Source: CNESA

The China Energy Storage Alliance (CNESA) continues to adhere to standardized, timely, and comprehensive information collection criteria, tracking energy storage project developments on an ongoing basis. Leveraging its long-accumulated solid database and in-depth industry expertise, CNESA regularly publishes objective analytical reports on the energy storage installation market, providing valuable references for industry stakeholders. Given the distinct differences between grid-side and user-side energy storage markets, CNESA has, since June 2025, divided its monthly project analysis into two separate reports: grid-side market and user-side market. This edition focuses on the user-side market performance in October.

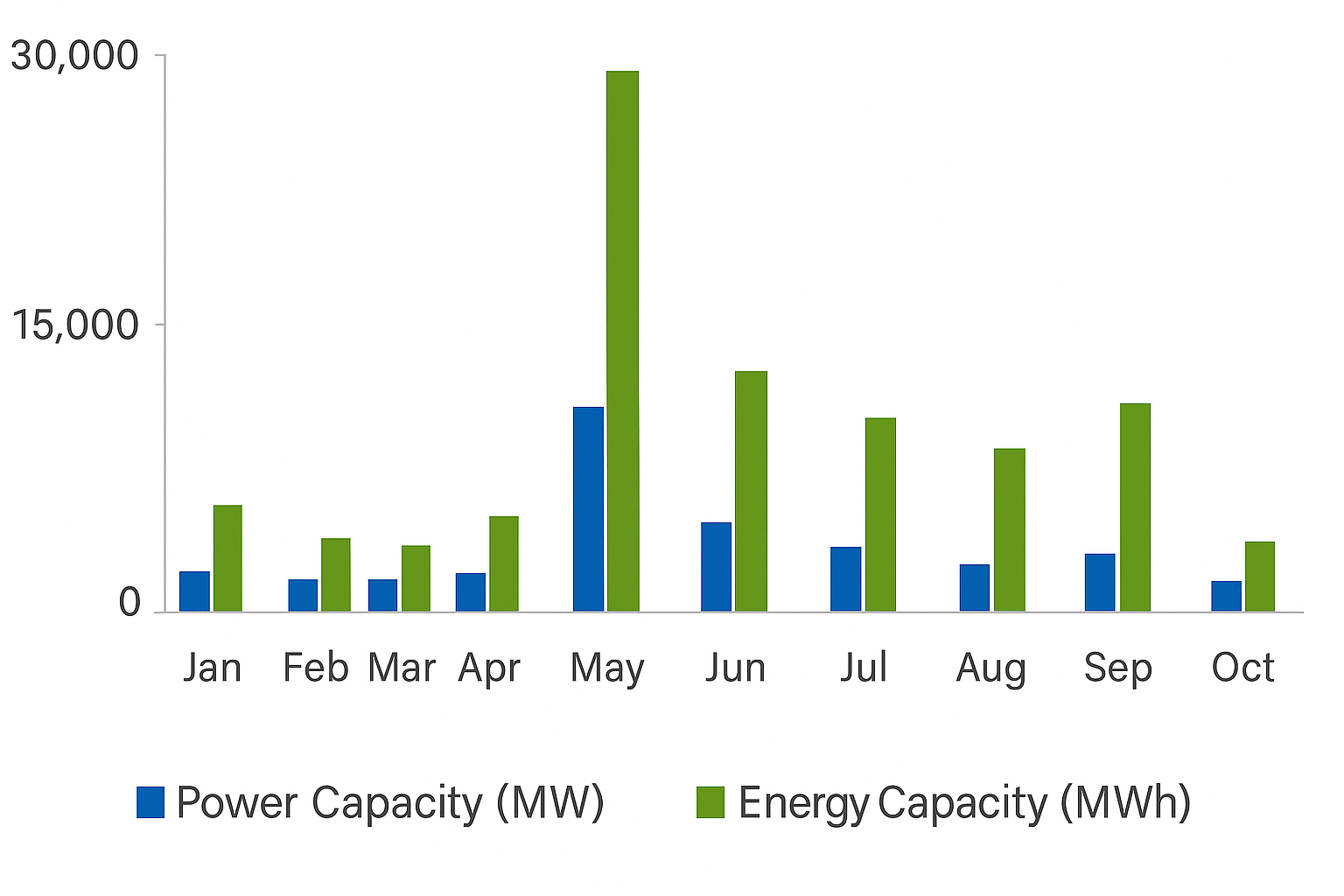

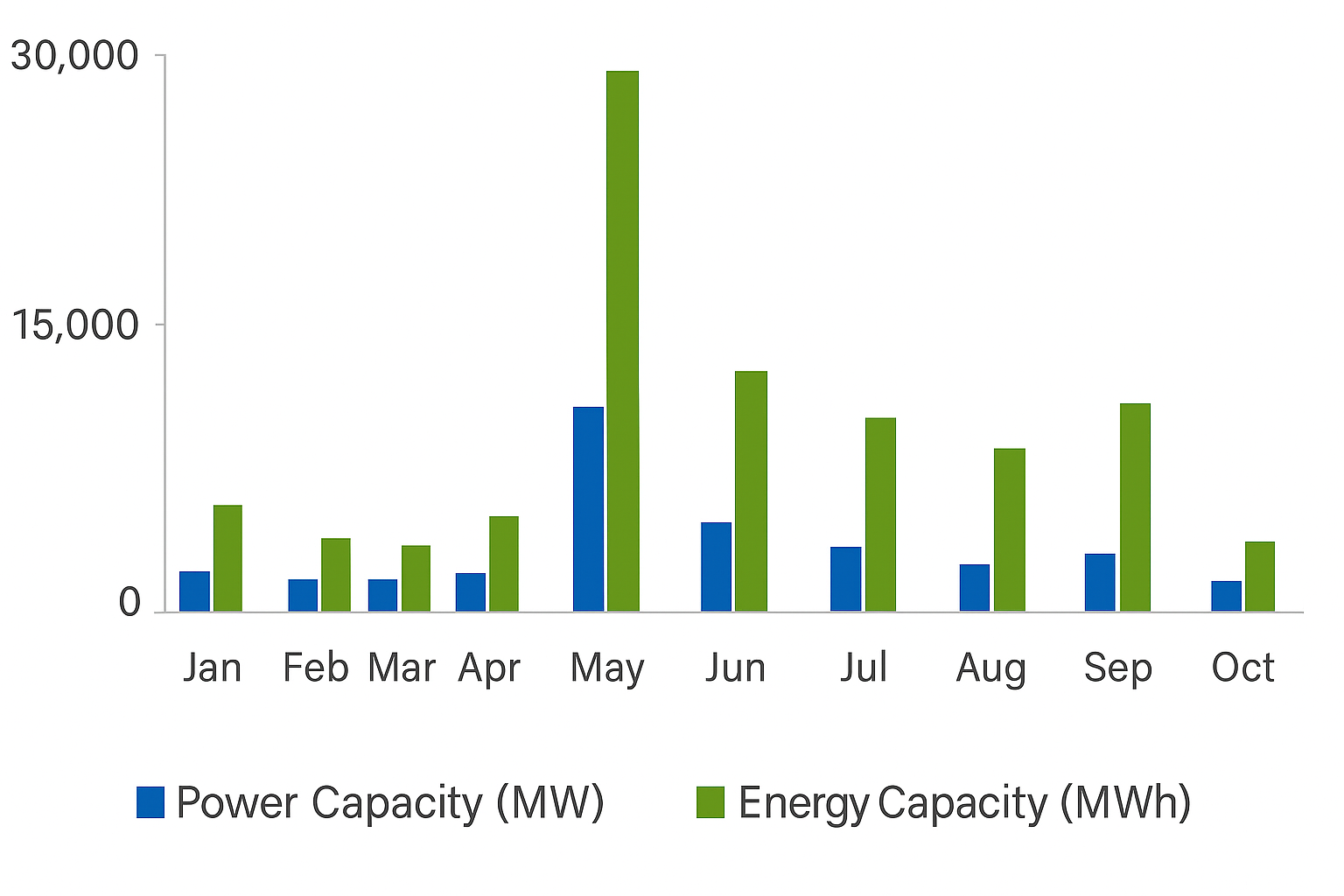

According to CNESA’s preliminary statistics, in October 2025, newly commissioned new-type energy storage capacity in China reached 1.70 GW / 3.52 GWh, representing a year-on-year decline of 35% and 49%, and a month-on-month decline of 51% and 66%, respectively.

