Source: CNESA

After a phase adjustment in China's new-type energy storage market in October 2025, the commissioning scale of new-type energy storage in November declined slightly year on year but rebounded markedly month on month. Meanwhile, the market's deeper structure adjusted compared with October:

Market recovery with a positive long-term outlook: Although installed capacity in November declined year on year, the month-on-month increase was significant. Newly added installations in the first 11 months reached nearly 40 GW, up more than 25% year on year, and full-year additions are expected to exceed last year.

Accelerated deployment of independent storage: In November, independent energy storage accounted for over 70%, with month-on-month growth rates exceeding 80% in power capacity and 200% in energy capacity. Inner Mongolia recorded more than 1.1 GW of newly commissioned independent storage, ranking first nationwide in both power and energy capacity.

Rise of local energy groups: Newly added installations by local energy groups reached a 45% share, surpassing for the first time the “Five Major and Six Minor” power generation groups and the “third-party enterprises”, highlighting a further diversification of market investors.

Faster rollout of diversified technologies: Beyond mainstream lithium batteries, technologies such as compressed air, flow batteries, and flywheels are being deployed at an accelerated pace, supporting the industry's long-term development.

Overall Analysis of New-Type Energy Storage Projects in November

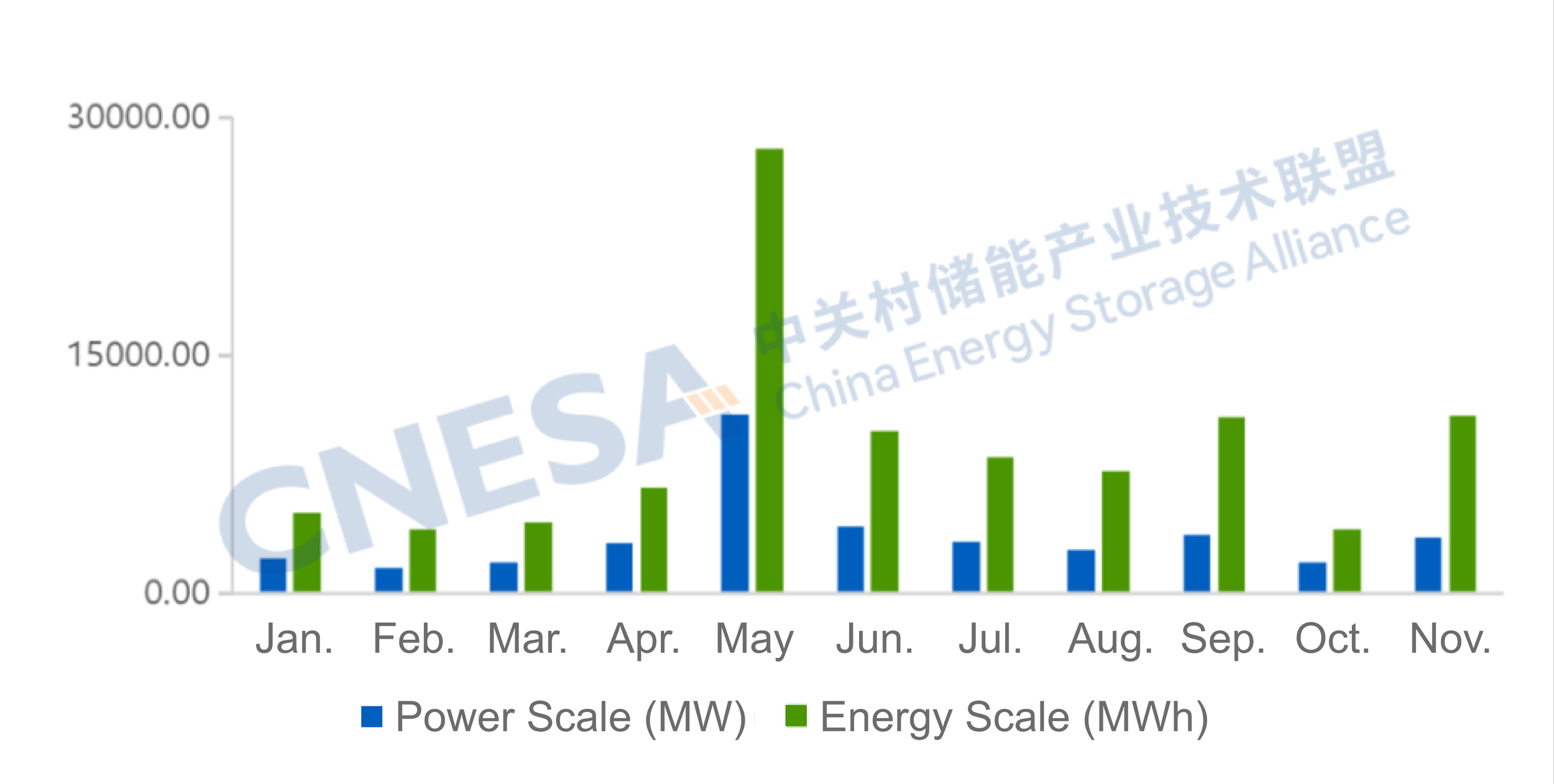

According to incomplete statistics from CNESA, in November 2025 China commissioned a total of 3.51 GW / 11.18 GWh of new-type energy storage projects, representing -22% / -7% year on year and +81% / +180% month on month. While monthly additions continued to decline year on year in November, cumulative additions in the first 11 months reached 39.5 GW, up 28% year on year. Considering potential concentrated grid connections ahead of the “12.30” commissioning deadline, total additions for the year are expected to exceed last year.

Figure 1. Installed Capacity of Newly Commissioned New-Type Energy Storage Projects in China, Jan-Nov 2025

Data source: CNESA DataLink Global Energy Storage Database

https://www.esresearch.com.cn/

Note: Year-on-year (YoY) compares the same period last year; month-on-month (MoM) compares the previous statistical period.

