On January 8, 2026, a 500MWh standalone Battery Energy Storage System(BESS) project located at Maritsa East 3 in Bulgaria was officially commissioned. The project was the jointly developed by BYD Energy Storage and ContourGlobal under their strategic collaboration which is one of the largest standalone energy storage projects in East Europe.

Tianneng Signs a 1GWh Project in Malaysia, Build a benchmark for Integrated “Solar- Storage- Computing”Solutions

Recently, Tianneng Group signed a strategic agreement with NASDAQ-listed company VCIG Group. The two parties will build a 1GWh AIDC solar energy storage power station in Malacca, Malaysia. The project aims to address the high-energy-consumption challenge of AIDC and will be developed under an “EPC+F” model.

Amazon buys 1.2GW Sunstone solar-plus-storage project from bankrupt Pine Gate

CORNEX Secures a 6GWh Energy Storage Order in Egypt, Successfully Expanding Into the North African Market

On January 16th, Cornex New Energy signed a strategic cooperation agreement with Egypt-based partners WeaCan and Kemet.

The agreement was signed by Dai Deming, chairman of Cornex New Energy and Ahmed Salaheldin Abdelwahab Elabd, Chiarman of the Board of Kemet. The signing ceremony was witnessed by Moustafa Kamal Esmat Mahmoud, minister of Egypt’s Ministry of Electricity and Renewable Energy, along with other government officials and senior executives from relevent enterprises.

Sungrow’s First Energy Storage Plant in the Middle East Launched,with an Annual Capacity of 10 GWh

Egypt has taken a major step toward accelerating its clean energy transition, as Chinese energy storage leader Sungrow and Norwegian renewable developer Scatec partner with the Egyptian government to deliver large-scale solar+storage projects and establish the Middle East’s first battery energy storage manufacturing base, with a planned annual capacity of 10 GWh.

Google Acquires U.S. Energy Storage Giant for $4.75 Billion

As the global tech giants engage in a frenzied race for AI computing power, a more fundamental battle over “energy supply” is unveiling. Google’s multi-billion dollar power play procured not just an energy storage company but the the “electricity passport” towards the AI-driven future.

I. Blockbuster Acquisition: Acquisition of U.S. Energy Storage Giant for $4.75 Billion

On December 22, Alphabet, Google's parent company, announced that it will acquire Intersect Power, a leading U.S. battery energy storage system developer and operator, for $4.75 billion in cash plus the assumption of debt.

What to watch:

Targeted Assets: The acquisition does not cover the already operational assets but targets its future clean energy power generation projects, data center and energy storage system, totaling 10GWh.

Strategic intention: directly circumvent the crowded traditional grid and build an exclusive “power generation + energy storage” closed loop for AI data center.

The Alphabet CEO said: “ Intersect will help us synchronize the creation of power generation and energy storage system so as to match the added data center load and reshape energy solutions of AI data center.

II. Urgency: The high energy consumption “black hole” of AI data center

It is the tremendous energy pressure alongside generative AI behind the acquisition.

Surge in electricity consumption: the electricity demand is estimated to grow manyfold of data center hubs including State of Texas and California in 2030.

Stringent Reliability requirement: The AI data center requires 99.999% power supply reliability, which is hard to satisfy for traditional grid.

Solutions: Battery Energy Storage System emerges as the key infrastructure to balance the intermittency of renewable energy and achieve 24/7 uninterrupted power supply.

III. Ecological Synergy: Tesla makes an indirect play and broaden the collaboration zone

It is noteworthy that Intersect and Tesla are long-term collaboration partners. Google’s move means Tesla will step into the collaboration zone.

Current collaboration: Many operational energy storage projects of Intersect have employed the Megapack energy storage system of Tesla (like the Oberon 1 GWh project of California)

A huge order: Intersect also signed the 15.3GWh supply contract with Tesla, becoming one of the world’s largest purchasers and operators of this model of energy storage equipment.

