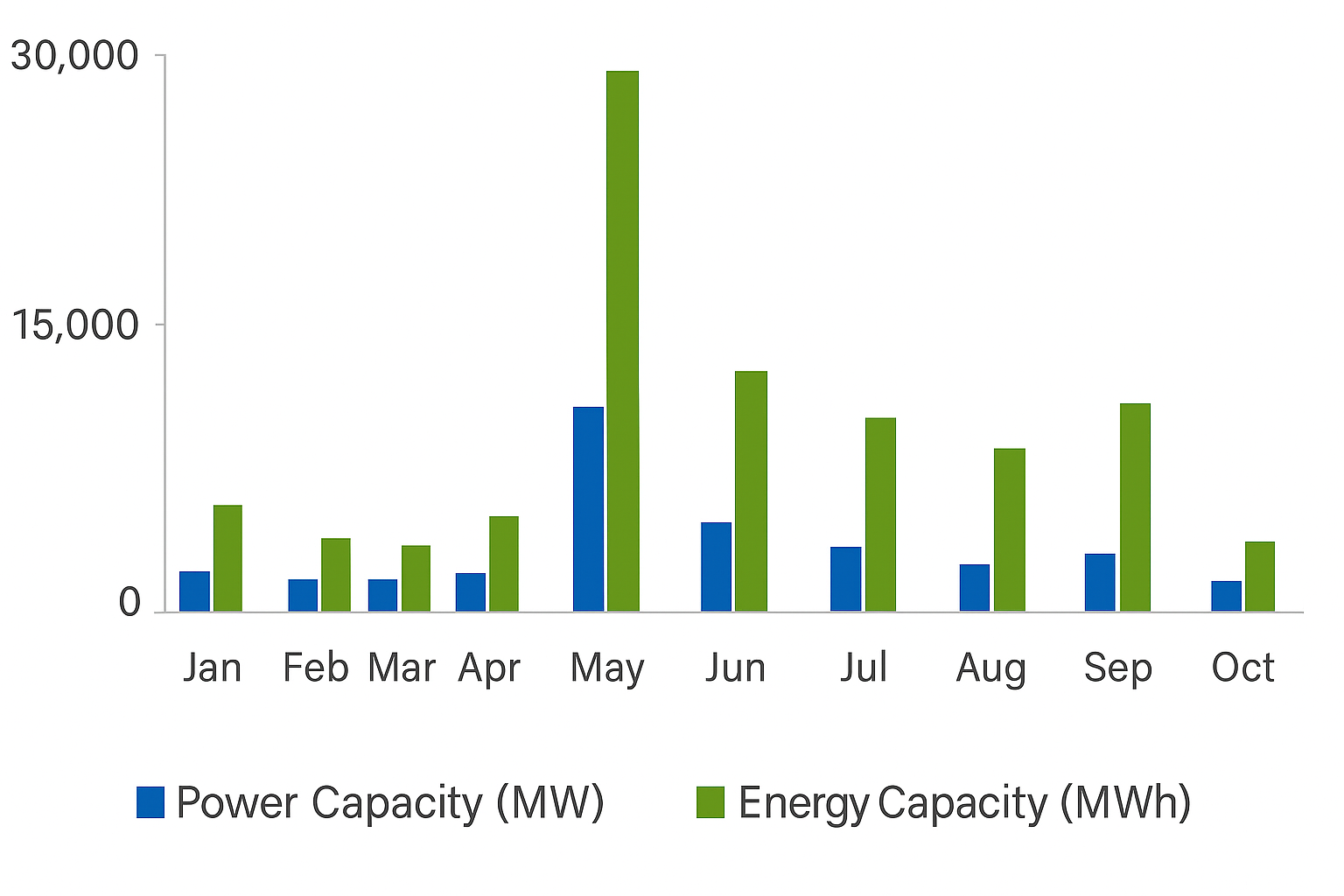

Source: CNESA

“How big is AI's appetite? The power consumption of a large AI data center is comparable to that of a small-to-medium-sized city. More challenging is its power usage pattern, which is like a ‘roller coaster’: one moment it computes at full capacity, and power spikes to its peak; the next moment it exchanges data, and power consumption drops sharply.” Such drastic fluctuations overwhelm traditional power grids and backup power sources represented by UPS (Uninterruptible Power Supply).