Analysis of Grid&Source-Side New-Type Energy Storage Projects in November

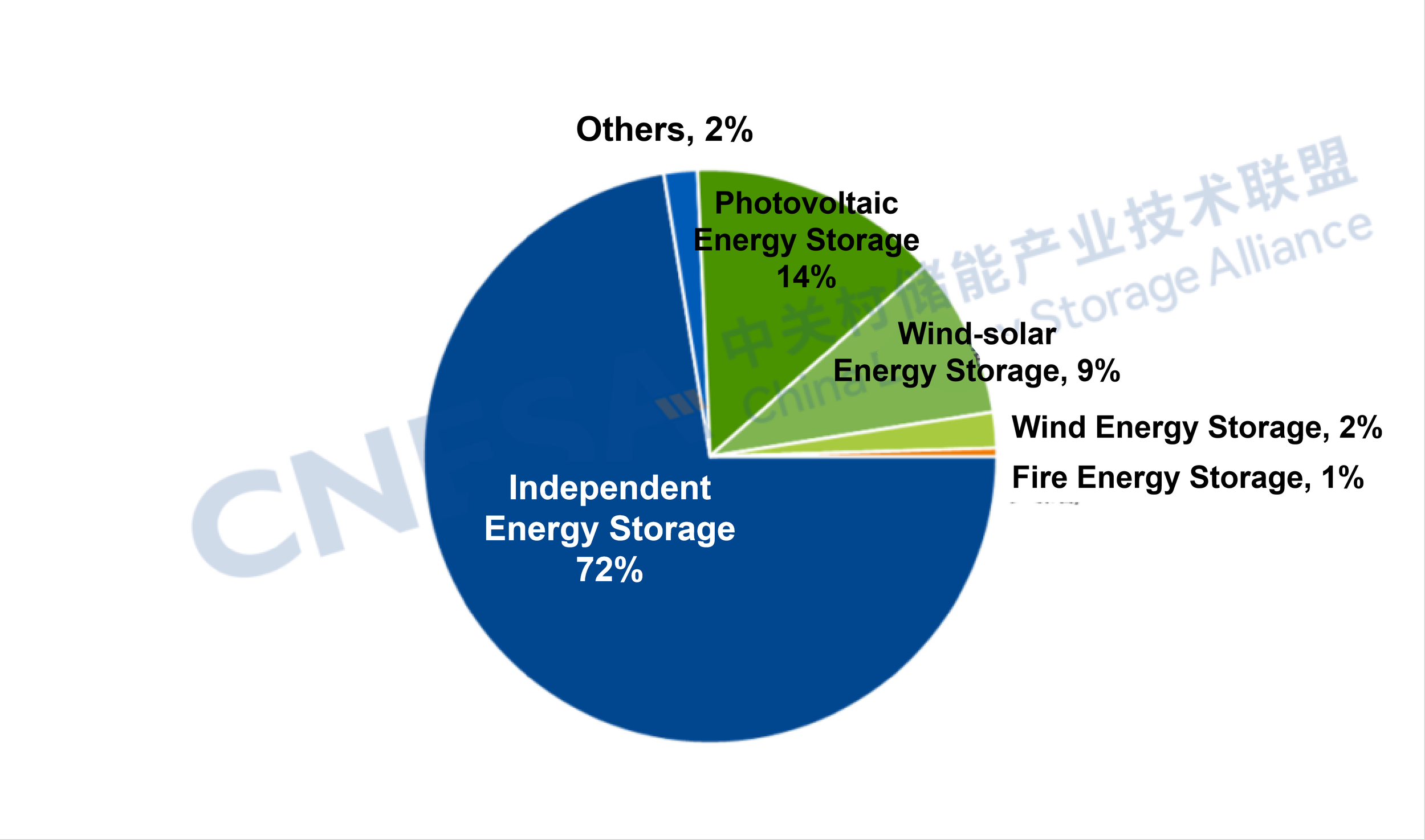

In November, newly added grid&source-side installations totaled 3.32 GW / 10.62 GWh, -15% / -1% year on year and +90% / +202% month on month.

Key characteristics include:

Newly added Independent storage accounted for 72%, down 6 percentage points from October.

Independent storage additions reached 2.41 GW / 8.19 GWh, -9% / +11% year on year and +82% / +217% month on month, with projects of 100 MW or above accounting for 79% by number.

Power-generation-side additions were 853.3 MW / 2,322.1 MWh, -33% / -31% year on year and +99% / +148% month on month. Renewable-plus-storage projects accounted for 98% of power capacity, covering multiple application scenarios such as UHV DC projects, agrivoltaics, and pastoral-solar hybrid systems.

Figure 2. Application Breakdown of Newly Commissioned Grid&Source-Side Energy Storage Projects in Nov. 2025 (MW%)

Data source: CNESA DataLink Global Energy Storage Database

https://www.esresearch.com.cn/

Note: “Others” include substations, emergency power supply, etc.

