Recently, Wuhu Electric Power Company in Anhui Province under the State Grid, together with the Wuhu Fanchang District Federation of Trade Unions, held the Fanchang District 2025 Power Emergency Supply and Service Skills Competition, supporting the development of local skilled talent and power emergency guarantee.

Total electricity consumption in China has consecutively exceeded 1 trillion kWh! Recently, the National Energy Administration released electricity consumption data for July and August. In July, total electricity consumption reached 1,022.6 billion kWh, up 8.6% year-on-year; in August, it reached 1,015.4 billion kWh, up 5% year-on-year.

What does it mean for a single month’s consumption to surpass 1 trillion kWh? What economic development trends does this reflect?

How should we understand 1 trillion kWh?

-- Horizontally, 1 trillion kWh is roughly equivalent to the total annual electricity consumption of Japan; Vertically, this figure has doubled over the past 10 years.

Electricity consumption is regarded as a “barometer” and “weathervane” of economic and social activity. By observing changes in this data, one can gain a relatively direct insight into the underlying momentum of economic development.

In July this year, China’s total electricity consumption reached 1,022.6 billion kWh, marking the first time monthly consumption exceeded 1 trillion kWh, a milestone also unprecedented globally. In August, total electricity consumption reached 1,015.4 billion kWh, crossing the 1 trillion kWh threshold once again.

What does 1 trillion kWh mean? Horizontally, 1 trillion kWh is roughly equivalent to the total annual electricity consumption of Japan or that of the ASEAN countries; Vertically, compared with July 2015, when electricity consumption first exceeded 500 billion kWh, this figure has doubled over the past 10 years.