Although new installations in the first month of Q4 decreased, cumulative new user-side installations from January to October have reached 35.8 GW, a year-on-year increase of 36%. Following a mini-peak of project commissioning in September, October saw a decline due mainly to project construction cycle constraints.

Figure 1: Installed Capacity of Newly Commissioned New-type Energy Storage Projects in China (January–October 2025)

Data Source: CNESA DataLink Global Energy Storage Database

Website: https://www.esresearch.com.cn/

Note: “Year-on-year (YoY)” compares with the same period last year; “month-on-month (MoM)” compares with the immediately preceding statistical period.

In October, user-side new installations reached 193.45 MW / 474.64 MWh, representing a year-on-year decline of 34% and 48%, and a month-on-month decline of 30% and 17%, respectively. User-side new-type energy storage installations in October demonstrated the following characteristics:

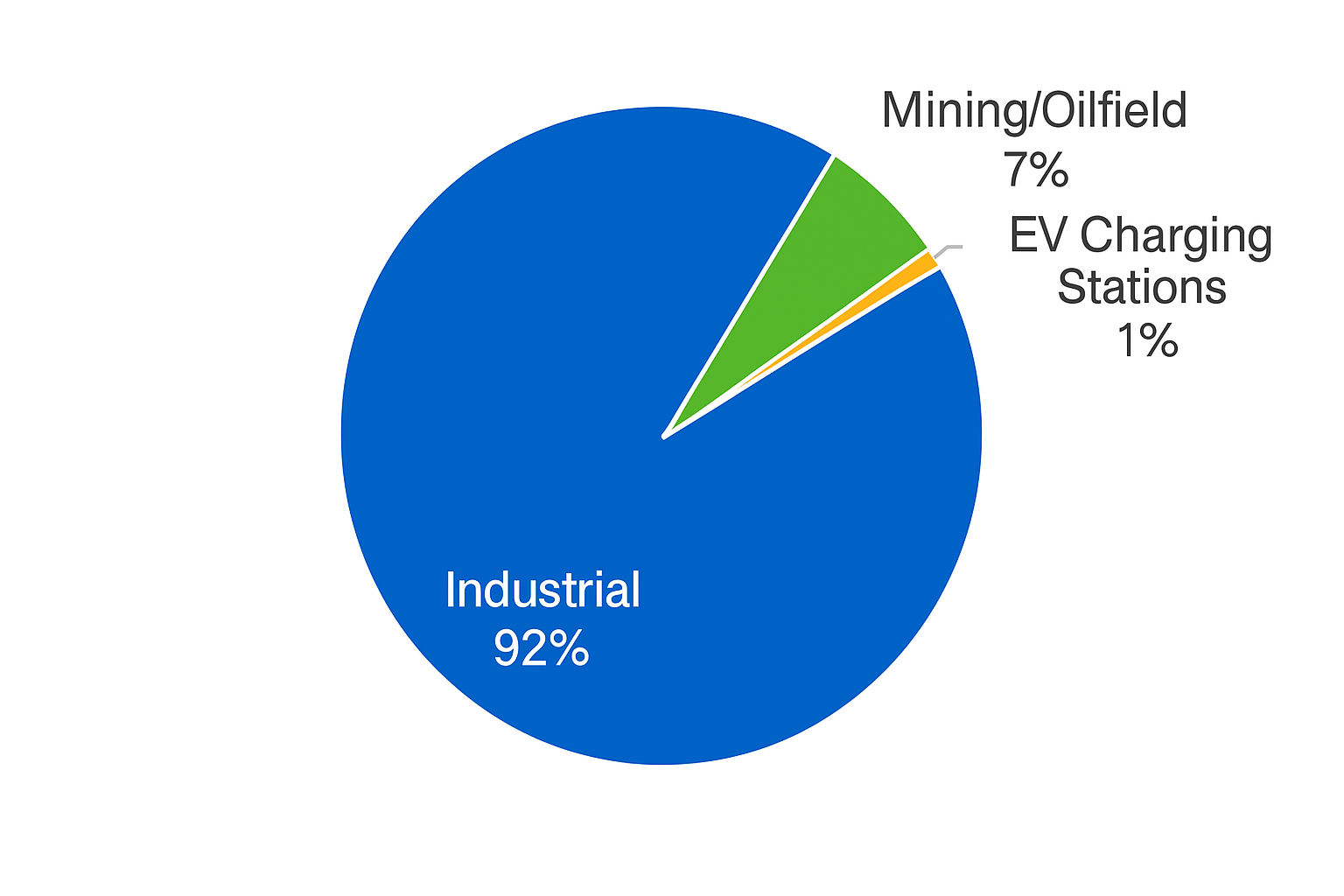

(1) C&I storage dominates; non-lithium technologies are accelerating their deployment.

In October, the user-side storage market was dominated by commercial and industrial (C&I) applications, accounting for over 90% of total new installations.

C&I scenarios added 178.00 MW / 445.19 MWh, down 39% and 51% year-on-year.

From a technology perspective, all newly commissioned projects adopted electrochemical energy storage technologies. LFP (lithium iron phosphate) batteries accounted for 99% of the newly installed power capacity. In terms of non-lithium technologies, a 2 MW / 8 MWh C&I all-vanadium flow battery project was completed and commissioned, alongside a hybrid LFP + vanadium flow battery demonstration project that also came online.

Figure 2 : Application Breakdown of Newly Commissioned User-side New-type Energy Storage Projects in October 2025 (MW%)

