During the 14th Five-Year Plan period, China’s energy storage technology mix witnessed noticeable changes where pumped hydro storage accounted for less than 40% for the first time while the new-type energy storage represented by lithium batteries saw explosive growth.

500MWh!BYD Energy Storage Has Commissioned Its Largest Energy Storage Project in East Europe

On January 8, 2026, a 500MWh standalone Battery Energy Storage System(BESS) project located at Maritsa East 3 in Bulgaria was officially commissioned. The project was the jointly developed by BYD Energy Storage and ContourGlobal under their strategic collaboration which is one of the largest standalone energy storage projects in East Europe.

Tianneng Signs a 1GWh Project in Malaysia, Build a benchmark for Integrated “Solar- Storage- Computing”Solutions

Recently, Tianneng Group signed a strategic agreement with NASDAQ-listed company VCIG Group. The two parties will build a 1GWh AIDC solar energy storage power station in Malacca, Malaysia. The project aims to address the high-energy-consumption challenge of AIDC and will be developed under an “EPC+F” model.

Amazon buys 1.2GW Sunstone solar-plus-storage project from bankrupt Pine Gate

Annual Power Cost Savings Exceed RMB 60 Million ! Great Power’s 107MW/428MWh Hydropower-based Aluminium User-side Energy Storage Project is Commissioned

RMB 180 Billion! China Southern Power Grid Hit a New High for Investment in 2026

Expanding effective investment is a key lever for stabilizing growth and improving people’s livelihoods. According to China Southern Power Grid, the company has embarked RMB 180 billion for fixed-asset investment in 2026, marking a record high for fifth consecutive year, with an annual growth rate of 9.5%. Investment will be directed primarily toward the development of a new-type power system, the growth of strategic emerging industries and the enhancement of high-quality power supply services, providing solid support for a strong start to the 15th Five-Year Plan period.

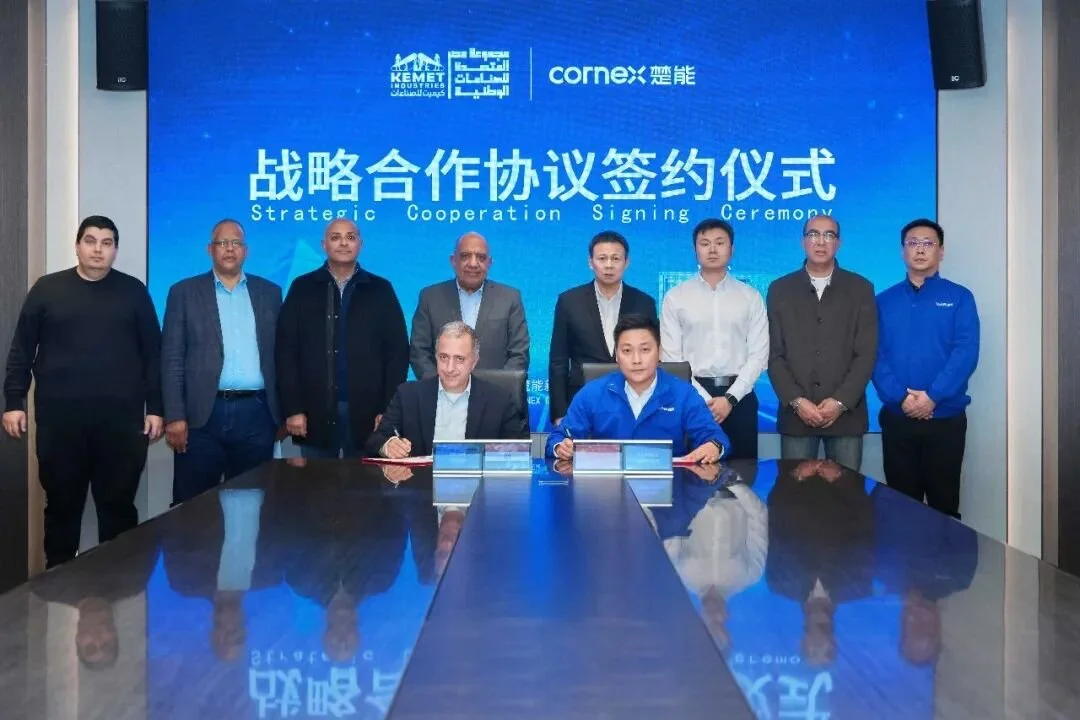

CORNEX Secures a 6GWh Energy Storage Order in Egypt, Successfully Expanding Into the North African Market

On January 16th, Cornex New Energy signed a strategic cooperation agreement with Egypt-based partners WeaCan and Kemet.

The agreement was signed by Dai Deming, chairman of Cornex New Energy and Ahmed Salaheldin Abdelwahab Elabd, Chiarman of the Board of Kemet. The signing ceremony was witnessed by Moustafa Kamal Esmat Mahmoud, minister of Egypt’s Ministry of Electricity and Renewable Energy, along with other government officials and senior executives from relevent enterprises.

100MW/200MWh! Sineng Electric Supports Commissioning of Phase I of Nanlang Energy Storage Power Station

The Phase I 100MW/200MWh Nanlang energy storage power station, supplied by Sineng Electric, has now been successfully commissioned and put into operation. As the first large-scale standalone energy storage project on the grid side to be completed and commissioned in Zhongshan, China, the facility not only injects enhanced flexibility into the regional power grid, but establishes efficient and reliable revenue mechanism through an innovative frequency regulation service model.

500MW/200MWh! JD Energy’s First GWh-Level Project Successfully Grid-Connected

In December 2025, the 500MW/2000MWh energy storage project was successfully grid-connected in Dengkou, Inner Mongolia. The energy storage station, standing proudly under the winter sun, is the first GWh-level project delivered by JD Energy. It not only set a new record for the scale of a single project but marked a significant milestone in the company’s development with its outstanding construction achievements.

2025 Marks the First Year of Mass Production for Large Energy Storage Cells! 500Ah+ Mass Deliveries, ESIE 2026 Energy Storage Expo Invites Global Buyers to Explore New Opportunities

2025 marks a pivotal year for the energy storage industry. The large energy storage cells, which were once limited to “theoretical parameters”, will officially bid farewell to the technical competition phase and enter the practical testing stage of capacity release, yield improvement, and project implementation. Leading enterprises like CATL, EVE, Envision, HTHIUM, and SUNWODA have successively achieved mass production and delivery, and with the intensive landing of GWh-level strategic cooperation and accelerated expansion into overseas markets, this marks the transition of large-capacity cells from lab prototypes to commercial applications. The speed at which energy storage systems are evolving to higher energy density and lower cost has far exceeded industry expectations.

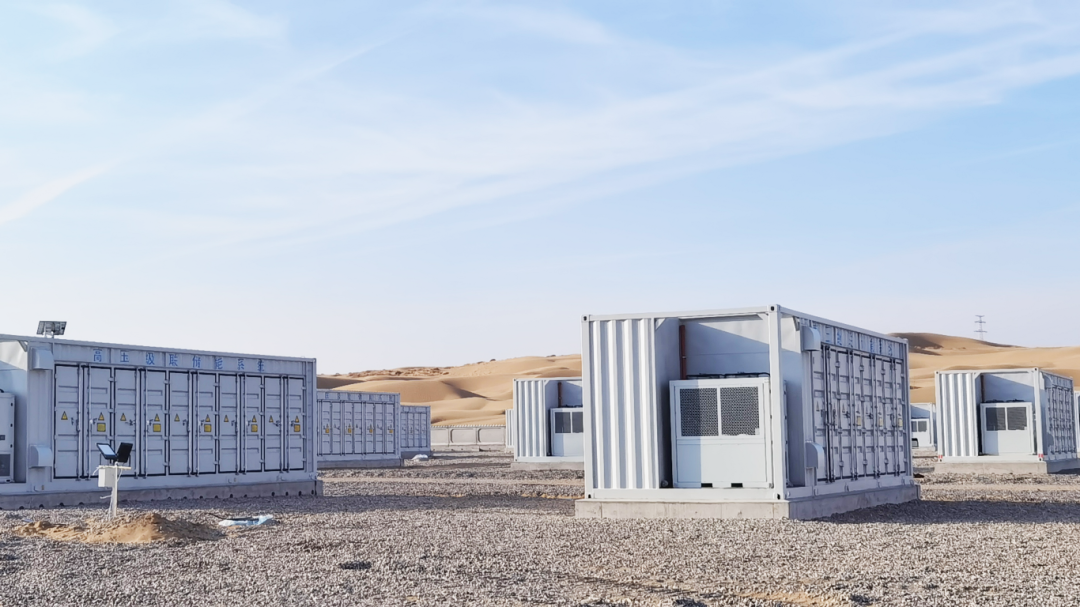

Sungrow’s First Energy Storage Plant in the Middle East Launched,with an Annual Capacity of 10 GWh

Egypt has taken a major step toward accelerating its clean energy transition, as Chinese energy storage leader Sungrow and Norwegian renewable developer Scatec partner with the Egyptian government to deliver large-scale solar+storage projects and establish the Middle East’s first battery energy storage manufacturing base, with a planned annual capacity of 10 GWh.

4.8 GWh Installed: Beijing KeRui Supports the Grid Connection of Two Major Grid-Side Energy Storage Projects in Inner Mongolia, Chi

China Mingyang Longyuan’s First 100MW/400MWh High-Voltage Cascade Independent Energy Storage Project Achieves Full-Capacity Grid Connection

Mingyang Longyuan has built a major milestone in China’s energy storage sector with the successful full-capacity grid connection of its first 100MW/400MWh high-voltage cascade independent energy storage project in Ordos, Inner Mongolia. The project’s commissioning highlights the company’s technological strength in large-scale, high-efficiency, and highly reliable energy storage solutions, while reinforcing the critical role of advanced storage systems in supporting grid stability and renewable energy integration.

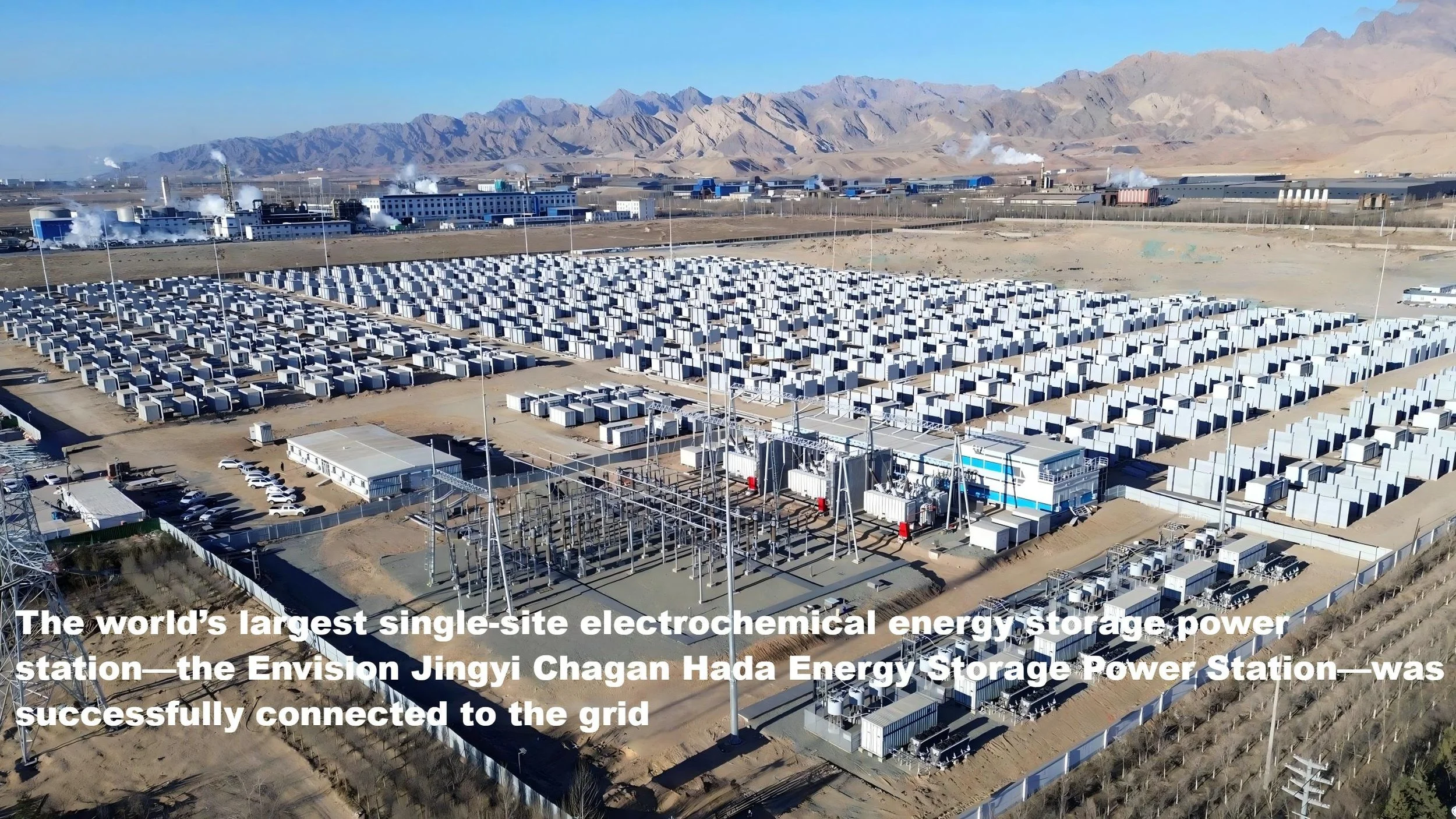

12.8 GWh Energy Storage Cluster Connected to the Grid AI-Powered Energy Storage Reshapes the Future of New Power Systems

The world’s largest single-site electrochemical energy storage power station—the Envision Jingyi Chagan Hada Energy Storage Power Station—was successfully connected to the grid, completing a 12.8 GWh AI-powered energy storage cluster in Inner Mongolia. The project sets new global benchmarks for scale, grid-connection speed, and system reliability, while demonstrating advanced grid-forming capabilities that enable rapid commissioning, deep grid interaction, and large-scale renewable integration.

Breaking Through the Waves and Going Global! Hear the New Expectations from Overseas Markets for China’s Energy Storage

Source: CNESA

On December 3-5, 2025, the 2025 China Energy Storage CEO Summit and the Preliminary Round of the 10th International Energy Storage Innovation Competition, hosted by the China Energy Storage Alliance (CNESA) and co-hosted by Xiamen University, Kehua Digital Energy, and Cornex New Energy, was successfully held in Xiamen.

As CNESA’s flagship concluding event of the year, this summit was anchored in the southeastern coastal region - a strategic hub linking global markets - and was themed “Breaking Waves · Coexisting - Shaping a New Global Energy Storage Ecosystem for 2026.” It brings together senior representatives from energy investment institutions, project developers, asset owners, and EPC companies from Saudi Arabia, Australia, Denmark, Austria, Bulgaria, India, and other countries for in-depth engagement.

