Source: CNESA

The China Energy Storage Alliance (CNESA) has consistently adhered to standardized, timely, and comprehensive information collection practices to continuously track developments in energy storage projects. Leveraging its long-term data accumulation and in-depth professional analysis, CNESA regularly publishes objective market analyses on installed energy storage capacity, providing valuable references for industry decision-making. Since June 2025, the monthly energy storage project analysis has been divided into two sections: “Grid&Source-Side Market” and “User-Side Market”. This issue focuses on interpreting the grid&source-side market in September.

● Market Continues to Rise: In September, grid&source-side energy storage installations grew by over 180% year-on-year, with independent storage capacity increasing by nearly 340%.

● Regional Highlights: Jiangsu Province contributed the largest share of new installations, with an average duration of 3.84 hours.

● Changing Landscape: Beyond the “Five Major and Six Minor” power generation groups, third-party enterprises are accelerating their entry, capturing 40% of the market share.

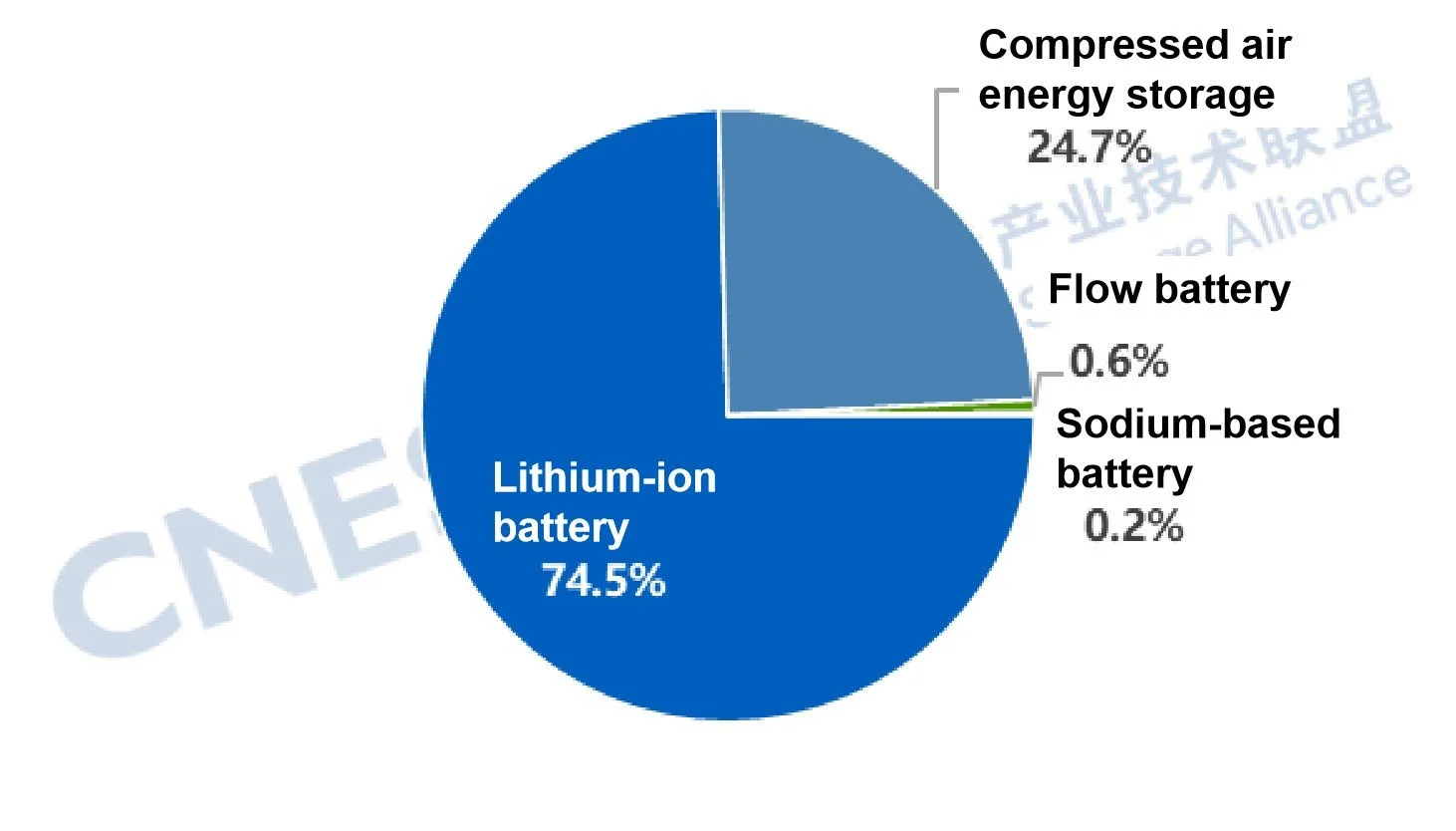

● Technological Breakthroughs: Long-duration energy storage is being rapidly deployed, with compressed air energy storage projects accounting for one-fourth of the total.

