On January 16th, a 107.12MW/428.48MWh green hydropower-based aluminium user-side energy storage project jointly developed by Great Power and Henan Zhongfu Industry was officially commissioned in Guangyuan, Sichuan Province.

4.8 GWh Installed: Beijing KeRui Supports the Grid Connection of Two Major Grid-Side Energy Storage Projects in Inner Mongolia, Chi

China Mingyang Longyuan’s First 100MW/400MWh High-Voltage Cascade Independent Energy Storage Project Achieves Full-Capacity Grid Connection

Mingyang Longyuan has built a major milestone in China’s energy storage sector with the successful full-capacity grid connection of its first 100MW/400MWh high-voltage cascade independent energy storage project in Ordos, Inner Mongolia. The project’s commissioning highlights the company’s technological strength in large-scale, high-efficiency, and highly reliable energy storage solutions, while reinforcing the critical role of advanced storage systems in supporting grid stability and renewable energy integration.

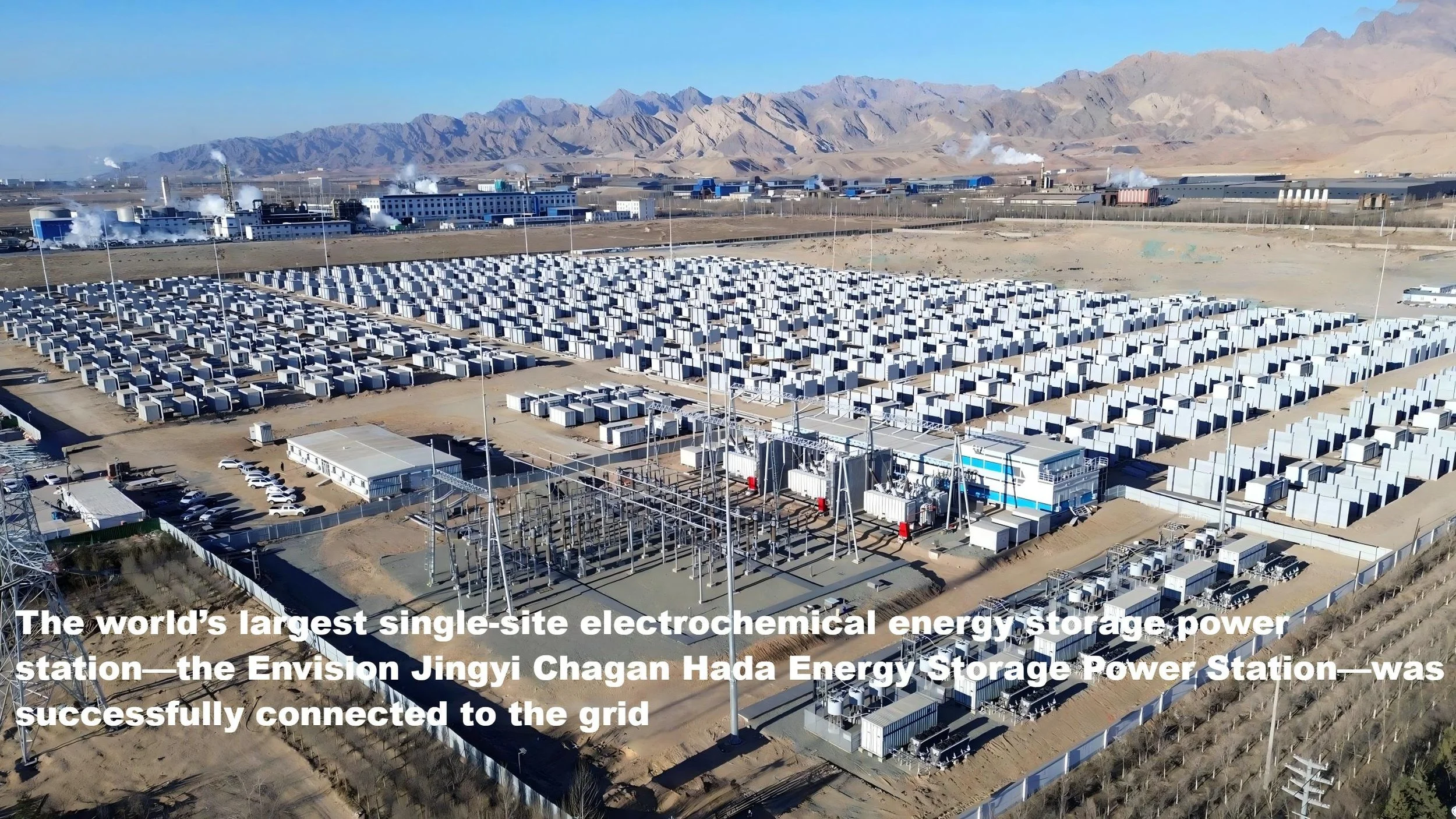

12.8 GWh Energy Storage Cluster Connected to the Grid AI-Powered Energy Storage Reshapes the Future of New Power Systems

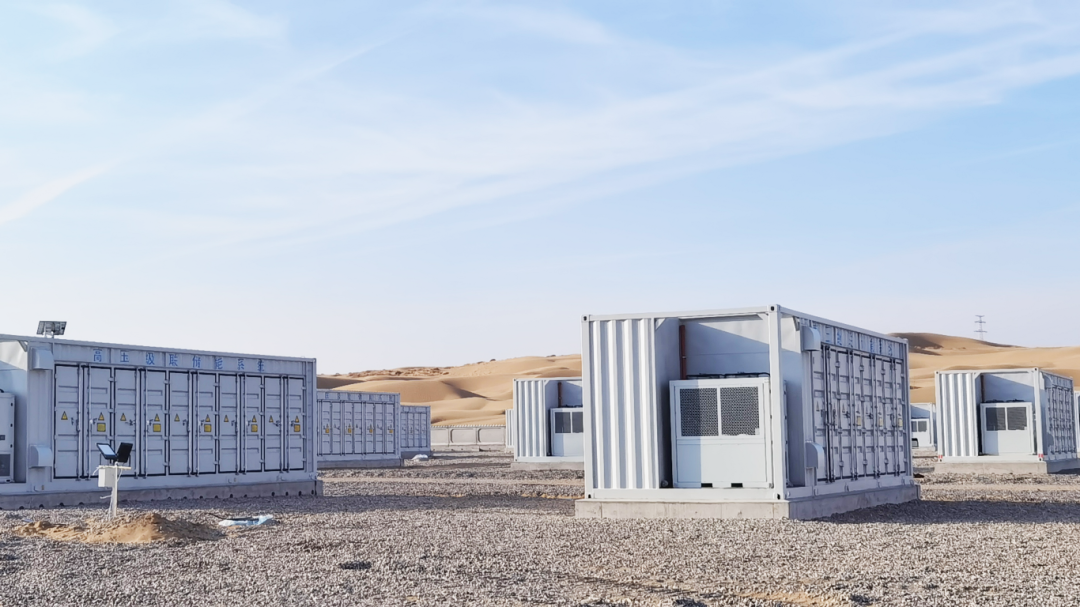

The world’s largest single-site electrochemical energy storage power station—the Envision Jingyi Chagan Hada Energy Storage Power Station—was successfully connected to the grid, completing a 12.8 GWh AI-powered energy storage cluster in Inner Mongolia. The project sets new global benchmarks for scale, grid-connection speed, and system reliability, while demonstrating advanced grid-forming capabilities that enable rapid commissioning, deep grid interaction, and large-scale renewable integration.

4GW/5.12GWh Malaysia Solar-Plus-Storage Hub Receives World Bank Funding

Source: PV Tech

The agreement was signed this week, in the presence of the Queen of Malaysia (pictured). Image: IFC

The World Bank will invest in a huge 4GW, 5.12GWh solar-plus-storage complex in Malaysia, which will form part of a pan-Southeast Asian power grid initiative.

The Southern Johor Renewable Energy Corridor (SJREC) will be a roughly 2,000sqKm area dedicated to solar PV and energy storage capacity. The US$6 billion project is backed by the World Bank’s private investment arm, the Iternational Finance Corporation (IFC), alongside the state investment firm of Johor, Permodalan Darul Ta’zim (PDT), and Ditrolic Energy, a Malaysian integrated energy company.

