun

Senior Vice President, Envision; President, Envision Energy

“Chinese energy storage enterprises are born global. Going overseas has shifted from being an option to a matter of survival. In the face of inevitable globalization and its risks, the industry must evolve from simply going out to truly integrating in. Deep local operations and international talent development are key to long-term presence. At the same time, companies should foster competitive collaboration across the value chain, avoid vicious price wars, and win global respect through long-term value and quality.”

Huang Feng

President, Cornex New Energy

“We respect technology, respect safety, and respect quality - technology is the key to improve performance and cost challenges, and quality is the foundation of market confidence. In a race defined by both speed and endurance, only continuous innovation and customer alignment can lead to shared value.”

Cui Jian

President, Kehua Digital Energy

“Grid-forming technology has become a fundamental necessity for energy storage. In the future, PCS will no longer distinguish between ‘grid-following’ and ‘grid-forming’; the technologies will converge. Through deep technical refinement and intelligent upgrades, we will support the stable operation of new power systems and enable diverse value creation.”

Yang Rui

Chairman, Shuangdeng Group

“Energy storage companies must be ‘born global’ and capable of ‘deep globalization’. In certain high-certainty tracks such as AIDC, the real challenge lies in whether an organization can truly capture and sustain explosive market opportunities. By prioritizing talent and building a ‘carrier-class architecture’, we aim to lead with products and efficiency, establishing a resilient moat for long-term survival in fast-paced cycles.”

Lian Zhanwei

Chairman, XYZ Storage

“Safety is the lifeline of the energy storage industry. Innovative technologies such as immersion liquid cooling represent proactive breakthroughs for high-safety application scenarios. We look forward to working with the industry to advance energy storage toward higher safety, efficiency, and reliability.”

Yang Bao

President, Trina Storage

“Global experience in solar has paved the way for storage going overseas. With global networks and localized teams, we are accelerating the deep integration of solar and storage, enabling technology and markets to evolve together, and delivering value across regions and cultures in the global energy transition.”

Yang Guang

Chief Technology Officer, HyperStrong

“Strong partnerships and complementary strengths are vital to ensuring stable industrial delivery. Facing diverse global application scenarios, we are advancing platform-based products and AI-driven strategies to deeply integrate ‘Energy Storage + X’ and provide customized solutions for different markets.”

Richard Wan

Vice President of Technology, Potisegde

“Full-stack independent development is the foundation of quality, and global-localized delivery is the guarantee of stability. We adopt EV-grade standards for energy storage and build a closed-loop technology chain with intelligent manufacturing, reinforcing safety and efficiency amid intensifying competition.”

Zhu Wei

Senior Vice President, Phoenix Contact China

“Rooted in China, serving the world. We combine a century of electrical engineering experience with local R&D and manufacturing, providing secure and efficient system-level support for complex, multi-scenario energy storage applications through advanced connectivity and industrial automation technologies.”

As a key prelude to the 14th Energy Storage International Conference and Expo (ESIE 2026), the 2025 China Energy Storage CEO Summit served not only as a platform for high-level intellectual exchange but also as a catalyst for deeper industry collaboration. Leading companies including Kehua Digital Energy, Envision Energy, Cornex New Energy, Shuangdeng Group, XYZ Storage, Trina Storage, HyperStrong, Potisegde, and Phoenix Contact have confirmed participation in ESIE 2026 and will showcase their latest technologies and solutions at this global energy storage event.

We sincerely invite industry colleagues to join us next year as we work together to advance the energy storage industry toward higher quality and greater sustainability.

CENSA Upcoming Events:

Apr. 1-3, 2026 | The 14th Energy Storage International Conference & Expo

Register Now to attend, free before Dec 31, 2025.

Cache Power Plans ‘Canada’s First’ Commercial-Scale Compressed Air Energy Storage Facility

Source: Energy Storage News

The facility will be constructed in two phases and located next to the Marguerite Lake substation to enhance efficiency and facilitate grid integration. Image: EllisDon

Compressed air energy storage (CAES) developer Cache Power is partnering with construction company EllisDon to deliver a CAES facility in Northeast Alberta, Canada.

The facility will be constructed in two phases and located next to the Marguerite Lake substation to enhance efficiency and facilitate grid integration.

Cache Power does not have any information on its website, but appears to be a special purpose vehicle (SPV) for Federation Engineering.

On Federation’s website, the company clarifies that the Marguerite Lake facility will have a 250MW load capacity and 640MW generation capacity. Energy storage capacity or planned duration were not referred to in publicly available materials.

The companies assert that the technology will be essential in stabilising Alberta’s grid and supporting both provincial and national efforts toward a net-zero electricity future. The project has secured all key regulatory approvals, with early construction scheduled to start soon.

CAES technology operates by pressurising and directing air into a storage medium to load the system. When discharging, the stored air is released through a heating system to expand, driving a turbine generator.

Notably, the companies claim the project will be the first commercial scale CAES facility in Canada.

Ontario-headquartered Hydrostor is known for its advanced compressed air energy storage (A-CAES) projects.

A-CAES operates similarly to traditional CAES but captures heat from the compressor and passes it through heat exchangers to store in pressurised water. This water is kept in a reservoir and then released into a cavern to displace air during discharging, a process known as hydrostatic compensation.

In conventional CAES, less than 50% of the energy can typically be recovered. The thermal energy produced during compression is often wasted, and the power output varies depending on the residual underground air pressure.

Hydrostor has two small operational projects in Canada, one a pilot and the other a commercial demonstrator, with the larger one being a 2.2MW/10MWh commercial system in Goderich, Ontario.

Hydrostor noted the Goderich Energy Storage Centre as the world’s first commercially contracted A-CAES facility. In addition to its role as technology provider, the A-CAES company is also developing large-scale projects around the world, including its 1.6GWh Silver City project in New South Wales, Australia, and 4GWh Willow Rock project in California, US. The company has secured some funding and offtake agreements for both, including a recent renegotiation of contracts for Willow Rock (ESN Premium article).

It has also proposed a 500MW/8,000MWh project in Ontario (ESN Premium), adjacent to Ontario Power Generation’s Lennox Generating Station in Greater Napanee.

Speaking with Energy-Storage.news, a representative from Federation clarified that the distinction between the CAES system titles for itself and Hydrostor came down to scale and usage.

Cache Power’s facility can store up to 48 hours of energy by compressing air with excess grid electricity and sequestering it in underground salt caverns formed through solution mining.

It can also blend up to 75% hydrogen with natural gas, with a future plan for complete hydrogen utilisation, aligning with Canada’s net-zero ambitions.

Power plant equipment supplier Babcock & Wilcox are collaborating on engineering the possible hydrogen facility expansion, employing the company’s BrightLoop technology.

Babcock & Wilcox claim that BrightLoop can produce hydrogen while isolating carbon dioxide for capture and storage.