International guests focused on topics including project implementation, cooperation models with Chinese companies, grid connection and interconnection standards, and industrial chain collaboration, collectively presenting the global market's genuine expectations of - and directions for cooperation with - China's energy storage industry.

Europe:

Focusing on building long-term partnerships rather than

engaging in short-term transactions.

Renalfa IPP - Chief Investment Officer (Austria / Bulgaria)

Kalina Pelovska

Renalfa IPP is a leading independent power producer in Europe, with more than 5.6 GW of renewable energy assets deployed across Central and Eastern Europe.

“Investment decision-making has evolved from a singular focus on levelized cost of energy to a comprehensive evaluation of system reliability and revenue stability. The strengths of Chinese energy storage companies are expanding from pricing advantages to delivery efficiency, technical responsiveness, and long-term stability. We look forward to jointly cultivating the Central and Eastern European (CEE) energy storage asset market with Chinese companies through joint ventures and co-investment models, building long-term partnerships.”

Solarpro Technology AD - Head of Energy Storage Division (Bulgaria)

Gabriel Nenov

Solarpro is a major EPC contractor and energy storage project developer in Southeast Europe, with extensive experience in PV+BESS projects across Bulgaria, Romania, Greece, and other countries.

“The energy storage market in Eastern Europe is rapidly taking off, but complex grid-connection rules and diverse approval processes place very high demands on information transparency and depth of technical communication. Large-scale projects of 200 MWh and above are becoming mainstream. The Eastern European energy storage market is optimistic about deep collaboration with Chinese partners at the inverter, battery cell, and EMS integration levels. Through standards alignment and early-stage design coordination, project bankability and execution certainty can be significantly improved.”

Australia:

Not Just Batteries, but “Plug-and-Play” System Solutions

Green Gold Energy - Head of Energy Engineering Department (Australia)

Alessandro Wei

Green Gold Energy is a leading renewable energy developer and EPC contractor in Australia, with extensive experience in developing large-scale photovoltaic and battery energy storage projects across South Australia, New South Wales, Victoria, and other regions.

“In the Australian market, the Chinese energy storage supply chain has already built a high level of trust. Looking ahead, there is a stronger expectation for entry through system-level solutions rather than standalone equipment - integrated coordination across PCS, BMS, EMS, and grid-connection models. Australia’s energy storage business model is shifting from frequency regulation-led applications to a parallel model combining medium- to long-duration energy storage arbitrage and capacity assurance, placing higher demands on overall system compliance, long-term O&M capabilities, and localized services. Grid-forming technologies, validation of grid-connection models, and technical confirmation prior to tendering will become key levers for China-Australia collaboration.”

Middle East:

Focusing on long-duration energy storage and system integration

capabilities

Aramco Ventures - President of China Strategic Investments (Saudi Arabia)

Rongtao Sun

Aramco Ventures, the strategic investment arm of Saudi Aramco - the world's largest energy company - is accelerating its global investments in renewable energy, hydrogen, energy storage, and advanced materials.

“The global energy system is rapidly evolving toward a more diversified structure, with energy storage becoming a critical foundational asset. Large-scale energy base projects in the Middle East and North Africa impose higher thresholds for long-duration energy storage, system integration capabilities, and project-level reliability. China holds significant advantages in energy storage manufacturing capacity, industrial clustering, and supply chain completeness. Going forward, we will pay closer attention to the maturity of Chinese energy storage companies in safety standards, long-term operations and maintenance, project documentation systems, and global delivery capabilities. Through joint investments, demonstration projects, and localized deployment, we aim to promote deeper levels of cooperation.”

Nordic Region:

Strong emphasis on full life-cycle services and close coordination

with the power grid

DRSOLAR Denmark ApS - Chief Executive Officer (Denmark)

Salomon Martens

DRSOLAR is a Danish renewable energy system integrator and distributor, with long-term engagement in battery energy storage sales and system services across Nordic and European markets.

“In Denmark and the broader Nordic region, demand for energy storage is shifting from simple grid-connection support to system services and flexibility resources. The market increasingly emphasizes system safety, full life-cycle services, and the ability to collaborate with grid operators. Chinese energy storage products are competitive in performance and delivery. If further alignment can be achieved in certification standards, after-sales systems, and localized technical support, their market penetration will be significantly strengthened.”

RJS Construction ApS - Chief Operating Officer (Denmark)

Robert Kraszewski

RJS Construction is a Danish engineering and EPC service provider involved in the construction and delivery of multiple renewable energy and energy storage projects across Europe.

“From an EPC perspective, European projects place greater emphasis on engineering feasibility and on-site adaptability. Energy storage systems must fully consider construction, commissioning, and O&M conditions during the design phase. Chinese companies perform strongly in modular design and manufacturing efficiency. If closer coordination can be established with local EPC teams, project delivery efficiency can be significantly improved while risks are better controlled.”

India:

Seeking Partners to Scale from Pilot Projects to Full Deployment

At the Energy Storage CEO Summit, representatives of Coca-Cola’s Indian bottling operations expressed clear interest in collaboration. Their purpose for attending was highly practical: “In India, energy storage is booming, so we want to explore this for our company.”

Their demand stems directly from the company’s energy transition efforts. They have already built dedicated solar power plants for their own operations, and their current focus is to use battery energy storage systems to replace grid electricity during peak hours, achieving a better balance between solar generation and energy storage.

Regarding cooperation, they outlined a clear roadmap: “Maybe we can start the pilot project in India. And once if we will find it good, we would scale it up in India and do a business over there with the help of China.” They also explicitly noted that they regard the China Energy Storage Alliance (CNESA) as an important support platform in this field and attended the summit specifically to seek connections through CNESA.

As a key prelude to the 14th Energy Storage International Conference & Expo (ESIE 2026), this year’s China Energy Storage CEO Summit delivered a clear message through its high level of international participation and practice-oriented agenda: the global market not only recognizes China’s manufacturing strength in energy storage, but also expects deeper collaboration across technology standards, ecosystem development, and long-term value creation.

As Chinese energy storage companies further integrate into the global energy system, a new ecosystem built on co-creation, co-development, and shared growth is taking shape. This is no longer merely about exporting products, but a collective journey of technologies, standards, and cooperative models going global together.

CENSA Upcoming Events:

Apr. 1-3, 2026 | The 14th Energy Storage International Conference & Expo

Register Now to attend, free before Dec 31, 2025.

New Installations Down 67% YoY: Analysis of China's User-Side New Energy Storage Projects in November

Source: CNESA

In November 2025, newly installed user-side new energy storage capacity in China recorded a year-on-year decline of over 65%.

Compared with October, the market structure showed notable adjustments:

Commercial and industrial (C&I) energy storage accounted for nearly 90%, while long-duration energy storage technologies accelerated deployment.

East China contributed more than half of newly commissioned capacity, with Fujian leading in installed capacity.

Although filing activity in traditional user-side markets (Zhejiang, Guangdong, Jiangsu) declined compared with the same period last year, overall demand remained higher year-on-year. Emerging markets such as Anhui, Henan, and Sichuan are becoming new growth engines driving the national user-side energy storage market.

Analysis of User-Side New Energy Storage Projects in November

In November, newly installed user-side capacity reached 185.27 MW / 555.83 MWh, representing -67% / -57% year-on-year, and -5% / +16% month-on-month. User-side new energy storage projects exhibited the following characteristics:

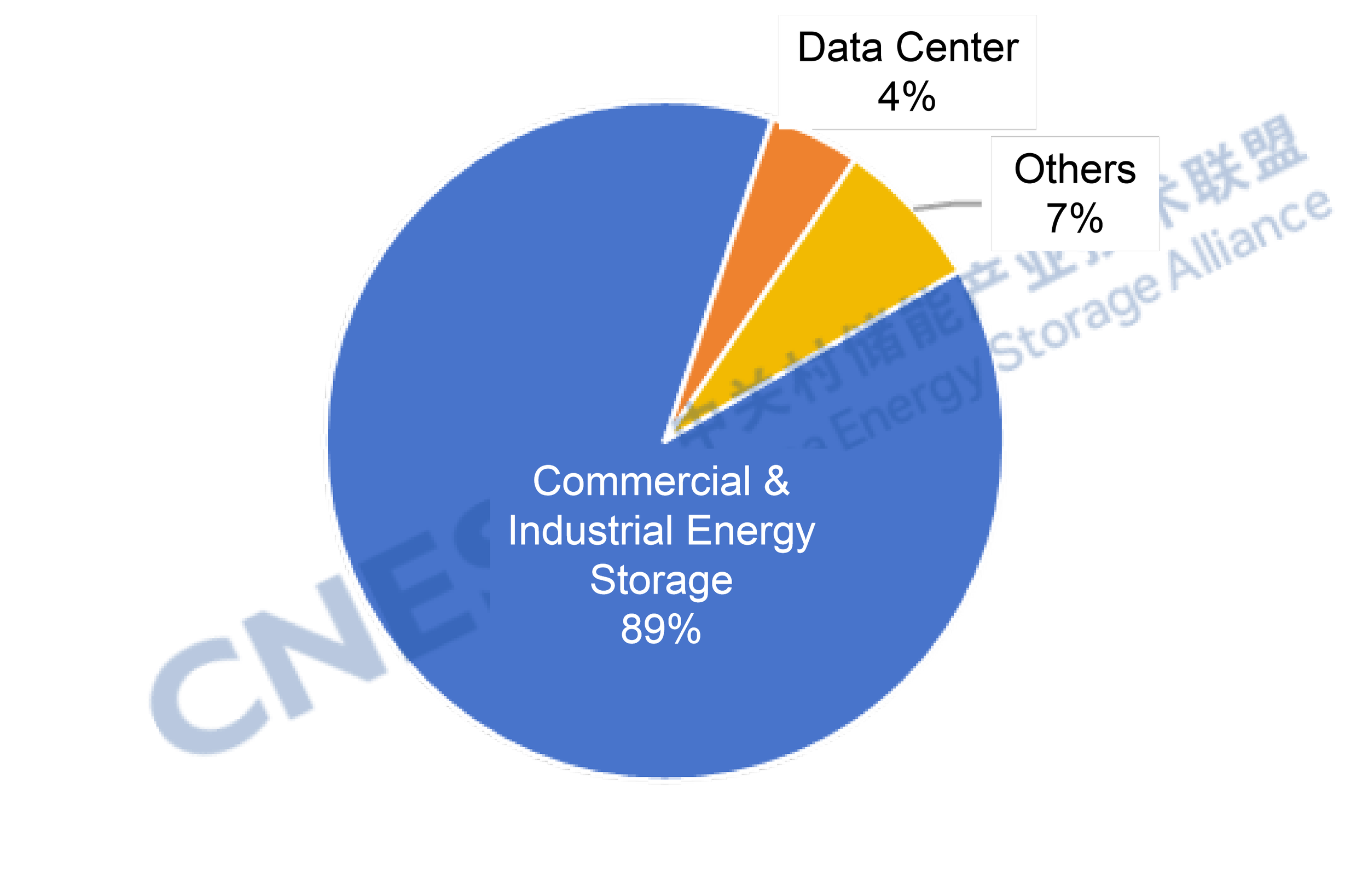

(1) Installed Capacity by Application

In November, the user-side energy storage market continued to be dominated by C&I applications, accounting for nearly 90% of total installations. Newly installed C&I capacity reached 163.9 MW / 541.3 MWh, -68% / -58% year-on-year, and -9% / +15% month-on-month.

The largest data center user-side energy storage project in Zhejiang was officially commissioned. Rapid development of AI data centers (AIDC) and intelligent computing centers is driving growth in user-side energy storage demand.

From a technology perspective, all newly commissioned projects adopted electrochemical energy storage technologies. Lithium iron phosphate (LFP) batteries accounted for over 99% of installed power capacity. In terms of long-duration storage, one 8-hour, 202 MWh lithium-based C&I energy storage project and one 8-hour, 2 MWh all-vanadium redox flow battery project were completed and put into operation.

Figure 1: Application Distribution of Newly Commissioned User-Side New Energy Storage Projects in November 2025 (MW%)

Data Source: CNESA DataLink Global Energy Storage Database

https://www.esresearch.com.cn/

Note: “C&I” includes industrial facilities, industrial parks, and commercial buildings. “Others” include mining areas, oilfields, remote regions, and municipal institutions, etc.

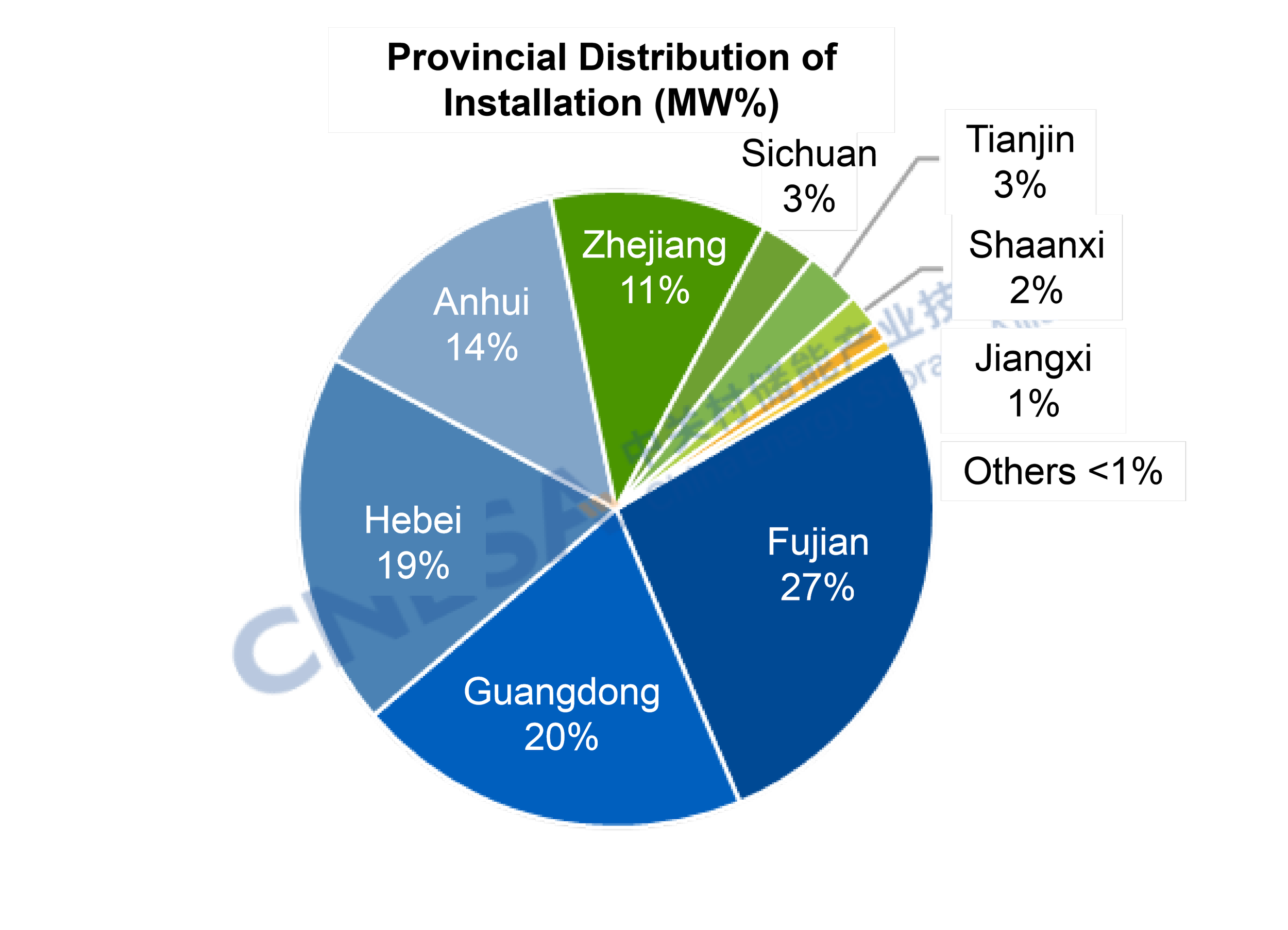

(2) Regional Distribution of User-Side Energy Storage

By region, newly commissioned projects were mainly distributed across 11 provinces, including Fujian, Guangdong, Hebei, Anhui, and Zhejiang. East China led the market in November, accounting for 52% of newly installed capacity and 39% of total projects, ranking first nationwide in both installed scale and number of commissioned projects.