IV. Chinese Companies: A head start in the Global data center energy storage arena

In fact, China’s top-tier energy storage companies have identified the opportunities early on, actively expanding their presence in the global “data center + energy storage” sector:

Companies like SUNGROW, SHUANGDENG, HUAWEI, KWLONG, ZTT, NARADA, HTHIUM, ROBESTEC, Potis Edge, Ampace, CLOU, Hopewind, CHNT, KSTAR, Vertiv, DELTA, EATON, VISION, SINEXCEL, JST(JINPAN TECHNOLOGY), TONGFEI, Envicool, Goaland, Shenling, HAIWU and so on has played their respective roles engaging in data center energy construction.

The market demonstrates that China’s supply chain ranging from power sources, battery to management system is becoming an important power to underpin the global AI data center energy transformation.

V. Industry Barometer: the summit forum focuses on “data center + energy storage” future

Google’s acquisition does not stand alone and it points to a global trend: energy storage combined with data center has become the central arena where global technology and energy industry converge.

This trend will be fully represented in the upcoming industry grand.

_____________________________________________________________________________________________

Register now to attend Asia's Largest Energy Storage Trade Show for free:

What: The 14th Energy Storage International Conference & Expo

When: Conferences: March 31 - April 2, 2026

Exhibitions: April 1-3, 2026

Where: CIECC Beijing, China

Address: No. 55 Yudong road, Shunyi District, Beijing China

Germany Roundup: 500MW BESS and Data Centre Transaction, Seven-Year Toll and 370MW Pipeline Secured

Source: Energy Storage News

The BESS with which ju:niz Energy will enter into a toll with Next Kraftwerke. Image: ju:niz Energy

A trio of German grid-scale BESS news items, with Next Kraftwerke and ju:niz Energy agreeing a seven-year toll, Alpiq announcing a 370MW pipeline, and WBS Power selling the country’s largest solar-plus-storage project and planning a data centre on the same site.

Germany has this year become a hotbed of battery energy storage system (BESS) project announcements and deal-making, driven by its substantial revenue opportunities as Europe’s largest electricity market and a looming August 2029 deadline for getting projects operational to avoid charge-discharge grid fees. See all recent coverage here.

WBS Power sells solar-plus-storage project, plans data centre

Developer WBS Power has sold the 150MW solar, 500MW/2,000MWh BESS Project Jupiter in Brandenburg, Germany, to investor Prime Capital.

WBS acquired the site for the clean energy project in 2022, and the project will require €500 million (US$583 million), with construction expected in late 2026/early 2027. Both technologies will share a 380kV grid connection in the area of TSO 50Hertz. The acquisition is subject to Project Jupiter reaching ready-to-build (RTB) status.

The transaction also establishes a joint venture to co-locate a hyperscale data centre of up to 500MW in power demand in the same area.

WBS Power said there is growing demand for data centres in Germany, which are highly energy-intensive and benefit significantly from direct access to renewable power and grid stability.

“By integrating Germany’s largest co-located BESS and Solar PV project with a hyperscale data center, we are creating a unique platform that supports both the energy transition and digital transformation,” said Maciej Marcjanik, CEO of WBS Power Group.

Alpiq secures 370MW Germany pipeline

Switzerland-based energy firm Alpiq has expanded in Germany with a 370MW BESS pipeline the company has ‘secured’, in partnership with developer SPP Development. The projects in Brandenburg and Saxony-Anhalt are expected to reach RTB status in 2026.

Lukas Gresnigt, Head International and member of the Executive Board of Alpiq said that Germany is a competitive and complex market for BESS, with many projects are queuing for grid access and permits, and the partnership combined Alpiq’s financial strength and SPP’s local expertise.

Last week, Energy-Storage.news reported on Alpiq entering into a long-term toll for a BESS in Germany owned and operated by Eco Stor. Alpiq has acquired projects in France and Finland, where it recently commissioned a 30MW/36MW project.