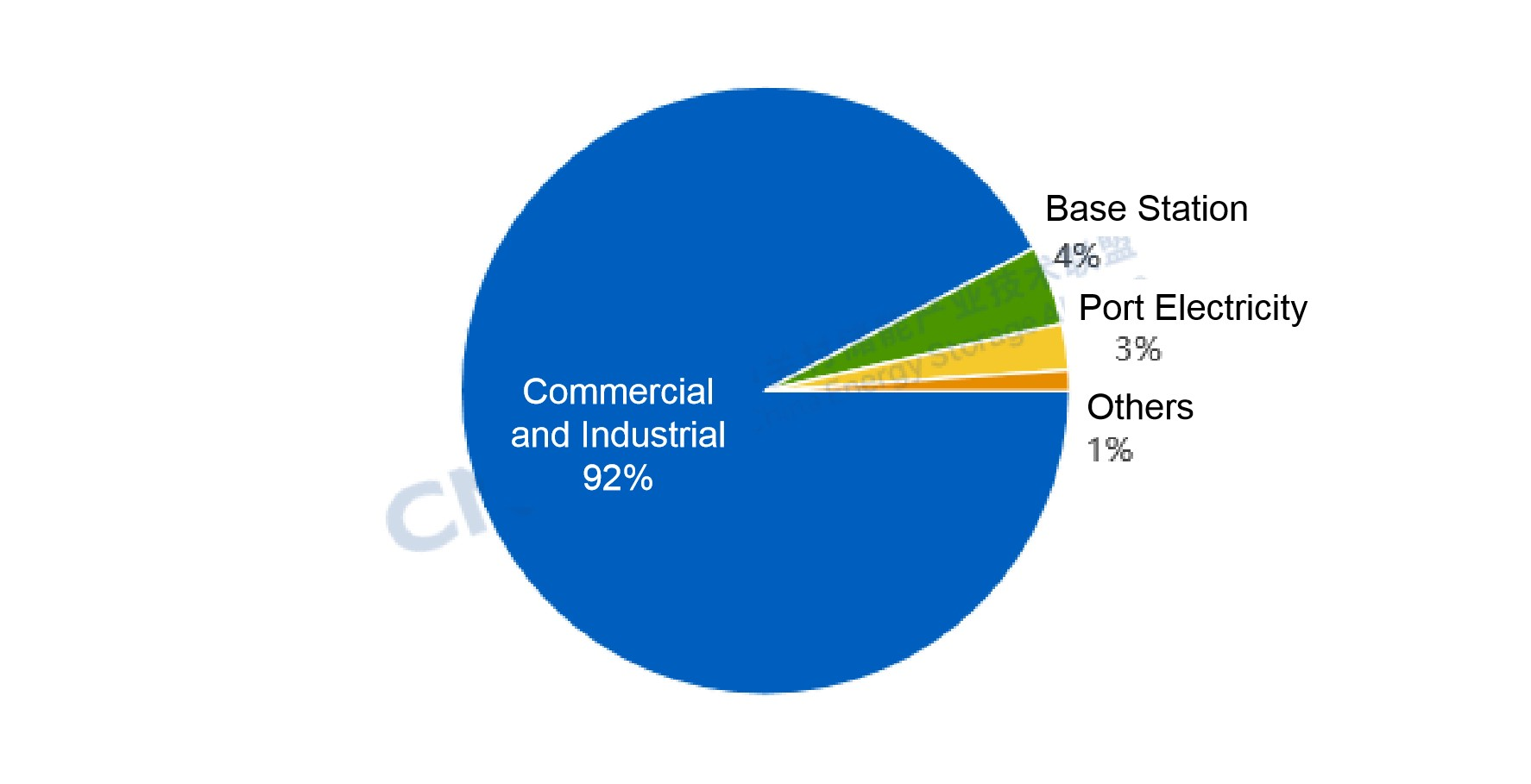

By industry, in July, electricity consumption in the primary sector reached 17 billion kWh, up 20.2% year-on-year, with a growth rate 15.3 percentage points higher than the previous month. The secondary sector consumed 593.6 billion kWh, up 4.7% year-on-year, with a growth rate 1.5 percentage points higher than last month. electricity consumption in the the tertiary sector used 208.1 billion kWh, up 10.7% year-on-year, 1.7 percentage points higher than June. Urban and rural household electricity consumption reached 203.9 billion kWh, up 18.0% year-on-year.

It is evident that the secondary sector accounted for the largest share of total electricity consumption in July. As a fundamental factor of industrial production, the stable growth in electricity use indicates the steady development of industrial economy.

“In July, electricity consumption in the secondary sector continued to grow, with high-tech and equipment manufacturing leading the increase”, analyzed by Jiang Debin, Deputy Director of the Statistics and Digital Intelligence Department at the China Electricity Council (CEC). Specifically, in July, electricity consumption in the four high-energy-consuming industries grew 0.5% year-on-year, an increase of 1.2 percentage points compared to the previous month, turning positive after two months of decline. Additionally, most consumer goods manufacturing sectors saw rising electricity usage. In July, electricity consumption in food manufacturing, tobacco products, and agricultural and sideline food processing increased 7.3%, 5.3%, and 5.1% year-on-year, respectively.

In August, electricity consumption in the primary sector grew 9.7% year-on-year, 5.1 percentage points higher than the same period last year, with livestock and fisheries leading at 12.3% and 10.9%, respectively. Electricity consumption in the secondary sector increased 5% year-on-year, 0.3 percentage points higher than July and 1 percentage point higher than August 2024. Within this, the four high-energy-consuming industries grew 4.2% year-on-year, 3.7 percentage points higher than last month. Growth in the tertiary sector slightly declined month-on-month but remained robust at 7.2%. Meanwhile, urban and rural household electricity consumption reached 196.3 billion kWh, up 2.4% year-on-year.

What factors are driving electricity consumption?

-- Rapidly rising power loads under sustained high temperatures; Macroeconomic recovery supporting continued capacity release across industries

What explains the monthly electricity consumption exceeding 1 trillion kWh?

Firstly, sustained high temperatures have driven demand. Since the start of summer, many regions nationwide have experienced hot and humid weather, causing electricity loads to climb rapidly and boosting urban and rural household electricity consumption. On July 4, the national peak load reached 1.465 billion kW, approximately 200 million kW higher than the end of June, setting a historic record (compared with 1.451 billion kW in 2024) and nearly 150 million kW higher than the same period last year. Provinces including Jiangsu, Anhui, Shandong, Henan, and Hubei saw their grids load reach all-time highs. In Jiangsu, the grid load exceeded 150 million kW for the first time, with the peak load rising nearly 40 million kW above the spring average, about 90% of the incremental load used for air conditioning.

