Source: CNESA

After a small installation peak in September, China's new energy storage market saw a temporary decline in October 2025. According to incomplete statistics from the CNESA Datalink Global Energy Storage Database, both the month-on-month and year-on-year growth of newly commissioned capacity declined in October, mainly due to project cycle factors. Meanwhile, profound structural changes are taking place in the market:

● Short-term decline while long-term growth:

Although October's installed capacity declined, the cumulative capacity in the first ten months of 2025 still maintained a robust 36% growth, and 7-9 GW of projects are expected to come online before year-end, suggesting a record-breaking annual installation.

● Independent storage takes the lead:

In October, independent energy storage projects accounted for more than three-quarters of total installations, becoming the absolute main force.

● Third-party enterprises surpass state-owned giants:

A landmark shift occurred - “third-party enterprises”, represented by equipment manufacturers, accounted for over half of the newly installed capacity for the first time, surpassing traditional large energy groups and highlighting a clear trend toward diversified investment.

● Diverse technologies and accelerated non-lithium deployment:

In addition to mainstream lithium-ion systems, technologies such as compressed air, flow batteries, and flywheels are being accelerated in planning and construction, injecting new momentum into the industry's long-term development.

Overall Analysis of New Energy Storage Projects in October

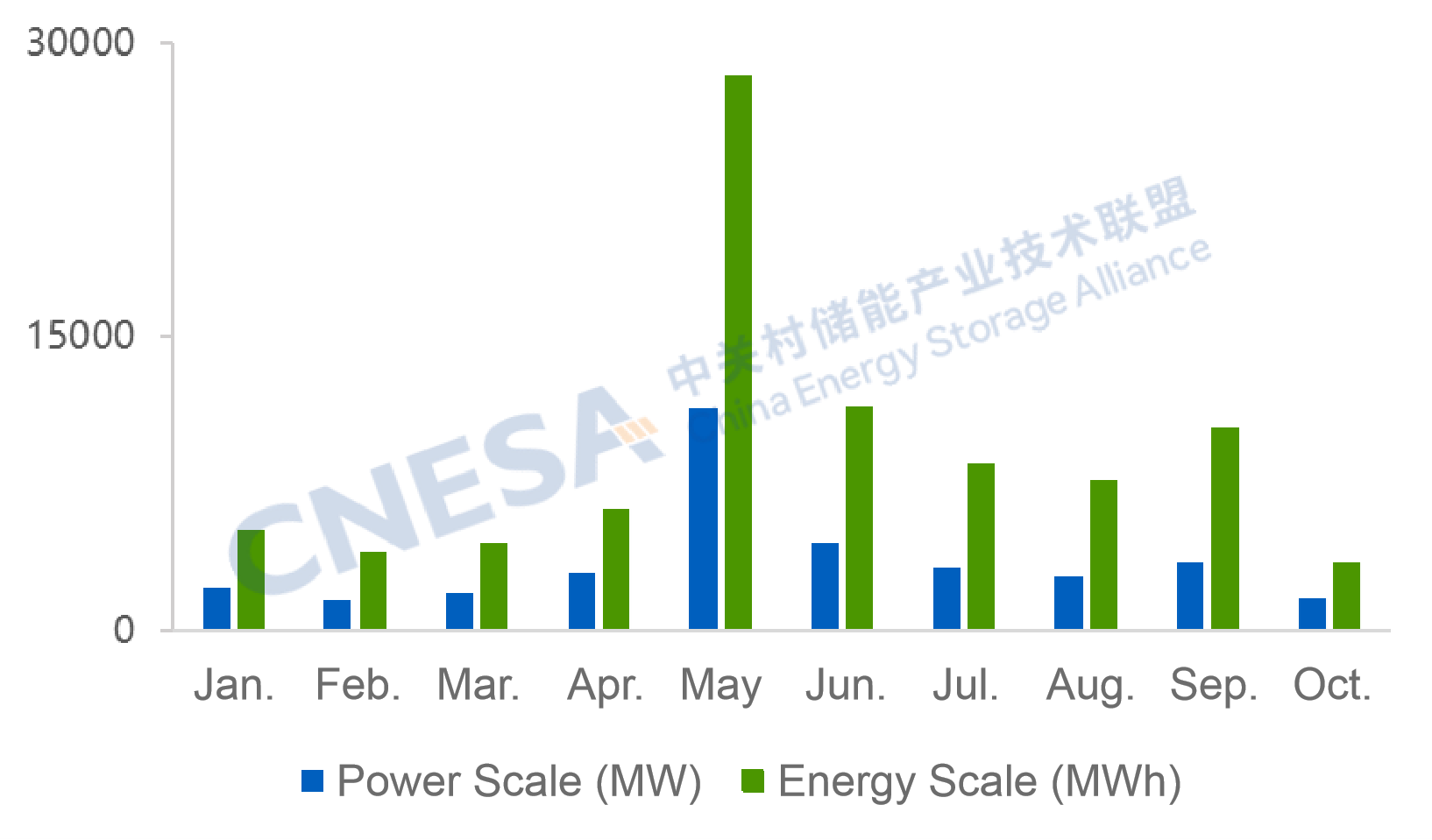

According to incomplete statistics from the CNESA Datalink Global Energy Storage Database, in October 2025, China added 1.70 GW / 3.52 GWh of newly commissioned new energy storage capacity - down 35% and 49% YoY, and 51% and 66% MoM, respectively. Although the first month of Q4 saw a decrease, total new capacity from January to October reached 35.8 GW, up 36% YoY. Following the September commissioning surge, the October decline mainly reflected the influence of construction cycles.

As of the end of October, about 7-9 GW of new energy storage projects were under commissioning or scheduled for grid connection by year-end. If these projects proceed as planned, China's new commissioned capacity in 2025 could reach 42-45 GW. This estimate is based solely on currently known under-construction/commissioned project data and does not represent a final forecast.

Figure 1. Installed Capacity of Newly Commissioned New Energy Storage Projects in China, Jan-Oct 2025

Source: CNESA Datalink Global Energy Storage Database

https://www.esresearch.com.cn/

Note: Year-on-year (YoY) compares the same period last year; month-on-month (MoM) compares the previous statistical period.

Analysis of Grid&Source-side New Energy Storage Projects in October

In October, newly commissioned grid&source-side new energy storage capacity totaled 1.51 GW / 3.04 GWh, representing year-on-year declines of 35% and 49%, and month-on-month declines of 53% and 69%.

Key trends included:

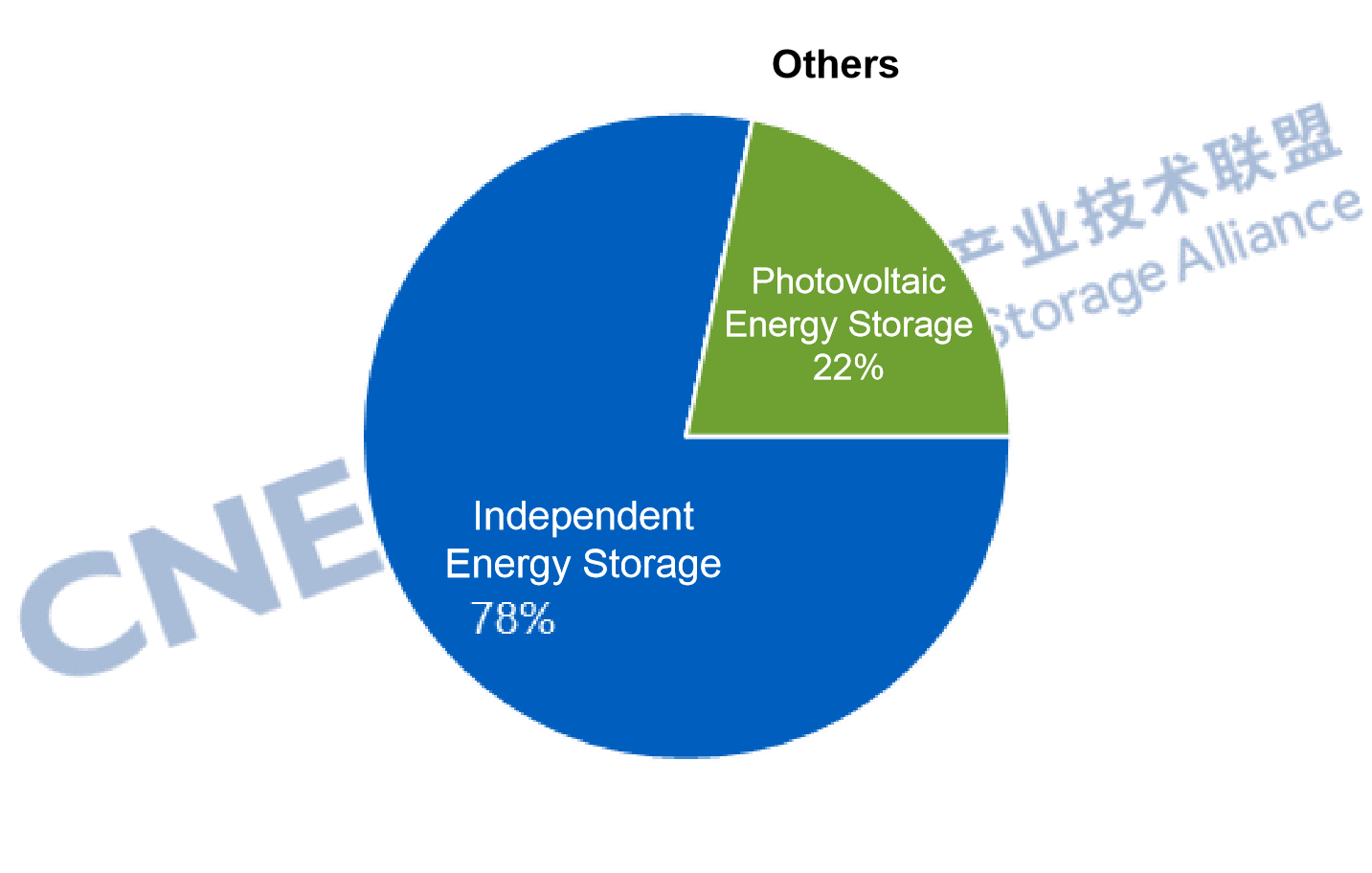

Independent storage accounts for over 75%, with capacity down 30% YoY

Independent energy storage added 1.18 GW / 2.31 GWh, down 30% and 48% YoY, with 78% of projects above 100 MW.

On the source side, new installations totaled 327.5 MW / 735 MWh, representing a YoY growth of -47%/-52%, all paired with renewable energy projects, involving various specific application scenarios including UHV DC transmission and solar-grazing hybrid application.

Figure 2. Application Distribution of Newly Commissioned Grid&Source-Side Energy Storage Projects in Oct. 2025 (MW%)

Source: CNESA Datalink Global Energy Storage Database

https://www.esresearch.com.cn/

Note: “Others” include substations and similar facilities.