Shell and EQT companies agree Germany BESS toll

VPP operator Next Kraftwerke, acquired by Shell in 2021, has concluded a Germany BESS toll with BESS platform ju:niz Energy, acquired by investor EQT in 2024.

The seven-year toll is for a 20MW/40MWh project in Vöhringen, Bavaria, and Next said it is one of the first operational contracts of its kind in Germany, live since 1 November.

Next Kraftwerke will pay ju:niz Energy a fixed monthly fee per installed MW for the use of the BESS capacity. The model offers stable revenues for the operator (ju:niz) and flexibility for the optimiser (Next Kraftwerke). The toll is 80% fixed remuneration and 20% merchant, Next said.

(By Cameron Murray)

CENSA Upcoming Events:

Apr. 1-3, 2026 | The 14th Energy Storage International Conference & Expo

Register Now to attend, free before Dec 31, 2025.

Puerto Rico Advances on Its Delayed Accelerated BESS Deployment Programme

Source: Energy Storage News

In Puerto Rico, the electric generation, transmission, and distribution facilities managed by PREPA are operated privately by Luma Energy. Both entities are overseen by the Puerto Rico Energy Bureau (PREB). Image: Trish Hartmann.

The Puerto Rico Energy Bureau (PREB) has issued a resolution and order requiring the Puerto Rico Electric Power Authority (PREPA) to complete the Accelerated Battery Energy Storage Addition Programme (ASAP).

The resolution and order require PREPA to finish the necessary review process with the Financial Oversight and Management Board (FOMB) concerning the four final agreements of the ASAP.

Implementation and delay of ASAP

In Puerto Rico, the electric generation, transmission, and distribution facilities managed by PREPA are operated privately by Luma Energy. Both entities are overseen by the Puerto Rico Energy Bureau (PREB).

ASAP aims to enhance grid reliability across the island by deploying utility-scale battery energy storage systems (BESS) alongside existing generation facilities.

Under the programme, independent power producers (IPPs) with existing power purchase and operating agreements (PPOAs) with PREPA will install BESS at their sites, “on an accelerated basis,” as stated in PREB documents available on the regulator’s website.

In 2024, PREB informed Luma Energy that its plan to contract with IPPs for BESS resources was consistent with public power policy.

In April 2024, Luma identified Phase 1 projects that could start immediately with minimal costs and no network upgrades, with some developers claiming they could be operational in less than 12 months and contracts expected to be executed by April 2025.

However, in August 2025, the projects remained stalled, with only one developer (Ecoeléctrica) responding to PREPA’s communications to say it was working to complete documentation by September, while three others (San Fermín, Horizon, and Oriana) did not respond at all.

PREB called the delays “extremely concerning” and required all four developers to provide detailed explanations for the lack of responsiveness, emphasising that these projects are crucial for addressing Puerto Rico’s electricity generation shortfall and warning that fines will be imposed if developers don’t comply with the information requests.

PREB issues resolution and order to PREPA

PREB concluded that Luma’s four final agreement terms for ASAP align with the island’s Energy Public Policy and the Integrated Resource Plan (IRP).

As a result, the Bureau approved the four drafts and directed Luma to finalise the contracts, submit them to PREPA’s Governing Board for approval, and demonstrate this process. Furthermore, PREPA was instructed to obtain approval from the FOMB.

On 20 November, Luma submitted final agreements to PREPA’s Board. The private operator asked for these documents to be confidential due to critical infrastructure, sensitive data, and personal information. PREB confirmed Luma’s compliance and granted confidentiality.

PREB clarified that the 1,500MW of battery storage listed in the IRP is a guideline, not a strict cap.

The resolution and order confirmed that this figure is not fixed and can be exceeded; battery projects in development will be assessed regardless of whether they propose more than 1,500MW of storage capacity. PREB also highlighted that any decision to increase or decrease this limit is solely at its discretion.