Against this backdrop, NVIDIA's recently released 800V DC architecture white paper has significance beyond a simple technical upgrade. It explicitly proposes a key requirement for future AI data centers: the integration of advanced energy storage systems capable of fast response, instantaneous charge/discharge, and intelligent scheduling. This forward-looking guidance signals that the energy storage industry is poised for an AI-driven explosive growth opportunity.

The Energy Bottleneck of Computing Power and Architectural

Breakthroughs

To address this challenge, industry leaders led by NVIDIA have laid out a clear vision, outlining a “three-step” evolution roadmap for the entire sector, aiming to steadily move toward the ultimate 800V DC architecture.

The first step is a transitional solution, innovatively adopting a “side-mounted power cabinet” to physically separate power modules from the core computing area.

The second step, the mid-term solution, promotes the architecture from “distributed” toward “centralized.”

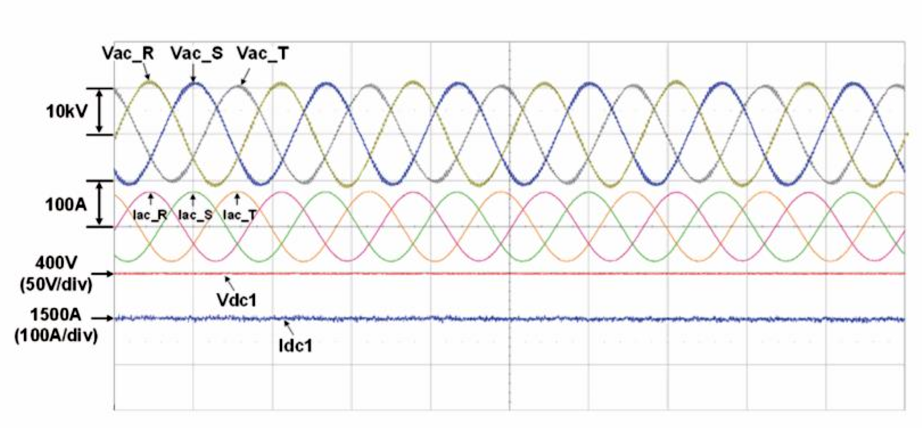

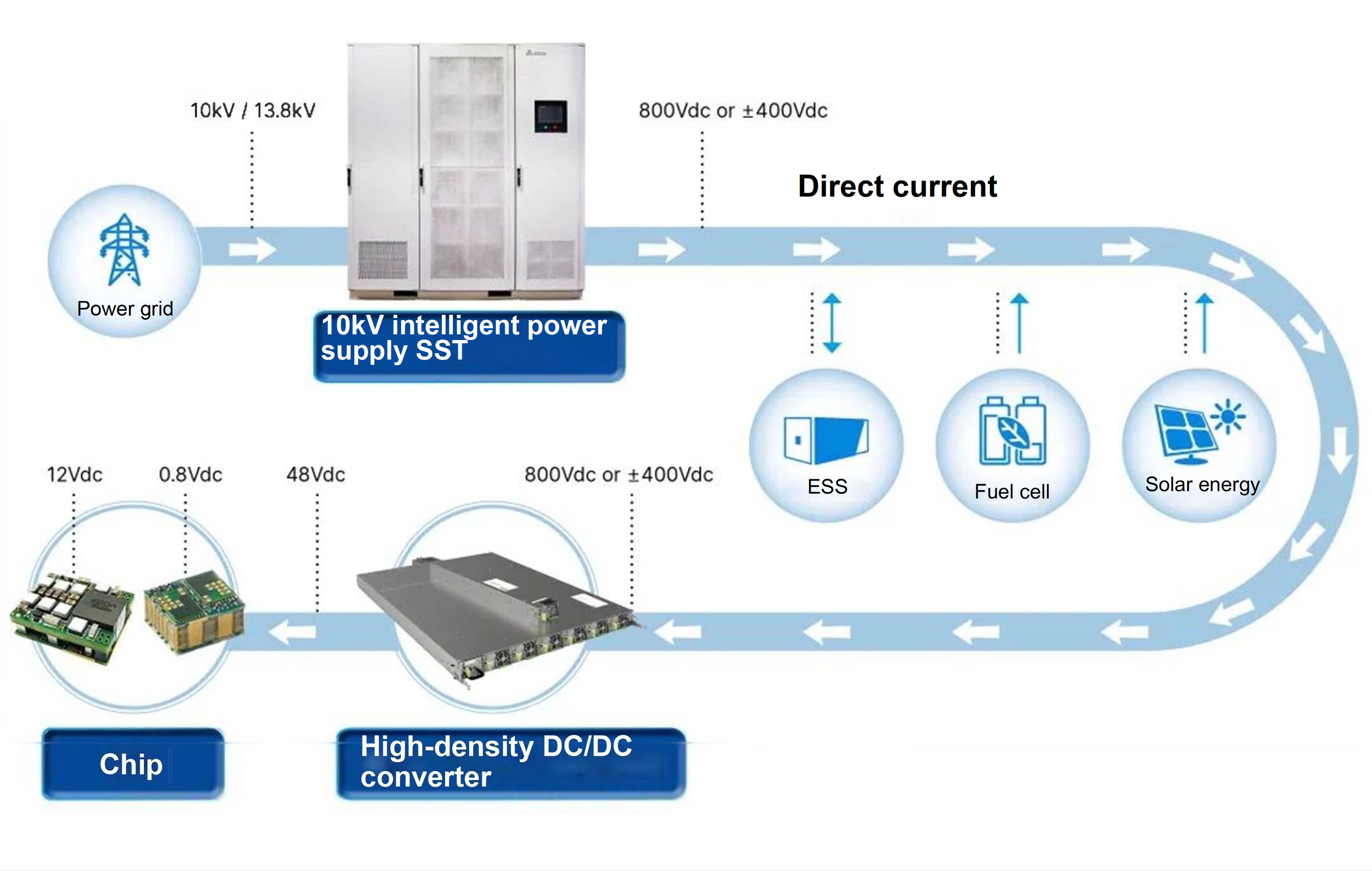

The third step, the ultimate solution, uses SST to achieve a “one-step” conversion from the grid's 10kV medium-voltage AC to 800V DC.

Overview of the 800VDC MGX Cabinet

To enable this new architecture to effectively handle power fluctuations, “hybrid energy storage” becomes an inevitable technical core. By organically combining supercapacitors (responding to millisecond-level surges), high-rate batteries (addressing second-to-minute demands), and large-scale energy storage systems, it forms a multi-layered, fast-response backup power system.

However, the new architecture also raises the technical threshold comprehensively.