Overall Analysis of New Energy Storage Projects in September

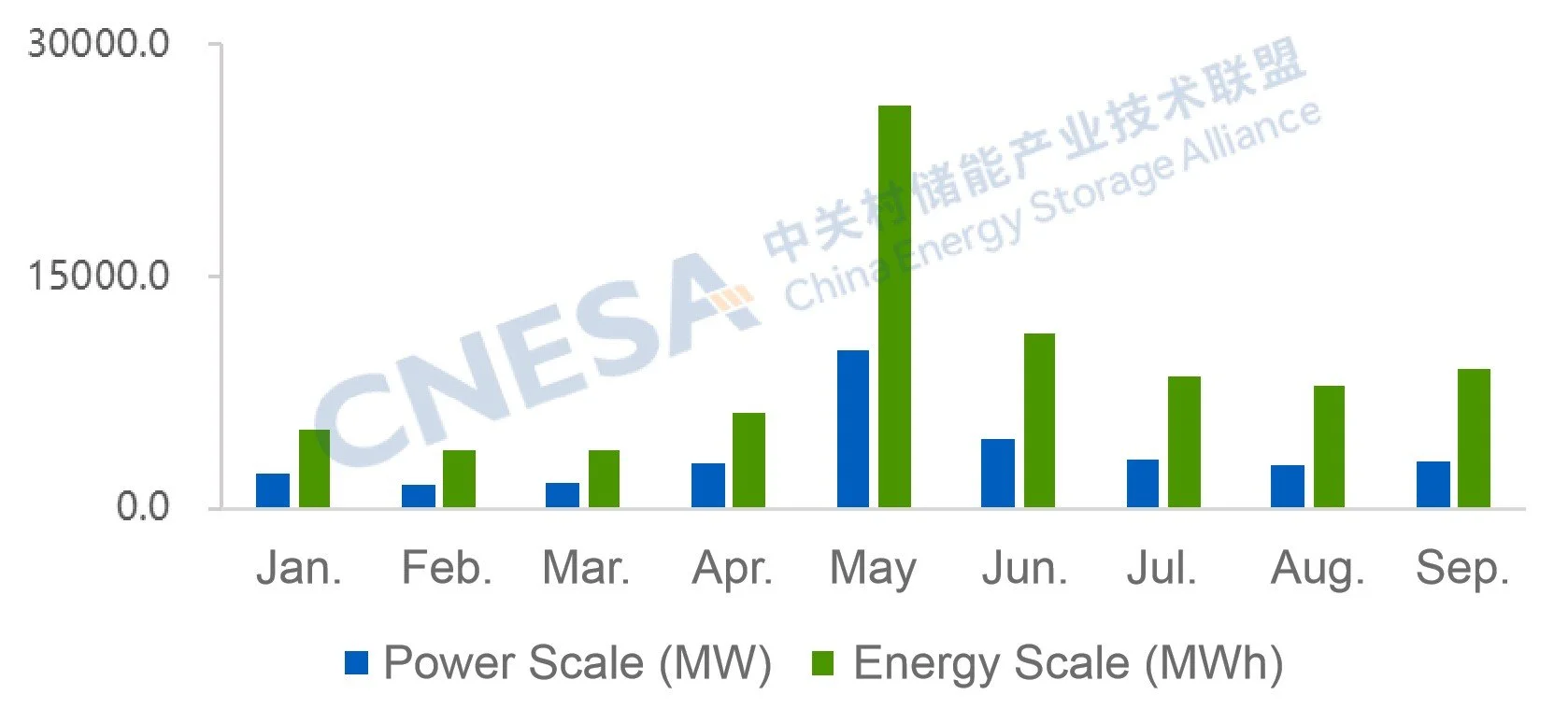

According to incomplete statistics from the CNESA Datalink Global Energy Storage Database, in Sep. 2025, newly commissioned new energy storage projects in China reached a total installed capacity of 3.08 GW / 9.08 GWh, representing a YoY increase of 166% and 200%, and a MoM growth of 7% and 15%, respectively. New installations totaled 9.16 GW / 25.52 GWh in the third quarter, marking a YoY increase of 10% and 24%. The cumulative new installed capacity for the first three quarters has already reached 74% of the total added capacity for the entire year of 2024, indicating that the total new installations in 2025 are likely to surpass last year’s level.

Figure 1: Installed Capacity of Newly Commissioned New Energy Storage Projects in China, Jan.-Sep. 2025

Data Source: Global Energy Storage Database of the CNESA DataLink

https://www.esresearch.com.cn/

Note: YoY (year-on-year) increase compares with the same period last year; MoM (month-on-month) decrease compares with the previous reporting period

September Analysis of Grid&Source-Side Energy Storage Projects

In September, newly commissioned grid&source-side energy storage installations reached 2.84 GW / 8.50 GWh, representing a YoY increase of 189% and 226%, and a MoM growth of 15% and 21%, respectively. The new grid&source-side energy storage projects showed the following characteristics:

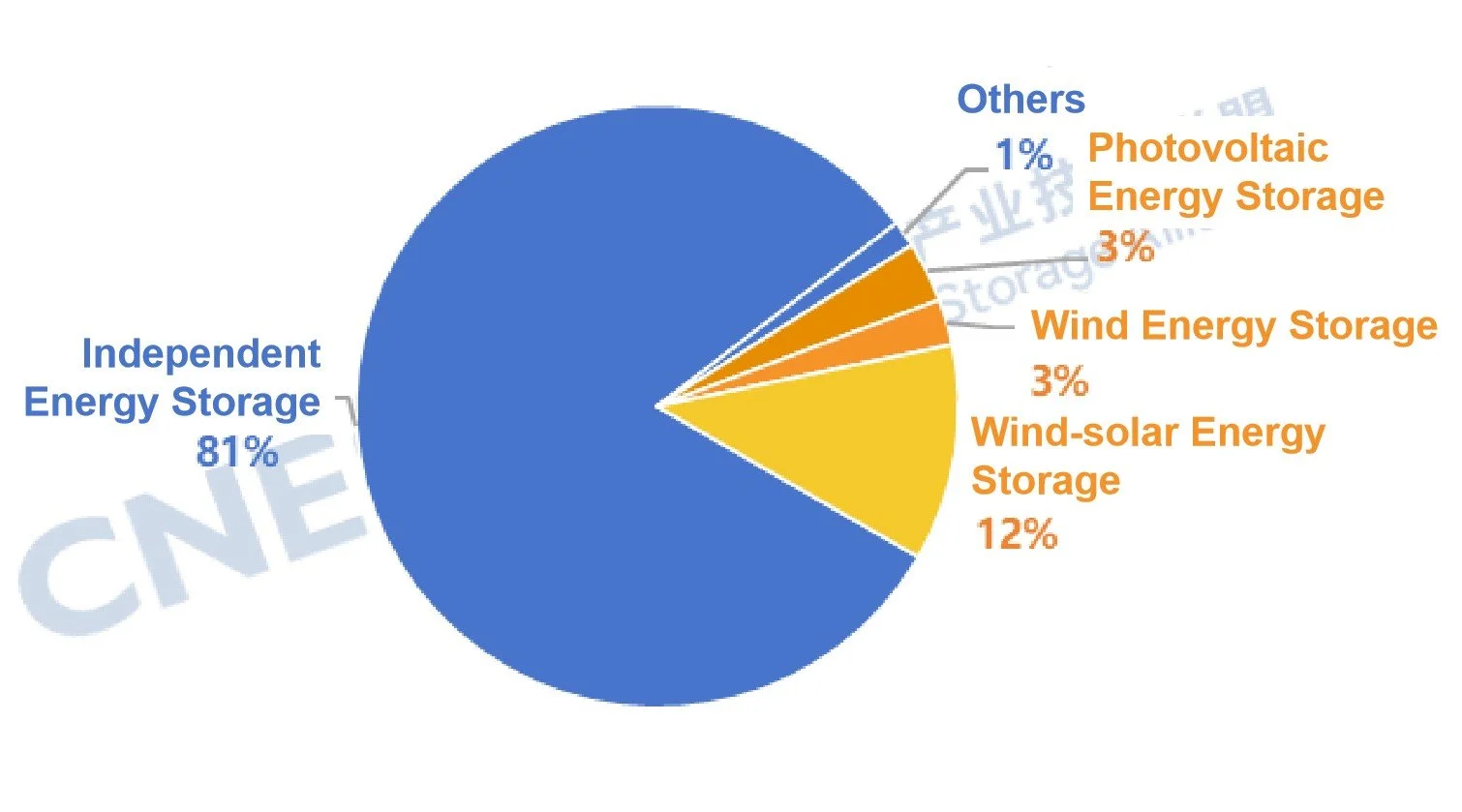

01. New Installations of Independent Energy Storage Accounts for Over 80%, with Capacity Up Nearly 340% YoY

In September, newly added independent energy storage installations totaled 2.31 GW / 6.73 GWh, marking a YoY increase of 340% and 576%. Projects of 100 MW and above accounted for 64% of the total. Newly added source-side installations reached 492.2 MW / 1,610.9 MWh, up 7.6% / down 0.3% YoY, covering a wide range of application scenarios such as supporting ultra-high-voltage (UHV) DC transmission projects, prevention and control of desertification, and integrated fishery-solar and agrivoltaic projects.

Figure 2: Application Distribution of Newly Commissioned Grid&Source-Side New Energy Storage Projects in Sep. 2025 (MW%)

Data Source: CNESA DataLink Global Energy Storage Database

https://www.esresearch.com.cn/

Note: “Others” include empirical research, etc.

