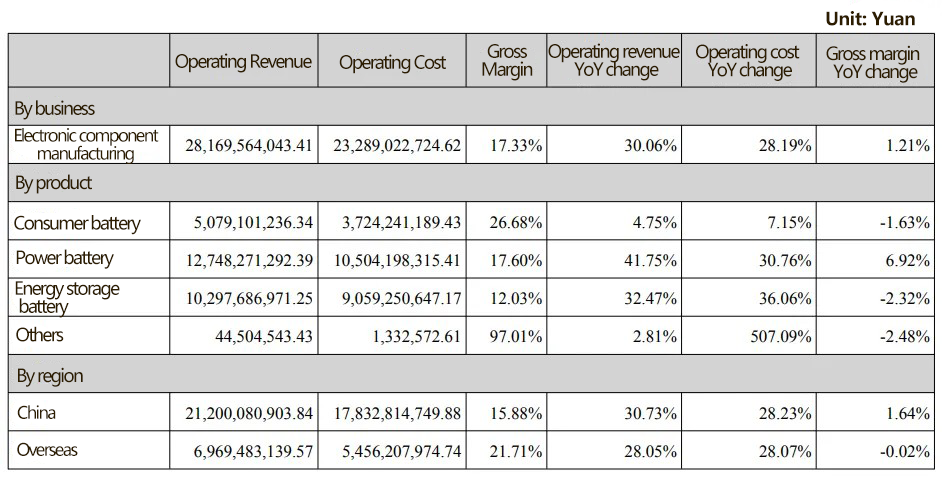

On the evening of August 25, Sungrow released its 2025 semi-annual report. In the first half of the year, the company achieved operating revenue of RMB 43.533 billion, a year-on-year increase of 40.34%. Net profit attributable to the parent company was RMB 7.735 billion, up 55.97% year-on-year, and net profit excluding non-recurring items was RMB 7.495 billion, up 53.52% year-on-year.

On the same day, Sungrow announced plans to issue H-shares and list on the Hong Kong Stock Exchange, aiming to deepen its global strategic deployment, build diversified financing channels, and further enhance the company’s core competitiveness.

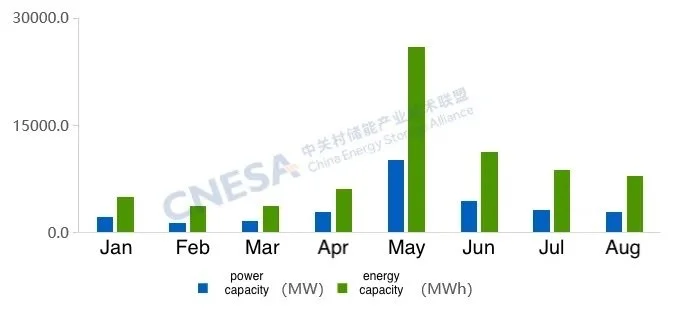

Energy Storage Revenue RMB 17.803 Billion, Up 127.78% Year-on-Year, with a Gross Margin of 39.92%

By industry:

Photovoltaic industry revenue was RMB 22.513 billion, accounting for 51.72%, up 4.84% year-on-year;

Energy storage industry revenue was RMB 17.803 billion, accounting for 40.89%, up 127.78% year-on-year;

Other business revenue was RMB 3.217 billion, accounting for 7.39%, up 85.96% year-on-year.

By product:

Photovoltaic inverters and other power electronic conversion equipment revenue was RMB 15.327 billion, up 17.06% year-on-year, with a gross margin of 35.74%, down 1.88% year-on-year;

Energy storage systems revenue was RMB 17.803 billion, up 127.78% year-on-year, with a gross margin of 39.92%, down 0.16% year-on-year;

New energy investment and development revenue was RMB 8.398 billion, down 6.22% year-on-year;

Photovoltaic power plant generation revenue was RMB 761 million, up 59.44% year-on-year.

Revenue from energy storage system products exceeded photovoltaic inverters.

By region:

Domestic revenue was RMB 18.155 billion, up 3.48% year-on-year, accounting for 41.70%;

Overseas revenue was RMB 25.379 billion, up 88.32% year-on-year, accounting for 58.30%.

Initiating Hong Kong Stock Listing

On the same day, Sungrow announced plans to issue H-shares and apply for listing on the main board of the Hong Kong Stock Exchange, in order to deepen its global strategic layout, enhance its international brand image, build diversified financing channels, and further strengthen core competitiveness.

R&D Personnel Account for About 40% of the Total, R&D Investment Up 37% Year-on-Year

The financial report shows that in the first half of 2025, the company continued to increase R&D investment to RMB 2.037 billion, a year-on-year increase of 37%, with R&D personnel accounting for about 40% of the total. By the end of the reporting period, the company had filed a total of 10,541 patent applications, including 5,690 invention patents, 4,142 utility model patents, and 709 design patents.