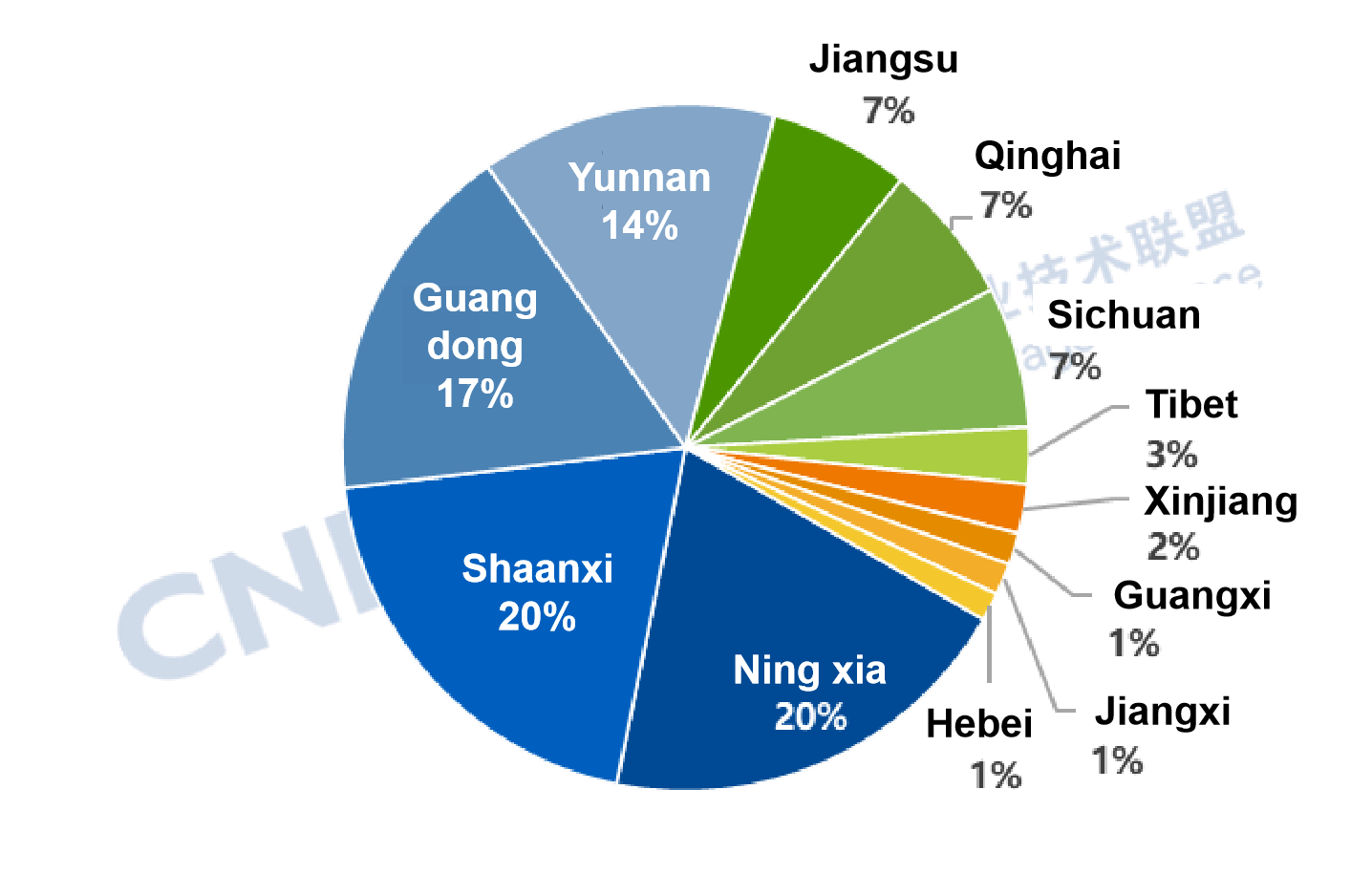

Western China accounts for over 50% of new installations; Ningxia and

Shanxi lead in scale

By region, western China contributed over half of October's new capacity, with the northwest region alone accounting for nearly 30%, the highest nationwide.

By province, Ningxia and Shanxi province ranked joint first in new power capacity, while Ningxia topped in new energy capacity.

As a key national new energy demonstration zone, Ningxia's renewable capacity had exceeded 50 GW by August 2025, representing 60% of total power installations - with solar surpassing coal to become the largest power source.

High proportions of wind and solar have created growing demand for storage to smooth grid fluctuations and enhance renewable integration. In addition, large-scale national initiatives such as the “Desert, Gobi and Wasteland” renewable base and UHV DC transmission projects have further expanded the application space for energy storage in Ningxia.