The project is part of a number of larger schemes, chiefly the ASEAN Power Grid Initiative, a plan to integrate power grids and energy supply across Southeast Asian nations. In this vein, the SJREC will be part of the Johor–Singapore Special Economic Zone (JS-SEZ) “masterplan”, able to transmit clean energy to Singapore, which sits on Johor’s southern border.

As a densely populated city state, Singapore relies heavily on energy imports and has made significant plans for cross-border renewables transmission, perhaps most notably the mammoth AA PowerLink project in Northern Australia, which aims to deploy almost 20GW of solar capacity when fully operational and supply power to Singapore via undersea cables.

The site is also part of the Johor Green Development Policy 2030, which the state government introduced to expand its green industries and renewable energy developments.

“As the state agency entrusted to formulate the Johor Green Development Policy 2030, PDT is proud to witness our strategic framework transition into tangible reality today,” said Dato’ Ramlee bin A Rahman, president and group chief executive of Permodalan Darul Ta’zim.

“The Southern Johor Renewable Energy Corridor was conceived as the cornerstone of this policy, specifically Strategy one, to unlock the immense solar potential of the Kota Tinggi and Mersing districts.”

Tham Chee Aun, CEO of Ditrolic Energy, said the SJREC hub would “Anchor Johor’s clean energy export potential and provide a foundation for industries seeking renewable, low-cost power in the region.”

In an announcement, the IFC said the project would supply renewable energy to “local and multinational corporations, including hyperscale data centre operators, manufacturers, and other businesses in Johor”.

Renewables development is a major driver for meeting data centre power demand, primarily because of the affordability of solar projects and solar energy and the stability offered by coupling the technology with energy storage. In its most recent report, the International Energy Agency (IEA) said the world would become “thirsty for energy” in the coming years and that data centres were an “Important driver” of growing power demand.

(By Will Norman)

CENSA Upcoming Events:

Apr. 1-3, 2026 | The 14th Energy Storage International Conference & Expo

Register Now to attend, free before Oct 31, 2025.

200MW/800MWh! China's Largest Semi-Solid-State Energy Storage Project Connected to the Grid

Source: CCTV News

According to a report by CCTV News on December 1, China Green Development Group announced that a 200MW/800MWh semi-solid-state battery energy storage project located in Wuhai, Inner Mongolia, has been successfully connected to the grid. The project not only sets a new record for the installed capacity of grid-connected semi-solid-state lithium battery energy storage in China, but also marks a crucial step for China's semi-solid-state energy storage technology from pilot demonstration to large-scale commercial operation.

As a major new energy hub in northwest China, Wuhai city in the Inner Mongolia Autonomous Region, has leveraged its abundant wind and solar resources to consistently advance integrated development of “source-grid-load-storage” in recent years. This newly grid-connected energy storage facility serves as a core infrastructure project for enhancing local renewable energy consumption. Covering an area of about 100 mu (about 6.67 hectares), the project is equipped with 160 energy storage battery containers and 40 converter and booster integrated units.

Semi-Solid-State Lithium Battery Energy Storage Project Successfully Connected to the Grid in Wuhai, Inner Mongolia

Qin Lei, Project Manager of Wuhai Energy Storage Project, Inner Mongolia Branch, China Green Development Group:

“This massive ‘power bank’ utilizes domestically-developed semi-solid-state lithium iron phosphate battery technology, which offers significant advantages in safety performance, energy density, and cycle life compared with conventional liquid lithium iron phosphate batteries.”

With the rapid upgrade of the new energy industry, energy storage - essential for grid peak regulation, frequency modulation, and improving renewable energy utilization - is entering a phase of large-scale expansion. Semi-solid-state lithium battery technology represents a key direction for the future development of power and storage batteries. Using a hybrid solid-liquid electrolyte, semi-solid-state batteries retain the high ionic conductivity of liquid systems while achieving a cycle life exceeding 12,000 cycles, which greatly reduces lifecycle operational costs. In addition, they can effectively suppress lithium dendrite growth, further enhancing safety.