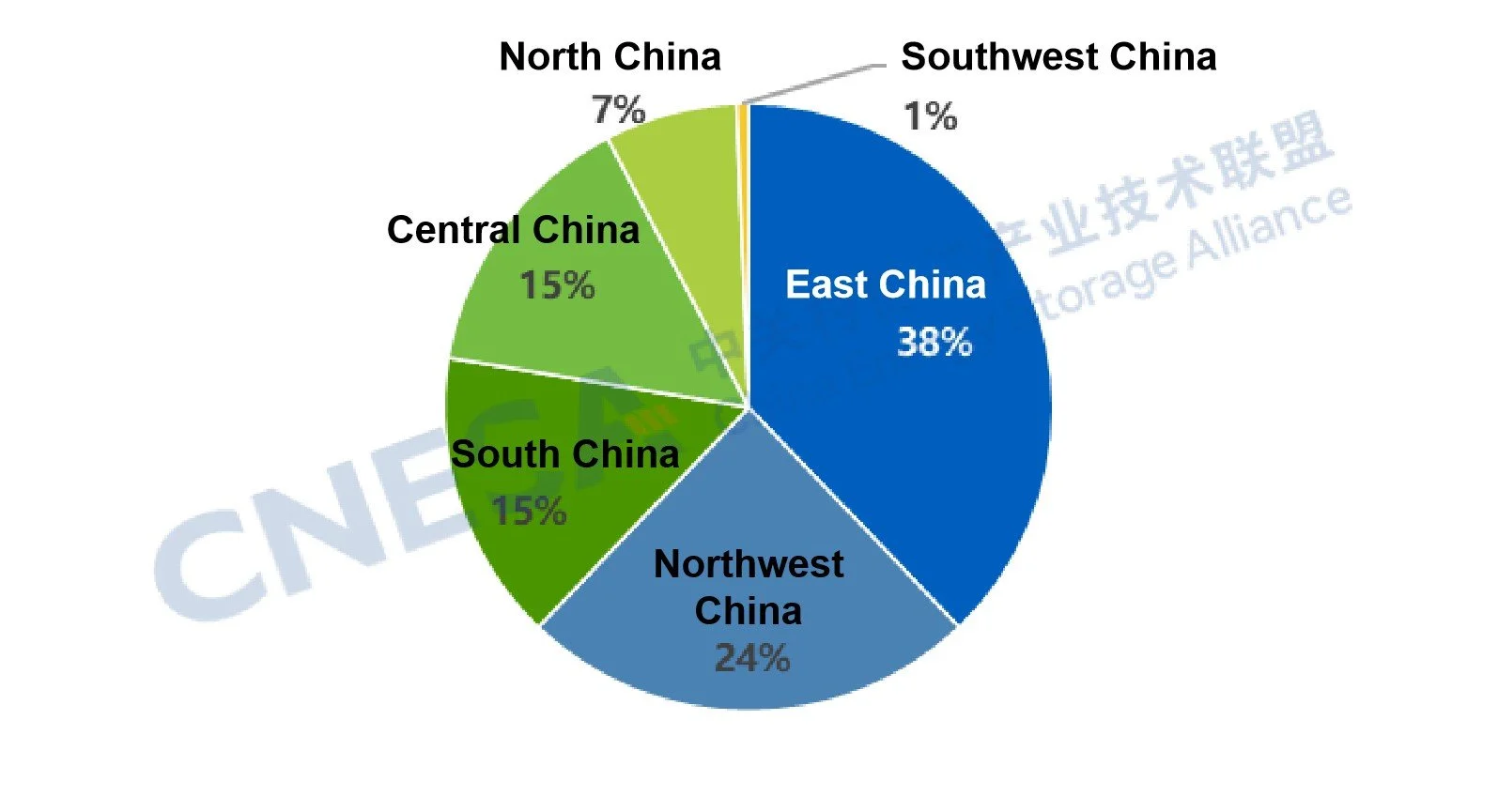

02. East China Accounts for Over 35% of New Installations, with Jiangsu Leading in Scale

In September, the East China region added more than 1 GW of grid&source-side energy storage capacity, accounting for 38% of the national total -- the highest among all regions. Among them, Jiangsu Province recorded the largest increase, with independent energy storage projects making up 99% of its new installations. As one of China’s major provinces in both economic output and energy consumption, Jiangsu faces growing challenges in power system regulation. According to State Grid data, the province’s maximum daily power load this summer exceeded 150 million kW (150 GW), and by the end of May, its installed wind and solar capacity had surpassed 100 million kW (100 GW).

On one hand, the high penetration of renewable energy has intensified grid load fluctuations, creating an urgent need to enhance system flexibility. On the other hand, Jiangsu’s power resources and demand are geographically mismatched -- wind and solar generation are concentrated in northern Jiangsu, while electricity consumption is mainly centered in the southern cities of Suzhou, Wuxi, and Changzhou. This regional imbalance between power supply and demand has further exacerbated pressure on power supply during peak demand periods.