Data Source: CNESA DataLink Global Energy Storage Database

Website: https://www.esresearch.com.cn/

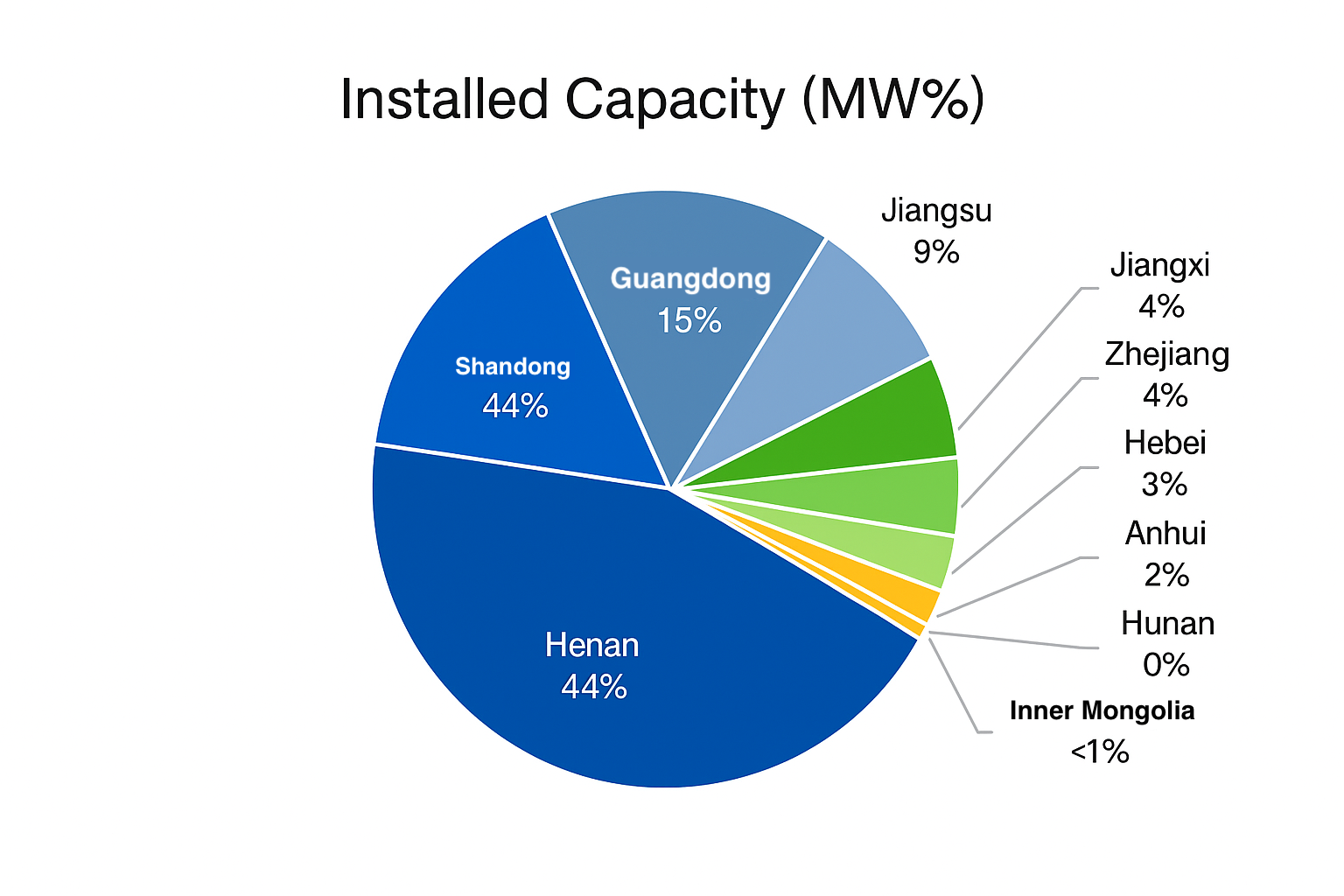

(2) Central China accounts for over 50% of new installations, with Henan leading in total capacity.

From a regional perspective, newly commissioned user-side projects in October were mainly distributed across 11 provinces, including Henan, Shandong, Guangdong, Jiangsu, and Jiangxi. Central China accounted for 50% of the newly added capacity, dominating the October installation market. East China recorded the largest number of newly commissioned projects, making up 38% of the national total. At the provincial level, Henan posted the largest new installed capacity, exceeding 40% of the national total, followed by Shandong. Guangdong ranked first nationwide in terms of the number of newly commissioned projects, contributing over 20%.

As a major industrial province, Henan has a strong presence of high-energy-consuming sectors such as steel, chemicals, and coal-fired power. The province also has a large electricity consumption base, with multiple energy-intensive industries—including steel and cement—facing increasing pressure related to renewable power consumption requirements. Driven by China’s push for green and low-carbon energy transition and industrial enterprises’ needs for carbon reduction, cost reduction, and supply security, user-side storage demand in Henan has expanded rapidly. At the same time, as a major agricultural province, Henan is tapping emerging application scenarios—especially in rural areas—under strong government support. The “green power + energy storage” model is accelerating demand growth in these new sectors, becoming an important new driver for user-side storage development in the province.

Moreover, Henan is one of the earliest provinces in China to advance integrated generation–grid–load–storage projects (source–grid–load–storage integration). As of October 2025, the province had released 14 batches of such projects, with over 650 projects included in the implementation scope. These projects span more than 10 application scenarios, including industrial facilities, rural areas, and data centers, providing broad opportunities for user-side C&I energy storage deployment.

In terms of energy storage revenue performance, following the adjustment of Henan’s C&I time-of-use electricity tariffs in 2024, the number of daily charge–discharge cycles decreased; however, the peak–valley price spread widened, and the duration of peak periods increased significantly—conditions that favor long-duration energy storage. Additionally, with strong demand for emergency support and peak shaving across various scenarios in Henan, C&I users aggregated through virtual power plants (VPPs) can participate in grid peak regulation and receive corresponding compensation.

Figure 3&4: Provincial Distribution of Newly Commissioned User-side New-type Energy Storage Projects in China, October 2025