Latest Release of PowerTitan 3.0 Energy Storage System Platform

During the reporting period, the company launched the PowerTitan 3.0 AC smart energy storage platform, introducing three models: Flex version 10 ft 3.45MWh, Class version 20 ft 6.9MWh, and Plus version 30 ft 12.5MWh. These adopt 684Ah stacked cells, silicon carbide PCS, and are equipped with the PowerBidder power trading decision-support software and the PowerDoctor intelligent power plant operation and maintenance platform. Continuing the advantages of the AC storage architecture, the Plus version achieves an energy density exceeding 500kWh/㎡, currently the highest in the world.

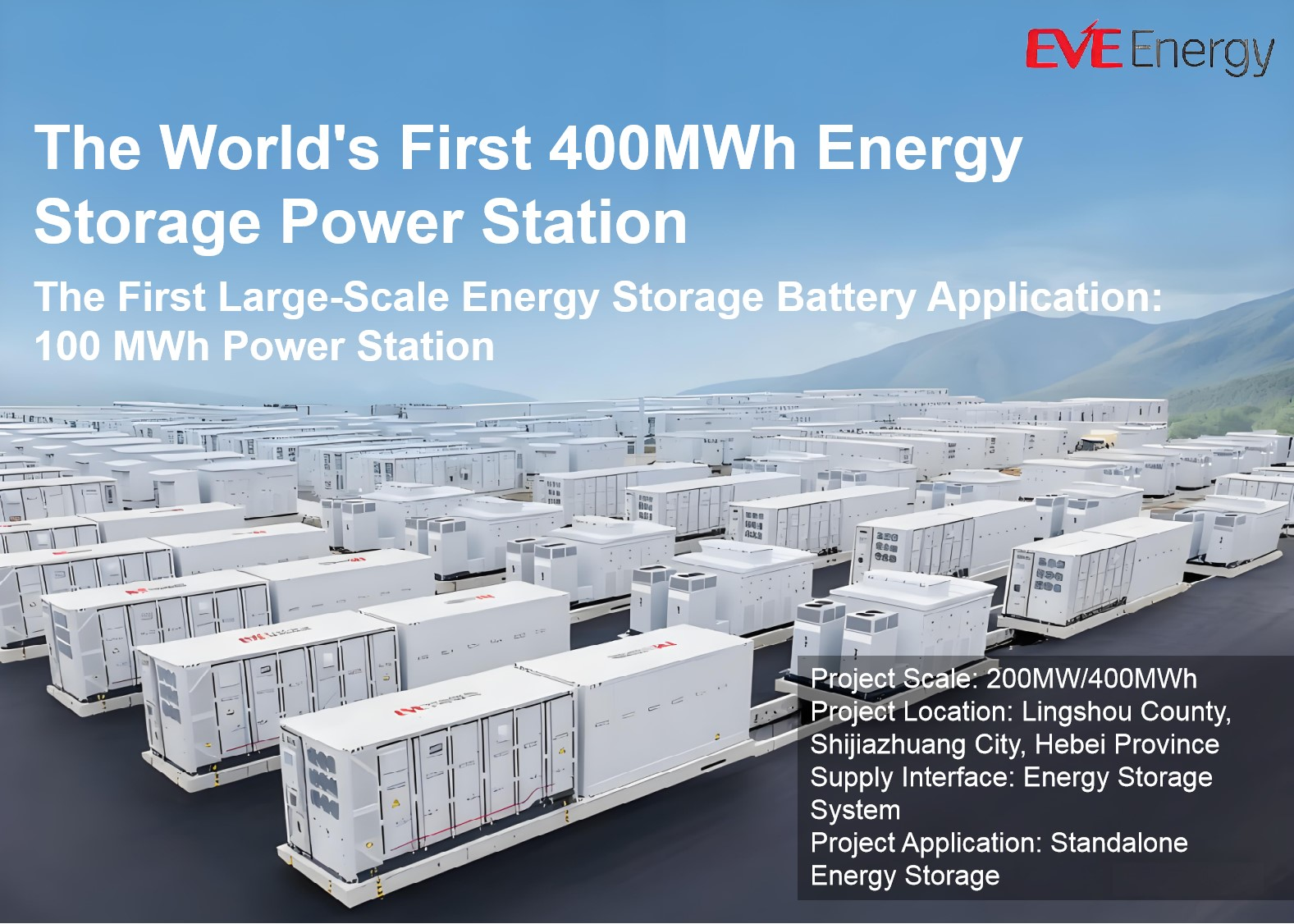

PowerTitan 2.0 Widely Applied Globally,

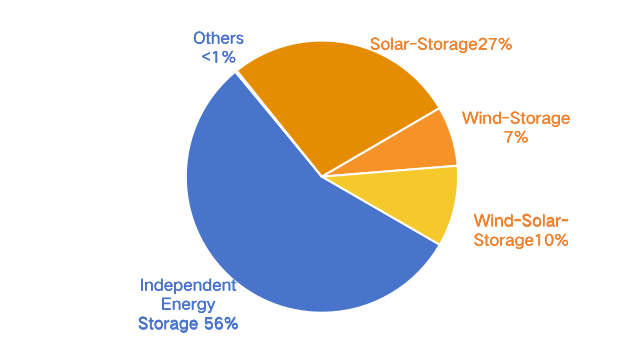

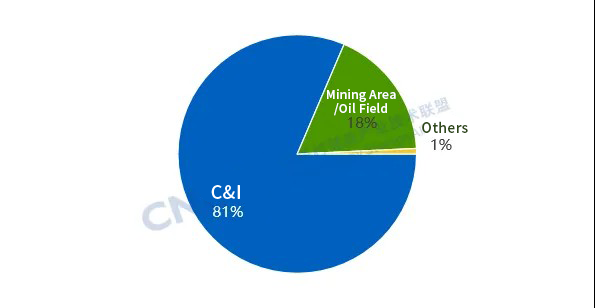

PowerStack 835CS Opens the Era of Customized C&I Energy Storage

During the reporting period, the company’s pioneering “AC-DC integrated” 10MWh full liquid-cooled energy storage system PowerTitan 2.0 was widely applied worldwide, supporting stable operations at projects such as the Taizhou Hailing independent energy storage plant, Kunshan Longteng Special Steel user-side energy storage plant, Chery’s first energy storage station in the automotive industry in Wuhu, Shandong Taiyang grid-side energy storage plant, and Uzbekistan’s largest energy storage station in Central Asia. The company also launched the PowerStack 835CS liquid-cooled energy storage system for 10/20kV industrial scenarios, which has been applied in bulk in high-energy-consuming factories and parks such as steel, metallurgy, automotive, and chemical industries, fully initiating the era of customized C&I energy storage.

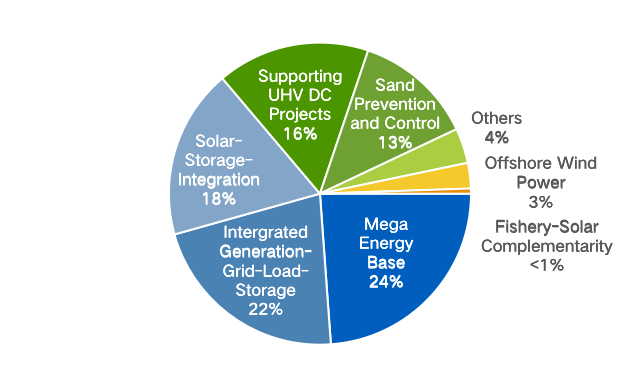

Grid-Forming Technology Stably Applied in Power Plants Worldwide

With the high penetration of wind, solar, and other renewable energy worldwide, traditional grid-following schemes are insufficient to support stable grid operation. During the reporting period, the company further upgraded its stem-cell grid technology, pioneering the “battery-converter-station” three-level collaborative architecture, and released the “Stem-Cell Grid-Forming Technology 2.0 White Paper.” From the perspective of solar-storage system applications, supported by a GW-level full-link electrical, thermal, and acoustic simulation platform, and all-scenario grid-forming algorithms, the solution meets diverse needs under different grid conditions, environments, and application scales, maximizing power plant benefits, adapting to grid conditions, and providing customized grid-forming solutions to safeguard grid safety and stability.