Figures 3. Regional Distribution of Newly Commissioned Grid&Source-Side New Energy Storage Projects in China, Oct. 2025 (MW%)

Source: CNESA Datalink Global Energy Storage Database

https://www.esresearch.com.cn/

Figures 4. Provincial Distribution of Newly Commissioned Grid&Source-Side New Energy Storage Projects in China, Oct. 2025 (MW%)

Source: CNESA Datalink Global Energy Storage Database

https://www.esresearch.com.cn/

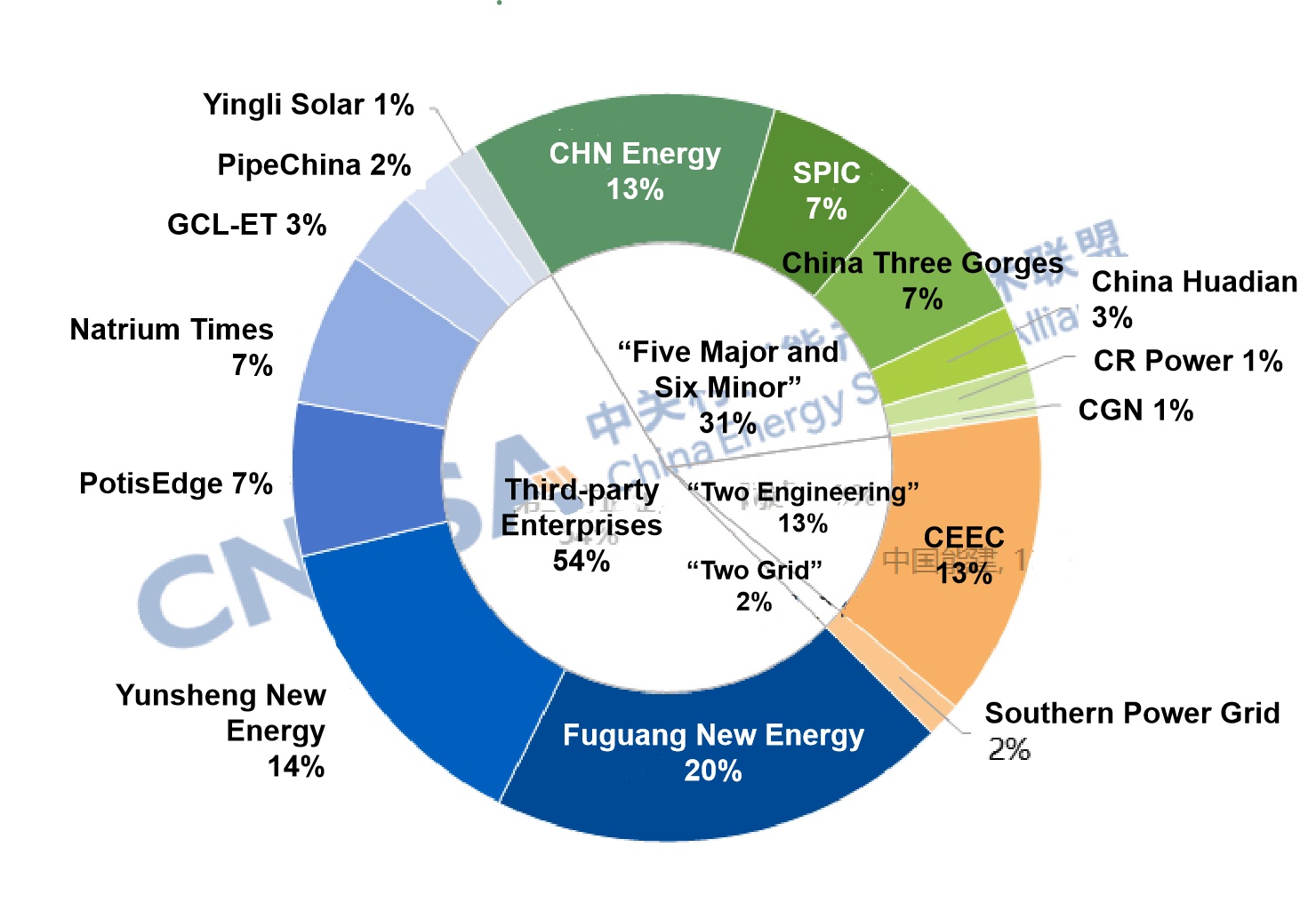

Third-party enterprises drive growth, highlighting diversification of

investors

Driven by rising market demand, national policy incentives, technological diversification, and declining costs, the energy storage market's investment ecosystem is becoming increasingly diverse.

In October, projects invested by private power companies such as Fuguang New Energy and Yunsheng New Energy and energy storage/new energy manufacturers such as PotisEdge and Natrium Times (NTEL) accounted for over 50% of new installations - up 18 percentage points from September.

Nevertheless, large state-owned energy groups remain key players due to their advantages in project investment scale, construction coordination, and operational management.

In October, China's “Five Major and Six Minor” and “Two Grid and Two Engineering” state-owned power enterprises contributed 46% of newly installed capacity. Among them, “Five Major and Six Minor” and “Two Grid and Two Engineering” including CHN Energy, SPIC, and China Three Gorges Corporation accounted for 31%, down 10 percentage points from September, while the “Two Grid and Two Engineering” increased their share by 4 points.

Figure 5. Ownership Distribution of Newly Commissioned Grid&Source-side New Energy Storage Project in China, Oct. 2025 (MW%)

Source: CNESA Datalink Global Energy Storage Database

https://www.esresearch.com.cn/

Note: “Third-party enterprises” refer to entities other than large state-owned generation groups, the two grid companies, two construction groups and local energy companies.

Acceleration in non-lithium technology deployment

From a technical perspective, newly commissioned grid&source-side projects were dominated by lithium iron phosphate batteries, accounting for 98.5% of capacity, with sodium-ion batteries representing 1.5%.