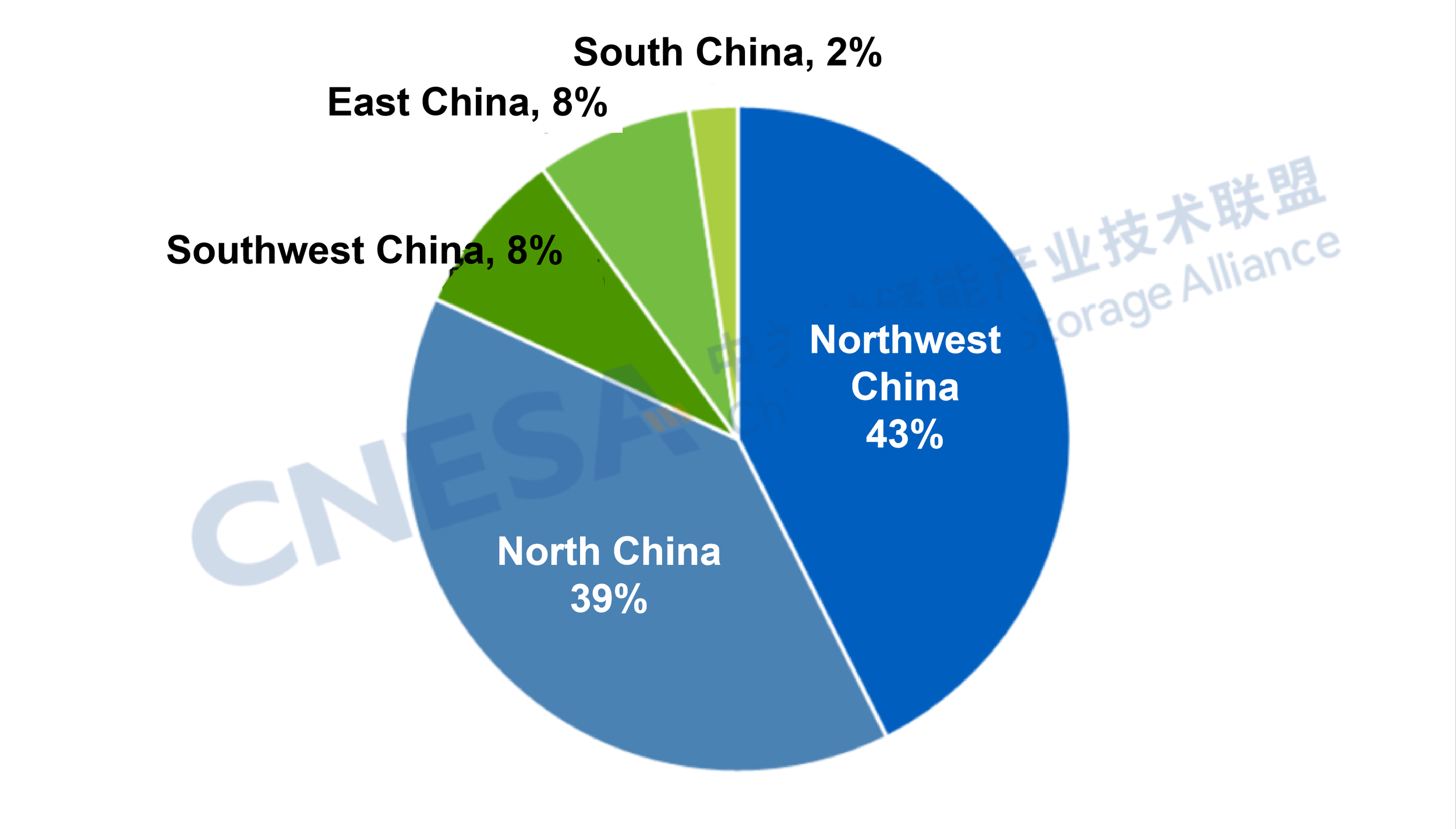

Northwest Leads with Over 40% Share; Inner Mongolia Ranks First

In November, the Northwest region accounted for 43% of newly added capacity, ranking first nationwide. Combined additions in the Northwest and Southwest exceeded half of the national total.

