The development of renewable energy is unquestionably a critical factor to the transformation of China’s energy structure towards a safe, low-carbon, and high efficiency modern energy system. As renewable energy moves towards greater large-scale development and deployment, it provides new opportunities for energy storage. In the future, energy storage and renewable energy generation will develop in tandem. Energy storage will soon become a prerequisite for large-scale renewable generation, a trend that will likely become mainstream in China as well as many other countries. The high-scale penetration of renewables in power grids will require continued integration of energy storage, while energy storage itself will prove its value through smoothing and stabilization of the power system.

With a Market Mechanism Still Absent, Energy Storage is Not Yet Ready to Support Large-scale Renewable Development

The pairing of energy storage with renewable generation cannot occur without thorough exploration of its economics, and the question of who should pay for energy storage when it is paired with renewable generation is of critical importance. In the current system in which a cost price transmission mechanism is still lacking, any current mechanism must be seen as part of an awkward yet unavoidable transmission period. Even more awkward is that while energy storage is the key to solving limitations on large-scale renewable generation expansion, many still do not see the point of constructing energy storage. Part of the issue is the debate over how much renewable energy can be curtailed. Without curtailment, there is no application for energy storage. Therefore, the acceptance of a certain amount of curtailment is a beneficial choice which can not only support the development of renewable generation at a large scale, but also support the pairing of energy storage applications with renewables.

In 2017, Qinghai province began requiring wind energy stations to install energy storage equivalent to 10% of station capacity. While energy storage providers were delighted, many others in the energy industry were left scratching their heads at the decision. With energy storage entering a new stage, some believed that it was still too early to require renewable generators to foot the bill for energy storage investment. In addition, without a clearly defined goal, energy storage could not be seen as the only possible solution. Yet even a switch from compulsory to noncompulsory deployment of storage has not affected the interest of renewable energy generators in exploring energy storage, with Qinghai remaining a key region for energy storage applications paired with centralized renewable generation. The root cause for the policy is that the value acquisition problem for new energy storage investment has not been solved. The relevant policy terms and market mechanism do not match, but the direction and ultimate goal of the policy have not deviated, and it has brought greater recognition of energy storage system applications to this field.

In 2019 and onward, policies similar to the above “10% mandate” have been released or been the subject of research. Yet few people have come out to criticize such policies, one reason being that these policies have not required completely mandatory deployment of storage for renewable generation, an approach which has inspired enthusiasm among energy storage investors and renewable energy station owners. Another reason is that these policies often carry some policy support for projects, including guaranteed increases in generation, supplementary peak shaving and other ancillary services, and guaranteed grid dispatch. With grid-side and behind-the-meter storage investments and applications declining, energy storage paired with centralized renewables will become a driving force for growth of new energy storage applications. Even so, integration of renewables and storage still carries many challenges:

Current curtailment issues, which are the primary focus of energy storage, may not be a problem in the future, meaning that energy storage may not be guaranteed profit in the long term.

It is difficult to provide a guaranteed amount of renewable energy dispatch, creating uncertainty in short-term profits.

Ancillary services compensation lacks a long-term mechanism, and both “handshake promises” and policy guarantees are uncertain.

Models requiring combined energy storage and renewables are still reliant on government subsidies, while project operations are affected by policy changes during the investment return period and fund recovery delays.

On the one hand, energy storage investors want more explicit points of policy support, going so far as to make unreasonable demands that push policy makers to provide explicit commitments. On the other hand, policy makers want to release policies which can be implemented quickly, but it is difficult for all parties to participate. While it is easy to encourage the deployment of storage, long-term management is a different matter, and such management challenges will need to be solved through the future energy market. It should be unanimously agreed that no market mechanism needs to be tilted solely for energy storage. Policies and market rules can solve the problem of identity for energy storage, and help solve operational difficulties for new technologies participating in energy storage applications. Only when the specific demand for energy storage is reflected under a fair and open market mechanism can its application value truly emerge.

At present, energy storage can solve the near-term problem of consumption of renewable energy. In the end, energy storage must follow the principle of “who benefits, who pays.” The main entities which pay for the large-scale development and utilization of renewable energy are not just renewable energy developers themselves. As the beneficiary of “green development,” all of society has responsibility in bearing the costs for renewable energy. When it comes to energy storage, electricity consumers and renewable energy companies which enjoy the smoothing and stabilization services provided by energy storage should be the ones to bear the costs. Only in a market with a basic economic logic can a long-term effective mechanism for energy storage paired with renewables be constructed. Additionally, in order to maintain safe and stable operation of a future grid with high penetration of renewables, the deployment of energy storage to counter intermittency and unpredictability should be one of the basic duties of generation companies. In the future, energy storage will not exist as simply a special tool for solving consumption problems that come with the expansion of large-scale renewable energy, but will be an essential service necessary to solve the operational risks that will exist in a new energy structure.

Awkward Setbacks to Energy Storage Development

The current simplistic manner in which energy storage is paired with renewables is one which creates setbacks for the development of energy storage technology applications. Characteristics of this current structure include:

Energy storage may serve as a precondition to give priority to the construction of renewable energy projects, but allocation ratio and capacity requirements are not properly evaluated. Whether existing supporting projects can meet the actual needs of the power system and whether the energy storage projects can be fully utilized remains to be verified.