Data Source: CNESA DataLink Global Energy Storage Database

Website: https://www.esresearch.com.cn/

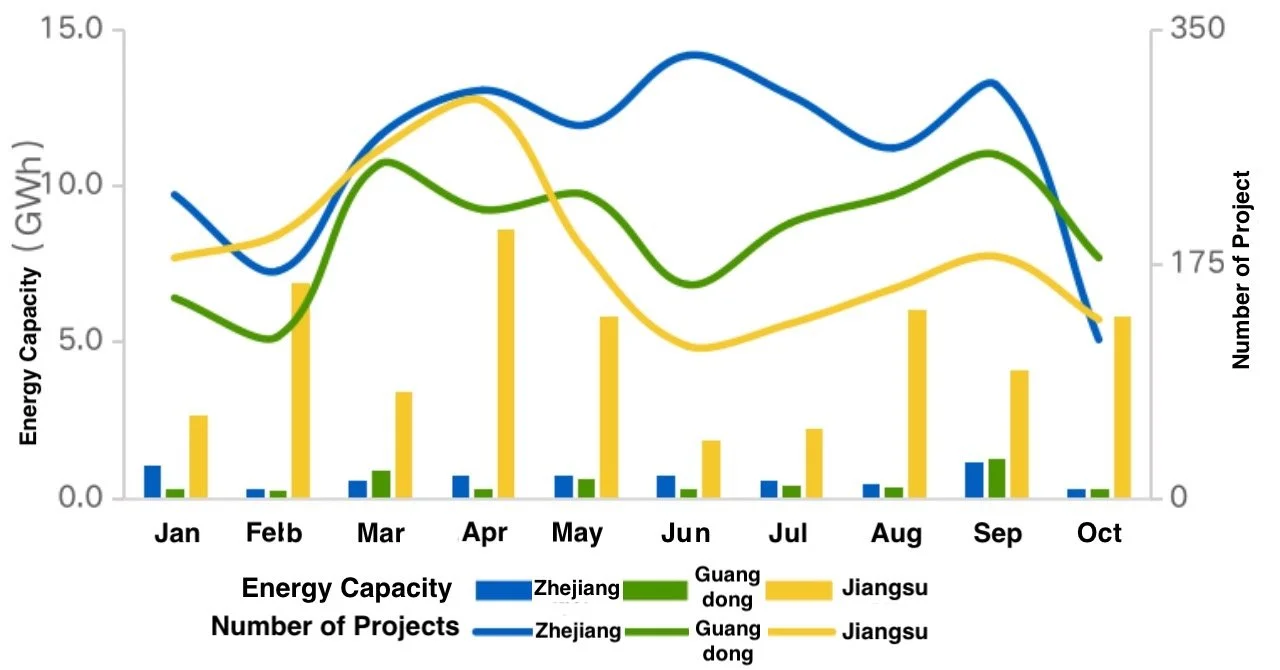

Based on project filings, national user-side market demand in October showed growth compared with the same period last year. Nationwide, both the scale and number of newly filed user-side projects in October exceeded last year’s levels, rising 91% and 4% year-on-year respectively. In traditional core markets, the number of newly filed projects in Zhejiang, Guangdong, and Jiangsu all fell compared with the same period last year. Together, the three provinces recorded 430 new filings, a 41% year-on-year decline, while total energy capacity increased by 37% year-on-year. In October, Guangdong had the highest number of newly filed projects nationwide, but still registered an 8% year-on-year decrease. Jiangsu recorded a 36% decline, while Zhejiang saw the steepest drop, down 64% year-on-year. From the perspective of project scale, Zhejiang’s newly filed energy capacity decreased 26% year-on-year, and Guangdong saw a 52% decline. Jiangsu, however, continued to lead the country in the scale of newly filed projects, with a 60% increase in energy capacity, reflecting a clear trend toward larger average project sizes. In October, Jiangsu’s market scale continued to expand, mainly driven by the rigid demand of C&I enterprises for energy storage to secure power supply and reduce operating costs. Nationwide, Anhui, Henan, and Sichuan collectively recorded 300 new filings, accounting for one-third of all newly filed user-side projects in October. These three provinces demonstrated strong market demand and significant growth potential for user-side energy storage, positioning them as emerging markets likely to drive national user-side storage expansion in the coming years.

Figure 4 : Monthly Trend of Newly Filed Energy Storage Projects in Zhejiang, Guangdong, and Jiangsu (January–October 2025)