In addition, Jiangsu’s average energy storage duration reached 3.84 hours, 0.85 hours longer than the national average for September, reflecting the province’s higher requirements for peak-shaving capability. Nationally, the average energy storage duration in September was 2.99 hours, up 13% YoY and 5% MoM, marking the highest level since 2025. The East China, Northwest China, and Southwest China regions all recorded average durations exceeding 3 hours.

Figure 3: Regional Distribution of Newly Commissioned Grid&Source-Side New Energy Storage Projects in China, Sep. 2025 (MW%)

Data Source: CNESA DataLink Global Energy Storage Database

https://www.esresearch.com.cn/

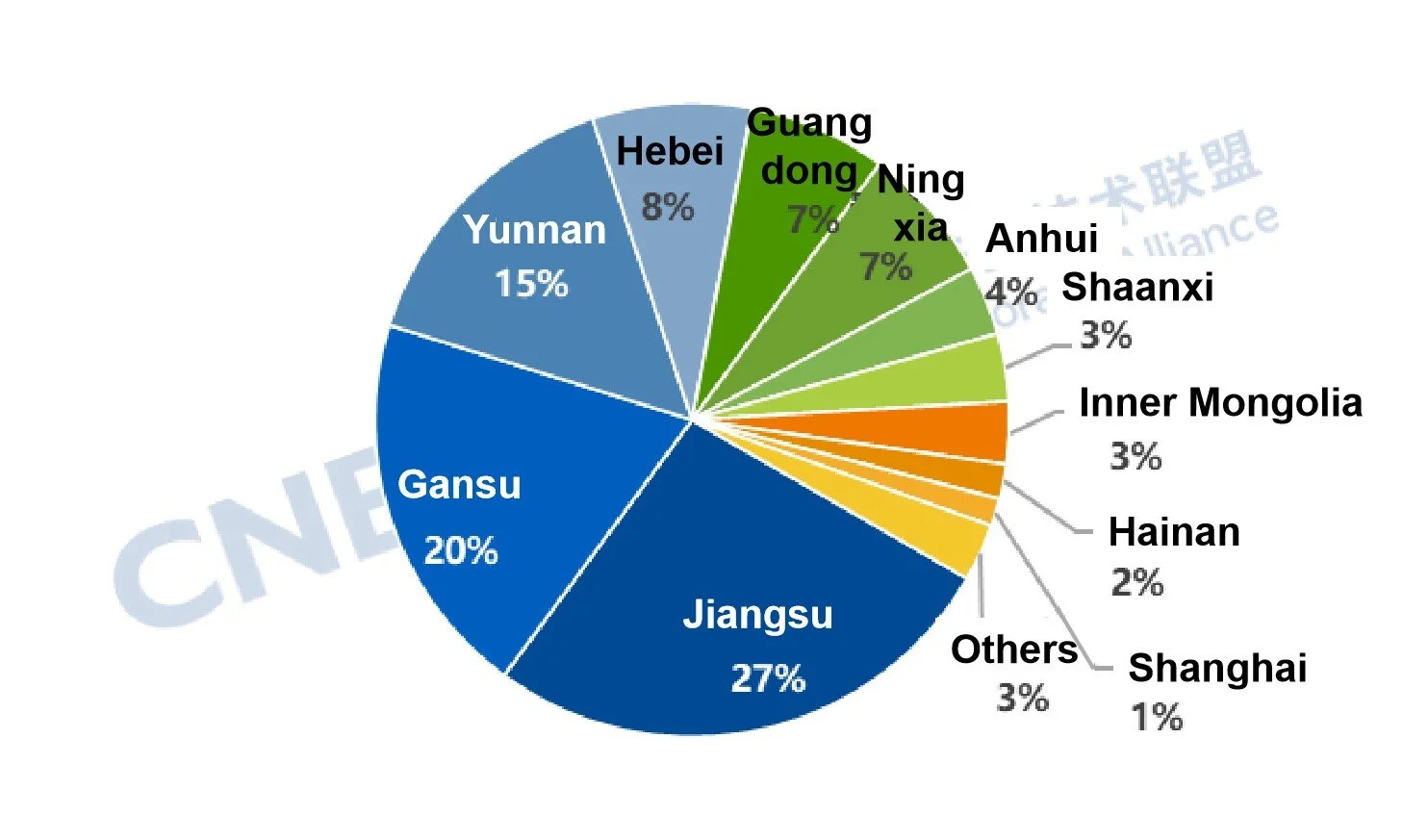

Figure 4: Provincial Distribution of Newly Commissioned Grid&Source-Side New Energy Storage Projects in China, Sep. 2025 (MW%)