At the provincial level, Fujian recorded the largest share of newly installed power capacity, exceeding 25%, while Hebei led in newly installed energy capacity, accounting for 40%. Guangdong had the highest number of newly commissioned projects, representing over 18%, ranking first nationwide.

Fujian hosts a high concentration of energy-intensive industries such as steel and chemicals, where demand for peak shaving, valley filling, and backup power is strong. In addition, diversified application scenarios - including integrated PV-storage-charging systems and virtual power plant aggregation - are being increasingly developed, leaving substantial growth potential for the user-side energy storage market.

From an industrial and supply chain perspective, Fujian is home to the country's largest lithium battery R&D and manufacturing base, with lithium battery production capacity ranking among the national leaders. Driven by leading energy storage companies, a complete local supply chain has been established for core components such as cells, PCS, BMS, and EMS, effectively reducing overall system costs. Moreover, Fujian supports energy storage project financing through green credit and industrial funds, covering multiple project types including pumped hydro storage and new energy storage.

Figure 2: Provincial Distribution of Newly Operating User-Side New Energy Storage Projects in China, November 2025

Data Source: CNESA DataLink Global Energy Storage Database

https://www.esresearch.com.cn/

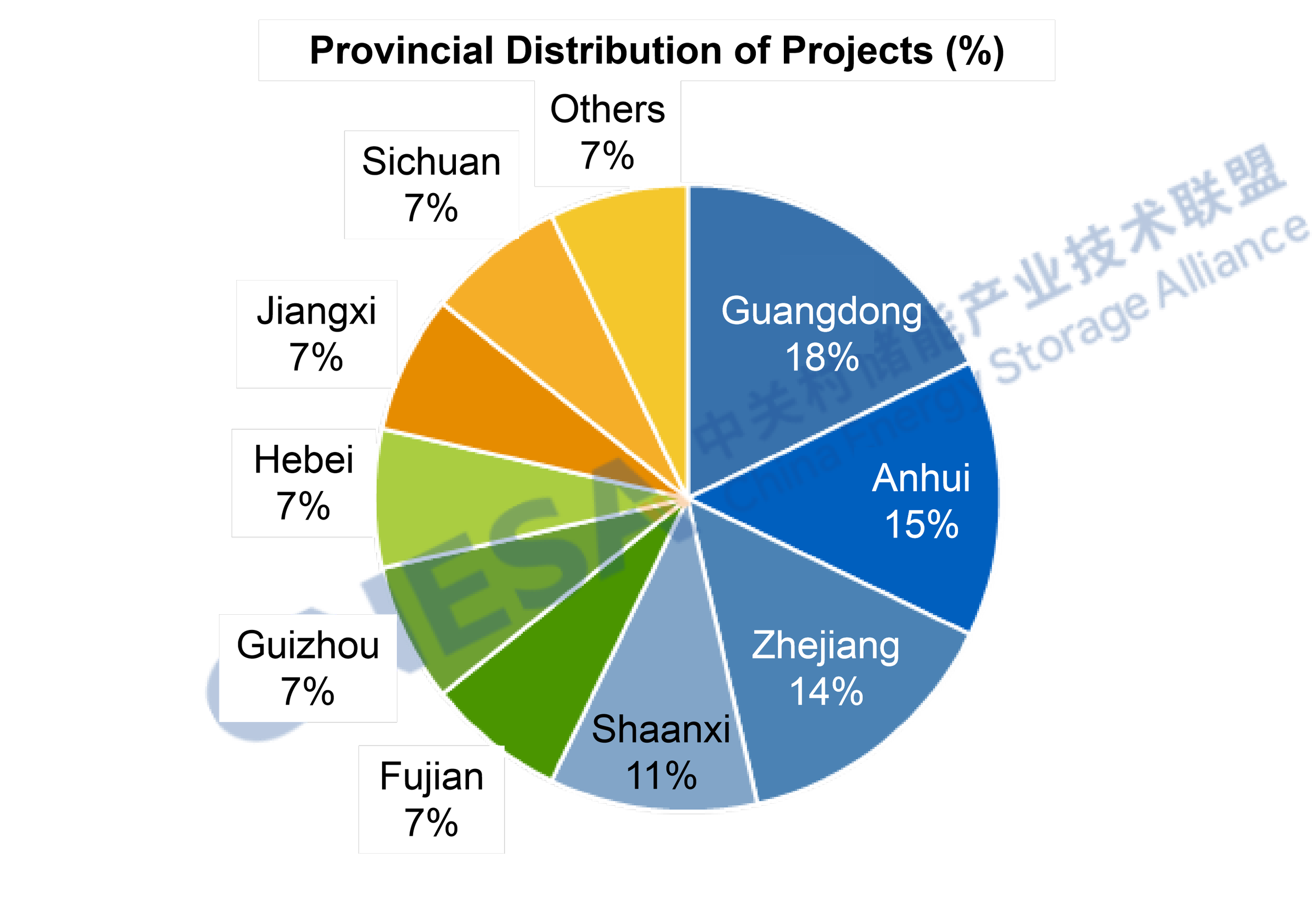

(3) Filed User-Side Energy Storage Projects

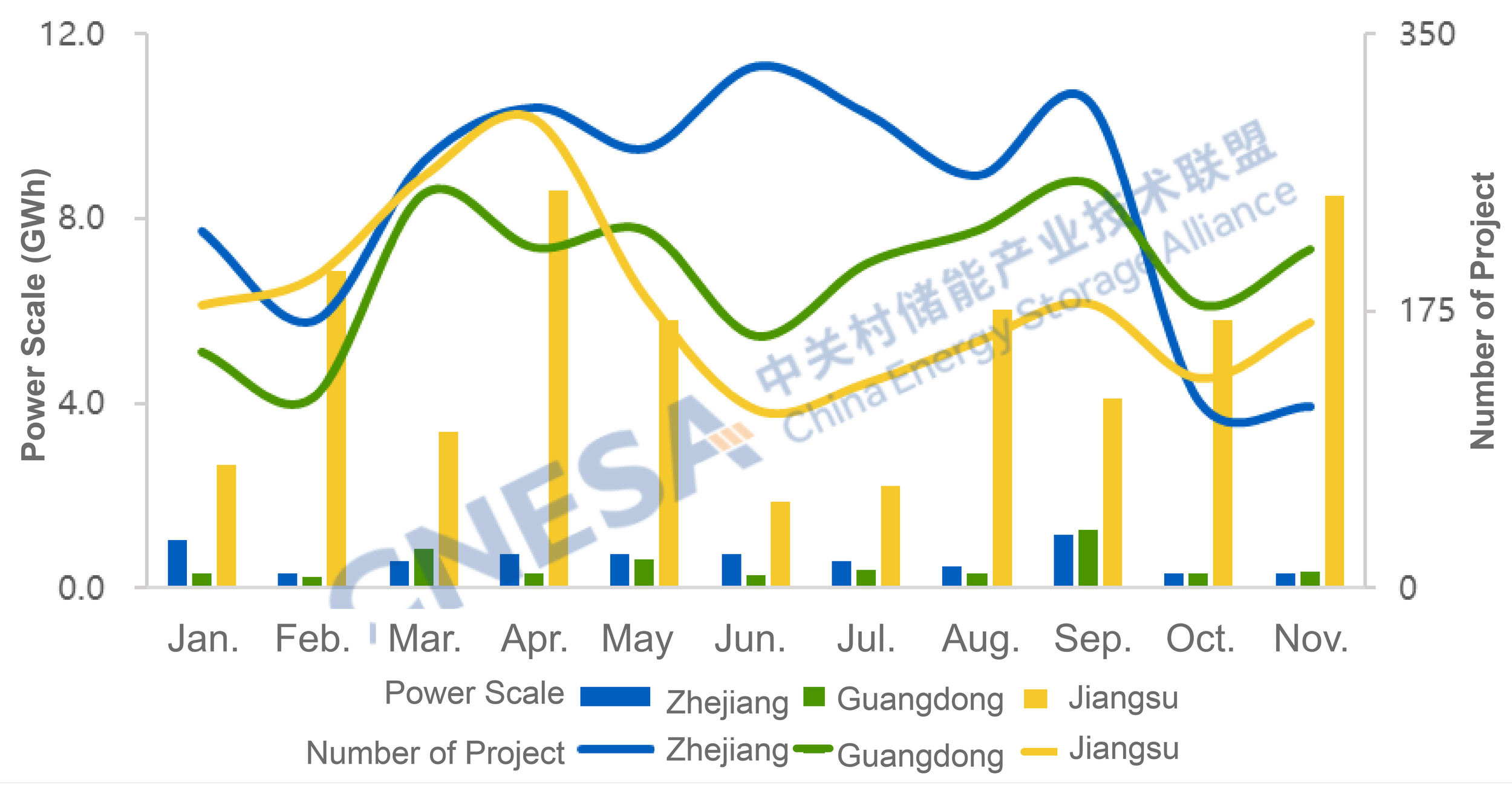

Based on project filings, national user-side market demand in November exceeded the level of the same period last year, with differentiated regional adjustments. Nationwide, both the total scale and number of newly filed user-side projects in November were higher year-on-year, up 8% and 5%, respectively. However, filing activity in traditional markets - Zhejiang, Guangdong, and Jiangsu - declined compared with last year.

Across these three provinces, a total of 497 new projects were filed, down 47% year-on-year, while energy capacity declined 7% year-on-year.

Guangdong recorded the highest number of newly filed projects, but project count fell 25% year-on-year, and scale declined 73%.

Zhejiang saw the largest drop in project count, down 65% year-on-year, with scale decreasing 34%.

Jiangsu recorded a 48% year-on-year decline in project count, but project scale increased 6%.

In November, Jiangsu ranked first nationwide in newly filed project scale. The average project size was approximately twice that of the same period last year, indicating a shift in user-side energy storage development from small-scale, distributed projects toward large-scale, centralized investments in high-quality application scenarios.

Meanwhile, Anhui, Henan, and Sichuan collectively added 440 newly filed projects, up 89% year-on-year and 47% month-on-month, accounting for about 38% of the national total, 5 percentage points higher than in October. Emerging user-side markets represented by Anhui, Henan, and Sichuan are rapidly releasing growth potential and are expected to become new engines driving nationwide user-side energy storage market growth.

Figure 3: Monthly Distribution of Newly Filed Energy Storage Project Scale in Zhejiang, Guangdong, and Jiangsu (January - November 2025)

Data Source: CNESA DataLink Global Energy Storage Database

https://www.esresearch.com.cn/

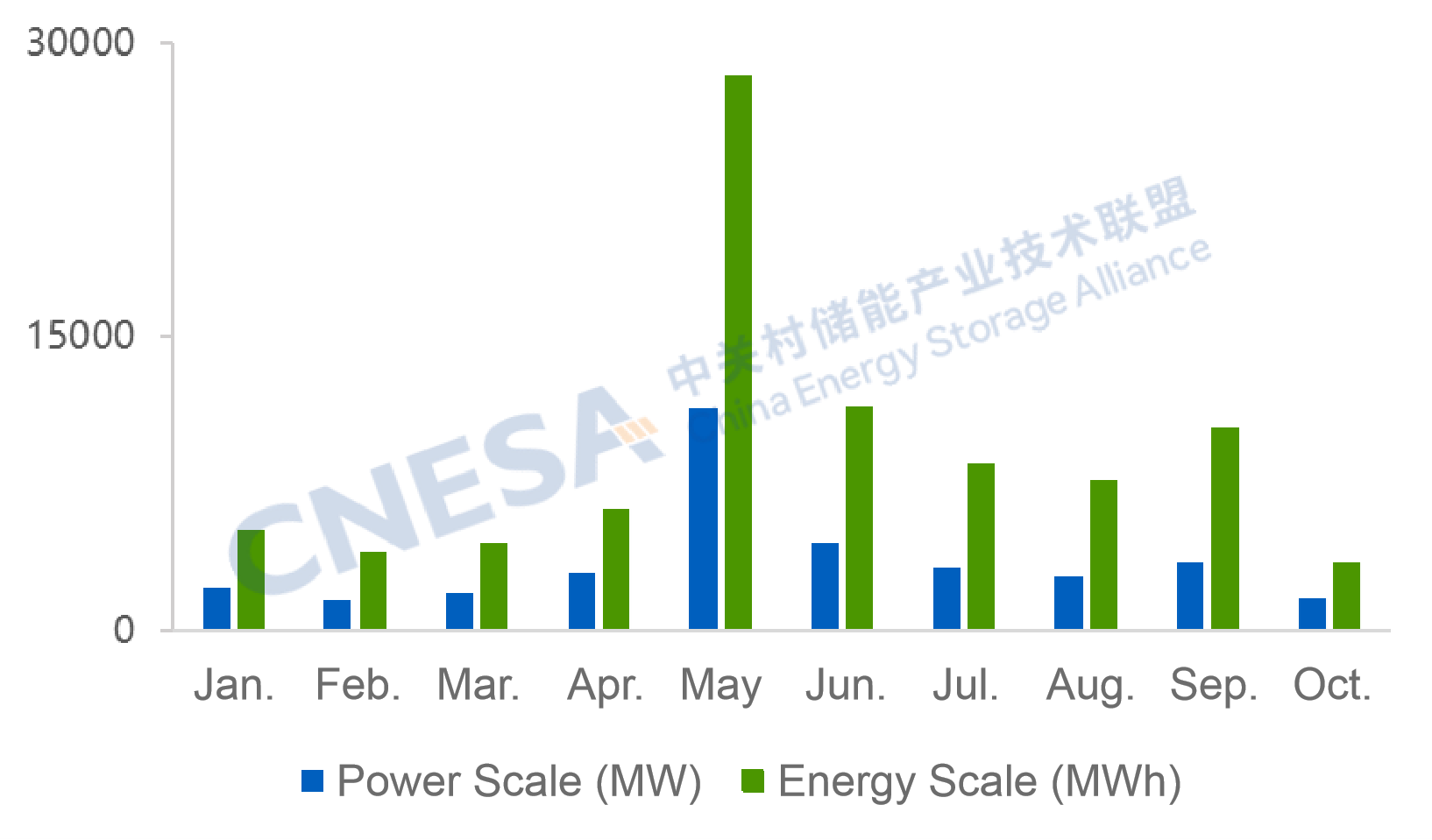

Overall Analysis of New Energy Storage Projects in November

According to incomplete statistics from CNESA, in November 2025, newly commissioned new energy storage projects in China totaled 3.51 GW / 11.18 GWh, representing -22% / -7% year-on-year, and +81% / +180% month-on-month. While monthly additions continued to decline year-on-year, cumulative newly installed capacity in the first eleven months reached 39.5 GW, up 28% year-on-year. Considering the potential for concentrated grid connections ahead of the “12.30” commissioning deadline, total new installations for the year are expected to exceed last year's level.