“According to the National Climate Center, many places across the country experienced multiple rounds of high temperatures in July, with the national average temperature reaching a historical high for the same period since 1961, driving urban and rural household electricity consumption up 18% year-on-year. Under the sustained hot and humid weather, multiple regions reached record loads. In July, household electricity consumption in Henan, Shaanxi, Shandong, Sichuan, Anhui, and Hubei all rose more than 30% year-on-year”, said Jiang Debin.

Secondly, macroeconomic recovery and industrial production expansion have boosted electricity demand. A series of policies promoting consumption through the “Two New” (large-scale equipment renewal and trade-in of consumer goods) and “Two Majors” (the implementation of major national strategies and the construction of security capabilities in key areas) measures, along with efforts to stabilize industrial growth and curb over-competition, have maintained a recovering economic trend, releasing industrial capacity and further driving total electricity consumption.

“In August, nationwide manufacturing electricity consumption grew 5.5% year-on-year, the highest monthly growth this year. Electricity use in raw material industries such as steel, building materials, non-ferrous metals, and chemicals showed clear recovery, with total consumption up 4.2% year-on-year, 3.7 percentage points higher than July. High-tech and equipment manufacturing demonstrated strong resilience, with total electricity consumption up 9.1% year-on-year, about 4.6 percentage points above the average manufacturing growth rate”, Jiang Debin said. Importantly, all sub-sectors of high-tech and equipment manufacturing saw positive growth, with new energy vehicle production and photovoltaic industry manufacturing maintaining rapid growth, reflecting the robust development of new-quality productivity, creating new economic growth points, and driving electricity consumption upward.

Rising consumption has also contributed to higher electricity use. The consumer market has maintained steady growth this year, and service consumption policies have taken effect, sustaining rapid growth in the service sector. For example, in Jiangsu Province, host of the popular “Jiangsu Football City League” summer events, electricity consumption in fitness and leisure venues increased 23% year-on-year in July. During the same month, catering industry electricity use rose 10.1% year-on-year, while tourist attractions and accommodation electricity consumption increased 10.3% and 5.3% year-on-year, respectively.

What Ensures Stable Power Supply Amid Soaring Electricity

Consumption?

-- Strong energy self-sufficiency, stable operational regulation, and robust emergency response capabilities are key

From the consumption side, China’s record-breaking monthly electricity use -- exceeding 1 trillion kWh -- not only highlights the vitality of economic and social development but also reflects the steady reliability of the power supply.

According to Wang Hongzhi, Director of the China’s National Energy Administration, during the summer peak period (from the second half of July to the first half of August), China experienced extensive high temperatures, heavy rainfall, floods, and typhoons. Meanwhile, the country’s steadily recovering economy posed even greater demands on energy security. Despite these challenges, China’s power supply remained stable and orderly throughout the summer. “Our energy system withstood the peak and safeguarded the bottom line”, said Wang. Overall, China’s energy supply security and resilience have reached a high level.