Because PREB has granted confidentiality to Luma, it is unclear for which participants the agreements have been submitted.

Developers Ecoeléctrica, San Fermín, Horizon, and Oriana have had ongoing communications with Luma. Though, as noted above, San Fermin, Horizon, and Oriana have previously failed to respond to PREPA’s communications.

Additionally, in August, Polaris Renewable Energy submitted a BESS standard offer (SO1) agreement on behalf of PREPA to PREB.

The SO1 agreement is included in the ASAP scheme. When submitted, Polaris appeared to distinguish itself from the other developers who had not delivered BESS projects on the island.

Included in the resolution and order, Commissioner Mateo Santos dissented in part and concurred in part, and stated:

“As I have previously expressed, I do not agree with the pass-through concepts included in the contracts under the ASAP programme, and therefore I dissent on that aspect. However, I concur with the Energy Bureau’s determination regarding the integration of battery energy storage resources.”

Santos continued, “Specifically, I agree with the Energy Bureau’s clarification that the approximately 1,500MW of Battery Energy Storage Resources identified in the Approved IRP’s Modified Action Plan constitutes a guideline rather than a fixed limit. Any final determination on the appropriate level of integration will be made by the Energy Bureau.”

(By April Bonner)

CENSA Upcoming Events:

Apr. 1-3, 2026 | The 14th Energy Storage International Conference & Expo

Register Now to attend, free before Oct 31, 2025.

Multiple Gigawatts of European BESS Project M&A, Financing and Route-to-Market Deals

Source: Energy Storage News

European BESS news from project owners Premier Energy Group, Verbund, Eco Stor, Ingrid Capacity, Ric Energy, Ganfeng Lithium, EP Group, RWE and Giga Storage, securing acquisitions, financings and route-to-market (RTM) deals for multiple gigawatts of capacity this past week.

Romania: Premier buys 400MWh BESS, Verbund enlists

contractors for project

Energy firm Premier Energy Group has acquired a ready-to-build (RTB) 200MW/400MWh battery energy storage system (BESS) in Romania, near Iasi.

Construction on the project will start in 2026, with commissioning anticipated in late 2026 or early 2027. The project will support the integration or more renewables on Romania’s grid with fast-response capacity and grid balancing applications.

Premier is currently in advanced discussions on financing options for the project, with the expectation of securing a long-term structure, it said. The announcement did not say whether it was one of the winning projects from a recent EU-backed capex support scheme.

In related news, Austria-based utility and power firm Verbund’s local arm Verbund Wind Power Romania has enlisted OEM Prime Batteries and engineering firm Enevo Group to supply and integrate a 48MW/76MWh project.

It will be built at Verbund’s Alpha Nord Wind Farm in Tulcea County. The installation will help integrate more renewables but also improve the operational flexibility of the Verbund’s local renewable assets.

Prime Batteries Technology and Enevo Group will deliver the full engineering, procurement and construction (EPC) scope, including design, equipment supply, system integration, installation and commissioning.

Construction is scheduled to begin in February 2026 with commissioning set for September 2026.

Prime Batteries made headlines last year when it integrated a BESS for owner Monsson with an emphasis on locally manufactured technology.

Germany: Eco Stor project toll and Ingrid Capacity enters market

Project owner-operator and EPC Eco Stor has entered into a long-term toll with energy firm Alpiq for a 103.5MW/238 MWh BESS in Schleswig-Holstein, Germany.

Alpiq will partner with optimisers Enspired and Entelios to manage the BESS project’s activity in the electricity market.

It is Eco Stor’s second major grid-scale project in Germany, and identically sized to its first which came online in June this year, in Bollingstedt. The project with Alpiq in Schleswig-Holstein will come online in mid-2026.

The announcement coincided with one from Sweden-headquartered BESS owner-operator Ingrid Capacity, revealing it has partnered with developer Energiequelle for 200MW of grid-scale projects in Germany.