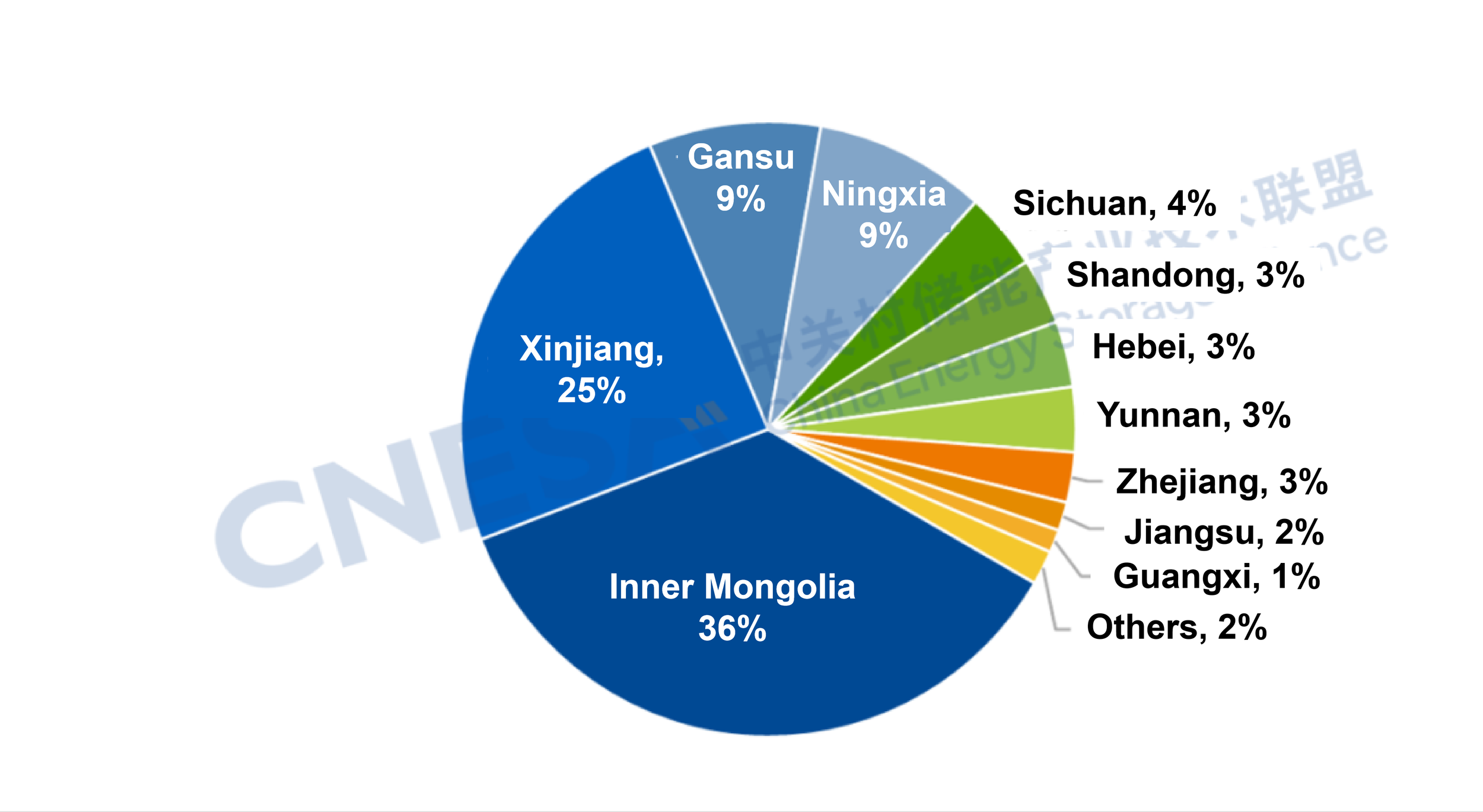

By province, the Inner Mongolia Autonomous Region saw multiple Independent grid-side demonstration projects commissioned - such as those included in the 2025 New-Type Energy Storage Special Action Implementation Project List and the first batch of Independent storage construction projects - totaling over 1.1 GW with an average storage duration of 4 hours, ranking first nationwide in both power and energy capacity. Xinjiang, Gansu, and Ningxia followed closely.

As a key national energy and strategic resource base in China, Inner Mongolia had surpassed 150 GW of installed renewable capacity by the end of October 2025, ranking first nationwide. Wind and solar accounted for over 80% of new installed capacity, further solidifying their dominant role (data source: Inner Mongolia Autonomous Region Energy Bureau). From the perspective of consumption, approximately 80% of renewable generation is consumed locally, with around 20% exported. The combined pressure of local consumption and grid stabilization continues to drive demand for new-type energy storage.