Additionally, Cache Power states it will deliver economic and social advantages to the local community and Indigenous Partners. Cold Lake First Nations has actively engaged in the project’s development and is anticipated to collaborate as a partner with Cache Power in both the project and its operations.

Update: Jordan Costley, Director of Sustainability Projects at Federation Engineering, and President of Cache Power has clarified that the project will be 30.72GWh. Costley also added about CAES energy recovery:

“(The 50% recovery statistic) may have been true for the original D-CAES projects such as Huntorf (Germany 1978) and McIntosh (USA 1991) but our project is utilizing the latest D-CAES technology from Siemens Energy.“

“Today’s compression technology utilising multi-stage integrally geared and intercooled compressors is very efficient resulting in the heat of compression being low grade not valuable for thermal energy storage and reuse in the expansion process. The expander trains also include 90% effective dual-reheat recuperators again significantly increasing the overall efficiency. The technology we are utilizing is not “conventional CAES” as defined by Huntorf and McIntosh.

(By April Bonner)

CENSA Upcoming Events:

Apr. 1-3, 2026 | The 14th Energy Storage International Conference & Expo

Register Now to attend, free before Dec 31, 2025.

Puerto Rico Advances on Its Delayed Accelerated BESS Deployment Programme

Source: Energy Storage News

In Puerto Rico, the electric generation, transmission, and distribution facilities managed by PREPA are operated privately by Luma Energy. Both entities are overseen by the Puerto Rico Energy Bureau (PREB). Image: Trish Hartmann.

The Puerto Rico Energy Bureau (PREB) has issued a resolution and order requiring the Puerto Rico Electric Power Authority (PREPA) to complete the Accelerated Battery Energy Storage Addition Programme (ASAP).

The resolution and order require PREPA to finish the necessary review process with the Financial Oversight and Management Board (FOMB) concerning the four final agreements of the ASAP.

Implementation and delay of ASAP

In Puerto Rico, the electric generation, transmission, and distribution facilities managed by PREPA are operated privately by Luma Energy. Both entities are overseen by the Puerto Rico Energy Bureau (PREB).

ASAP aims to enhance grid reliability across the island by deploying utility-scale battery energy storage systems (BESS) alongside existing generation facilities.

Under the programme, independent power producers (IPPs) with existing power purchase and operating agreements (PPOAs) with PREPA will install BESS at their sites, “on an accelerated basis,” as stated in PREB documents available on the regulator’s website.

In 2024, PREB informed Luma Energy that its plan to contract with IPPs for BESS resources was consistent with public power policy.

In April 2024, Luma identified Phase 1 projects that could start immediately with minimal costs and no network upgrades, with some developers claiming they could be operational in less than 12 months and contracts expected to be executed by April 2025.

However, in August 2025, the projects remained stalled, with only one developer (Ecoeléctrica) responding to PREPA’s communications to say it was working to complete documentation by September, while three others (San Fermín, Horizon, and Oriana) did not respond at all.

PREB called the delays “extremely concerning” and required all four developers to provide detailed explanations for the lack of responsiveness, emphasising that these projects are crucial for addressing Puerto Rico’s electricity generation shortfall and warning that fines will be imposed if developers don’t comply with the information requests.

PREB issues resolution and order to PREPA

PREB concluded that Luma’s four final agreement terms for ASAP align with the island’s Energy Public Policy and the Integrated Resource Plan (IRP).

As a result, the Bureau approved the four drafts and directed Luma to finalise the contracts, submit them to PREPA’s Governing Board for approval, and demonstrate this process. Furthermore, PREPA was instructed to obtain approval from the FOMB.

On 20 November, Luma submitted final agreements to PREPA’s Board. The private operator asked for these documents to be confidential due to critical infrastructure, sensitive data, and personal information. PREB confirmed Luma’s compliance and granted confidentiality.

PREB clarified that the 1,500MW of battery storage listed in the IRP is a guideline, not a strict cap.

The resolution and order confirmed that this figure is not fixed and can be exceeded; battery projects in development will be assessed regardless of whether they propose more than 1,500MW of storage capacity. PREB also highlighted that any decision to increase or decrease this limit is solely at its discretion.

Because PREB has granted confidentiality to Luma, it is unclear for which participants the agreements have been submitted.

Developers Ecoeléctrica, San Fermín, Horizon, and Oriana have had ongoing communications with Luma. Though, as noted above, San Fermin, Horizon, and Oriana have previously failed to respond to PREPA’s communications.

Additionally, in August, Polaris Renewable Energy submitted a BESS standard offer (SO1) agreement on behalf of PREPA to PREB.

The SO1 agreement is included in the ASAP scheme. When submitted, Polaris appeared to distinguish itself from the other developers who had not delivered BESS projects on the island.

Included in the resolution and order, Commissioner Mateo Santos dissented in part and concurred in part, and stated:

“As I have previously expressed, I do not agree with the pass-through concepts included in the contracts under the ASAP programme, and therefore I dissent on that aspect. However, I concur with the Energy Bureau’s determination regarding the integration of battery energy storage resources.”

Santos continued, “Specifically, I agree with the Energy Bureau’s clarification that the approximately 1,500MW of Battery Energy Storage Resources identified in the Approved IRP’s Modified Action Plan constitutes a guideline rather than a fixed limit. Any final determination on the appropriate level of integration will be made by the Energy Bureau.”

(By April Bonner)

CENSA Upcoming Events:

Apr. 1-3, 2026 | The 14th Energy Storage International Conference & Expo

Register Now to attend, free before Oct 31, 2025.

200MW/800MWh! China's Largest Semi-Solid-State Energy Storage Project Connected to the Grid

Source: CCTV News

According to a report by CCTV News on December 1, China Green Development Group announced that a 200MW/800MWh semi-solid-state battery energy storage project located in Wuhai, Inner Mongolia, has been successfully connected to the grid. The project not only sets a new record for the installed capacity of grid-connected semi-solid-state lithium battery energy storage in China, but also marks a crucial step for China's semi-solid-state energy storage technology from pilot demonstration to large-scale commercial operation.

As a major new energy hub in northwest China, Wuhai city in the Inner Mongolia Autonomous Region, has leveraged its abundant wind and solar resources to consistently advance integrated development of “source-grid-load-storage” in recent years. This newly grid-connected energy storage facility serves as a core infrastructure project for enhancing local renewable energy consumption. Covering an area of about 100 mu (about 6.67 hectares), the project is equipped with 160 energy storage battery containers and 40 converter and booster integrated units.

Semi-Solid-State Lithium Battery Energy Storage Project Successfully Connected to the Grid in Wuhai, Inner Mongolia

Qin Lei, Project Manager of Wuhai Energy Storage Project, Inner Mongolia Branch, China Green Development Group:

“This massive ‘power bank’ utilizes domestically-developed semi-solid-state lithium iron phosphate battery technology, which offers significant advantages in safety performance, energy density, and cycle life compared with conventional liquid lithium iron phosphate batteries.”