Energiequelle will develop the projects while finance, operate, and optimise the assets using its in-house trading and optimisation platform. The projects are expected to reach RTB in 2026. Ingrid has so far been active primarily in Sweden and Finland.

Italy: Ric Energy buys 200MW BESS

Spain-headquartered Ric Energy Group has acquired a 200MW BESS in the Apulia region of Italy. The firm’s development pipeline in Italy now stands at 942MW, it said announcing the post on LinkedIn.

It didn’t provide more details about the project in its post. Italy is currently a hotbed of activity, with the long-awaited first auction of its MACSE scheme concluded with 10GWh of BESS handed long-term revenue contracts. Many investors and owner-operators were waiting for the auction before taking FIDs and proceeding to construction.

Our publisher Solar Media will host the Battery Asset Management Summit Europe 2025 in Rome tomorrow and Wednesday (2 & 3 December), where MACSE and Italy will undoubtedly be big talking points.

Netherlands: Giga Storage toll with Vattenfall

BESS owner-operator Giga Storage has entered into a long-term toll with energy firm Vattenfall for its Project Leopard, a 300MW/1,200MWh BESS in the Netherlands.

The toll covers 100MW, one-third of Leopard’s total capacity. It will provide Giga with a fixed, long-term income stream that supports the project’s financing. Vattenfall will optimise the contracted portion of Leopard’s capacity for services such as grid stability, portfolio balancing, and electricity trading.

RTM deals for grid-scale BESS in the Netherlands are characterised by portioning a project’s capacity into different slices with different tollers and offtakers to spread risk, the same strategy adopted by other major BESS owner-operators there including Lion Storage and SemperPower.

UK: RWE to build 700MWh BESS, two optimisation deals announced

Germany-headquartered power firm RWE has made a final investment decision (FID) on a 350MW/700MWh BESS in Wales, called Pembroke Battery Storage. It is part of the wider Pembroke Net Zero Centre project combining renewable generation including green hydrogen production.

The project received planning consent in January 2025 and also won contracts in the UK’s most recent capacity market (CM) auction. Construction will start in 2026 with commissioning and commercial operation in H2 2028, ‘subject to receiving an updated and timely grid connection’, RWE said. That probably alludes to the ongoing grid connection queue reshuffle.

The news follows hot on the heels of two BESS optimisation announcements in the UK, both covered by our sister site Solar Power Portal.

China-based Ganfeng Lithium has enlisted power firm EDF to provide RTM and optimisation services for its 50MW/160MWh Kintore BESS project, while EP Group has contracted optimiser GridBeyond to do the same for its 50MW North Baddesley BESS.

(By Cameron Murray)

CENSA Upcoming Events:

1. Dec.4-5 | 2025 China Energy Storage CEO Summit | Xiamen, Fujian

Register Now to attend

Read more: http://en.cnesa.org/new-events-1/2025/12/4/dec4-5-2025-china-energy-storage-ceo-summit

2. Apr. 1-3, 2026 | The 14th Energy Storage International Conference & Expo

Register Now to attend, free before Oct 31, 2025.

Australia Opens Capacity Investment Scheme Tender 8, Seeking 16GWh of Energy Storage across NEM

Source: Energy Storage News

Pacific Green was one of the successful participants in the CIS, with the Limestone Coast Energy Park (pictured) having been awarded a CISA. Image: Pacific Green.

The Australian government has officially opened the Capacity Investment Scheme (CIS) Tender 8, targeting 16GWh of energy storage capacity across the National Electricity Market (NEM).

The tender represents the largest single energy storage procurement under the CIS programme, reflecting the government’s accelerated deployment timeline for grid-scale storage infrastructure.

Tender 8 registrations opened earlier today (28 November) and will close on 23 January, with submissions closing on 6 February. The tender specifically targets energy storage projects with a minimum 4-hour duration requirement, emphasising the government’s focus on medium-duration storage technologies capable of providing extended grid support services during peak demand periods and renewable energy intermittency events.