The company’s grid-forming technology has helped the UK grid rapidly recover frequency, preventing large-scale blackout, and has been stably applied in numerous projects such as the Weizhou Island isolated energy storage plant in Guangxi, the world’s largest wind-solar-ES-hydrogen multi-energy complementary project NEOM in Saudi Arabia, the solar-storage project in Caipeng, Naidong, Xizang Autonomous Region, and the world’s largest grid-forming off-grid storage project, the 60MW/120MWh project in Ali Prefecture, Xizang Autonomous Region. During the reporting period, the company successively supported the grid connection of more than ten grid-forming storage plants in Xizang and provided system solutions for China Southern Power Grid’s first grid-forming storage project—the Wenshan plant in Yunnan.

To fill the industry gap, during the reporting period the company released the industry’s first battery cell management white paper, “BM²T Battery Management Technology White Paper,” which deeply integrates AI and IoT technologies, breaking data silos and adapting to the development of grid-forming technology.

C&I Energy Storage Product Iteration Accelerates

In response to the complex and variable industrial and commercial storage market, the company further accelerated the iteration speed of new product development. During the reporting period, it launched the latest PowerStack 255CS system with power of 125kW and upgraded capacity to 257kWh, supporting 2/4h configurations, with a tested all-weather average efficiency of ≥88%, delivering RMB 40,000 additional annual revenue per 1MWh for power plants. In the industrial and commercial sector, it launched customized grid-forming technology for the first time, supporting MW-level park black-start capability, resilient to outages and load fluctuations. Equipped with an AI intelligent decision-making system, it can predict electricity prices and loads in real time and automatically settle for optimal returns.

Currently, the company’s energy storage systems are widely applied in mature power markets across Europe, the Americas, the Middle East, and Asia-Pacific, continuously strengthening deep integration of wind, solar, and storage. None of the storage projects it participated in have experienced a single safety incident. The company has accumulated extensive application experience in fields including frequency regulation and peak shaving, renewable energy integration support, microgrids, C&I and residential energy storage.