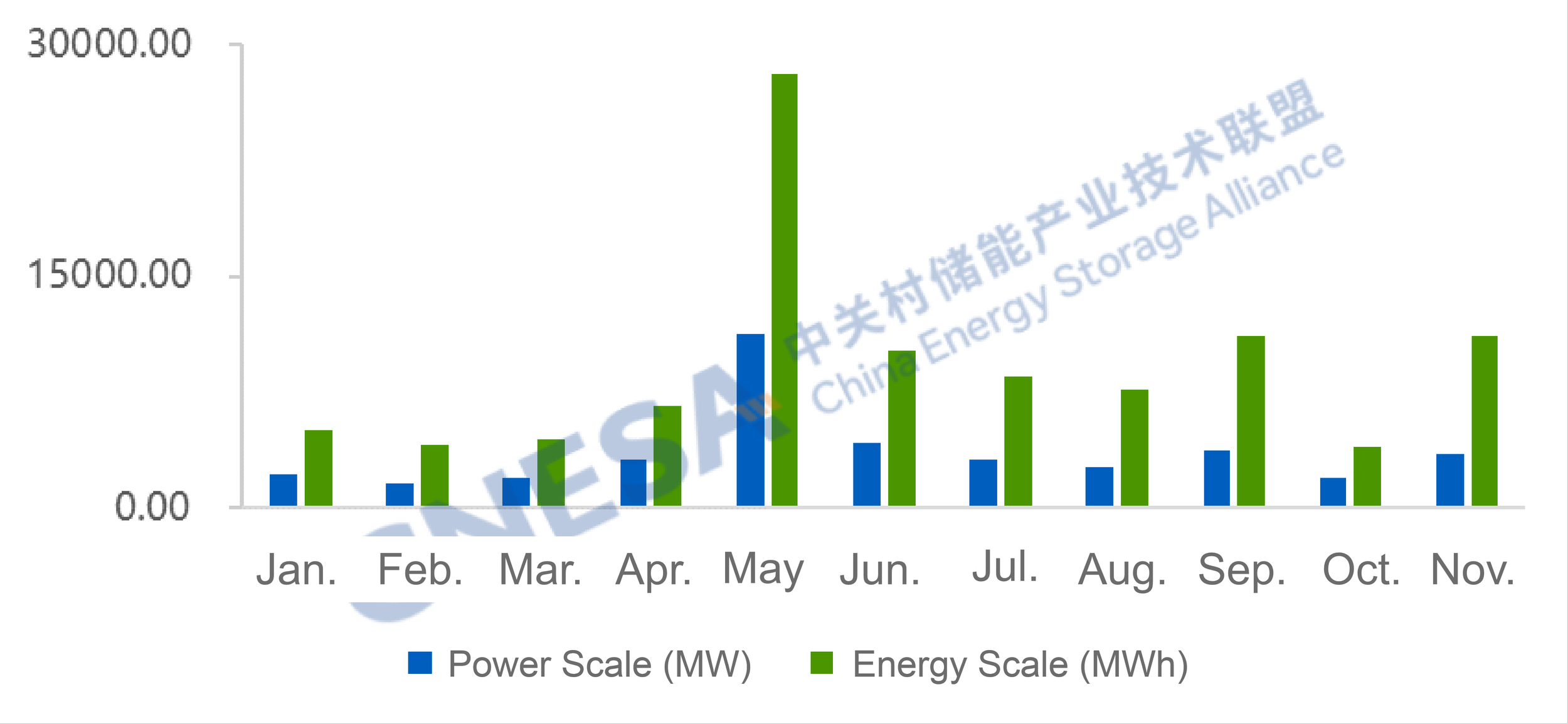

Figure 4: Installed Capacity of Newly Operating New Energy Storage Projects in China, January - November 2025

Data Source: CNESA DataLink Global Energy Storage Database

https://www.esresearch.com.cn/

Note: Year-on-year comparisons are based on the same period of the previous year; month-on-month comparisons are based on the immediately preceding statistical period.

The China Energy Storage Alliance (CNESA) has consistently adhered to standardized, timely, and comprehensive information collection practices to continuously track developments in energy storage projects. Leveraging its long-term data accumulation and in-depth professional analysis, CNESA regularly publishes objective market analyses on installed energy storage capacity, providing valuable references for industry decision-making. Since June 2025, the monthly energy storage project analysis has been divided into two sections: “Grid&Source-Side Market” and “User-Side Market”. This issue focuses on interpreting the user-side market in November.

CENSA Upcoming Events:

Apr. 1-3, 2026 | The 14th Energy Storage International Conference & Expo

Register Now to attend, free before Dec 31, 2025.

MoM Surge of 90%! Grid&Source-Side Energy Storage Rebounds Sharply in November, with Full-Year Scale Expected to Exceed Last Year

Source: CNESA

After a phase adjustment in China's new-type energy storage market in October 2025, the commissioning scale of new-type energy storage in November declined slightly year on year but rebounded markedly month on month. Meanwhile, the market's deeper structure adjusted compared with October:

Market recovery with a positive long-term outlook: Although installed capacity in November declined year on year, the month-on-month increase was significant. Newly added installations in the first 11 months reached nearly 40 GW, up more than 25% year on year, and full-year additions are expected to exceed last year.

Accelerated deployment of independent storage: In November, independent energy storage accounted for over 70%, with month-on-month growth rates exceeding 80% in power capacity and 200% in energy capacity. Inner Mongolia recorded more than 1.1 GW of newly commissioned independent storage, ranking first nationwide in both power and energy capacity.

Rise of local energy groups: Newly added installations by local energy groups reached a 45% share, surpassing for the first time the “Five Major and Six Minor” power generation groups and the “third-party enterprises”, highlighting a further diversification of market investors.

Faster rollout of diversified technologies: Beyond mainstream lithium batteries, technologies such as compressed air, flow batteries, and flywheels are being deployed at an accelerated pace, supporting the industry's long-term development.

Overall Analysis of New-Type Energy Storage Projects in November

According to incomplete statistics from CNESA, in November 2025 China commissioned a total of 3.51 GW / 11.18 GWh of new-type energy storage projects, representing -22% / -7% year on year and +81% / +180% month on month. While monthly additions continued to decline year on year in November, cumulative additions in the first 11 months reached 39.5 GW, up 28% year on year. Considering potential concentrated grid connections ahead of the “12.30” commissioning deadline, total additions for the year are expected to exceed last year.

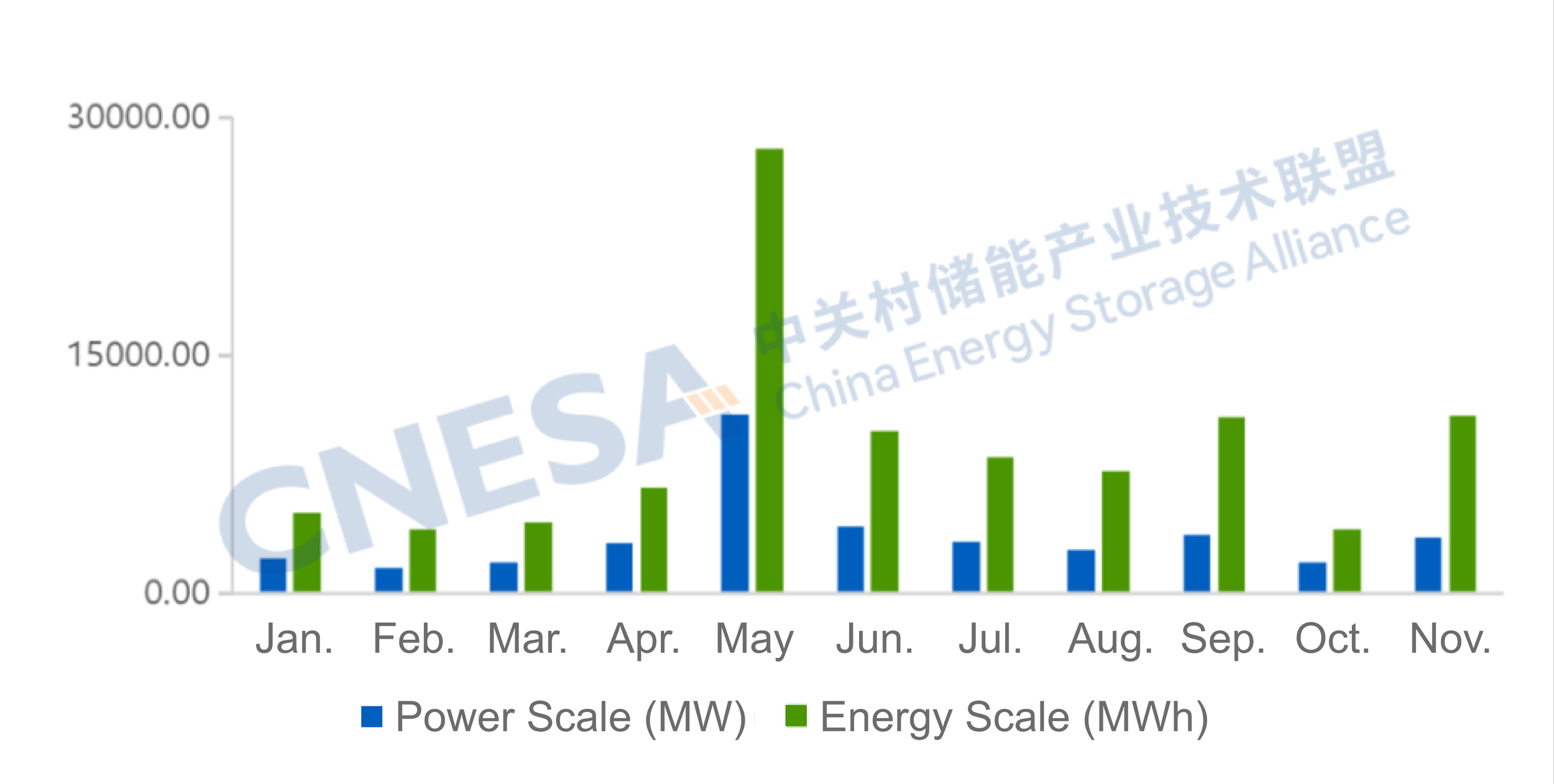

Figure 1. Installed Capacity of Newly Commissioned New-Type Energy Storage Projects in China, Jan-Nov 2025

Data source: CNESA DataLink Global Energy Storage Database

https://www.esresearch.com.cn/

Note: Year-on-year (YoY) compares the same period last year; month-on-month (MoM) compares the previous statistical period.

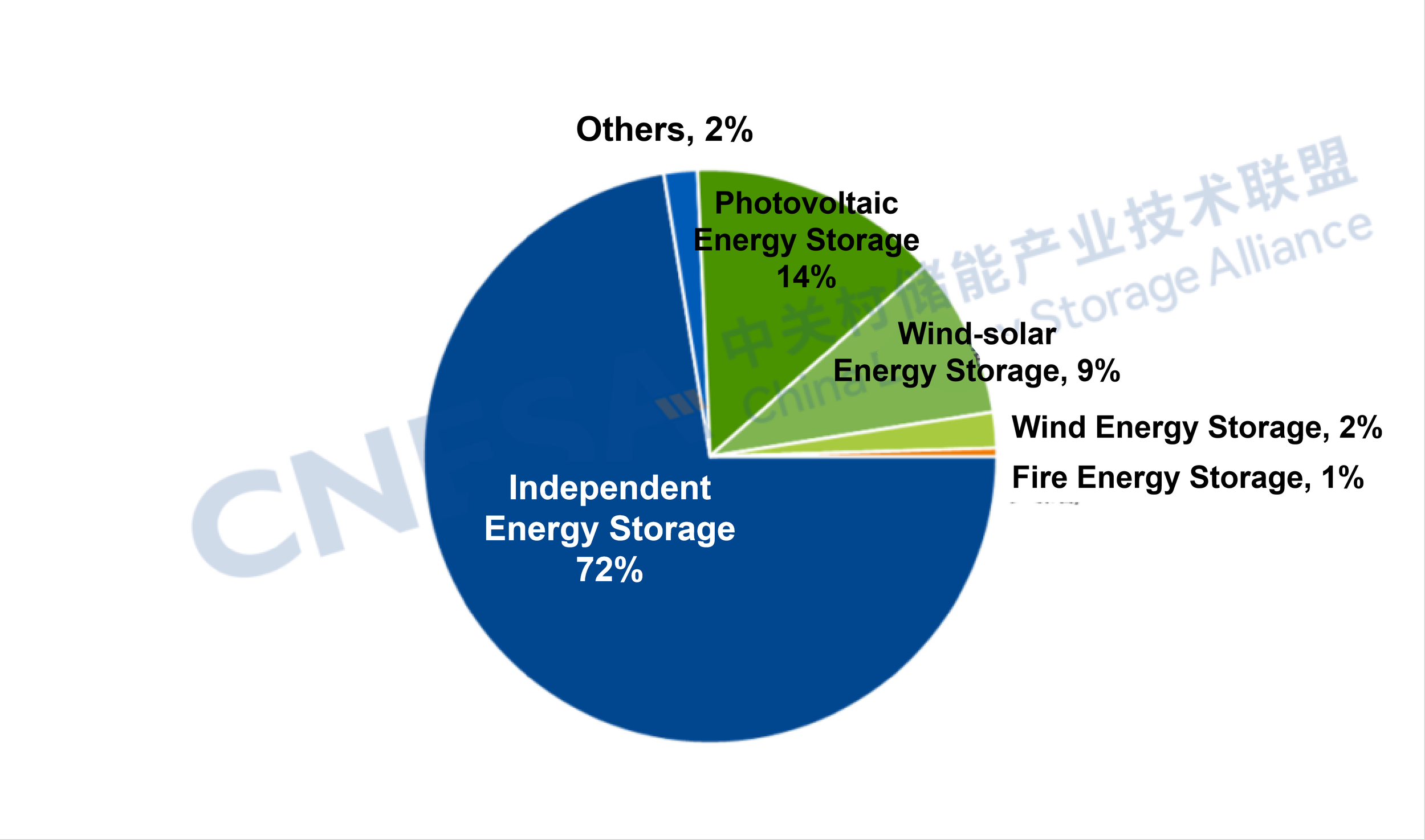

Analysis of Grid&Source-Side New-Type Energy Storage Projects in November

In November, newly added grid&source-side installations totaled 3.32 GW / 10.62 GWh, -15% / -1% year on year and +90% / +202% month on month.