The 16GWh capacity target represents a substantial increase from previous tender rounds and aligns with Australia’s expanded CIS target of a total 40GW of renewables and energy storage.

The tender incorporates streamlined assessment processes developed through previous rounds, building on reforms introduced when the government unveiled four tenders for 2025.

These process improvements aim to reduce assessment timeframes and provide greater certainty for project developers while maintaining rigorous evaluation criteria for technical capability, financial viability, and grid integration requirements.

Eligible technologies under Tender 8 include battery energy storage systems, pumped hydro energy storage (PHES), compressed air energy storage, and other proven energy storage technologies capable of meeting the 4-hour minimum duration requirement.

The tender excludes hybrid renewable energy projects, focusing exclusively on standalone energy storage systems that can provide grid services, including frequency regulation, voltage support, and energy arbitrage across multiple market timeframes.

The CIS has demonstrated significant success in previous tender rounds, with substantial energy storage capacity awarded across multiple procurement cycles.

Tender 3 resulted in over 15GWh of energy storage being awarded to successful applicants, while Tender 4 saw 11.4GWh of solar-plus-storage projects receive government support through the programme.

The scheme provides revenue support through Capacity Investment Scheme Agreements (CISAs) that supplement market revenues, enabling project developers to secure financing for energy storage projects that might otherwise face commercial viability challenges in merchant market conditions.

The support mechanism includes floor and ceiling price arrangements that provide revenue certainty while maintaining market exposure and incentives for efficient operation.

Tender 8 evaluation criteria encompass technical specifications, commercial arrangements, grid connection requirements and project development timelines.

Projects must demonstrate grid connection agreements or advanced connection applications with relevant transmission network service providers, along with evidence of site control, environmental approvals, and financial capacity to complete construction and commissioning activities.

The geographic distribution requirements under Tender 8 aim to ensure the deployment of energy storage across multiple states and regions within the NEM, thereby supporting grid resilience and renewable energy integration under diverse network conditions.

The scheme includes milestone requirements and progress reporting obligations to ensure that successful projects advance through the development, construction, and commissioning phases according to agreed-upon schedules.

The DCCEEW will conduct information sessions for potential applicants during December 2025 and January 2026, providing guidance on application requirements, evaluation criteria and commercial arrangements.

Successful Tender 8 projects are expected to be announced in mid-2026, with CISAs enabling project financing and construction commencement. You can find out more about CIS Tender 8 on the official website.

CENSA Upcoming Events:

1. Dec.4-5 | 2025 China Energy Storage CEO Summit | Xiamen, Fujian

Register Now to attend

Read more: http://en.cnesa.org/new-events-1/2025/12/4/dec4-5-2025-china-energy-storage-ceo-summit

2. Apr. 1-3, 2026 | The 14th Energy Storage International Conference & Expo

Register Now to attend, free before Oct 31, 2025.

Germany BESS ‘Firsts’: Integrated Software, Multi-Party Optimisation, Privileged Permitting

Source: Energy Storage News

Germany BESS ‘firsts’: Integrated software, multi-party optimisation, privileged permitting

A week of claimed first-of-their-kind advances in Germany’s BESS market, including the combination of monitoring, diagnostics and energy trading on one platform, an optimisation deal allowing multiple companies to trade one asset virtually, and a law change accelerating permitting.

In summary:

· Investor Dynamic is deploying a BESS where digital monitoring, battery analytics and diagnostics, and energy trading are combined into one single, coordinated system: an industry-first according to the analytics provider Volytica

· Optimisation platform Terralayr has enabled three optimisers – Entrix, Suena and The Mobility House – to virtually trade portions of one single BESS asset

· The German Federal Parliament (Bundestag) has passed a law simplifying the development of energy storage projects, and expressly granting them privileged status

Dynamic’s Tangermünde project’s ‘first-of-its-kind’ integration

Investor Dynamic has partnered with digital monitoring and asset management solutions firm Amperecloud, battery analytics and diagnostics provider Volytica and optimiser Enspired for a 15.8MW/32MWh battery energy storage system (BESS) in Tangermünde, Saxony-Anhalt.