Semi-Solid-State Lithium Battery Energy Storage Project Successfully Connected to the Grid in Wuhai, Inner Mongolia

Liu Xiaofei, Assistant General Manager, Inner Mongolia Branch, China Green Development Group:

“Once fully operational, the project will feature a peak-shaving and frequency-regulating capability of 200MW/800MWh, providing 189,000 MWh of clean electricity to the grid annually. It enables flexible scheduling - storing energy during the day and supporting peak loads at night - significantly enhancing power system stability. It will also ensure that local green electricity can be fully delivered, stably transmitted, and efficiently utilized, solving key bottlenecks in regional renewable energy consumption.”

Semi-Solid-State Lithium Battery Energy Storage Project Successfully Connected to the Grid in Wuhai, Inner Mongolia

In recent years, semi-solid-state lithium batteries - offering both high safety and strong economic performance - have become a core direction of technological evolution in the energy storage sector. Previously, China's largest grid-connected semi-solid-state storage project had a capacity of 100MW/200MWh. The Wuhai project doubles that scale, demonstrating that China is now at the global forefront of large-scale applications of semi-solid-state energy storage technology.

CENSA Upcoming Events:

1. Dec.4-5 | 2025 China Energy Storage CEO Summit | Xiamen, Fujian

Register Now to attend

Read more: http://en.cnesa.org/new-events-1/2025/12/4/dec4-5-2025-china-energy-storage-ceo-summit

2. Apr. 1-3, 2026 | The 14th Energy Storage International Conference & Expo

Register Now to attend, free before Oct 31, 2025.

Australia Opens Capacity Investment Scheme Tender 8, Seeking 16GWh of Energy Storage across NEM

Source: Energy Storage News

Pacific Green was one of the successful participants in the CIS, with the Limestone Coast Energy Park (pictured) having been awarded a CISA. Image: Pacific Green.

The Australian government has officially opened the Capacity Investment Scheme (CIS) Tender 8, targeting 16GWh of energy storage capacity across the National Electricity Market (NEM).

The tender represents the largest single energy storage procurement under the CIS programme, reflecting the government’s accelerated deployment timeline for grid-scale storage infrastructure.

Tender 8 registrations opened earlier today (28 November) and will close on 23 January, with submissions closing on 6 February. The tender specifically targets energy storage projects with a minimum 4-hour duration requirement, emphasising the government’s focus on medium-duration storage technologies capable of providing extended grid support services during peak demand periods and renewable energy intermittency events.

The 16GWh capacity target represents a substantial increase from previous tender rounds and aligns with Australia’s expanded CIS target of a total 40GW of renewables and energy storage.

The tender incorporates streamlined assessment processes developed through previous rounds, building on reforms introduced when the government unveiled four tenders for 2025.

These process improvements aim to reduce assessment timeframes and provide greater certainty for project developers while maintaining rigorous evaluation criteria for technical capability, financial viability, and grid integration requirements.

Eligible technologies under Tender 8 include battery energy storage systems, pumped hydro energy storage (PHES), compressed air energy storage, and other proven energy storage technologies capable of meeting the 4-hour minimum duration requirement.

The tender excludes hybrid renewable energy projects, focusing exclusively on standalone energy storage systems that can provide grid services, including frequency regulation, voltage support, and energy arbitrage across multiple market timeframes.

The CIS has demonstrated significant success in previous tender rounds, with substantial energy storage capacity awarded across multiple procurement cycles.

Tender 3 resulted in over 15GWh of energy storage being awarded to successful applicants, while Tender 4 saw 11.4GWh of solar-plus-storage projects receive government support through the programme.

The scheme provides revenue support through Capacity Investment Scheme Agreements (CISAs) that supplement market revenues, enabling project developers to secure financing for energy storage projects that might otherwise face commercial viability challenges in merchant market conditions.

The support mechanism includes floor and ceiling price arrangements that provide revenue certainty while maintaining market exposure and incentives for efficient operation.

Tender 8 evaluation criteria encompass technical specifications, commercial arrangements, grid connection requirements and project development timelines.

Projects must demonstrate grid connection agreements or advanced connection applications with relevant transmission network service providers, along with evidence of site control, environmental approvals, and financial capacity to complete construction and commissioning activities.

The geographic distribution requirements under Tender 8 aim to ensure the deployment of energy storage across multiple states and regions within the NEM, thereby supporting grid resilience and renewable energy integration under diverse network conditions.

The scheme includes milestone requirements and progress reporting obligations to ensure that successful projects advance through the development, construction, and commissioning phases according to agreed-upon schedules.