Key characteristics include:

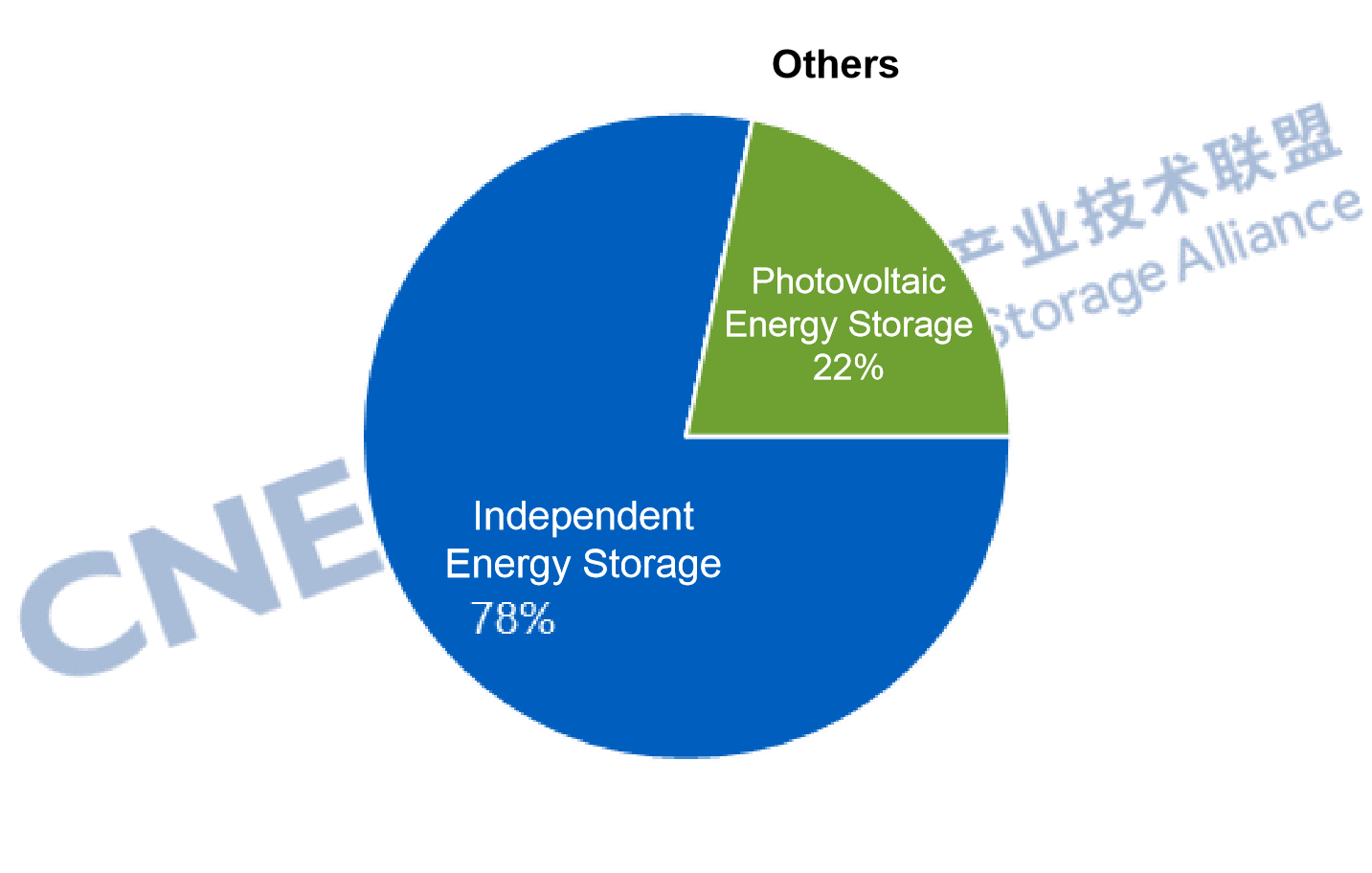

Newly added Independent storage accounted for 72%, down 6 percentage points from October.

Independent storage additions reached 2.41 GW / 8.19 GWh, -9% / +11% year on year and +82% / +217% month on month, with projects of 100 MW or above accounting for 79% by number.

Power-generation-side additions were 853.3 MW / 2,322.1 MWh, -33% / -31% year on year and +99% / +148% month on month. Renewable-plus-storage projects accounted for 98% of power capacity, covering multiple application scenarios such as UHV DC projects, agrivoltaics, and pastoral-solar hybrid systems.

Figure 2. Application Breakdown of Newly Commissioned Grid&Source-Side Energy Storage Projects in Nov. 2025 (MW%)

Data source: CNESA DataLink Global Energy Storage Database

https://www.esresearch.com.cn/

Note: “Others” include substations, emergency power supply, etc.

