Source: CNESA

In November 2025, newly installed user-side new energy storage capacity in China recorded a year-on-year decline of over 65%.

Compared with October, the market structure showed notable adjustments:

Commercial and industrial (C&I) energy storage accounted for nearly 90%, while long-duration energy storage technologies accelerated deployment.

East China contributed more than half of newly commissioned capacity, with Fujian leading in installed capacity.

Although filing activity in traditional user-side markets (Zhejiang, Guangdong, Jiangsu) declined compared with the same period last year, overall demand remained higher year-on-year. Emerging markets such as Anhui, Henan, and Sichuan are becoming new growth engines driving the national user-side energy storage market.

Analysis of User-Side New Energy Storage Projects in November

In November, newly installed user-side capacity reached 185.27 MW / 555.83 MWh, representing -67% / -57% year-on-year, and -5% / +16% month-on-month. User-side new energy storage projects exhibited the following characteristics:

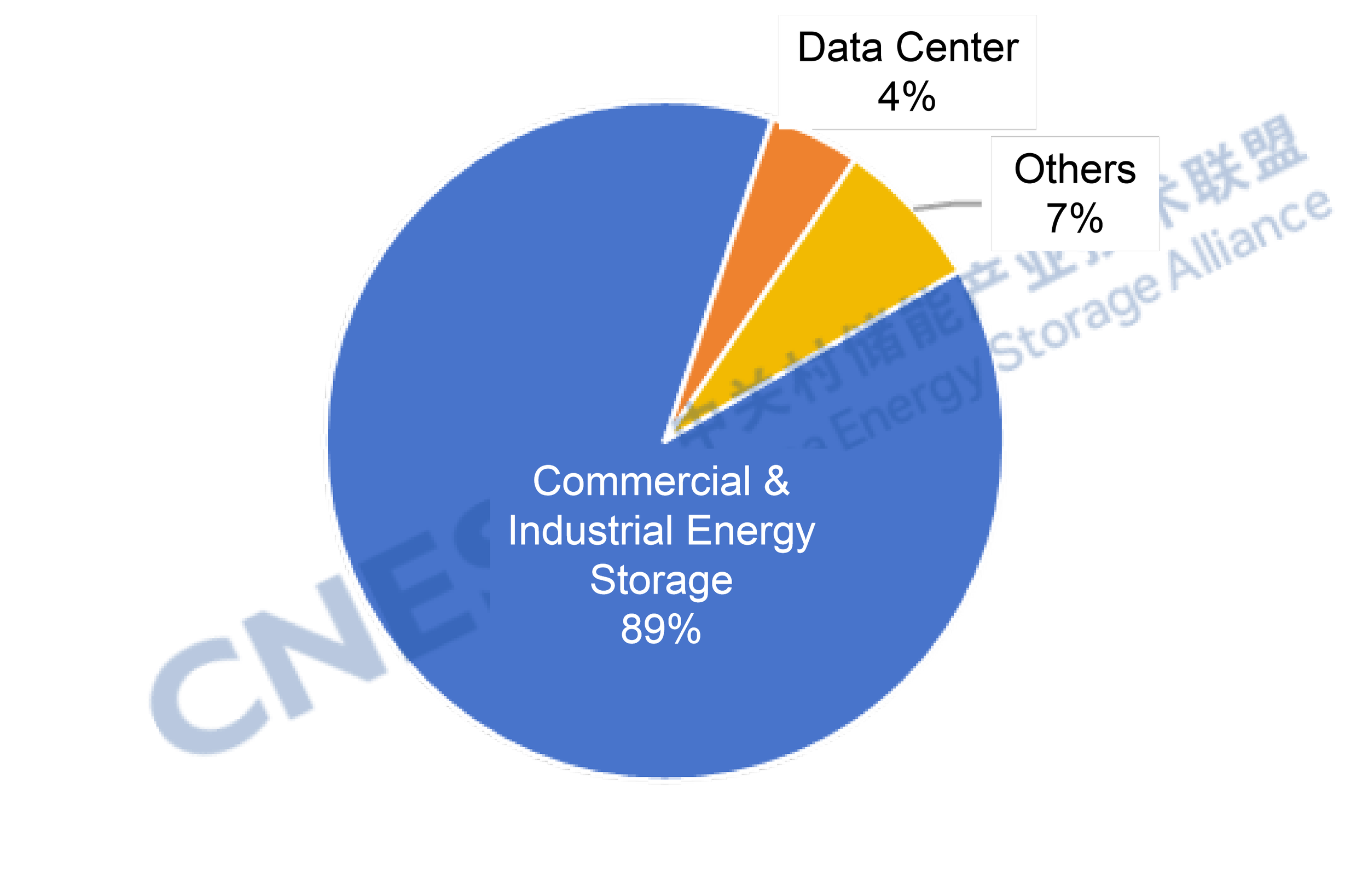

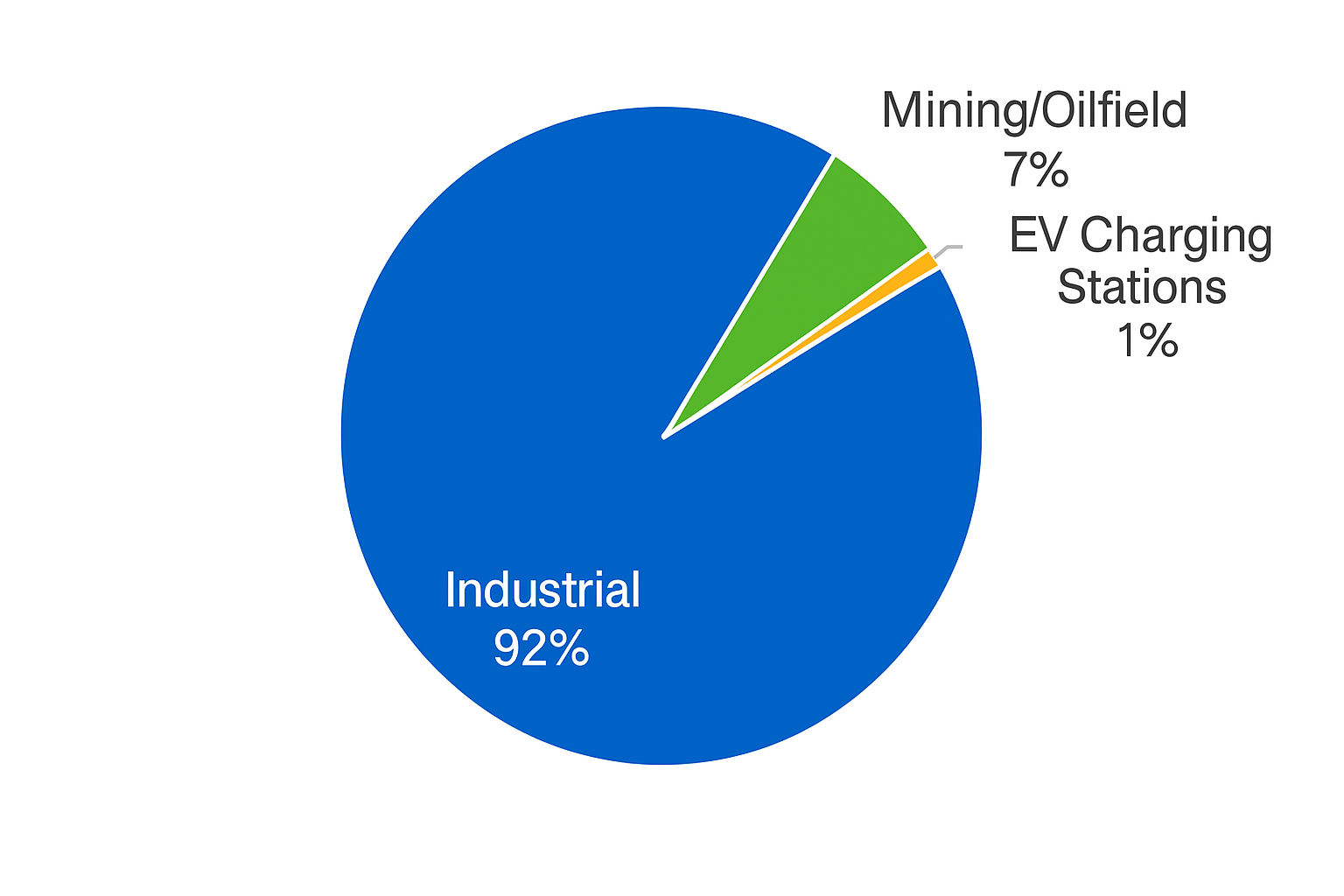

(1) Installed Capacity by Application

In November, the user-side energy storage market continued to be dominated by C&I applications, accounting for nearly 90% of total installations. Newly installed C&I capacity reached 163.9 MW / 541.3 MWh, -68% / -58% year-on-year, and -9% / +15% month-on-month.

The largest data center user-side energy storage project in Zhejiang was officially commissioned. Rapid development of AI data centers (AIDC) and intelligent computing centers is driving growth in user-side energy storage demand.

From a technology perspective, all newly commissioned projects adopted electrochemical energy storage technologies. Lithium iron phosphate (LFP) batteries accounted for over 99% of installed power capacity. In terms of long-duration storage, one 8-hour, 202 MWh lithium-based C&I energy storage project and one 8-hour, 2 MWh all-vanadium redox flow battery project were completed and put into operation.

Figure 1: Application Distribution of Newly Commissioned User-Side New Energy Storage Projects in November 2025 (MW%)

Data Source: CNESA DataLink Global Energy Storage Database

https://www.esresearch.com.cn/

Note: “C&I” includes industrial facilities, industrial parks, and commercial buildings. “Others” include mining areas, oilfields, remote regions, and municipal institutions, etc.