The DCCEEW will conduct information sessions for potential applicants during December 2025 and January 2026, providing guidance on application requirements, evaluation criteria and commercial arrangements.

Successful Tender 8 projects are expected to be announced in mid-2026, with CISAs enabling project financing and construction commencement. You can find out more about CIS Tender 8 on the official website.

CENSA Upcoming Events:

1. Dec.4-5 | 2025 China Energy Storage CEO Summit | Xiamen, Fujian

Register Now to attend

Read more: http://en.cnesa.org/new-events-1/2025/12/4/dec4-5-2025-china-energy-storage-ceo-summit

2. Apr. 1-3, 2026 | The 14th Energy Storage International Conference & Expo

Register Now to attend, free before Oct 31, 2025.

CLOU Electronics’ Indonesia Energy Storage Base Set for 2026 Commissioning, Targets 3GWh Capacity

Source: CNESA

On November 6, CLOU Electronics announced key progress in its global manufacturing expansion, revealing that its energy storage production base in Indonesia is currently under construction and scheduled to commence operation in 2026. The facility has an initial planned capacity of 3GWh per year, with flexibility for future expansion based on market demand and business growth.

CLOU Electronics is a national high-tech enterprise in China with a number of national and provincial technical centers and laboratories. Focusing on two major fields including new electrochemical energy storage and new power system, CLOU Electronics has long accumulated deep technological expertise and extensive project experience in the energy storage sector. The company has achieved full in-house research, development, and manufacturing capabilities for core system components - including PCS, BMS, EMS, DC/DC converters, and O&MS platforms - enabling it to deliver comprehensive integrated energy storage solutions.

The Indonesia Energy Storage Base marks a strategic milestone in CLOU Electronics’ globalization roadmap. The site will focus on research, development, and large-scale production of key products such as lithium-ion battery energy storage systems and energy storage inverters (PCS). It will also include intelligent production lines, R&D and testing centers, and warehousing and logistics facilities.

Leveraging Indonesia’s abundant nickel and cobalt resources, the project aims to establish a fully integrated overseas industrial ecosystem of “resources-R&D-manufacturing-application.” This approach is expected to reduce supply chain costs and mitigate geopolitical risks, while enhancing production efficiency and responsiveness to regional demand.

As one of the world’s fastest-growing energy storage markets, Southeast Asia has seen rapid expansion driven by the rise of renewable energy installations and urgent power grid upgrades. The commissioning of CLOU’s Indonesian base will enable the company to provide localized products and solutions for utility-scale, industrial, commercial, and off-grid energy storage applications across ASEAN countries, the Middle East, and beyond.

CLOU Electronics has already implemented multiple energy storage projects in Southeast Asia, building a strong reputation and customer network that will support future market development once the new base becomes operational.

The relevant person in charge of CLOU Electronics stated that the Indonesian energy storage production base is a vital component of the company’s globalization strategy. The release of 3GWh annual capacity will significantly enhance the company’s global supply capability and competitiveness. Going forward, CLOU will use the Indonesian base as a hub to deepen its international market presence, accelerate technological innovation, and provide efficient, reliable, and cost-effective energy storage solutions that support global energy transition under the “dual-carbon” goals.

CENSA Upcoming Events:

1. Dec.4-5 | 2025 China Energy Storage CEO Summit | Xiamen, Fujian

Register Now to attend

Read more: http://en.cnesa.org/new-events-1/2025/12/4/dec4-5-2025-china-energy-storage-ceo-summit

2. Apr. 1-3, 2026 | The 14th Energy Storage International Conference & Expo

Register Now to attend, free before Oct 31, 2025.

China’s Newly Installed Renewable Energy Capacity Up 47.7% Year-on-Year in First Three Quarters

Source: Xinhua News Agency

According to China’s National Energy Administration (NEA), in the first three quarters of 2025, China added 310 GW of newly installed renewable energy capacity, representing a year-on-year increase of 47.7% and accounting for 84.4% of the nation’s total new power installations. Specifically, new hydropower capacity reached 7.16 GW, wind power 61.09 GW, solar power (including solar thermal) 240 GW, and biomass power 1.05 GW.