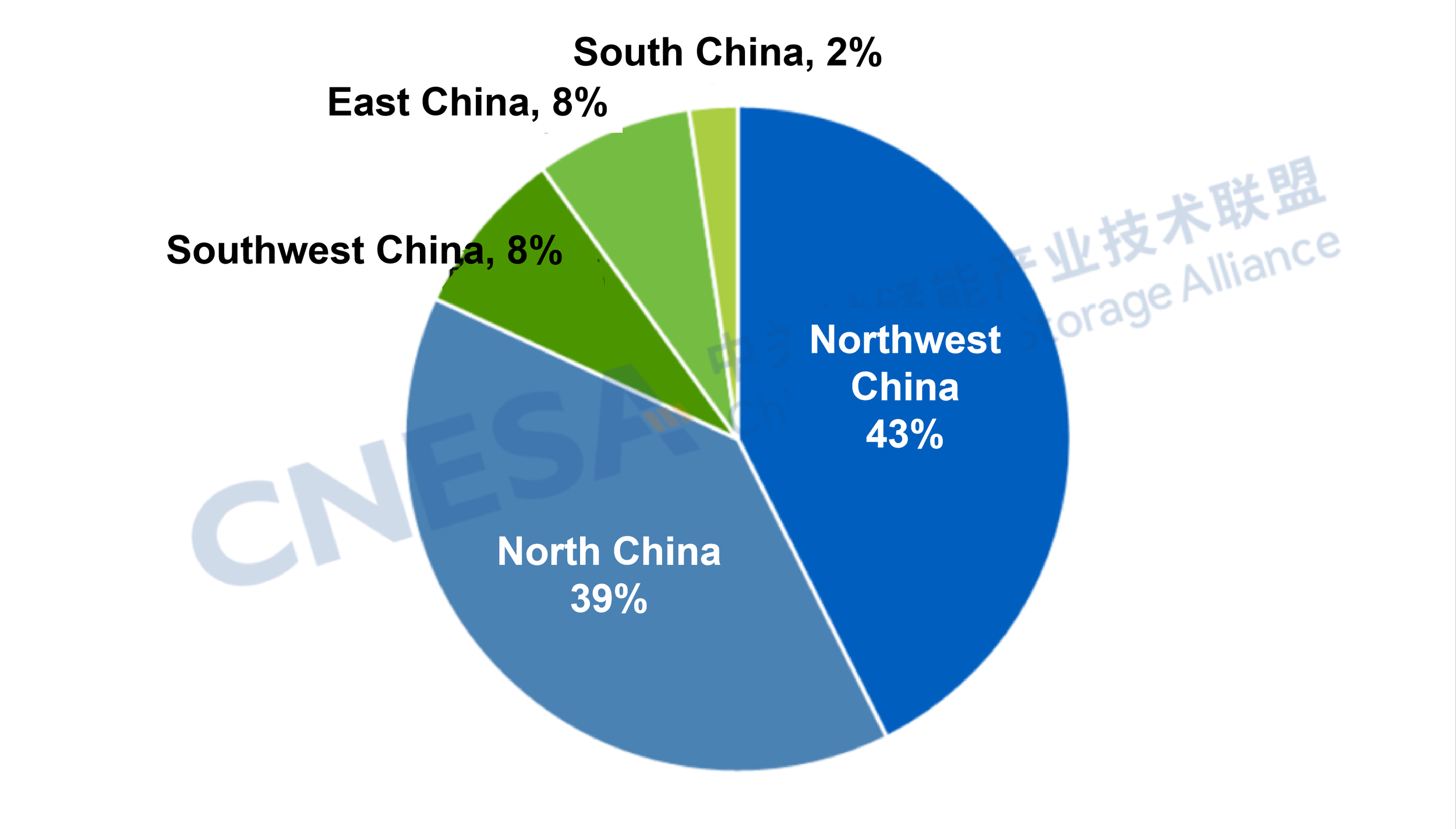

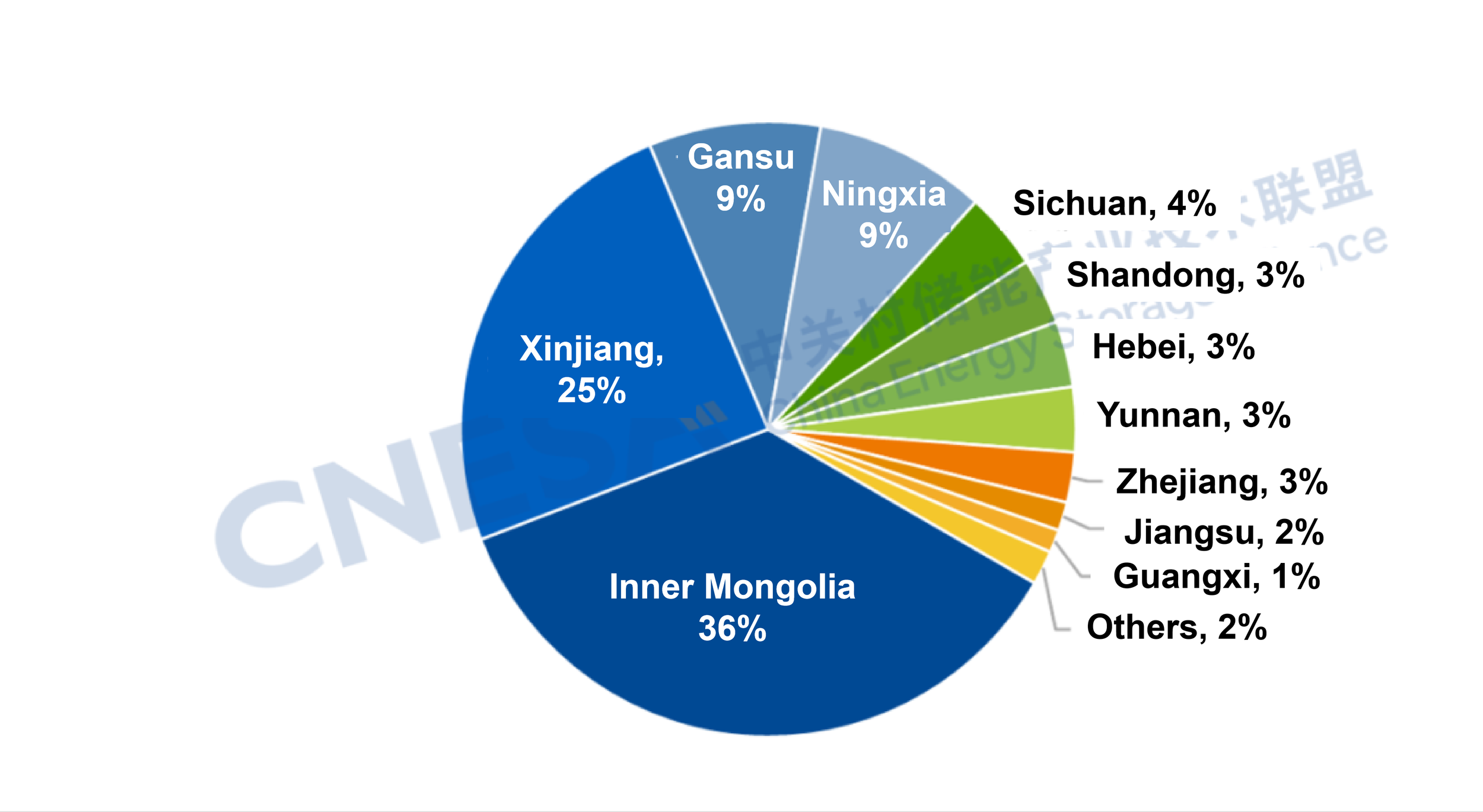

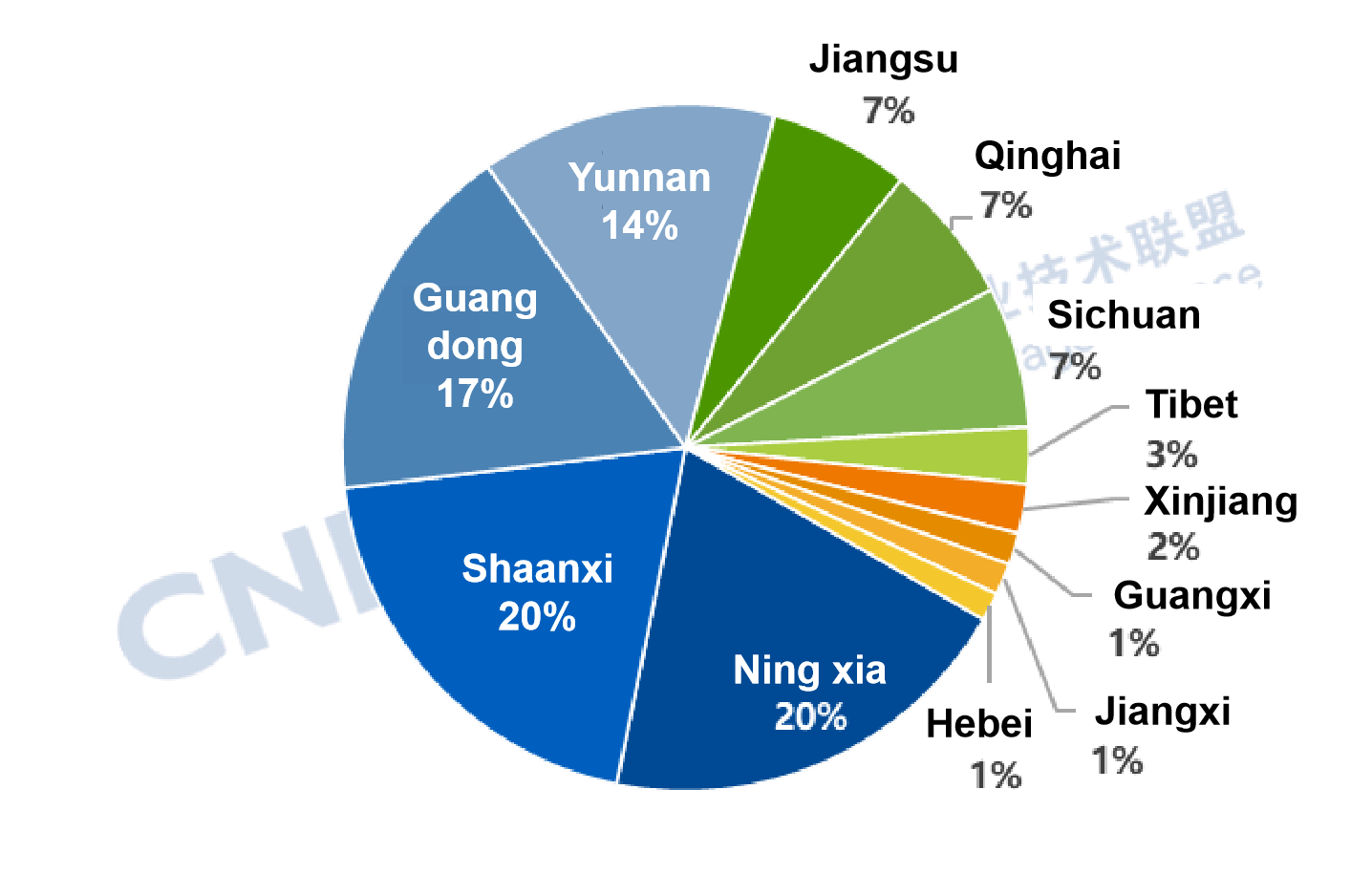

Northwest Leads with Over 40% Share; Inner Mongolia Ranks First

In November, the Northwest region accounted for 43% of newly added capacity, ranking first nationwide. Combined additions in the Northwest and Southwest exceeded half of the national total.

By province, the Inner Mongolia Autonomous Region saw multiple Independent grid-side demonstration projects commissioned - such as those included in the 2025 New-Type Energy Storage Special Action Implementation Project List and the first batch of Independent storage construction projects - totaling over 1.1 GW with an average storage duration of 4 hours, ranking first nationwide in both power and energy capacity. Xinjiang, Gansu, and Ningxia followed closely.

As a key national energy and strategic resource base in China, Inner Mongolia had surpassed 150 GW of installed renewable capacity by the end of October 2025, ranking first nationwide. Wind and solar accounted for over 80% of new installed capacity, further solidifying their dominant role (data source: Inner Mongolia Autonomous Region Energy Bureau). From the perspective of consumption, approximately 80% of renewable generation is consumed locally, with around 20% exported. The combined pressure of local consumption and grid stabilization continues to drive demand for new-type energy storage.

Figure 3. Regional Distribution of Newly Commissioned Grid&Source-Side Energy Storage Projects in China, November 2025 (MW%)

Source: CNESA Datalink Global Energy Storage Database

Figure 4. Provincial Distribution of Newly Commissioned Grid&Source-Side Energy Storage Projects in China, November 2025 (MW%)

Source: CNESA Datalink Global Energy Storage Database

https://www.esresearch.com.cn/

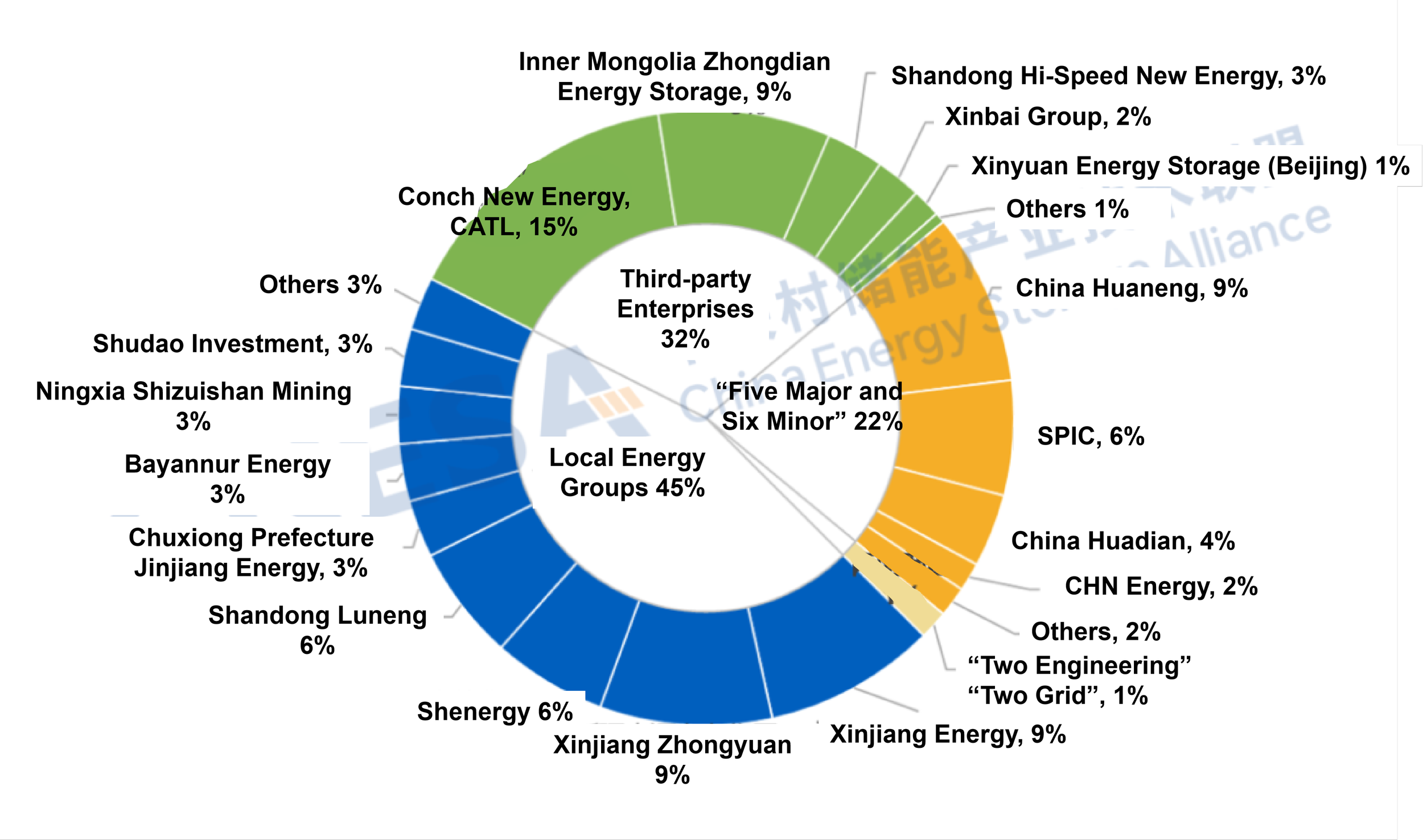

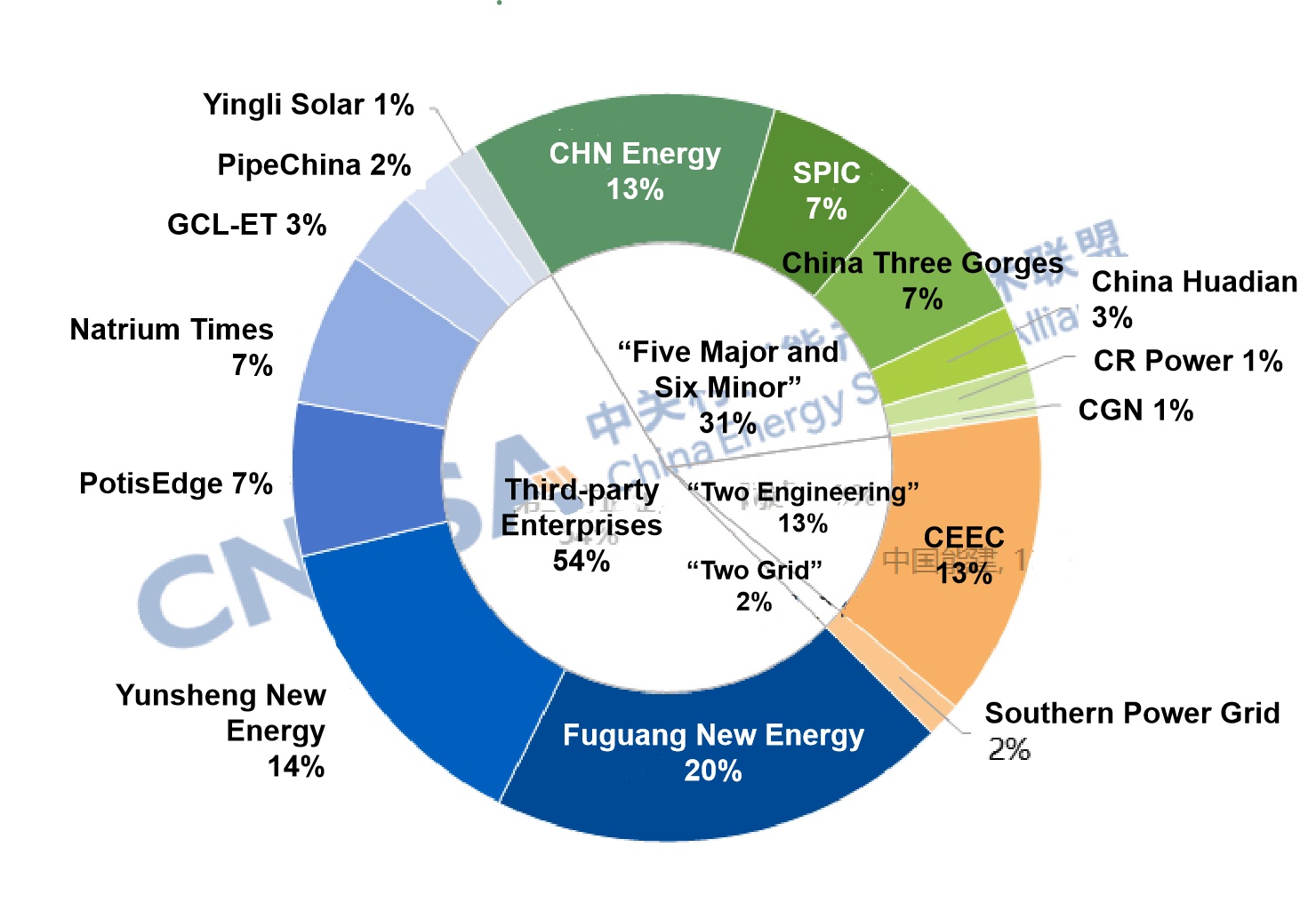

Faster Deployment by Local Energy Groups Highlights Investor Diversification

Driven by rising market demand, supportive national policies, diversified technology pathways, and declining costs, the market potential of energy storage is being fully released, with increasing investor diversification.

In November, projects invested in and built by local energy groups such as Xinjiang Energy Group, Xinjiang Zhongyuan Power Group, and Shenergy Group were commissioned in succession. Local energy groups accounted for 45% of newly added power capacity - the highest among all enterprise types - contrasting sharply with September and October, when third-party enterprises and the “Five Major and Six Minor” power generation groups dominated.

Leveraging advantages in policy coordination and approvals, resource integration and location, business linkage and industrial chain synergy, capital strength and decision-making efficiency, and operations, local energy groups have become a key pillar of the new-type energy storage market. Meanwhile, third-party enterprises - such as joint entities involving Conch New Energy and CATL, and Inner Mongolia Zhongdian Energy Storage - maintained a high level of participation, accounting for over 30% of monthly additions. The “Five Major and Six Minor” power generation groups (including China Huaneng, SPIC, and China Huadian) accounted for 22%, down 9 percentage points from October, continuing the decline seen since August.

Figure 5. Owner Distribution of Newly Commissioned Grid&Source-Side Energy Storage Projects in China, November 2025 (MW%)

Data source: CNESA DataLink Global Energy Storage Database

https://www.esresearch.com.cn/

Note: “Third-party enterprises” refer to entities other than large state-owned generation groups, the two grid companies, two construction groups and local energy companies.

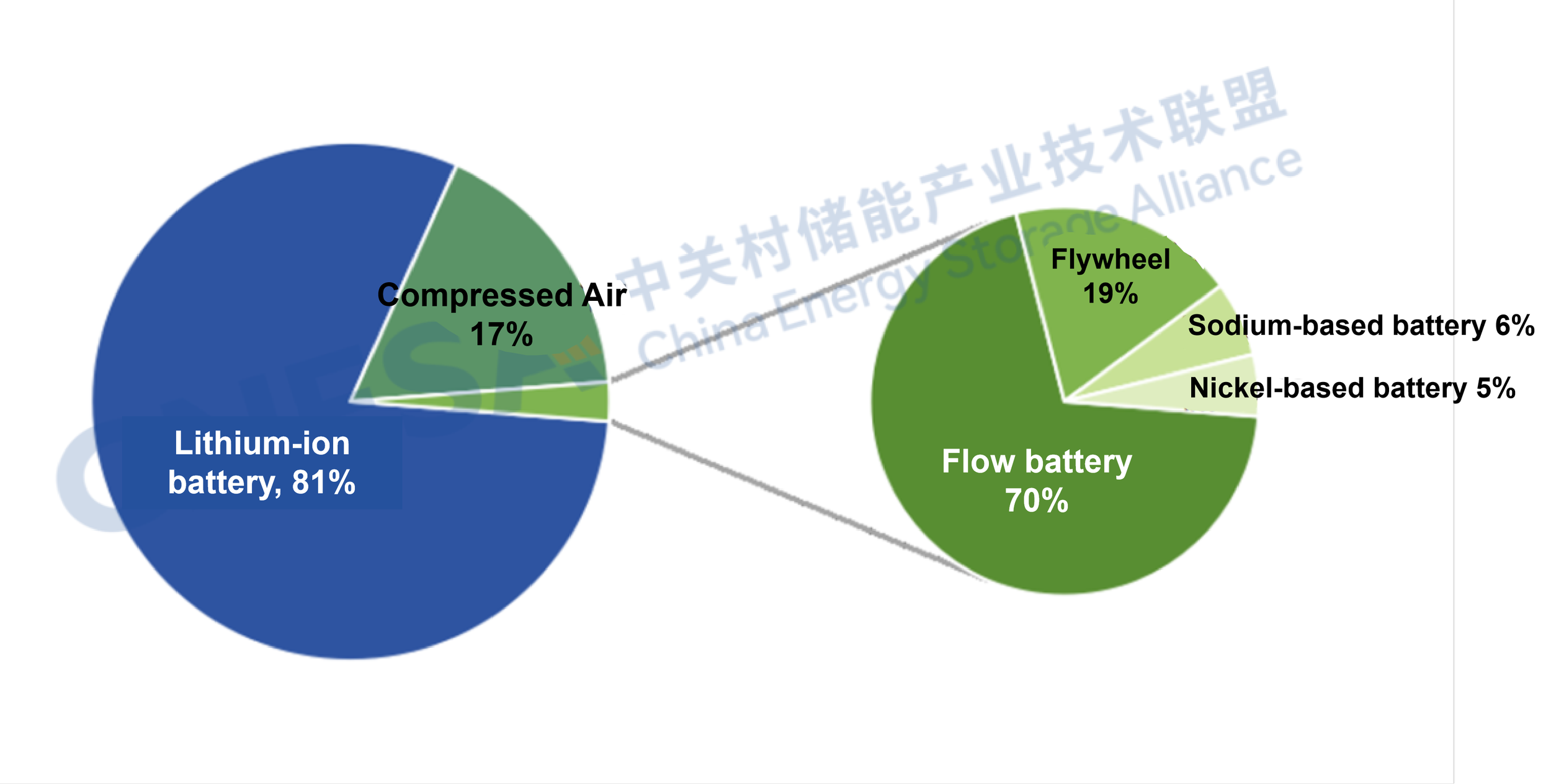

Accelerated Deployment of Non-Lithium Technologies

Technologically, newly commissioned grid&source-side projects were dominated by lithium iron phosphate (LFP) batteries, accounting for 91% of power capacity, followed by lead-carbon batteries (6%) and flow batteries (3%).