With the rapid upgrade of the new energy industry, energy storage - essential for grid peak regulation, frequency modulation, and improving renewable energy utilization - is entering a phase of large-scale expansion. Semi-solid-state lithium battery technology represents a key direction for the future development of power and storage batteries. Using a hybrid solid-liquid electrolyte, semi-solid-state batteries retain the high ionic conductivity of liquid systems while achieving a cycle life exceeding 12,000 cycles, which greatly reduces lifecycle operational costs. In addition, they can effectively suppress lithium dendrite growth, further enhancing safety.

Semi-Solid-State Lithium Battery Energy Storage Project Successfully Connected to the Grid in Wuhai, Inner Mongolia

Liu Xiaofei, Assistant General Manager, Inner Mongolia Branch, China Green Development Group:

“Once fully operational, the project will feature a peak-shaving and frequency-regulating capability of 200MW/800MWh, providing 189,000 MWh of clean electricity to the grid annually. It enables flexible scheduling - storing energy during the day and supporting peak loads at night - significantly enhancing power system stability. It will also ensure that local green electricity can be fully delivered, stably transmitted, and efficiently utilized, solving key bottlenecks in regional renewable energy consumption.”

Semi-Solid-State Lithium Battery Energy Storage Project Successfully Connected to the Grid in Wuhai, Inner Mongolia

In recent years, semi-solid-state lithium batteries - offering both high safety and strong economic performance - have become a core direction of technological evolution in the energy storage sector. Previously, China's largest grid-connected semi-solid-state storage project had a capacity of 100MW/200MWh. The Wuhai project doubles that scale, demonstrating that China is now at the global forefront of large-scale applications of semi-solid-state energy storage technology.

CENSA Upcoming Events:

1. Dec.4-5 | 2025 China Energy Storage CEO Summit | Xiamen, Fujian

Register Now to attend

Read more: http://en.cnesa.org/new-events-1/2025/12/4/dec4-5-2025-china-energy-storage-ceo-summit

2. Apr. 1-3, 2026 | The 14th Energy Storage International Conference & Expo

Register Now to attend, free before Oct 31, 2025.

Australia Opens Capacity Investment Scheme Tender 8, Seeking 16GWh of Energy Storage across NEM

Source: Energy Storage News

Pacific Green was one of the successful participants in the CIS, with the Limestone Coast Energy Park (pictured) having been awarded a CISA. Image: Pacific Green.

The Australian government has officially opened the Capacity Investment Scheme (CIS) Tender 8, targeting 16GWh of energy storage capacity across the National Electricity Market (NEM).

The tender represents the largest single energy storage procurement under the CIS programme, reflecting the government’s accelerated deployment timeline for grid-scale storage infrastructure.

Tender 8 registrations opened earlier today (28 November) and will close on 23 January, with submissions closing on 6 February. The tender specifically targets energy storage projects with a minimum 4-hour duration requirement, emphasising the government’s focus on medium-duration storage technologies capable of providing extended grid support services during peak demand periods and renewable energy intermittency events.

The 16GWh capacity target represents a substantial increase from previous tender rounds and aligns with Australia’s expanded CIS target of a total 40GW of renewables and energy storage.

The tender incorporates streamlined assessment processes developed through previous rounds, building on reforms introduced when the government unveiled four tenders for 2025.

These process improvements aim to reduce assessment timeframes and provide greater certainty for project developers while maintaining rigorous evaluation criteria for technical capability, financial viability, and grid integration requirements.

Eligible technologies under Tender 8 include battery energy storage systems, pumped hydro energy storage (PHES), compressed air energy storage, and other proven energy storage technologies capable of meeting the 4-hour minimum duration requirement.

The tender excludes hybrid renewable energy projects, focusing exclusively on standalone energy storage systems that can provide grid services, including frequency regulation, voltage support, and energy arbitrage across multiple market timeframes.

The CIS has demonstrated significant success in previous tender rounds, with substantial energy storage capacity awarded across multiple procurement cycles.

Tender 3 resulted in over 15GWh of energy storage being awarded to successful applicants, while Tender 4 saw 11.4GWh of solar-plus-storage projects receive government support through the programme.

The scheme provides revenue support through Capacity Investment Scheme Agreements (CISAs) that supplement market revenues, enabling project developers to secure financing for energy storage projects that might otherwise face commercial viability challenges in merchant market conditions.

The support mechanism includes floor and ceiling price arrangements that provide revenue certainty while maintaining market exposure and incentives for efficient operation.

Tender 8 evaluation criteria encompass technical specifications, commercial arrangements, grid connection requirements and project development timelines.

Projects must demonstrate grid connection agreements or advanced connection applications with relevant transmission network service providers, along with evidence of site control, environmental approvals, and financial capacity to complete construction and commissioning activities.

The geographic distribution requirements under Tender 8 aim to ensure the deployment of energy storage across multiple states and regions within the NEM, thereby supporting grid resilience and renewable energy integration under diverse network conditions.

The scheme includes milestone requirements and progress reporting obligations to ensure that successful projects advance through the development, construction, and commissioning phases according to agreed-upon schedules.

The DCCEEW will conduct information sessions for potential applicants during December 2025 and January 2026, providing guidance on application requirements, evaluation criteria and commercial arrangements.

Successful Tender 8 projects are expected to be announced in mid-2026, with CISAs enabling project financing and construction commencement. You can find out more about CIS Tender 8 on the official website.

CENSA Upcoming Events:

1. Dec.4-5 | 2025 China Energy Storage CEO Summit | Xiamen, Fujian

Register Now to attend

Read more: http://en.cnesa.org/new-events-1/2025/12/4/dec4-5-2025-china-energy-storage-ceo-summit

2. Apr. 1-3, 2026 | The 14th Energy Storage International Conference & Expo

Register Now to attend, free before Oct 31, 2025.

73 Billion Yuan Investment! 4.8 GWh of Energy Storage! SPIC Launches 19.44 GW “Desert-Gobi-Wasteland” Mega Project

Source: CCTV News

On November 27, according to the State Power Investment Corporation (SPIC), construction has officially begun in Xining, Qinghai Province on China's largest power supply project with the highest share of new energy - the Qinghai Hainan Clean Energy Delivery Base Project, part of the national “Desert-Gobi-Wasteland” mega base initiative.

“Desert-Gobi-Wasteland” refers to vast desert and semi-arid regions, which are rich in wind and solar resources. The project in Qinghai's Hainan Prefecture represents a total investment of nearly 73 billion yuan, with a planned installed capacity of 19.44 GW. New energy accounts for 86.4% of the total, including 9.6 GW of solar PV, 6 GW of wind power, 2.64 GW of supporting coal-fired power, and 1.2 GW/4-hour of electrochemical energy storage (4.8 GWh). The project will transmit electricity directly to Guangdong via a ±800 kV ultra-high-voltage DC transmission line with a capacity of 8 GW.