At a regular press conference held by the NEA on the same day, Zhang Xing, Deputy Director-General of the NEA’s General Affairs Department, stated that in the first three quarters of 2025, the NEA remained focused on China’s carbon peaking and carbon neutrality goals, fully implemented the new energy security strategy, and made all-out efforts to advance larger-scale and higher-quality renewable energy development.

On one hand, the installed capacity of renewable energy continued to expand, driving the optimization of China’s energy structure. As of the end of September 2025, China’s total installed renewable energy capacity approached 2,200 GW, up 27.2% year-on-year, accounting for 59.1% of the nation’s total power generation capacity. The combined installed capacity of wind and solar power exceeded 1,700 GW.

On the other hand, renewable power generation maintained steady growth, providing strong support for the country’s overall electricity supply. The latest data show that in the first three quarters of 2025, China’s renewable power generation reached 2.89 million GWh, up 15.5% year-on-year, accounting for around 40% of total power generation and roughly 60% of total industrial power consumption during the same period.

At the press conference, Xing Yiteng, Deputy Director-General of the NEA’s Development and Planning Department, noted that since the beginning of this year, funding and resource guarantees for key energy projects have been continuously strengthened, with accelerated formation of tangible project progress. As a result, national energy investment has maintained rapid growth - with 1.97 trillion yuan invested in key energy projects during the first eight months, marking an 18.2% year-on-year increase.

(Reported by Wang Xi and Dai Xiaohe)

CENSA Upcoming Events:

1. Dec.4-5 | 2025 China Energy Storage CEO Summit | Xiamen, Fujian

Register Now to attend

Read more: http://en.cnesa.org/new-events-1/2025/12/4/dec4-5-2025-china-energy-storage-ceo-summit

2. Apr. 1-3, 2026 | The 14th Energy Storage International Conference & Expo

Register Now to attend, free before Oct 31, 2025.

Power Consumption Exceeds 1 Trillion kWh for Consecutive Periods -- What Does It Mean?

People’s Daily Overseas Edition

In July and August of this year, China’s total electricity consumption

reached 1,022.6 billion kWh and 1,015.4 billion kWh, respectively --

surpassing 1 trillion kWh for two consecutive months.

What does this indicate?

Wind turbines in the Beibu Gulf sea area of the Suping district within the Comprehensive Experimental Zone in Pingtan County, Fujian Province. Photo by Xie Guiming (People Visual)

The Pingtan Comprehensive Experimental Zone in Fujian Province is focusing on the development of the wind power industry, leveraging its abundant offshore wind resources to create a complementary model of “green energy + offshore farms”, delivering clean electricity and supporting carbon reduction efforts.

Recently, residents of Leshan City, Sichuan Province, were shopping for home appliances in a large shopping mall. Photo by Li Huashi (People Visual)

Contestants participating in the distribution network live-line operation competition. Photo by Lu Junyuan (People Visual)

Recently, Wuhu Electric Power Company in Anhui Province under the State Grid, together with the Wuhu Fanchang District Federation of Trade Unions, held the Fanchang District 2025 Power Emergency Supply and Service Skills Competition, supporting the development of local skilled talent and power emergency guarantee.

Total electricity consumption in China has consecutively exceeded 1 trillion kWh! Recently, the National Energy Administration released electricity consumption data for July and August. In July, total electricity consumption reached 1,022.6 billion kWh, up 8.6% year-on-year; in August, it reached 1,015.4 billion kWh, up 5% year-on-year.

What does it mean for a single month’s consumption to surpass 1 trillion kWh? What economic development trends does this reflect?

How should we understand 1 trillion kWh?

-- Horizontally, 1 trillion kWh is roughly equivalent to the total annual electricity consumption of Japan; Vertically, this figure has doubled over the past 10 years.

Electricity consumption is regarded as a “barometer” and “weathervane” of economic and social activity. By observing changes in this data, one can gain a relatively direct insight into the underlying momentum of economic development.

In July this year, China’s total electricity consumption reached 1,022.6 billion kWh, marking the first time monthly consumption exceeded 1 trillion kWh, a milestone also unprecedented globally. In August, total electricity consumption reached 1,015.4 billion kWh, crossing the 1 trillion kWh threshold once again.