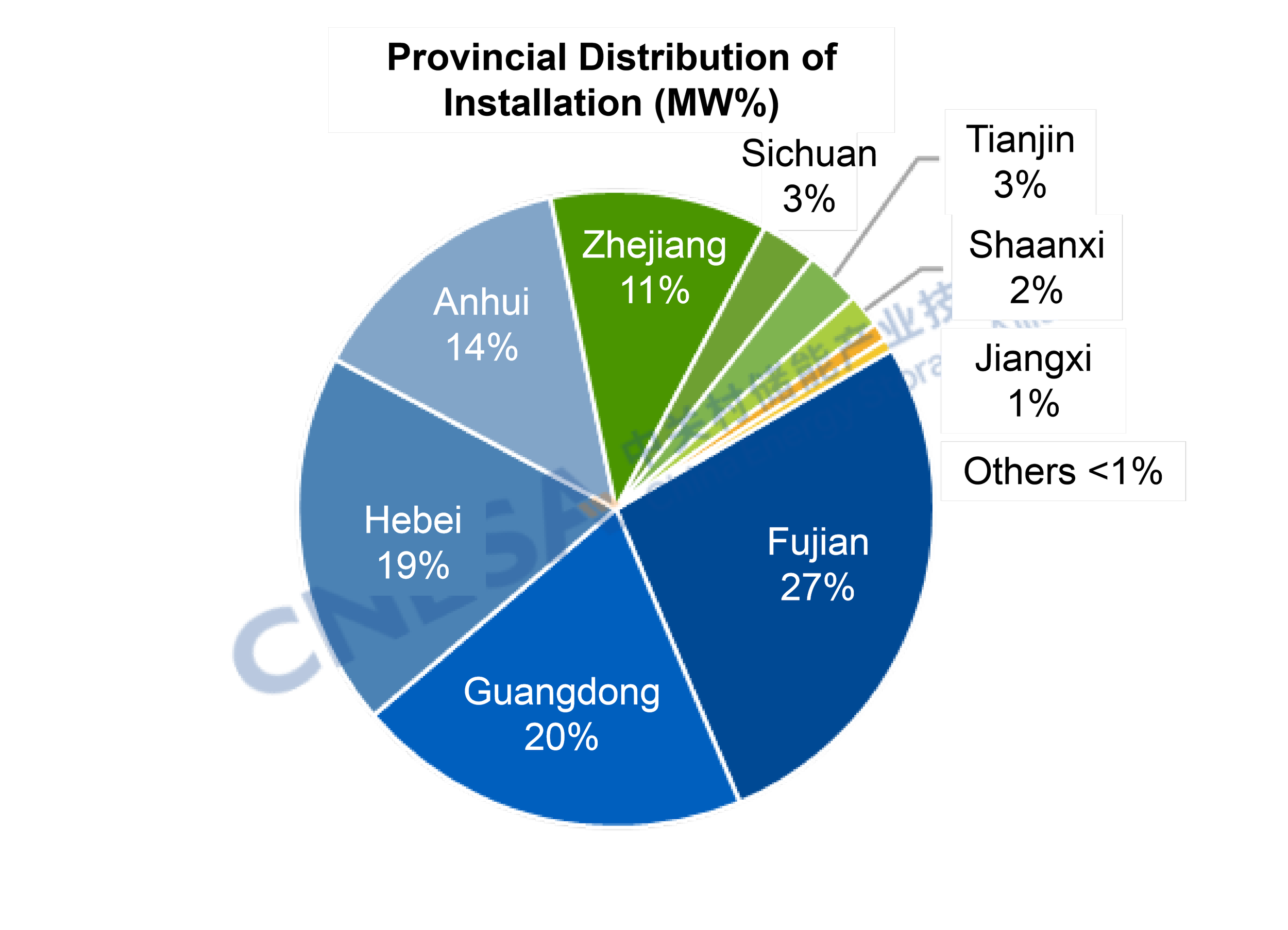

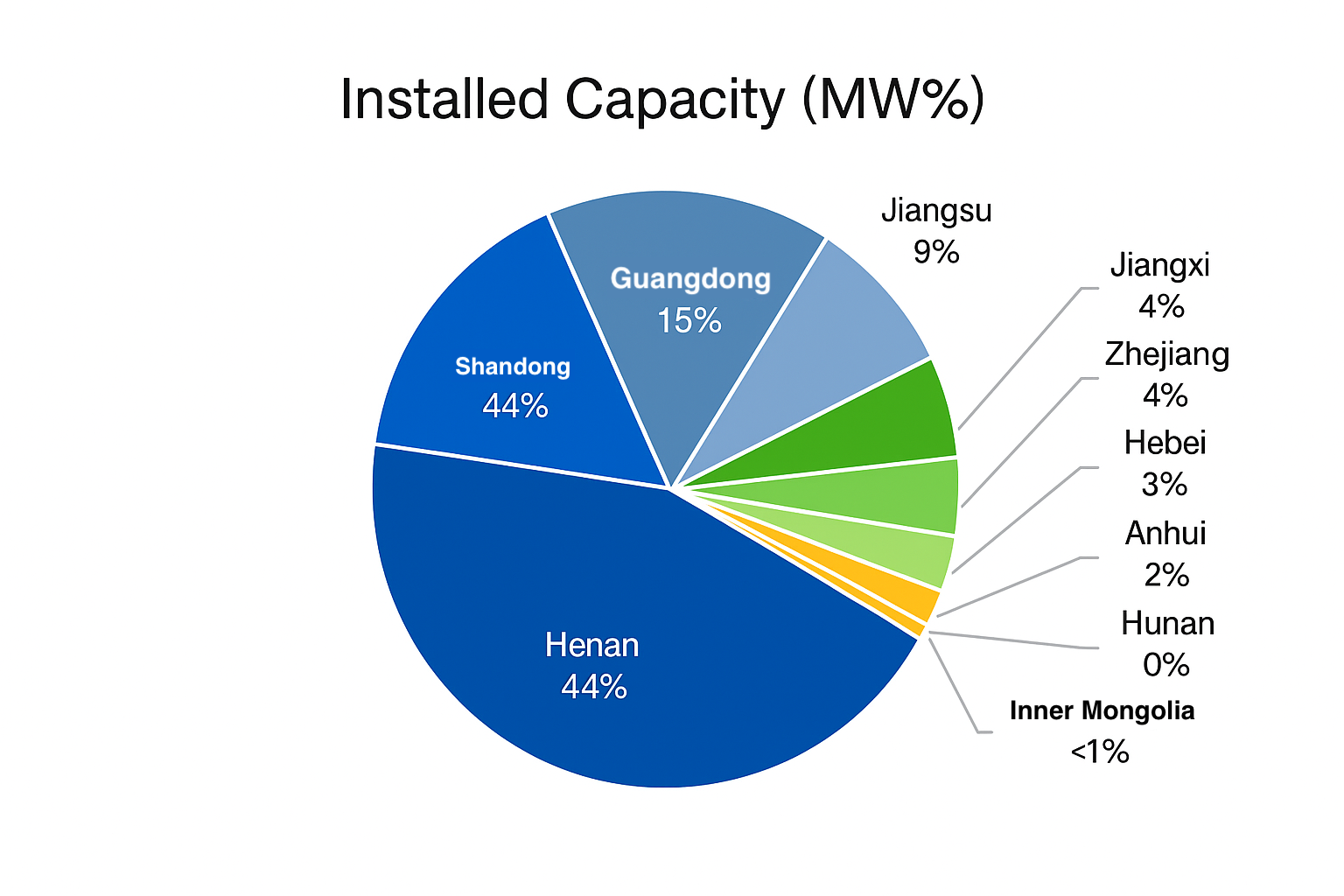

(2) Regional Distribution of User-Side Energy Storage

By region, newly commissioned projects were mainly distributed across 11 provinces, including Fujian, Guangdong, Hebei, Anhui, and Zhejiang. East China led the market in November, accounting for 52% of newly installed capacity and 39% of total projects, ranking first nationwide in both installed scale and number of commissioned projects.

At the provincial level, Fujian recorded the largest share of newly installed power capacity, exceeding 25%, while Hebei led in newly installed energy capacity, accounting for 40%. Guangdong had the highest number of newly commissioned projects, representing over 18%, ranking first nationwide.

Fujian hosts a high concentration of energy-intensive industries such as steel and chemicals, where demand for peak shaving, valley filling, and backup power is strong. In addition, diversified application scenarios - including integrated PV-storage-charging systems and virtual power plant aggregation - are being increasingly developed, leaving substantial growth potential for the user-side energy storage market.

From an industrial and supply chain perspective, Fujian is home to the country's largest lithium battery R&D and manufacturing base, with lithium battery production capacity ranking among the national leaders. Driven by leading energy storage companies, a complete local supply chain has been established for core components such as cells, PCS, BMS, and EMS, effectively reducing overall system costs. Moreover, Fujian supports energy storage project financing through green credit and industrial funds, covering multiple project types including pumped hydro storage and new energy storage.

Figure 2: Provincial Distribution of Newly Operating User-Side New Energy Storage Projects in China, November 2025

