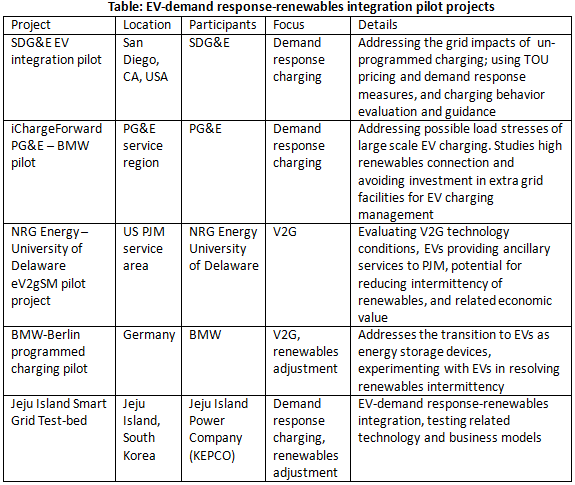

On March 3rd, the National Energy Administration released “Guiding Opinions on Establishing Renewable Energy Portfolio Standards,” which set renewable energy consumption targets for China. The country aims to rely on renewable energy for 15% of total primary energy consumption by 2020, and 20% by 2030. Non-hydro renewables should produce 9% of consumed electricity by 2020. The Opinions break down the non-hydro renewable electricity consumption requirements for each province and region, shown below.

| Region | Region | ||

|---|---|---|---|

| Beijing | 10% | Hubei | 7% |

| Tianjin | 10% | Hunan | 7% |

| Hebei | 10% | Guangdong | 7% |

| Shanxi | 10% | Guangxi | 5% |

| Inner Mongolia | 13% | Hainan | 10% |

| Liaoning | 13% | Chongqing | 5% |

| Jinan | 13% | Sichuan | 5% |

| Heilongjiang | 13% | Guizhou | 5% |

| Shanghai | 5% | Yunnan | 10% |

| Jiangsu | 7% | Tibet | 13% |

| Zhejiang | 7% | Shaanxi | 10% |

| Anhui | 7% | Gansu | 13% |

| Fujian | 7% | Qinghai | 10% |

| Jiangxi | 5% | Ningxia | 13% |

| Shandong | 10% | Xinjiang | 13% |

| Henan | 7% | Total | 9% |

Based on the government 2020 forecasts for power consumption and renewable energy capacity, we made a few simple calculations.

| 2020 Installed Capacity | 2020 Annual Use-Hours | 2020 Generation | |

|---|---|---|---|

| Wind | 250 GW | 1728 hours | 432 TWh |

| Solar PV | 160 GW | 1133 hours | 181.3 TWh |

Sources: Renewable Energy Development 13th Five Year Plan (Draft Version); 2015 wind and solar generation statistics, NEA

Graph assumes 2020 generation patterns are similar to 2015. 2020 annual generation=Installed capacity*utilization hours. Annual use-hours (利用小时) is derived by dividing total generated electricity over the course of one year (GWh) by the total capacity of the generation fleet (GW).

Assuming that the overall capacity factors for wind and solar in China don’t change from 2015 levels (I’ll get to that in a moment), wind and solar together are expected to produce 613 TWh annually in 2020. The National Development and Reform Commission anticipates that the entire country will consume 7390 TWh in 2020, meaning that solar and wind generation would comprise about 8% of the total. Once you factor in biomass and other non-hydro renewables, you can just about expect to meet the Opinions’ target of 9% renewable electricity production nationwide by 2020.

Is it Ambitious Enough?

While the target earns marks for realism, it struggles to make the grade in terms of ambition. We based our above calculation on wind and solar consumption for 2015. Thing is, wind and solar consumption was disastrous last year. Average solar and wind curtailment reached 10%, with some regions experiencing curtailment rates exceeding 30%.

Additionally, experts are mixed in their assessment of the strength of the new policy. Back in 2012, aware that existing mechanisms wouldn’t be enough to drive renewable energy consumption, the NEA drafted policies establishing renewable energy consumption targets, called the “Renewable Energy Quota Management Method.” The policies included robust assessment and enforcement mechanisms, but due to conflicts of interest, the policies never went into effect.

The newly-announced energy consumption policy published this month cover many of the same topics, but is believed to be pretty weak in comparison with the 2012 draft proposal. Industry players have even dubbed the new rules “Renewable Energy Quota Lite.”

The new energy consumption policy does suggest the creation of a “green certificate” trading mechanism, which would allow utilities unable to meet their renewable energy consumption targets to trade with utilities who consume above their own target. It’s an interesting idea, but it lacks an existing management mechanism, and it doesn’t get to the heart of the problem – that China’s dispatch rules, transmission infrastructure, and regulatory support for distributed energy are still inadequate.

Regulatory gridlock notwithstanding, the government has attempted to address this problem through a variety of channels:

1) Promoting local consumption

Given that renewable energy resources are concentrated in China’s north, the National Energy Administration has been eager to encourage communities in that region to consume locally-generated renewable energy. To do so, the government has expanded direct electricity trading provisions for large consumers.

The results from this effort have been mixed, due to the fact that these areas have very few load centers to begin with. Even local consumers that do directly consume renewable energy often do so in a package deal that includes coal-fired generation to manage wind variability. In reality, these consumers are still buying very little power from renewable sources.

2) Power-to-gas

One option that has been under examination since 2012 has been power-to-gas, in which electricity is used to power hydrogen reformers. This hydrogen can then be transported to load centers via traditional pipelines. A number of influential organizations have begun research or demonstration projects in power-to-gas, including State Grid, Shenhua Group, and China Energy Conservation and Environmental Protection Group.

This method faces challenges as well. A stable hydrogen market is a prerequisite for commercializing power-to-gas, and such a market does not yet exist in China. Additionally, pipelines are firmly under the control of China’s oil companies, who so far have not been proactive in exploring this business model.

3) Energy storage

Combining energy storage with wind and solar production has already drawn significant attention in China. But regulatory barriers still stand in the way of making it a commercially-viable solution.

Let’s take a hypothetical lithium-ion battery energy storage system priced at 3000 RMB (US$460) per kWh, including all supporting equipment. If the battery operates to spec for 3000 cycles at 80% DOD, can the numbers pencil out?

The short answer is no. Such a system would have a lifetime cost of 1.04-1.25 RMB (US$0.16-0.19) per kWh discharged. China’s current feed-in tariff compensates wind generators at a rate between 0.47 and 0.54 RMB (US$0.07-0.08) per kWh. At these rates, generators using energy storage to store wind-produced electricity during times of grid congestion face the hard math that storing electricity costs more than it earns when fed into the grid.

Now, this math changes when those batteries can be dispatched to provide other services, particularly ancillary services to the grid. China’s ancillary services markets are still focused on generator responsibility, and are not yet open to the value that energy storage technologies can provide.

China’s grid is an institution with enormous inertia, so changes are bound to be slow. Nonetheless, we expect that China’s support for energy storage as an emerging technology and its concurrent power sector reforms are a positive signal that changes are on the way.