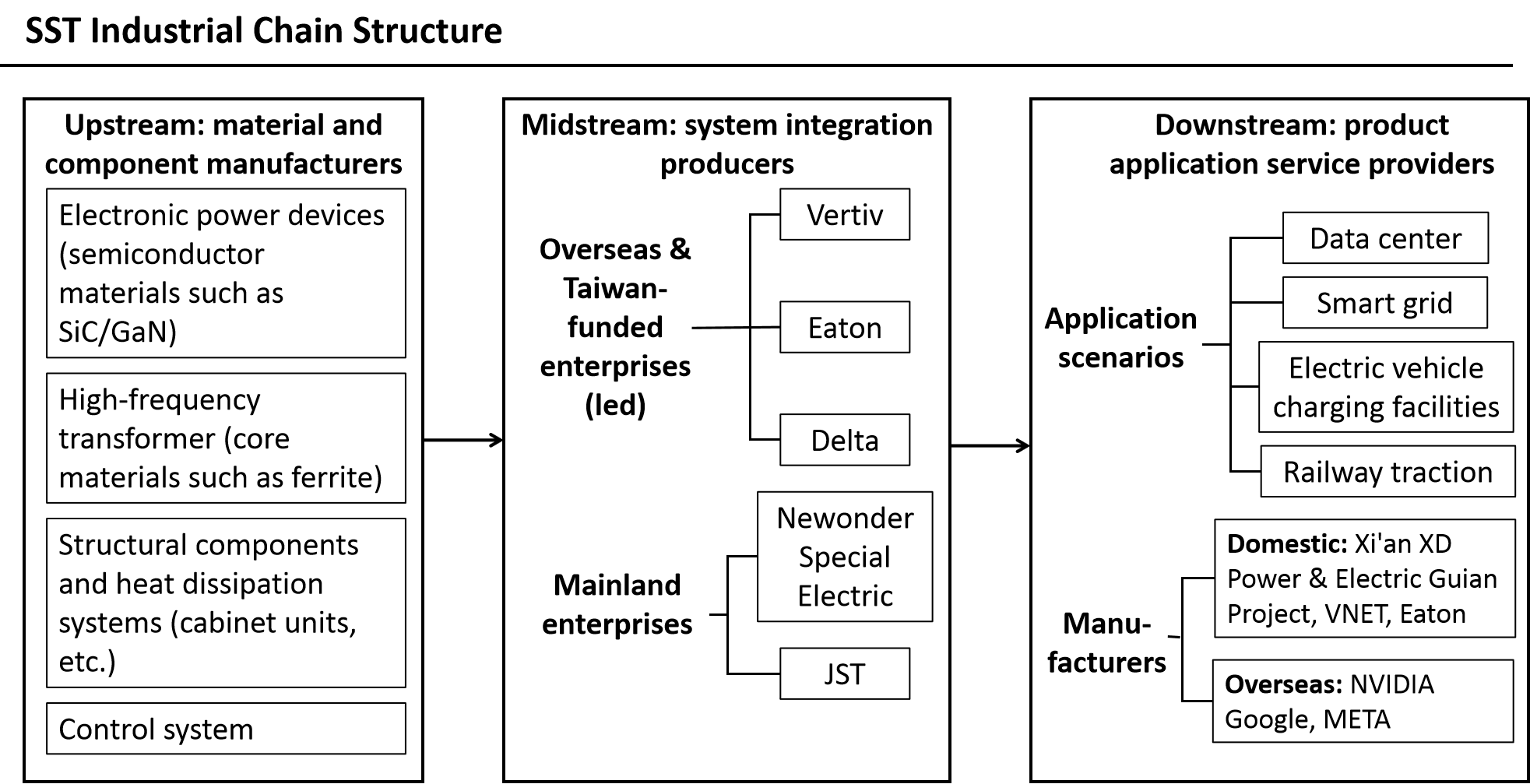

Traditional silicon-based power chips, like inefficient old engines, can no longer meet the stringent requirements of 800V high voltage. Consequently, third-generation semiconductors represented by silicon carbide (SiC) and gallium nitride (GaN) have emerged.

In this new architecture, SiC acts as the “strongman,” stabilizing high-voltage conversion of tens of thousands of volts in components such as solid-state transformers (SST), while GaN, like a “sprinter,” delivers precise low-voltage power to GPUs inside servers at extremely high speed. They are not just a performance upgrade but the cornerstone enabling the entire new architecture.