Figure 3. Regional Distribution of Newly Commissioned Grid&Source-Side Energy Storage Projects in China, November 2025 (MW%)

Source: CNESA Datalink Global Energy Storage Database

Figure 4. Provincial Distribution of Newly Commissioned Grid&Source-Side Energy Storage Projects in China, November 2025 (MW%)

Source: CNESA Datalink Global Energy Storage Database

https://www.esresearch.com.cn/

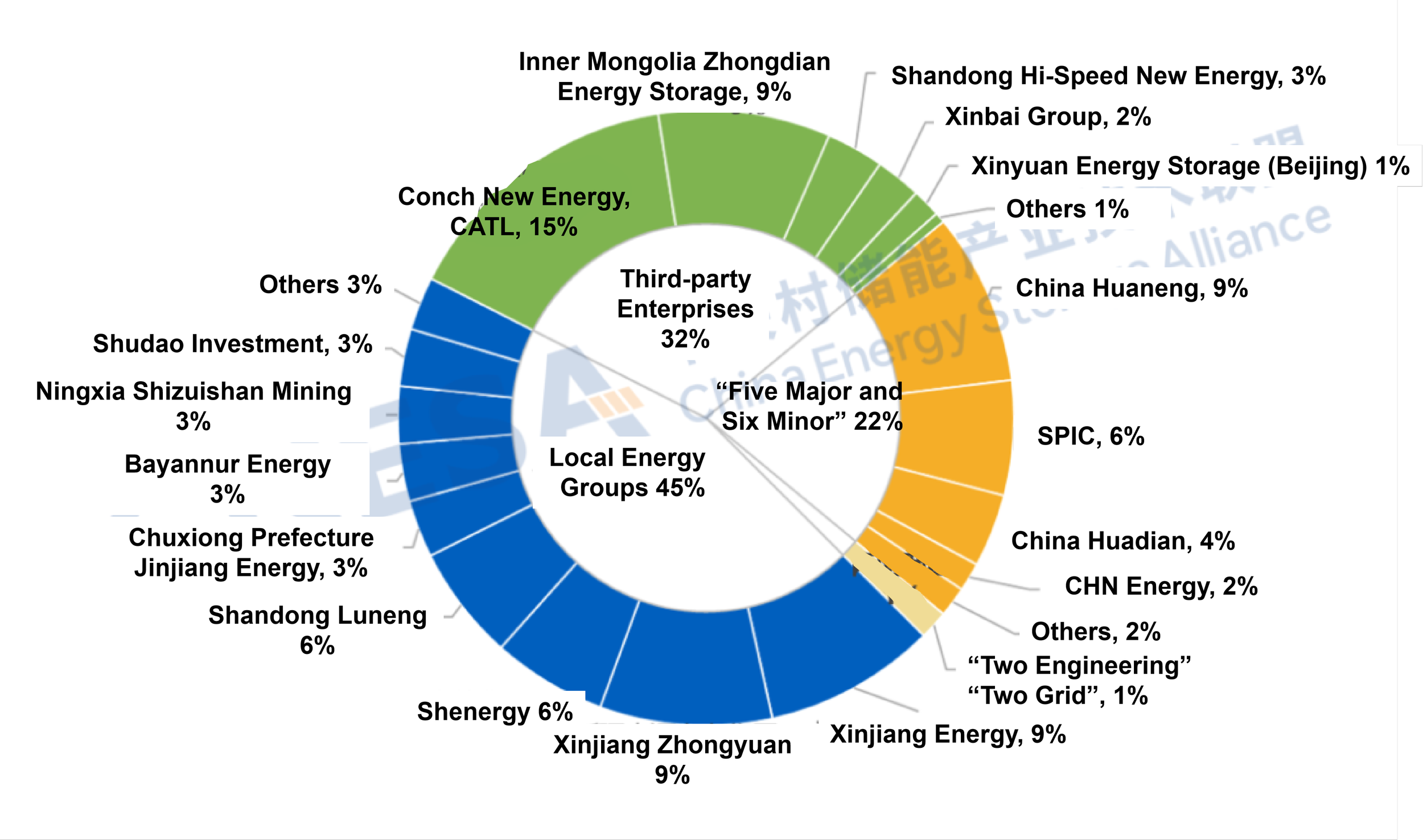

Faster Deployment by Local Energy Groups Highlights Investor Diversification

Driven by rising market demand, supportive national policies, diversified technology pathways, and declining costs, the market potential of energy storage is being fully released, with increasing investor diversification.

In November, projects invested in and built by local energy groups such as Xinjiang Energy Group, Xinjiang Zhongyuan Power Group, and Shenergy Group were commissioned in succession. Local energy groups accounted for 45% of newly added power capacity - the highest among all enterprise types - contrasting sharply with September and October, when third-party enterprises and the “Five Major and Six Minor” power generation groups dominated.

Leveraging advantages in policy coordination and approvals, resource integration and location, business linkage and industrial chain synergy, capital strength and decision-making efficiency, and operations, local energy groups have become a key pillar of the new-type energy storage market. Meanwhile, third-party enterprises - such as joint entities involving Conch New Energy and CATL, and Inner Mongolia Zhongdian Energy Storage - maintained a high level of participation, accounting for over 30% of monthly additions. The “Five Major and Six Minor” power generation groups (including China Huaneng, SPIC, and China Huadian) accounted for 22%, down 9 percentage points from October, continuing the decline seen since August.

Figure 5. Owner Distribution of Newly Commissioned Grid&Source-Side Energy Storage Projects in China, November 2025 (MW%)

Data source: CNESA DataLink Global Energy Storage Database

https://www.esresearch.com.cn/

Note: “Third-party enterprises” refer to entities other than large state-owned generation groups, the two grid companies, two construction groups and local energy companies.