Once completed, the project will generate an average of 36,000 GWh of electricity annually, equivalent to saving about 10 million tons of standard coal and reducing carbon emissions by roughly 23.5 million tons. It will deliver 36,000 GWh of power annually to the Guangdong-Hong Kong-Macao Greater Bay Area, playing a major strategic role in optimizing China's energy mix and supporting high-quality development in the eastern region.

CENSA Upcoming Events:

1. Dec.4-5 | 2025 China Energy Storage CEO Summit | Xiamen, Fujian

Register Now to attend

Read more: http://en.cnesa.org/new-events-1/2025/12/4/dec4-5-2025-china-energy-storage-ceo-summit

2. Apr. 1-3, 2026 | The 14th Energy Storage International Conference & Expo

Register Now to attend, free before Oct 31, 2025.

Germany BESS ‘Firsts’: Integrated Software, Multi-Party Optimisation, Privileged Permitting

Source: Energy Storage News

Germany BESS ‘firsts’: Integrated software, multi-party optimisation, privileged permitting

A week of claimed first-of-their-kind advances in Germany’s BESS market, including the combination of monitoring, diagnostics and energy trading on one platform, an optimisation deal allowing multiple companies to trade one asset virtually, and a law change accelerating permitting.

In summary:

· Investor Dynamic is deploying a BESS where digital monitoring, battery analytics and diagnostics, and energy trading are combined into one single, coordinated system: an industry-first according to the analytics provider Volytica

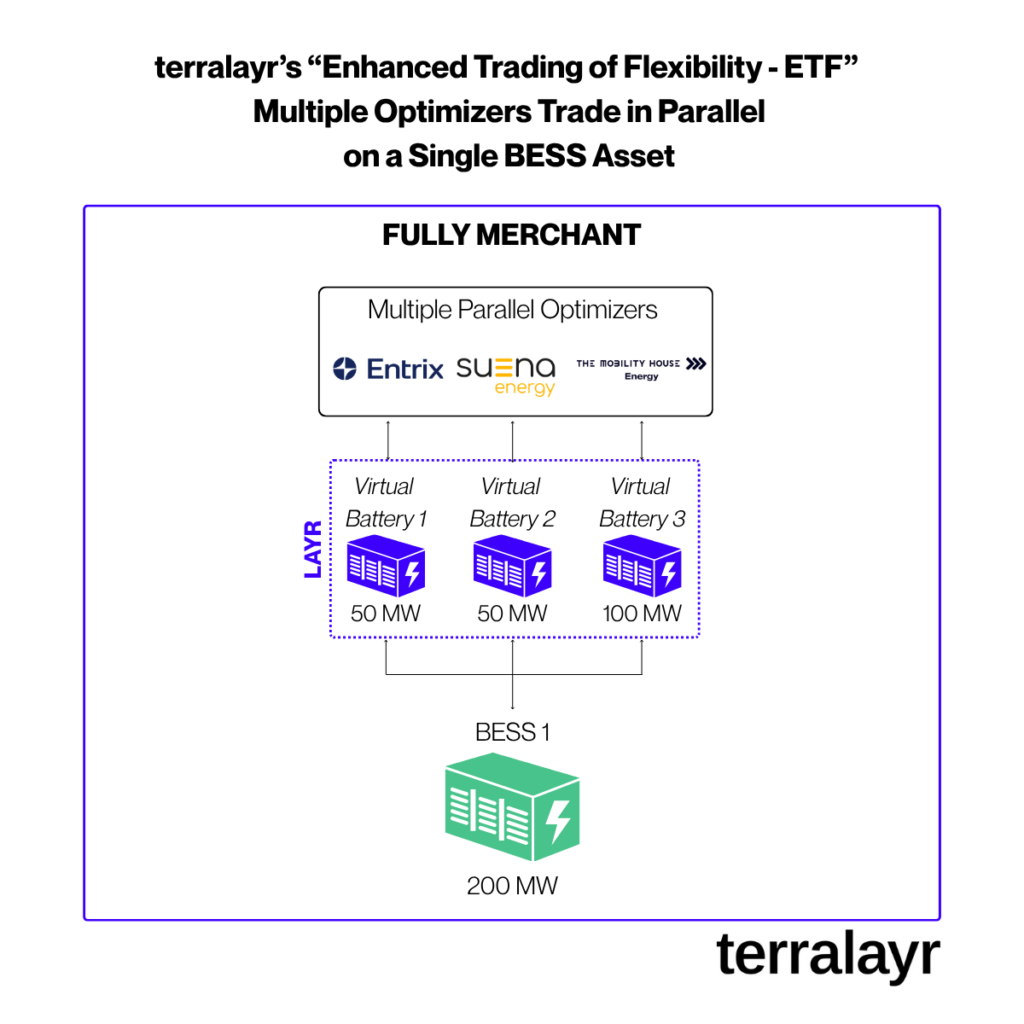

· Optimisation platform Terralayr has enabled three optimisers – Entrix, Suena and The Mobility House – to virtually trade portions of one single BESS asset

· The German Federal Parliament (Bundestag) has passed a law simplifying the development of energy storage projects, and expressly granting them privileged status

Dynamic’s Tangermünde project’s ‘first-of-its-kind’ integration

Investor Dynamic has partnered with digital monitoring and asset management solutions firm Amperecloud, battery analytics and diagnostics provider Volytica and optimiser Enspired for a 15.8MW/32MWh battery energy storage system (BESS) in Tangermünde, Saxony-Anhalt.

Volytica said it is the first project to “…combine monitoring, battery diagnostics, and energy trading into a single, coordinated system. These features are integrated to simplify operations and ensure competitiveness in today’s energy market”.

The analytics provider said the initiative addresses the common BESS industry challenge of fragmented digital tools for operational control, battery condition monitoring, and commercial optimisation. By integrating their platforms, the partners aim to enable continuous, data-driven system management, from performance monitoring to market participation, it said.

A spokesperson for Volytica said that, normally, you have individual software tools for asset management to operate and maintain the BESS, one tool for trading, one tool to access BMS data and one tool for analytics and monitoring, with no connection between providers.

Volytica CEO Claudius Jehle posted in more detail on his LinkedIn about the concept when Volytica announced the project.

The spokesperson said the integrated approach saves time and money, improves efficiency and competitiveness, and erases blind spots and increase transparency.

The project appears to already be operational, with a photo provided showing BESS units from Trina Storage, though the release did not refer to this.

Terralayr’s multi-optimiser BESS arrangement

BESS optimisation and virtual aggregation platform Terralayr has also claimed an industry-first, software-related asset management breakthrough.

It said its latest commercialisation model creates the “world’s first, risk-adjusted portfolio-effect for storage operators”.

The firm’s virtualisation set up allows multiple optimisers to trade a slice of one or multiple physical assets. The solution is live on Terralayr’s assets, will be rolled out to all future ones as well and available to asset owners in Germany.