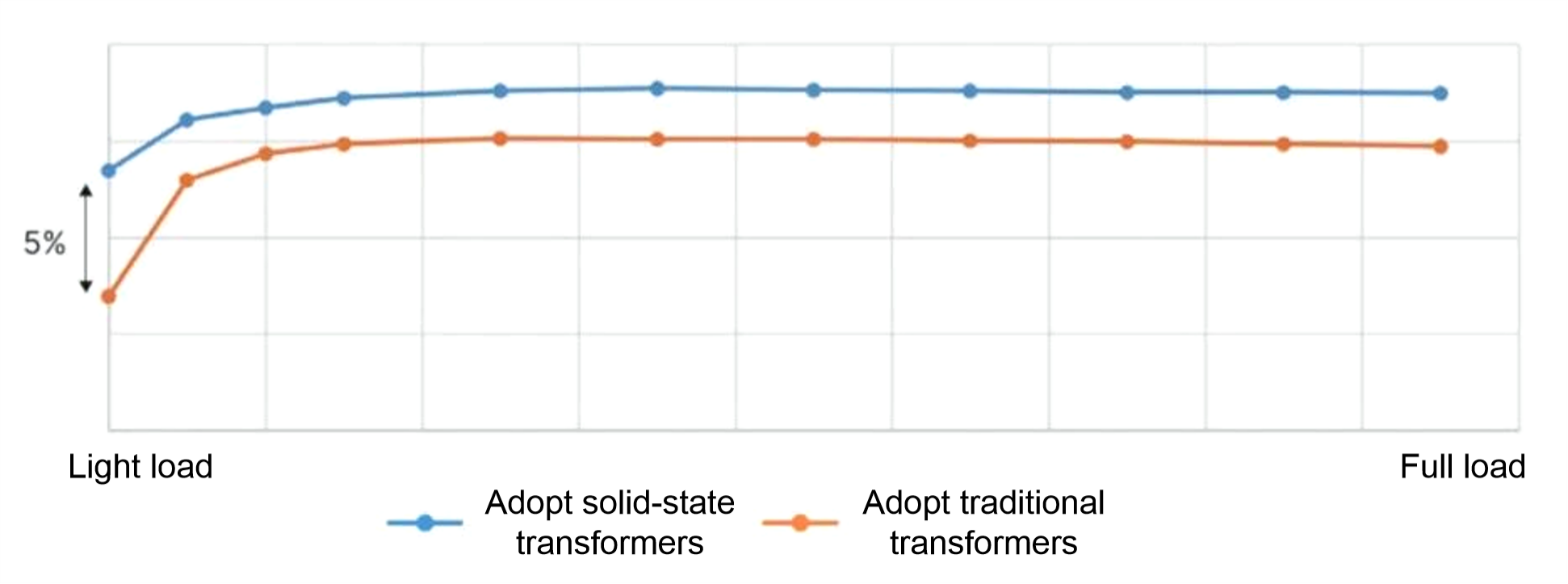

The ultimate form of this technological revolution is embodied in the disruptive product, the solid-state transformer (SST). It uses a “high-speed direct route” approach to efficiently convert medium-voltage grid power directly into 800V DC required by data centers, eliminating energy losses from multiple intermediate conversions, saving tens of millions of kWh annually for a large data center.

Under light load, SST efficiency is 5% higher than traditional transformers

Improved Power Quality

Meanwhile, SST replaces heavy copper coils with advanced chips, achieving “silicon in, copper out,” reducing the power supply system footprint by more than half and freeing valuable space for core computing equipment. More importantly, it functions as an intelligent “energy router,” seamlessly integrating photovoltaics, energy storage, and other new energy sources, becoming an indispensable intelligent core for building future AI factories.

Technological and product transformation will ultimately lead to a reshaping of business models. Future competition will no longer be a battle of hardware parameters but a contest of “intelligence,” with suppliers required to evolve into solution providers “understanding computing power.”

This means energy systems must have predictive capabilities, anticipating computing load changes and proactively scheduling resources; simultaneously, they must coordinate intelligently, directing supercapacitors, batteries, and other energy storage units to work efficiently together.

In this transformation, true value is shifting from hardware itself to the control algorithms and software behind it. Future winners will no longer be mere equipment manufacturers but service providers capable of delivering integrated hardware-software intelligent energy solutions.

The Blue Ocean Emerges: “Consensus and Competition” in a

Trillion-Yuan Track

With the surge in computing power and data center energy demand, relevant companies in the energy storage industry chain have actively responded, and a strategic competition over technical routes and market positioning has fully unfolded. From UPS suppliers to thermal management solution providers to energy storage system integrators, numerous market participants are showcasing their core technologies and solutions, forming a vibrant competitive landscape. The following outlines the main market players in this field.

1. Sungrow Power: A leading new energy company entering the AI data center power foundation

As a global leader in PV inverters and energy storage, Sungrow is actively deploying AI data center power solutions. In May 2025, the company announced the establishment of the AIDC division, with related products expected in 2026. The team is positioned at a high starting point, focusing on overseas markets, planning comprehensive solutions including cabinet power, high-voltage side, and low-voltage side DC microgrid solutions.

2. Huawei: A system-level player building AI data centers with full-stack energy digital capabilities

Huawei places great emphasis on future data center trends. In January 2024, it released the Top 10 Trends of Data Center Facility 2024 White Paper, proposing that future data centers should achieve three features: “safe and reliable, ultra-simple integration, low-carbon and green.” Huawei, alongside Schneider and Emerson, is a leading domestic company in data center power distribution, emphasizing high integration and green transformation.