Volytica said it is the first project to “…combine monitoring, battery diagnostics, and energy trading into a single, coordinated system. These features are integrated to simplify operations and ensure competitiveness in today’s energy market”.

The analytics provider said the initiative addresses the common BESS industry challenge of fragmented digital tools for operational control, battery condition monitoring, and commercial optimisation. By integrating their platforms, the partners aim to enable continuous, data-driven system management, from performance monitoring to market participation, it said.

A spokesperson for Volytica said that, normally, you have individual software tools for asset management to operate and maintain the BESS, one tool for trading, one tool to access BMS data and one tool for analytics and monitoring, with no connection between providers.

Volytica CEO Claudius Jehle posted in more detail on his LinkedIn about the concept when Volytica announced the project.

The spokesperson said the integrated approach saves time and money, improves efficiency and competitiveness, and erases blind spots and increase transparency.

The project appears to already be operational, with a photo provided showing BESS units from Trina Storage, though the release did not refer to this.

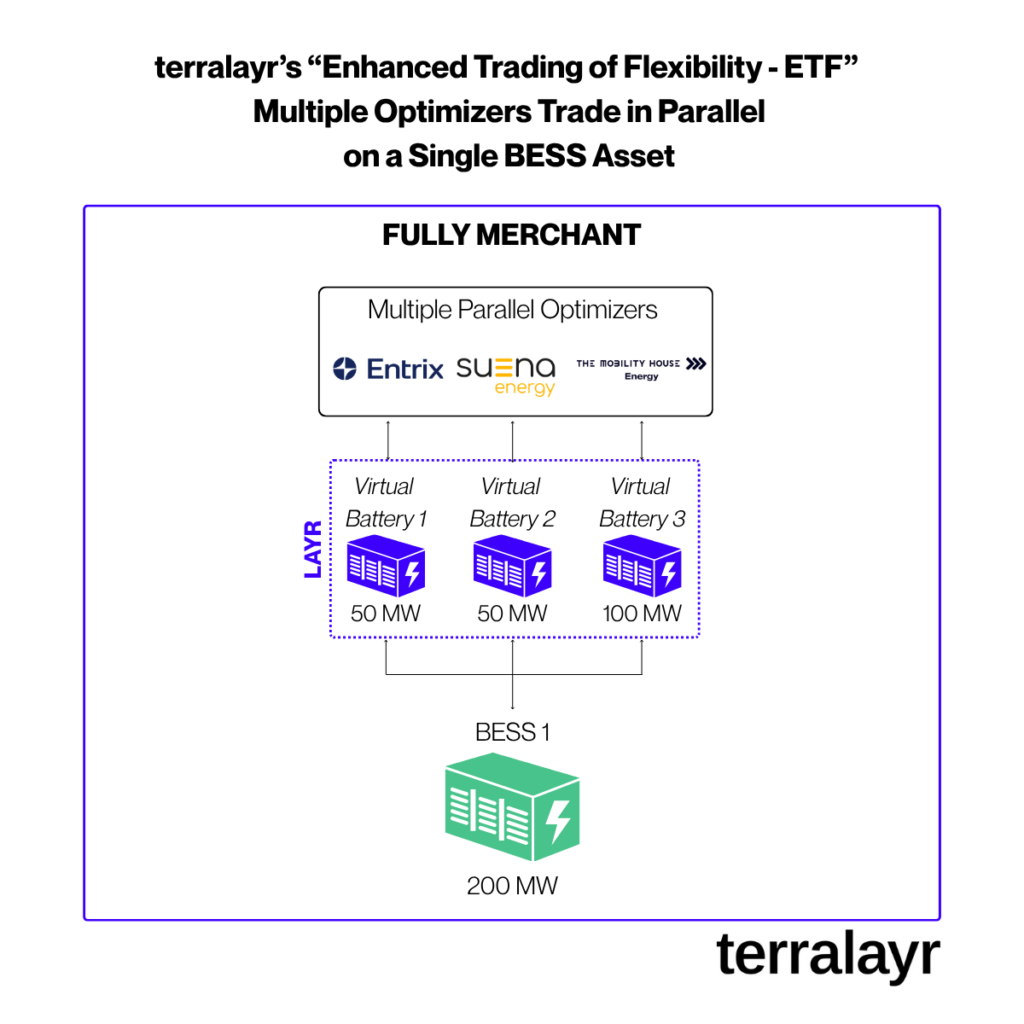

Terralayr’s multi-optimiser BESS arrangement

BESS optimisation and virtual aggregation platform Terralayr has also claimed an industry-first, software-related asset management breakthrough.

It said its latest commercialisation model creates the “world’s first, risk-adjusted portfolio-effect for storage operators”.

The firm’s virtualisation set up allows multiple optimisers to trade a slice of one or multiple physical assets. The solution is live on Terralayr’s assets, will be rolled out to all future ones as well and available to asset owners in Germany.

Every asset owner has one contract per physical asset and that asset would be disaggregated into virtual batteries. Each virtual battery is then optimised by one different optimiser. As a result, one physical asset is optimised by multiple optimisers in parallel, a spokesperson explained.

A hypothetical arranagement is visualised in the infographic the firm provided below, with the BESS sliced into three virtual assets, 50MW each for Entrix and Suena and 100MW for The Mobility House (for example).