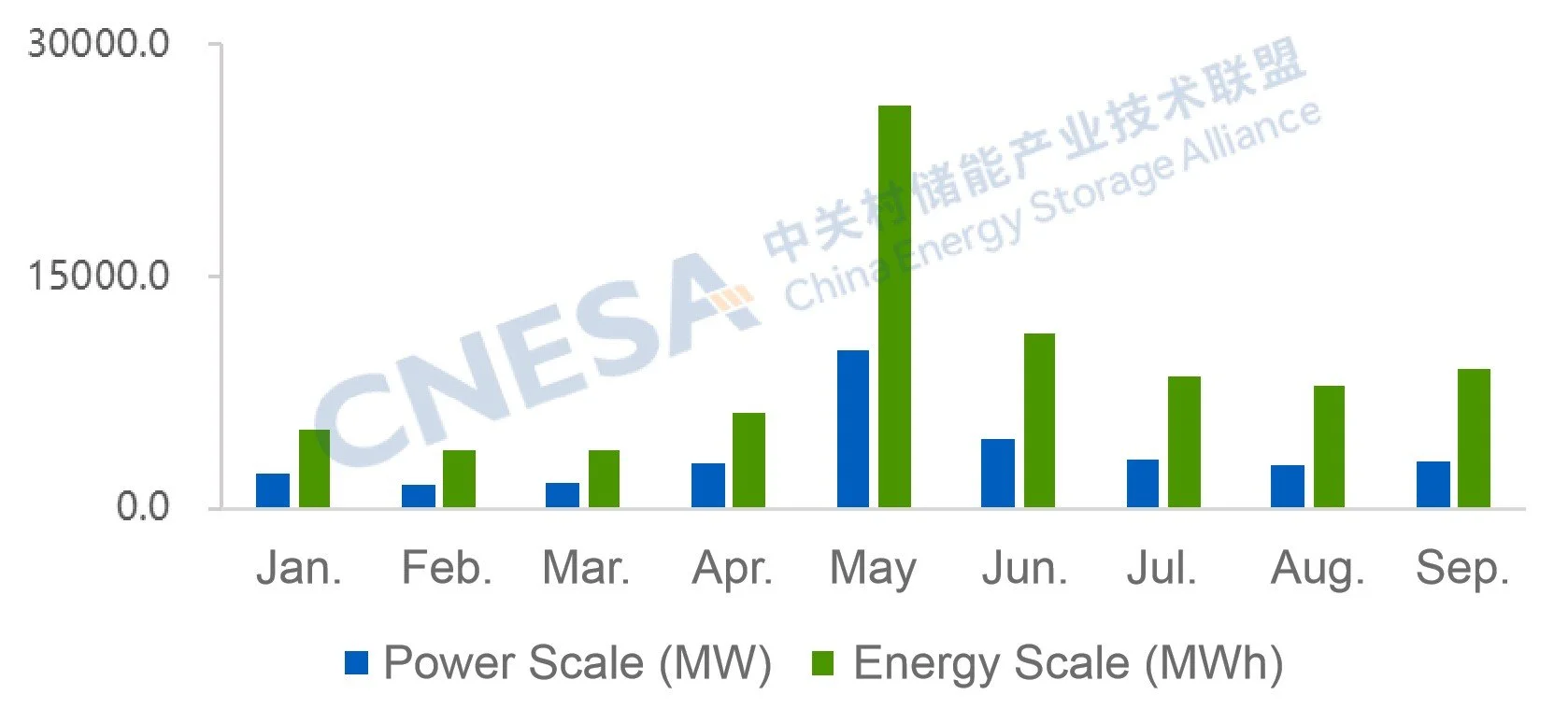

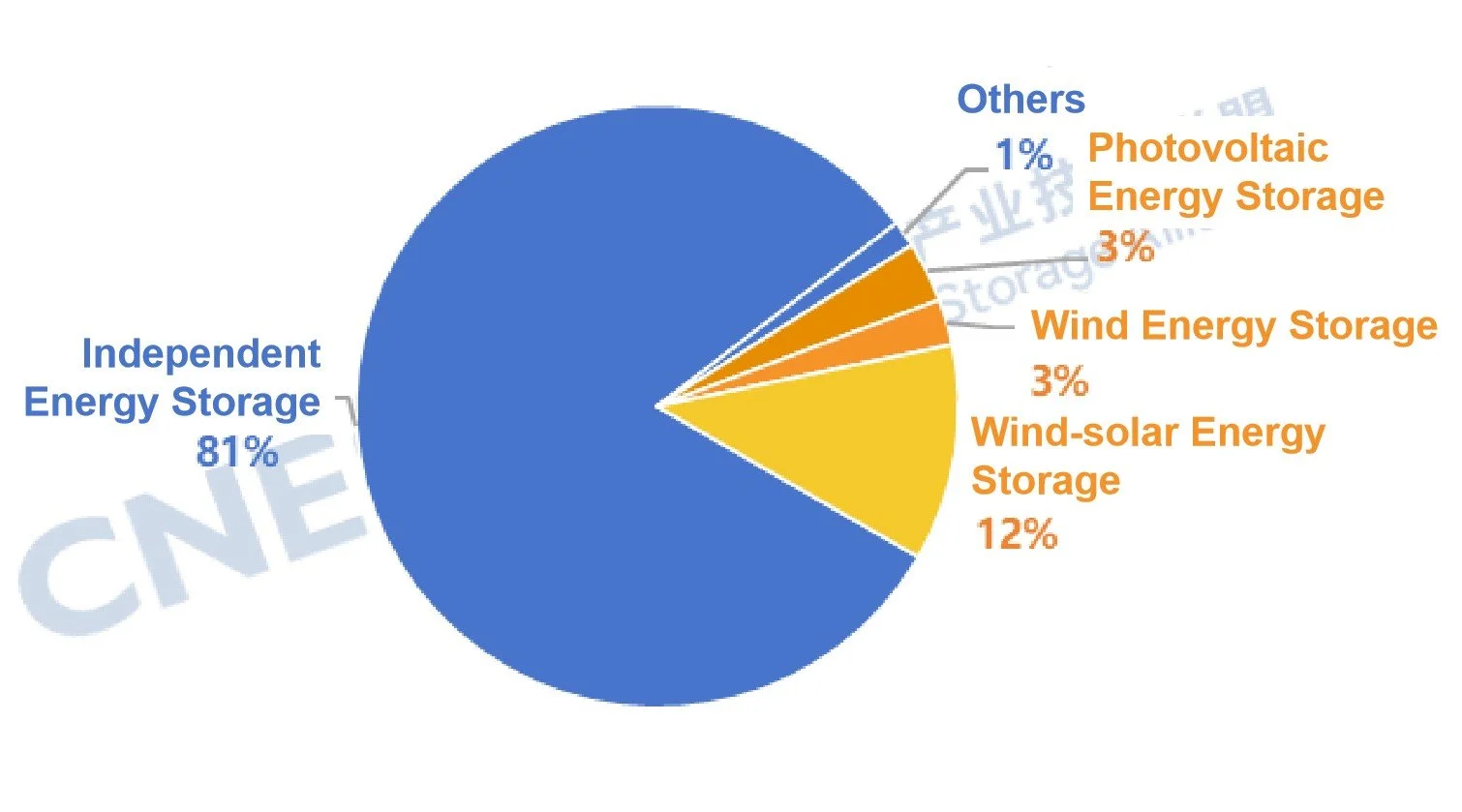

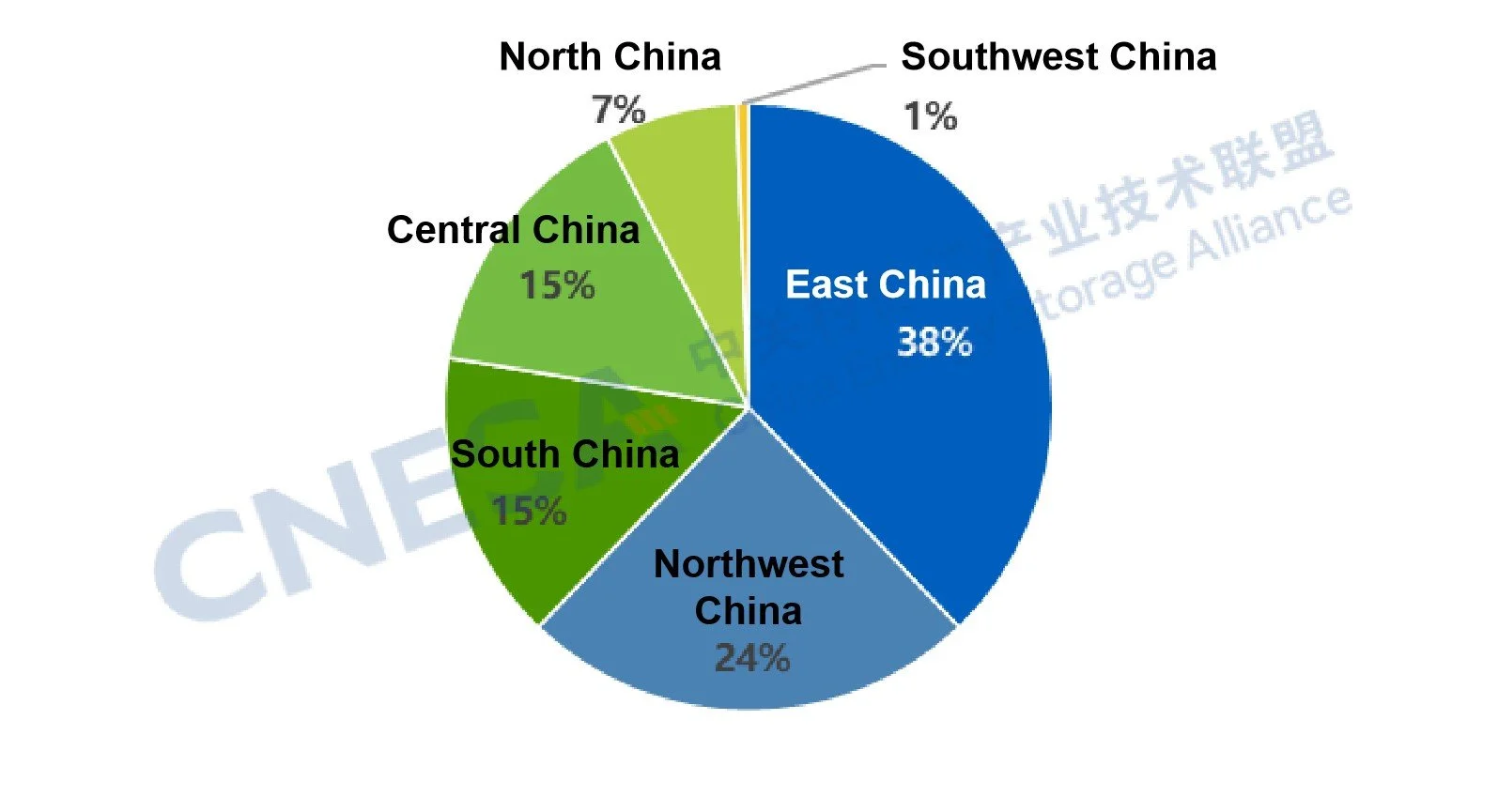

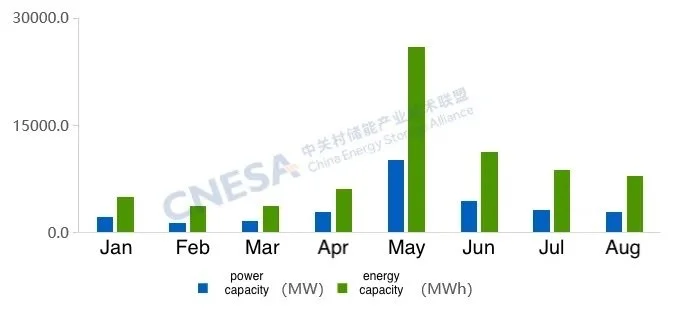

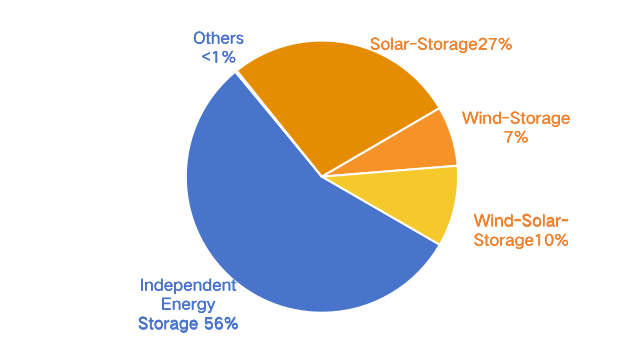

Stable electricity use is underpinned by a high degree of energy self-sufficiency. Since the start of the 14th Five-Year Plan, China has taken multiple measures to strengthen the stability and security of its energy supply chain. Over 90% of the increase in energy consumption has been met through domestic production. New energy sources have played a major role, achieving two “50%” milestones: The increase in renewable power generation accounts for nearly 50% of total new generation capacity nationwide; Non-fossil energy sources have contributed nearly 50% of the total increase in energy supply. As of the end of August, China’s total installed power generation capacity reached 3.69 billion kW, up 18.0% year-on-year, with wind and solar power combined totaling around 1.7 billion kW. This demonstrates that China’s energy self-sufficiency “base” has become more solid, while the share of green energy continues to rise.