What does 1 trillion kWh mean? Horizontally, 1 trillion kWh is roughly equivalent to the total annual electricity consumption of Japan or that of the ASEAN countries; Vertically, compared with July 2015, when electricity consumption first exceeded 500 billion kWh, this figure has doubled over the past 10 years.

By industry, in July, electricity consumption in the primary sector reached 17 billion kWh, up 20.2% year-on-year, with a growth rate 15.3 percentage points higher than the previous month. The secondary sector consumed 593.6 billion kWh, up 4.7% year-on-year, with a growth rate 1.5 percentage points higher than last month. electricity consumption in the the tertiary sector used 208.1 billion kWh, up 10.7% year-on-year, 1.7 percentage points higher than June. Urban and rural household electricity consumption reached 203.9 billion kWh, up 18.0% year-on-year.

It is evident that the secondary sector accounted for the largest share of total electricity consumption in July. As a fundamental factor of industrial production, the stable growth in electricity use indicates the steady development of industrial economy.

“In July, electricity consumption in the secondary sector continued to grow, with high-tech and equipment manufacturing leading the increase”, analyzed by Jiang Debin, Deputy Director of the Statistics and Digital Intelligence Department at the China Electricity Council (CEC). Specifically, in July, electricity consumption in the four high-energy-consuming industries grew 0.5% year-on-year, an increase of 1.2 percentage points compared to the previous month, turning positive after two months of decline. Additionally, most consumer goods manufacturing sectors saw rising electricity usage. In July, electricity consumption in food manufacturing, tobacco products, and agricultural and sideline food processing increased 7.3%, 5.3%, and 5.1% year-on-year, respectively.

In August, electricity consumption in the primary sector grew 9.7% year-on-year, 5.1 percentage points higher than the same period last year, with livestock and fisheries leading at 12.3% and 10.9%, respectively. Electricity consumption in the secondary sector increased 5% year-on-year, 0.3 percentage points higher than July and 1 percentage point higher than August 2024. Within this, the four high-energy-consuming industries grew 4.2% year-on-year, 3.7 percentage points higher than last month. Growth in the tertiary sector slightly declined month-on-month but remained robust at 7.2%. Meanwhile, urban and rural household electricity consumption reached 196.3 billion kWh, up 2.4% year-on-year.

What factors are driving electricity consumption?

-- Rapidly rising power loads under sustained high temperatures; Macroeconomic recovery supporting continued capacity release across industries

What explains the monthly electricity consumption exceeding 1 trillion kWh?

Firstly, sustained high temperatures have driven demand. Since the start of summer, many regions nationwide have experienced hot and humid weather, causing electricity loads to climb rapidly and boosting urban and rural household electricity consumption. On July 4, the national peak load reached 1.465 billion kW, approximately 200 million kW higher than the end of June, setting a historic record (compared with 1.451 billion kW in 2024) and nearly 150 million kW higher than the same period last year. Provinces including Jiangsu, Anhui, Shandong, Henan, and Hubei saw their grids load reach all-time highs. In Jiangsu, the grid load exceeded 150 million kW for the first time, with the peak load rising nearly 40 million kW above the spring average, about 90% of the incremental load used for air conditioning.

“According to the National Climate Center, many places across the country experienced multiple rounds of high temperatures in July, with the national average temperature reaching a historical high for the same period since 1961, driving urban and rural household electricity consumption up 18% year-on-year. Under the sustained hot and humid weather, multiple regions reached record loads. In July, household electricity consumption in Henan, Shaanxi, Shandong, Sichuan, Anhui, and Hubei all rose more than 30% year-on-year”, said Jiang Debin.

Secondly, macroeconomic recovery and industrial production expansion have boosted electricity demand. A series of policies promoting consumption through the “Two New” (large-scale equipment renewal and trade-in of consumer goods) and “Two Majors” (the implementation of major national strategies and the construction of security capabilities in key areas) measures, along with efforts to stabilize industrial growth and curb over-competition, have maintained a recovering economic trend, releasing industrial capacity and further driving total electricity consumption.