The model is called ‘Enhanced Trading of Flexibility – ETF’, and Terralayr claimed that it drives market efficiency, lowers revenue volatility, and creates a more stable risk-return profile for operators.

It also described an additional benefit called the “netting-off effects”, which regularly occurs when optimisers’ dispatch schedules offset each other, saving battery cycles and reducing degradation.

Terralayr’s platform bundles all optimiser dispatch and ancillary service signals and allocates them to the physical asset, while guaranteeing adherence to all technical restrictions and manufacturer specifications.

The firm launched in 2022, and has onboarded big-name energy firms in Germany including RWE and Vattenfall to its virtual BESS aggregation and optimisation platform as offtakers. Terralayr is deploying its own, smaller grid-scale BESS projects, at least partially to provide capacity for, and prove out, its platform.

Parliament in Germany adopts faster permitting for storage

In related BESS industry news, the German Federal Parliament (Bundestag) passed an amendment to the Energy Industry Act and the Federal Building Code which significantly simplifies the development of energy storage projects, law firm Evershed Sutherlands said in a note.

In a nutshell, the reform elevates legal certainty regarding the privileged treatment of thermal storage facilities, hydrogen storage facilities, and large-scale BESS in outside areas (Außenbereich), the firm explained: such projects are now expressly granted privileged status. The reform aims to accelerate energy storage permitting and deployment.

It creates a major simplification of future permit procedures, whereas previously energy storage was subject to considerable legal uncertainty.

Most grid-scale development in Germany is currently focused around projects that will come online before August 2028, when a three-year exemption from grid fees for charging and discharging ends. The government is discussing a more long-term solution, but whether this new change will benefit projects that can be deployed within the next three years is unclear.

(By Cameron Murray)

CENSA Upcoming Events:

1. Dec.4-5 | 2025 China Energy Storage CEO Summit | Xiamen, Fujian

Register Now to attend

Read more: http://en.cnesa.org/new-events-1/2025/12/4/dec4-5-2025-china-energy-storage-ceo-summit

2. Apr. 1-3, 2026 | The 14th Energy Storage International Conference & Expo

Register Now to attend, free before Oct 31, 2025.