Policies which support the development of combined energy storage and renewables are still lacking. Current policies in support of frequency regulation are unable to support the recovery of system investments, and maintain an interesting behind-the-scenes “dispatch logic” (namely, verbal guarantees of charge and discharge times and dispatch strategies). Therefore, the value of energy storage in improving the operation and regulation capability of the power system cannot be realized.

The current practice of low-price bidding does not have guiding significance and does not represent progress in industry or technologies. Centralized renewables have become the only energy storage application sector which does not have any threshold requirements to entry. A summary of China’s energy storage development at the end of 2020 is likely to reveal a false sense of prosperity due to incremental new growth. Continued development in such a manner will cause energy storage systems to become completely unusable and unnecessary.

Most seriously, the series of energy storage system accidents in South Korea and other regions provides a wealth of learning experience and has highlighted the importance of energy storage system safety. Issues must be handled preemptively, otherwise the industry will fall into stagnation. Without a proper regulatory body, energy storage in some regions has already been “orphaned,” left to develop independently. With this lack of requirements for energy storage system construction and operations, it can be predicted that large-scale expansion of energy storage will inevitably bring new safety risks.

A multi-stage release of effective supporting policies is imperative. The critical issue to the paired application of energy storage with renewables is still the question of “who foots the bill?” Although we now have a relatively clear picture of what an effective short-to-medium term mechanism should look like, a substantive policy has yet to materialize. In order to lower the risk of liability for electricity charging, energy storage has already become a special technology for balance between the government, grid, and generation companies.

First, we must engage in forward-thinking research in our planning, to avoid misuses of resources. Currently, many areas require the deployment of a certain proportion and duration of energy storage systems, but basic analysis of the energy storage requirements for a power system featuring a high proportion of renewable energy reveal that the allocation ratio and energy storage duration requirements are unreasonably designed. It is also necessary to provide clear guidance to each region to measure the energy storage demand under different renewable energy development situations, so as to ensure that the additional energy storage system will be fully utilized.

Second, we must set clear entry requirements for energy storage to ensure the quality of energy storage applications. Many regions have released policies directed at the deployment of storage with renewables, but have not provided specific standards for energy storage systems. Without such standards, there is a risk of deploying low-quality energy storage systems in order to prioritize construction and grid connection. Technological thresholds need to be established before a project is launched to ensure safe and reliable operations of energy storage applications.

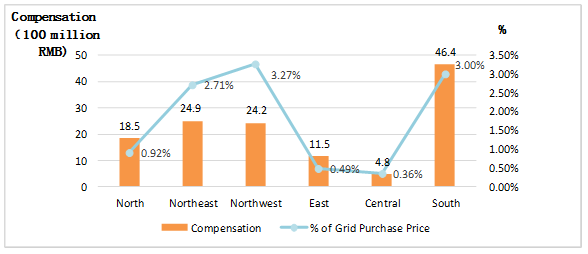

Third, we must launch policies which support paired renewable and storage applications to support the development of a friendly renewable energy development model. By viewing renewable energy stations which support energy storage technology as “friendly” renewable energy stations, appropriate support can be given to supporting projects to increase power generation and reduce the risk of curtailment. It is also necessary to clarify the identity of the energy storage project and its participation in the power market as soon as possible, so that dispatched energy storage systems participating in peak shaving and ancillary services may receive appropriate compensation.

In the short term, with a current power market and price mechanism unable to reflect the value of energy storage to renewable energy, it is necessary to release transitional policies which will help support development of combined usages of renewable energy and energy storage, that is, to study the energy storage quota mechanism and improve the weight of “green power.” Combining green certificate transactions and renewable energy quota mechanisms, power generation companies, grid companies, and power users which deploy energy storage can increase the importance of green certificates, and allow green power certifications to be transacted. Market entities can also freely invest and construct or rent energy storage systems to earn their quotas, or purchase such quotas in the market, creating a pairing of renewable energy and energy storage under a new transaction mechanism.

Over the long term, generation prices for renewable energy and costs for deploying storage should be covered by the beneficiaries and customers. In the current situation in which kilowatt prices for renewable energy are higher than traditional generators, value compensation is still required to promote the paired development of renewables and storage. Therefore, a long-term mechanism must be established which can guide the cost reduction of green value. At present, the cost of solar storage and wind storage in some global regions can compete with traditional thermal generation. We must continue to promote renewable energy grid parity, reducing the dependence on renewable energy financial subsidies. We must also promote comprehensive marketization, allowing power prices to reflect the actual cost of energy provision. We must also work to develop a widespread awareness of the social responsibility for green development, including the responsibility of the cost of green energy development, helping to transition from a subsidized system to one where price reflects value. Yet with current progress in renewable energy development being inconsistent with price reforms, a price compensation mechanism is still necessary to promote renewable energy and energy storage development, and stimulate both industries to lower costs while increasing quality.

The pairing of renewable energy with storage is a trend that is not going to reverse, and we must take a forward-looking approach to resolving the technological and commercial obstacles facing energy storage as soon as possible. Although energy storage has yet to take on an irreplaceable role in the power system, its important value in promoting the large-scale development of renewable energy storage in China cannot be ignored.

Author: Wang Si Translation: George Dudley