“In August, nationwide manufacturing electricity consumption grew 5.5% year-on-year, the highest monthly growth this year. Electricity use in raw material industries such as steel, building materials, non-ferrous metals, and chemicals showed clear recovery, with total consumption up 4.2% year-on-year, 3.7 percentage points higher than July. High-tech and equipment manufacturing demonstrated strong resilience, with total electricity consumption up 9.1% year-on-year, about 4.6 percentage points above the average manufacturing growth rate”, Jiang Debin said. Importantly, all sub-sectors of high-tech and equipment manufacturing saw positive growth, with new energy vehicle production and photovoltaic industry manufacturing maintaining rapid growth, reflecting the robust development of new-quality productivity, creating new economic growth points, and driving electricity consumption upward.

Rising consumption has also contributed to higher electricity use. The consumer market has maintained steady growth this year, and service consumption policies have taken effect, sustaining rapid growth in the service sector. For example, in Jiangsu Province, host of the popular “Jiangsu Football City League” summer events, electricity consumption in fitness and leisure venues increased 23% year-on-year in July. During the same month, catering industry electricity use rose 10.1% year-on-year, while tourist attractions and accommodation electricity consumption increased 10.3% and 5.3% year-on-year, respectively.

What Ensures Stable Power Supply Amid Soaring Electricity

Consumption?

-- Strong energy self-sufficiency, stable operational regulation, and robust emergency response capabilities are key

From the consumption side, China’s record-breaking monthly electricity use -- exceeding 1 trillion kWh -- not only highlights the vitality of economic and social development but also reflects the steady reliability of the power supply.

According to Wang Hongzhi, Director of the China’s National Energy Administration, during the summer peak period (from the second half of July to the first half of August), China experienced extensive high temperatures, heavy rainfall, floods, and typhoons. Meanwhile, the country’s steadily recovering economy posed even greater demands on energy security. Despite these challenges, China’s power supply remained stable and orderly throughout the summer. “Our energy system withstood the peak and safeguarded the bottom line”, said Wang. Overall, China’s energy supply security and resilience have reached a high level.

Stable electricity use is underpinned by a high degree of energy self-sufficiency. Since the start of the 14th Five-Year Plan, China has taken multiple measures to strengthen the stability and security of its energy supply chain. Over 90% of the increase in energy consumption has been met through domestic production. New energy sources have played a major role, achieving two “50%” milestones: The increase in renewable power generation accounts for nearly 50% of total new generation capacity nationwide; Non-fossil energy sources have contributed nearly 50% of the total increase in energy supply. As of the end of August, China’s total installed power generation capacity reached 3.69 billion kW, up 18.0% year-on-year, with wind and solar power combined totaling around 1.7 billion kW. This demonstrates that China’s energy self-sufficiency “base” has become more solid, while the share of green energy continues to rise.

Stable electricity use also relies on robust operational coordination. China has established a comprehensive energy production, supply, storage, and marketing system and a sound mechanism to ensure supply and stabilize prices. Energy storage capacity has been steadily enhanced, while the nationwide oil and gas pipeline network has been expanding rapidly. The large-scale power grid’s capacity to allocate and balance resources across regions has been fully utilized. Before this summer’s power demand peak, several cross-provincial transmission projects, including the Longdong-Shandong and Hami-Chongqing lines, were completed and put into operation. These channels have delivered stable power to many cities, ensuring smooth electricity use during high-demand periods.

Stable power supply also relies on strong emergency support capabilities. When electricity demand surges sharply, power grids face serious challenges, particularly amid increasingly frequent global extreme weather events and natural disasters. To address this, China has established a national-level emergency power support system, consisting of four regional emergency bases in Sichuan-Chongqing-Tibet, South China, North China, and East China. These facilities aim to strengthen the country’s emergency response capacity for coal, oil, and gas, ensuring the long-term stability and reliability of the national energy and power systems. Therefore, no large-scale blackouts have occurred nationwide.

Looking ahead, the National Energy Administration will take the 15th Five-Year Plan for the new-type power system as a guiding framework, adhering to the principle of moderately advanced power development. Efforts will focus on promoting rational and green energy consumption, supporting both economic and social development as well as the public’s growing demand for a better life, moving from “having access to electricity” toward “using electricity efficiently and intelligently.”

(By Liao Ruiling)

The 14th ESIE - largest energy storage event in China is coming on April 1-3, 2026, Beijing, China!

Register Now to attend, free before Oct 31, 2025.