Every asset owner has one contract per physical asset and that asset would be disaggregated into virtual batteries. Each virtual battery is then optimised by one different optimiser. As a result, one physical asset is optimised by multiple optimisers in parallel, a spokesperson explained.

A hypothetical arranagement is visualised in the infographic the firm provided below, with the BESS sliced into three virtual assets, 50MW each for Entrix and Suena and 100MW for The Mobility House (for example).

The model is called ‘Enhanced Trading of Flexibility – ETF’, and Terralayr claimed that it drives market efficiency, lowers revenue volatility, and creates a more stable risk-return profile for operators.

It also described an additional benefit called the “netting-off effects”, which regularly occurs when optimisers’ dispatch schedules offset each other, saving battery cycles and reducing degradation.

Terralayr’s platform bundles all optimiser dispatch and ancillary service signals and allocates them to the physical asset, while guaranteeing adherence to all technical restrictions and manufacturer specifications.

The firm launched in 2022, and has onboarded big-name energy firms in Germany including RWE and Vattenfall to its virtual BESS aggregation and optimisation platform as offtakers. Terralayr is deploying its own, smaller grid-scale BESS projects, at least partially to provide capacity for, and prove out, its platform.

Parliament in Germany adopts faster permitting for storage

In related BESS industry news, the German Federal Parliament (Bundestag) passed an amendment to the Energy Industry Act and the Federal Building Code which significantly simplifies the development of energy storage projects, law firm Evershed Sutherlands said in a note.

In a nutshell, the reform elevates legal certainty regarding the privileged treatment of thermal storage facilities, hydrogen storage facilities, and large-scale BESS in outside areas (Außenbereich), the firm explained: such projects are now expressly granted privileged status. The reform aims to accelerate energy storage permitting and deployment.

It creates a major simplification of future permit procedures, whereas previously energy storage was subject to considerable legal uncertainty.

Most grid-scale development in Germany is currently focused around projects that will come online before August 2028, when a three-year exemption from grid fees for charging and discharging ends. The government is discussing a more long-term solution, but whether this new change will benefit projects that can be deployed within the next three years is unclear.

(By Cameron Murray)

CENSA Upcoming Events:

1. Dec.4-5 | 2025 China Energy Storage CEO Summit | Xiamen, Fujian

Register Now to attend

Read more: http://en.cnesa.org/new-events-1/2025/12/4/dec4-5-2025-china-energy-storage-ceo-summit

2. Apr. 1-3, 2026 | The 14th Energy Storage International Conference & Expo

Register Now to attend, free before Oct 31, 2025.

NVIDIA's 800V Architecture Reshapes AI Data Centers: 31 Core Industry Chain Companies Unveiled

Source: CNESA

“How big is AI's appetite? The power consumption of a large AI data center is comparable to that of a small-to-medium-sized city. More challenging is its power usage pattern, which is like a ‘roller coaster’: one moment it computes at full capacity, and power spikes to its peak; the next moment it exchanges data, and power consumption drops sharply.” Such drastic fluctuations overwhelm traditional power grids and backup power sources represented by UPS (Uninterruptible Power Supply).

Against this backdrop, NVIDIA's recently released 800V DC architecture white paper has significance beyond a simple technical upgrade. It explicitly proposes a key requirement for future AI data centers: the integration of advanced energy storage systems capable of fast response, instantaneous charge/discharge, and intelligent scheduling. This forward-looking guidance signals that the energy storage industry is poised for an AI-driven explosive growth opportunity.

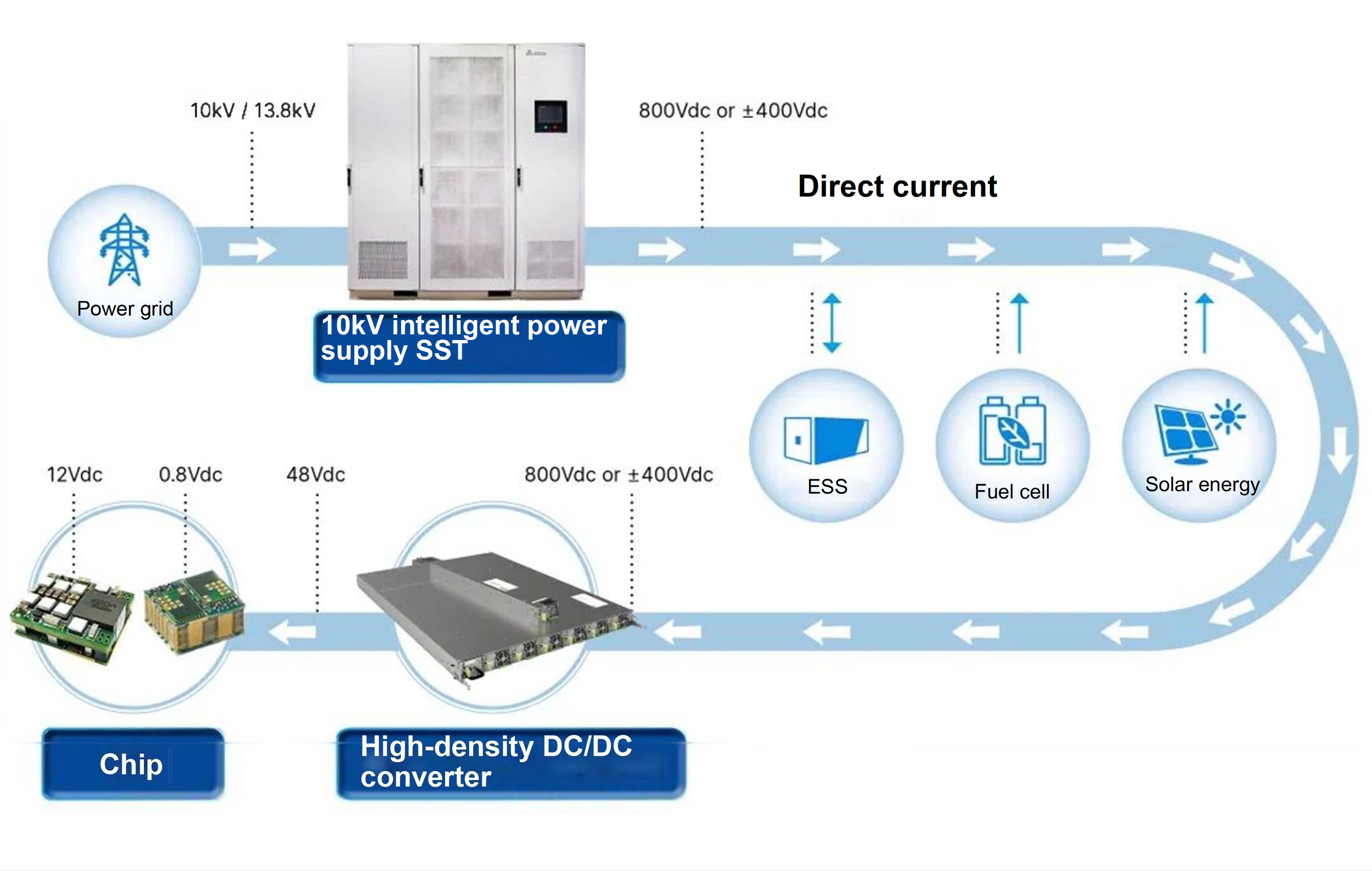

The Energy Bottleneck of Computing Power and Architectural

Breakthroughs

To address this challenge, industry leaders led by NVIDIA have laid out a clear vision, outlining a “three-step” evolution roadmap for the entire sector, aiming to steadily move toward the ultimate 800V DC architecture.