Data Source: CNESA DataLink Global Energy Storage Database

https://www.esresearch.com.cn/

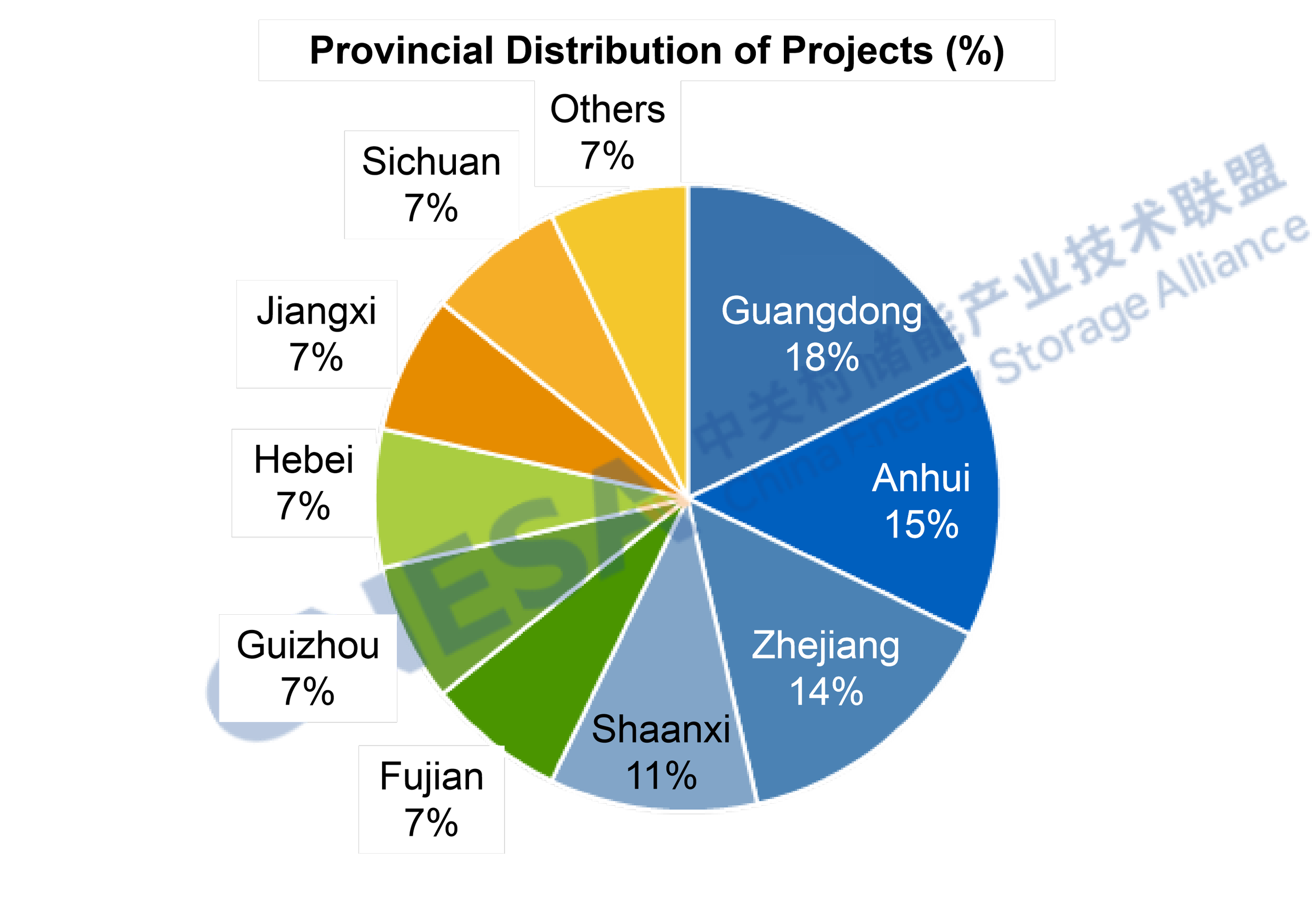

(3) Filed User-Side Energy Storage Projects

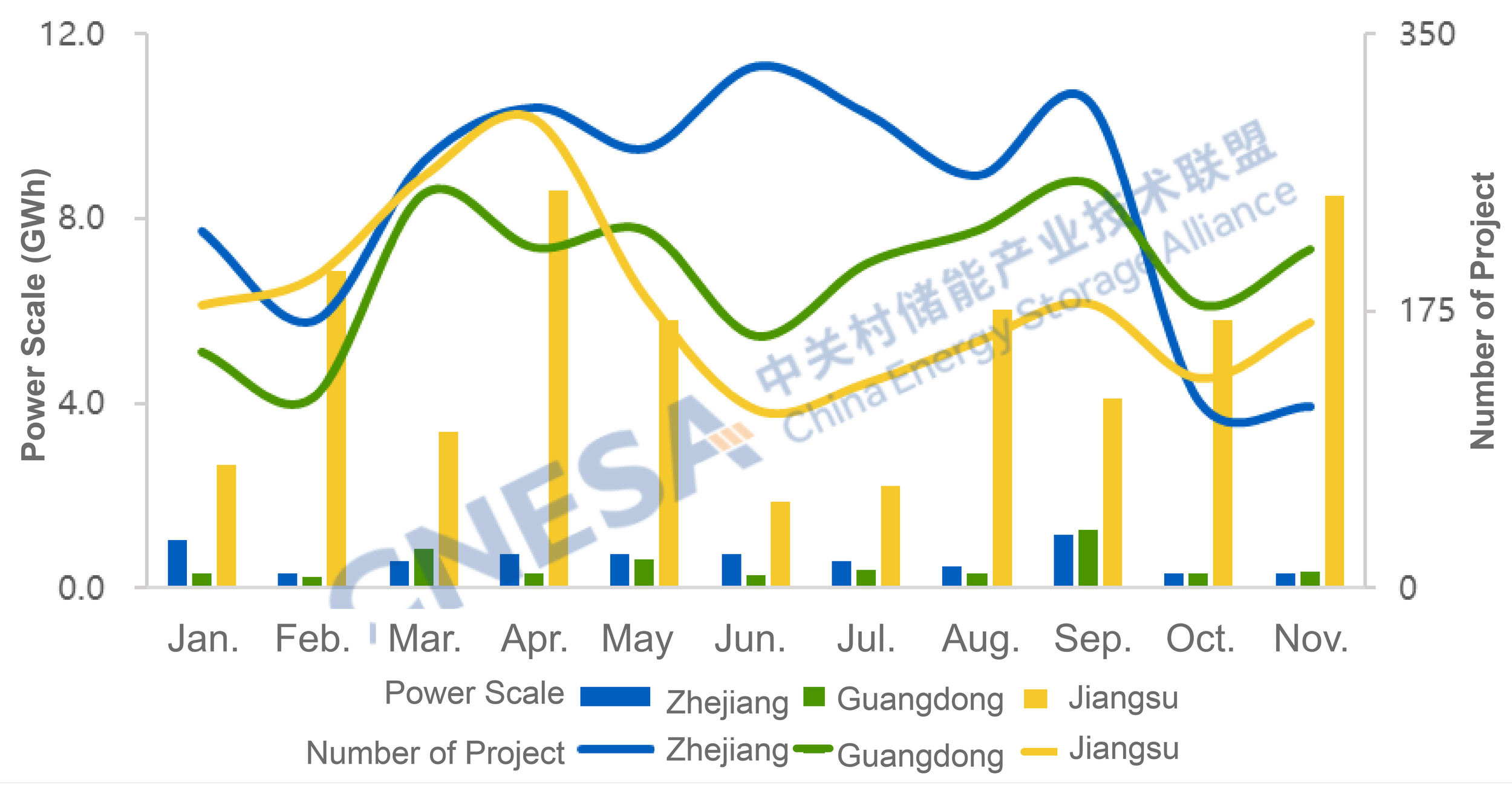

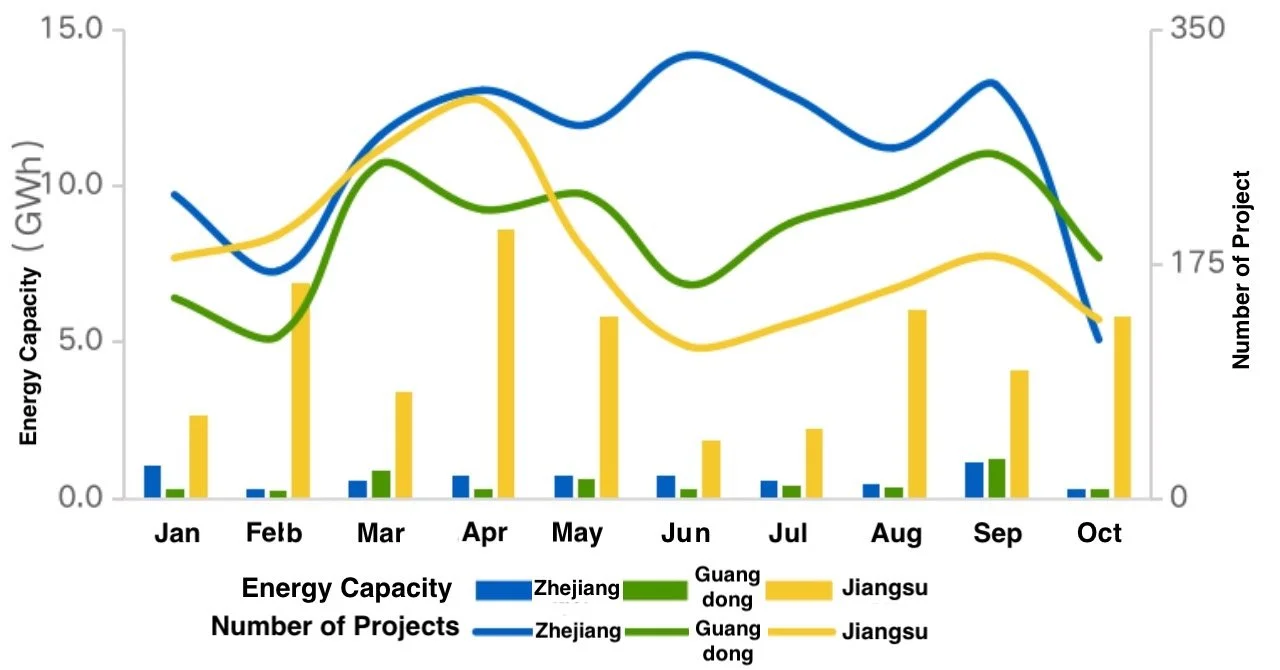

Based on project filings, national user-side market demand in November exceeded the level of the same period last year, with differentiated regional adjustments. Nationwide, both the total scale and number of newly filed user-side projects in November were higher year-on-year, up 8% and 5%, respectively. However, filing activity in traditional markets - Zhejiang, Guangdong, and Jiangsu - declined compared with last year.

Across these three provinces, a total of 497 new projects were filed, down 47% year-on-year, while energy capacity declined 7% year-on-year.

Guangdong recorded the highest number of newly filed projects, but project count fell 25% year-on-year, and scale declined 73%.