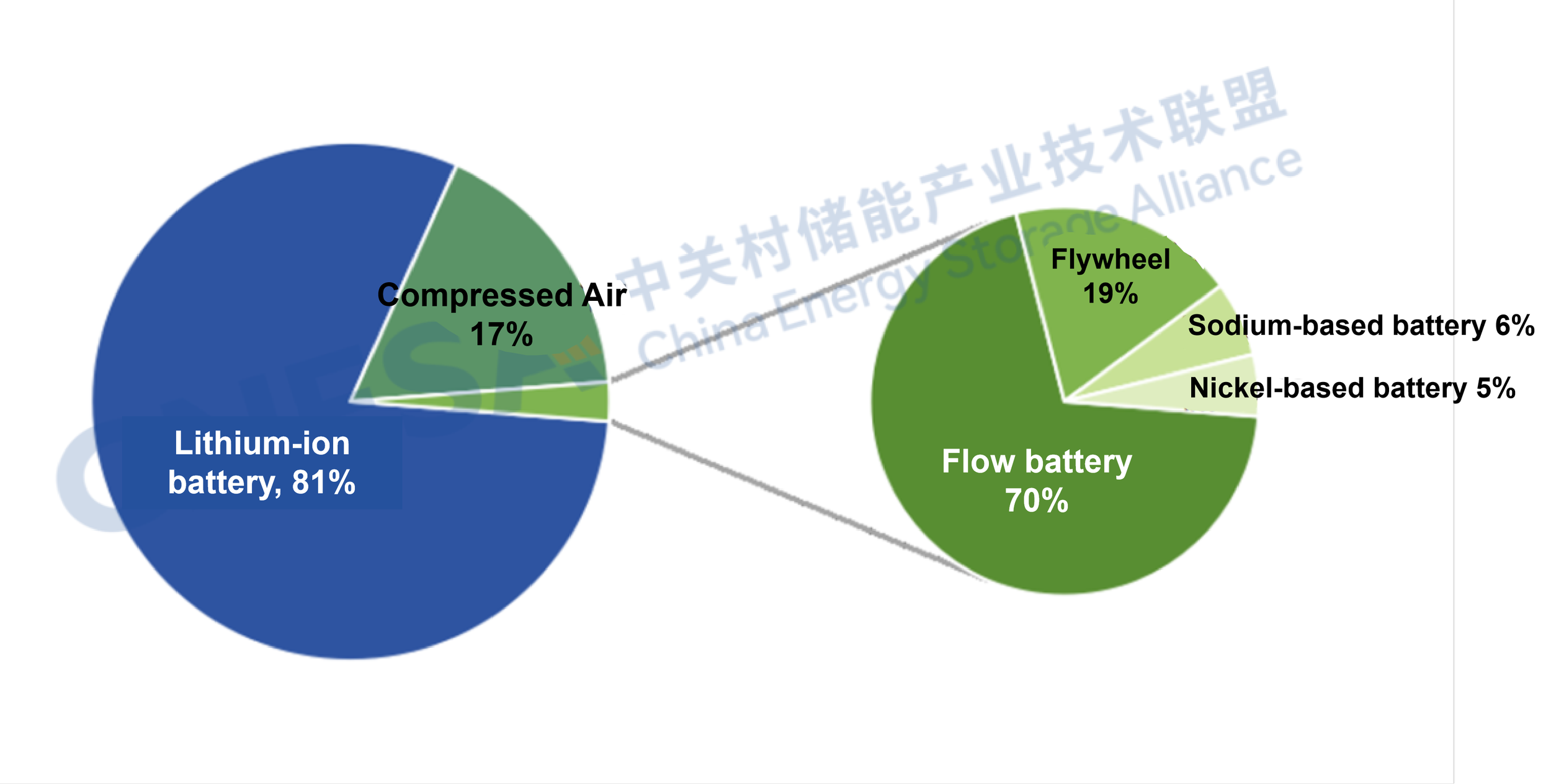

Accelerated Deployment of Non-Lithium Technologies

Technologically, newly commissioned grid&source-side projects were dominated by lithium iron phosphate (LFP) batteries, accounting for 91% of power capacity, followed by lead-carbon batteries (6%) and flow batteries (3%).

From a project development perspective, non-lithium technologies such as compressed air energy storage and hybrid systems are accelerating, highlighting a trend toward diversified technology pathways.

In compressed air storage, multiple 300 MW-class projects have completed filings and entered the planning stage; the Golmud 60 MW liquid air energy storage demonstration project and the Yumen 300 MW compressed air energy storage demonstration project have entered commissioning.

For hybrid storage, multiple 100 MW-class demonstration projects have launched or completed tenders, with some under construction or advancing, involving combinations such as lithium + sodium-ion batteries, lithium + flow batteries, lithium + flywheels, and lithium + nickel-metal hydride batteries.

Figure 6. Technology Distribution of Newly Planned and Under-Construction Grid&Source-Side Energy Storage Projects in China, November 2025 (MW%)

Source: CNESA Datalink Global Energy Storage Database

https://www.esresearch.com.cn/

The China Energy Storage Alliance (CNESA) has consistently adhered to standardized, timely, and comprehensive information collection practices to continuously track developments in energy storage projects. Leveraging its long-term data accumulation and in-depth professional analysis, CNESA regularly publishes objective market analyses on installed energy storage capacity, providing valuable references for industry decision-making. Since June 2025, the monthly energy storage project analysis has been divided into two sections: “Grid&Source-Side Market” and “User-Side Market”. This issue focuses on interpreting the grid&source-side market in November.

CENSA Upcoming Events:

Apr. 1-3, 2026 | The 14th Energy Storage International Conference & Expo

Register Now to attend, free before Dec 31, 2025.