Data Source: CNESA DataLink Global Energy Storage Database

Website: https://www.esresearch.com.cn/

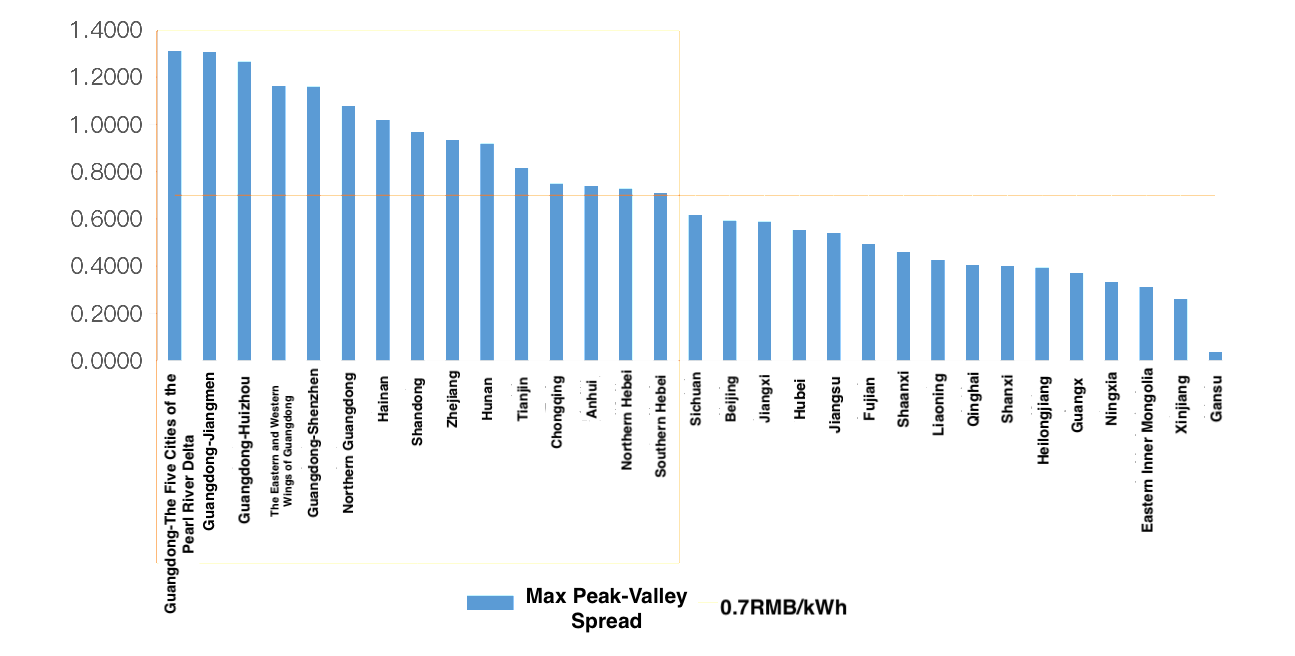

Based on the maximum peak–valley electricity price spread, 15 provinces and municipalities recorded spreads above 0.70 RMB/kWh, and 7 regions exceeded 1.0 RMB/kWh. Guangdong had the largest peak–valley price spread nationwide. In parts of the Greater Bay Area—including the five core cities of the Pearl River Delta, as well as Jiangmen and Huizhou—the maximum spread remained above 1.0 RMB/kWh, mainly due to the continued implementation of critical-peak pricing in the province. In October, many regions discontinued the critical-peak and deep-valley tariff mechanisms that were implemented during the summer peak period. Only five regions—Guangdong, Shandong, North Hebei (Jibei), South Hebei, and Hubei—continued to apply critical-peak pricing, while Shandong, Zhejiang, and Jiangxi maintained deep-valley tariffs. Considering both the maximum peak–valley price spread and the high achievable charge–discharge cycling frequency of user-side storage systems (which can exceed 600 cycles per year), the arbitrage potential in Guangdong remains substantial. Therefore, Guangdong is likely to remain one of the most important and active markets for user-side energy storage in the foreseeable future.

Figure 5: Distribution of Peak–Valley Electricity Price Spreads for Utility Power Purchases Across Regions, October 2025

Data Source: Provincial Grid Companies; compiled and analyzed by CNESA

CENSA Upcoming Events:

1.Dec.4-5 | 2025 China Energy Storage CEO Summit | Xiamen, Fujian

Register Now to attend

Read more: http://en.cnesa.org/new-events-1/2025/12/4/dec4-5-2025-china-energy-storage-ceo-summit

2.Apr. 1-3, 2026 | The 14th Energy Storage International Conference & Expo

Register Now to attend, free before Oct 31, 2025.