Data Source: CNESA DataLink Global Energy Storage Database

https://www.esresearch.com.cn/

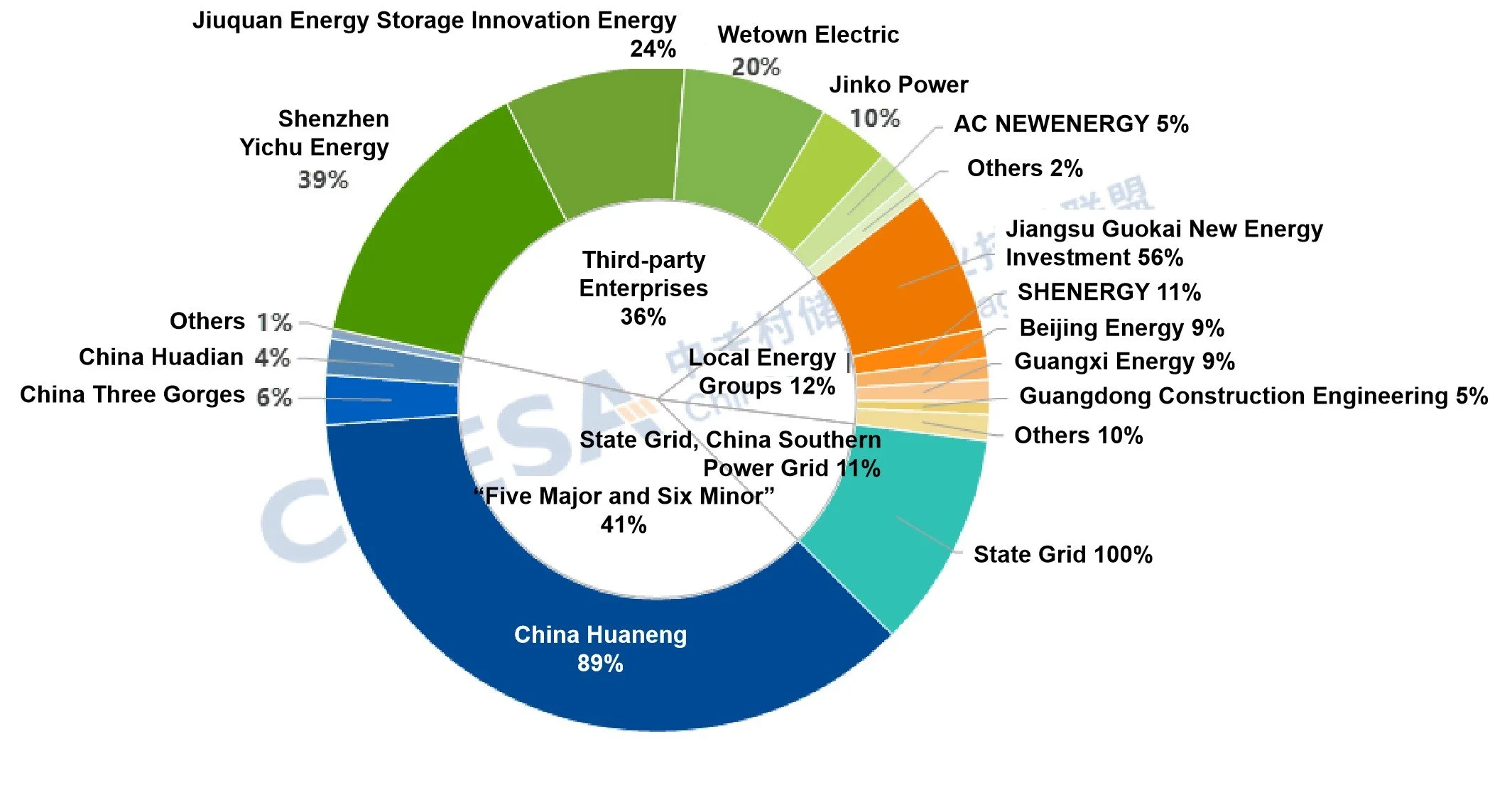

03. Increasingly Evident Diversification of Energy Storage Investors

From the perspective of project ownership, major power generation groups such as China Huaneng, China Three Gorges Corporation (CTG), and China Huadian -- collectively known among the “Five Major and Six Minor” state-owned power enterprises -- continued to maintain a leading position in the energy storage installation market. However, their combined market share declined by 10 percentage points compared with August. Among them, China Huaneng held the largest market share, with several projects such as the Huaneng Energy Base in Gansu Province’s Energy Storage Project Supporing for New Energy and the Huaneng Jintan Phase II Compressed Air Energy Storage Project succeeded in power transmission, contributing a total installed capacity exceeding 1 GW. These large energy groups possess comprehensive advantages in investment scale, project coordination, and operational management.

At the same time, the diversification of investment entities in the energy storage market has become increasingly apparent. In September, third-party enterprises including energy storage and new energy manufacturing companies such as Ganfeng Lithium, Weiteng Electric, and Jinko Power, along with private equity-controlled enterprises, accelerated the deployment of energy storage projects invested and constructed. Projects funded by third-party enterprises accounted for nearly 40% of new installations, an increase of 28 percentage points from August. This growth is mainly driven by the continued expansion of demand in the new energy storage market, government policies encouraging diversified participation in project investment and construction, the emergence of multiple technological pathways, and the decline in energy storage technology costs. With these favorable factors, the market potential of new energy storage has been fully unleashed, attracting a wider range of participants into the sector.