In terms of planned and under-construction projects, deployment of non-lithium technologies such as compressed air and hybrid storage is accelerating, signaling faster diversification of technology pathways.

Compressed air: Multiple 100 MW-level compressed air projects have completed filing and entered the planning stage; the 350 MW Anning (Yunnan) compressed air project has begun construction.

Hybrid storage: Hebei Province announced a pilot list including 97 hybrid projects totaling 13.82 GW; construction of two 100 MW lithium + flow battery projects began in Weifang, Shandong; the 100 MW flywheel-lithium hybrid station is under construction in Heishan, Liaoning; the 300 MW / 1200 MWh independent power-side storage project using lithium + flow battery hybrid technology has entered the grid-commissioning stage at Gushanliang, Ordos, Inner Mongolia.

Figure 6: Technological Distribution of Newly Commissioned Grid&Source-Side New Energy Storage Projects in China, Oct. 2025 (MW%)

Source: CNESA Datalink Global Energy Storage Database

https://www.esresearch.com.cn/

The China Energy Storage Alliance (CNESA) has consistently adhered to standardized, timely, and comprehensive information collection practices to continuously track developments in energy storage projects. Leveraging its long-term data accumulation and in-depth professional analysis, CNESA regularly publishes objective market analyses on installed energy storage capacity, providing valuable references for industry decision-making. Since June 2025, the monthly energy storage project analysis has been divided into two sections: “Grid&Source-Side Market” and “User-Side Market”. This issue focuses on interpreting the grid&source-side market in October.

CENSA Upcoming Events:

1. Dec.4-5 | 2025 China Energy Storage CEO Summit | Xiamen, Fujian

Register Now to attend

Read more: http://en.cnesa.org/new-events-1/2025/12/4/dec4-5-2025-china-energy-storage-ceo-summit

2. Apr. 1-3, 2026 | The 14th Energy Storage International Conference & Expo

Register Now to attend, free before Oct 31, 2025.