The first step is a transitional solution, innovatively adopting a “side-mounted power cabinet” to physically separate power modules from the core computing area.

The second step, the mid-term solution, promotes the architecture from “distributed” toward “centralized.”

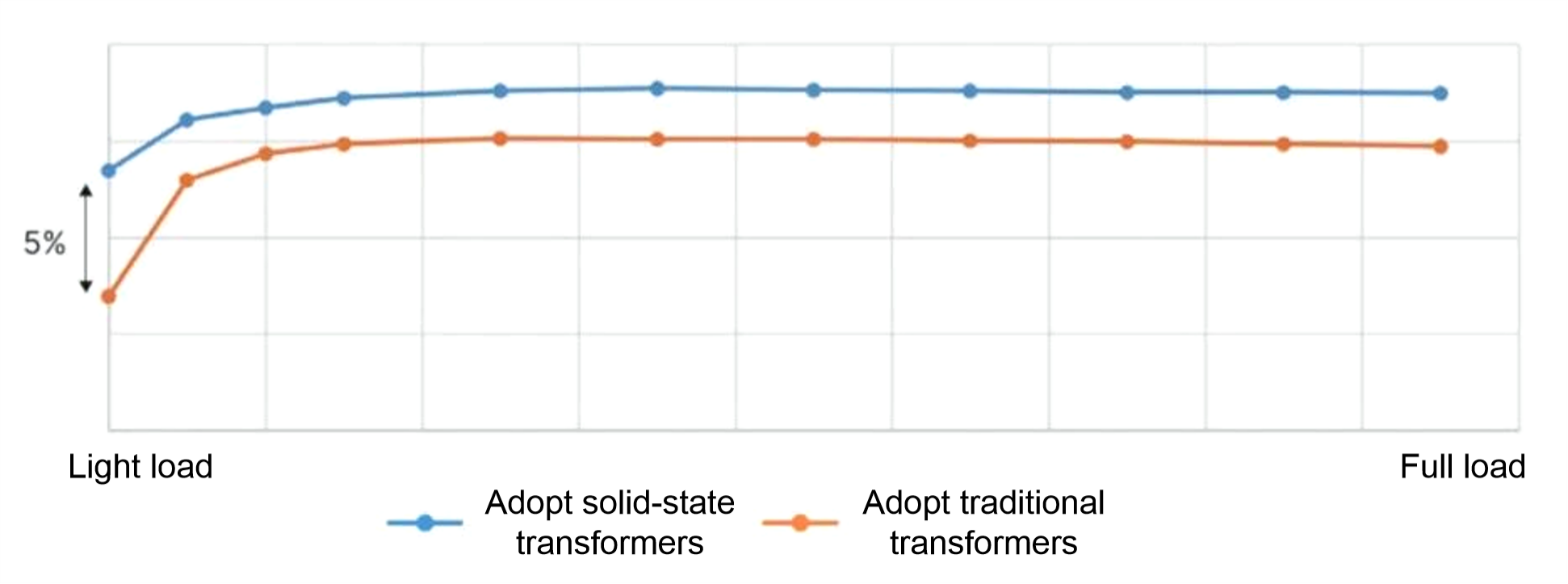

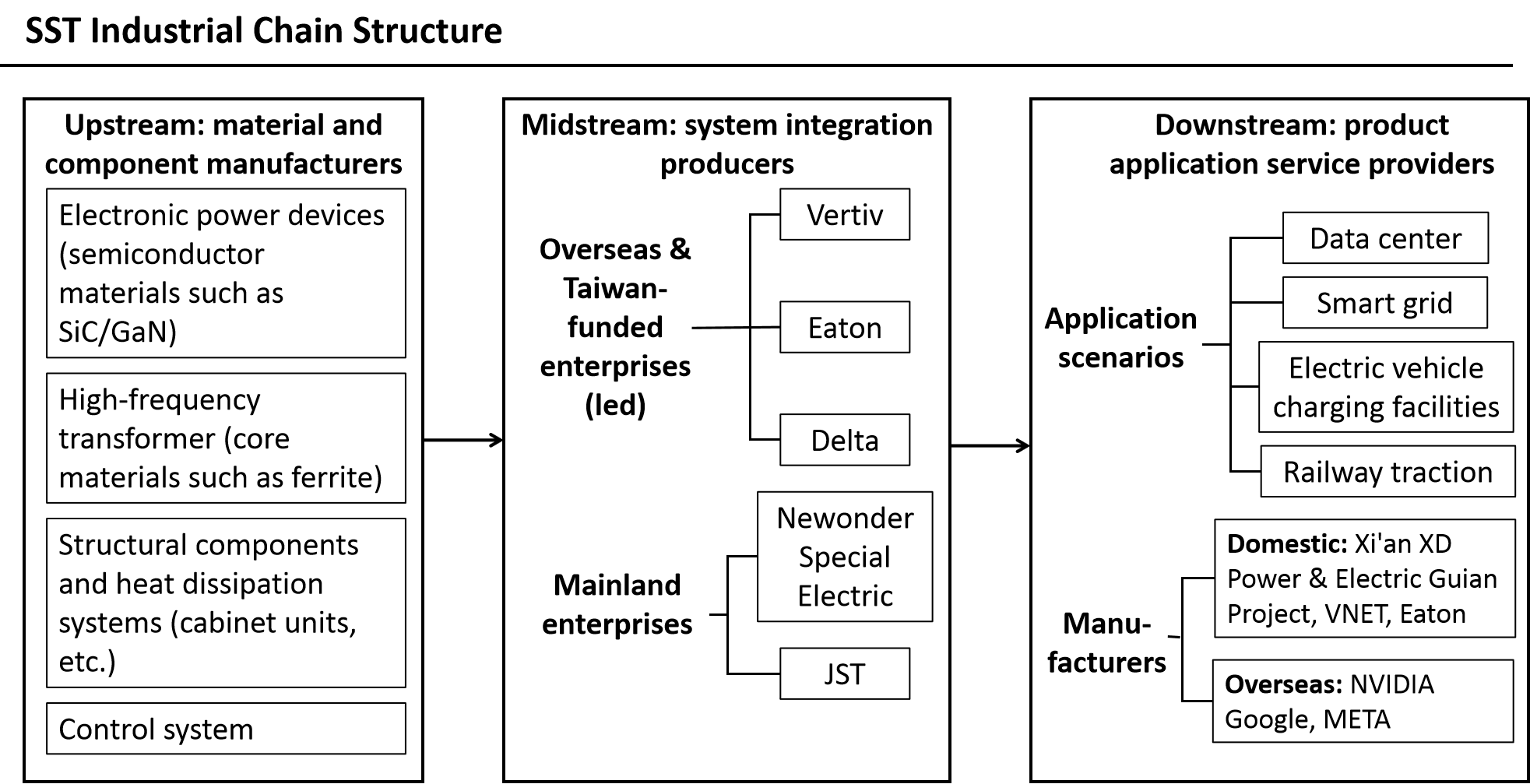

The third step, the ultimate solution, uses SST to achieve a “one-step” conversion from the grid's 10kV medium-voltage AC to 800V DC.