Zhejiang saw the largest drop in project count, down 65% year-on-year, with scale decreasing 34%.

Jiangsu recorded a 48% year-on-year decline in project count, but project scale increased 6%.

In November, Jiangsu ranked first nationwide in newly filed project scale. The average project size was approximately twice that of the same period last year, indicating a shift in user-side energy storage development from small-scale, distributed projects toward large-scale, centralized investments in high-quality application scenarios.

Meanwhile, Anhui, Henan, and Sichuan collectively added 440 newly filed projects, up 89% year-on-year and 47% month-on-month, accounting for about 38% of the national total, 5 percentage points higher than in October. Emerging user-side markets represented by Anhui, Henan, and Sichuan are rapidly releasing growth potential and are expected to become new engines driving nationwide user-side energy storage market growth.

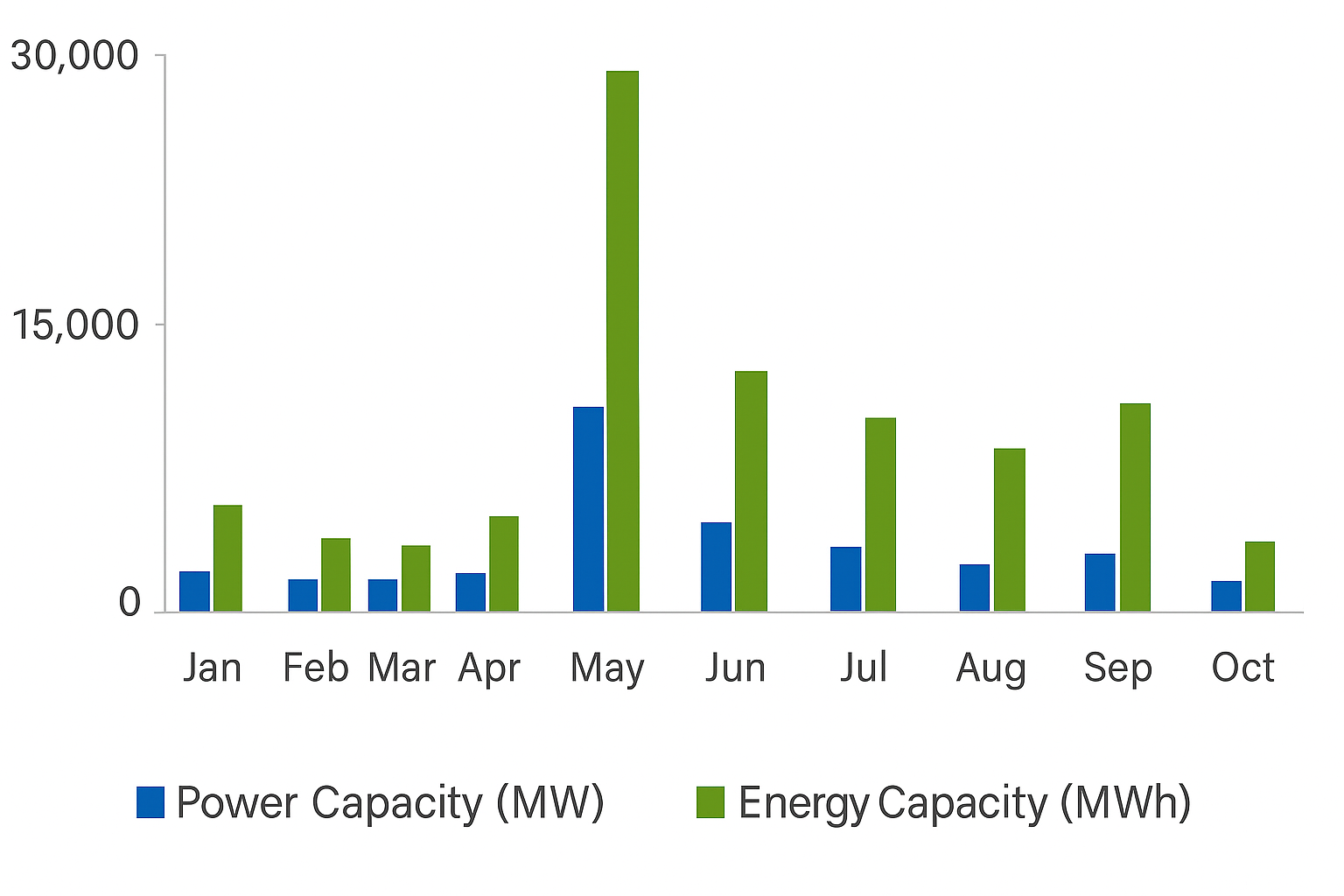

Figure 3: Monthly Distribution of Newly Filed Energy Storage Project Scale in Zhejiang, Guangdong, and Jiangsu (January - November 2025)

Data Source: CNESA DataLink Global Energy Storage Database

https://www.esresearch.com.cn/

Overall Analysis of New Energy Storage Projects in November

According to incomplete statistics from CNESA, in November 2025, newly commissioned new energy storage projects in China totaled 3.51 GW / 11.18 GWh, representing -22% / -7% year-on-year, and +81% / +180% month-on-month. While monthly additions continued to decline year-on-year, cumulative newly installed capacity in the first eleven months reached 39.5 GW, up 28% year-on-year. Considering the potential for concentrated grid connections ahead of the “12.30” commissioning deadline, total new installations for the year are expected to exceed last year's level.