From a project development perspective, non-lithium technologies such as compressed air energy storage and hybrid systems are accelerating, highlighting a trend toward diversified technology pathways.

In compressed air storage, multiple 300 MW-class projects have completed filings and entered the planning stage; the Golmud 60 MW liquid air energy storage demonstration project and the Yumen 300 MW compressed air energy storage demonstration project have entered commissioning.

For hybrid storage, multiple 100 MW-class demonstration projects have launched or completed tenders, with some under construction or advancing, involving combinations such as lithium + sodium-ion batteries, lithium + flow batteries, lithium + flywheels, and lithium + nickel-metal hydride batteries.

Figure 6. Technology Distribution of Newly Planned and Under-Construction Grid&Source-Side Energy Storage Projects in China, November 2025 (MW%)

Source: CNESA Datalink Global Energy Storage Database

https://www.esresearch.com.cn/

The China Energy Storage Alliance (CNESA) has consistently adhered to standardized, timely, and comprehensive information collection practices to continuously track developments in energy storage projects. Leveraging its long-term data accumulation and in-depth professional analysis, CNESA regularly publishes objective market analyses on installed energy storage capacity, providing valuable references for industry decision-making. Since June 2025, the monthly energy storage project analysis has been divided into two sections: “Grid&Source-Side Market” and “User-Side Market”. This issue focuses on interpreting the grid&source-side market in November.

CENSA Upcoming Events:

Apr. 1-3, 2026 | The 14th Energy Storage International Conference & Expo

Register Now to attend, free before Dec 31, 2025.

2025 China Energy Storage CEO Summit & Preliminary Round of the 10th International Energy Storage Innovation Competition Successfully Held in Xiamen

Source: CNESA

On December 4, 2025, the 2025 China Energy Storage CEO Summit & Preliminary Round of the 10th International Energy Storage Innovation Competition, hosted by the China Energy Storage Alliance (CNESA) and co-organized by Xiamen University, Kehua Digital Energy, and Cornex New Energy, was successfully held in Xiamen, China.

As CNESA's final flagship event of the year, the Summit took Southeast China - an important strategic gateway to global markets - as its anchor and adopted the theme “Breaking Waves · Coexistence - Co-Creating a New Globalized Ecosystem for Energy Storage 2026.” The event gathered government officials, academicians, industry leaders, and corporate executives to review China's industry landscape in 2025, explore the development path toward 2026 and the longer-term 15th Five-Year Plan period, and jointly seek new pathways for the high-quality and global advancement of energy storage.

The opening ceremony was hosted by Liu Wei, Secretary-General of CNESA.

Distinguished speakers and guests included:

Prof. Zheng Nanfeng of Xiamen University; leaders from Xiamen Municipal Bureau of Commerce, Xiamen Municipal Bureau of Science and Technology, and Xiamen Municipal Development and Reform Commission; Chen Haisheng, Chairman of CNESA and Director of the Institute of Engineering Thermophysics, Chinese Academy of Sciences; Chen Chenghui, Chairman of Kehua Data; Huang Feng, President of Cornex New Energy; Wang Shunchao, Deputy Director of the International Consulting & Design Institute of the China Electric Power Planning and Engineering Institute; Zheng Yaodong, Honorary Chairman of the Energy Storage Team of China Southern Power Grid; Wen Zhaoyin, Researcher of the Shanghai Institute of Ceramics, Chinese Academy of Sciences; Prof. Yang Yong of Xiamen University; Huang Junhui, former Deputy Director of the Jiangsu Institute of Economic Research, State Grid, and senior technical expert, among others.

Also present were CNESA Vice Chairs and representatives: Yu Zhenhua, Executive Vice Chairman of CNESA; Yang Bao, President of Trina Storage; Gao Xinhua, Chief Engineer of China Southern Power Grid Technology; Yang Rui, Chairman of Shuangdeng Group; Cui Jian, President of Kehua Digital Energy; Tian Qingjun, Senior VP of Envision Energy & President of Envision Storage; Lian Zanwei, Chairman of XYZ Storage; Liu Mingyi, Director of Energy Storage Technology, Huaneng Clean Energy Research Institute; Yu Jianhua, VP of Narada; Lv Lin, GM of TBEA Xi'an, and many other industry leaders.

The Summit also received strong support from co-organizer Fujian New Energy Technology Industry Promotion Association and supporting partners including Envision Energy, Trina Storage, Shuangdeng, HyperStrong, Ampace, Phoenix Contact, Potisegde, and KE Electric, jointly presenting a high-level industry event.

This year's Summit featured an impressive international lineup, gathering energy asset owners and project developers from key global regions including Denmark, Austria, Bulgaria, India, Saudi Arabia, Singapore, Australia, Malaysia, and France. Special invited foreign guests included Li Yilin, Deputy Director of Enterprise Singapore (South China), and Victor Goutte, Deputy Head of the Renewable Energy Sector, Embassy of the French Republic in China.

This strong participation across the entire value chain created an efficient and pragmatic bridge connecting Chinese and international enterprises.

High-Level Speeches

Driving High-Quality Development and Co-Shaping a New

Global Energy Storage Ecosystem

Zheng Nanfeng - Professor, Xiamen University

Prof. Zheng Nanfeng, Dean of the School of Energy, Xiamen University, and Director of the Jiageng Innovation Laboratory, emphasized China's remarkable progress in renewable energy, with total installed capacity exceeding 1,700 GW. Despite challenges such as higher curtailment rates in western regions, the new 2035 targets indicate vast application opportunities for energy storage.

He stressed that Xiamen University, as a “Double First-Class” institution, is committed to breaking barriers between scientific research and industrial innovation, exploring new models for integrating education, research, and industry. The university will continue working with all sectors to focus on technological breakthroughs, talent development, and solutions for scaling up and commercializing energy storage, strengthening the foundation for global energy transition.

Chen Haisheng - Chairman, CNESA

Chairman Chen Haisheng noted that China's energy storage industry is undergoing a profound shift from rapid expansion to high-quality development. This is reflected in China's global leadership in installed capacity, significant improvement in application performance, diversified technological pathways, and a shift in market mechanisms from mandatory allocation to market-driven deployment.

He highlighted globalization as a key agenda, with Chinese companies accelerating their overseas strategy based on strong technological and supply chain advantages. CNESA will continue building platforms to support global deployment, promote technological ecosystem restructuring, and strengthen China's high-quality “going global” process.

Chen Chenghui - Chairman, Kehua Data

Chairman Chen Chenghui emphasized that energy storage is the “accelerator” of the new power system and a key enabler of the global low-carbon transition, with China increasingly providing “Chinese approach” to the world.

He introduced Kehua's innovation-driven approach, focusing on grid-forming energy storage and full-scenario solutions, and noted the company's collaboration with central SOEs on world-first projects. Internationally, Kehua follows a strong localization strategy, with business presence in over 100 countries. He called for building resilient global supply chains and advancing open collaboration to accelerate global energy transformation.

Keynote Reports

Deepening Industry-Research Integration and Jointly Planing

Global Deployment

Zheng Nanfeng - Professor, Xiamen University

In his keynote “From Free Exploration to Dual Empowerment: Integrating Basic Research with Industrial Innovation,” Prof. Zheng outlined the two-way empowerment mechanism of “research serving industry” and “industry boosting research”: Relying on the Jiageng Innovation Laboratory, actively explore a new system of "combination of allocation and investment" and "fiscal funds + market-oriented operation", and achieve the deep integration of technology and industry by breaking the single academic evaluation orientation.

The Jiageng Lab focuses on low-carbon energy, high-efficiency storage, and next-generation displays, establishing public validation platforms to accelerate commercialization. He advocated integrated development of university campuses, science parks, and industrial parks to transform the high-failure-rate path of innovation into a new norm of high-quality industrial growth.

Wang Shunchao - Deputy Director, International Energy Consulting Institute, EPPEI

Dr. Wang Shunchao delivered a keynote titled “Green Power Planning for Overseas Markets.”

He emphasized the rapid growth of clean energy demand along the Belt and Road, contrasted with weaker power system foundations, making power system planning increasingly critical. He introduced EPPEI's modeling and simulation experience as well as insights from international power system planning projects.

Tian Qingjun - Senior VP, Envision Energy

Tian Qingjun highlighted that Chinese energy storage companies are “born global,” and internationalization has become an imperative.

He stressed the need to move from simply “going out” to deeply “integrating in,” with local operations, local talent, and long-term value creation. He called for ecosystem collaboration, avoidance of harmful price competition, and positioning Chinese companies as global enablers and ecosystem co-builders.

Huang Feng - President, Cornex New Energy

President Huang Feng noted that the industry faces both fierce competition and supply shortfalls, yet remains in a golden period of rapid growth. He forecasted global energy storage installations reaching 550-600 GWh in 2025, with overseas markets surpassing China for the first time.

He explained the company's “four-circle growth model,” evolving from market entry to customer trust, and then to domestic-global parallel expansion, positioning Cornex as a rising force shaping future industry ecosystems.

10th International Energy Storage Innovation Competition

A Decade of Excellence: Recognizing Industry Benchmarks

The preliminary awards ceremony of the 10th International Energy Storage Innovation Competition was held during the opening ceremony. Out of 183 project applications, 129 advanced to the preliminary round, and after rigorous review, 77 projects won the Outstanding Project Award.

Over the past decade, the competition has witnessed every major technological iteration and set recognized benchmarks for the industry. The winning projects will advance to the annual finals to compete for the highest honors.

CEO Roundtable

Toward 2030: Reshaping the Global Energy Storage Ecosystem

In 2025, industry reshuffling intensified amid complex global trade dynamics. The CEO roundtable - “Toward 2030: Synergy & Prospect Between China's Energy Storage and the Global Industrial Ecosystem” - became a highlight of the Summit.

The CEO roundtable was hosted by Yu Zhenhua, Executive Vice Chairman of CNESA, participants included: Prof. Zheng Zhifeng (College of Energy, Xiamen University), Cui Jian (President of Kehua Digital Energy), Yang Guang (CTO, HyperStrong), Yang Rui (Chairman, Shuangdeng Group), Lian Zhanwei (Chairman, XYZ Storage), Yang Bao (President, Trina Storage), Richard Wan (VP, Potisegde), Zhu Wei (SVP, Phoenix Contact China), etc.

Discussions centered on global strategy, supply-chain collaboration, ecosystem development, and technology innovation as the core driving engine for 2030 competitiveness.

Three Parallel Sessions

Overseas Markets • Technology Innovation • Computing Power

+ Energy Storage

Session 1: Overseas Energy Storage Opportunities & Business Models

Hosted by Richard Wan (VP, Potisegde), experts from academia and industry - including Prof. Chen Haoyong (South China University of Technology), Liu Yudong (Senior Solutions Director, Kehua Digital Energy Overseas), Li Zhongli (VP, HyperStrong Europe),Richard Wan (VP, Potisegde), Alessandro Wei (Engineering Director, Green Gold Energy), Salomon Martens (CEO, DRSOLAR Denmark ApS) and others - shared insights on grid-forming storage, battery intelligence, grid-structured energy storage technology, ultra-safety systems, and commercial opportunities across Europe and Australia.

The International Roundtable 1 focused on “Overseas Energy Storage Opportunities and Ecosystem Collaboration.” Under the moderation of Prof. Chen Haoyong, South China University of Technology (part-time professor, Universiti Tunku Abdul Rahman), the discussion brought together Sun Rongtao, President of Strategic Investments, China, Saudi Aramco; Salomon Martens, CEO of DRSOLAR Denmark; Alessandro Wei (Wei Xiaowei), Engineering Director of Green Gold Energy; Wang Yichao, Deputy General Manager of XYZ Storage; and Shi Wenbo, President of the Hisense Network Energy and Vice Chairman of KE Electric. They engaged in an in-depth exchange on strategies for overseas market expansion and ecosystem collaboration.

Session 2: Advanced Energy Storage Technology & Solutions

Hosted by Huang Junhui, former Deputy Director of SGCC Jiangsu Institute of Economic Research, Lin Jinshui, senior expert in energy storage solutions of Kehua Digital Energy; Li Ming, global product management head of Trina Storage; Yang Xinyu, market development manager of Ampace; Li Bingzhang, director of energy storage technology of Zhuzhou CRRC Times Electric; Tan Cheng, industry manager of Phoenix Contact; Wu Junjie, marketing manager of Prima Power Sheet Metal Equipment (Suzhou); Kalina Pelovska, chief investment officer of Renalfa IPP; Robert Kraszewski, CEO of RJS Construction; and Fu Chungui, industry director of Hymson Laser Technology shared insights on grid-forming storage, AIDC applications, full life cycle safety protection and intelligent upgrade of production lines under Document 136, and BESS commercial applications in Eastern Europe.

