Thanks to generous subsidies and incentive programs, electric vehicle sales in China are booming. Chinese EV drivers enjoy a number of perks, including tax incentives when purchasing a vehicle and exemptions from restrictions designed to reduce traffic congestion.

In part due to these measures, sales of plug-in electric vehicles have soared. In the first nine months of 2015, automakers sold 136,733 units – twice the amount sold in the same period last year, according to Wards Auto.

These policies are part of a drive to put 5 million new energy vehicles (NEVs) on Chinese roads by 2020. Although it’s unclear whether or not this target will be met, it is certain that the grid will be faced with new challenges and opportunities as more plug-in electric vehicles hit the road.

In particular, Chinese regulators will need to begin examining how electric vehicle demand response can help address grid instability and support China’s transition to a low-carbon power system.

Electric vehicles and demand response

As the transportation sector electrifies, electricity consumption patterns will change. In order to meet demand, utilities need capacity and incentive mechanisms to address potential spikes in consumption. A study commissioned by the Regulatory Assistance Project and the International Council for Clean Transportation compared the expected impact on peak load in various countries as the number of plug-in electric vehicles rises. The report found that China’s grid was particularly susceptible to disruption in cases of high EV penetration.

To avoid power shortages, Chinese regulators will need to adopt measures to minimize the impact of electric vehicle charging on the grid. Policymakers have several options on the demand side to do this.

Programmable charging

Programmed charging allows grid operators to control EV load. In this model, EVs receive signals from the grid to optimize efficiency and reduce grid impact, while also factoring in battery constraints and the user's charging requirements.

EV programmable charging can be regarded as a flexible demand response resource, providing a certain amount of peak shaving functionality. Via smart grid signals and time-of-use pricing incentives, EV owners can be encouraged to charge their vehicles when wholesale electricity prices are low. Entities like charging facility operators and vehicle companies can act as load aggregators, earning subsidies and lowering EV lifetime ownership costs via participation in such demand response programs.

Large scale implementation of programmable charging faces several problems: chargers and charging stations do not all support remotely programmed control, there are issues with ITC standards and data compatibility issues, and there is a lack of attractive pricing mechanisms and business models.

Vehicle-grid integration (V2G)

Vehicle-to-grid integration (V2G) takes the role of EVs a step further by using the vehicle battery to provide grid services, including peak shaving, frequency regulation, renewables smoothing, and non-power supporting functions. An NRDC study, Electric Vehicles, Demand Response and Renewable Energy – Jointly Advancing Low Carbon Development, estimated that vehicle-to-grid integration could yield billions of yuan in cost savings each year by using electric vehicles for flexible capacity.

But V2G, while technologically feasible, still requires a great deal of standardization and business model development. Most EVs and charging infrastructure do not support output to the grid, ancillary service markets are not open to such participants, and the extra wear and tear on vehicle batteries will be a disincentive unless proper compensation is provided to vehicle owners. These challenges are compounded in China due to a regulatory framework that makes market-driven demand response particularly challenging.

Demand Response with Chinese Characteristics

China’s current load management mechanisms are, to a large degree, vestiges of the planned economy era. Chinese grid operators typically rely on administrative rationing during electricity shortages, rather than market-based demand response.

Nonetheless, China is implementing a small number of demand response pilot programs, including one in Beijing, which are helping set the stage for policy reforms expected to be released soon. In March 2015, the government introduced power sector reforms addressing issues that will affect demand response: pricing reforms, ancillary services markets, and the opening up of wholesale electricity markets. Those reforms will be followed by more specific policy measures later this year.

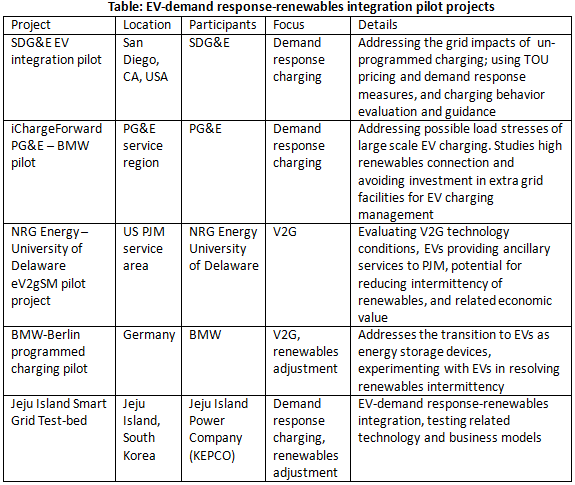

In the meantime, more demonstration projects integrating electric vehicles and grid operations are needed. Internationally, there are a number of demonstration projects which may serve as good models.

At the time of writing, we are unaware of any electric vehicle demand response programs in mainland China. But with record-breaking electric vehicle sales unlikely to slow down, we fully expect to see these programs coming soon.

Original article by Daixin Li, translation by Matt Stein, editing by Charlie Vest.