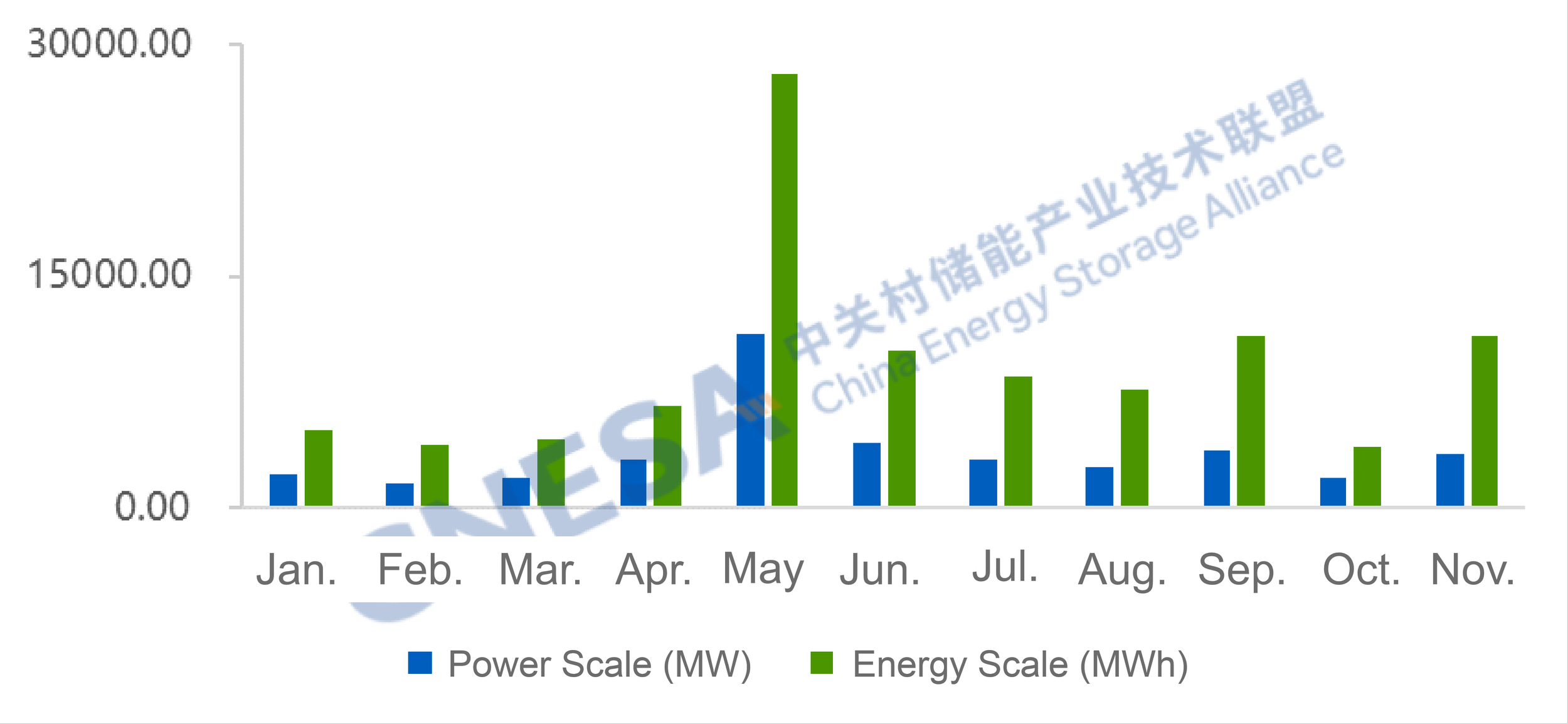

Figure 4: Installed Capacity of Newly Operating New Energy Storage Projects in China, January - November 2025

Data Source: CNESA DataLink Global Energy Storage Database

https://www.esresearch.com.cn/

Note: Year-on-year comparisons are based on the same period of the previous year; month-on-month comparisons are based on the immediately preceding statistical period.

The China Energy Storage Alliance (CNESA) has consistently adhered to standardized, timely, and comprehensive information collection practices to continuously track developments in energy storage projects. Leveraging its long-term data accumulation and in-depth professional analysis, CNESA regularly publishes objective market analyses on installed energy storage capacity, providing valuable references for industry decision-making. Since June 2025, the monthly energy storage project analysis has been divided into two sections: “Grid&Source-Side Market” and “User-Side Market”. This issue focuses on interpreting the user-side market in November.

CENSA Upcoming Events:

Apr. 1-3, 2026 | The 14th Energy Storage International Conference & Expo

Register Now to attend, free before Dec 31, 2025.