3. Kehua Data: Pioneer in self-built data centers and HVDC solutions

As a leading domestic and the world's fourth-largest modular UPS supplier, Kehua Data focuses on data centers. In China, it has independently built more than 20 data centers, and its efficient liquid cooling, UPS, and power distribution products are deeply adopted by top clients such as Tencent Yangtze River Delta data center, ByteDance data center, and Alibaba Cloud.

4. Shuangdeng Group: The “invisible champion” of data center energy storage

As one of China's earliest companies in communication and data center energy storage, Sundeng is hailed as an “invisible champion.” According to the China Energy Storage Alliance (CNESA) ranking, the company topped the 2024 global market for base station/data center battery shipments.

5. ZTT: Empowering AI data center infrastructure with “communication + power” dual engines

Focused on lithium battery energy storage systems, ZhongTian Energy Storage Technology Co., Ltd. aims to fully develop in communication and power energy storage. Its products are widely used in new energy vehicles, communication backends, and grid-side energy storage systems. Annual capacity has reached billions of ampere-hours, with investment in a top domestic lithium battery R&D center, laying the foundation for integrated product R&D and application.

6. Narada Power: Deep development in energy storage technology, winning overseas AI projects

With over 30 years of energy storage expertise, Zhejiang Narada Power Source Co., Ltd. ranked second in the 2024 global base station/data center battery shipment ranking. In October 2025, it successfully won a lithium battery storage project for a massive AI data center campus in Texas, USA. Its self-developed high-voltage, high-power lithium-ion backup power system is containerized, high-rate, and capable of evolving to HVDC, gradually applied in global top data center projects.

7. Hithium Energy Storage: Dedicated energy storage solutions for AI data centers

Specializing in long-duration and high-density storage, Xiamen Hithium Energy Storage Technology Co., Ltd. launched a comprehensive energy storage solution for AI data centers at the U.S. data center exhibition in September 2025.

8. Potisegde: Focused practitioner of AIDC intelligent energy solutions

In September 2025, iPotisEdge Co., Ltd. launched a new-generation data center solution overseas, including the PotisBank-L6.25-AC energy storage system and intelligent energy management system (EMS).

9. Ampace: Semi-solid batteries safeguarding data centers

Xiamen Ampace Technology Limited has integrated this battery of high rate and high safety into the latest “PU200” data center power supply and “PR-S4” UPS systems for financial, communication, and other critical backup scenarios, featuring multiple safety measures like liquid detection and cell-level fire prevention.

10. CLOU: Next-generation liquid-cooled storage systems empowering data centers

Shenzhen CLOU Electronics Co. Ltd launched the Aqua-C3.0 Pro liquid-cooled storage system globally in September 2025, providing integrated EMS for cloud-edge collaboration.

11. Hopewind: Core supplier in the 800V HVDC supply chain

As a supplier of power electronics and energy storage systems, Shenzhen Hopewind Electric Corporation Limited plays a significant role in the supply chain of NVIDIA's 800V DC architecture. The company is the key subcontractor for Vertiv's 800V HVDC system, providing cabinet-level power modules and dynamic load adapters.

12. Chint Electrics: “Source-Grid-Load-Storage-Charge” integrated solutions empowering green data centers

As a globally renowned comprehensive service provider in new energy and power intelligence, Zhejiang Chint Electrics Co., Ltd. actively promotes the integration of "source-grid-load-storage-charging" and microgrid technology, offering comprehensive energy solutions for scenarios such as industrial parks and data centers. Its "integrated" microgrid architecture can operate in coordination with DC bus technology to optimize energy from the source.

13. Kstar: Winning overseas national AI data center projects

Shenzhen Kstar Science & Technology Co.,Ltd is a leading domestic provider of UPS and energy storage overall solutions. Recently, it successfully won the bid for the National AI Data Center project in Malaysia with its independently developed high-power VRLA lead-acid battery system.

14. Vertiv: Global leader in critical data center infrastructure

As a leading global provider of critical infrastructure, Vertiv Group Corp. closely collaborates with industry partners such as NVIDIA to drive the upgrade of power architectures in AI data centers. The company announced in October 2025 the plan to launch a complete 800V DC (HVDC) product line in 2026 to support NVIDIA's Rubin Ultra platform.

15. Delta Electronics: Author of the 800V DC technical white paper

As a global leader in power supply and cooling solutions, Delta Electronics, Inc. is one of the key power module suppliers in NVIDIA's 800VDC ecosystem. Delta Electronics co-developed the “Panama” medium-voltage DC power solution with Alibaba and released China's first Data Center 800V DC Power Technology White Paper.