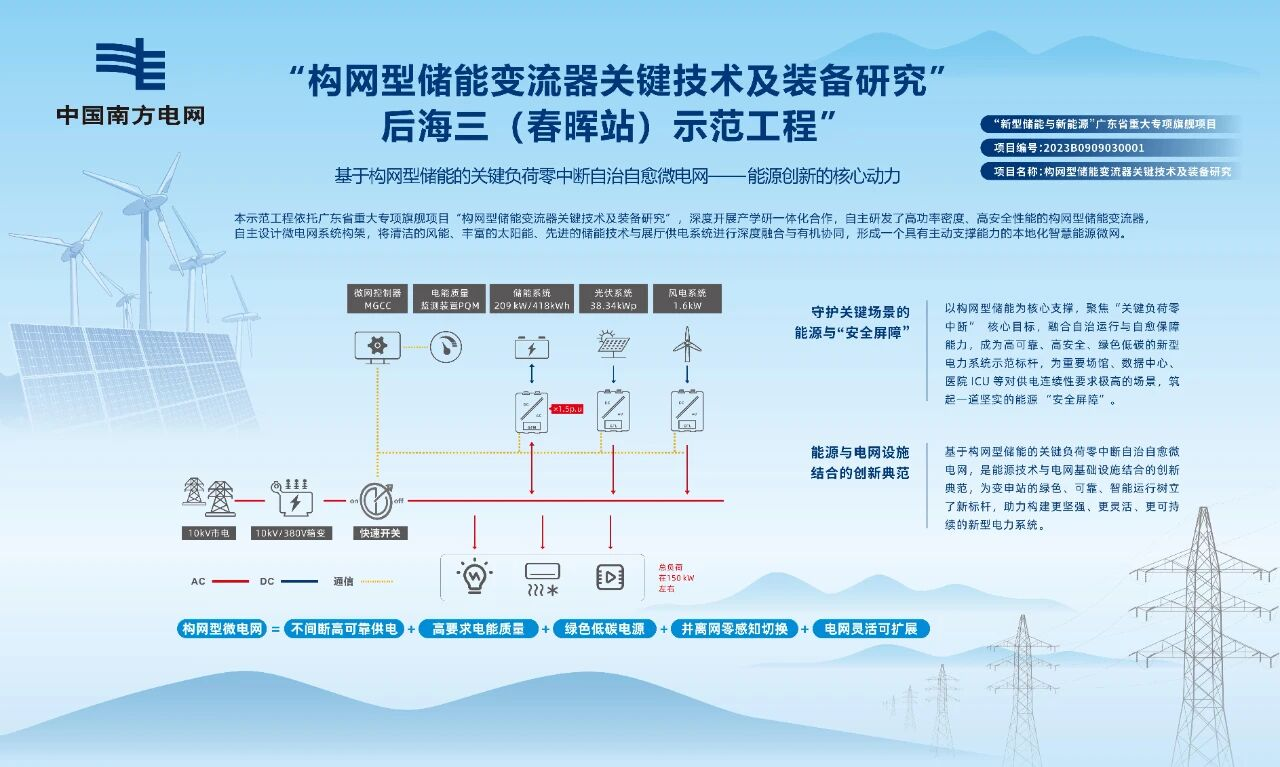

Stable electricity use also relies on robust operational coordination. China has established a comprehensive energy production, supply, storage, and marketing system and a sound mechanism to ensure supply and stabilize prices. Energy storage capacity has been steadily enhanced, while the nationwide oil and gas pipeline network has been expanding rapidly. The large-scale power grid’s capacity to allocate and balance resources across regions has been fully utilized. Before this summer’s power demand peak, several cross-provincial transmission projects, including the Longdong-Shandong and Hami-Chongqing lines, were completed and put into operation. These channels have delivered stable power to many cities, ensuring smooth electricity use during high-demand periods.

Stable power supply also relies on strong emergency support capabilities. When electricity demand surges sharply, power grids face serious challenges, particularly amid increasingly frequent global extreme weather events and natural disasters. To address this, China has established a national-level emergency power support system, consisting of four regional emergency bases in Sichuan-Chongqing-Tibet, South China, North China, and East China. These facilities aim to strengthen the country’s emergency response capacity for coal, oil, and gas, ensuring the long-term stability and reliability of the national energy and power systems. Therefore, no large-scale blackouts have occurred nationwide.

Looking ahead, the National Energy Administration will take the 15th Five-Year Plan for the new-type power system as a guiding framework, adhering to the principle of moderately advanced power development. Efforts will focus on promoting rational and green energy consumption, supporting both economic and social development as well as the public’s growing demand for a better life, moving from “having access to electricity” toward “using electricity efficiently and intelligently.”

(By Liao Ruiling)