Overview of the 800VDC MGX Cabinet

To enable this new architecture to effectively handle power fluctuations, “hybrid energy storage” becomes an inevitable technical core. By organically combining supercapacitors (responding to millisecond-level surges), high-rate batteries (addressing second-to-minute demands), and large-scale energy storage systems, it forms a multi-layered, fast-response backup power system.

However, the new architecture also raises the technical threshold comprehensively.

Traditional silicon-based power chips, like inefficient old engines, can no longer meet the stringent requirements of 800V high voltage. Consequently, third-generation semiconductors represented by silicon carbide (SiC) and gallium nitride (GaN) have emerged.

In this new architecture, SiC acts as the “strongman,” stabilizing high-voltage conversion of tens of thousands of volts in components such as solid-state transformers (SST), while GaN, like a “sprinter,” delivers precise low-voltage power to GPUs inside servers at extremely high speed. They are not just a performance upgrade but the cornerstone enabling the entire new architecture.

The ultimate form of this technological revolution is embodied in the disruptive product, the solid-state transformer (SST). It uses a “high-speed direct route” approach to efficiently convert medium-voltage grid power directly into 800V DC required by data centers, eliminating energy losses from multiple intermediate conversions, saving tens of millions of kWh annually for a large data center.

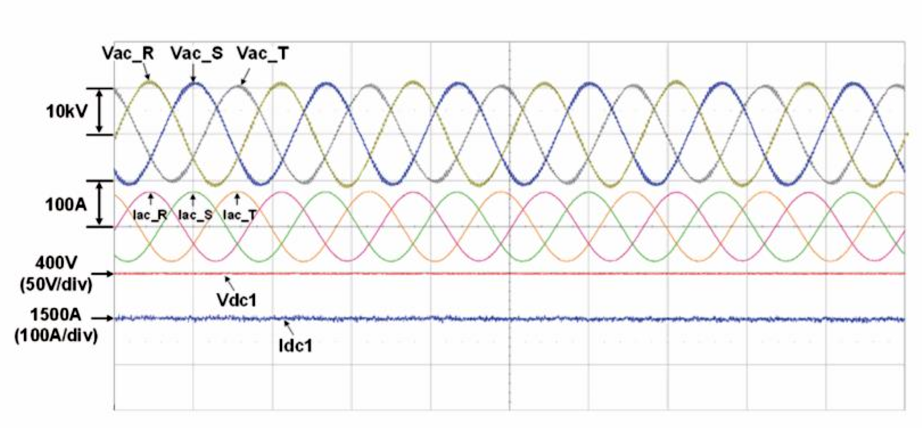

Under light load, SST efficiency is 5% higher than traditional transformers

Improved Power Quality

Meanwhile, SST replaces heavy copper coils with advanced chips, achieving “silicon in, copper out,” reducing the power supply system footprint by more than half and freeing valuable space for core computing equipment. More importantly, it functions as an intelligent “energy router,” seamlessly integrating photovoltaics, energy storage, and other new energy sources, becoming an indispensable intelligent core for building future AI factories.

Technological and product transformation will ultimately lead to a reshaping of business models. Future competition will no longer be a battle of hardware parameters but a contest of “intelligence,” with suppliers required to evolve into solution providers “understanding computing power.”

This means energy systems must have predictive capabilities, anticipating computing load changes and proactively scheduling resources; simultaneously, they must coordinate intelligently, directing supercapacitors, batteries, and other energy storage units to work efficiently together.

In this transformation, true value is shifting from hardware itself to the control algorithms and software behind it. Future winners will no longer be mere equipment manufacturers but service providers capable of delivering integrated hardware-software intelligent energy solutions.

The Blue Ocean Emerges: “Consensus and Competition” in a

Trillion-Yuan Track

With the surge in computing power and data center energy demand, relevant companies in the energy storage industry chain have actively responded, and a strategic competition over technical routes and market positioning has fully unfolded. From UPS suppliers to thermal management solution providers to energy storage system integrators, numerous market participants are showcasing their core technologies and solutions, forming a vibrant competitive landscape. The following outlines the main market players in this field.

1. Sungrow Power: A leading new energy company entering the AI data center power foundation

As a global leader in PV inverters and energy storage, Sungrow is actively deploying AI data center power solutions. In May 2025, the company announced the establishment of the AIDC division, with related products expected in 2026. The team is positioned at a high starting point, focusing on overseas markets, planning comprehensive solutions including cabinet power, high-voltage side, and low-voltage side DC microgrid solutions.

2. Huawei: A system-level player building AI data centers with full-stack energy digital capabilities

Huawei places great emphasis on future data center trends. In January 2024, it released the Top 10 Trends of Data Center Facility 2024 White Paper, proposing that future data centers should achieve three features: “safe and reliable, ultra-simple integration, low-carbon and green.” Huawei, alongside Schneider and Emerson, is a leading domestic company in data center power distribution, emphasizing high integration and green transformation.

3. Kehua Data: Pioneer in self-built data centers and HVDC solutions

As a leading domestic and the world's fourth-largest modular UPS supplier, Kehua Data focuses on data centers. In China, it has independently built more than 20 data centers, and its efficient liquid cooling, UPS, and power distribution products are deeply adopted by top clients such as Tencent Yangtze River Delta data center, ByteDance data center, and Alibaba Cloud.

4. Shuangdeng Group: The “invisible champion” of data center energy storage

As one of China's earliest companies in communication and data center energy storage, Sundeng is hailed as an “invisible champion.” According to the China Energy Storage Alliance (CNESA) ranking, the company topped the 2024 global market for base station/data center battery shipments.

5. ZTT: Empowering AI data center infrastructure with “communication + power” dual engines

Focused on lithium battery energy storage systems, ZhongTian Energy Storage Technology Co., Ltd. aims to fully develop in communication and power energy storage. Its products are widely used in new energy vehicles, communication backends, and grid-side energy storage systems. Annual capacity has reached billions of ampere-hours, with investment in a top domestic lithium battery R&D center, laying the foundation for integrated product R&D and application.