16. Eaton: New 800V DC reference architecture for AI data centers

As a global intelligent power management company, Eaton Corporation plc closely collaborated with NVIDIA to launch a brand-new 800V DC reference architecture for AI data centers in October 2025. This solution integrates innovative technologies such as supercapacitors as fast backup power and bus distribution supporting the Open Rack V3 standard.

17. Shenzhen Center Power Tech. Co., Ltd.: Full-range backup power solutions

Shenzhen Center Power Tech. Co., Ltd. has clearly identified data center UPS as its core strategic direction and launched the "REVO 3.0" AI computing center backup power solution that supports 5 to 60 minutes of backup power.

In March 2025, the company provided over 14,000 high-power VRLA lead-acid batteries (model HFS12-710WS) for the second phase of the Shanghai Songjiang Big Data Computing Center project, meeting the backup power demand of this ultra-large-scale autonomous computing infrastructure for up to tens of minutes.

18. Shenzhen Sinexcel Electric Co., Ltd.: Power quality expert for HVDC systems

Shenzhen Sinexcel Electric Co., Ltd. is a provider of core equipment for the energy Internet, specializing in power electronics and power quality management. In 800V DC and HVDC scenarios, its active power filter (APF) and static reactive power generator (SVG) can smooth out harmonics and voltage fluctuations. The company has reached a cooperation with Vertiv to provide a corresponding power quality solution for its HVDC power supply system.

19. JST: Leading SST exporter

As a global supplier of power equipment, JST Power Equipment not only has the delivery capacity for medium and low voltage switch cabinets, transformers and other products, but also has successfully independently developed a 10kV/2.4MW solid-state transformer (SST) prototype specially designed for 800V DC power supply architecture, and is actively promoting customer certification.

20. VNET: Nasdaq-listed IDC cornerstone and green computing pioneer

As the first third-party neutral data center operator in China to be listed on the Nasdaq in the United States, VNET Group is one of the pioneers of China's IDC industry. In 2023, the company will fully focus on the coordinated development of "green electricity + computing power". VNET Group operates over 50 data centers and more than 52,000 cabinets in over 30 cities across the country, and focuses on building projects such as the "10GW Green DC" ultra-large-scale intelligent computing base in Ulanqab and the AIDC node in Huailai, Hebei Province.

21. Sinnet: AWS core operator in China and cloud-network integration service provider

As a digital infrastructure integrated service provider listed on the Growth Enterprise Market of the Shenzhen Stock Exchange, Beijing Sinnet Technology Co., Ltd. has over 12 self-built data centers in core regions such as the Beijing-Tianjin-Hebei area and the Yangtze River Delta, with more than 70,000 operational cabinets. It also actively responds to the "East Data West Computing" strategy and is accelerating the layout of large-scale computing power bases in places like Hohhot and Ulanqab in Inner Mongolia.

22. Aofei Data: “PV + IDC” zero-carbon computing explorer

As an important computing power leasing provider for Alibaba Cloud in South China, Guangdong Aofei Data Technology Co., Ltd. promises to provide it with a cumulative total of tens of thousands of PFlops of AI computing power. The company has established over 13 large-scale data centers across the country and completed a private placement of 1.69 billion yuan in the first half of 2025, which was invested in the Langfang Smart Computing Park project.

23. @hub: State-backed green IDC leader

Shanghai @hub Co.,Ltd. has been operating 35 data centers in seven core markets across the country, with a total installed power of 371.1MW. Dataport is renowned for its outstanding technological and operational capabilities. Not only has it provided security guarantees for Alibaba's "Double 11" promotion for 16 consecutive years, but its Heyuan Data center, in collaboration with Alibaba, has also been rated as a "National Green Data Center of 2025" with a PUE of 1.19.

24. Range Technology: Park-level ultra-large-scale AIDC operator

Range Technology Development Co., Ltd. has in-depth cooperation with operators such as China Telecom and China Unicom. We have completed the layout of seven AIDC computing power clusters across the country, with a planned number of 320,000 racks, covering core regions such as the Beijing-Tianjin-Hebei area, the Yangtze River Delta, the Greater Bay Area, the Chengdu-Chongqing region, Gansu and Hainan, and initially established an "integrated computing power center system".