Figure 5: Ownership Distribution of Newly Commissioned Grid&Source-side New Energy Storage Project in China, Sep. 2025 (MW%)

Data Source: CNESA DataLink Global Energy Storage Database

https://www.esresearch.com.cn/

Note: Third-party enterprises refer to those other than large state-owned power generation groups, State Grid, China Southern Power Grid, Power China, Energy China, and local energy groups.

Statistic Analysis by CENSA

04. Long-Duration Energy Storage Technologies Accelerate Deployment

From a technological perspective, lithium iron phosphate (LFP) batteries remain the dominant technology, while long-duration storage technologies such as compressed air energy storage (CAES) are being deployed at an accelerating pace. The CAES Demonstration Project in Huade County, Three Gorges supported with leading technologies by the Tsinghua University (EEA) - Anhui USEM Technology Co., Ltd., and the Huaneng Jintan Phase II CAES Project supported by Tsinghua University and the Xi’an Thermal Power Research Institute, have both been succeeded in power transmission. Together, their installed power capacity accounted for nearly 25% of all new installations in September. In terms of hybrid energy storage, the first grid-side hybrid energy storage station in Fengxian District, Shanghai, integrating four technologies of flow batteries, sodium-ion batteries, semi-solid-state batteries, and lithium iron phosphate batteries was officially put into operation.

Figure 6: Technological Distribution of Newly Commissioned Grid&Source-Side New Energy Storage Projects in China, Sep. 2025 (MW%)

Data Source: CNESA DataLink Global Energy Storage Database

https://www.esresearch.com.cn/

CENSA Upcoming Events:

1. Dec.4-5 | 2025 China Energy Storage CEO Summit | Xiamen, Fujian

Register Now to attend

Read more: http://en.cnesa.org/new-events-1/2025/12/4/dec4-5-2025-china-energy-storage-ceo-summit

2. Apr. 1-3, 2026 | The 14th Energy Storage International Conference & Expo

Register Now to attend, free before Oct 31, 2025.