6. Narada Power: Deep development in energy storage technology, winning overseas AI projects

With over 30 years of energy storage expertise, Zhejiang Narada Power Source Co., Ltd. ranked second in the 2024 global base station/data center battery shipment ranking. In October 2025, it successfully won a lithium battery storage project for a massive AI data center campus in Texas, USA. Its self-developed high-voltage, high-power lithium-ion backup power system is containerized, high-rate, and capable of evolving to HVDC, gradually applied in global top data center projects.

7. Hithium Energy Storage: Dedicated energy storage solutions for AI data centers

Specializing in long-duration and high-density storage, Xiamen Hithium Energy Storage Technology Co., Ltd. launched a comprehensive energy storage solution for AI data centers at the U.S. data center exhibition in September 2025.

8. Potisegde: Focused practitioner of AIDC intelligent energy solutions

In September 2025, iPotisEdge Co., Ltd. launched a new-generation data center solution overseas, including the PotisBank-L6.25-AC energy storage system and intelligent energy management system (EMS).

9. Ampace: Semi-solid batteries safeguarding data centers

Xiamen Ampace Technology Limited has integrated this battery of high rate and high safety into the latest “PU200” data center power supply and “PR-S4” UPS systems for financial, communication, and other critical backup scenarios, featuring multiple safety measures like liquid detection and cell-level fire prevention.

10. CLOU: Next-generation liquid-cooled storage systems empowering data centers

Shenzhen CLOU Electronics Co. Ltd launched the Aqua-C3.0 Pro liquid-cooled storage system globally in September 2025, providing integrated EMS for cloud-edge collaboration.

11. Hopewind: Core supplier in the 800V HVDC supply chain

As a supplier of power electronics and energy storage systems, Shenzhen Hopewind Electric Corporation Limited plays a significant role in the supply chain of NVIDIA's 800V DC architecture. The company is the key subcontractor for Vertiv's 800V HVDC system, providing cabinet-level power modules and dynamic load adapters.

12. Chint Electrics: “Source-Grid-Load-Storage-Charge” integrated solutions empowering green data centers

As a globally renowned comprehensive service provider in new energy and power intelligence, Zhejiang Chint Electrics Co., Ltd. actively promotes the integration of "source-grid-load-storage-charging" and microgrid technology, offering comprehensive energy solutions for scenarios such as industrial parks and data centers. Its "integrated" microgrid architecture can operate in coordination with DC bus technology to optimize energy from the source.

13. Kstar: Winning overseas national AI data center projects

Shenzhen Kstar Science & Technology Co.,Ltd is a leading domestic provider of UPS and energy storage overall solutions. Recently, it successfully won the bid for the National AI Data Center project in Malaysia with its independently developed high-power VRLA lead-acid battery system.

14. Vertiv: Global leader in critical data center infrastructure

As a leading global provider of critical infrastructure, Vertiv Group Corp. closely collaborates with industry partners such as NVIDIA to drive the upgrade of power architectures in AI data centers. The company announced in October 2025 the plan to launch a complete 800V DC (HVDC) product line in 2026 to support NVIDIA's Rubin Ultra platform.

15. Delta Electronics: Author of the 800V DC technical white paper

As a global leader in power supply and cooling solutions, Delta Electronics, Inc. is one of the key power module suppliers in NVIDIA's 800VDC ecosystem. Delta Electronics co-developed the “Panama” medium-voltage DC power solution with Alibaba and released China's first Data Center 800V DC Power Technology White Paper.

16. Eaton: New 800V DC reference architecture for AI data centers

As a global intelligent power management company, Eaton Corporation plc closely collaborated with NVIDIA to launch a brand-new 800V DC reference architecture for AI data centers in October 2025. This solution integrates innovative technologies such as supercapacitors as fast backup power and bus distribution supporting the Open Rack V3 standard.

17. Shenzhen Center Power Tech. Co., Ltd.: Full-range backup power solutions

Shenzhen Center Power Tech. Co., Ltd. has clearly identified data center UPS as its core strategic direction and launched the "REVO 3.0" AI computing center backup power solution that supports 5 to 60 minutes of backup power.

In March 2025, the company provided over 14,000 high-power VRLA lead-acid batteries (model HFS12-710WS) for the second phase of the Shanghai Songjiang Big Data Computing Center project, meeting the backup power demand of this ultra-large-scale autonomous computing infrastructure for up to tens of minutes.

18. Shenzhen Sinexcel Electric Co., Ltd.: Power quality expert for HVDC systems

Shenzhen Sinexcel Electric Co., Ltd. is a provider of core equipment for the energy Internet, specializing in power electronics and power quality management. In 800V DC and HVDC scenarios, its active power filter (APF) and static reactive power generator (SVG) can smooth out harmonics and voltage fluctuations. The company has reached a cooperation with Vertiv to provide a corresponding power quality solution for its HVDC power supply system.

19. JST: Leading SST exporter

As a global supplier of power equipment, JST Power Equipment not only has the delivery capacity for medium and low voltage switch cabinets, transformers and other products, but also has successfully independently developed a 10kV/2.4MW solid-state transformer (SST) prototype specially designed for 800V DC power supply architecture, and is actively promoting customer certification.

20. VNET: Nasdaq-listed IDC cornerstone and green computing pioneer

As the first third-party neutral data center operator in China to be listed on the Nasdaq in the United States, VNET Group is one of the pioneers of China's IDC industry. In 2023, the company will fully focus on the coordinated development of "green electricity + computing power". VNET Group operates over 50 data centers and more than 52,000 cabinets in over 30 cities across the country, and focuses on building projects such as the "10GW Green DC" ultra-large-scale intelligent computing base in Ulanqab and the AIDC node in Huailai, Hebei Province.

21. Sinnet: AWS core operator in China and cloud-network integration service provider

As a digital infrastructure integrated service provider listed on the Growth Enterprise Market of the Shenzhen Stock Exchange, Beijing Sinnet Technology Co., Ltd. has over 12 self-built data centers in core regions such as the Beijing-Tianjin-Hebei area and the Yangtze River Delta, with more than 70,000 operational cabinets. It also actively responds to the "East Data West Computing" strategy and is accelerating the layout of large-scale computing power bases in places like Hohhot and Ulanqab in Inner Mongolia.

22. Aofei Data: “PV + IDC” zero-carbon computing explorer

As an important computing power leasing provider for Alibaba Cloud in South China, Guangdong Aofei Data Technology Co., Ltd. promises to provide it with a cumulative total of tens of thousands of PFlops of AI computing power. The company has established over 13 large-scale data centers across the country and completed a private placement of 1.69 billion yuan in the first half of 2025, which was invested in the Langfang Smart Computing Park project.

23. @hub: State-backed green IDC leader