The International Roundtable 2 focused on “the demand distribution and potential of emerging energy storage markets”. Under the moderation of Wendy Wen (Wen Mingyuan), the discussion brought together Kalina Pelovska, chief investment officer of Renalfa IPP GmbH (Austria/Bulgaria); Gabriel Nenov, head of the energy storage division (eastern Europe) of Solarpro Technology AD; Robert Kraszewski, COO (Denmark) of RJS construction ApS; andLi Fengzhi, general manager of overseas marketing team of SAV Digital Power. They engaged in an in-depth exchange on opportunities and challenges in the global energy storage market.

Session 3: Energy Storage + Data Centers (AIDC)

Hosted by Zhang Jianing, senior policy research manager of CNESA, Zhong Yihua, VP of Shuangdeng Group; Li Yusheng, deputy director of the information energy innovation center of China Mobile Group Design Institute; Peng Huana, deputy chief engineer of Fujian Yongfu Power Engineering; Li Xu, technical expert of the power solutions department of Vertiv; Luo Guirong, former technical director of Kehua Data; Lu Zongshuo, product marketing manager of Ampace; Ding Changfu, senior product manager of Hithium Energy Storage; Zhang Wenjian, director of TAOS Data; Yang Qian, senior solution expert in the energy industry of Inspur KaiwuDB. They engaged in an in-depth exchange on the deep integration of "energy storage + computing power", high-rate and high-safety lithium battery solution empowering AIDC and green construction practice under the synergy of computing and electricity, and further explored how time series data and multimodal AI unlock the value of data assets in the energy industry.

The 2025 CEO Summit brought together the core strengths of the energy storage ecosystem to envision new scenarios, new landscapes, and new growth paths. Standing at the year's end and looking toward the future, we firmly believe that energy storage is not only a support technology for power systems but also a key engine driving global green transformation.

Toward 2030, let us take this Summit as a new starting point - strengthening collaboration, embracing open innovation, accelerating global supply-chain development, and co-building a win-win ecosystem.

With joint efforts across domestic and international markets, the industry will shift from rapid expansion to high-quality growth and inject strong, certain “Chinese contribution” into global energy security and a net-zero future.

A new journey begins - let us advance together, break the waves, and co-create a zero-carbon future.

CENSA Upcoming Events:

Apr. 1-3, 2026 | The 14th Energy Storage International Conference & Expo

Register Now to attend, free before Dec 31, 2025.

Energy Storage Leaders Converge in Xiamen: Executives from Ten Industry Giants Share Insights at the 2025 China Energy Storage CEO Summit

Source: CNESA

On December 4, 2025, the “2025 China Energy Storage CEO Summit & the 10th International Energy Storage Innovation Competition - Preliminary Round,” hosted by the China Energy Storage Alliance (CNESA) and co-hosted by Xiamen University, Kehua Digital Energy, and Cornex New Energy, was successfully held in Xiamen.

The summit brought together top leaders from the most influential companies in the energy storage sector - Kehua Data, Envision Energy, Cornex New Energy, Shuangdeng Group, XYZ Storage, Trina Storage, HyperStrong, Potisegde, and Phoenix Contact. Chairmen, presidents, and key executives gathered to explore breakthroughs in energy storage technology, global strategies, and the construction of a robust industrial ecosystem. Their insights not only represent the direction of their companies but also reflect the core trajectory and future momentum of China's energy storage industry.

Chen Chenghui

Chairman, Kehua Data

“Charting the course forward means not only seizing opportunities but anchoring growth in technological innovation and safeguarding it through coordinated standards. Going fast alone is not enough - only through openness, cooperation, and ecosystem-wide collaboration can we enhance the quality and sustainability of global energy transition.”

Tian Qingjun

Senior Vice President, Envision; President, Envision Energy

“Chinese energy storage enterprises are born global. Going overseas has shifted from being an option to a matter of survival. In the face of inevitable globalization and its risks, the industry must evolve from simply going out to truly integrating in. Deep local operations and international talent development are key to long-term presence. At the same time, companies should foster competitive collaboration across the value chain, avoid vicious price wars, and win global respect through long-term value and quality.”

Huang Feng

President, Cornex New Energy

“We respect technology, respect safety, and respect quality - technology is the key to improve performance and cost challenges, and quality is the foundation of market confidence. In a race defined by both speed and endurance, only continuous innovation and customer alignment can lead to shared value.”

Cui Jian

President, Kehua Digital Energy

“Grid-forming technology has become a fundamental necessity for energy storage. In the future, PCS will no longer distinguish between ‘grid-following’ and ‘grid-forming’; the technologies will converge. Through deep technical refinement and intelligent upgrades, we will support the stable operation of new power systems and enable diverse value creation.”

Yang Rui

Chairman, Shuangdeng Group

“Energy storage companies must be ‘born global’ and capable of ‘deep globalization’. In certain high-certainty tracks such as AIDC, the real challenge lies in whether an organization can truly capture and sustain explosive market opportunities. By prioritizing talent and building a ‘carrier-class architecture’, we aim to lead with products and efficiency, establishing a resilient moat for long-term survival in fast-paced cycles.”

Lian Zhanwei

Chairman, XYZ Storage

“Safety is the lifeline of the energy storage industry. Innovative technologies such as immersion liquid cooling represent proactive breakthroughs for high-safety application scenarios. We look forward to working with the industry to advance energy storage toward higher safety, efficiency, and reliability.”

Yang Bao

President, Trina Storage

“Global experience in solar has paved the way for storage going overseas. With global networks and localized teams, we are accelerating the deep integration of solar and storage, enabling technology and markets to evolve together, and delivering value across regions and cultures in the global energy transition.”

Yang Guang

Chief Technology Officer, HyperStrong

“Strong partnerships and complementary strengths are vital to ensuring stable industrial delivery. Facing diverse global application scenarios, we are advancing platform-based products and AI-driven strategies to deeply integrate ‘Energy Storage + X’ and provide customized solutions for different markets.”

Richard Wan

Vice President of Technology, Potisegde

“Full-stack independent development is the foundation of quality, and global-localized delivery is the guarantee of stability. We adopt EV-grade standards for energy storage and build a closed-loop technology chain with intelligent manufacturing, reinforcing safety and efficiency amid intensifying competition.”

Zhu Wei

Senior Vice President, Phoenix Contact China

“Rooted in China, serving the world. We combine a century of electrical engineering experience with local R&D and manufacturing, providing secure and efficient system-level support for complex, multi-scenario energy storage applications through advanced connectivity and industrial automation technologies.”

As a key prelude to the 14th Energy Storage International Conference and Expo (ESIE 2026), the 2025 China Energy Storage CEO Summit served not only as a platform for high-level intellectual exchange but also as a catalyst for deeper industry collaboration. Leading companies including Kehua Digital Energy, Envision Energy, Cornex New Energy, Shuangdeng Group, XYZ Storage, Trina Storage, HyperStrong, Potisegde, and Phoenix Contact have confirmed participation in ESIE 2026 and will showcase their latest technologies and solutions at this global energy storage event.

We sincerely invite industry colleagues to join us next year as we work together to advance the energy storage industry toward higher quality and greater sustainability.

CENSA Upcoming Events:

Apr. 1-3, 2026 | The 14th Energy Storage International Conference & Expo

Register Now to attend, free before Dec 31, 2025.

Down 35% Year-on-Year! CNESA Analysis of Installed Capacity of the New Grid&Source-Side Energy Storage Projects in October

Source: CNESA

After a small installation peak in September, China's new energy storage market saw a temporary decline in October 2025. According to incomplete statistics from the CNESA Datalink Global Energy Storage Database, both the month-on-month and year-on-year growth of newly commissioned capacity declined in October, mainly due to project cycle factors. Meanwhile, profound structural changes are taking place in the market:

● Short-term decline while long-term growth:

Although October's installed capacity declined, the cumulative capacity in the first ten months of 2025 still maintained a robust 36% growth, and 7-9 GW of projects are expected to come online before year-end, suggesting a record-breaking annual installation.

● Independent storage takes the lead:

In October, independent energy storage projects accounted for more than three-quarters of total installations, becoming the absolute main force.

● Third-party enterprises surpass state-owned giants:

A landmark shift occurred - “third-party enterprises”, represented by equipment manufacturers, accounted for over half of the newly installed capacity for the first time, surpassing traditional large energy groups and highlighting a clear trend toward diversified investment.

● Diverse technologies and accelerated non-lithium deployment:

In addition to mainstream lithium-ion systems, technologies such as compressed air, flow batteries, and flywheels are being accelerated in planning and construction, injecting new momentum into the industry's long-term development.

Overall Analysis of New Energy Storage Projects in October

According to incomplete statistics from the CNESA Datalink Global Energy Storage Database, in October 2025, China added 1.70 GW / 3.52 GWh of newly commissioned new energy storage capacity - down 35% and 49% YoY, and 51% and 66% MoM, respectively. Although the first month of Q4 saw a decrease, total new capacity from January to October reached 35.8 GW, up 36% YoY. Following the September commissioning surge, the October decline mainly reflected the influence of construction cycles.

As of the end of October, about 7-9 GW of new energy storage projects were under commissioning or scheduled for grid connection by year-end. If these projects proceed as planned, China's new commissioned capacity in 2025 could reach 42-45 GW. This estimate is based solely on currently known under-construction/commissioned project data and does not represent a final forecast.

Figure 1. Installed Capacity of Newly Commissioned New Energy Storage Projects in China, Jan-Oct 2025

Source: CNESA Datalink Global Energy Storage Database

https://www.esresearch.com.cn/

Note: Year-on-year (YoY) compares the same period last year; month-on-month (MoM) compares the previous statistical period.

Analysis of Grid&Source-side New Energy Storage Projects in October

In October, newly commissioned grid&source-side new energy storage capacity totaled 1.51 GW / 3.04 GWh, representing year-on-year declines of 35% and 49%, and month-on-month declines of 53% and 69%.

Key trends included:

Independent storage accounts for over 75%, with capacity down 30% YoY

Independent energy storage added 1.18 GW / 2.31 GWh, down 30% and 48% YoY, with 78% of projects above 100 MW.

On the source side, new installations totaled 327.5 MW / 735 MWh, representing a YoY growth of -47%/-52%, all paired with renewable energy projects, involving various specific application scenarios including UHV DC transmission and solar-grazing hybrid application.

Figure 2. Application Distribution of Newly Commissioned Grid&Source-Side Energy Storage Projects in Oct. 2025 (MW%)

Source: CNESA Datalink Global Energy Storage Database

https://www.esresearch.com.cn/

Note: “Others” include substations and similar facilities.

Western China accounts for over 50% of new installations; Ningxia and

Shanxi lead in scale

By region, western China contributed over half of October's new capacity, with the northwest region alone accounting for nearly 30%, the highest nationwide.

By province, Ningxia and Shanxi province ranked joint first in new power capacity, while Ningxia topped in new energy capacity.

As a key national new energy demonstration zone, Ningxia's renewable capacity had exceeded 50 GW by August 2025, representing 60% of total power installations - with solar surpassing coal to become the largest power source.

High proportions of wind and solar have created growing demand for storage to smooth grid fluctuations and enhance renewable integration. In addition, large-scale national initiatives such as the “Desert, Gobi and Wasteland” renewable base and UHV DC transmission projects have further expanded the application space for energy storage in Ningxia.

Figures 3. Regional Distribution of Newly Commissioned Grid&Source-Side New Energy Storage Projects in China, Oct. 2025 (MW%)

Source: CNESA Datalink Global Energy Storage Database

https://www.esresearch.com.cn/

Figures 4. Provincial Distribution of Newly Commissioned Grid&Source-Side New Energy Storage Projects in China, Oct. 2025 (MW%)

Source: CNESA Datalink Global Energy Storage Database

https://www.esresearch.com.cn/

Third-party enterprises drive growth, highlighting diversification of

investors

Driven by rising market demand, national policy incentives, technological diversification, and declining costs, the energy storage market's investment ecosystem is becoming increasingly diverse.

In October, projects invested by private power companies such as Fuguang New Energy and Yunsheng New Energy and energy storage/new energy manufacturers such as PotisEdge and Natrium Times (NTEL) accounted for over 50% of new installations - up 18 percentage points from September.

Nevertheless, large state-owned energy groups remain key players due to their advantages in project investment scale, construction coordination, and operational management.

In October, China's “Five Major and Six Minor” and “Two Grid and Two Engineering” state-owned power enterprises contributed 46% of newly installed capacity. Among them, “Five Major and Six Minor” and “Two Grid and Two Engineering” including CHN Energy, SPIC, and China Three Gorges Corporation accounted for 31%, down 10 percentage points from September, while the “Two Grid and Two Engineering” increased their share by 4 points.

Figure 5. Ownership Distribution of Newly Commissioned Grid&Source-side New Energy Storage Project in China, Oct. 2025 (MW%)

Source: CNESA Datalink Global Energy Storage Database

https://www.esresearch.com.cn/

Note: “Third-party enterprises” refer to entities other than large state-owned generation groups, the two grid companies, two construction groups and local energy companies.

Acceleration in non-lithium technology deployment

From a technical perspective, newly commissioned grid&source-side projects were dominated by lithium iron phosphate batteries, accounting for 98.5% of capacity, with sodium-ion batteries representing 1.5%.

In terms of planned and under-construction projects, deployment of non-lithium technologies such as compressed air and hybrid storage is accelerating, signaling faster diversification of technology pathways.

Compressed air: Multiple 100 MW-level compressed air projects have completed filing and entered the planning stage; the 350 MW Anning (Yunnan) compressed air project has begun construction.

Hybrid storage: Hebei Province announced a pilot list including 97 hybrid projects totaling 13.82 GW; construction of two 100 MW lithium + flow battery projects began in Weifang, Shandong; the 100 MW flywheel-lithium hybrid station is under construction in Heishan, Liaoning; the 300 MW / 1200 MWh independent power-side storage project using lithium + flow battery hybrid technology has entered the grid-commissioning stage at Gushanliang, Ordos, Inner Mongolia.

Figure 6: Technological Distribution of Newly Commissioned Grid&Source-Side New Energy Storage Projects in China, Oct. 2025 (MW%)

Source: CNESA Datalink Global Energy Storage Database

https://www.esresearch.com.cn/

The China Energy Storage Alliance (CNESA) has consistently adhered to standardized, timely, and comprehensive information collection practices to continuously track developments in energy storage projects. Leveraging its long-term data accumulation and in-depth professional analysis, CNESA regularly publishes objective market analyses on installed energy storage capacity, providing valuable references for industry decision-making. Since June 2025, the monthly energy storage project analysis has been divided into two sections: “Grid&Source-Side Market” and “User-Side Market”. This issue focuses on interpreting the grid&source-side market in October.

CENSA Upcoming Events:

1. Dec.4-5 | 2025 China Energy Storage CEO Summit | Xiamen, Fujian

Register Now to attend

Read more: http://en.cnesa.org/new-events-1/2025/12/4/dec4-5-2025-china-energy-storage-ceo-summit

2. Apr. 1-3, 2026 | The 14th Energy Storage International Conference & Expo

Register Now to attend, free before Oct 31, 2025.