25. Alibaba Cloud: Absolute leader in China's public cloud market

As a core business under Alibaba Group, Alibaba Cloud is not only the largest public cloud service provider in China in terms of market size, but also a leading global provider of cloud infrastructure. Its infrastructure covers 29 regions and 92 availability zones around the world.

26. Tencent Cloud: Global cloud service provider backed by top ecosystem

By the end of 2024, Tencent Cloud's infrastructure had covered 21 regions and 58 availability zones worldwide, and its international business had become a new growth engine. In February 2025, Tencent Cloud announced an investment of 150 million US dollars to build its first Middle East data center in Riyadh, Saudi Arabia, marking an important step in its global layout.

27. TONGFEI: Industrial temperature control crossing over to AIDC liquid cooling

Sanhe Tongfei Refrigeration Co., Ltd. has launched a complete set of solutions covering both plate and immersion liquid cooling, including core products such as CDU, Manifold, outdoor dry coolers, and immersion boxes. The company has successfully expanded its customer base to include Kehua Data and has products for CPU/GPU cooling scenarios. With the surging demand for efficient heat dissipation in AIDC, TONGFEI is expected to transform its advantages in industrial temperature control into a new growth point in the data center field.

28. Envicool: Leader in full-chain liquid cooling solutions

In 2021, Shenzhen Envicool Technology Co., Ltd. was the first to launch the "Coolinside" full-chain liquid cooling solution, covering the entire architecture from CPU/GPU cold plates to coolants. It has provided a large number of highly efficient and energy-saving cooling products for large-scale Internet data centers such as Tencent, Alibaba, and Chindata.

29. Goaland: “Special forces” in data center liquid cooling

In recent years, Guangzhou Goaland Energy Conservation Tech. Co., Ltd. has successfully extended its technological advantages to the data center field and has formed a complete liquid cooling solution covering cold plate and immersion types. Its immersion liquid cooling technology has reached the international advanced level. The company has established stable cooperative relationships with leading enterprises in the industry such as ByteDance, Alibaba, Tencent and GDS.

30. Shenling: “Tech faction” in energy-saving data center environment control

In 2024, the revenue of the company's data services segment increased by 75.4% year-on-year, and new orders from leading clients such as ByteDance, Tencent, and Alibaba nearly doubled. Since 2011, Guangdong Shenling Environmental Systems Co., Ltd. has been engaged in the research and development of liquid cooling technology and holds over 68 related patents. Its technology has been appraised by the Ministry of Industry and Information Technology as being at the "international leading level".

31. Haiwu: Digital energy and critical infrastructure solutions expert

Beijing Haiwu Technology Co., Ltd. is committed to presenting innovative achievements in thermal management across all scenarios, from air cooling to liquid cooling, and from equipment to systems, providing reliable and efficient intelligent temperature control solutions for data centers. Meanwhile, as a director unit of the China Association of Communication Enterprises and a vice chairman unit of the China Association for Engineering Construction Standardization, the company, relying on its profound technological accumulation, provides innovative products and services for the industry to respond to the global demand for low-carbon transformation.

The 2025 China Energy Storage CEO Summit, held on December 4 in Xiamen, Fujian, will set up a “Energy Storage + Data Center” forum, providing an in-depth discussion and precise matching platform for industry peers to seize new market opportunities. Details: 2025 China Energy Storage CEO Summit & The 10th “International Energy Storage Innovation Competition”

Additionally, the upcoming 14th Energy Storage International Conference and Expo (ESIE 2026) will focus on hot scenarios like data centers, with specialized forums, ecosystem salons, and featured matching events, exploring innovative applications and development trends of energy storage technology in data centers.

Looking forward to your attendance!

CENSA Upcoming Events:

1. Dec.4-5 | 2025 China Energy Storage CEO Summit | Xiamen, Fujian

Register Now to attend

Read more: http://en.cnesa.org/new-events-1/2025/12/4/dec4-5-2025-china-energy-storage-ceo-summit

2. Apr. 1-3, 2026 | The 14th Energy Storage International Conference & Expo

Register Now to attend, free before Oct 31, 2025.